Europe Over the Counter (OTC) Drugs Market – By Product Type (Analgesics, Cough, Cold, & Flu Products, Vitamins & Minerals, Dermatological Products, Gastrointestinal Products, Ophthalmic Products, Sleep Aid Products, Weight Loss/Diet Products, Others), By Formulation Type (Pharmacies, Supermarkets/Hypermarkets, Convenience Store, Online Drug Stores) – Industrial Analysis From 2025 to 2033

Europe Over the Counter (OTC) Drugs Market Size

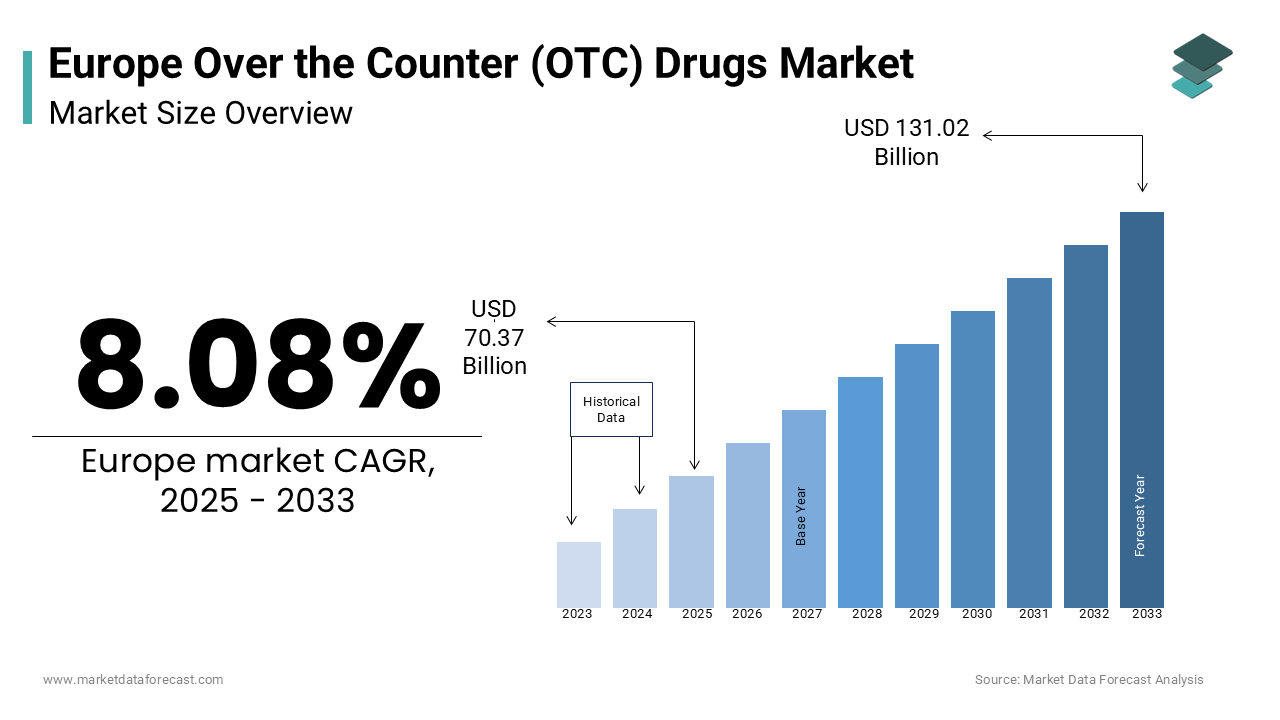

The Europe over the counter (OTC) drugs market was estimated at USD 65.11 billion in 2024 and is projected to reach USD 131.02 billion by 2033 from USD 70.37 billion in 2025, growing at a CAGR of 8.08% between 2025 and 2033.

