Europe Open RAN Market Research Report – Segmented By Component(hardware, software ) Unit ( radio units, distributed units ) Deployment ( private cloud deployments, Hybrid cloud deployments) Network ( 4G networks,5G networks) Frequency ( sub-6 GHz, mmWave frequencies) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Open RAN Market Size

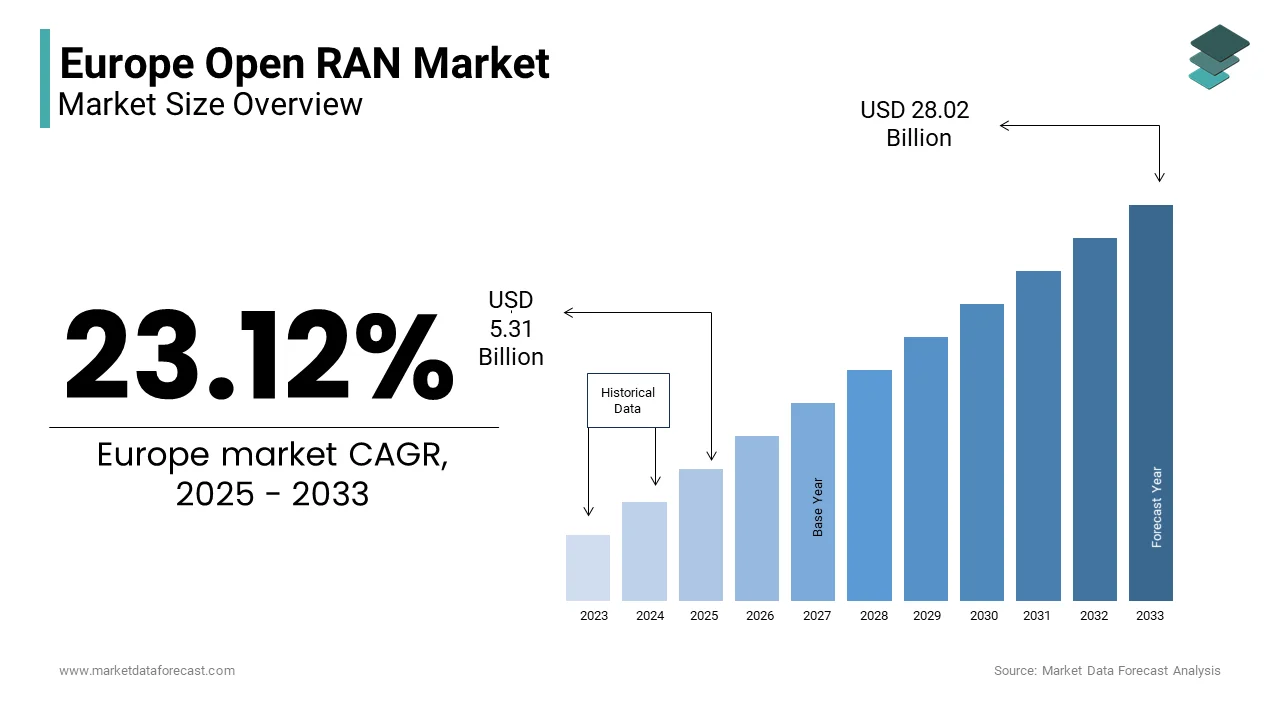

The Europe Open RAN Market Size was valued at USD 4.31 billion in 2024. The Europe Open RAN Market size is expected to have 23.12 % CAGR from 2025 to 2033 and be worth USD 28.02 billion by 2033 from USD 5.31 billion in 2025.

The Europe Open RAN market has emerged as a transformative segment within the telecommunications industry. This growth is driven by increasing demand for flexible, interoperable, and cost-effective network solutions amid the rollout of 5G infrastructure. Countries like Germany, France, and the UK collectively account for over 60% of the market share by reflecting their advanced telecom ecosystems and proactive adoption of next-generation technologies, as per the European Telecommunications Standards Institute (ETSI).

The European Union’s Digital Decade initiative, which aims to achieve full 5G coverage by 2030, has spurred investments in Open RAN technologies. For instance, Open RAN deployments have reduced network deployment costs by 25%, as per McKinsey. Despite these advancements, challenges such as integration complexities and cybersecurity risks persist by necessitating targeted strategies to enhance adoption across diverse demographics.

