Europe Nutrition and Supplements Market Size, Share, Trends & Growth Forecast Report By Product Type (Dietary Supplements, Functional Foods, Functional Beverages, Sports Nutrition, Weight Management Products), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Nutrition and Supplements Market Size

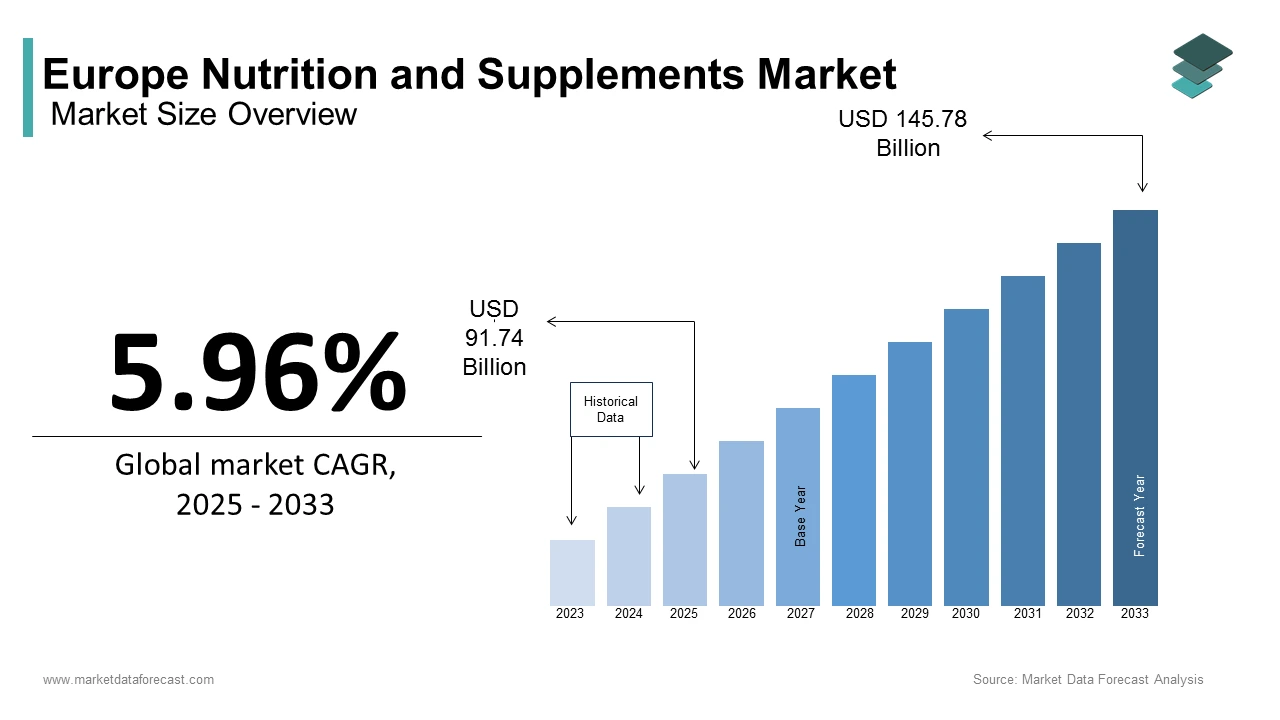

The Europe nutrition and supplements market size was calculated to be USD 86.58 billion in 2024 and is anticipated to be worth USD 145.78 billion by 2033 from USD 91.74 billion in 2025, growing at a CAGR of 5.96% during the forecast period.

Nutritional and supplements are a wide array of products that are designed to enhance health, support dietary needs, and improve physical performance. This includes vitamins, minerals, herbal supplements, sports nutrition products, and weight management solutions. The changing consumer preferences, increasing health consciousness, and advancements in nutritional science are fuelling the demand for nutrition and supplement products in Europe. As per the European Food Safety Authority (EFSA), regulatory frameworks play a pivotal role in shaping the market landscape to ensure product safety and efficacy while fostering innovation. The aging population of Europe further amplifies demand, as older adults seek supplements to address age-related health concerns. Additionally, the proliferation of e-commerce platforms has expanded access to these products, enabling consumers to make informed choices. According to Statista, online sales accounted for nearly 35% of total revenue in 2022, underscoring the shift toward digital channels.

