Europe Offshore Support Vessels (OSVs) Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Anchor Handling Towing Supply Vessel, Platform Supply Vessel, Fast Supply Intervention Vessel, Multi-Purpose Service Vessel, and Others), Water Depth, Fuel, Service Type, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Offshore Support Vessels (OSVs) Market Size

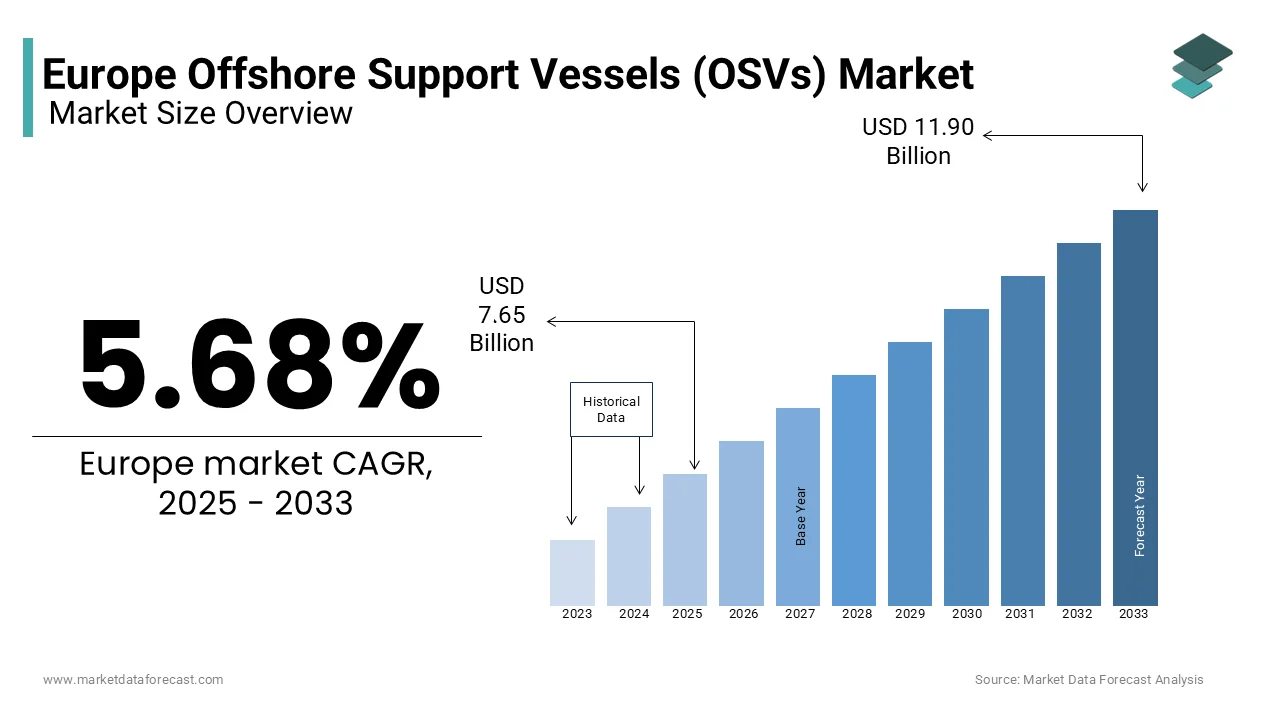

The Europe offshore support vessels market was worth USD 7.24 billion in 2024. The Europe market is estimated to reach USD 11.90 billion by 2033 from USD 7.65 billion in 2025, rising at a CAGR of 5.68% from 2025 to 2033.

Offshore support vessels include platform supply vessels (PSVs), anchor handling tug supply (AHTS) vessels, multipurpose support vessels (MPSVs), and others that provide specialized services such as towing, anchor handling, and subsea construction. The offshore energy activities in Europe, particularly in the North Sea and the Baltic Sea, drive significant demand for OSVs. According to the International Energy Agency, Europe is one of the largest markets for offshore wind energy, with over 120 GW of installed capacity targeted by 2030. This transition to renewable energy sources has increased the deployment of vessels for wind farm construction, maintenance, and cable-laying activities. Additionally, oil and gas operations in mature fields continue to require support services, sustaining the demand for traditional OSVs.