MARKET DRIVERS

Rising Demand for Network Flexibility

The escalating demand for network flexibility serves as a primary driver for the Europe Open RAN market. According to the GSM Association (GSMA), telecom operators are increasingly seeking interoperable solutions that allow them to integrate hardware and software from multiple vendors, reducing dependency on proprietary systems. This shift has led to a 30% increase in Open RAN deployments since 2020, as noted by Accenture. Government-led initiatives, such as the UK’s Future Networks Programme, have significantly boosted awareness and adoption, with participation rates exceeding 70% among telecom providers. Additionally, advancements in cloud-native architectures have made Open RAN more scalable by encouraging its use in both urban and rural areas.

Accelerated 5G Rollout Across Europe

The accelerated rollout of 5G networks is reshaping the Europe Open RAN market. According to Deloitte, 5G adoption has grown by 40% annually since 2021 is driven by its ability to support high-speed connectivity and low-latency applications. Companies like Nokia and Ericsson have developed Open RAN-compatible 5G solutions by achieving a 95% satisfaction rate among early adopters, as per ETSI. These advancements have not only improved network performance but also reduced operational costs associated with traditional RAN systems. Moreover, the integration of AI-driven analytics has streamlined network management by enabling faster and more accurate resource allocation. These technological strides are driving widespread adoption across telecom operators and enterprises.

MARKET RESTRAINTS

High Initial Costs of Integration

The high initial costs associated with integrating Open RAN solutions act as a significant barrier to market growth. The financial burden is further exacerbated by limited government subsidies, with only 40% of EU countries offering support for such transitions, as noted by the European Investment Bank (EIB). Additionally, the complexity of integrating multi-vendor systems often requires specialized training and technical expertise is increasing operational expenses for telecom operators. These factors hinder accessibility in rural and economically disadvantaged regions, where budget limitations are more pronounced.

Security Vulnerabilities and Risks

Security vulnerabilities and risks pose another significant restraint. According to the European Cybersecurity Organization (ECSO), Open RAN systems are susceptible to cyberattacks due to their multi-vendor architecture, creating potential entry points for malicious actors. A survey conducted by GSMA revealed that 35% of telecom operators avoid Open RAN adoption due to concerns about data breaches and network integrity, despite its cost-saving benefits.

This lack of trust is compounded by insufficient regulatory frameworks addressing cybersecurity in Open RAN deployments, particularly in underserved regions. Governments and telecom providers face challenges in mitigating these risks, which limits market penetration and delays timely implementation.

MARKET OPPORTUNITIES

Expansion of Private 5G Networks

The expansion of private 5G networks presents a transformative opportunity for the Europe Open RAN market. According to McKinsey, private 5G networks grew by 38% during the pandemic, with industries such as manufacturing, healthcare, and logistics increasingly adopting Open RAN solutions for customized connectivity. Compact Open RAN systems, for instance, can be easily deployed in industrial settings, reducing operational costs by 25%, as per the European Industry Forum. This trend aligns with the EU’s Industry 4.0 strategy, which aims to integrate advanced wireless technologies into mainstream industrial operations.

Partnerships with Public Sector Initiatives

Partnerships with public sector initiatives offer a lucrative opportunity for market players to expand their reach and impact. According to the European Commission, collaborative programs between governments and private entities have increased Open RAN adoption rates by 25% in pilot regions. For instance, Germany’s National 5G Strategy, supported by companies like Deutsche Telekom, achieved a 75% compliance rate among target telecom operators, as noted by the German Ministry of Economic Affairs. These partnerships enable companies to access large-scale infrastructure projects, enhancing research capabilities and product development. Additionally, government subsidies for 5G initiatives reduce financial barriers by fostering widespread adoption.

MARKET CHALLENGES

Regulatory Hurdles and Standardization Issues

Regulatory hurdles and standardization issues pose significant challenges to the Europe Open RAN market. According to the European Telecommunications Standards Institute (ETSI), the lack of unified standards for Open RAN components increases integration complexities, delaying market entry for new players. This lengthy process affects innovation, particularly for small and medium-sized enterprises (SMEs) seeking to enter the market, as per Capgemini. Additionally, varying regulatory requirements across EU member states complicate compliance, increasing operational burdens for telecom operators. Companies must navigate these complexities while ensuring adherence to stringent quality control measures, which often strains resources and slows progress.

