Europe Mobile Payment Market Size, Share, Trends, & Growth Forecast Report Segmented By Technology (Near Field Communication, Direct Mobile Billing, Mobile Web Payment, and SMS), Payment Type, Location, and End-use, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Mobile Payment Market Size

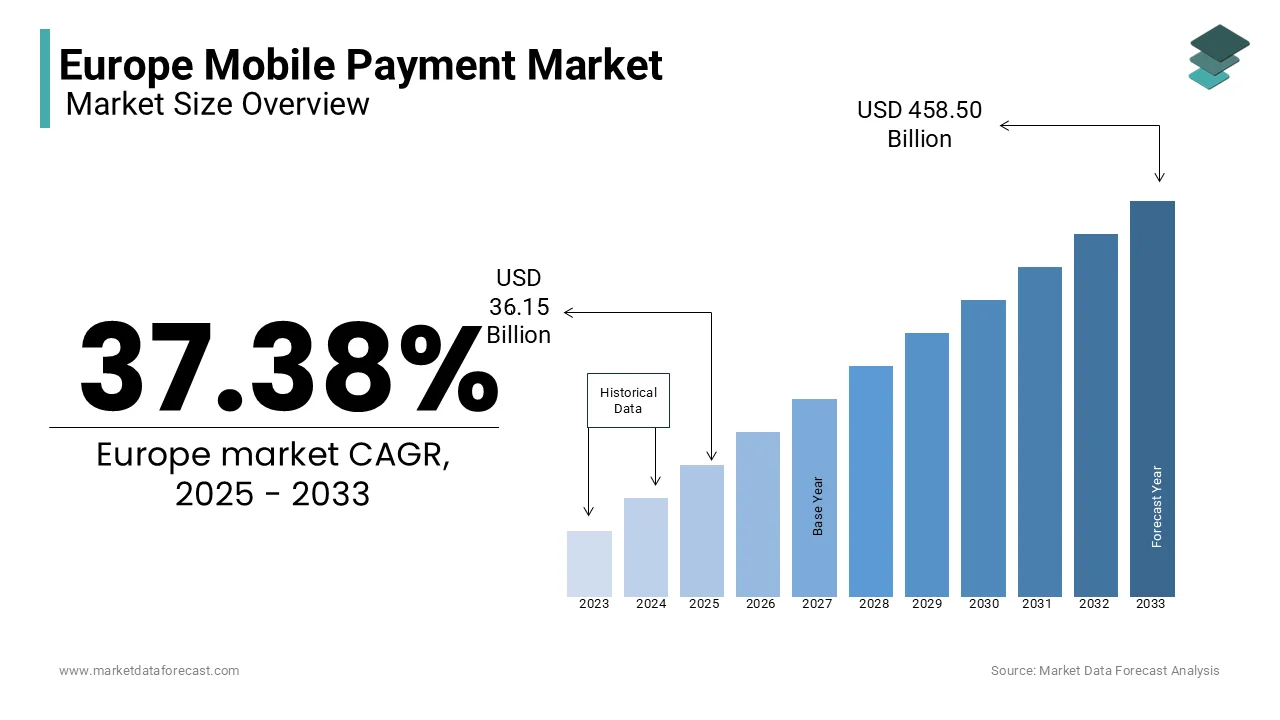

The Europe mobile payment market was worth USD 26.31 billion in 2024. The European market is estimated to reach USD 458.50 billion by 2033 from USD 36.15 billion in 2025, growing at a CAGR of 37.38% from 2025 to 2033.

Mobile payments have emerged as a transformative force in the financial ecosystem and revolutionized the way how consumers and businesses conduct transactions. Mobile payments, defined as financial transactions executed through mobile devices such as smartphones or tablets and include a wide range of services such as mobile wallets, contactless payments, and peer-to-peer transfers. The European mobile payments market has gained significant traction in recent years due to the proliferation of smartphones, advancements in digital infrastructure, and shifting consumer preferences toward cashless and contactless payment methods. According to a recent report by Statista, the transaction value of the mobile payment market in Europe is projected to grow at a CAGR of over 15% between 2023 and 2027, which is indicating the rapid adoption of digital payment solutions in Europe.

Northern and Western Europe, particularly nations like the UK, Sweden, and Germany, lead the charge in mobile payment adoption owing to the robust technological infrastructure and high smartphone penetration rates. In contrast, Southern and Eastern Europe are witnessing gradual but steady growth due to the increasing awareness and government initiatives promoting digital economies. According to the European Central Bank, contactless payments now account for over 60% of all card transactions in the Eurozone, which is confirming the growing reliance on mobile payment technologies. Furthermore, the rise of fintech companies and the integration of mobile payment solutions by traditional banks are further accelerating the expansion of the European mobile payments market.

