Europe Online Food Delivery Market Research Report – Segmented By Type ( Platform-to-Consumer , Restaurant-to-Consumer ) Channel ( Mobile Applications , Websites/Desktop ) Payment Method ( online payment methods, Cash on Delivery ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Online Food Delivery Market Size

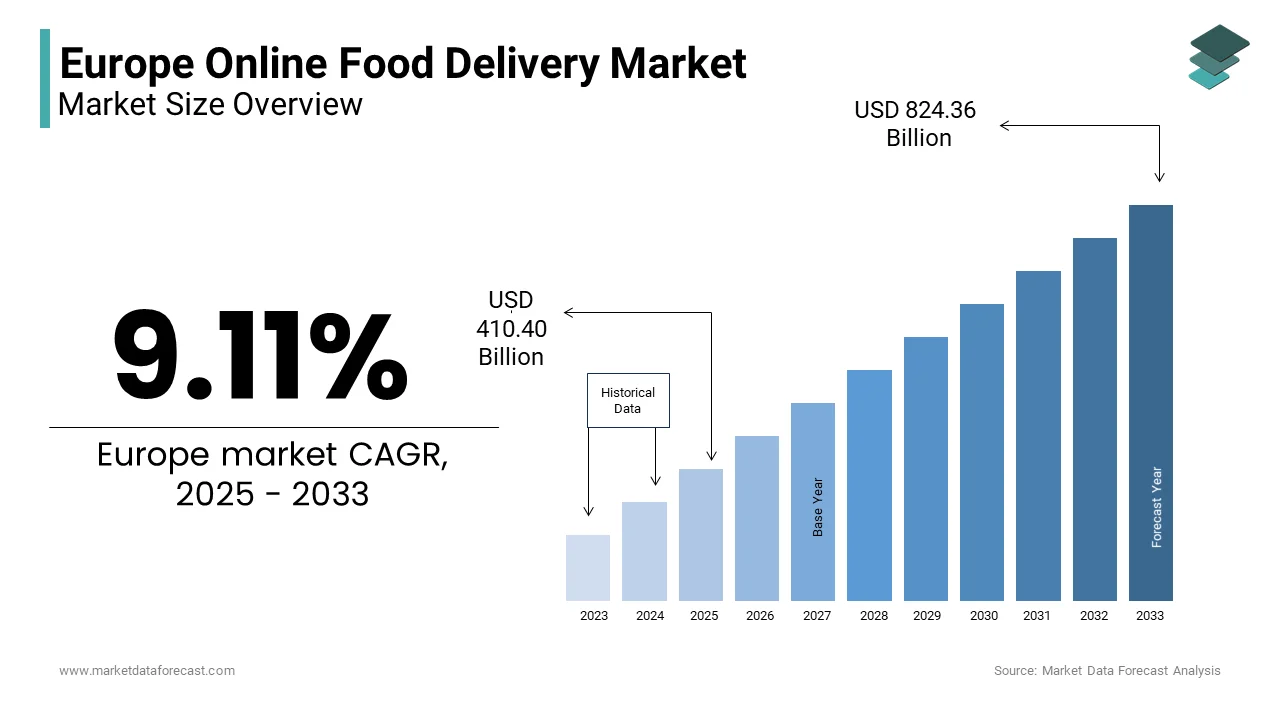

The Europe Online Food Delivery Market Size was valued at USD 376.13 billion in 2024. The Europe Online Food Delivery Market size is expected to have 9.11 % CAGR from 2025 to 2033 and be worth USD 824.36 billion by 2033 from USD 410.40 billion in 2025.

The Europe online food delivery market has emerged as a dynamic and rapidly expanding sector, driven by shifting consumer preferences and technological advancements. The United Kingdom, Germany, and France are at the forefront of this transformation, collectively accounting for over 60% of the total market share. As per Eurostat, urbanization trends have played a pivotal role, with over 75% of Europeans now residing in cities, fostering demand for convenient dining solutions.

