Europe Organic Food and Beverages Market Size, Share, Trends & Growth Forecast Report By Product (Organic Food, Organic Beverages), Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Organic Food and Beverages Market Size

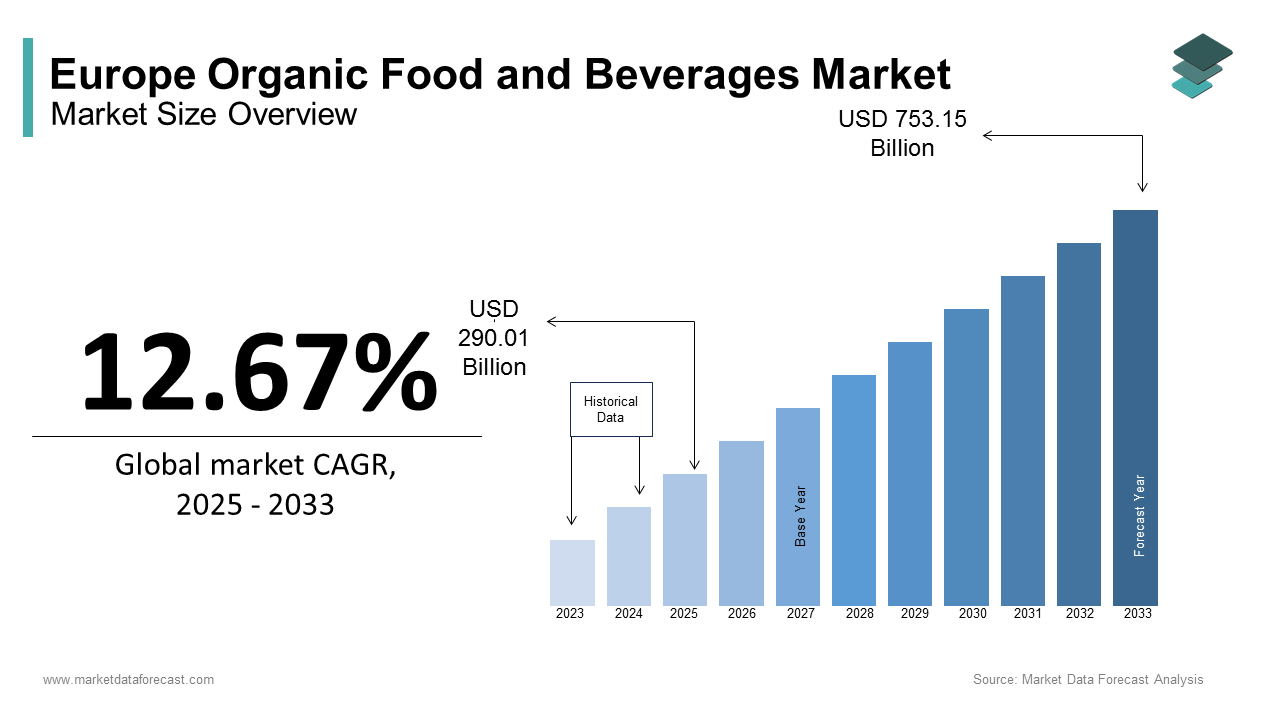

The Europe organic food and beverages market size was calculated to be USD 257.40 billion in 2024 and is anticipated to be worth USD 753.15 billion by 2033 from USD 290.01 billion in 2025, growing at a CAGR of 12.67% during the forecast period.

The organic food and beverages market in Europe has attained significant traction, supported by growing consumer focus on health and environmental sustainability. According to FiBL, the region represented nearly 23% of the world’s organic farmland in 2021, reflecting its central role in global organic agriculture. The market is further shaped by rigorous standards, notably the EU Organic Regulation, which governs production practices and quality assurance. Germany remains the leading consumer, recording over €15 billion in retail sales in 2021, based on data from the Research Institute of Organic Agriculture. Additional demand drivers include increasing urbanization and the rise of digital platforms specializing in organic grocery distribution. However, structural challenges persist; notably, Eurostat reported an 8% decline in organic crop yields in 2020 due to adverse weather conditions. Overall, the market demonstrates maturity while continuing to evolve in response to shifting environmental and consumer dynamics

MARKET DRIVERS

Health-Conscious Consumerism

Health-consciousness plays a central role in driving the European organic food and beverages market, particularly among millennials and Gen Z, who allocate more of their spending to organic products than older generations. The rising prevalence of chronic conditions, such as obesity and diabetes, has further spurred demand. The World Health Organization reports that nearly 60% of Europeans are overweight, highlighting the growing inclination towards healthier eating habits. Organic foods, being free from synthetic pesticides, appeal to consumers concerned about food safety. Retailers are adapting by expanding their organic offerings, while governments, such as France’s National Organic Plan, aim to designate at least 18% of agricultural land to organic farming by 2027, supporting supply growth to meet consumer demand.

