Europe Orthopedic Braces and Support Market Size, Share, Trends & Growth Forecast Report By Product (Knee, Ankle, Hip, Spine, Shoulder, Neck, Elbow, Hand, Wrist), Category (Soft, Rigid, Hinged), Application (Ligament (ACL, LCL), Preventive, OA), Distribution (Pharmacies), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Orthopedic Braces and Support Market Size

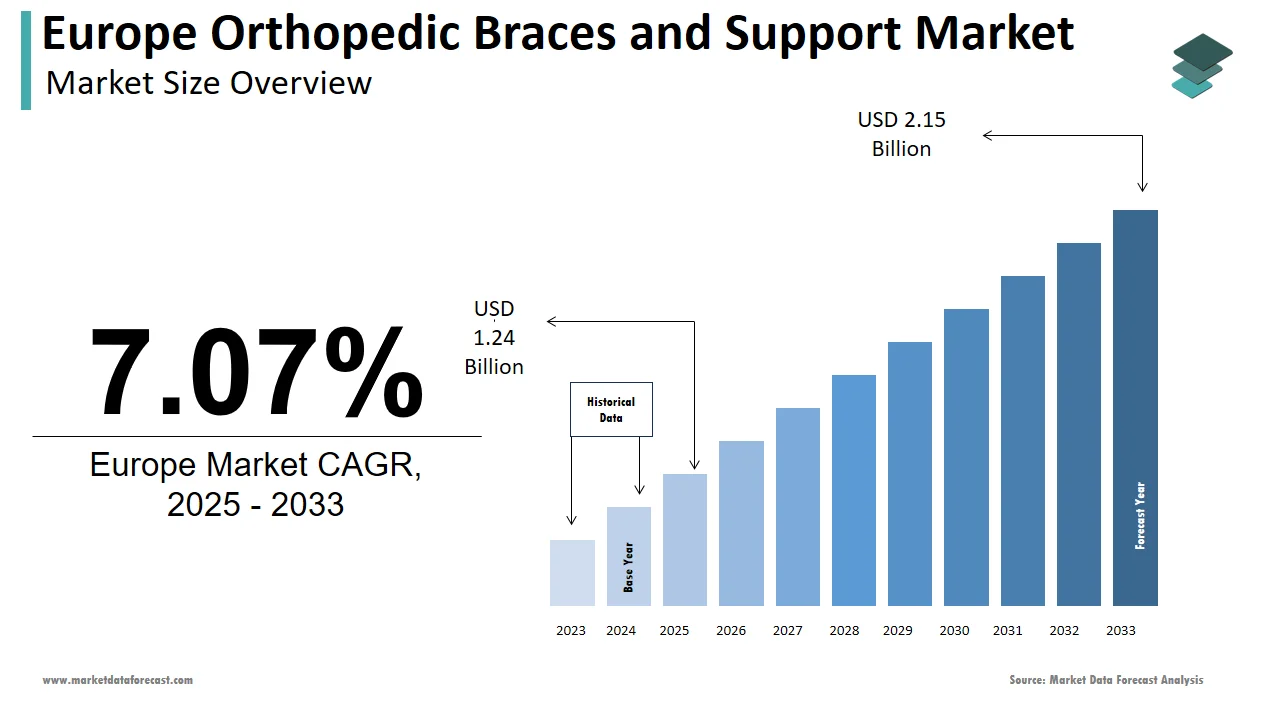

The orthopedic braces and support market size in Europe was valued at USD 1.16 billion in 2024. The European market is estimated to be worth USD 2.15 billion by 2033 from USD 1.24 billion in 2025, growing at a CAGR of 7.07% from 2025 to 2033.

The European orthopedic braces and support market growth is driven by an aging population and rising musculoskeletal disorders. According to Eurostat, over 20% of Europe's population is aged 65 or above is contributing significantly to the demand for orthopedic solutions. As per the World Health Organization, nearly 40% of Europeans suffer from chronic joint-related conditions that is propelling market growth. Reimbursement policies in countries like France and the UK further bolster accessibility to orthopedic devices.