The rise of third-party aggregators like Deliveroo, Uber Eats, and Just Eat Takeaway has redefined the competitive landscape, enabling restaurants to reach broader audiences while catering to the growing preference for contactless services. A report by McKinsey & Company notes that approximately 40% of European consumers now prioritize speed and reliability in delivery services, prompting companies to invest in AI-driven logistics and real-time tracking systems. Furthermore, sustainability concerns are reshaping the market, as stated by the European Environment Agency, with eco-friendly packaging and carbon-neutral delivery options gaining traction. These factors showcase the market's robust growth potential amid evolving consumer expectations and operational innovations.

MARKET DRIVERS

Rising Urbanization and Changing Consumer Lifestyles

One of the primary drivers of the Europe online food delivery market is the rapid urbanization and the evolving lifestyle preferences of consumers. According to Eurostat, over 75% of Europe’s population resides in urban areas, where fast-paced lifestyles and time constraints have increased the demand for convenient dining options. This trend has been further amplified by the growing number of dual-income households, which now account for approximately 45% of European families, as stated by the European Institute for Gender Equality. These households often prioritize convenience, leading to a surge in online food delivery services. Moreover, the COVID-19 pandemic acted as a catalyst, accelerating the adoption of digital platforms for food ordering. A study by McKinsey & Company revealed that over 60% of European consumers who began using online food delivery services during the pandemic have continued to use them regularly. The integration of advanced technologies such as AI-driven recommendations and real-time tracking has enhanced user experience, further boosting demand. For instance, Just Eat Takeaway reported a 30% increase in active users in 2022, with over 60 million orders processed monthly across Europe. These factors, combined with the proliferation of smartphones and high-speed internet, have solidified online food delivery as an integral part of modern urban living.

Expansion of Delivery Platforms and Diverse Offerings

Another significant driver is the aggressive expansion of third-party delivery platforms and their ability to offer diverse cuisines and personalized experiences. Companies like Deliveroo, Uber Eats, and Glovo have expanded their reach, with operations spanning over 20 European countries, as noted by the European E-commerce Association. These platforms have capitalized on consumer preferences for variety, offering everything from gourmet meals to healthy, plant-based options. Also, partnerships with local restaurants and cloud kitchens have enabled these platforms to cater to niche markets while maintaining affordability. Furthermore, innovations such as subscription models and loyalty programs have incentivized repeat usage. For example, Uber Eats launched a subscription service in 2023 resulting in a 25% increase in customer retention. These strategies have not only broadened the appeal of online food delivery but also strengthened its position as a dominant force in Europe’s foodservice industry.

MARKET RESTRAINTS

High Operational Costs and Thin Profit Margins

One of the significant restraints in the Europe online food delivery market is the high operational costs associated with logistics and platform maintenance, which often result in thin profit margins for both delivery companies and restaurants. As per a study by McKinsey & Company, delivery platforms typically charge restaurants commission rates ranging from 20% to 40%, leaving many small eateries struggling to break even. For instance, a survey conducted by the European Hospitality Association revealed that over 30% of independent restaurants in Europe reported financial strain due to these fees, forcing some to either increase menu prices or discontinue their partnership with third-party platforms. Delivery services themselves face rising expenses, particularly in urban areas where labor and fuel costs are higher. Besides these, customer expectations for faster deliveries have pushed companies to invest heavily in advanced logistics systems such as AI-driven route optimization and real-time tracking. While these innovations enhance efficiency, they also add to operational expenses. For instance, Deliveroo reported that nearly 70% of its revenue in 2022 was spent on rider payments and technological infrastructure spotlighting the financial pressures within the industry.