MARKET DRIVERS

Increasing Health Consciousness Among Consumers

According to the World Health Organization (WHO), Europe has witnessed a significant rise in health awareness, with over 60% of adults actively seeking ways to improve their well-being through dietary interventions. This growing trend is a primary driver of the Nutritional and supplements market, as individuals prioritize preventive healthcare measures. For instance, the WHO reports that cardiovascular diseases account for 45% of all deaths in Europe, prompting consumers to adopt healthier lifestyles and incorporate supplements into their daily routines. Furthermore, Eurostat data reveals that spending on health-related products increased by 8% annually between 2018 and 2022, highlighting the economic impact of this behavioral shift. The surge in gym memberships and participation in fitness activities also underscores the demand for sports nutrition products, with the European Sports Nutrition Federation estimating a 12% year-on-year increase in protein supplement consumption. As consumers become more educated about the benefits of micronutrients and functional foods, the market is poised for continued growth, driven by this heightened focus on holistic health.

Rising Prevalence of Chronic Diseases

According to the European Centre for Disease Prevention and Control (ECDC), chronic conditions such as obesity, diabetes, and osteoporosis are becoming increasingly prevalent across Europe, affecting over 50% of the adult population. These conditions necessitate long-term dietary management, thereby fueling demand for targeted nutritional supplements. For example, the ECDC notes that obesity rates have risen by 20% in the past decade, leading to a corresponding spike in the use of fat burners and weight management products. Additionally, the International Osteoporosis Foundation estimates that 22 million women and 5.5 million men in Europe suffer from osteoporosis, driving the popularity of calcium and vitamin D supplements. Government initiatives aimed at reducing the burden of chronic diseases, such as the UK’s National Health Service promoting vitamin D supplementation during winter months, further bolster market growth. With healthcare costs associated with chronic diseases exceeding €700 billion annually, as reported by the Organisation for Economic Co-operation and Development (OECD), the role of supplements in mitigating these expenses cannot be overstated.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

The regulatory environment governing Nutritional and supplements in Europe is among the most stringent globally, posing a significant restraint to market growth. Manufacturers must navigate complex approval processes, including rigorous testing and clinical trials, to demonstrate product safety and efficacy. EFSA mandates that all health claims on supplements undergo scientific validation, a process that can take up to two years and cost millions of euros. This has deterred smaller companies from entering the market, limiting innovation and product diversity. Moreover, the European Commission reports that non-compliance with labeling and ingredient standards results in the recall of approximately 5% of supplements annually, further complicating operations for businesses. Such regulatory hurdles not only increase production costs but also delay time-to-market, stifling growth potential.

Economic Uncertainty and Consumer Spending Constraints

Economic volatility in Europe has led to fluctuating consumer spending patterns, negatively impacting the Nutritional and supplements market. Inflation rates exceeding 8% in several EU countries have forced households to prioritize essential expenditures over discretionary purchases, including premium-priced supplements. The European Central Bank highlights that disposable income declined by an average of 3% in 2022, disproportionately affecting middle- and lower-income groups who constitute a significant portion of the market. Additionally, Statista reports that 40% of consumers have reduced their spending on health and wellness products due to financial constraints. This trend is particularly pronounced in regions with higher unemployment rates, such as Southern Europe, where Spain and Italy recorded jobless rates of 12.8% and 7.8%, respectively. As economic uncertainty persists, maintaining consumer affordability while ensuring product quality remains a critical challenge for industry players.