MARKET DRIVERS

Aging Population and Chronic Diseases

Europe’s rapidly aging population is a pivotal driver, with over 20% of the population aged above 65. The rising aging population is increasing cases of osteoarthritis and other degenerative diseases, driving steady demand for orthopedic braces. According to the European Federation of Pharmaceutical Industries and Associations, musculoskeletal disorders account for 40% of all chronic diseases in the region. For instance, Germany alone reported 10 million cases of osteoarthritis in 2022. Additionally, governments across Europe are investing in geriatric care, which enhances accessibility to orthopedic solutions.

Sports Injuries and Rising Awareness

The growing number of sport injuries is ascribed to fuel the growth of the Europe orthopedic braces and support market. Athletes and fitness enthusiasts are increasingly adopting braces to prevent ligament injuries, particularly ACL tears, which account for 40% of all sports-related injuries. Furthermore, awareness campaigns by organizations like the European Society for Sports Traumatology have educated individuals about injury prevention is boosting brace adoption. Countries like the UK and Spain have witnessed a surge in recreational sports participation, further fueling demand.

MARKET RESTRAINTS

High Costs and Limited Accessibility

The high cost of advanced orthopedic braces acts as a significant restraint is limiting accessibility for low-income groups. In countries like Italy and Spain, where healthcare budgets are constrained, reimbursement policies often fail to cover expensive devices, further exacerbating affordability issues. As per a study by the European Alliance for Access to Safe Medicines, only 30% of patients receive full reimbursement for orthopedic supports. This financial barrier restricts market penetration in rural areas where disposable incomes are lower. Consequently, the inability to afford high-quality braces hinders widespread adoption is posing a challenge to market growth.

Stringent Regulatory Framework

Stringent regulatory requirements also impede market progress, as manufacturers face prolonged approval processes. The European Medical Device Regulation (MDR) mandates rigorous testing and certification is delaying product launches. According to the European Federation of Pharmaceutical Industries, compliance costs have risen by 25% since the MDR’s implementation in 2021. Smaller companies struggle to meet these demands by leading to reduced innovation and slower market entry. Furthermore, frequent updates to regulatory standards create uncertainty by discouraging investment.

MARKET OPPORTUNITIES

Technological Advancements

Innovations in materials and design present a significant opportunity for the European orthopedic braces market. Lightweight, durable materials like carbon fiber and advanced polymers are gaining traction by offering enhanced comfort and performance. According to the European Technology Platform on Smart Systems Integration, these innovations reduce production costs by 15% is making braces more affordable. Germany and France are at the forefront, with the German Orthopaedic Association noting a 20.1% rise in smart brace sales in 2022. Such advancements not only improve patient outcomes but also open new revenue streams is positioning technology as a key growth driver.

Expansion into Emerging Markets

Eastern European nations, including Poland and Romania, offer untapped potential due to improving healthcare infrastructure and rising disposable incomes. The Polish Ministry of Health reports a 25% increase in orthopedic device imports during this period, reflecting growing demand. Companies expanding into these markets can capitalize on partnerships with local distributors and government initiatives promoting preventive healthcare.

MARKET CHALLENGES

Patient Non-Compliance

Patient non-compliance poses a significant challenge, as many individuals fail to adhere to prescribed brace usage. According to a study by the European Society for Patient Safety, approximately 30% of patients discontinue brace use within the first month due to discomfort or inconvenience. This issue is particularly prevalent among younger users, who prioritize aesthetics and mobility over medical recommendations. Manufacturers must address these concerns by designing more user-friendly products that balance functionality with comfort. Overcoming non-compliance is essential to maximizing market penetration and achieving desired health outcomes.

