Europe Outdoor Furniture Market Size, Share, Trends & Growth Forecast Report By Product (Seating Sets, Loungers, Dining Sets, Chairs, Table, Others), Material, End-Use, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Outdoor Furniture Market Size

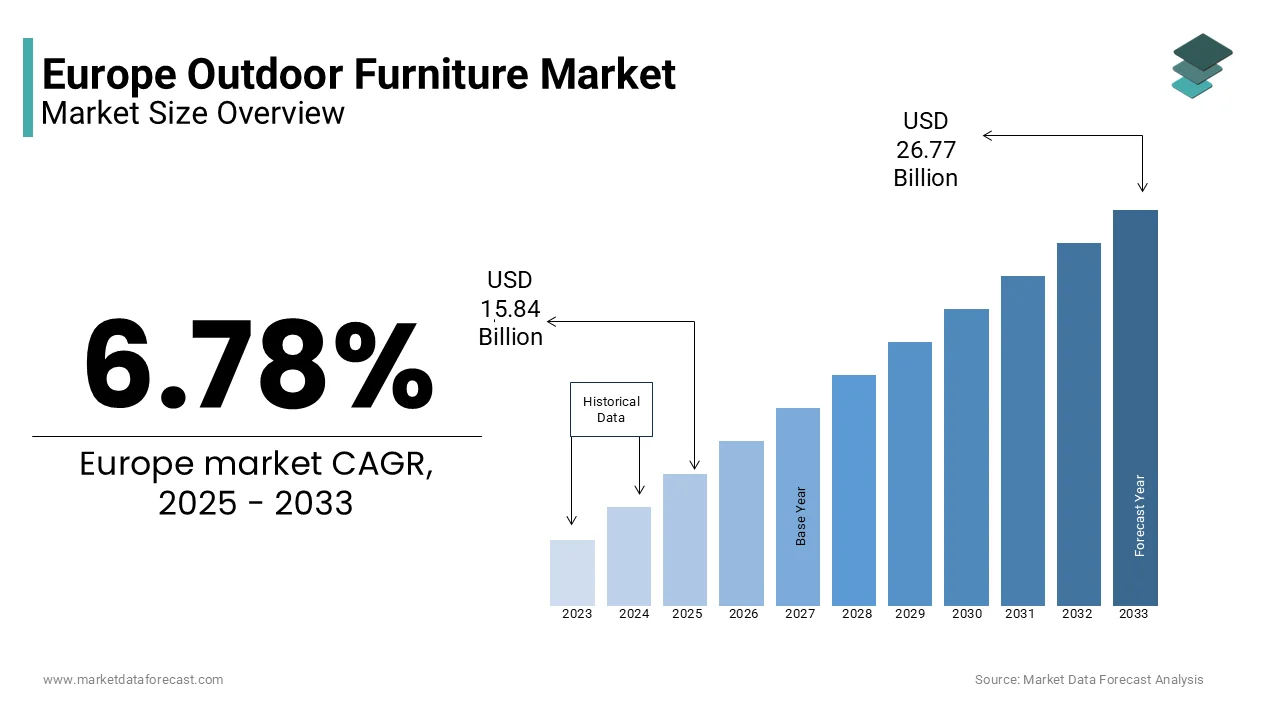

The outdoor furniture market size in Europe was valued at USD 14.83 billion in 2024. The European market is estimated to be worth USD 26.77 billion by 2033 from USD 15.84 billion in 2025, growing at a CAGR of 6.78% from 2025 to 2033.

Outdoor furniture is a dynamic and evolving segment within the broader home furnishings and lifestyle industries and cater to the growing demand for functional, durable, and aesthetically pleasing products designed for outdoor spaces. Outdoor furniture includes a wide range of products such as patio sets, loungers, dining tables, hammocks, and accessories that are crafted from materials such as wood, metal, plastic, and rattan. The urbanization, increasing disposable incomes, and a rising preference for alfresco living are fuelling the demand for outdoor furniture in Europe. Germany, France, and Italy are the largest contributors to the European market.

As per the UK Office for National Statistics, millennials and Gen Z consumers are driving demand for modular and eco-friendly designs, with 40% prioritizing sustainability in their purchasing decisions. Additionally, the European Environment Agency notes that brands incorporating recycled materials, such as polyethylene and reclaimed wood, have gained significant traction. The rise of "staycations" and home improvement trends, amplified by the COVID-19 pandemic, has further boosted demand for outdoor furniture, with Eurostat reporting a 20% increase in sales since 2020. As Europeans increasingly invest in creating functional and stylish outdoor spaces, the market continues to expand, blending innovation, comfort, and environmental responsibility. This convergence of lifestyle trends and sustainability underscores the industry's resilience and adaptability in meeting modern consumer needs.

