Europe Natural Sweeteners Market Size, Share, Trends & Growth Forecast Report By Product Type (Stevia, Xylitol, Sorbitol, Mannitol, Erythritol, and Others), Form, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Natural Sweeteners Market Size

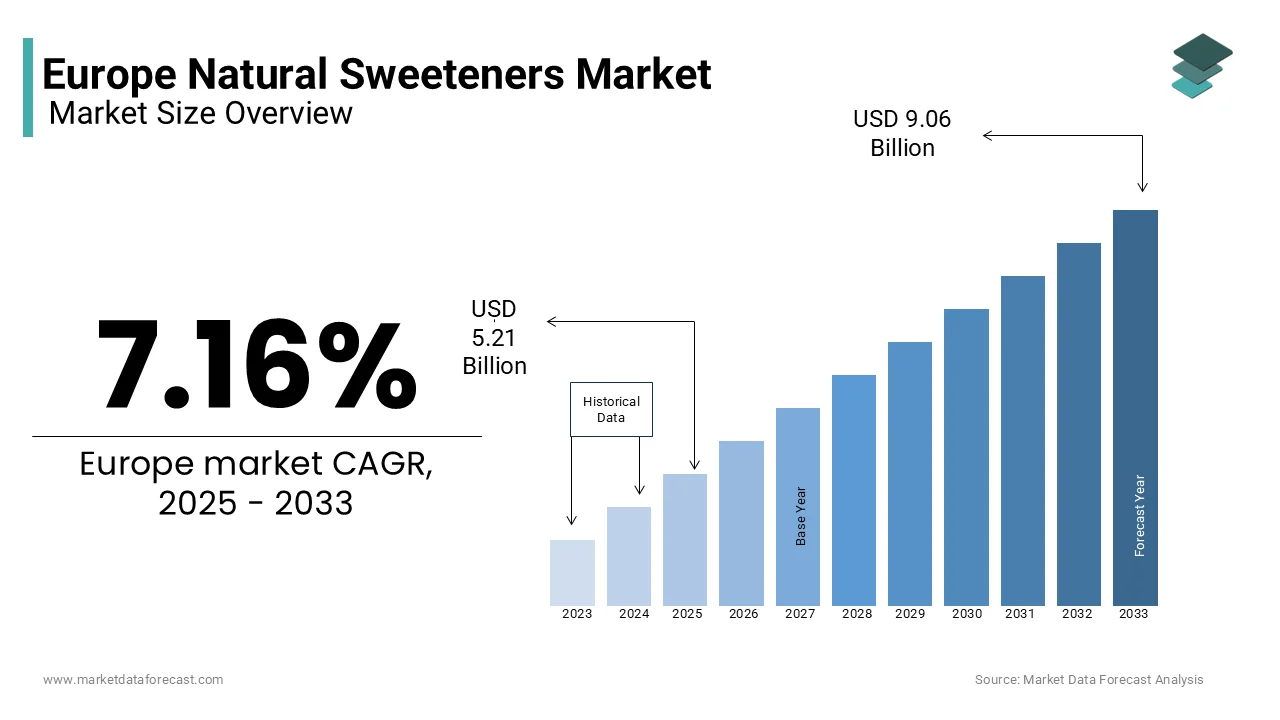

The Natural sweeteners market size in Europe was valued at USD 4.86 billion in 2024. The European market is estimated to be worth USD 9.06 billion by 2033 from USD 5.21 billion in 2025, growing at a CAGR of 7.16% from 2025 to 2033.

Natural sweeteners are derived from plant-based sources or fermentation processes, include products such as stevia, xylitol, sorbitol, mannitol, and erythritol. These substitutes are gaining prominence due to their low-calorie content and minimal impact on blood glucose levels, making them ideal for individuals managing diabetes or adhering to weight management programs. According to the European Food Safety Authority, the consumption of natural sweeteners in Europe has increased by over 15% annually since 2020, reflecting growing awareness about health and wellness. The World Health Organization further notes that excessive sugar intake contributes to obesity and related chronic diseases, prompting regulatory bodies to advocate for reduced sugar consumption across the continent.