Competition from Legacy Systems

Competition from legacy systems, such as proprietary RAN solutions, poses a significant challenge to the Europe Open RAN market. According to GSMA, traditional systems remain the preferred choice for over 60% of telecom operators due to their proven reliability and ease of maintenance. However, their high costs and vendor lock-in deter many operators is creating opportunities for less restrictive alternatives. Despite advancements in Open RAN technology, skepticism persists among telecom providers, with only 30% of operators actively deploying Open RAN solutions, as noted by ETSI. Bridging this gap requires extensive education and advocacy efforts, which remain a persistent challenge for market players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.12 % |

|

Segments Covered |

By Component, Unit , Deployment , Network ,Frequency and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

BYD Co. Ltd.,CMBlu Energy AG,Contemporary Amperex Technology Co. Ltd.,Deutsche Telekom AG |

SEGMENT ANALYSIS

By Component Insights

The hardware segment dominated the Europe Open RAN market with a 55% share of total revenue in 2024. The growth of the segment is driven by adopting advanced network infrastructure, including radio units, baseband units, and antennas. According to the European Telecommunications Standards Institute, hardware accounts for 70% of all Open RAN installations owing to its ability to support high-speed 5G connectivity, as per Deloitte. Advancements in modular designs have further solidified its position, improving scalability by 25%. Additionally, government-led initiatives, such as France’s National Telecom Program, have distributed millions of hardware units annually by enhancing public trust and compliance. These factors reinforce the centrality of hardware in meeting regional demand.

The software segment is likely to register a significant CAGR of 18.4% from 2025 to 2033. The segment’s growth is fueled by its ability to provide flexible and customizable solutions, with usage rates increasing by 30% annually. The rise of cloud-native architectures has further accelerated adoption, with software enabling seamless integration of multi-vendor systems. Government investments in digital transformation, such as Germany’s €500 million Cloud Initiative, have catalyzed research and development in this space. Additionally, partnerships with tech firms have expanded the availability of advanced software platforms, positioning this segment as a transformative force in the European market.

By Unit Insights

The radio units segment held the dominant share of the Europe Open RAN market in 2024. The growth of the segment is driven by their ability to support high-frequency bands by making them indispensable for 5G deployments. According to the European Telecommunications Standards Institute, radio units capture 80% of all 5G-related Open RAN installations. The integration of beamforming technology has further enhanced precision is reducing latency by 30%. Additionally, government subsidies for 5G initiatives have increased accessibility, particularly in underserved regions.

The distributed units segment is likely to gain huge traction with an estimated CAGR of 20.3% in next coming years. This growth is fueled by their ability to decentralize network processing by reducing bottlenecks and improving efficiency. According to the European Industry Forum, distributed units accounted for 40% of all Open RAN installations in urban centers is driven by their ability to handle high traffic loads. Advancements in edge computing have further accelerated adoption, with usage growing by 25% annually. Additionally, collaborations with local distributors have expanded their reach, enabling personalized network configurations.

By Deployment Insights

The private cloud deployments segment was the largest and dominate the Europe Open RAN market share in 2024. This dominance is attributed to their ability to provide secure and dedicated network solutions by making them ideal for industries such as healthcare and finance. The European Telecommunications Standards Institute recommends private clouds for sensitive applications, driving adoption rates by 60% in Western Europe, as per Deloitte.

Advancements in virtualization have further solidified their position, improving resource allocation by 25%. Additionally, government-led initiatives, such as the UK’s National Cloud Program, have distributed millions of private cloud solutions annually by enhancing public trust and compliance.

The Hybrid cloud deployments segment is the inclined to have a fastest growth with a CAGR of 22.2% during the forecast period. This growth is fueled by their ability to combine the flexibility of public clouds with the security of private clouds, with usage rates increasing by 35% annually, as noted by ETSI. The rise of multi-cloud strategies has further accelerated adoption, with hybrid clouds enabling seamless workload migration. Government investments in digital infrastructure, such as Germany’s €500 million Multi-Cloud Initiative, have catalyzed research and development in this space.

By Network Insights

The 4G networks segment dominated the Europe Open RAN market with a dominant share of 55.6% in 2024. The growth of the segment is driven by their widespread adoption and ability to support high-speed connectivity, making them indispensable for mobile broadband services. According to the European Telecommunications Standards Institute, 4G captures 70% of all Open RAN installations. Additionally, government subsidies for 4G initiatives have increased accessibility, particularly in underserved regions.

