Europe Orthodontic Supplies Market Size, Share, Trends & Growth Forecast Report By Product, Patients & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033.

Europe Orthodontic Supplies Market Size

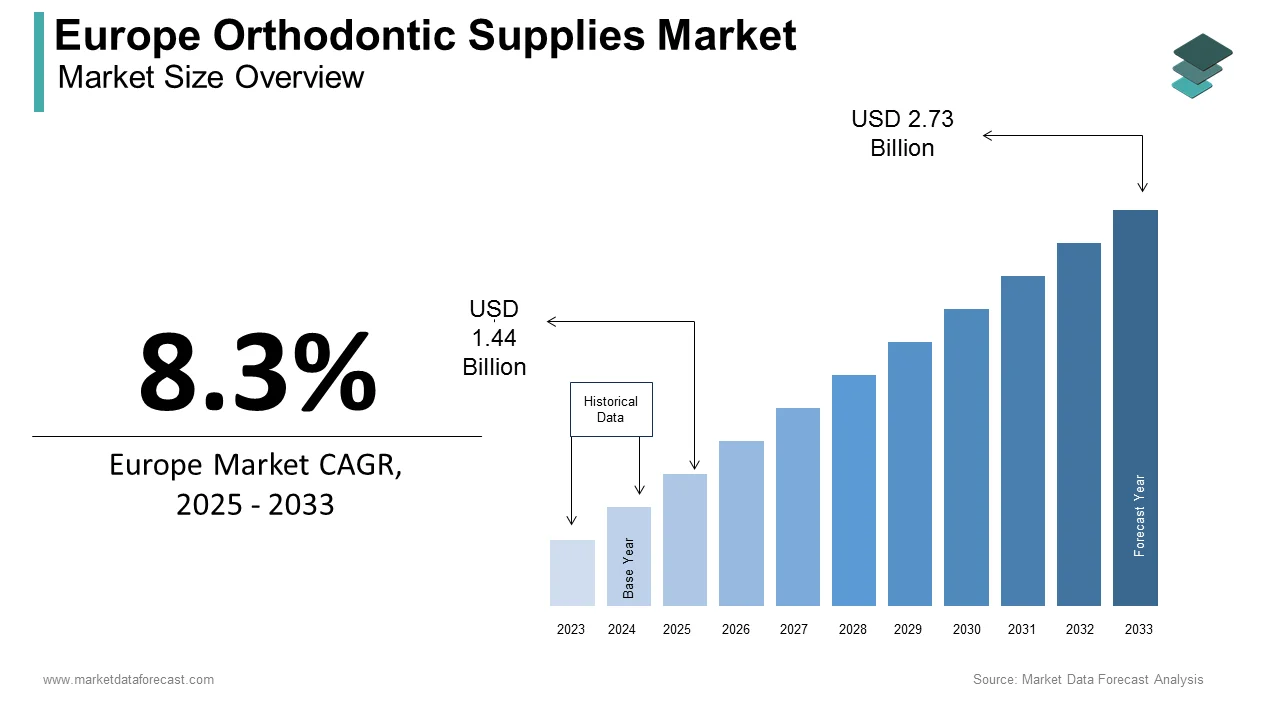

The orthodontic supplies market size in Europe was valued at USD 1.33 billion in 2024. The European market is estimated to grow at a CAGR of 8.3% from 2025 to 2033 and be worth USD 2.73 billion by 2033 from USD 1.44 billion in 2025.

Orthodontic supplies are products and tools used in the diagnosis, prevention, and correction of dental irregularities, including misaligned teeth and jaws. The growing prevalence of malocclusion and rising awareness about dental aesthetics are key factors driving the demand for these products. According to the World Health Organization, malocclusion affects nearly 20% of the global population, with Europe accounting for a significant share due to its high dental care access and awareness levels. Moreover, advancements in orthodontic technologies, such as clear aligners and self-ligating brackets, have revolutionized treatment options, offering greater convenience and aesthetic appeal. Countries like Germany, the UK, and France dominate the market due to their well-developed healthcare systems, high disposable incomes, and widespread adoption of modern orthodontic treatments. The British Orthodontic Society highlights that nearly 75% of orthodontic patients in the UK are adolescents, reflecting strong demand in this demographic.

