Europe Mobile Phone Insurance Market Size, Share, Trends, & Growth Forecast Report By Phone Type (New Phone and Refurbished), Coverage, Distribution Channel, End User, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Mobile Phone Insurance Market Size

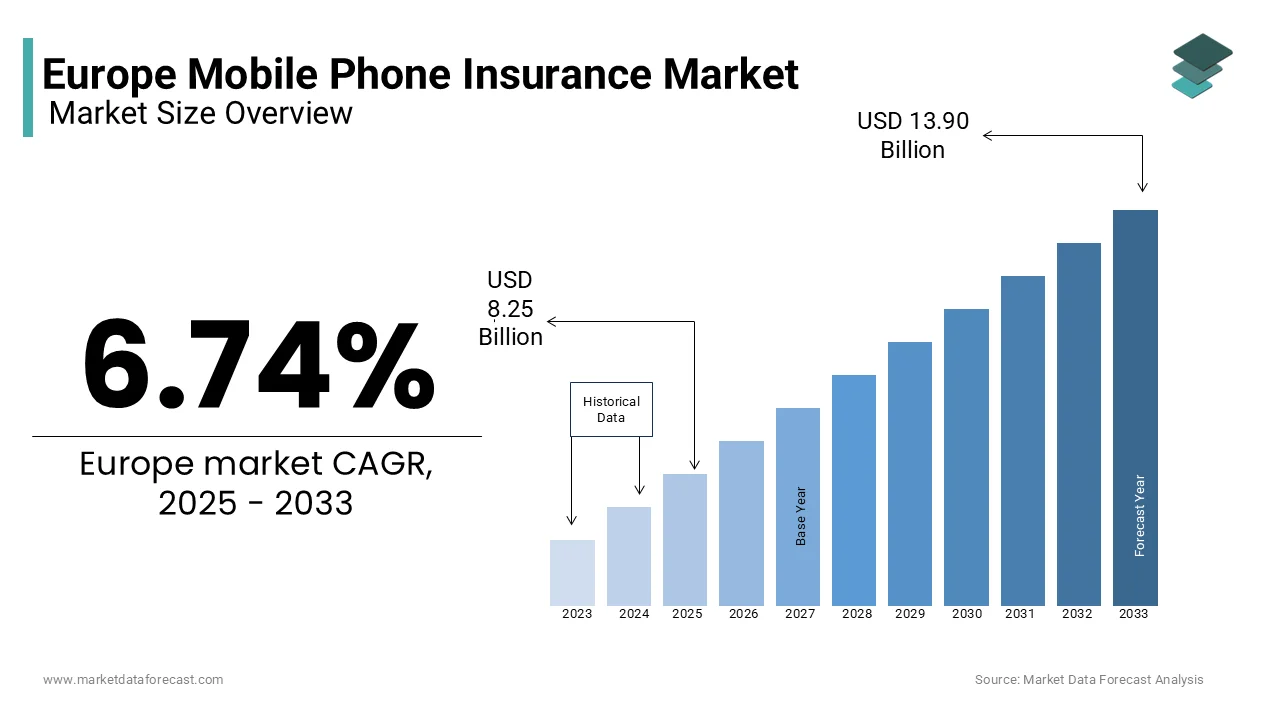

The Europe mobile phone insurance market was worth USD 7.73 billion in 2024. The European market is projected to reach USD 13.90 billion by 2033 from USD 8.25 billion in 2025, growing at a CAGR of 6.74% from 2025 to 2033.

Mobile phone insurance provides coverage for damages, theft, loss, and technical malfunctions and offer consumers peace of mind in an era where smartphones have become indispensable tools for communication, work, and entertainment. According to Eurostat, over 85% of Europeans own a smartphone, with the average cost of premium devices exceeding €600, making insurance an attractive option for risk mitigation. According to the European Commission, smartphone theft accounts for approximately 40% of all electronic device-related crimes, further underscoring the need for robust insurance solutions.

