Europe Non-Residential Polished Concrete Market Research Report – Segmented By Application (flooring segment, wall cladding segment ) Finish and Color (matte finish segment , semi-gloss finish segment ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Non-Residential Polished Concrete Market Size

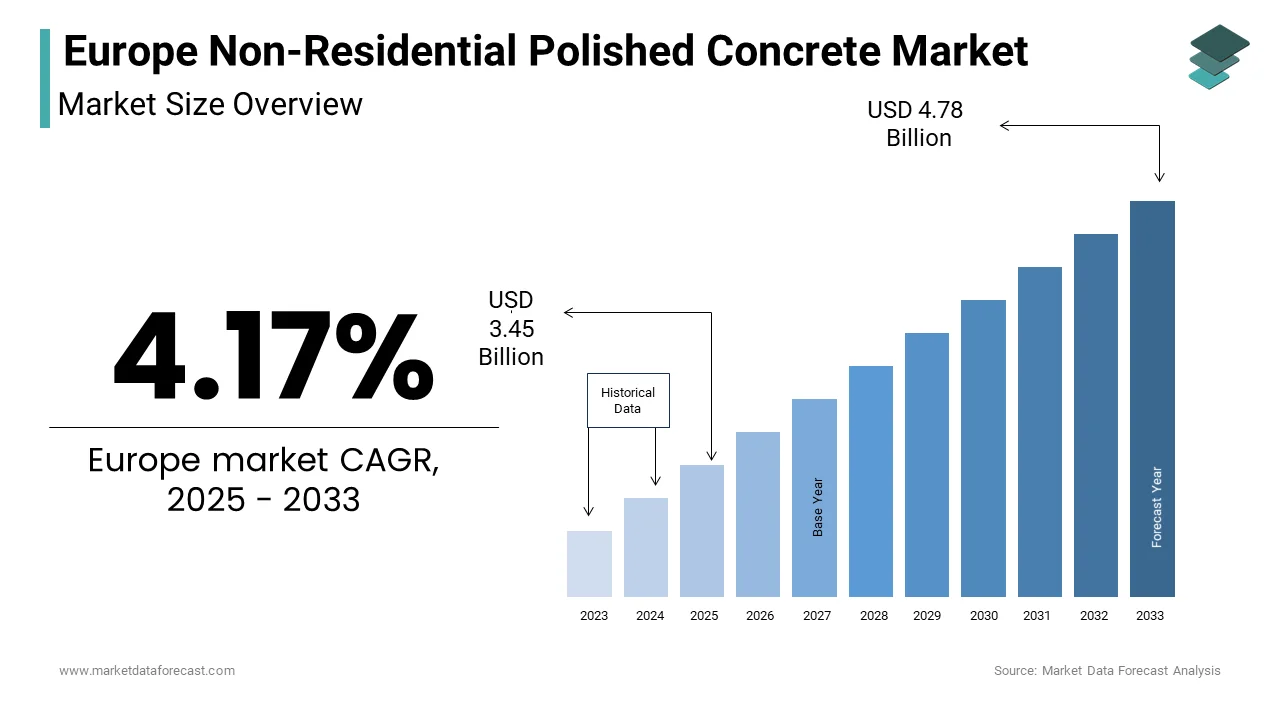

The europe non-residential polished concrete market Size was valued at USD 3.31 billion in 2024. The europe non-residential polished concrete market size is expected to have 4.17 % CAGR from 2025 to 2033 and be worth USD 4.78 billion by 2033 from USD 3.45 billion in 2025.

Polished concrete has emerged as a transformative material in Europe’s non-residential construction sector, driven by its durability, aesthetic versatility, and sustainability. According to the European Construction Industry Federation, polished concrete is increasingly adopted in commercial spaces, industrial facilities, and public infrastructure due to its low maintenance costs and eco-friendly attributes. Germany and France are at the forefront of this trend, accounting for over 40% of regional demand, as per the German Federal Ministry of Housing. The Italian National Institute for Sustainable Development highlights that polished concrete reduces carbon emissions by 30% compared to traditional flooring materials like tiles or carpets. As industries prioritize energy efficiency and modern design, the demand for polished concrete continues to grow, positioning it as a cornerstone of contemporary non-residential architecture.