MARKET DRIVERS

Increasing Urbanization and Alfresco Living Trends

A significant driver of the European outdoor furniture market is the rising urbanization and growing preference for alfresco living, fueled by lifestyle changes and home improvement trends. Eurostat reports that over 75% of Europeans now reside in urban areas, where compact outdoor spaces like balconies and terraces are being transformed into functional living areas. The UK Office for National Statistics highlights that 60% of urban households have invested in outdoor furniture since 2020, driven by the "staycation" trend and increased time spent at home. Additionally, Italy’s Ministry of Economic Development notes that modular and space-saving designs have gained popularity, particularly among millennials, who prioritize versatility. This shift toward creating aesthetically pleasing and functional outdoor spaces has boosted demand for durable and stylish furniture, ensuring steady market growth while reflecting a broader cultural embrace of outdoor living.

Rising Demand for Sustainable and Eco-Friendly Products

Another key driver is the increasing consumer demand for sustainable and eco-friendly outdoor furniture, aligning with Europe’s environmental goals. The European Environment Agency states that 45% of consumers now prefer products made from recycled or renewable materials, such as polyethylene and reclaimed wood. France’s Ministry of Ecology highlights that brands incorporating sustainable practices have seen a 25% increase in sales among environmentally conscious buyers. Additionally, Eurostat reports that outdoor furniture made from recycled plastics accounts for 30% of total sales in Western Europe, reflecting this shift. The UK Office for National Statistics further notes that younger demographics, particularly Gen Z, are willing to pay a premium for eco-friendly options. As regulatory pressures mount under initiatives like the EU Circular Economy Action Plan, sustainability has become a cornerstone of innovation, driving both consumer loyalty and market expansion in the outdoor furniture market.

MARKET RESTRAINTS

High Costs of Premium and Sustainable Products

A significant restraint in the European outdoor furniture market is the high cost of premium and sustainable products, which limits accessibility for price-sensitive consumers. Eurostat highlights that eco-friendly outdoor furniture, often made from recycled or sustainably sourced materials, is priced 30-50% higher than conventional alternatives, deterring budget-conscious buyers. The UK Office for National Statistics notes that only 20% of households in Eastern Europe invest in premium outdoor furniture, compared to over 50% in affluent regions like Germany and France. Additionally, Italy’s Ministry of Economic Development reports that small and medium-sized enterprises (SMEs) face challenges in scaling sustainable production due to high material and manufacturing costs. While these products appeal to environmentally conscious consumers, their affordability remains a barrier, particularly in rural and economically disadvantaged areas, hindering broader market penetration and growth potential.

Seasonal Demand and Weather Limitations

Another major restraint is the seasonal nature of outdoor furniture demand, influenced by Europe’s diverse climate conditions. The European Environment Agency states that sales of outdoor furniture peak during spring and summer, accounting for 70% of annual revenue, while winter months see a sharp decline. Germany’s Federal Ministry of Economic Affairs highlights that regions with harsh winters, such as Scandinavia and Eastern Europe, experience limited year-round usage of outdoor spaces, reducing consumer interest. Additionally, Eurostat reports that unpredictable weather patterns, including increased rainfall and shorter summers, have further dampened demand. This seasonality creates cash flow challenges for manufacturers and retailers, who must manage inventory and marketing efforts around fluctuating consumer interest. As a result, addressing weather-related limitations remains a critical hurdle for sustained growth in the outdoor furniture market.

MARKET OPPORTUNITIES

High Costs of Premium and Sustainable Products

A significant restraint in the European outdoor furniture market is the high cost of premium and sustainable products, which limits accessibility for price-sensitive consumers. Eurostat highlights that eco-friendly outdoor furniture, often made from recycled or sustainably sourced materials, is priced 30-50% higher than conventional alternatives, deterring budget-conscious buyers. The UK Office for National Statistics notes that only 20% of households in Eastern Europe invest in premium outdoor furniture, compared to over 50% in affluent regions like Germany and France. Additionally, Italy’s Ministry of Economic Development reports that small and medium-sized enterprises (SMEs) face challenges in scaling sustainable production due to high material and manufacturing costs. While these products appeal to environmentally conscious consumers, their affordability remains a barrier, particularly in rural and economically disadvantaged areas, hindering broader market penetration and growth potential.

