Europe Molded Pulp Packaging Market Size, Share, Trends & Growth Forecast Report By Source (Wood Pulp, Non-wood Pulp), Molded Type, Product Type, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Molded Pulp Packaging Market Size

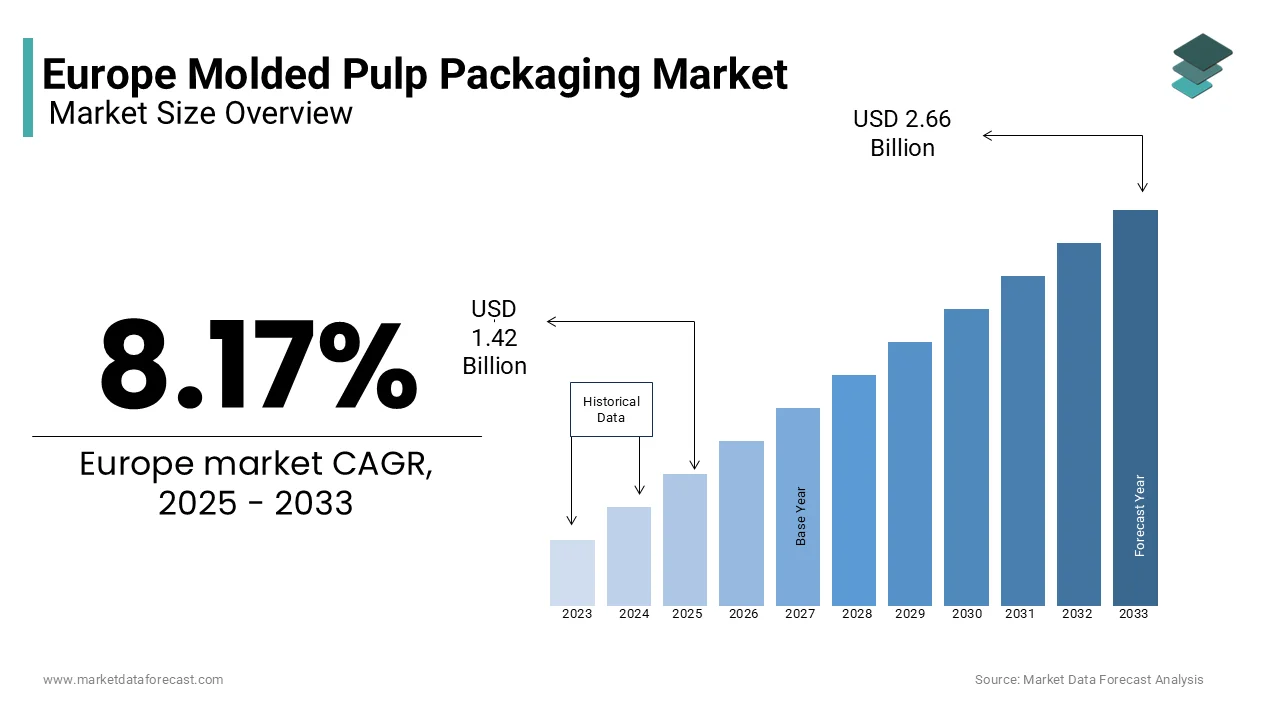

The molded pulp packaging market size in Europe was valued at USD 1.31 billion in 2024. The European market is estimated to be worth USD 2.66 billion by 2033 from USD 1.42 billion in 2025, growing at a CAGR of 8.17% from 2025 to 2033.

Molded pulp packaging is made from recycled paperboard, cardboard, or plant fibers and widely used for protective packaging in industries such as food and beverages, electronics, healthcare, and consumer goods. This eco-friendly alternative to traditional plastic packaging offers advantages such as biodegradability, recyclability, and cost-effectiveness, making it an ideal choice for companies striving to meet sustainability goals.