Regulatory Challenges and Labor Disputes

Another critical restraint is the growing regulatory scrutiny and labor disputes surrounding gig economy models, which are central to the online food delivery ecosystem. A report by the European Trade Union Confederation stresses that over 50% of delivery riders in Europe operate under precarious employment conditions lacking benefits such as health insurance, sick pay, and job security. This issue has led to widespread protests and legal challenges, with countries like Spain and Italy implementing stricter labor laws to classify gig workers as employees rather than independent contractors. These regulatory changes have significant financial implications for delivery platforms. For example, Just Eat Takeaway estimated that compliance with Spain’s new "Rider Law" could increase its labor costs by 25% in the region. Additionally, local governments are increasingly imposing taxes and fees on delivery services to address congestion and environmental concerns. According to the European Environment Agency, over 60% of urban deliveries contribute to traffic congestion, prompting cities like Berlin and Amsterdam to introduce levies on commercial vehicles. These challenges not only strain profitability but also create uncertainty about the long-term sustainability of the current business models in the online food delivery market.

MARKET OPPORTUNITIES

Integration of AI and Personalization Technologies

One of the most promising opportunities in the Europe online food delivery market lies in leveraging artificial intelligence (AI) and personalization technologies to enhance customer experiences and drive loyalty. According to a report by the European Technology Platform for Smart Systems Integration (EPoSS), companies that adopt AI-driven recommendation engines have seen a 30% increase in repeat orders, as these systems analyze user behavior to suggest tailored meal options. For instance, platforms like Uber Eats and Deliveroo are already using machine learning algorithms to predict customer preferences, with Uber Eats reporting a 25% rise in average order value after implementing personalized suggestions in 2022. Also, AI is being utilized to optimize logistics and reduce delivery times, which remains a key consumer priority. A study by McKinsey & Company notes that real-time route optimization powered by AI has decreased delivery times by up to 15% in major European cities such as Paris and Berlin. These innovations not only improve operational efficiency but also enhance customer satisfaction. Besides these, the growing adoption of voice-activated ordering systems, as noted by Eurostat, is expected to expand the user base by appealing to tech-savvy consumers. With over 40% of European households projected to own smart home devices by 2025, integrating AI into the ordering process presents a significant opportunity to attract new customers and retain existing ones.

Expansion into Rural Areas and Niche Markets

Another key opportunity for the Europe online food delivery market is the untapped potential of rural areas and niche markets, which remain underserved compared to urban centers. As indicated by a study by the European Commission’s Directorate-General for Agriculture and Rural Development, over 25% of Europe’s population resides in rural regions, yet less than 10% of these areas have access to reliable food delivery services. Moreover, catering to niche dietary preferences, such as vegan, gluten-free, and halal meals, presents another avenue for growth. Platforms like Just Eat Takeaway have already partnered with specialty restaurants to offer curated menus, resulting in a 35% increase in orders from this segment. Moreover, collaborations with local farmers and cloud kitchens can enable cost-effective delivery in rural areas while promoting sustainable practices. These strategies not only broaden the market reach but also align with consumer trends toward sustainability and inclusivity, creating a win-win scenario for businesses and customers alike.

MARKET CHALLENGES

Intense Competition and Market Saturation

The Europe online food delivery market faces significant challenges due to intense competition and market saturation, which have led to price wars and eroded profitability for many players. A report by the European E-commerce Association reveals that over 20 major platforms are competing in key markets like the UK, Germany, and France, resulting in an overcrowded landscape. This saturation has forced companies to engage in aggressive discounting and promotional campaigns, with some platforms offering discounts as high as 50% during peak seasons. A study by McKinsey & Company highlights that such practices have reduced average order margins by 10-15%, making it difficult for smaller players to sustain operations.

Moreover, the dominance of global giants like Uber Eats, Deliveroo, and Just Eat Takeaway has created barriers for regional startups attempting to gain market share. For instance, a survey by Statista revealed that these three companies collectively control over 70% of the European market, leaving limited room for new entrants. The competition is further exacerbated by the rise of direct-to-consumer models, where restaurants develop their own delivery apps to bypass third-party platforms. As per Eurostat, over 40% of medium-sized restaurants in Europe now operate proprietary delivery systems, reducing dependency on aggregators. This fragmentation intensifies the pressure on delivery platforms to innovate while grappling with shrinking profit margins.