Sustainability and Environmental Awareness

Sustainability continues to be a key market driver. According to the European Commission, 77% of Europeans are willing to pay a premium for environmentally friendly products. Organic farming methods, which lower carbon emissions compared to conventional farming, resonate strongly with environmentally aware consumers, particularly amidst growing climate change concerns. Additionally, the EU Green Deal sets an ambitious goal of a 25% share of organic farming by 2030, offering incentives to producers. Major retailers, including Carrefour, have responded by creating dedicated organic sections, which have contributed to a 40% increase in sales. The biodiversity benefits of organic farming also strengthen demand, with organic farms hosting 30% more species than their conventional counterparts, as noted by FiBL. These trends reflect the increasing alignment between consumer preferences and organic products.

MARKE RESTRAINTS

High Production Costs

High production costs remain a substantial barrier to the growth of the European organic food and beverages market. Organic farming, as noted by Eurostat, requires more labor-intensive methods than conventional agriculture. The prohibition of synthetic fertilizers and pesticides in organic farming necessitates manual interventions, driving up operational expenses. These higher costs often result in premium pricing, which limits accessibility for price-sensitive consumers. Additionally, economies of scale are constrained, especially for smaller producers. In Poland, for instance, a large portion of organic farmers operate on small plots of land, hindering cost efficiencies. These financial challenges restrict the broader adoption of organic products, despite increasing demand.

Limited Supply Chain Infrastructure

The organic market is also hindered by insufficient supply chain infrastructure. The transportation of perishable organic goods demands specialized cold chain systems, which are notably underdeveloped in rural areas. Romania, for example, experiences significant annual losses in organic produce due to inadequate storage facilities, as reported by the Romanian Ministry of Agriculture. Furthermore, the lengthy certification processes, averaging six months, delay market entry for new players, according to FiBL. Fragmented distribution networks compound the problem, with approximately 70% of organic farmers relying on local markets, which limits their reach to urban areas where demand is strongest. These logistical and certification bottlenecks restrict the market's scalability, despite rising consumer interest.

MARKET OPPORTUNITIES

Expansion of E-Commerce Platforms

The rise of e-commerce platforms represents a significant growth opportunity for the European organic food and beverages market. Online grocery sales experienced a surge during the pandemic, as reported by McKinsey, with organic products seeing an increase in digital transactions. Leading platforms such as Amazon Fresh and Ocado have expanded their organic offerings to meet the demands of tech-savvy consumers. For example, Ocado reported a 50% year-over-year increase in organic product orders in 2022. This trend is further supported by government initiatives aimed at enhancing digital infrastructure, such as the UK’s Digital Strategy, which promotes online retail development. Additionally, subscription-based models, exemplified by services like HelloFresh offering organic meal kits, are gaining popularity. These innovations align with consumer preferences for convenience, positioning e-commerce as a pivotal growth driver.

Growing Demand for Plant-Based Organic Products

The increasing popularity of plant-based diets provides another substantial opportunity for market expansion. According to ProVeg International, plant-based organic sales in Europe grew by 28% in 2021, fueled by the rise of vegan and flexitarian lifestyles. Retailers are responding to this shift; Lidl, for instance, launched a dedicated organic plant-based range, resulting in notable sales growth. Government policies also support this dietary change, with France’s National Nutrition Health Program advocating for plant-based consumption. Moreover, the introduction of organic plant-based snacks, such as gluten-free crackers, is attracting health-conscious consumers, further accelerating market growth

MARKET CHALLENGES

Regulatory Compliance Complexity

egulatory compliance continues to pose a considerable obstacle in the European organic food and beverages market. The EU Organic Regulation enforces strict certification protocols, which can extend up to nine months, according to FiBL. Failure to comply may result in financial penalties or exclusion from the market, discouraging smaller enterprises. In 2021, Italy experienced a decline in new organic certifications due to procedural difficulties. Cross-border trade adds further complexity, as differing national standards lead to inconsistencies. A report by the European Court of Auditors revealed that organic imports frequently fail initial inspections, causing shipment delays. Moreover, frequent policy revisions require ongoing adjustments. The UK’s post-Brexit organic certification framework now diverges from EU requirements, creating uncertainty for exporters. These regulatory challenges consume resources and hinder broader market participation.