As of 2023, the European molded pulp packaging market is experiencing robust growth due to the Single-Use Plastics Directive of the European Union that bans certain single-use plastics and encourages the adoption of sustainable alternatives. In Europe, countries like Germany, France, and the United Kingdom are leading adopters due to their proactive policies promoting circular economies and waste reduction. According to the study by the European Environment Agency, over 70% of European consumers prefer eco-friendly packaging, which is driving demand for molded pulp solutions. For instance, the food and beverage industry accounts for the largest share of molded pulp packaging, with applications in egg trays, fruit containers, and takeaway food packaging. Additionally, PwC notes that 45% of European businesses have increased investments in sustainable packaging to align with consumer preferences and regulatory mandates. These trends underscore the pivotal role of molded pulp packaging in fostering environmental sustainability while addressing the growing need for innovative and functional packaging solutions across diverse industries.

MARKET DRIVERS

Stringent Environmental Regulations and Policies

The implementation of stringent environmental regulations is a major driver for the European molded pulp packaging market. The European Union’s Single-Use Plastics Directive, enforced in 2021, bans certain single-use plastic products and mandates the adoption of sustainable alternatives. According to the European Commission, this directive aims to reduce plastic waste by 50% by 2030, encouraging businesses to transition to eco-friendly packaging solutions like molded pulp. Eurostat reports that over 80% of EU member states have introduced national policies supporting biodegradable and recyclable packaging materials. Additionally, extended producer responsibility (EPR) schemes require companies to manage the lifecycle of their packaging, further boosting demand for molded pulp. These regulatory frameworks not only promote sustainability but also create a favorable environment for innovation in green packaging technologies, positioning molded pulp as a key solution for achieving circular economy goals across Europe.

Rising Consumer Demand for Sustainable Packaging

Growing consumer awareness about environmental issues has significantly increased demand for sustainable packaging solutions in Europe. A survey conducted by the European Environment Agency reveals that 70% of European consumers actively seek products with eco-friendly packaging, influencing purchasing decisions and brand loyalty. This shift in consumer behavior is particularly evident in industries such as food and beverages, where molded pulp packaging is widely used for items like egg trays, fruit containers, and takeaway boxes. PwC highlights that 45% of European businesses have prioritized investments in sustainable packaging to meet consumer expectations and enhance brand reputation. Furthermore, the European Commission notes that 60% of retailers are replacing plastic packaging with biodegradable alternatives, driven by public pressure to reduce carbon footprints. This rising demand underscores the critical role of molded pulp packaging in addressing environmental concerns while aligning with evolving consumer preferences.

MARKET RESTRAINTS

High Production Costs and Economic Constraints

High production costs associated with advanced manufacturing processes and raw material procurement is one of the significant restraints to the European molded pulp packaging market. According to Eurostat, molded pulp packaging can be 20-30% more expensive to produce than traditional plastic alternatives, primarily due to energy-intensive drying processes and the cost of sourcing high-quality recycled fibers. This economic barrier is particularly challenging for small and medium-sized enterprises (SMEs), which represent a significant portion of Europe’s manufacturing sector. The European Commission highlights that 40% of SMEs cite cost as a major obstacle to adopting sustainable packaging solutions. Additionally, fluctuations in raw material prices, such as paperboard and plant fibers, further exacerbate financial constraints. While molded pulp offers long-term environmental benefits, its higher upfront costs hinder widespread adoption, especially in price-sensitive industries like retail and logistics.

Limited Durability and Performance Challenges

Another restraint is the limited durability and performance of molded pulp packaging compared to plastic alternatives, particularly in demanding applications. A report by the European Environment Agency notes that molded pulp packaging has lower resistance to moisture and impact, making it unsuitable for certain uses, such as heavy-duty industrial packaging or products requiring extended shelf life. This limitation restricts its adoption in sectors like electronics, where protective packaging must meet stringent quality standards. Furthermore, PwC highlights that 35% of businesses face challenges in transitioning to molded pulp due to concerns about its ability to provide adequate protection during transportation. Although innovations are being made to enhance its performance, such as coatings and reinforcements, these modifications often increase costs and complexity. These factors create hesitation among manufacturers, slowing the pace of market expansion despite growing demand for sustainable options.