The European mobile phone insurance market has witnessed steady growth over the last few years owing to the proliferation of high-value devices, growing awareness about insurance benefits, and partnerships between insurers and telecom operators. For instance, major carriers like Vodafone and Orange now offer bundled insurance plans with device purchases, enhancing accessibility. Additionally, the European Insurance and Occupational Pensions Authority (EIOPA) emphasizes that regulatory frameworks are evolving to ensure transparency and fairness in policy terms, boosting consumer trust. As Europe continues to embrace digital transformation and the adoption of 5G technology accelerates, the demand for comprehensive mobile phone insurance solutions is expected to surge.

MARKET DRIVERS

Increasing Adoption of High-Value Smartphones in Europe

The rising adoption of high-value smartphones is primarily driving the European mobile phone insurance market growth. According to Eurostat, over 85% of Europeans own a smartphone, with premium devices costing an average of €600 or more, making repairs and replacements financially burdensome for consumers. As per the European Commission, accidental damages, such as cracked screens, account for 60% of smartphone-related claims, while theft contributes to 40% of electronic device crimes. This financial exposure has led to increased awareness and demand for insurance coverage. Statista projects that the average cost of repairing a high-end smartphone exceeds €150, further encouraging consumers to opt for insurance plans. Additionally, telecom operators like Vodafone and Orange are capitalizing on this trend by bundling insurance with device purchases, enhancing accessibility. As smartphone prices continue to rise, the demand for affordable protection plans is set to grow, driving the expansion of the mobile phone insurance market across Europe.

Growing Awareness and Accessibility of Insurance Plans

Growing consumer awareness and improved accessibility to mobile phone insurance plans are boosting the European mobile phone insurance market growth. The European Insurance and Occupational Pensions Authority (EIOPA) notes that regulatory frameworks promoting transparency have boosted consumer trust in insurance products, with over 50% of smartphone users now considering insurance essential. Eurostat highlights that partnerships between insurers and telecom operators have made insurance plans more accessible, with bundled offerings reaching 30% of new device buyers. Furthermore, Statista reports that marketing campaigns emphasizing the benefits of insurance have increased policy uptake by 25% in the past five years. The convenience of digital platforms for purchasing and managing policies has also contributed to higher adoption rates. As awareness spreads and accessibility improves, mobile phone insurance is becoming a mainstream solution, addressing consumer concerns about device security and financial risks in an increasingly digitalized Europe.

MARKET RESTRAINTS

High Premium Costs and Perceived Value Gap

High premium costs and the perceived value gap is a key restraint for the European mobile phone insurance market. As per the European Commission, over 40% of consumers find insurance premiums disproportionately expensive compared to the actual cost of repairs, leading to hesitation in purchasing policies. Eurostat reports that the average annual premium for mobile phone insurance ranges between €50 and €120, while the cost of repairing a cracked screen typically falls below €150. This disparity creates skepticism among budget-conscious consumers, particularly in regions with lower smartphone penetration rates. Additionally, the European Consumer Organisation (BEUC) notes that 35% of users perceive claims processes as cumbersome, further deterring adoption. With many consumers opting for self-repair or third-party services, the market faces challenges in demonstrating the long-term financial benefits of insurance, limiting its appeal despite rising device values.

Complex Claims Processes and Low Trust in Providers

Complex claims processes and low consumer trust in insurance providers are major barriers hindering the growth of the European mobile phone insurance market. The European Insurance and Occupational Pensions Authority (EIOPA) reports that 30% of policyholders face difficulties during claims processing, including lengthy approval times and stringent documentation requirements. Eurostat highlights that such inefficiencies result in claim rejection rates as high as 20%, discouraging potential buyers. Furthermore, the European Consumer Organisation (BEUC) emphasizes that 45% of consumers express concerns about hidden clauses and lack of transparency in policy terms, eroding trust in insurers. These issues are compounded by negative perceptions stemming from past experiences, where claim denials or unsatisfactory resolutions have been reported. As trust remains a critical factor in purchasing decisions, simplifying claims procedures and enhancing transparency are essential to overcoming these challenges and fostering wider adoption of mobile phone insurance across Europe.