Climate Change Impact on Yields

The impact of climate change presents a growing concern for organic crop yields, disrupting market stability. Data from the European Environment Agency indicates that extreme weather events in 2022 significantly reduced organic production. Drought conditions in Spain contributed to a 2% decline in organic olive oil output, as reported by the Spanish Ministry of Agriculture. Due to their reliance on natural methods, organic farms are especially susceptible to climatic variability. Increased temperatures are also intensifying pest outbreaks. Although adaptation techniques such as agroforestry are available, adoption remains limited, with uptake at only 10%. These disruptions pose risks to supply consistency, potentially undermining consumer confidence and restraining market expansion

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.67% |

|

Segments Covered |

By Product, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Danone, Nestlé S.A., The Hain Celestial Group, General Mills Inc., Amys Kitchen Inc., Organic Valley, Hipp GmbH & Co. Vertrieb KG, Bjorg Bonneterre et Compagnie, Green & Blacks, Alnatura Produktions- und Handels GmbH |

SEGMENTAL ANALYSIS

By Product Insights

The organic food segment dominated the Europe organic food and beverages market by holding a 65% market share in 2024. This prominence is supported by a wide array of offerings, including fruits, vegetables, and dairy products. Consumer preference for organic staples such as bread and pasta continues to sustain demand. Retail chains like Aldi and Lidl have broadened their organic selections, improving availability across regions. Public sector support also contributes to growth; in 2022, France allocated €1.1 billion to promote organic agriculture. Urbanization plays a significant role, with metropolitan areas like London registering a notable increase in organic food purchases. Collectively, these drivers establish organic food as the foundation of the regional market.

Organic beverages exhibit the fastest growth, with a CAGR of 12.5% from 2025 to 2033. This is largely attributed to rising consumption of organic teas and juices, especially among health-conscious millennials. Product innovations, including organic kombucha and plant-based milk alternatives, continue to attract younger demographics. Retailers such as Rewe have launched private-label organic beverages, enhancing affordability and access. Public health initiatives, including the UK’s Healthy Drinks Campaign, further encourage adoption. With a growing share of European consumers willing to transition to organic beverage options, this segment is well-positioned for sustained and rapid expansion.

By Distribution Channel Insights

Specialty stores led the Europe organic food and beverages market in 2024, securing a 55.2% market share. Their ability to curate premium organic products appeals to quality-conscious consumers. These outlets also deliver personalized services, including organic cooking classes, fostering stronger customer retention. Public policy measures, such as tax benefits for independent retailers, further reinforce their competitive edge. These factors collectively position specialty stores as the primary distribution channel in the regional organic market.

Convenience stores represent the fastest-expanding distribution channel, recording a CAGR of 10.2% over the forecast period. Their widespread urban presence and extended operating hours meet the needs of time-constrained consumers. Retailers such as Spar have integrated organic snack sections, encouraging impulse purchases. As disposable income levels rise, consumers increasingly value convenience over cost considerations. Given that 70% of the European population resides in urban areas, the accessibility of convenience stores is a key driver of this segment’s growth trajectory.

REGIONAL ANALYSIS

Germany accounted for 27.3% of the Europe organic food and beverages market in 2024, establishing its position as the region’s leading contributor. This prominence is supported by a comprehensive regulatory framework and high levels of consumer engagement. The National Organic Action Plan targets a 30% share of organic farmland by 2030, reinforcing long-term growth. Major urban centers such as Berlin, Munich, and Hamburg are key consumption hubs, with retail sales surpassing €15 billion in 2022. The growth is further advanced through specialty retailers and digital grocery platforms. Germany’s strategic focus on sustainability and health-conscious consumption continues to align with market demand, sustaining its leadership.

Spain is projected to record the fastest growth in the region, with a CAGR of 11.8% from 2025 to 2033. Increasing public awareness of health and nutrition, particularly in metropolitan areas like Madrid and Barcelona, is a major demand driver. Organic olive oil remains a key export product, with volumes rising as of 2021. Supportive policy measures and favorable agricultural conditions have accelerated local production. The Spanish Organic Farming Plan seeks to double the area under organic cultivation by 2025. Additionally, Spain’s geographic positioning strengthens its role as a key exporter to other European markets, enhancing its regional and international relevance.

France and Italy are expected to maintain steady expansion. Growth in France is encouraged by premium product preferences and policies under the National Nutrition Health Program. Italy benefits from its established agricultural base and strong emphasis on exports. In the UK, post-Brexit regulatory divergence presents ongoing challenges; however, consumer interest remains strong, especially in cities like London and Manchester. Leading retailers, including Tesco and Sainsbury’s, continue to expand their organic product lines, supporting consistent market development despite evolving trade conditions.