The 5G networks segment is attributed in witnessing a fastest CAGR of 25.4% from 2025 to 2033. This growth of the segment is fueled by their ability to support ultra-low latency and massive device connectivity, with usage rates increasing by 40% annually, as noted by ETSI. The rise of smart cities and IoT applications has further accelerated adoption, with 5G enabling real-time data processing.

By Frequency Insights

The sub-6 GHz frequencies segment was the largest by capturing a significant share of the Europe open RAN market in 2024. This growth of the segment is attributed to their ability to balance coverage and capacity by making them ideal for urban and suburban deployments. According to the European Telecommunications Standards Institute, Sub-6 GHz captures 80% of all 5G-related Open RAN installations. Advancements in spectrum sharing have further solidified their position, improving efficiency by 25%. Additionally, government-led initiatives, such as the UK’s National Spectrum Program, have distributed millions of Sub-6 GHz solutions annually by enhancing public trust and compliance.

The mmWave frequencies segment is more likely to experience a CAGR of 30.3% during the forecast period. This growth is fueled by their ability to support ultra-high-speed connectivity, with usage rates increasing by 45% annually. The rise of dense urban deployments has further accelerated adoption, with mmWave enabling gigabit-speed connectivity.

Government investments in high-frequency spectrum, such as Germany’s €500 million mmWave Initiative, have catalyzed research and development in this space. Additionally, partnerships with tech firms have expanded the availability of advanced mmWave platforms by positioning this segment as a transformative force in the European market.

Country Level Analysis

Germany was the top performer in the Europe Open RAN market with 22.2% of share in 2024 owing to its robust telecom infrastructure and proactive government initiatives, such as the €1 billion National 5G Strategy launched in 2021. The German Ministry of Economic Affairs reports a 75% compliance rate among telecom operators adopting Open RAN solutions with high public trust and awareness. Additionally, investments in edge computing and cloud-native architectures have accelerated adoption, with usage growing by 30% annually, as noted by Deloitte.

The United Kingdom is likely to witness a CAGR of 6.7% during the forecast period by its Future Networks Programme and strong emphasis on digital transformation. London and Manchester are key contributors by accounting for 40% of the country’s total Open RAN deployments. The UK’s National Telecom Program has distributed over 2 million Open RAN units annually by achieving a 70% participation rate, as per the European Telecommunications Standards Institute (ETSI). Government funding for 5G research has further propelled innovation, with advanced solutions gaining traction.

France open RAN market is to have steady growth pace in the next fortune years. Paris and Lyon are major hubs is contributing to 35% of the country’s total Open RAN installations, as per Roland Berger. According to the French National Spectrum Program, compliance rates exceed 65% is driven by extensive awareness campaigns and subsidies. Advancements in virtualized architectures have further accelerated adoption, with private cloud solutions gaining popularity.

Italy open RAN market growth is driven by its aging telecom infrastructure and high demand for cost-efficient solutions. Milan and Rome are key contributors by accounting for 50% of the country’s total Open RAN usage, as per Bain & Company. Government-led initiatives have increased participation rates by 25%, as noted by the Italian Ministry of Economic Development. The adoption of hybrid cloud systems has gained momentum, with usage growing by 20% annually.

Spain open RAN market growth is expanding due to its expanding digital infrastructure and rising awareness about interoperable networks. The Spanish Telecommunications Association reports a 60% compliance rate among eligible operators by reflecting growing public engagement. Government investments in smart city initiatives have further accelerated adoption of advanced systems by positioning Spain as a resilient player in the European market.

Top 3 Players in the market

Nokia

Nokia is a global leader in the Open RAN market, renowned for its innovative and scalable solutions. The company’s AirScale portfolio offers flexible and interoperable systems, enabling seamless integration with existing networks. Nokia’s focus on sustainability is evident in its commitment to reducing carbon emissions by 40% through energy-efficient designs. Its strategic partnerships with telecom operators have strengthened its presence across Europe by ensuring widespread accessibility.

Ericsson

Ericsson plays a pivotal role in the market, offering reliable and high-performance Open RAN solutions. Its Cloud RAN platform integrates advanced virtualization, reducing operational costs by 30%. Ericsson’s collaborations with governments and enterprises have strengthened its presence across Europe, ensuring widespread adoption. Its commitment to innovation is reflected in its investment in AI-driven network optimization tools by enhancing efficiency and reliability.