Supply Chain Disruptions

Supply chain disruptions, exacerbated by geopolitical tensions and pandemics, threaten market stability. Raw material shortages for specialized fabrics and polymers, have driven up costs, impacting profit margins. The German Mechanical Engineering Industry Association reports that 40% of orthopedic device manufacturers faced delays in sourcing critical components last year. These disruptions hinder timely delivery is eroding customer trust and market share. To mitigate risks, companies are exploring localized manufacturing and diversifying suppliers. Addressing these vulnerabilities is crucial for sustaining growth and ensuring consistent product availability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Category, Application, Distribution, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

3M (US), Essity (Sweden), DJO LLC (US), Ossur HF (Iceland), Breg Inc. (US), Bauerfeind AG (Germany), Devicor Medical Products Inc. (Leica Biosystems) (Germany), Hologic Inc. (US), Argon Medical Devices (US), Zimmer Biomet (US), Ottobock Healthcare (Germany), Thuasne (France), ALCARE Co. Ltd (Japan), Nippon Sigmax (Japan), Bird & Cronin (US), DeRoyal Industries (US), medi GmbH (Germany), Foundation Wellness (US), and others. |

SEGMENTAL ANALYSIS

By Product Insights

The knee braces segment captured the largest share of the European orthopedic braces market in 2024, accounting for 35.5%, driven by the high prevalence of knee-related conditions such as osteoarthritis, which affects 10% of adults over 60, as per the European League against Rheumatism. The demand is further fueled by advancements in knee brace technology, such as lightweight materials and adjustable designs by enhancing user comfort. Government initiatives promoting preventive care also play a role, with the French Ministry of Health allocating €50 million annually to orthopedic device subsidies.

The ankle braces segment is likely to register a CAGR of 9.5% throughout the forecast period. This rapid growth is driven by increasing sports participation in soccer and basketball, which are prone to ankle sprains. The Spanish Sports Injury Center reports a 20% annual rise in ankle injuries among athletes. Moreover, innovations in hinged ankle braces are offering superior stability, have gained traction, with an increase in sales. Governments are also prioritizing injury prevention, with the UK launching awareness campaigns targeting youth sports safety.

By Category Insights

The soft braces command segment was the largest by capturing 45.4% of the European orthopedic braces market share in 2024. Their dominance is attributed to their versatility and comfort by making them suitable for mild to moderate conditions. According to the German Orthopaedic Association, soft braces are preferred for preventive care, with usage increasing by 18% annually. Additionally, advancements in breathable materials have enhanced patient compliance is addressing discomfort concerns. Governments across Europe, including Italy and Spain, provide subsidies for soft braces that is enhancing the growth of the segment.

The hinged braces segment is likely to register a CAGR of 10.2% in the next coming years. Their ability to provide superior joint stability appeals to athletes recovering from ligament injuries, such as ACL tears. Technological innovations, including customizable hinges and shock-absorbing features, have boosted adoption. Furthermore, partnerships between manufacturers and sports organizations have expanded market reach.

By Application Insights

The ligament braces, particularly for ACL and LCL injuries segment dominated the Europe orthopedic braces and support market with an estimated share of 40.2% in 2024. The prevalence of ligament injuries is high, with the British Sports Medicine Journal reporting 100,000 ACL tears annually in Europe. Sports like soccer and skiing contribute significantly, with Switzerland and Austria witnessing a prominent rise in such cases. Advanced designs are offering targeted support and flexibility, enhance usability is driving the growth of the market. Government-funded rehabilitation programs further promote adoption is ensuring sustained growth.

The preventive braces segment is likely to register a prominent CAGR of 11.3% in the next coming years. Increasing awareness of preventive healthcare, coupled with rising sports participation, fuels demand. The Italian Sports Medicine Association notes a 30% annual increase in preventive brace usage among amateur athletes. Innovations in lightweight, breathable materials have improved comfort, encouraging prolonged use. Public health campaigns, such as those by the UK Department of Health, emphasize injury prevention, further boosting adoption.

COUNTRY LEVEL ANALYSIS

Germany led the European orthopedic braces and support market in 2024, accounting for 28.7% of the total market share. The country’s advanced healthcare infrastructure, high prevalence of chronic musculoskeletal conditions, and robust reimbursement policies. The demand for orthopedic solutions remains consistently high with over 10 million osteoarthritis cases reported in 2022, according to the German Orthopaedic Association. Additionally, government initiatives promoting preventive care and injury rehabilitation further amplify adoption rates. The presence of leading manufacturers like Bauerfeind AG also strengthens Germany’s dominance by ensuring accessibility to cutting-edge products.