Environmental Concerns and Sustainability Pressures

Another pressing challenge is the growing scrutiny over the environmental impact of online food delivery services, particularly regarding packaging waste and carbon emissions. The European Environment Agency states that single-use plastic packaging from food deliveries contributes to approximately 30% of urban plastic waste in major cities like London and Paris. This issue has sparked widespread criticism from consumers and environmental groups, prompting calls for stricter regulations. Additionally, the carbon footprint of delivery logistics remains a concern, with last-mile deliveries accounting for nearly 25% of total transportation emissions in urban areas, as stated by the International Transport Forum. While some companies have introduced electric vehicles and bike couriers to address this, the transition is slow and costly. For instance, Deliveroo reported that replacing 50% of its fleet with electric bikes in London increased operational expenses by 15%. Furthermore, regulatory pressures are mounting, with cities like Amsterdam imposing levies on non-sustainable delivery practices. These challenges necessitate significant investments in green technologies, which could strain profitability while reshaping operational models.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.11 % |

|

Segments Covered |

By Type,Channel,Payment Method and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Deliveroo PLC,DoorDash Inc.,Delivery Hero Group,Just Eat Limited,Uber Technologies Inc.,Swiggy,Zomato. |

SEGMENT ANALYSIS

By Type Insights

The Platform-to-Consumer segment dominated the Europe online food delivery market by accounting for a significant portion of the total market share in 2024. This segment's prominence is driven by the widespread adoption of third-party platforms like Uber Eats, Deliveroo, and Just Eat Takeaway, which act as intermediaries between restaurants and consumers. These platforms have capitalized on their ability to offer a diverse range of cuisines from multiple restaurants through a single interface, making them highly convenient for users. A key factor driving this dominance is the extensive reach and technological infrastructure of these platforms. According to Eurostat, over 80% of urban consumers in Europe prefer using third-party apps due to features like real-time tracking, AI-driven recommendations, and seamless payment systems. Additionally, partnerships with local eateries have enabled these platforms to cater to niche markets, such as vegan or gluten-free options, further enhancing their appeal. A report by McKinsey & Company shows that platform-to-consumer services processed over 600 million orders in 2022 alone. Furthermore, aggressive marketing strategies, including discounts and loyalty programs, have solidified their position. For instance, Uber Eats launched a subscription model in 2023 boosting its active user base by 20%. These factors collectively underscore why Platform-to-Consumer remains the largest and most influential segment in the market.

The Restaurant-to-Consumer segment is emerging as the fastest-growing segment in the Europe online food delivery market, with a CAGR of 18.5% from 2025 to 2033. This rapid expansion is fueled by restaurants developing their own direct-ordering apps and websites to reduce dependency on third-party platforms and retain higher profit margins. A major driver of this growth is the rising consumer preference for personalized experiences. In addition, advancements in technology have made it easier for restaurants to manage logistics independently. Moreover, regulatory pressures on third-party platforms, such as high commission fees and labor disputes, have encouraged restaurants to adopt direct models. A survey by the European Trade Union Confederation revealed that 40% of medium-sized restaurants in Europe now operate proprietary delivery systems, contributing to the segment’s accelerated growth. These innovations and strategic shifts position Restaurant-to-Consumer as the most dynamic and rapidly expanding segment in the market.