MARKET DRIVERS

Increasing Prevalence of Malocclusion and Orthodontic Disorders

The rising prevalence of malocclusion and orthodontic disorders is a primary driver of the Europe orthodontic supplies market. According to the World Health Organization, nearly 20% of the global population suffers from malocclusion, with a notable portion of cases requiring orthodontic intervention. In Europe, the high rate of dental consultations and access to advanced healthcare services further highlights the demand for orthodontic treatments. The European Journal of Orthodontics reports that approximately 35% of adolescents in Western Europe undergo orthodontic care. This widespread need for corrective procedures significantly drives the adoption of orthodontic supplies such as braces, aligners, and retainers across the region.

Growing Demand for Aesthetic Orthodontic Solutions

The increasing focus on dental aesthetics and the rising demand for discreet orthodontic treatments are major drivers of the market. Products like clear aligners and ceramic brackets have gained popularity due to their minimal visibility and comfort, especially among adults seeking orthodontic care. According to the British Orthodontic Society, 80% of orthodontists in the UK reported a rise in adult patients seeking treatment in 2022. This trend underscores the growing preference for aesthetic solutions, driving innovation and adoption of advanced orthodontic supplies. Manufacturers focusing on aesthetic products are well-positioned to capitalize on this demand, contributing to the market's growth.

MARKET RESTRAINTS

High Cost of Orthodontic Treatments and Supplies

The high cost of orthodontic treatments and supplies remains a significant restraint in the Europe orthodontic supplies market. Advanced orthodontic solutions, such as clear aligners and self-ligating braces, are expensive, with treatment costs ranging between €2,000 and €8,000 depending on complexity. According to Eurostat, approximately 21.7% of Europeans were at risk of poverty or social exclusion in 2022, making these treatments inaccessible for many. Public healthcare systems in certain countries provide limited coverage for orthodontic care, especially for adults, further limiting affordability. This financial barrier hinders market penetration, particularly in low-income and underserved regions, reducing access to orthodontic solutions.

Limited Availability of Skilled Orthodontists

The shortage of skilled orthodontists across parts of Europe is another critical restraint for the orthodontic supplies market. According to the European Federation of Orthodontics, there is an uneven distribution of orthodontists, with a higher concentration in urban areas and a scarcity in rural regions. For example, countries in Eastern Europe face challenges in accessing specialized orthodontic care due to a lack of training facilities and professionals. This disparity limits the adoption of orthodontic treatments in underserved areas, restricting market growth. Addressing this issue requires significant investment in orthodontic education and training programs to expand the availability of qualified professionals across the region.

MARKET OPPORTUNITIES

Growing Adoption of Digital Orthodontics

The rising adoption of digital orthodontics presents a significant opportunity for the Europe orthodontic supplies market. Advanced technologies like 3D printing, intraoral scanners, and computer-aided design/computer-aided manufacturing (CAD/CAM) systems are transforming orthodontic workflows. The European Federation of Orthodontics notes that digital tools enhance precision and reduce treatment times, leading to better patient outcomes. For example, 3D-printed aligners allow for customized and efficient production, catering to the growing demand for aesthetic and personalized solutions. With the digital dentistry market in Europe projected to grow steadily, manufacturers and clinics investing in digital orthodontics can enhance operational efficiency and capitalize on this technological shift.

Expanding Demand for Pediatric Orthodontic Care

The increasing focus on early orthodontic intervention offers substantial growth potential for the market. Pediatric orthodontic care aims to address dental issues during developmental stages, reducing the need for complex treatments later. According to the British Orthodontic Society, approximately 33% of children in the UK undergo orthodontic assessments by age 12, reflecting a strong demand for pediatric orthodontic supplies. Governments and healthcare organizations across Europe are emphasizing the importance of preventive dental care, including subsidies for orthodontic treatments in children. This trend creates an opportunity for suppliers of traditional and advanced products, such as brackets and aligners, to meet the needs of this growing demographic.