MARKET DRIVERS

Increasing Prevalence of Lifestyle Diseases

The rising incidence of lifestyle-related diseases, including obesity and diabetes, serves as a significant driver propelling the Europe natural sweeteners market. According to the World Health Organization, over 60 million adults in Europe are living with diabetes, while nearly 59% of the adult population is classified as overweight or obese. This alarming trend has heightened consumer awareness regarding the adverse effects of excessive sugar consumption, prompting a shift towards healthier alternatives. Natural sweeteners, such as stevia and erythritol, offer a viable solution due to their low glycemic index and calorie-free properties. The European Society of Cardiology reports that countries like the UK and Germany have witnessed a 20% increase in the adoption of natural sweeteners among diabetic patients over the past five years. Furthermore, government-led initiatives promoting healthier diets, such as the UK's sugar tax introduced in 2018, have reinforced the demand for these products. As per Eurostat, the annual sales of natural sweeteners in the food and beverage sector have grown by 18%, underscoring their critical role in addressing public health concerns and driving market expansion.

Stringent Regulations Against Artificial Additives

The implementation of stringent regulations restricting the use of artificial sweeteners and additives has significantly contributed to the growth of the Europe natural sweeteners market. According to the European Food Safety Authority, several synthetic sweeteners, including aspartame and saccharin, have been subject to safety reviews and usage restrictions due to potential health risks. This regulatory landscape has encouraged manufacturers to reformulate their products using natural alternatives, thereby boosting demand for ingredients like xylitol and stevia. The European Commission highlights that over 40% of processed food products launched in 2022 featured clean-label claims, emphasizing the growing preference for natural ingredients. Additionally, consumer advocacy groups have played a pivotal role in raising awareness about the benefits of natural sweeteners, further accelerating their adoption. The International Diabetes Federation estimates that the market for natural sweeteners in Europe will grow at a compound annual growth rate (CAGR) of 7.5%, driven by regulatory compliance and the increasing emphasis on transparency in food labeling.

MARKET RESTRAINTS

High Production Costs and Pricing Challenges

One of the primary restraints impeding the growth of the Europe natural sweeteners market is the high production costs associated with sourcing and processing raw materials. According to the European Commission, the cultivation of stevia plants and the extraction of compounds such as steviol glycosides require advanced technologies and significant capital investment, leading to elevated production expenses. These costs are subsequently passed on to consumers, making natural sweeteners less affordable compared to conventional sugar or artificial alternatives. The Organisation for Economic Co-operation and Development (OECD) reports that the average retail price of natural sweeteners is approximately 30% higher than refined sugar, limiting their accessibility, particularly in low-income households. Additionally, fluctuations in the availability of raw materials, such as corn for producing erythritol, further exacerbate pricing volatility. This economic barrier not only restricts market penetration but also challenges manufacturers in achieving economies of scale, thereby hindering widespread adoption.

Limited Consumer Awareness and Misconceptions

Another significant restraint facing the Europe natural sweeteners market is the limited awareness and misconceptions surrounding their health benefits and usage. According to Eurostat, nearly 45% of European consumers remain uncertain about the differences between natural and artificial sweeteners, often perceiving all sugar substitutes as unhealthy. The European Consumer Organisation highlights that misinformation campaigns and conflicting scientific studies have created confusion, deterring potential users from adopting natural sweeteners. For instance, some consumers associate sugar alcohols like xylitol and sorbitol with gastrointestinal discomfort, despite evidence suggesting that moderate consumption poses no significant risks. Furthermore, the lack of standardized labeling practices across the region complicates efforts to educate consumers about the nutritional advantages of these products. The European Food Information Council notes that only 30% of surveyed individuals actively seek out natural sweeteners, underscoring the need for targeted marketing and educational initiatives to dispel myths and enhance consumer confidence.