MARKET OPPORTUNITIES

Expansion of E-Commerce and Protective Packaging Needs

The rapid growth of e-commerce in Europe is a significant opportunity for the molded pulp packaging market in Europe, driven by the increasing demand for sustainable protective packaging solutions. According to Eurostat, e-commerce sales in Europe grew by 20% annually between 2020 and 2023, leading to a surge in demand for eco-friendly packaging materials that ensure product safety during transit. Molded pulp packaging, with its excellent cushioning properties, is ideal for protecting fragile items such as electronics, glassware, and cosmetics. The European Commission highlights that 60% of online retailers are transitioning to biodegradable packaging to meet consumer expectations and regulatory mandates. Additionally, PwC notes that 45% of logistics companies are investing in sustainable packaging innovations to reduce their carbon footprint. As e-commerce continues to expand, molded pulp packaging is poised to play a pivotal role in addressing the growing need for environmentally responsible protective packaging solutions.

Innovations in Molded Pulp Applications and Material Enhancements

Technological advancements and material innovations offer another major opportunity for the European molded pulp packaging market. Research by the European Environment Agency reveals that 50% of manufacturers are exploring new coatings and additives to enhance the durability and water resistance of molded pulp, making it suitable for broader applications such as foodservice and industrial packaging. For instance, biodegradable coatings can extend the usability of molded pulp in wet or humid environments, addressing previous limitations. Furthermore, Statista reports that investments in R&D for sustainable packaging technologies have increased by 15% annually since 2021, driven by government incentives and private sector initiatives. These innovations not only improve performance but also expand the range of industries adopting molded pulp, including pharmaceuticals and luxury goods. By leveraging cutting-edge technologies, the market can unlock new revenue streams and solidify its position as a leader in sustainable packaging solutions.

MARKET CHALLENGES

Competition from Alternative Sustainable Materials

The rising competition from alternative sustainable materials, such as bioplastics and plant-based polymers is one of the major challenges to the Europe molded pulp packaging market. According to a report by the European Bioplastics Association, bioplastics production capacity in Europe is expected to grow by 30% by 2025, driven by advancements in material science and increased investment in bio-based alternatives. These materials often offer superior durability and moisture resistance compared to molded pulp, making them more attractive for certain applications like food packaging and industrial use. Eurostat highlights that 40% of manufacturers are exploring multiple sustainable options, creating intense competition within the eco-friendly packaging sector. Additionally, PwC notes that consumer confusion about the environmental benefits of different materials further complicates market positioning for molded pulp. This competitive landscape poses a significant hurdle, requiring continuous innovation and marketing efforts to maintain market share.

Infrastructure and Supply Chain Limitations

Limited infrastructure and supply chain constraints hindering the widespread adoption of molded pulp packaging in Europe. The European Commission reports that only 50% of EU member states have adequate recycling and waste management systems to support the efficient production and disposal of molded pulp products. This lack of infrastructure increases logistical costs and delays the scaling of production capabilities. Furthermore, Eurostat reveals that 35% of businesses face challenges in sourcing consistent supplies of high-quality recycled fibers, which are essential for manufacturing molded pulp. Supply chain disruptions, exacerbated by global events such as the pandemic, have further strained raw material availability. These limitations restrict the ability of manufacturers to meet growing demand, particularly in regions with underdeveloped recycling networks, posing a significant barrier to the market’s expansion and long-term sustainability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.17% |

|

Segments Covered |

By Source, Molded Type, Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Omni-Pac Group, Huhtamaki, Pulp-Tec Limited, PAPACKS Sales GmbH, KIEFEL GmbH, James Cropper PLC, buhl-paperform GmbH, International Paper, Graphic Packaging International, LLC, and Great Northern Corporation., and others. |