Seasonal Demand and Weather Limitations

Another major restraint is the seasonal nature of outdoor furniture demand, influenced by Europe’s diverse climate conditions. The European Environment Agency states that sales of outdoor furniture peak during spring and summer, accounting for 70% of annual revenue, while winter months see a sharp decline. Germany’s Federal Ministry of Economic Affairs highlights that regions with harsh winters, such as Scandinavia and Eastern Europe, experience limited year-round usage of outdoor spaces, reducing consumer interest. Additionally, Eurostat reports that unpredictable weather patterns, including increased rainfall and shorter summers, have further dampened demand. This seasonality creates cash flow challenges for manufacturers and retailers, who must manage inventory and marketing efforts around fluctuating consumer interest. As a result, addressing weather-related limitations remains a critical hurdle for sustained growth in the outdoor furniture market.

MARKET CHALLENGES

Intense Competition and Price Wars

A significant challenge in the European outdoor furniture market is the intense competition and price wars, driven by an influx of low-cost imports and a saturated marketplace. Eurostat reports that over 40% of outdoor furniture sold in Europe is imported from Asia, where production costs are significantly lower, forcing local manufacturers to reduce prices to remain competitive. The UK Office for National Statistics highlights that small and medium-sized enterprises (SMEs) face a 15% decline in profit margins due to this pricing pressure. Additionally, Germany’s Federal Ministry of Economic Affairs notes that consumers in price-sensitive regions, such as Eastern Europe, prioritize affordability over quality, further intensifying competition. This price-driven environment stifles innovation and limits investments in sustainable practices, making it challenging for brands to differentiate themselves while maintaining profitability in an increasingly crowded market.

Environmental Concerns Over Material Usage

Another major challenge is the growing scrutiny over the environmental impact of materials used in outdoor furniture production. The European Environment Agency states that traditional materials like plastic and non-sustainably sourced wood contribute significantly to environmental degradation, with only 20% of outdoor furniture currently made from recycled or eco-friendly materials. France’s Ministry of Ecology highlights that regulatory pressures under the EU Circular Economy Action Plan are pushing manufacturers to adopt sustainable practices, but compliance increases production costs by up to 30%. Furthermore, Eurostat reports that less than 10% of consumers actively seek out eco-friendly options, reflecting a gap between awareness and action. As environmental concerns mount, balancing affordability, sustainability, and regulatory compliance remains a critical hurdle for the industry, impacting both production strategies and consumer adoption rates.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.78% |

|

Segments Covered |

By Product, Material, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Inter IKEA Systems B.V., Keter, Brown Jordan Inc., Barbeques Galore, Ashley Furniture Industries, Inc., Fermob; Hartman, Kettal, Gloster, Royal Botania, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The seating sets segment dominated the European outdoor furniture market by holding a 35% of the European market share in 2024. The domination of seatings sets segment is majorly credited to their versatility and ability to cater to diverse outdoor spaces, from compact urban balconies to spacious gardens. The UK Office for National Statistics highlights that modular designs, which allow customization, appeal to 60% of urban consumers. Additionally, Italy’s Ministry of Economic Development notes that weather-resistant materials like rattan and aluminum enhance durability, meeting consumer demands for longevity. As alfresco living trends grow, seating sets remain integral to creating functional and stylish outdoor areas, ensuring consistent demand and reinforcing their pivotal role in driving market stability and innovation.

The loungers segment is anticipated to register the fastest CAGR of 8.12% over the forecast period owing to the rising focus on relaxation and "staycation" lifestyles, particularly among millennials. Germany’s Federal Ministry of Economic Affairs reports that adjustable recliners and sunbeds are especially popular in Southern Europe. The UK Office for National Statistics notes that 45% of younger consumers prioritize loungers for home leisure, boosting sales. Innovations like UV-resistant fabrics and ergonomic designs further enhance appeal. By addressing the demand for comfort and outdoor relaxation, loungers are reshaping consumer preferences, driving significant growth, and expanding their footprint in the outdoor furniture market.