MARKET OPPORTUNITIES

Expansion of Clean-Label Product Offerings

The growing consumer demand for clean-label products presents a substantial opportunity for the Europe natural sweeteners market. According to the European Food Safety Authority, over 70% of European consumers prioritize transparency in food labeling, seeking products free from artificial additives and preservatives. This trend has prompted manufacturers to incorporate natural sweeteners into a wide range of applications, from beverages to baked goods. The European Commission reports that the clean-label food segment is projected to grow at a CAGR of 9.2%, creating a fertile ground for natural sweeteners to thrive. Ingredients like stevia and erythritol, known for their natural origins and minimal processing, align perfectly with clean-label requirements. Additionally, the rise of health-conscious millennials and Gen Z consumers has further amplified demand for products featuring natural sweeteners. The International Food Information Council highlights that nearly 60% of new product launches in Europe now emphasize natural ingredients, underscoring the immense potential for market players to capitalize on this trend and expand their portfolios.

Rising Popularity of Plant-Based Diets

The increasing popularity of plant-based diets offers another lucrative opportunity for the Europe natural sweeteners market. According to the European Vegetarian Union, the number of individuals adopting vegetarian or vegan lifestyles has surged by 30% over the past five years, driven by environmental and ethical considerations. This dietary shift has spurred demand for plant-derived ingredients, including natural sweeteners like stevia, which is extracted from the leaves of the Stevia rebaudiana plant. The European Environment Agency notes that plant-based food products accounted for over €5 billion in sales in 2022, with natural sweeteners playing a pivotal role in enhancing flavor profiles without compromising health standards. Furthermore, the integration of natural sweeteners into plant-based beverages, desserts, and snacks has gained traction, as highlighted by the European Association for the Promotion of Health.

MARKET CHALLENGES

Supply Chain Vulnerabilities and Raw Material Scarcity

A significant challenge confronting the Europe natural sweeteners market is the vulnerability of supply chains and the scarcity of raw materials essential for production. According to the European Commission, disruptions caused by geopolitical tensions, climate change, and logistical bottlenecks have led to shortages of key inputs, such as stevia leaves and corn-based derivatives used in erythritol production. The European Environment Agency reports that extreme weather events, including droughts and floods, have adversely impacted agricultural yields, reducing the availability of raw materials by up to 25% in certain regions. These supply chain constraints have resulted in increased production costs and prolonged lead times, adversely affecting market dynamics. Furthermore, the reliance on imports for certain raw materials exposes manufacturers to currency fluctuations and trade uncertainties. The Organisation for Economic Co-operation and Development (OECD) notes that over 30% of companies in the natural sweeteners industry reported supply chain-related challenges in 2022, underscoring the urgent need for diversification and localization strategies to mitigate risks and ensure business continuity.

Regulatory Hurdles and Approval Delays

Another pressing challenge facing the Europe natural sweeteners market is the complex regulatory landscape governing the approval and commercialization of new products. According to the European Food Safety Authority, obtaining regulatory clearance for novel natural sweeteners involves rigorous safety assessments and lengthy approval processes, often taking up to three years. This delay hampers innovation and limits the introduction of cutting-edge formulations to the market. The European Parliament highlights that inconsistencies in regulatory frameworks across member states further complicate compliance, creating barriers for smaller manufacturers and startups. Additionally, the absence of harmonized standards for labeling and advertising natural sweeteners leads to confusion among consumers and stakeholders. The European Consumer Organisation reports that nearly 40% of new product launches face delays due to regulatory hurdles, stifling market growth and innovation. Addressing these challenges requires collaborative efforts between regulatory bodies, industry players, and research institutions to streamline approval processes and foster a conducive environment for market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.16% |

|

Segments Covered |

By Product Type, Form, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Symrise AG, Tereos Starch and Sweeteners, Ingredion Incorporated, Roquette Freres, HYET Sweet B.V., PureCircle, DuPont De Nemours Inc., Tate & Lyle PLC, Cargill Incorporated, The Archer Daniels Midland Company, Associated British Foods PLC, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The stevia segment dominated the Europe natural sweeteners market by capturing 35.9% of the European market share in 2024 owing to its zero-calorie profile, natural origin, and suitability for diabetic and weight-conscious consumers. According to the International Diabetes Federation, the demand for stevia has surged by over 20% annually, driven by its ability to replace sugar without compromising taste. The versatility of stevia, which can be used in beverages, baked goods, and dairy products, enhances its appeal across various applications. The European Commission reports that stevia accounts for nearly 50% of all new product launches featuring natural sweeteners, underscoring its pivotal role in shaping market trends. Additionally, advancements in extraction technologies have improved the taste profile of stevia, addressing earlier consumer concerns about bitterness and further solidifying its dominance.

