Europe Online Grocery Market Size, Share, Trends, & Growth Forecast Report Segmented By Product Type (Fresh produce, Breakfast & dairy, Snacks & beverages, Meat & seafood, Staples & cooking essentials, and Others), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Online Grocery Market Size

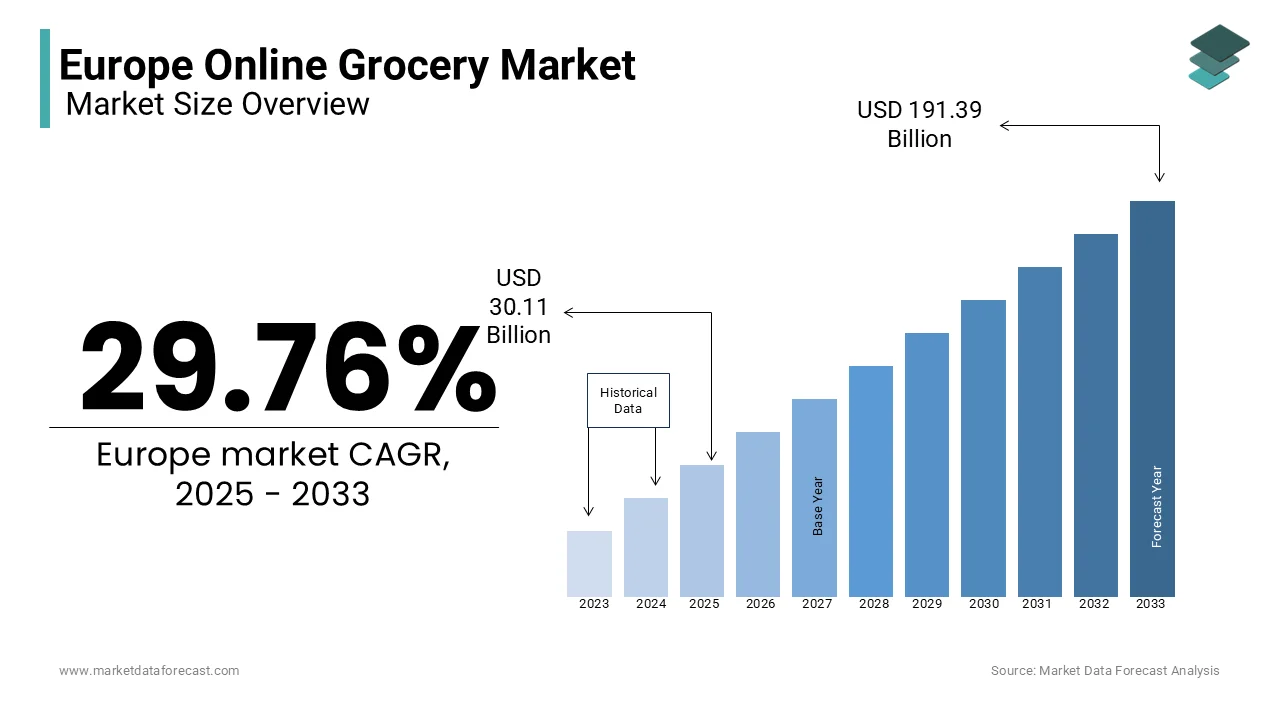

The Europe online grocery market was valued at USD 23.89 billion in 2024. The European market is estimated to reach USD 191.39 billion by 2033 from USD 30.11 billion in 2025, rising at a CAGR of 29.76% from 2025 to 2033.

Online grocery refers to the digital commerce sector where consumers purchase groceries, including food, beverages, and household essentials, through online platforms. The online grocery market in Europe has evolved rapidly due to the shifting consumer preferences, technological advancements, and changing retail landscapes. Online grocery shopping provides convenience, a wider selection of products, and flexible delivery or pickup options. Consumers can access these services via e-commerce websites, dedicated grocery apps, and subscription-based delivery models. Retailers and supermarkets have increasingly integrated digital strategies, including AI-driven recommendations, efficient supply chain management, and quick-commerce models, to enhance customer experiences.