MARKET CHALLENGES

Regulatory Complexities and Approval Processes

Stringent regulatory requirements and lengthy approval processes pose significant challenges for the Europe orthodontic supplies market. Orthodontic products must comply with the European Union’s Medical Device Regulation (MDR), which enforces strict standards for safety and performance. According to the European Commission, the MDR implementation in 2021 increased compliance costs for manufacturers by up to 10-15%. Smaller companies face difficulties navigating these regulations, leading to delayed product launches and reduced market competitiveness. This challenge is particularly significant for innovative products, such as clear aligners and digital orthodontic solutions, which must undergo rigorous testing and certification to enter the market.

Uneven Access to Orthodontic Care Across Europe

Unequal access to orthodontic care across different European regions hinders the market’s growth potential. While Western European countries like Germany and France have well-developed healthcare systems, Eastern Europe faces challenges due to limited infrastructure and financial resources. The European Federation of Orthodontics highlights that rural areas in countries such as Romania and Bulgaria have significantly fewer orthodontic clinics compared to urban centers. This disparity limits the adoption of orthodontic supplies in underserved regions, where many individuals lack access to essential dental care. Bridging these gaps requires targeted investments in infrastructure and awareness campaigns to ensure equitable orthodontic care across Europe.

SEGMENT ANALYSIS

By Product Insights

REGIONAL ANALYSIS

Germany was the leading market for orthodontic supplies in Europe in 2024 and the lead of Germany is majorly attributed to its advanced healthcare infrastructure and high adoption of orthodontic treatments. According to the German Dental Association, nearly 35% of adolescents receive orthodontic care, reflecting strong demand for braces, aligners, and related products. The country’s focus on integrating digital technologies, such as 3D printing and intraoral scanners, enhances precision and efficiency in orthodontic practices. Germany also benefits from robust public and private healthcare systems, which subsidize orthodontic care for children and adolescents. These factors, combined with high disposable income, position Germany as a top-performing market in the region.

The UK ranks among the leading markets for orthodontic supplies in Europe. The growth of the UK market is driven by increasing awareness of dental aesthetics and strong healthcare access. According to the British Orthodontic Society, nearly 75% of orthodontic patients in the UK are adolescents, highlighting substantial demand for traditional braces and aligners. Additionally, the rise in adult orthodontic treatments, fueled by the popularity of clear aligners, supports market growth. The UK’s robust dental infrastructure, along with its public healthcare system, provides significant support for orthodontic care, particularly for younger patients. This combination of aesthetic demand and healthcare access reinforces the UK’s leading position in the orthodontic supplies market.

France is a key player in the Europe orthodontic supplies market. The comprehensive healthcare policies of France and a strong emphasis on preventive dental care are propelling the French market growth. The French National Health Insurance system partially reimburses orthodontic treatments for individuals under 16, driving high adoption rates for braces and retainers among children and teenagers. The French Dental Association reports that nearly 30% of adolescents undergo orthodontic treatments, creating a sustained demand for orthodontic supplies. Additionally, France’s growing adult orthodontic segment, driven by clear aligners and aesthetic solutions, further bolsters the market. This combination of public support and evolving consumer preferences cements France’s position as a top market in Europe.

KEY MARKET PLAYERS

Companies playing a pivotal role in the European orthodontic supplies market profiled in this report are Align Technology Inc., Danaher Corporation, Henry Schein, Inc., DENTSPLY International, Inc., Dentaurum GmbH & Co. KG, and TP Orthodontics, Inc. are some of the other key players in this market.

MARKET SEGMENTATION

This research report on the European orthodontic supplies market has been segmented and sub-segmented into the following categories.

By Product

- Fixed Supplies

- Removable Supplies

- Adhesives

By Patients

- Children & Adolescents

- Adults

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]