Technological advancements, such as hybrid propulsion systems and digital fleet management, are reshaping the market to meet stricter environmental standards. The European Maritime Safety Agency highlights the importance of reducing emissions in maritime operations, prompting a shift toward energy-efficient and eco-friendly vessel designs. These developments underscore the critical role of offshore support vessels in ensuring the sustainability and efficiency of Europe’s offshore activities.

MARKET DRIVERS

Expansion of Offshore Wind Energy Projects

The rapid expansion of offshore wind energy projects is a key driver of the European offshore support vessels market. Europe leads globally in offshore wind capacity, with the European Commission reporting that the region aims to achieve 120 GW of installed capacity by 2030 and 300 GW by 2050. This growth necessitates specialized vessels for tasks such as turbine installation, maintenance, and cable laying. The North Sea, Baltic Sea, and Atlantic Ocean are primary hubs for offshore wind development, with countries like the UK and Germany spearheading large-scale projects. Offshore support vessels, including wind farm service vessels, are integral to achieving these ambitious renewable energy goals and ensuring operational efficiency.

Sustained Offshore Oil and Gas Activities

Despite the transition to renewables, Europe’s offshore oil and gas sector remains a significant contributor to the offshore support vessels market. The International Energy Agency highlights that mature fields in the North Sea and Arctic regions continue to require support for drilling, production, and decommissioning activities. For instance, Norway and the UK are key players in offshore oil production, with operations relying on anchor handling tug supply (AHTS) and platform supply vessels (PSVs). These vessels facilitate critical logistics, such as transporting equipment, personnel, and supplies, ensuring the continuity of offshore energy production and supporting economic stability in the energy sector.

MARKET RESTRAINTS

Stringent Environmental Regulations

Strict environmental regulations pose a significant restraint on the European offshore support vessels market. The European Maritime Safety Agency emphasizes that vessels operating in European waters must comply with rigorous emissions standards, including the International Maritime Organization’s (IMO) MARPOL Annex VI, which limits sulfur emissions to 0.5% globally and 0.1% in Emission Control Areas (ECAs) like the North Sea and Baltic Sea. Retrofitting existing vessels with eco-friendly technologies, such as scrubbers or LNG propulsion, is costly and time-intensive. Smaller operators often struggle with these financial and technical requirements, limiting their ability to compete. These regulations aim to reduce maritime pollution but also increase operational expenses, slowing market growth.

High Operational and Maintenance Costs

The offshore support vessels market in Europe faces challenges due to high operational and maintenance costs. The European Commission highlights that fuel expenses alone account for a substantial share of a vessel’s operating budget, and fluctuating oil prices exacerbate this financial burden. Additionally, regular maintenance, including hull inspections and engine upgrades, is essential to ensure compliance with safety standards and efficient operations. For example, advanced vessels equipped with hybrid propulsion systems require specialized technicians and components, further raising maintenance costs. These financial pressures discourage new market entrants and strain smaller operators, restricting the overall growth potential of the offshore support vessels market.

MARKET OPPORTUNITIES

Growth in Offshore Renewable Energy Infrastructure

The expansion of offshore renewable energy infrastructure presents a significant opportunity for the European offshore support vessels market. The European Commission has set ambitious targets to achieve 120 GW of offshore wind capacity by 2030 and 300 GW by 2050, requiring extensive support for installation and maintenance activities. Specialized vessels, such as wind turbine installation vessels (WTIVs) and service operation vessels (SOVs), are critical for constructing and servicing offshore wind farms. The Baltic and North Seas are key areas for development, with major projects like Dogger Bank in the UK driving demand for advanced vessel fleets. This focus on renewable energy aligns with Europe’s climate objectives and underscores the importance of OSVs in supporting sustainable growth.

Advancements in Hybrid and Green Propulsion Technologies

The adoption of hybrid and green propulsion technologies offers substantial opportunities for the offshore support vessels market. The European Maritime Safety Agency highlights that hybrid and LNG-powered vessels reduce greenhouse gas emissions by up to 30%, aligning with stringent European Union regulations such as the Green Deal. These eco-friendly technologies also enhance fuel efficiency, lowering operational costs. For example, Norway has pioneered the deployment of battery-hybrid offshore vessels, setting a benchmark for sustainability in maritime operations. The push toward carbon-neutral shipping solutions creates a favorable environment for investment in next-generation OSVs, fostering innovation and positioning Europe as a leader in green maritime technologies.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the European offshore support vessels market. The European Commission highlights that the COVID-19 pandemic and geopolitical tensions, such as the Russia-Ukraine conflict, have impacted the availability of critical components like engines, propulsion systems, and electronic control units. These delays have led to increased lead times for vessel manufacturing and retrofitting. For example, shipyards across Europe reported delays of up to six months for key parts during 2022. This uncertainty affects project timelines for both new vessel constructions and upgrades, creating operational bottlenecks and financial strain for operators reliant on timely deliveries.

