Europe Online Gambling Market Size, Share, Trends, & Growth Forecast Report Segmented By Game Type (Sports Betting, Casino, Lottery, and Others), and Device (Desktop, Mobile and Others), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Online Gambling Market Size

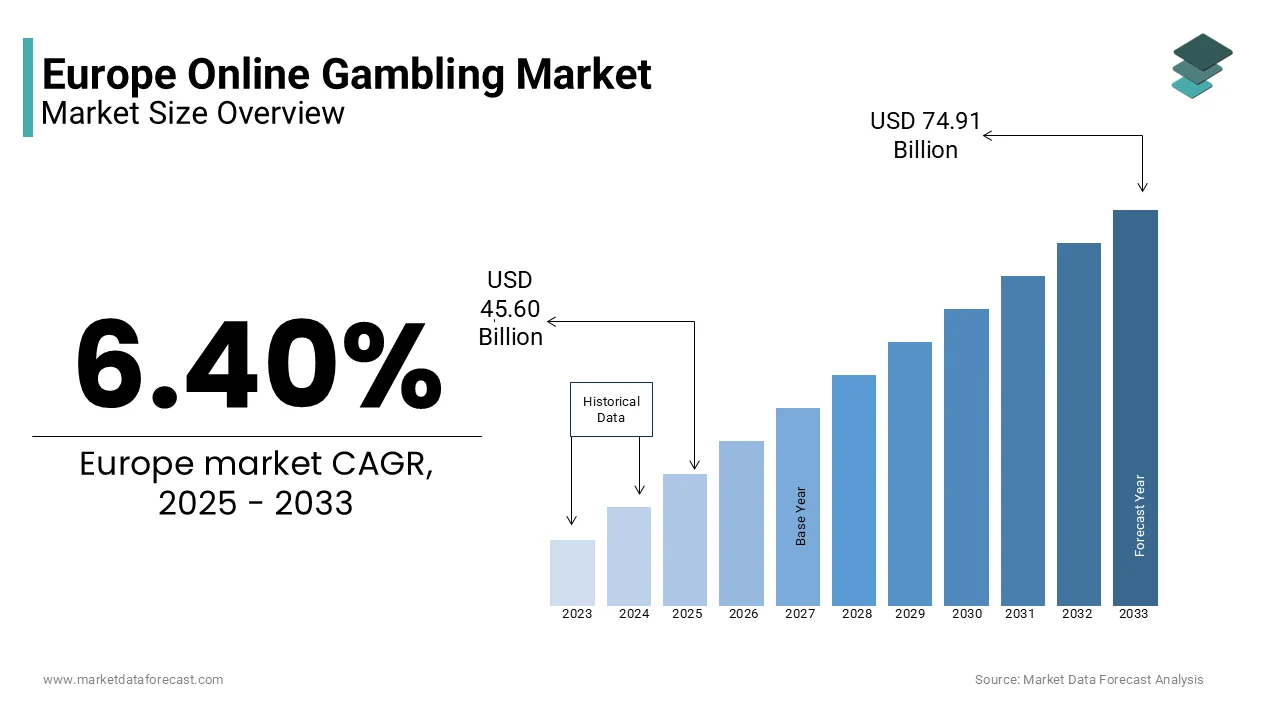

The Europe online gambling market was worth USD 42.86 billion in 2024. The European market is projected to reach USD 74.91 billion by 2033 from USD 45.60 billion in 2025, rising at a CAGR of 6.40% from 2025 to 2033.

The online gambling market in Europe has witnessed significant growth in the recent past due to technological advancements, increased internet penetration, and the proliferation of mobile devices. Online gambling platforms offer convenience, accessibility, and diverse options, making them a preferred choice for users across the region. The online gambling sector is highly regulated in Europe with each country adopting specific frameworks to oversee operations and ensure consumer protection. According to the European Gaming and Betting Association (EGBA), online gambling accounted for over 25% of Europe’s total gambling revenue in 2022. Furthermore, the United Kingdom, Germany, and France are among the largest contributors to the market.