MARKET DRIVERS

Rising Demand for Sustainable Building Materials in Europe

The rising demand for sustainable building materials is one of the major factors propelling the Europe non-residential polished concrete market forward. The European Green Building Council states that polished concrete reduces material waste by 50% during installation and eliminates the need for additional coatings or finishes, aligning with circular economy principles. For instance, Sweden’s commercial real estate sector has embraced polished concrete flooring, achieving a 25% reduction in embodied carbon in new office buildings. Additionally, the French Ministry of Urban Planning highlights that the material’s thermal mass properties contribute to energy savings of up to 15% in heating and cooling systems. This trend underscores the pivotal role of polished concrete in supporting Europe’s green building initiatives while addressing ecological concerns.

Growing Adoption in Commercial Spaces

The growing adoption of polished concrete in commercial spaces is another major driver boosting the market. The European Commercial Real Estate Association reports that polished concrete accounts for 60% of flooring installations in new office developments, driven by its sleek appearance and cost-effectiveness. For example, the Netherlands’ retail sector has seen a 40% increase in polished concrete usage, enhancing store aesthetics and reducing long-term maintenance costs. Furthermore, the UK’s National Office Design Council highlights that the material’s durability and resistance to wear make it ideal for high-traffic areas, such as shopping malls and airports. As businesses increasingly prioritize modern and functional interiors, the adoption of polished concrete in this sector is set to grow significantly, ensuring its continued relevance in commercial architecture.

MARKET RESTRAINTS

High Initial Costs and Labor Intensity

High initial costs and labor-intensive processes is one of the key restraints to the growth of the Europe non-residential polished concrete market, particularly for small-scale projects. The European Construction Contractors Association estimates that polished concrete installations can cost up to 30% more than traditional flooring options due to specialized equipment and skilled labor requirements. For instance, rural regions in Eastern Europe report that only 10% of construction firms have access to the necessary expertise, as per the Czech Technical University. Additionally, the Swiss Construction Research Institute highlights that the time-consuming nature of polishing processes often delays project timelines, deterring smaller developers from adopting the material. Without targeted subsidies or training programs, these barriers will continue to limit broader market penetration.

Limited Awareness Among Stakeholders

Limited awareness among stakeholders about the benefits and proper application of polished concrete in Europe is further hampering the regional market growth. As per a survey conducted by the European Federation of Architects, only 25% of building owners in Southern Europe are familiar with the material’s long-term cost savings and environmental advantages. This knowledge gap often results in underutilization or resistance to change, undermining broader adoption. For example, Spain’s hospitality sector has reported a 15% slower adoption rate compared to other regions, as stated by the Spanish Chamber of Commerce. Additionally, misinformation spread through unverified sources exacerbates the problem, deterring potential adopters. Without educational campaigns and accessible resources, the full potential of polished concrete cannot be realized, limiting its adoption in underserved markets.

MARKET OPPORTUNITIES

Expansion into Industrial Applications

The expansion of polished concrete into industrial applications is one of the major opportunities for the market players seeking to diversify their portfolios. As per the estimations of the European Industrial Design Association, the demand for polished concrete in warehouses and manufacturing facilities is expected to fuel significantly through 2030, driven by its durability and resistance to heavy machinery. For instance, Germany’s automotive sector has adopted polished concrete flooring to achieve a 30% reduction in maintenance costs, according to the German Automotive Manufacturers Association. Similarly, the Netherlands’ logistics hubs have embraced the material for its ability to withstand high traffic and heavy loads, improving operational efficiency. As industries increasingly prioritize longevity and performance, the adoption of polished concrete in this sector is poised to accelerate, unlocking new revenue streams for manufacturers.

Adoption of Innovative Finishes and Colors

The adoption of innovative finishes and colors in polished concrete is another significant opportunity in the regional market. The European Design Innovation Council states that advancements in staining and polishing techniques have increased customization options, allowing architects to create bespoke solutions tailored to specific client needs. For example, Italy’s luxury retail sector has pioneered the use of semi-gloss beige finishes to enhance store aesthetics, achieving a 20% increase in customer engagement. Additionally, the Swedish Innovation Agency highlights that matte black polished concrete has gained traction in modern office designs, aligning with minimalist trends. As Europe continues to invest in creative and functional architecture, the role of aesthetically versatile polished concrete is set to expand, positioning it as a cornerstone of future-ready interiors.