SEGMENTAL ANALYSIS

By Source Insights

The wood pulp segment led the market by holding 71.4% of the European market share in 2024. The dominance of wood pulp segment in the European market is driven by the abundant availability of sustainably managed forests, with the European Forest Institute highlighting that over 40% of Europe’s forests are certified for sustainable management. Wood pulp’s high tensile strength and compatibility with existing manufacturing processes make it ideal for applications like egg trays and protective packaging. Its cost-effectiveness and reliability ensure consistent supply chains, addressing the growing demand for eco-friendly packaging solutions while minimizing environmental impact.

The non-wood pulp segment is predicted to expand at a CAGR of 8.5% over the forecast period owing to the rising focus on reducing deforestation and utilizing agricultural waste, such as sugarcane bagasse and wheat straw. PwC reports that 30% of European manufacturers are adopting non-wood pulp to meet circular economy goals. Non-wood pulp’s ability to transform agricultural byproducts into sustainable packaging aligns with consumer demand for innovative, low-carbon solutions, making it a critical driver of eco-friendly advancements in the molded pulp packaging industry.

By Molded Type Insights

The thick wall segment dominated the market by accounting for 45.9% of the European market share in 2024 due to its robust structure and cost-effectiveness, making it ideal for heavy-duty applications like egg trays and fruit containers. The European Commission highlights that 60% of agricultural producers rely on thick wall packaging to protect perishable goods during transportation, reducing product damage and waste. Its widespread adoption in the food and beverage sector underscores its importance in ensuring sustainability and compliance with EU regulations. Thick wall’s ability to provide durable, eco-friendly solutions solidifies its position as the largest segment in the molded pulp packaging market.

The thermoformed segment is projected to register the fastest CAGR of 7.2% over the forecast period owing to its lightweight design and suitability for foodservice applications like plates, bowls, and clamshell containers. The European Environment Agency notes that 40% of foodservice providers have transitioned to thermoformed pulp to replace single-use plastics, aligning with EU sustainability goals. Its ability to combine functionality with aesthetic appeal makes it a preferred choice for eco-conscious businesses. As demand for innovative, sustainable packaging rises, thermoformed pulp is pivotal in driving market expansion and reducing environmental impact.

By Product Type Insights

The trays segment led the market by accounting for 43.9% of the European market share in 2024. The dominating position of trays segment in the European market is driven by their versatility and widespread use in the food and beverage industry, particularly for egg trays, fruit containers, and meat packaging. The European Commission highlights that 50% of agricultural producers rely on trays to protect perishable goods during transportation, reducing spoilage and waste. Trays are cost-effective, recyclable, and align with EU sustainability goals, making them indispensable for eco-friendly packaging solutions. Their ability to extend shelf life and ensure product safety underscores their critical role in the market.

The bowls and cups segment is anticipated to witness a CAGR of 6.8% over the forecast period. Factors such as the ban of European Union on single-use plastics and increasing demand for sustainable foodservice packaging. The European Environment Agency notes that 35% of foodservice providers have adopted molded pulp bowls and cups to replace plastic alternatives. Their biodegradability and suitability for both hot and cold food make them ideal for takeaways and institutional dining. As consumer preferences shift toward eco-friendly options, bowls and cups are pivotal in driving innovation and reducing environmental impact in the foodservice sector.

By Application Insights

The food packaging segment held 45.4% of the European market share in 2024. Its leadership is driven by the EU’s ban on single-use plastics and the need for sustainable alternatives in the food and beverage industry. The European Commission highlights that 60% of food producers use molded pulp packaging for egg trays, fruit containers, and meat packaging, reducing spoilage and waste. Molded pulp’s biodegradability, recyclability, and ability to extend shelf life make it indispensable for meeting environmental goals while ensuring product safety and compliance with stringent regulations.