By Channel Insights

The mobile applications segment commanded the Europe online food delivery market by capturing 65.3% of the total market share in 2024. This segment's growth is driven by the widespread adoption of smartphones and the convenience offered by mobile apps, which provide seamless navigation, real-time tracking, and one-touch ordering. As per Eurostat, over 85% of Europeans aged 16-64 own a smartphone, with mobile apps being the preferred channel for accessing digital services. A key factor propelling this dominance is the integration of advanced features such as AI-driven recommendations, personalized offers, and secure payment gateways. A report by McKinsey & Company states that mobile app users spend 30% more on average compared to desktop users, thanks to features like push notifications and loyalty rewards. Also, the COVID-19 pandemic accelerated mobile app adoption, with platforms like Uber Eats and Deliveroo reporting a 40% increase in app downloads during lockdowns. Furthermore, partnerships with device manufacturers have enhanced user experience. These innovations, combined with the growing preference for on-the-go solutions, strengthen mobile applications as the largest and most influential channel in the market.

The websites/desktop-based ordering is emerging as the swiftest expanding in the Europe online food delivery market, with a CAGR of 14.2% in the coming years. This progress is caused by the increasing accessibility of high-speed internet and the rising number of consumers who prefer larger screens for browsing menus and customizing orders. A major driver of this expansion is the growing demand for detailed meal customization and transparency. Also, advancements in web-based technologies, such as Progressive Web Apps (PWAs), have bridged the gap between mobile and desktop experiences. For instance, Just Eat Takeaway reported a 20% increase in desktop orders after launching a PWA in 2022, which improved load times and user engagement. Moreover, the rise of remote work has contributed to this trend, with Eurostat noting that over 40% of European professionals now work from home, creating opportunities for desktop-based food ordering. These factors position websites/desktop as the fastest-growing and increasingly competitive segment in the market.

By Payment Method Insights

The online payment methods segment was the top performing category in the Europe online food delivery market by accounting for a significant portion of all transactions in 2024. This is due to the widespread adoption of digital wallets, credit/debit cards, and integrated payment systems like Apple Pay and Google Pay. According to Eurostat, over 80% of Europeans aged 16-74 have used online banking or digital payment platforms, reflecting a strong preference for cashless transactions. A key factor propelling this dominance is the convenience and security offered by online payment systems. A study by McKinsey & Company notes that online payments reduce transaction times by up to 50% compared to cash on delivery, enhancing customer satisfaction. Besides these, the integration of AI-driven fraud detection systems has increased trust among consumers. Furthermore, the pandemic accelerated the shift toward digital payments, as many consumers avoided physical cash due to hygiene concerns. For instance, Uber Eats reported a 45% surge in online payments during 2020-2021, driven by contactless delivery options. These innovations, coupled with government initiatives promoting cashless economies, such as Sweden’s move toward becoming a fully digital payment society reinforce online payment as the largest and most trusted segment in the market.

Despite being a smaller segment, cash on delivery (COD) is becoming the fastest-growing payment method in the Europe online food delivery market, with a CAGR of 16.8%. This growth is fueled by its appeal to specific demographics, particularly older adults and rural populations who remain hesitant about digital payment systems. A major driver of this expansion is the growing emphasis on inclusivity in e-commerce. According to Eurostat, approximately 25% of Europeans aged 65 and above still prefer COD due to unfamiliarity with online payment methods. Additionally, rural areas with limited internet access and banking infrastructure rely heavily on COD. Platforms like Just Eat Takeaway have responded by expanding COD options in underserved regions resulting in a 20% increase in orders from these areas in 2022. Moreover, regulatory changes mandating flexible payment options have further boosted COD adoption. For example, new EU directives require delivery platforms to offer at least two payment methods ensuring COD remains available. These factors position cash on delivery as the fastest-growing segment, bridging the gap for underrepresented consumer groups.