The increasing consumer preference for self-medication, rising healthcare costs, and an aging population seeking affordable healthcare solutions are key driving factors fort he Europe over-the-counter (OTC) drugs market growth. For instance, as per Eurostat, over 60% of Europeans aged 65 and above rely on OTC drugs for minor ailments is creating a robust demand for analgesics, vitamins, and dermatological products. Additionally, government initiatives promoting preventive healthcare have accelerated adoption rates.

MARKET DRIVERS

Rising Preference for Self-Medication

A key driver of the Europe OTC drugs market is the growing preference for self-medication among consumers. According to the European Health Consumer Index, over 70% of Europeans now opt for OTC drugs to treat minor ailments like headaches, colds, and allergies, avoiding costly doctor visits. This trend is particularly pronounced in urban areas, where health literacy and awareness are high. Additionally, advancements in product formulations have enhanced efficacy and safety. For example, as per the UK National Health Service, OTC analgesics accounted for over 50% of pain relief sales in 2022. These factors collectively position OTC drugs as an indispensable tool in modern healthcare.

Aging Population and Chronic Conditions

The aging population represents another major driver. According to Eurostat, over 20% of Europe’s population is aged 65 or above, with this demographic expected to grow by 15% through 2030. This demographic shift has increased the prevalence of chronic conditions like arthritis and gastrointestinal disorders are fueling demand for OTC medications. For instance, as per the German Federal Ministry of Health, sales of OTC gastrointestinal products grew by 25% annually since 2020 with their growing importance. Partnerships between manufacturers and pharmacies have amplified adoption is positioning OTC drugs as a transformative force in geriatric care.

MARKET RESTRAINTS

Stringent Regulatory Standards

The stringent regulatory standards pose a significant restraint. Smaller players face difficulties in meeting these requirements that is hindering the growth of the market. As per a survey by the European Pharmaceutical Industry Association, nearly 30% of small-scale manufacturers have exited the market due to regulatory pressures.

Proliferation of Counterfeit Products

The proliferation of counterfeit OTC drugs pose as an another restraint for the Europe over the counter drugs market growth. Additionally, limited awareness about counterfeit risks among rural consumers exacerbates the issue. A study by the Italian Ministry of Health reveals that only 40% of rural buyers verify product authenticity is creating a formidable challenge for legitimate manufacturers.

MARKET OPPORTUNITIES

Expansion into Online Drug Stores

The growing adoption of online drug stores presents a significant opportunity for the Europe OTC drugs market. According to the European E-Commerce Association, online sales of OTC drugs grew by 35% annually since 2021 due to its convenience and accessibility. For instance, as per the Swedish Ministry of Health, over 60% of urban consumers prefer purchasing OTC drugs online with their growing importance.

Advancements in secure payment systems and delivery logistics have driven adoption. Partnerships between manufacturers and e-commerce platforms further amplify growth is positioning online channels as a transformative force in the market.

Growing Demand for Preventive Healthcare Solutions

Another major opportunity lies in the demand for preventive healthcare solutions. According to the European Centre for Disease Prevention and Control, over 80% of consumers prioritize vitamins and supplements to boost immunity and prevent illnesses. For example, as per the Spanish Ministry of Health, vitamin sales increased by 40% during the pandemic. Government subsidies for preventive healthcare have increased accessibility is positioning OTC drugs as a key driver of public health initiatives.

MARKET CHALLENGES

Competition from Alternative Remedies

Competition from alternative remedies, such as herbal and homeopathic products, poses a significant challenge. This competition is particularly intense in Southern Europe, where cultural preferences favor traditional medicine. Additionally, innovations in plant-based formulations threaten to erode market share for conventional OTC drugs. According to a study by the Italian Ministry of Agriculture, herbal products are preferred by over 50% of rural consumers is creating a formidable rival for synthetic alternatives.