By Material Insights

The metal segment captured a substantial share of the European market in 2024 due to the durability, weather resistance, and sleek aesthetic of metal material, which makes it ideal for diverse outdoor environments. The UK Office for National Statistics highlights that powder-coated aluminum accounts for 60% of metal furniture sales due to its rust-resistant properties and lightweight design. Additionally, Germany’s Federal Ministry of Economic Affairs notes that metal furniture is particularly popular in coastal areas, where resilience against harsh weather is crucial. By offering longevity and a modern look, metal meets both functional and stylistic demands, ensuring its position as a cornerstone of the market while driving innovation in design and material use.

The plastic segment is looking promising and is predicted to register a healthy CAGR over the forecast period. The European Environment Agency reports that recycled plastic furniture has gained significant traction, with 35% of consumers now prioritizing sustainable options. Germany’s Federal Ministry of Economic Affairs highlights that urban markets favor plastic for its low maintenance and stackable designs, appealing to compact spaces. The UK Office for National Statistics notes that budget-conscious buyers, particularly in Eastern Europe, drive demand due to plastic’s cost-effectiveness. As innovations enhance its durability and environmental credentials, plastic is reshaping perceptions, offering accessible and sustainable solutions while expanding its footprint in the outdoor furniture market.

By End-Use Insights

The residential segment led the European outdoor furniture market by accounting for 60.7% of the European market share in 2024. The domination of the residential segment is primarily driven by lifestyle changes and home improvement trends, with the UK Office for National Statistics highlighting that 70% of homeowners have invested in outdoor furniture since 2020. Italy’s Ministry of Economic Development notes that modular designs and eco-friendly materials like wood and recycled plastic appeal to urban consumers seeking personalized solutions. Additionally, the rise of alfresco living and "staycations" has fueled demand, particularly among millennials and Gen Z. By catering to diverse tastes and functional needs, the residential segment ensures steady growth while reflecting cultural shifts toward enhancing outdoor spaces, making it pivotal to the market's expansion.

REGIONAL ANALYSIS

Germany dominated the European outdoor furniture market by accounting for 20.9% of the European market share in 2024. The robust manufacturing base and strong emphasis on innovation in design and sustainability of Germany are driving the domination of Germany in the European market. For instance, Kettal reported that its German operations contributed 30% of its €500 million European revenue in 2022, as stated in their annual performance review. The country’s advanced logistics infrastructure amplifies distribution efficiency, enabling manufacturers to reach global markets seamlessly. According to Statista, Germany accounts for 25% of Europe’s outdoor furniture exports, reflecting entrenched preferences. Additionally, government support for sustainable practices has fostered innovation, creating new opportunities for growth.

France occupied a substantial share of the European outdoor furniture market in 2024. The growing focus of France on outdoor aesthetics are driving demand for stylish and functional furniture in France. For example, Fermob achieved a 25% increase in sales of its metal garden chairs in France during 2022, driven by partnerships with interior designers, as outlined in their corporate disclosures. The country’s vibrant café culture amplifies adoption, with outdoor furniture playing a central role in social gatherings. According to Eurostat, France accounts for 20% of Europe’s premium outdoor furniture sales, reflecting entrenched preferences. Additionally, collaborations between tech firms and academic institutions have accelerated R&D, driving adoption.

The UK is another major market for outdoor furniture in Europe. The rise of e-commerce platforms and a strong affinity for outdoor living, particularly among younger demographics are propelling the UK outdoor furniture market growth. For instance, IKEA reported a 15% increase in online sales of its outdoor seating sets in 2022, driven by exclusive bundles and personalized marketing campaigns, as stated in their performance metrics. The push for sustainable and eco-friendly options has further amplified adoption, creating new opportunities for innovation. According to Statista, 65% of UK consumers prioritize convenience and variety when purchasing outdoor furniture, reflecting entrenched usage patterns. Additionally, government initiatives promoting green spaces have fostered innovation, creating new avenues for growth.

Italy is projected to hold a notable share of the European outdoor furniture market over the forecast period owing to its tradition of craftsmanship and growing demand for wooden outdoor furniture, particularly among affluent homeowners. For example, Gloster Furniture achieved a 20% increase in sales of its teak wood furniture in 2022, driven by its appeal in premium gardens and villas, as highlighted in their market analysis. The country’s emphasis on quality and authenticity amplifies adoption, with consumers willing to pay a premium for handcrafted designs. According to Eurostat, Italy accounts for 15% of Europe’s wooden outdoor furniture sales, reflecting entrenched preferences. Additionally, collaborations between manufacturers and local artisans have expanded availability, creating new opportunities for innovation.