The erythritol segment is projected to register a CAGR of 12.5% over the forecast period owing to its unique combination of health benefits, including low caloric content and minimal impact on blood sugar levels. According to the World Health Organization, erythritol is increasingly favored in sugar-free confectionery and beverages due to its excellent taste and stability under heat. The rise of keto and low-carb diets has further propelled its adoption, particularly among health-conscious millennials. The European Association for the Promotion of Health highlights that erythritol is projected to account for 25% of the natural sweeteners market by 2028, driven by innovations in fermentation-based production methods. Its compatibility with clean-label trends positions it as a key driver of future market growth.

By Form Insights

The powdered segment led the market by holding 60.4% of the European market share in 2024. The growth of the powdered segment in the European market is driven by ease of use, long shelf life, and compatibility with a wide range of applications, including baking, beverages, and tabletop sweeteners. According to Eurostat, powdered forms are particularly popular in the food and beverage industry, where they are used to enhance flavor without altering texture. The European Commission reports that the demand for powdered natural sweeteners has grown by 18% annually, supported by innovations in blending technologies that improve solubility and taste. Additionally, the affordability and widespread availability of powdered formats make them accessible to both industrial manufacturers and individual consumers, further reinforcing their leadership position in the market.

The pharmaceuticals segment is predicted to witness a promising CAGR of 10.8% over the forecast period. Factors such as the increasing use of natural sweeteners in oral medications, syrups, and dietary supplements to improve palatability without compromising health standards are propelling the growth of the pharmaceuticals segment in the European market. According to the International Diabetes Federation, over 40% of new pharmaceutical formulations now incorporate natural sweeteners like xylitol and stevia to cater to diabetic patients. The European Association for the Study of Diabetes highlights that the demand for sugar-free medications has surged by 25% over the past five years, driven by rising awareness about the adverse effects of sugar in medical products. The versatility and safety of natural sweeteners make them an ideal choice for pediatric and geriatric formulations, positioning this segment as a critical driver of future market expansion.

By Distribution Channel Insights

The supermarkets and hypermarkets are the major distribution channels in the European market. The supermarkets and hypermarkets segment accounted for 45.8% of the European market share in 2024. The lead of the segment in the European market is attributed to their extensive reach, diverse product offerings, and ability to cater to a broad consumer base. According to the European Retail Forum, these retail channels benefit from strategic partnerships with manufacturers, enabling them to stock a wide variety of natural sweeteners, from mainstream brands to niche products. The convenience of one-stop shopping and promotional discounts further enhances consumer engagement. The European Commission reports that supermarkets and hypermarkets have witnessed a 20% increase in natural sweetener sales over the past three years, driven by rising health consciousness and the growing availability of clean-label products. Their established infrastructure and trusted brand presence solidify their position as the leading distribution channel in the market.

The online retailers segment is anticipated to witness a CAGR of 15.2% over the forecast period owing to the increasing penetration of e-commerce platforms and shifting consumer preferences towards digital shopping. According to Eurostat, online sales of natural sweeteners have surged by over 30% annually, driven by the convenience of home delivery and access to detailed product information. The rise of subscription-based models and personalized recommendations has further enhanced customer engagement. The European Consumer Organisation highlights that nearly 50% of millennials prefer purchasing natural sweeteners online due to competitive pricing and exclusive deals. Additionally, the proliferation of mobile apps and social media marketing has expanded the reach of online retailers, positioning them as a key driver of future market growth.