MARKET OPPORTUNITIES

Integration of AI and Digital Platforms for Enhanced Customer Experience

The integration of artificial intelligence (AI) and digital platforms is a significant opportunity for the European mobile phone insurance market. As per the European Commission, over 60% of consumers prefer digital channels for purchasing and managing insurance policies due to the convenience and real-time support. As per Eurostat, AI-driven chatbots and automated claims processing systems have reduced claim resolution times by 50%, enhancing customer satisfaction. Additionally, the adoption of digital tools in insurance is growing exponentially due to the increasing demand for seamless experiences. These technologies enable insurers to offer personalized plans based on user behavior and device usage patterns, increasing policy uptake. By leveraging AI and digital platforms, insurers can address consumer concerns about complex claims processes, improve transparency, and build trust, positioning themselves as innovators in a competitive market.

Expansion into Emerging Markets and Affordable Device Segments

Expanding into emerging markets and targeting affordable device segments is another promising opportunity for the European mobile phone insurance market. Eurostat reports that smartphone penetration in Eastern Europe and rural areas is projected to reach 75% by 2025, creating a vast untapped customer base. The European Insurance and Occupational Pensions Authority (EIOPA) notes that offering low-cost insurance plans for budget devices could attract 40% of new smartphone users who previously avoided insurance due to high premiums. Furthermore, Statista highlights that partnerships with local telecom operators and retailers can increase accessibility, with bundled offerings reaching 35% of first-time smartphone buyers. By tailoring products to meet the needs of price-sensitive consumers and expanding geographically, insurers can unlock new revenue streams while fostering financial inclusion. This strategy aligns with Europe’s digital transformation goals, driving broader adoption of mobile phone insurance.

MARKET CHALLENGES

Increasing Competition and Market Saturation

The growing competition and market saturation, particularly in Western Europe is a significant challenge to the European mobile phone insurance market. According to the Eurostat, over 70% of urban consumers in countries like Germany, France, and the UK already have access to multiple insurance providers, intensifying price wars and reducing profit margins. The European Commission reports that the number of new entrants offering low-cost plans has risen by 25% in the past three years, further fragmenting the market. Additionally, Statista notes that premium differentiation has become difficult, with many insurers offering similar coverage terms, making it harder for smaller players to compete. This saturation not only limits growth opportunities but also forces companies to invest heavily in marketing and customer retention strategies. As competition escalates, insurers must innovate to differentiate their offerings while managing operational costs, posing a persistent challenge to sustainable profitability.

Rising Incidence of Fraudulent Claims

Fraudulent claims represent a growing challenge for the European mobile phone insurance market, undermining its financial stability and consumer trust. The European Insurance and Occupational Pensions Authority (EIOPA) reports that fraudulent claims account for approximately 15% of all mobile phone insurance payouts, costing the industry over €500 million annually. Eurostat highlights that common fraud tactics, such as staged thefts or duplicate claims, have increased by 30% in the past five years, driven by the ease of online claim submissions. Furthermore, the European Consumer Organisation (BEUC) notes that insurers’ stringent measures to combat fraud often lead to genuine claims being delayed or rejected, worsening consumer perceptions. This dual impact of financial losses and eroded trust creates operational and reputational risks for insurers. Addressing this issue requires advanced fraud detection technologies and regulatory oversight, adding complexity to an already competitive market landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.74% |

|

Segments Covered |

By Phone Type, Coverage, Distribution Channel, End User, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Assurant, Inc., Allianz SE, Chubb Limited, CPP Group Plc, SquareTrade, Inc., Nationwide Building Society, Lloyds Bank, Virgin Money, Co-op Bank, and Halifax. |