Country Level Analysis

The UK remains the largest online food delivery market in Europe, capturing an estimated 34.7% share in 2024. Its dominance over the market is fueled by a tech-savvy population and a robust digital infrastructure that supports seamless transactions. According to Eurostat, over 90% of UK households have access to high-speed internet enabling widespread adoption of mobile apps and websites for food ordering. A key driver of the UK's influence is the aggressive expansion of global platforms like Deliveroo and Just Eat Takeaway both headquartered in the country. These platforms processed over 300 million orders in 2022, with an average order value of £25, as noted by McKinsey & Company. Urban centers like London and Manchester are hotspots for innovation, with cloud kitchens and AI-driven logistics gaining traction. Furthermore, government initiatives promoting gig economy reforms have ensured sustainable growth. These factors, combined with a culture of convenience, cement the UK’s position as a trailblazer in the European market.

Germany represents a mature and high-volume market. The country’s focus on sustainability and technological advancements has positioned it as a leader in eco-friendly delivery solutions. Berlin has become a testing ground for innovations such as electric delivery vehicles and reusable packaging. Also, a major aspect assisting growth is the increasing preference for plant-based meals. Moreover, partnerships between local restaurants and platforms like Lieferando have expanded the variety of cuisines available, appealing to diverse consumer preferences. Besides these, regulatory support for green logistics has encouraged companies to adopt carbon-neutral practices. These initiatives, coupled with Germany’s emphasis on quality and efficiency, solidify its status as a key player in the market.

France has grown steadily in the Europe online food delivery market. The nation’s rich culinary heritage has seamlessly integrated with modern technology making online food delivery a thriving industry. Paris, Lyon, and Marseille are leading cities where demand is particularly strong. Among the prime drivers is the growing popularity of premium dining experiences delivered to homes. In addition, the French government’s "FoodTech Initiative" has allocated €100 million to support startups in the sector, fostering innovation. A report by Eurostat reveals that 70% of French urban households now rely on online food delivery for convenience. Furthermore, the introduction of eco-friendly packaging mandates has pushed companies to adopt sustainable practices aligning with consumer values. These factors underscore France’s pivotal role in shaping the European market.

Italy’s adoption of online food delivery reflects a balance between its strong culinary heritage and a growing appetite for convenience. Known for its traditional dining culture, it has embraced digital transformation, particularly in urban areas like Milan, Rome, and Turin. The pandemic acted as a catalyst, with online food delivery usage doubling between 2019 and 2021, according to ISTAT. A prime aspect of growth is the rising demand for authentic Italian cuisine delivered to homes. Just Eat Takeaway reported a 50% increase in pizza and pasta orders in 2022, reflecting strong consumer loyalty to local flavors. Besides these, collaborations with small family-owned restaurants have expanded platform offerings while preserving culinary traditions. Apart from these, initiatives like "Digital Italy 2026" aim to enhance internet accessibility in rural areas, boosting market penetration. These efforts show Italy’s dynamic contribution to the European landscape.

Spain stands out as the fastest-growing country in the region, with an expected CAGR of 11.1% in 2024. The country’s youthful population and vibrant urban centers like Barcelona and Madrid have made it a hotspot for online food delivery services. As per the Eurostat, over 85% of Spaniards aged 16-44 use smartphones for daily activities, including food ordering. A major factor propelling Spain’s growth is the increasing adoption of subscription-based models. Glovo, a Barcelona-based platform, introduced a subscription service in 2023, resulting in a 30% rise in customer retention. Also, the demand for healthy and Mediterranean-inspired meals has surged, with Statista reporting a 35% increase in orders for salads and grilled dishes. Furthermore, Spain’s focus on reducing urban congestion has led to incentives for bike couriers and electric vehicles, enhancing delivery efficiency. These strategies, combined with Spain’s embrace of digital innovation, position it as a rapidly growing contributor to the European market.