Rising Healthcare Costs and Economic Uncertainty

Rising healthcare costs and economic uncertainty represent another challenge. According to the European Central Bank, inflationary pressures have reduced disposable incomes is limiting consumer spending on non-essential healthcare products. Additionally, economic downturns in Eastern Europe have shifted preferences toward cheaper alternatives. A survey by the Polish Ministry of Health reveals that over 40% of consumers are opting for generic OTC drugs by reducing profitability for premium brands.

SEGMENTAL ANALYSIS

By Product Type Insights

The analgesics segment dominated the Europe over the counter drugs market with 25.4% of share in 2024 with their widespread use in treating common ailments like headaches and muscle pain. Key factors driving this segment include advancements in formulation technologies and partnerships with pharmacies. Additionally, government initiatives promoting pain management have increased adoption rates that will also promote the growth of the segment.

The vitamins and minerals segment is projected to register a CAGR of 7.2% from 2025 to 2033. This growth is fueled by rising consumer awareness about preventive healthcare and immunity-boosting solutions. According to the Spanish Ministry of Health, vitamin sales increased by 40% annually since 2020. Advancements in bioavailability and personalized formulations have driven adoption. Partnerships between manufacturers and health organizations further amplify growth by positioning vitamins as a transformative force in the market.

By Formulation Type Insights

The tablets segment was the largest by accounting for 45.3% of the Europe over the counter drugs market share in 2024. The growth of the segment is escalated due to their convenience, ease of use, and long shelf life by making them suitable for a wide range of OTC products like analgesics and vitamins. For instance, as per the German Federal Ministry of Health, over 60% of OTC drugs sold in Europe are in tablet form. Key factors driving this segment include advancements in controlled-release technologies and compact packaging designs. Additionally, government incentives for cost-effective formulations have increased accessibility with the tablets as the preferred choice among consumers.

The sprays segment is likely to gain a CAGR of 8.5% during the forecast period. The growth of the segment is fueled by their rapid action and targeted delivery in dermatological and nasal applications. According to the French National Institute for Health, spray-based formulations have increased consumer satisfaction rates by 35% since 2021 with their growing importance. Innovations in aerosol-free and eco-friendly sprays have driven adoption.

By Distribution Channel Insights

The pharmacies segment was the largest by occupying 55.4% of the Europe over the counter drugs market share in 2024 due to their role as trusted healthcare providers and their ability to offer personalized advice on OTC products. For instance, according to the UK National Health Service, over 70% of OTC drug purchases occur in pharmacies. Key factors driving this segment include partnerships with manufacturers and the availability of trained pharmacists. Additionally, government initiatives promoting pharmacy-based healthcare have increased adoption rates by ensuring sustained growth.

The online drug stores segment is swiftly growing with a CAGR of 12.3% in the next coming years. This growth is fueled by rising internet penetration and consumer preference for convenience. According to the Swedish Ministry of Health, online sales of OTC drugs grew by 50% annually since 2021 with their growing importance. Advancements in secure payment systems and same-day delivery logistics have driven adoption. Partnerships between e-commerce platforms and manufacturers further amplify growth by positioning online channels as a key driver of market expansion.

REGIONAL ANALYSIS

Germany was the largest contributor for the Europe OTC drugs market by capturing a share of 28.1% in 2024. The growth of the market in this country is attributed to the robust pharmaceutical industry and high accessibility to OTC products through pharmacies and online platforms. Germany’s emphasis on preventive healthcare aligns with EU mandates is driving adoption of vitamins and analgesics. For instance, as per Eurostat, over 65% of Germans aged 65 and above rely on OTC drugs for minor ailments is creating a robust demand for affordable healthcare solutions.

Turkey is anticipated to register a CAGR of 9.8% in the foreseen years owing to the rapid urbanization, increasing consumer spending, and rising awareness about self-medication. Turkey’s investments in modern manufacturing facilities is also to escalate the growth of the market. Additionally, government-led initiatives promoting preventive healthcare have accelerated adoption is prompting the growth of the market in this country.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few of the key players in the European Over-the-counter drugs Market profiled in this report are GlaxoSmithKline, Johnson and Johnson, Novartis, Bayer, Pfizer, Sanofi, and Takeda. They are the top companies contributing to the European over-the-counter drugs market. However, the loss of patent protection leads companies to switch to OTC.