Fluctuations in Oil and Gas Investments

The volatility of investments in the offshore oil and gas sector significantly affects the offshore support vessels market. The International Energy Agency notes that declining oil prices in recent years have led to reduced capital expenditures in offshore exploration and production. For instance, European upstream investment fell by approximately 40% between 2015 and 2020. This reduction in spending has decreased demand for anchor handling tug supply (AHTS) vessels and platform supply vessels (PSVs), which are integral to oil and gas operations. While renewable energy projects are growing, the reliance on oil and gas-related activities for a significant portion of the OSV market creates vulnerability to market fluctuations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.68% |

|

Segments Covered |

By Type, Water Depth, Fuel, Service Type, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Bourbon, Grupo CBO, Gulfmark, Havila, Maersk, Seacor Marine, SIEM Offshore, Solstad, Swire, Tayrona Offshore, Tidewater, and Vroon Group. |

REGIONAL ANALYSIS

Norway held the largest share of the European offshore support vessels market in 2024 due to its advanced maritime infrastructure and strong offshore oil and gas industry. The Norwegian Petroleum Directorate reports that Norway is Europe’s largest producer of offshore oil and gas, with extensive operations in the North Sea and Arctic regions. The country’s investment in eco-friendly vessels, including LNG and battery-hybrid propulsion systems, further strengthens its position. Additionally, Norway is a pioneer in integrating renewable energy projects, such as offshore wind farms, creating a dual demand for OSVs.

The United Kingdom is another major player in the European market and is expected to be driven by the leadership of the UK in offshore wind energy and substantial oil and gas activities. According to the UK Department for Business, Energy & Industrial Strategy, the UK aims to achieve 50 GW of offshore wind capacity by 2030, necessitating a robust fleet of OSVs. The North Sea oil fields also continue to drive demand for platform supply vessels (PSVs) and anchor handling tug supply (AHTS) vessels, maintaining the UK’s stronghold in the OSV market.

The Netherlands is anticipated to account for a notable share of the European market over the forecast period due to its strategic focus on offshore renewable energy and advanced maritime logistics. The Dutch government highlights that the Netherlands is a major hub for offshore wind projects in the North Sea, supported by specialized installation and maintenance vessels. Its emphasis on sustainability and efficient port operations further consolidates its leading position in the European OSV market.

KEY MARKET PLAYERS

The major players in the Europe offshore support vessels market include Bourbon, Grupo CBO, Gulfmark, Havila, Maersk, Seacor Marine, SIEM Offshore, Solstad, Swire, Tayrona Offshore, Tidewater, and Vroon Group.

MARKET SEGMENTATION

This research report on the Europe offshore support vessels market is segmented and sub-segmented into the following categories.

By Type Insights

- Anchor Handling Towing Supply Vessel

- Platform Supply Vessel

- Fast Supply Intervention Vessel

- Multi-Purpose Service Vessel

- Others

By Water Depth Insights

- Shallow Water

- Deepwater

By Fuel Insights

- Fuel Oil

- LNG

By Service Type Insights

- Technical Services

- Inspection & Survey

- Crew Management

- Logistics & Cargo Management

- Anchor Handling & Seismic Support

- Others

By Application Insights

- Oil and Gas Applications

- Offshore Applications

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the OSV market in Europe?

The growth is driven by increasing offshore wind farm installations, decommissioning of aging oil platforms, and rising deepwater exploration activities.

How are European regulations affecting the OSV market?

Stricter emissions standards and sustainability goals are pushing OSV operators to invest in cleaner technologies like hybrid and LNG-powered vessels.

How is technology improving OSV operations in Europe?

Technologies like automation, digital monitoring, and remote-controlled operations are enhancing vessel efficiency, safety, and reducing fuel consumption.

What is the future outlook for the European OSV market?

The future looks promising with continued investment in offshore renewables, increased demand for multi-purpose vessels, and advancements in vessel electrification and automation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]