The food service segment is predicted to register a CAGR of 7.5% over the forecast period. Factors such as the EU’s Single-Use Plastics Directive and rising consumer demand for eco-friendly alternatives are propelling the growth of the food service segment in the European market. The European Environment Agency notes that 40% of foodservice providers have adopted molded pulp cups, plates, and clamshells to replace plastics. Its suitability for both hot and cold food, combined with its biodegradability, makes it ideal for takeaways and institutional dining. As sustainability becomes a priority, food service applications are pivotal in driving innovation and reducing environmental impact across Europe.

REGIONAL ANALYSIS

Germany accounted for 28.8% of the European market share in 2024. The dominating position of Germany in the European market is attributed to their stringent environmental regulations, such as the German Packaging Act, which mandates the use of recyclable and biodegradable materials. The European Environment Agency highlights that over 70% of German manufacturers have adopted sustainable packaging solutions, driven by consumer demand and government incentives. Germany’s robust industrial base, particularly in automotive and electronics, further boosts demand for protective molded pulp packaging. Additionally, the country’s advanced recycling infrastructure ensures a steady supply of raw materials like recycled paper and wood pulp. These factors, combined with investments in R&D, position Germany as a pioneer in eco-friendly packaging innovations, driving both market growth and sustainability.

France had a substantial share of the European market in 2024. The prominent position of France in the European market is attributed to its proactive stance on reducing plastic waste. The French Anti-Waste Law, implemented in 2020, bans single-use plastics and promotes alternatives like molded pulp, as noted by the European Commission. France’s strong food and beverage industry, which accounts for 45% of molded pulp applications, drives demand for sustainable food packaging. According to Statista, 60% of French consumers prefer eco-friendly packaging, encouraging retailers and foodservice providers to adopt molded pulp trays, bowls, and clamshells. France’s commitment to circular economy goals and its focus on reducing carbon footprints make it a key contributor to the market’s expansion, fostering innovation in sustainable packaging.

The UK is predicted to account for a notable share of the European molded pulp packaging market over the forecast period owing to the ambitious environmental policies, including the UK Plastics Pact, which aims to eliminate unnecessary plastics by 2025. PwC reports that 50% of UK businesses have transitioned to molded pulp packaging to align with these goals and meet consumer expectations for sustainability. The UK’s thriving e-commerce sector, which grew by 20% annually between 2020 and 2023, according to Eurostat, further accelerates demand for protective and eco-friendly packaging solutions. Additionally, the NHS and retail sectors are adopting molded pulp for medical device packaging and retail applications, respectively. The UK’s focus on reducing plastic waste and promoting green initiatives solidifies its position as a leading market for molded pulp packaging.

KEY MARKET PLAYERS

The major key players in the Europe Molded pulp packaging market are Omni-Pac Group, Huhtamaki, Pulp-Tec Limited, PAPACKS Sales GmbH, KIEFEL GmbH, James Cropper PLC, buhl-paperform GmbH, International Paper, Graphic Packaging International, LLC, and Great Northern Corporation.

MARKET SEGMENTATION

This research report on the Europe molded pulp packaging market is segmented and sub-segmented into the following categories.

By Source

- Wood Pulp

- Non-wood Pulp

By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

By Product Type

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

By Application

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the European molded pulp packaging market in 2024?

The European molded pulp packaging market was valued at approximately USD 1.31 billion in 2024.

2. What factors are driving the growth of the European molded pulp packaging market?

Key drivers include increasing demand for sustainable packaging, rising consumer preference for eco-friendly materials, and government regulations aimed at reducing plastic waste.

3. Which companies are major players in the European molded pulp packaging market?

Major players include Omni-Pac Group, Huhtamaki, Pulp-Tec Limited, PAPACKS Sales GmbH, KIEFEL GmbH, and James Cropper PLC.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]