Spain is swiftly emerging with a CAGR of 10.5% throughout the forecast period. This growth is fueled by rising sports injuries among amateur athletes, and increasing investments in healthcare infrastructure. Furthermore, awareness campaigns targeting injury prevention have resonated with younger demographics is boosting demand for preventive braces.

France and Italy are anticipated to witness steady growth, supported by aging populations and advancements in orthopedic technology. Brace adoption is expected to increase by supportive government policies. Similarly, Italy’s focus on geriatric care and technological innovation ensures sustained market expansion.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe orthopedic braces and support market profiled in this report are 3M (US), Essity (Sweden), DJO LLC (US), Ossur HF (Iceland), Breg Inc. (US), Bauerfeind AG (Germany), Devicor Medical Products Inc. (Leica Biosystems) (Germany), Hologic Inc. (US), Argon Medical Devices (US), Zimmer Biomet (US), Ottobock Healthcare (Germany), Thuasne (France), ALCARE Co. Ltd (Japan), Nippon Sigmax (Japan), Bird & Cronin (US), DeRoyal Industries (US), medi GmbH (Germany), Foundation Wellness (US), and others.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the European orthopedic braces and support market employ diverse strategies to maintain competitiveness and drive growth. A primary focus is on research and development , with companies investing heavily in innovative materials and smart technologies. For instance, DJO Global and Össur have launched products integrating IoT-enabled sensors for real-time monitoring, addressing patient compliance issues. Strategic partnerships and collaborations are another critical strategy, enabling firms to expand their geographic reach and enhance product portfolios. Companies like Bauerfeind AG have partnered with hospitals and clinics across Europe to promote preventive care solutions. Additionally, geographic expansion into emerging markets, such as Eastern Europe, has become a priority, as these regions offer untapped potential due to improving healthcare systems.

COMPETITION OVERVIEW

The European orthopedic braces and support market is characterized by intense competition, with a mix of global giants and regional players vying for market share. Leading companies like DJO Global, Össur, and Bauerfeind AG are leveraging their strong brand recognition and extensive distribution networks. Smaller firms, however, are gaining ground by focusing on niche segments, such as customizable or eco-friendly braces, catering to specific consumer needs. Innovation remains a key differentiator, with manufacturers racing to introduce advanced designs and materials that enhance comfort and functionality. Strategic mergers and acquisitions are also prevalent by enabling companies to consolidate their positions and expand their product offerings.

TOP 5 MAJOR ACTIONS BY KEY COMPANIES

- In April 2023, DJO Global launched a smart knee brace with real-time monitoring capabilities by enhancing user experience.

- In June 2023, Ossur acquired a German startup specializing in 3D-printed braces by expanding its product portfolio.

- In August 2023, Bauerfeind AG partnered with Italian hospitals to promote preventive care solutions.

- In October 2023, Medi GmbH introduced eco-friendly materials by targeting sustainability-conscious consumers.

- In December 2023, Thuasne Group invested €20 million in R&D to develop next-gen hinged braces.

MARKET SEGMENTATION

This Europe orthopedic braces and support market research report is segmented and sub-segmented into the following categories.

By Product

- Knee

- Ankle

- Hip

- Spine

- Shoulder

- Neck

- Elbow

- Hand

- Wrist

By Category

- Soft

- Rigid

- Hinged

By Application

- Ligament (ACL, LCL)

- Preventive

- OA

By Distribution

- Pharmacies

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the European orthopedic braces and support market?

The market growth is driven by an aging population, rising musculoskeletal disorders, increased sports injuries, and advancements in brace technology

2. What challenges does the orthopedic braces and support market face in Europe?

High costs, limited reimbursement policies, stringent regulations, and patient non-compliance are key challenges limiting market accessibility and adoption.

3. Which segment holds the largest share in the European market?

Knee braces lead the market with 35.5% share, driven by osteoarthritis prevalence and technological innovations enhancing user comfort

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]