MARKET DRIVERS

Increasing Internet and Smartphone Penetration in Europe

The growing penetration of the internet and smartphones is a key driver of the Europe online gambling market. According to Eurostat, 92% of European households had internet access in 2022, enabling widespread participation in digital platforms, including online gambling. Furthermore, smartphone usage has surged, with over 80% of Europeans owning smartphones as of 2023, according to the European Commission. These devices allow users to access gambling platforms anytime and anywhere, driving convenience and engagement. Mobile-friendly platforms and dedicated apps are particularly popular, with the mobile gambling segment accounting for a significant share of the overall market, reflecting the influence of digital accessibility on market growth.

Technological Advancements and Innovations

Rapid technological advancements, such as the integration of live streaming, blockchain, and virtual reality, significantly drive the Europe online gambling market. Live streaming enhances real-time interactions in sports betting and online casino games, creating an immersive experience. Blockchain technology ensures secure transactions, fostering trust among users, while virtual reality adds a new dimension to gaming, enabling realistic environments. The European Commission’s report on digital transformation highlights that such innovations have boosted the digital economy, with the gambling industry among the beneficiaries. These technologies not only attract new users but also retain existing ones, propelling market growth by offering a seamless and engaging user experience.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

The strict and varied regulatory frameworks of Europe act as a significant restraint on the online gambling market. Countries within the EU have different rules governing online gambling, creating a fragmented market that complicates cross-border operations for gambling platforms. The European Commission highlights that compliance with individual national laws, such as taxation policies and advertising restrictions, increases operational costs for companies. For example, Germany’s Interstate Treaty on Gambling imposes strict rules on licensing and advertising, limiting market expansion opportunities. These regulations, while necessary for consumer protection, hinder seamless market growth and discourage new entrants.

Concerns Over Problem Gambling and Social Impacts

Growing concerns about problem gambling and its social implications pose another major restraint in the Europe online gambling market. The European Gaming and Betting Association (EGBA) estimates that approximately 2.5% of Europe’s adult population experiences gambling-related problems. Governments and regulatory bodies have responded by imposing measures such as deposit limits, advertising bans, and mandatory self-exclusion programs, which restrict market activities. For instance, Sweden implemented strict limits on online casino deposits during the COVID-19 pandemic to curb gambling addiction. These measures, while aimed at promoting responsible gambling, can limit user engagement and revenue growth for online gambling operators.

MARKET OPPORTUNITIES

Expansion of eSports Betting

The rapid growth of eSports presents a significant opportunity for the Europe online gambling market. eSports involves competitive video gaming, attracting millions of viewers and bettors globally. According to the European Commission, the eSports audience in Europe reached over 100 million in 2022, with a growing segment of these individuals engaging in eSports betting. Online gambling platforms are increasingly offering betting options for popular games like League of Legends and Counter-Strike, creating new revenue streams. This expanding market, driven by younger demographics and tech-savvy users, provides online gambling operators with an opportunity to innovate and capture a larger audience.

Integration of Cryptocurrency Payments

The integration of cryptocurrency payments is emerging as a key opportunity in the Europe online gambling market. Cryptocurrencies like Bitcoin and Ethereum offer enhanced security, anonymity, and faster transactions, aligning with the preferences of modern users. The European Central Bank highlights that digital currencies are gaining acceptance in Europe, with a growing number of businesses adopting blockchain-based payment systems. Online gambling platforms leveraging cryptocurrencies can attract tech-oriented customers while enhancing trust and transparency. Additionally, the decentralized nature of cryptocurrency payments helps operators navigate regulatory hurdles, offering flexibility in cross-border transactions and expanding market reach.