MARKET CHALLENGES

Resistance to Change in Traditional Construction Practices

Resistance to change in traditional construction practices is a major challenge to the Europe non-residential polished concrete market, particularly among established builders and contractors. The European Construction Federation reports that over 60% of construction firms in Central Europe remain hesitant to adopt polished concrete due to concerns about perceived risks and lack of familiarity. For instance, Italy’s residential construction sector has reported that only 5% of projects utilize polished concrete, as stated by the Italian Chamber of Commerce. Additionally, cultural biases favoring conventional materials like tiles and carpets further exacerbate this issue, limiting innovation and market growth. To overcome these barriers, stakeholders must focus on demonstrating the long-term benefits of polished concrete through pilot projects and industry collaborations.

Supply Chain Disruptions and Material Scarcity

Supply chain disruptions and material scarcity are also challenging the growth of the Europe non-residential polished concrete market, particularly amid global uncertainties. The European Cement Association reports that shortages of key raw materials like aggregates have led to a 20% increase in production costs since 2022, severely impacting manufacturers in countries like Germany and Belgium. For example, Russia’s export restrictions on raw materials have forced European suppliers to seek alternative sources, increasing lead times by 35%.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.17 % |

|

Segments Covered |

By Application, Finish and Color and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

Flooring Technologies Group,Fosroc,ParexGroup,GCP Applied Technologies |

SEGMENT ANALYSIS

By Application Insights

The flooring segment accounted for 68.8% of the Europe non-residential polished concrete market share in 2024. The dominating position of flooring segment in the European market is driven by its durability, ease of maintenance, and aesthetic appeal, making it ideal for high-traffic areas like offices, retail spaces, and industrial facilities. The German Federal Ministry of Housing reports that polished concrete flooring reduces lifecycle costs by 40% compared to traditional materials, enhancing affordability and accessibility. Additionally, its compatibility with underfloor heating systems ensures consistent performance across diverse applications.

The wall cladding segment is a promising segment and anticipated to register a CAGR of 15.4% over the forecast period owing to its increasing use in modern office designs and public infrastructure, where aesthetics and functionality are paramount. For instance, Sweden’s healthcare sector has adopted polished concrete wall cladding to achieve a 30% improvement in hygiene and durability. Its alignment with contemporary architectural trends makes it a focal point for future innovations, ensuring sustained growth in the construction industry.

By Finish and Color Insights

The matte finish segment captured 51.4% of the European market share in 2024. The dominating position of matte finish segment in the European market is attributed to its understated elegance and resistance to visible scratches, making it suitable for high-traffic environments. The Italian National Institute for Sustainable Development reports that matte finishes reduce glare by 25%, enhancing visual comfort in office spaces. Additionally, their ease of maintenance drives widespread adoption.

The semi-gloss finish segment is predicted to grow at a CAGR of 18.9% over the forecast period. The growing use of semi-gloss finish in luxury retail and hospitality sectors to achieve aesthetics and durability is one of the major factors propelling the growth of the semi-gloss finish segment in the European market. For example, France’s high-end fashion boutiques have embraced semi-gloss finishes to achieve a 20% increase in customer engagement. Its ability to meet the exacting requirements of premium applications positions it as a key growth driver in the coming years.

Country Level Analysis

The United Kingdom is a dominant force in the European non-residential polished concrete market. This strong position is largely attributed to the UK’s robust construction sector, which has rebounded significantly post-pandemic. According to the Office for National Statistics, construction output in the UK surged by 12.5% in 2021, driven by increased investments in infrastructure and commercial real estate. The demand for polished concrete is particularly high in urban centers, where its durability and aesthetic appeal make it a preferred choice for modern office spaces and retail environments. Additionally, the UK government’s commitment to sustainability has spurred the adoption of eco-friendly materials, including polished concrete, which is often sourced locally. The trend towards open-plan office designs further enhances the demand for polished concrete, as it provides a seamless and visually appealing surface that meets contemporary design standards. This combination of factors solidifies the UK’s leading position in the non-residential polished concrete market in Europe.