Top 3 Players in the market

The Europe online food delivery market is dominated by three major players: Just Eat Takeaway, Deliveroo, and Uber Eats , each contributing significantly to the global landscape. Just Eat Takeaway, headquartered in the Netherlands, leads with a presence in over 20 European countries. Its acquisition of Grubhub in 2021 expanded its footprint into North America, solidifying its position as a global leader. Deliveroo, based in the UK, has revolutionized urban delivery with its focus on premium restaurants and real-time tracking. Uber Eats, leveraging its parent company’s logistics expertise, operates in more than 45 countries, with Europe accounting for 30% of its global revenue. These companies have collectively driven innovation in AI-driven logistics, eco-friendly packaging, and subscription models influencing global trends in convenience and sustainability.

Top strategies used by the key market participants

Key players in the Europe online food delivery market employ strategies such as partnerships, technological investments, and geographic expansion to maintain their competitive edge. For instance, Just Eat Takeaway partnered with PayPal in 2023 to offer seamless payment solutions, enhancing user experience. Deliveroo focuses on exclusive collaborations with high-end restaurants, introducing curated menus that appeal to niche markets. Uber Eats has invested heavily in AI-driven logistics, reducing delivery times by 20% in major cities like Paris and Berlin. Additionally, all three companies have introduced subscription services such as Uber One and Deliveroo Plus to boost customer retention. Sustainability initiatives, including carbon-neutral deliveries and reusable packaging, are also central to their strategies, aligning with consumer demands for eco-conscious practices.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe online food delivery market are Deliveroo PLC,DoorDash Inc.,Delivery Hero Group,Just Eat Limited,Uber Technologies Inc.,Swiggy,Zomato,Delivery.com LLC,Yelp Inc.,Amazon.com Inc.,Rappi Inc.

The Europe online food delivery market is highly competitive, characterized by intense rivalry among global giants and regional players. Just Eat Takeaway, Deliveroo, and Uber Eats dominate the landscape, collectively controlling over 70% of the market share, as per a report by the European E-commerce Association. However, smaller startups and direct-to-consumer models from restaurants are challenging their dominance. The competition is further intensified by price wars, aggressive marketing campaigns, and innovations in delivery logistics. According to McKinsey & Company, over 60% of consumers switch platforms based on discounts or loyalty rewards, forcing companies to continuously innovate. Regulatory pressures, particularly regarding gig worker rights and environmental impact, add another layer of complexity. Despite these challenges, the market remains dynamic, with players leveraging advanced technologies and personalized experiences to differentiate themselves.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Just Eat Takeaway launched its "Green Delivery" initiative in partnership with local governments across Europe, introducing electric bikes and reusable packaging to reduce carbon emissions by 30%.

- In January 2024, Deliveroo acquired a majority stake in Taster, a cloud kitchen startup, to expand its portfolio of virtual brands and enhance operational efficiency in urban areas.

- In November 2023, Uber Eats introduced its AI-powered "Dynamic Routing System" in major European cities, cutting delivery times by 15% and improving customer satisfaction.

- In July 2023, Just Eat Takeaway partnered with PayPal to integrate advanced payment options, allowing users to split bills and earn cashback, thereby increasing transaction volumes by 25%.

- In February 2024, Deliveroo launched its "Deliveroo Plus" subscription service in France and Germany, offering unlimited free deliveries for €9.99/month, resulting in a 40% increase in active users within three months.

MARKET SEGMENTATION

This research report on the Europe Online Food Delivery Market has been segmented and sub-segmented into the following categories.

By Type

- Platform-to-Consumer

- Restaurant-to-Consumer

By Channel

- Mobile Applications

- Websites/Desktop

By Payment Method

- online payment methods

- Cash on Delivery

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is the current size of the online food delivery market in Europe?

The market size is growing rapidly, driven by increasing internet penetration, changing consumer lifestyles, and the rise of food delivery apps.

What is the future outlook for online food delivery in Europe?

The market is expected to continue growing, with innovations in AI, sustainability, and logistics driving efficiency. More consolidation and acquisitions are likely as competition remains fierce.

Which countries in Europe have the largest food delivery markets?

The biggest markets are United Kingdom ,Germany, France, Italy, Spain.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]