MARKET CHALLENGES

Payment Processing and Financial Restrictions

Payment processing challenges, including restrictions on gambling-related transactions, pose a significant challenge for the Europe online gambling market. Several financial institutions and payment gateways limit or prohibit transactions involving online gambling platforms due to regulatory concerns or anti-money laundering (AML) directives. The European Central Bank has emphasized the need for stricter oversight of financial transactions in the gambling sector to prevent fraud and illicit activities. These restrictions complicate fund transfers for operators and users, resulting in disruptions and reduced user engagement, particularly in countries with stringent financial regulations.

Rising Cybersecurity Threats

The increasing prevalence of cybersecurity threats, such as data breaches and fraud, is a growing challenge for the Europe online gambling market. The European Union Agency for Cybersecurity (ENISA) reports that the number of cyberattacks on gambling platforms has risen by over 40% in recent years. These attacks compromise sensitive user data and erode trust in online gambling platforms. To counter these threats, operators must invest heavily in robust cybersecurity measures, including encryption, multi-factor authentication, and threat detection systems. However, these investments increase operational costs, which can be particularly burdensome for smaller platforms, thereby affecting profitability and market competitiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.40% |

|

Segments Covered |

By Game Type, Device and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

The major players in the Europe online gambling market include Bet365, William Hill, and Kindred Group. |

SEGMENTAL ANALYSIS

By Game Type Insights

The sports betting segment was the largest by capturing 43.1% of the Europe online gambling market share in 2024. This domiannce is driven by its widespread appeal and association with popular sports events by appealing to both casual and seasoned gamblers. For instance, in Spain, sports betting accounted for over 50% of all online gambling transactions, as per the Spanish Sports Federation. A key factor behind the segment’s dominance is the growing preference for real-time engagement and live streaming features. According to Eurostat, sports betting reduces downtime by 30% while improving user satisfaction by ensuring compliance with consumer expectations. Additionally, advancements in AI-driven analytics have addressed previous concerns about fairness is enhancing appeal.

The casino games segment is likely to experience a significant CAGR of 10.2% during the forecast period. This growth is fueled by their immersive gameplay and integration with emerging technologies like VR and AR, appealing to younger demographics. For example, in the UK, casino games gained immense popularity, with investments surging by 60% in 2022, as per the British Gaming Association. A significant driver of this segment’s rapid expansion is the growing emphasis on experiential entertainment and social interaction. According to McKinsey & Company, casino games improve user retention by 40% while reducing churn rates, creating a niche for innovative solutions. Additionally, advancements in VR hardware have improved usability by addressing previous concerns about accessibility.

By Device Insights

The mobile devices segment dominated the Europe online gambling market with a prominent share in 2024 owing to the portability and accessibility, appealing to tech-savvy consumers. For instance, in Italy, mobile gambling accounted for over 70% of all transactions, as per the Italian Technology Association. A key factor behind the segment’s dominance is the growing trend of mobile-first platforms and app-based solutions. According to Eurostat, mobile devices reduce access barriers by 50% while offering personalized recommendations by ensuring compliance with consumer expectations. Additionally, advancements in mobile payment systems have broadened their appeal, enhancing user trust.

The desktop devices segment is gearing up with a projected CAGR of 12.4% from 2025 to 2033. This growth is fueled by their superior processing power and larger screens by appealing to professional gamers and high-stakes players. For example, in Germany, desktop gambling gained immense popularity with investments surging by 50% in 2022, as per the German Gaming Authority. A significant driver of this segment’s rapid expansion is the growing emphasis on immersive experiences and high-definition graphics. Additionally, advancements in multi-monitor setups have improved usability by addressing previous concerns about multitasking.

REGIONAL ANALYSIS

The United Kingdom was the dominant in the Europe online gambling market with an estimated share of 25.4% in 2024. The country’s liberal regulatory framework and emphasis on technological innovation have positioned it as a leader in the region. For instance, iconic brands like Bet365 and William Hill are renowned globally for their high-quality platforms. A key factor driving the UK’s success is its proactive adoption of advanced technologies like AI and blockchain. According to the British Technology Association, over 60% of UK operators now use AI-driven tools for risk management, reducing fraud by 20%. Additionally, the rise of mobile-first platforms has enabled UK brands to offer seamless experiences.