Germany ranks as the second-largest market for non-residential polished concrete in Europe. The country’s strong economy and thriving construction sector are pivotal in driving this growth. The German Construction Industry Association reported that the construction output reached €400 billion in 2021, with non-residential projects comprising a significant portion of this figure. Polished concrete is increasingly favored for its low maintenance requirements and aesthetic versatility, making it suitable for various applications, including warehouses, shopping centers, and office buildings. Furthermore, Germany’s commitment to sustainability and energy efficiency aligns with the benefits of polished concrete, which can contribute to green building certifications such as LEED. The urbanization trend, particularly in cities like Berlin and Munich, is also propelling the demand for polished concrete flooring solutions, as developers seek modern and durable materials that can withstand heavy foot traffic. This combination of economic strength and sustainability initiatives positions Germany as a key player in the European non-residential polished concrete market.

France is a significant contributor to the European non-residential polished concrete market. The French construction industry has been on a recovery trajectory, with a growth rate of 5.5% in 2021, as reported by the French Ministry of Ecological Transition. The demand for polished concrete is driven by its aesthetic qualities and durability, making it a popular choice for high-end retail spaces and corporate offices. Additionally, France’s commitment to sustainable development has led to increased interest in polished concrete, which is often perceived as an environmentally friendly option due to its longevity and low maintenance needs. The trend of urban renewal projects in cities like Paris is also contributing to the demand for polished concrete, as developers seek modern and visually appealing flooring solutions that can withstand heavy foot traffic. This combination of factors solidifies France’s position as a significant market for non-residential polished concrete in Europe, catering to both aesthetic and functional needs.

Spain is emerging as a notable player in the European non-residential polished concrete market. The Spanish construction sector has shown signs of recovery, with a growth rate of 6.2% in 2021, according to the Spanish Ministry of Transport, Mobility, and Urban Agenda. The demand for polished concrete in Spain is driven by the increasing number of commercial and industrial projects, particularly in urban areas like Madrid and Barcelona. Polished concrete is favored for its cost-effectiveness and aesthetic versatility, making it suitable for various applications, including shopping malls, offices, and warehouses. Additionally, the growing emphasis on sustainable construction practices in Spain has led to a rise in the adoption of polished concrete, which can contribute to energy efficiency and lower maintenance costs over time. The trend towards modern architectural designs also supports the demand for polished concrete, as it can be customized to meet specific aesthetic requirements, enhancing Spain's position in the market.

Italy is a notable player in the European non-residential polished concrete market. The Italian construction industry has been gradually recovering, with a reported growth of 4.5% in 2021, according to the Italian National Institute of Statistics. The demand for polished concrete in Italy is driven by its aesthetic appeal and durability, making it a popular choice for commercial spaces, including retail and hospitality sectors. The increasing focus on sustainable building practices in Italy has also contributed to the growth of polished concrete, as it is often seen as an eco-friendly flooring option. Additionally, the trend of renovating historical buildings and integrating modern design elements has led to a rise in the use of polished concrete, which can provide a contemporary look while maintaining the integrity of traditional architecture. This combination of factors positions Italy as a key player in the European non-residential polished concrete market, catering to both modern and traditional design needs.

KEY MARKET PLAYERS

Key players operating in the Europe Non-Residential Polished Concrete Market profiled in this report are Flooring Technologies Group,Fosroc,ParexGroup,GCP Applied Technologies,TDM,Euclid Chemical,BASF,MAPEI,RPM International,Sika,HCS,LATICRETE.

MARKET SEGMENTATION

This research report on the Europe Non-Residential Polished Concrete Market has been segmented and sub-segmented into the following categories.

By Application

- flooring segment

- wall cladding segment

By Finish and Color

- matte finish segment

- semi-gloss finish segment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

Which end-user segment dominates the European market?

The commercial segment holds a significant share, driven by demand from hotels, retail stores, and other commercial spaces.

What are some of the challenges facing the European market?

One of the challenges are the environmental concerns related to the production of concrete.

What types of businesses utilize non residential polished concrete?

Warehouses, retail stores, hospitals, schools, and offices are just a few examples.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]