MARKET OPPORTUNITIES

Expansion of E-Commerce Platforms

The rapid expansion of e-commerce platforms presents a lucrative opportunity for the European Nutritional and supplements market. The convenience and accessibility offered by digital channels have transformed consumer purchasing behavior, particularly among younger demographics. For instance, a survey conducted by the European E-Commerce Association revealed that 70% of millennials prefer buying supplements online due to competitive pricing and extensive product information. Furthermore, the integration of artificial intelligence and personalized recommendations on platforms like Amazon and local European retailers has enhanced customer engagement, driving repeat purchases. Eurostat reports that countries such as Germany and the UK lead in online health product sales, contributing over 40% of total revenue. As internet penetration continues to rise, reaching 90% across Europe, the potential for market expansion through e-commerce remains immense.

Growing Demand for Plant-Based and Organic Supplements

The demand for plant-based and organic supplements is surging, fueled by increasing veganism and environmental consciousness. Over 10% of Europeans now identify as vegetarian or vegan, creating a niche yet rapidly expanding segment within the market. The European Commission highlights that organic food and supplement sales grew by 12% annually between 2019 and 2022, with Germany accounting for 30% of total revenue. Consumers are drawn to these products due to their perceived health benefits and sustainability credentials, as confirmed by a Nielsen study indicating that 65% of buyers are willing to pay a premium for eco-friendly options. Additionally, regulatory support for organic farming, such as the EU’s Common Agricultural Policy, incentivizes manufacturers to develop innovative formulations. This trend not only aligns with global sustainability goals but also positions plant-based supplements as a key growth driver in the coming years.

MARKET CHALLENGES

Counterfeit and Substandard Products

Counterfeit and substandard supplements pose a significant challenge to the European market, undermining consumer trust and brand reputation. OLAF estimates that 15% of dietary supplements sold online are either counterfeit or fail to meet safety standards, often containing harmful substances or incorrect dosages. This issue is exacerbated by the anonymity of online sellers, making it difficult for authorities to enforce regulations effectively. The European Medicines Agency reports that adverse reactions linked to counterfeit products have increased by 25% since 2018, raising public health concerns. Furthermore, Eurostat data indicates that consumer complaints related to fraudulent supplements have surged by 30% in the past three years, highlighting the urgency of addressing this problem. Without robust measures to combat counterfeiting, the market risks losing credibility and facing stricter regulatory scrutiny.

Lack of Standardization in Product Formulations

The absence of standardized formulations across the Nutritional and supplements industry creates inconsistencies in product quality and efficacy. EFPIA notes that variations in ingredient sourcing, manufacturing processes, and dosage levels often result in products with differing therapeutic outcomes, confusing consumers and healthcare professionals alike. For instance, a study published by the European Journal of Clinical Nutrition found that the bioavailability of vitamin D supplements varied by up to 40% across brands, impacting their effectiveness. Additionally, the lack of harmonized standards complicates cross-border trade, as highlighted by the European Commission, which reports that 25% of supplements face regulatory hurdles when marketed in multiple EU countries. This fragmentation not only hinders market growth but also limits the ability of manufacturers to scale operations efficiently.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.96% |

|

Segments Covered |

By Product, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Nestlé S.A., Glanbia plc, DSM-Firmenich, Brenntag SE, Ajinomoto Co., Inc., Orthomol, Vitabiotics |

SEGMENTAL ANALYSIS

By Product Type Insights

The sports nutrition segment accounted for the leading share of 40.8% in the European market in 2024. The domination of sports nutrition segment in the European market is driven by the growing popularity of fitness culture, with Eurostat reporting a 20% increase in gym memberships over the past five years. Sports nutrition products, including protein powders, bars, and pre-workout supplements, cater to a diverse audience ranging from professional athletes to casual fitness enthusiasts. The European Sports Nutrition Federation highlights that protein supplement sales alone exceeded €5 billion in 2022, driven by their proven efficacy in muscle recovery and performance enhancement. Furthermore, the segment benefits from endorsements by fitness influencers and partnerships with gyms, amplifying brand visibility. Its importance lies in its ability to address specific nutritional needs, making it indispensable for individuals pursuing active lifestyles.