MARKET DRIVERS

Increasing Smartphone and Internet Penetration in Europe

The proliferation of smartphones and high-speed internet connectivity is a major driver of the Europe mobile payment market. According to the European Commission, over 85% of the EU population owned smartphones in 2023, with internet access available to 90% of households. This widespread adoption has facilitated the seamless integration of mobile payment solutions into daily life. Countries like Sweden and the Netherlands have achieved smartphone penetration rates exceeding 95%, accelerating the transition toward cashless societies. The convenience of mobile payments, supported by reliable internet infrastructure, has led to a significant rise in transaction volumes. The European Central Bank reports that digital payment adoption has grown by 20% annually, with mobile payments contributing substantially to this growth.

Supportive Regulatory Environment and Government Initiatives

The Europe mobile payment market has also been propelled by a robust regulatory framework and government-led digital transformation initiatives. The Revised Payment Services Directive (PSD2), implemented by the European Union, has been instrumental in enhancing the security and interoperability of mobile payment systems. By enabling third-party providers to access banking data securely, PSD2 has fostered innovation and competition in the market. Additionally, the European Commission’s Digital Single Market strategy has encouraged the shift toward cashless transactions. Data from the European Central Bank reveals that contactless payments, a key component of mobile payments, now account for over 60% of all card transactions in the Eurozone, underscoring the impact of these regulatory and policy measures.

MARKET RESTRAINTS

Data Security and Privacy Concerns

One of the significant restraints of the Europe mobile payment market is the growing concern over data security and privacy. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks on financial services, including mobile payment platforms, increased by 24% in 2022. Consumers and businesses remain wary of potential data breaches, fraud, and unauthorized access to sensitive financial information. The European Central Bank highlights that 35% of Europeans express reluctance to adopt mobile payments due to security fears. Despite regulatory measures like the General Data Protection Regulation (GDPR), which aims to safeguard user data, these concerns continue to hinder widespread adoption, particularly among older demographics and in regions with lower digital literacy.

Fragmented Regulatory Landscape Across Countries

The Europe mobile payment market faces challenges due to the fragmented regulatory environment across different countries. While the European Union has introduced unified frameworks like PSD2, individual member states often implement additional regulations, creating complexity for payment service providers. The European Commission notes that varying compliance requirements and standards across nations increase operational costs and slow down the rollout of innovative solutions. For instance, countries like Germany and France have distinct data localization laws, which complicate cross-border payment services. This regulatory inconsistency has led to slower adoption rates in some regions, with the European Central Bank reporting that only 58% of SMEs in the EU offer digital payment options, citing regulatory hurdles as a key barrier.

MARKET OPPORTUNITIES

Expansion of Open Banking and Fintech Collaboration

The Europe mobile payment market is poised for growth through the expansion of open banking and increased collaboration with fintech companies. The Revised Payment Services Directive (PSD2) has laid the foundation for open banking, enabling third-party providers to access banking data securely and develop innovative payment solutions. According to the European Banking Authority, over 300 fintech firms were authorized under PSD2 by 2023, fostering a competitive and dynamic market. The European Central Bank reports that open banking transactions have grown by 30% annually, creating opportunities for mobile payment providers to integrate advanced features like real-time payments and personalized financial services, thereby enhancing user experience and driving adoption.

Rising Demand for Contactless and QR Code Payments

The growing preference for contactless and QR code-based payments presents a significant opportunity for the Europe mobile payment market. The European Central Bank states that contactless payments now account for over 60% of all card transactions in the Eurozone, driven by the COVID-19 pandemic and consumer demand for hygienic payment methods. Additionally, QR code payments are gaining traction, particularly in Southern and Eastern Europe, where smartphone penetration is increasing. The European Commission highlights that QR code payment adoption has risen by 25% annually, offering a cost-effective and accessible solution for small businesses. This trend is expected to accelerate as merchants and consumers alike embrace these convenient and secure payment options.

MARKET CHALLENGES

Resistance to Digital Transformation Among Traditional Businesses

A significant challenge for the Europe mobile payment market is the resistance to digital transformation among traditional businesses, particularly small and medium-sized enterprises (SMEs). According to the European Central Bank, only 58% of SMEs in the EU offer digital payment options, citing high implementation costs and a lack of technical expertise as primary barriers. The European Commission notes that 40% of small businesses in Southern and Eastern Europe still rely heavily on cash transactions, reflecting slower adoption rates in these regions. This reluctance limits the reach of mobile payment solutions and creates a fragmented market, as consumers in areas with lower digital adoption continue to prefer traditional payment methods over innovative alternatives.