MARKET DRIVERS

Technological Advancements and Digital Integration

The integration of advanced technologies has significantly enhanced the online grocery shopping experience in Europe. Innovations such as user-friendly mobile applications, efficient supply chain management, and the adoption of artificial intelligence for personalized recommendations have streamlined operations and improved customer satisfaction or instance, the Schwarz Group, which operates Lidl, established 'Schwarz Digits' to bolster its digital infrastructure and explore artificial intelligence applications, as reported by Savills. These technological investments have made online platforms more accessible and appealing, thereby driving market growth.

Changing Consumer Preferences and Urbanization

Shifts in consumer behavior, particularly a growing preference for convenience and time-saving solutions, have bolstered the online grocery sector. Urbanization trends have led to denser city populations, where busy lifestyles increase the demand for home delivery services. the proliferation of smartphones and internet connectivity has facilitated easy access to online grocery platforms, catering to the needs of urban dwellers seeking efficient shopping alternatives. This alignment with modern consumer preferences has been instrumental in the market's expansion

MARKET RESTRAINTS

Logistical Complexities and High Operational Costs

Efficiently managing the supply chain for online grocery delivery is a significant hurdle. The necessity for rapid delivery, often within narrow time frames, demands substantial investment in infrastructure and technology. For instance, the quick-commerce model, which promises ultra-fast deliveries, has seen a slowdown due to high operational costs and logistical challenges. According to a report by Strategy& (PwC), the eGrocery market experienced a significant slowdown in key European countries, with growth almost coming to a standstill in Germany and the Netherlands in 2022. This deceleration is attributed to the end of the COVID-induced e-commerce boom, geopolitical crises, high inflation, and slower economic growth, particularly in Germany.

Consumer Price Sensitivity and Inflation

Rising inflation rates across Europe have led to increased food prices, making consumers more price sensitive. In 2025, food price inflation averaged 12.8% in Europe, peaking at 19.0% in March, which significantly impacted consumer purchasing power. This economic strain has led many consumers to cut back on spending and opt for cheaper products, like private labels and discount options. This heightened price sensitivity poses a challenge for online grocery retailers, as consumers become more cautious with their spending.

MARKET OPPORTUNITIES

Expansion of Quick Commerce Services

The rise of quick commerce, offering rapid delivery of groceries within hours, presents a substantial opportunity in urban areas. Companies like Tesco have launched services such as Whoosh, providing deliveries in as little as 20 minutes from over 1,000 stores, as reported by The Times. This model caters to consumers' increasing demand for convenience and immediacy, particularly in densely populated cities. The integration of quick commerce can enhance customer satisfaction and loyalty, potentially leading to increased market share for retailers who effectively implement these services

Investment in Digital Infrastructure and Automation

Investing in digital infrastructure and automation technologies offers a pathway to streamline operations and reduce costs in the online grocery sector. Ocado's recent advancements in warehouse automation and robotics have improved efficiency in order fulfilment, as highlighted by The Guardian. By adopting such technologies, retailers can optimize supply chain management, minimize human error, and accelerate delivery times. This not only meets consumer expectations for swift service but also positions retailers to handle higher order volumes, thereby capitalizing on the growing online grocery demand.

MARKET CHALLENGES

Intense Market Competition

The online grocery sector in Europe is characterized by fierce competition among numerous players, including traditional supermarkets expanding their digital presence and specialized online-only retailers. This saturation makes it challenging for companies to differentiate themselves and maintain profitability instance, Amazon's grocery venture, Amazon Fresh, has struggled in the UK market, facing issues such as empty shelves and the discontinuation of its own-brand ready-meal range, as reported by The Times. Despite plans to open over 250 stores by the end of 2024, only 21 are currently operational, all in London. This underscores the difficulties even major players encounter in establishing a foothold in the competitive European grocery landscape.