The fat burner segment is another promising segment and is expected to expand at a CAGR of 18.7% over the forecast period due to the rising obesity rates in Europe, with the European Centre for Disease Prevention and Control reporting a 20% increase in obesity prevalence over the past decade. Fat burners appeal to consumers seeking quick and effective weight management solutions, particularly in urban areas where sedentary lifestyles are prevalent. A study by the European Obesity Society reveals that 60% of users perceive fat burners as a convenient alternative to traditional dieting methods. Additionally, innovations in formulation, such as thermogenic blends and appetite suppressants, have enhanced product efficacy, driving adoption. The segment’s prominence underscores its role in addressing one of Europe’s most pressing public health challenges.

REGIONAL ANALYSIS

Germany captured the major share of 26.6% in the European nutritional and supplements market in 2024 due to its robust healthcare infrastructure and high consumer spending power. The dominating position of Germany in the European market is majorly due to the aging population of Germany, with over 21% aged 65 and above, drives demand for vitamins and mineral supplements, as reported by the Federal Statistical Office. Additionally, government initiatives promoting preventive healthcare, such as subsidies for dietary supplements, further stimulate market growth.

The UK nutritional and supplements market is estimated to progress at a promising CAGR during the forecast period owing to their strong e-commerce ecosystem and widespread health awareness. The National Health Service’s recommendation of vitamin D supplements has significantly boosted sales, with Mintel reporting a 25% increase in demand during winter months.

France is predicted to account for a notable share of the European market over the forecast period. The emphasis of France on organic and plant-based supplements is driving the French nutritional and supplements market growth. According to the French Ministry of Agriculture, organic supplement sales grew by 12% annually, reflecting consumer preference for sustainable products.

Italy is anticipated to witness a healthy CAGR during the forecast period due to the growing focus of Italy on sports nutrition. The Italian National Institute of Health notes that rising gym memberships and fitness events have propelled demand for protein-based products.

Spain is likely to hold a considerable share of the European market over the forecast period owingto the increasing obesity rates in Spain. The Spanish Society of Endocrinology reports a 20% rise in weight management supplement usage, underscoring the segment’s importance.

KEY MARKET PLAYERS

Major Players of the Europe nutrition and supplements market include Nestlé S.A., Glanbia plc, DSM-Firmenich, Brenntag SE, Ajinomoto Co., Inc., Orthomol, and Vitabiotics

DETAILED SEGMENTATION OF EUROPE NUTRITION AND SUPPLEMENTS MARKET INCLUDED IN THIS REPORT

This research report on the Europe nutrition and supplements market has been segmented and sub-segmented based on product type & region.

By Product Type

- Dietary Supplements

- Vitamins

- Minerals

- Herbal Supplements

- Probiotics

- Omega Fatty Acids

- Functional Foods

- Fortified Dairy Products

- Cereals

- Bakery & Confectionery

- Snack Bars

- Functional Beverages

- Sports Drinks

- Energy Drinks

- Fortified Juices

- Sports Nutrition

- Protein Powders

- Amino Acids

- Pre/Post Workout Supplements

- Weight Management Products

- Meal Replacements

- Fat Burners

- Appetite Suppressants

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which factors are driving the growth of the European nutrition and supplements market?

Rising health awareness, aging population, demand for sports nutrition, and the increasing popularity of plant-based and organic supplements.

2. What are the key trends shaping the European supplement market?

Growth in personalized nutrition, clean-label ingredients, plant-based supplements, and increased e-commerce sales.

3. Who are the leading players in the European nutrition and supplements market?

Major players include Nestlé S.A., Glanbia plc, DSM-Firmenich, Brenntag SE, Ajinomoto Co., Inc., Orthomol, and Vitabiotics.

4. How is technology impacting the European nutrition and supplement industry?

AI-driven personalized nutrition, advanced ingredient formulations, and smart packaging solutions are revolutionizing the industry.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]