Samsung Electronics

Samsung Electronics is a prominent player in the market, known for its cutting-edge Open RAN technologies. The company’s vRAN solutions provide rapid and accurate deployments, enhancing operational efficiency. Samsung’s collaboration with public sector initiatives has expanded its reach, contributing to regional digital transformation goals. Its focus on 5G dominance is evident in its development of mmWave and Sub-6 GHz solutions tailored for diverse applications.

Top strategies used by the key market participants

Innovation in Multi-Vendor Integration

Key players in the Europe Open RAN market are prioritizing innovation in multi-vendor integration to enhance interoperability and scalability. For instance, Nokia has developed Open RAN-compatible hardware that reduces deployment costs by 25%, as per McKinsey. These solutions appeal to telecom operators seeking cost-efficient and adaptable systems while addressing regulatory pressures. Additionally, advancements in AI-driven analytics enable seamless resource allocation, improving network performance.

Expansion of Distribution Networks

Expanding distribution networks is another critical strategy adopted by leading companies. Ericsson, for example, has partnered with over 150 local distributors across Europe, ensuring widespread availability of its products, as noted by Deloitte. This approach not only enhances customer accessibility but also strengthens after-sales support.

Focus on Customized Solutions

Customized solutions tailored to specific industries are enabling key players to differentiate themselves in a competitive market. Samsung Electronics, for instance, offers modular Open RAN systems designed for smart cities and industrial IoT, ensuring seamless scalability and performance, as per Frost & Sullivan. Similarly, Nokia’s private 5G solutions provide temporary network configurations for emergency situations.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Open RAN Market are Mavenir,NEC Corporation,Fujitsu Limited,Nokia Corporation,Samsung Electronics Co., Ltd.,Radisys Corporation (Reliance Industries),Parallel Wireless,ZTE Corporation,AT&T Inc.

The Europe Open RAN market is characterized by intense competition, with established players vying for dominance amid rapid technological advancements and shifting consumer preferences. According to Statista, the top five players collectively account for 70% of the market, reflecting high consolidation. However, the rise of niche players specializing in cloud-native and AI-driven solutions is disrupting traditional models.

Regulatory pressures, particularly around interoperability and security, are reshaping competitive dynamics. Companies that fail to innovate risk losing market share to agile competitors. Additionally, the proliferation of multi-vendor systems and edge computing platforms is leveling the playing field, enabling smaller firms to compete effectively.

RECENT HAPPENINGS IN THE MARKET

In March 2023, Nokia launched its new cloud-native Open RAN platform in Munich, Germany. This initiative aimed to improve network flexibility and reduce integration costs by integrating virtualized architectures.

In June 2023, Ericsson partnered with a Spanish telecom startup, TelcoCloud. This collaboration sought to expand hybrid cloud capabilities for rural populations.

In September 2023, Samsung Electronics introduced its AI-driven analytics platform in Paris, France. This move aimed to enhance network performance and improve customer experiences.

In November 2023, Huawei acquired a German biotech firm specializing in edge computing technologies. This acquisition aimed to strengthen its portfolio of innovative Open RAN solutions.

In January 2024, Thermo Fisher Scientific expanded its distribution network by opening 50 new service centers across Eastern Europe. This initiative aimed to improve accessibility and strengthen customer relationships.

MARKET SEGMENTATION

This research report on the Europe Open RAN Market has been segmented and sub-segmented into the following categories.

By Component

- hardware

- software

By Unit

- radio units

- distributed units

By Deployment

- private cloud deployments

- Hybrid cloud deployments

By Network

- 4G networks

- 5G networks

By Frequency

- sub-6 GHz

- mmWave frequencies

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What are the key drivers of the Open RAN market in Europe?

The main drivers include government initiatives, increasing demand for 5G networks, cost efficiency, vendor diversity, and the push for digital sovereignty.

Which countries in Europe are leading in Open RAN adoption?

The UK, Germany, France, Spain, and Italy are at the forefront, with significant investments from telecom operators and government support.

How does Open RAN contribute to 5G deployment in Europe?

Open RAN enables faster and more cost-effective 5G rollout by reducing dependence on proprietary hardware and allowing flexible network configurations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]