Regulatory Scrutiny and Compliance Issues

Online grocery retailers in Europe are subject to stringent regulations concerning food safety, data protection, and fair-trading practices. on-compliance can result in substantial fines and reputational damage. For example, Delivery Hero, a prominent online food delivery company, disclosed that it might be fined over €400 million by the European Union for alleged anti-competitive practices, including market-sharing agreements and exchanging sensitive information, as reported by the Financial Times. such regulatory challenges necessitate robust compliance frameworks, increasing operational complexities for online grocery businesses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

29.76% |

|

Segments Covered |

By Product Type and Country |

|

Various Analyses Covered |

Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

AEON CO., LTD., Alibaba.com., Amazon.com, Inc., Blink Commerce Private Limited, Instacart, JD.com, Inc., Natures Basket Limited., Ebates Performance Marketing Inc.d/b/a Rakuten Rewards, Reliance Retail., Supermarket Grocery Supplies Pvt. Ltd., Target Brands, Inc., Tesco.com, The Kroger Co., and Walmart are some of the major players in the Europe online grocery market. |

SEGMENTAL ANALYSIS

By Product Type Insights

The staples & cooking essentials segment accounted for 27.5% of European market share in 2024. This category includes essential items like grains, flour, edible oils, and spices that are indispensable in daily cooking. The high demand for these products is driven by their necessity across all households, ensuring consistent and repeat purchases. Additionally, urbanization and rising disposable incomes have contributed to increased spending on packaged staple goods. The segment's significance lies in its stability, as it is less affected by seasonal trends compared to perishable categories like fresh produce and dairy.

The breakfast & dairy segment is growing rapidly and is projected to expand at a CAGR of 24.6% over the forecast period owing to the rising consumer awareness of health and nutrition, increasing preference for protein-rich diets, and the expanding variety of dairy alternatives like plant-based milk. In developing markets, urban lifestyles have led to higher consumption of ready-to-eat breakfast items such as cereals, yogurt, and protein-based snacks. Additionally, the rapid expansion of cold-chain logistics and e-commerce penetration has made fresh dairy products more accessible. The segment’s importance is underscored by its role in daily nutrition, particularly as consumers shift towards convenient and fortified food options.

REGIONAL ANALYSIS

The UK held the major share of the European online grocery market in 2024. The well-developed e-commerce infrastructure of the UK, high internet penetration, and consumer preference for convenience are driving the UK online grocery market growth. Major players like Tesco, Ocado, and Sainsbury’s have expanded their digital presence, offering fast delivery and subscription-based services. The mature online shopping culture of the UK has led to rapid adoption, particularly after the pandemic boosted home deliveries.

France has emerged as a leading player in the European market. The rapid growth of click-and-collect models in France and investments by retailers like Carrefour and Leclerc are driving the French online grocery market growth. With a growing demand for fresh produce and sustainable grocery solutions, the market continues to expand. Government support for digital transformation in retail has further accelerated growth.

Germany is predicted to exhibit the fastest CAGR in the European online grocery market during the forecast period, owing to increased urbanization, technological advancements, and a preference for contactless shopping. The presence of established grocery chains like REWE and EDEKA, along with innovations in last-mile delivery, has strengthened the sector. Consumers increasingly favor organic and premium grocery products, further driving the German market growth.

KEY MARKET PLAYERS

AEON CO., LTD., Alibaba.com., Amazon.com, Inc., Blink Commerce Private Limited, Instacart, JD.com, Inc., Natures Basket Limited., Ebates Performance Marketing Inc.d/b/a Rakuten Rewards, Reliance Retail., Supermarket Grocery Supplies Pvt. Ltd., Target Brands, Inc., Tesco.com, The Kroger Co., and Walmart are some of the major players in the Europe online grocery market.

MARKET SEGMENTATION

This research report on the European online grocery market is segmented and sub-segmented into the following categories.

By Product Type

- Fresh produce

- Breakfast & dairy

- Snacks & beverages

- Meat & seafood

- Staples & cooking essentials

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe online grocery market?

The growth of the Europe online grocery market is driven by increasing internet penetration, rising demand for convenience, busy lifestyles, advancements in logistics, and the expansion of quick-commerce and same-day delivery services.

How do delivery time options impact consumer preference in the European online grocery market?

Consumers prefer retailers that offer flexible delivery options, including same-day and next-day delivery, as well as time-slot selections that fit their schedules. Quick-commerce services with delivery in under an hour are also gaining traction.

What are the biggest challenges faced by online grocery retailers in Europe?

Challenges include high operational costs, complex logistics, maintaining product freshness, ensuring timely delivery, and increasing competition from both traditional supermarkets and quick-commerce startups.

What future trends are expected in the European online grocery market?

Future trends include expanding AI-driven recommendations, drone and autonomous vehicle deliveries, increased focus on sustainability, and a shift toward more personalized shopping experiences through data analytics.

4o

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]