SEGMENTAL ANALYSIS

By Phone Type Insights

The new phone segment was the largest segment and accounted for 79.4% of the European market share in 2024. The growth of the new phone segment in the European market is driven by the high adoption of premium smartphones, with devices costing an average of €800 or more, as highlighted by Statista. The European Commission notes that 60% of new phone buyers opt for insurance due to the high repair costs, which exceed €150 on average. Bundled offerings with telecom operators further boost accessibility. The growing concern in addressing financial risks associated with expensive devices to ensure consumer protection and peace of mind while driving significant revenue for insurers is one of the major factors propelling growth of the new phone segment in the European market.

On the other hand, the refurbished phone segment is estimated to grow at a prominent CAGR of 14.5% over the forecast period owing to the rising popularity of refurbished devices. According to Eurostat, 20% of consumers now choose refurbished phones due to affordability and sustainability. However, their lower durability increases demand for tailored insurance plans. The European Commission emphasizes circular economy initiatives have boosted this trend. Insurers offering flexible coverage for refurbished phones are tapping into this expanding market, making it a key driver of innovation and sustainability in the mobile phone insurance landscape.

By Coverage Insights

The physical damage segment occupied 60.7% of the European market share in 2024. The domination of the physical damage segment in the European market is attributed to the high frequency of accidents like cracked screens and water damage that account for 60% of all claims. The European Commission highlights that repair costs for physical damage average €150, making insurance essential for consumers. With smartphones becoming more fragile due to features like foldable screens, the demand for this coverage has surged. Additionally, telecom operators often bundle physical damage plans with new devices, enhancing accessibility. This segment’s dominance underscores its critical role in addressing common risks, ensuring affordability, and driving significant revenue for insurers while providing peace of mind to users.

The virus protection is another notable segment and is expected to register a CAGR of 15.8% over the forecast period owing to the rising incidence of mobile malware attacks, which ENISA reports have increased by 45% over the past three years. Eurostat notes that 30% of smartphone users have experienced virus-related issues, fueling demand for robust protection plans. The European Commission emphasizes that consumer awareness about cybersecurity is rising, with 40% prioritizing virus protection. Insurers are integrating advanced tools like real-time scanning and cloud-based recovery into policies. This segment’s rapid expansion highlights its importance in combating emerging digital threats, positioning it as a key driver of innovation and trust in the mobile phone insurance market.

By Distribution Channel Insights

The mobile operators segment held 45.3% of the European market share in 2024. The growth of the mobile operators segment is driven by their extensive customer base and ability to bundle insurance with postpaid plans, offering seamless integration and convenience. The European Commission highlights that partnerships with telecom giants like Vodafone and Orange have driven adoption, with over 60% of smartphone buyers opting for insurance through this channel. Statista notes that mobile operators account for €2.5 billion in annual premiums, leveraging promotional offers and extended warranties to enhance uptake. This segment’s prominence underscores its critical role in driving accessibility, affordability, and trust, ensuring widespread adoption while contributing significantly to market revenue.

The online distribution channel segment is estimated to exhibit a CAGR of 14.2% over the forecast period due to the increasing digitization of consumer behavior, with 30% of insurance policies now purchased online. According to Eurostat, online platforms reduce operational costs by 25%, enabling insurers to offer competitive pricing and flexible plans. The European Commission notes that digital channels provide real-time policy management and convenience, attracting tech-savvy consumers. As e-commerce expands, online sales are projected to reach €1.8 billion by 2030. This segment’s rapid expansion underscores its transformative role in enhancing accessibility and scalability, positioning it as a key driver of innovation in the mobile phone insurance market.