LEADING PLAYERS IN THE MARKET

Danone

Danone is a dominant player in the Europe organic food and beverages market. Its Actimel and Alpro brands are household names, catering to diverse consumer needs. The company focuses heavily on plant-based innovations, with Alpro experiencing an annual growth in sales in 2022, as reported by Euromonitor. Danone’s commitment to sustainability is evident in its “One Planet. One Health” initiative, which emphasizes regenerative agriculture and carbon neutrality. By partnering with local organic farmers, Danone ensures a consistent supply chain while supporting rural economies.

Nestlé

Nestlé is leveraging its Garden Gourmet line to capture the organic and plant-based segment. The company invests heavily in R&D, launching innovative products like plant-based burgers and dairy-free ice creams. Strategic partnerships with European organic farms ensure sustainable sourcing, while acquisitions like Kraft Heinz’s natural cheese line expand its footprint. Nestlé’s focus on reducing plastic packaging aligns with consumer values, enhancing brand loyalty.

Unilever

Unilever with Knorr Organic being a key contributor. The company prioritizes sustainability, aiming to achieve net-zero emissions by 2039. Unilever’s organic portfolio includes teas, soups, and plant-based spreads, targeting health-conscious consumers. Initiatives like blockchain tracing enhance transparency, allowing consumers to verify the origins of their purchases. Unilever’s aggressive marketing campaigns and collaborations with retailers like Carrefour and Tesco ensure widespread distribution, strengthening its position as a market leader.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe organic food and beverages market employ a variety of strategies to strengthen their positions and drive growth. Product innovation is a cornerstone strategy, with companies investing heavily in R&D to launch novel products that cater to evolving consumer preferences. For instance, Danone’s development of plant-based yogurt alternatives and Nestlé’s introduction of vegan snacks highlight their commitment to meeting demand for healthier and sustainable options. Partnerships with local organic farmers are another critical strategy, ensuring a reliable supply chain while supporting small-scale producers. Acquisitions play a pivotal role in market consolidation; for example, Unilever’s acquisition of a plant-based beverage startup expanded its portfolio and enhanced its competitive edge. Additionally, sustainability initiatives, such as zero-waste campaigns and carbon-neutral certifications, resonate with environmentally conscious buyers. Finally, digital transformation through e-commerce platforms and blockchain technology improves accessibility and transparency, fostering consumer trust and loyalty.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe organic food and beverages market include Danone, Nestlé S.A., The Hain Celestial Group, General Mills Inc., Amys Kitchen Inc., Organic Valley, Hipp GmbH & Co. Vertrieb KG, Bjorg Bonneterre et Compagnie, Green & Blacks, Alnatura Produktions- und Handels GmbH

The Europe organic food and beverages market is characterized by intense competition, with a mix of multinational corporations and niche players vying for market share. Large corporations like Danone, Nestlé, and Unilever dominate the landscape, leveraging their extensive resources and economies of scale to maintain leadership. These companies invest heavily in branding, sustainability, and innovation, setting high standards for quality and consumer engagement. Niche players, on the other hand, focus on specialization, offering unique products tailored to specific demographics or dietary preferences. For instance, smaller brands like Bio c’Bon and Alnatura cater to premium segments, emphasizing organic certification and ethical sourcing. Regulatory compliance also plays a significant role in shaping competition, as stringent EU standards ensure product quality but pose barriers for new entrants. Retailers like Aldi, Lidl, and Carrefour further intensify competition by launching private-label organic products at competitive prices. Despite these challenges, the market’s fragmented nature fosters innovation and collaboration, driving overall growth. Consumer demand for transparency and sustainability continues to influence competitive dynamics, ensuring a dynamic and evolving marketplace.

RECENT HAPPENINGS IN THE MARKET

- In June 2023, Nestlé partnered with German farmers to source organic raw materials, ensuring sustainable practices and reducing carbon footprints.

- In January 2023, Bio c’Bon expanded its stores across France, increasing accessibility to organic products in suburban and rural areas.

MARKET SEGMENTATION

This research report on the Europe Organic Food and Beverages Market has been segmented and sub-segmented based on product, distribution channel, and region.

By Product

- Organic Food

- Organic Beverages

By Distribution Channel

- Specialty Stores

- Convenience Stores

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the main drivers of growth in this market?

Key drivers include rising health awareness, increasing environmental concerns, government support for organic farming, and growing demand for clean-label products.

2. Which countries in Europe have the largest market share?

Germany, France, Italy, and the United Kingdom are among the top countries with the highest consumption and production of organic food and beverages.

3. Who are the key players in the market?

Major players include Danone, Nestlé S.A., The Hain Celestial Group, General Mills Inc., Amy’s Kitchen Inc., Organic Valley, and Alnatura Produktions- und Handels GmbH.

4. How is the European Union supporting organic agriculture?

The EU supports organic farming through financial subsidies, the Common Agricultural Policy (CAP), and the European Green Deal, aiming to increase the share of organic farming land.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]