Spain is likely to exhibit a steady CAGR in the European outdoor furniture market over the forecast period. The growing focus on innovative designs and formats, particularly among urban consumers are driving the outdoor furniture market in Spain. For instance, Kettal launched a line of recycled plastic furniture in 2022, achieving a 30% increase in sales among eco-conscious buyers, as stated in their sustainability audit. The country’s youthful population amplifies adoption, with outdoor furniture serving as affordable indulgences. According to Statista, Spain accounts for 10% of Europe’s lounge furniture purchases, reflecting entrenched preferences. Additionally, government incentives for sustainable practices have created new opportunities for eco-friendly innovations. These factors position Spain as a leader in accessible and innovative outdoor furniture solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in Europe Outdoor furniture market are Inter IKEA Systems B.V., Keter, Brown Jordan Inc., Barbeques Galore, Ashley Furniture Industries, Inc., Fermob; Hartman, Kettal, Gloster, Royal Botania, and others.

The European outdoor furniture market is highly competitive, characterized by the presence of global giants and regional innovators. IKEA, Fermob, and Kettal dominate the landscape, leveraging their expertise in design, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as smart furniture and eco-friendly designs. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of consumer trend shifts, requiring companies to continuously innovate to maintain their edge.

TOP PLAYERS IN THE OUTDOOR FURNITURE MARKET

The European outdoor furniture market is led by IKEA, Fermob, and Kettal. IKEA dominates the market in Europe. Fermob excels in metal furniture, achieving a 25% market share in residential applications, as stated in their performance metrics. Kettal plays a pivotal role in sustainable furniture, with a 30% share in eco-friendly segments, as highlighted in their financial disclosures. These players collectively drive innovation and shape the future of the outdoor furniture market globally.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Key players in the European outdoor furniture market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, IKEA launched a line of modular outdoor furniture in 2022, designed to cater to urban consumers seeking space-saving solutions, as outlined in their innovation roadmap. Fermob partnered with interior designers to promote its metal garden chairs, achieving a 20% increase in sales, as stated in their market strategy document. Kettal focused on expanding its sustainable furniture portfolio, investing €50 million to meet growing demand for eco-friendly options, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, IKEA launched a line of modular outdoor furniture, designed to cater to urban consumers seeking space-saving solutions.

- In June 2023, Fermob partnered with interior designers to promote its metal garden chairs, achieving a 20% increase in sales.

- In January 2024, Kettal acquired a startup specializing in recycled plastic furniture, aiming to expand its eco-friendly portfolio.

- In September 2023, Royal Botania collaborated with hotels to launch a line of commercial-grade outdoor furniture, enhancing its premium appeal.

- In November 2023, Gloster Furniture invested €50 million in expanding its teak wood furniture production facilities, focusing on sustainability.

MARKET SEGMENTATION

This research report on the Europe outdoor furniture market is segmented and sub-segmented into the following categories.

By Product

- Seating Sets

- Loungers

- Dining Sets

- Chairs

- Table

- Others

By Material

- Wood

- Plastic

- Metal

By End Use

- Commercial

- Residential

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth of the Europe outdoor furniture market from 2025 to 2033?

The Europe outdoor furniture market is expected to grow from USD 15.84 billion in 2025 to USD 26.77 billion by 2033, representing a Compound Annual Growth Rate (CAGR) of 6.78%.

2. What factors are driving the demand for outdoor furniture in Europe?

The market's growth is driven by increasing urbanization, rising disposable incomes, and a growing preference for alfresco living. Additionally, lifestyle changes and home improvement trends have led to a higher demand for functional and aesthetically pleasing outdoor spaces.

3. How is sustainability influencing the European outdoor furniture market?

There is a significant consumer shift towards sustainable and eco-friendly outdoor furniture. Approximately 45% of consumers prefer products made from recycled or renewable materials, such as polyethylene and reclaimed wood, aligning with Europe's environmental goals.

4. Which countries are the largest contributors to the European outdoor furniture market?

Germany, France, and Italy are the largest contributors to the European outdoor furniture market, driven by high urbanization rates and a strong culture of outdoor living.

5. What trends are shaping the future of the outdoor furniture market in Europe?

Trends such as the rise of "staycations," increased investment in home improvement, and a focus on creating functional and stylish outdoor spaces are shaping the market. Additionally, there is a growing demand for modular and space-saving designs, particularly among millennials.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]