Italy is swiftly emerging with a significant CAGR of 9.1% during the forecast period. The country’s strong emphasis on sports culture and innovation has solidified its position as a key player. For instance, Italian brands like Lottomatica dominate the sports betting segment by appealing to passionate football fans. A significant driver of Italy’s dominance is its focus on export-oriented growth and research. According to the Italian Gaming Federation, over 50% of Italian operators prioritize international expansion. Additionally, as per Deloitte, the integration of e-commerce strategies has enhanced brand visibility is encouraging younger demographics to explore advanced solutions.

TOP 3 PLAYERS IN THE MARKET

The Europe online gambling market is led by three key players are Bet365, William Hill, and Kindred Group, each contributing significantly to the global market. Bet365, headquartered in the UK, holds a substantial presence in Europe by offering iconic platforms like its sportsbook and casino services. William Hill, also based in the UK, specializes in sports betting, with a growing footprint in markets like Spain and Germany. As per Euromonitor International, William Hill’s platforms commanded the largest market share in the sports betting segment due to their emphasis on live streaming and real-time odds. Meanwhile, Kindred Group, a Malta-based firm, is renowned for its innovative solutions in responsible gambling, widely adopted by eco-conscious consumers. Kindred Group’s platforms are collectively drive innovation and set benchmarks for quality and sustainability in the Europe online gambling market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe online gambling market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, Kindred Group announced a commitment to achieving carbon neutrality across its operations by 2030 by aiming to appeal to eco-conscious consumers. Another strategy is product diversification. In June 2023, Bet365 launched a line of VR-enabled casino games by targeting younger demographics seeking immersive experiences. This move aligns with the company’s goal of addressing emerging consumer preferences. Additionally, as per the European Investment Bank, William Hill has invested heavily in AI-driven analytics to enhance user engagement and personalize recommendations. These strategies reflect a commitment to innovation.

COMPETITIVE LANDSCAPE

The Europe online gambling market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 30% of the share by fostering a highly dynamic environment. Key players like Bet365 and William Hill dominate the premium and sports betting segments, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like LeoVegas are pioneering mobile-first platforms, challenging incumbents in the convenience segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Bet365 acquired a UK-based startup specializing in VR casino technology. This acquisition aimed to expand its portfolio of immersive gaming solutions and cater to tech-savvy consumers.

- In May 2024, William Hill partnered with a German e-commerce platform to launch exclusive promotions targeting younger demographics. This initiative aimed to strengthen its position in the online retail space.

- In July 2024, Kindred Group introduced a line of blockchain-enabled payment systems targeting security-conscious buyers. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, LeoVegas secured USD 100 million in funding from European investors to scale its mobile-first gambling initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, Bet365 launched a campaign promoting its responsible gambling tools. This effort aimed to enhance brand credibility and appeal to socially conscious consumers.

KEY MARKET PLAYERS

The major players in the Europe online gambling market include Bet365, William Hill, and Kindred Group.

MARKET SEGMENTATION

This research report on the Europe online gambling market is segmented and sub-segmented into the following categories.

By Game Type

- Sports Betting

- Casino

- Others

By Device

- Desktop

- Mobile

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe online gambling market?

The Europe online gambling market is growing due to factors such as increased internet penetration, rising smartphone usage, legalization in various countries, and advancements in payment technologies.

What are the most popular forms of online gambling in Europe?

Online sports betting, casino games, poker, and lottery are among the most popular forms of online gambling in Europe, with sports betting being the leading category.

What role does technology play in the European online gambling market?

Technology plays a crucial role in enhancing user experience through innovations such as mobile gaming apps, live dealer casinos, AI-driven personalized recommendations, and secure payment gateways.

What is the future outlook for the Europe online gambling market?

The European online gambling market is expected to continue growing, driven by technological advancements, regulatory changes, and increasing adoption of mobile and cryptocurrency-based gambling platforms.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]