The Europe OTC drugs market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like Bayer, GSK, and Sanofi dominate the landscape through continuous innovation and strategic collaborations. Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as herbal remedies or dermatological care. Regulatory compliance and adherence to quality standards further intensify competition by ensuring that only the most reliable products gain traction.

Top Players in the Europe OTC Drugs Market

1. Bayer AG

Bayer AG is a leading player in the Europe OTC drugs market, contributing significantly to innovations in analgesics and dermatological products. The company specializes in producing high-quality formulations catering to diverse consumer needs. Its focus on integrating digital health solutions aligns with Europe’s demand for accessible healthcare, enabling it to maintain a competitive edge.

2. GlaxoSmithKline (GSK)

GSK is another key contributor, renowned for its expertise in respiratory and cold-care products. GSK’s strategic emphasis on expanding its product portfolio with vitamins and supplements has driven growth. Its presence in Europe is strengthened by partnerships with local pharmacies, ensuring widespread adoption of its products.

3. Sanofi S.A.

Sanofi plays a pivotal role in advancing OTC drug technologies, particularly in gastrointestinal and sleep aid products. Its commitment to innovation and collaboration positions it as a major player in the market in high-growth regions like Germany and France.

Top Strategies Used by Key Players in Europe OTC Drugs Market

Key players in the Europe OTC drugs market employ strategies such as product innovation, geographic expansion, and sustainability initiatives to strengthen their positions. Product innovation is central, with companies investing in advanced formulations to meet evolving consumer preferences. For instance, Bayer has introduced bioavailable vitamins, enhancing its appeal among health-conscious buyers. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential. These strategies collectively drive market growth and ensure sustained competitiveness.

RECENT MARKET DEVELOPMENTS

- In April 2023, Bayer launched a new line of bioavailable vitamins in Germany to reduce dosage requirements by 30% while maintaining efficacy.

- In June 2023, GSK partnered with Italian pharmacies to develop custom cough and cold formulations will enhance brand differentiation and market penetration.

- In September 2023, Sanofi acquired a leading OTC manufacturer in Turkey by strengthening its position in the fast-growing Middle Eastern market.

- In November 2023, Johnson & Johnson introduced a cloud-based platform in Switzerland is streamlining the customization of OTC formulations based on consumer preferences.

- In February 2024, Novartis collaborated with tech firms in France to develop recyclable packaging by positioning itself as a leader in sustainable solutions.

MARKET SEGMENTATION

This Europe over the counter drugs market research report has been segmented and sub-segmented into the following categories.

By Product Type

- Analgesics

- Cough, Cold, and Flu Products

- Vitamins and Minerals

- Dermatological Products

- Gastrointestinal Products

- Ophthalmic Products

- Sleep Aid Products

- Weight Loss/Diet Products

- Others

By Formulation Type

- Tablets

- Liquids

- Ointments

- Spray

By Distribution Channel

- Pharmacies

- Supermarkets/Hypermarkets

- Convenience Store

- Others (Online Drug Stores)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which countries contribute significantly to the over the counter drugs market in Europe?

Key contributors to the market include Germany, France, the UK, and Italy, with each playing a crucial role in shaping regional trends.

What factors are driving the growth of the over the counter drugs market in Europe?

Factors such as easy accessibility, cost-effectiveness, and a shift towards preventive healthcare are driving the European over the counter drugs market growth.

What are the factors challenging the growth of the over the counter drugs market in Europe?

Factors such as stringent regulatory processes, competition from prescription drugs, and the need for effective marketing to differentiate products are primarily challenging the growth of the European over the counter drugs market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]