REGIONAL ANALYSIS

Germany accounted for 24.4% of the European market share in 2024 and emerged as the leading player in the European market. The growth of the Germany in the European market is majorly attributed to the strong emphasis of Germany on health and wellness, coupled with a robust food and beverage industry. According to Eurostat, Germany accounts for over 30% of the region's organic food production, with natural sweeteners playing a pivotal role in clean-label formulations. The German Diabetes Association highlights that the demand for stevia and erythritol has grown by 22% annually, supported by government initiatives promoting healthier diets. Additionally, Germany's advanced manufacturing capabilities and strategic location within Europe facilitate efficient distribution, further strengthening the position of Germany in the European market.

The UK held the second biggest share of the European market in 2024. The stringent regulations of the UK against artificial additives and the introduction of a sugar tax in 2018 have significantly boosted the adoption of natural sweeteners in the UK. According to the British Nutrition Foundation, the demand for natural sweeteners in the UK is growing exponentially due to the rising consumer awareness about obesity and diabetes. The UK's thriving food and beverage sector, particularly in sugar-free confectionery, further amplifies demand. Additionally, the prevalence of health-conscious millennials has fueled the popularity of plant-based diets, creating a fertile ground for market expansion.

France is a prominent regional market for natural sweeteners in the European region. The culinary traditions and emphasis of France on gourmet products have driven the integration of natural sweeteners into premium food and beverage offerings. According to the French Ministry of Agriculture, the demand for xylitol and sorbitol has surged by 18% annually, supported by their use in artisanal chocolates and pastries. France's focus on sustainability and organic farming aligns with the clean-label trend, further propelling market growth. Additionally, the country's robust pharmaceutical industry has increased the adoption of natural sweeteners in sugar-free medications, enhancing their importance in the regional market.

Italy is anticipated to account for a considerable share of the European market over the forecast period. The rich culinary heritage of Italy and growing health consciousness have driven the adoption of natural sweeteners in traditional recipes and modern formulations. According to the Italian Association for Organic Agriculture, the demand for stevia and erythritol has grown by 20% annually, supported by their use in pasta sauces, gelato, and bakery items. Italy's strong export-oriented food industry further amplifies demand, as manufacturers seek to meet international clean-label standards. Additionally, the rise of plant-based diets and the popularity of Mediterranean cuisine have positioned natural sweeteners as a key ingredient in innovative product development.

Spain is estimated to play a key role in the Europe natural sweeteners market over the forecast period. The warm climate and agricultural expertise of Spain have facilitated the cultivation of raw materials like stevia, reducing dependency on imports. According to the Spanish Diabetes Federation, the demand for natural sweeteners has increased by 15% annually, driven by rising awareness about diabetes prevention and management. Spain's vibrant tourism industry has also contributed to market growth, as hotels and restaurants adopt healthier menu options featuring natural sweeteners. Additionally, the country's growing focus on sustainability and eco-friendly practices aligns with the clean-label trend, ensuring sustained demand for natural sweeteners.

KEY MARKET PLAYERS

The major key players in Europe natural sweeteners market are Symrise AG, Tereos Starch and Sweeteners, Ingredion Incorporated, Roquette Freres, HYET Sweet B.V., PureCircle, DuPont De Nemours Inc., Tate & Lyle PLC, Cargill Incorporated, The Archer Daniels Midland Company, Associated British Foods PLC.

MARKET SEGMENTATION

This research report on the Europe natural sweeteners market is segmented and sub-segmented into the following categories.

By Product Type

- Stevia

- Xylitol

- Sorbitol

- Mannitol

- Erythritol

- Others

By Form

- Powder

- Liquid

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retailers

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate of the European natural sweeteners market from 2025 to 2033?

The European natural sweeteners market is projected to grow at a CAGR of 7.16% from 2025 to 2033.

2. What factors are driving the growth of the natural sweeteners market in Europe?

Key drivers include increasing health consciousness, demand for clean-label products, and the rising prevalence of lifestyle-related health issues like obesity and diabetes. Additionally, regulatory changes and consumer preferences for natural ingredients are significant factors

3. Which regions or countries are leading the demand for natural sweeteners in Europe?

Countries like the UK, Germany, and France are significant contributors due to their strong focus on health and wellness, and the growing fitness culture

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]