By End User Insights

The personal segment held the leading share of 65.7% in the European market in 2024. The leading position of personal segment is attributed to the widespread adoption of smartphones, with over 85% of Europeans owning a device, as reported by the European Commission. Statista highlights that accidental damage claims account for 60% of cases, with repair costs averaging €150, making insurance essential for consumers. Bundled offerings through mobile operators and OEMs enhance accessibility, while raising awareness about financial risk mitigation boosts uptake.

The corporate segment is anticipated to expand at a CAGR of 12.3% over the forecast period due to the rise of remote work and digital transformation, with 40% of enterprises issuing smartphones to employees, according to the European Commission. Eurostat notes that corporate policies generate higher premiums, averaging €120 per device, due to added security features like data protection. As businesses prioritize operational continuity and cybersecurity, demand for tailored insurance plans is surging.

REGIONAL ANALYSIS

Germany captured the dominating position in the European mobile phone insurance market in 2024 with a market share of 23.1%. The leading position of Germany in the European market is attributed to its high smartphone penetration, with Eurostat highlighting that over 90% of Germans own a smartphone, many of which are premium devices costing €600 or more. The European Commission notes that partnerships between insurers and telecom operators like Deutsche Telekom have streamlined accessibility, while robust regulatory frameworks ensure transparency and consumer trust. Additionally, Germany’s focus on digital transformation and sustainability has spurred demand for innovative insurance solutions, including coverage for refurbished devices. With rising awareness about financial risk mitigation, Germany remains a pivotal player in shaping the growth trajectory of the mobile phone insurance market across Europe.

The UK is anticipated to register a promising CAGR in the European market over the forecast period. The growth of the UK market in the European region is driven by its high digital adoption rates, with Statista reporting that 85% of Britons use smartphones daily. The European Insurance and Occupational Pensions Authority (EIOPA) highlights that online distribution channels and partnerships with retailers like Carphone Warehouse have expanded accessibility. Furthermore, the UK’s competitive insurance market offers flexible premiums and bundled policies, appealing to tech-savvy consumers. As remote work and digital transactions surge, the demand for comprehensive coverage, including theft and virus protection, has grown significantly. This focus on innovation and convenience positions the UK as a key innovator in the European mobile phone insurance landscape.

France is estimated to hold a substantial share of the European market over the forecast period. The emphasis of France on sustainability, with the European Environmental Agency reporting a 12% annual growth in refurbished smartphone sales is boosting the French market growth. Insurers have responded by offering tailored coverage for these devices, addressing durability concerns. Additionally, the European Commission highlights that France’s proactive measures to combat smartphone theft, which accounts for 40% of electronic crimes, have increased demand for theft protection plans. France’s focus on eco-friendly initiatives and innovative solutions, such as affordable insurance for budget devices, underscores its role in driving inclusivity and sustainability in the mobile phone insurance market across Europe.

KEY MARKET PLAYERS

The major players in the Europe mobile phone insurance market include Assurant, Inc., Allianz SE, Chubb Limited, CPP Group Plc, SquareTrade, Inc., Nationwide Building Society, Lloyds Bank, Virgin Money, Co-op Bank, and Halifax.

MARKET SEGMENTATION

This research report on the Europe mobile phone insurance market is segmented and sub-segmented into the following categories.

By Phone Type

- New Phone

- Refurbished

By Coverage

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

By Distribution Channel

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

By End User

- Corporate

- Personal

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe mobile phone insurance market?

The market is growing due to the rising smartphone adoption, increasing repair costs, and higher incidents of accidental damage and theft.

What types of coverage are included in mobile phone insurance plans?

Most plans cover accidental damage, screen cracks, liquid damage, theft, and sometimes loss, depending on the policy.

Are there any technological advancements shaping the Europe mobile phone insurance market?

AI-powered claims processing, blockchain for fraud prevention, and digital-only insurance platforms are transforming the industry.

What future trends are expected in the Europe mobile phone insurance market?

Growth in embedded insurance models, increased adoption of pay-as-you-use plans, and partnerships between insurance providers and smartphone brands are expected to shape the future.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]