Interoperability Issues Across Payment Platforms

Interoperability challenges across different mobile payment platforms pose another major hurdle for the Europe mobile payment market. The European Central Bank highlights that the lack of standardized systems often results in inefficiencies, particularly for cross-border transactions. While PSD2 aims to address these issues, the European Commission reports that only 65% of payment service providers have fully implemented interoperable solutions as of 2023. This fragmentation complicates user experiences, as consumers and merchants must navigate multiple platforms with varying functionalities. Additionally, the European Union Agency for Cybersecurity emphasizes that inconsistent security protocols across platforms increase vulnerabilities, further deterring adoption and trust in mobile payment systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

37.38% |

|

Segments Covered |

By Technology, Payment Type, Location, End-use, and Country |

|

Various Analyses Covered |

Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Google (Alphabet Inc), Alipay, Amazon.com, Inc. (Amazon Payments), Apple, Inc. (Apple Pay), C-SAM, Inc. (MasterCard Incorporated), Tencent Holdings Ltd. (WeChat), MoneyGram International Inc., PayPal Holdings, Inc., Samsung Group (Samsung Pay), and Visa, Inc. |

SEGMENTAL ANALYSIS

By Technology Insights

The near field communication (NFC) segment dominated the market by accounting for 45.4% of the European market share in 2024. The dominance of the NFC segment in the European market is credited to its widespread adoption in contactless payments, supported by the proliferation of NFC-enabled smartphones and point-of-sale terminals. The European Commission reports that over 70% of card terminals in the Eurozone are NFC-enabled, facilitating seamless transactions. NFC’s importance lies in its convenience, speed, and security, making it the preferred choice for consumers and merchants alike. Its integration with digital wallets like Apple Pay and Google Pay has further solidified its leading position.

On the other hand, the mobile app-based payments segment is growing at a remarkable pace and is estimated to witness a CAGR of 25.4% over the forecast period. This growth is driven by the increasing popularity of digital wallets and the rise of e-commerce. The European Commission notes that mobile app transactions accounted for 30% of all digital payments in 2023, with platforms like Apple Pay and Google Pay leading the charge. The segment’s rapid expansion is fuelled by enhanced user experiences, robust security features, and the integration of loyalty programs. Mobile apps are becoming indispensable for consumers seeking convenience and personalized payment solutions.

By Payment Type Insights

The Business-to-Consumer (B2C) segment dominated the market and held 65.6% of the European market share in 2024. This dominance is driven by the widespread adoption of mobile payments in retail, e-commerce, and peer-to-peer transfers. The European Commission reports that consumer preference for convenience and contactless payments has significantly contributed to this growth, with countries like the UK and Sweden leading in B2C adoption. The segment’s importance lies in its ability to enhance consumer experiences, streamline transactions, and support the shift toward cashless economies, making it a cornerstone of the mobile payment ecosystem.

The Business-to-Business (B2B) segment is growing rapidly and is likely to register a CAGR of 20.8% over the forecast period. This growth is fueled by the increasing digitization of supply chains and the need for efficient invoice and payment processing solutions. The European Commission notes that B2B mobile payments are gaining traction due to their ability to reduce transaction times and costs, particularly in cross-border trade. The segment’s importance is underscored by its role in enhancing operational efficiency and financial transparency for businesses, driving innovation in corporate financial management and contributing to the overall growth of the mobile payment market.

By Location Insights

The proximity payments segment ruled the market in 2024 by accounting for 70.8% of the European market share due to the widespread adoption of contactless technology, such as NFC and QR codes, in retail stores, public transport, and restaurants. The European Commission reports that over 80% of card terminals in the Eurozone are contactless enabled, facilitating seamless transactions. The segment’s importance lies in its ability to offer fast, secure, and convenient payment solutions, making it the preferred choice for in-store transactions and driving the shift toward cashless economies.

The remote payments segment is on the rise and is estimated to witness a 25.3% over the forecast period owing to the surge in e-commerce and the increasing popularity of digital banking and peer-to-peer payment platforms. According to the European Commission, remote payments accounted for 30% of all digital transactions in 2023, with platforms like PayPal and mobile banking apps leading the charge. The segment’s importance is underscored by its role in enabling seamless online transactions, supporting the digital economy, and catering to the growing demand for flexible and secure payment solutions.

REGIONAL ANALYSIS

The UK dominated the mobile payments market in Europe by capturing 30.7% of the market share in 2024. The lead of the UK market in Europe is primarily attributed to the widespread adoption of contactless payments and digital wallets like Apple Pay and Google Pay in UK. According to UK Finance, contactless payments accounted for 60% of all transactions in 2022, which is indicating the advanced digital infrastructure in the UK and consumer preference for convenience.

Germany accounts for a notable share of the European market and is expected to showcase promising growth during the forecast period. The growth of the German market is driven by increasing smartphone penetration and the rise of fintech solutions like PayPal and Klarna, which cater to the tech-savvy population.

The mobile payments market in France is predicted to exhibit a healthy CAGR of 14.8% during the forecast period. The initiatives of French to promote cashless transactions and the popularity of mobile payment apps like Lydia and Paylib are propelling the French market growth.

These countries lead due to robust digital infrastructure, high smartphone usage, and supportive regulatory frameworks, making them key drivers of Europe’s mobile payment growth.

KEY MARKET PLAYERS

Google (Alphabet Inc), Alipay, Amazon.com, Inc. (Amazon Payments), Apple, Inc. (Apple Pay), C-SAM, Inc. (MasterCard Incorporated), Tencent Holdings Ltd. (WeChat), MoneyGram International Inc., PayPal Holdings, Inc., Samsung Group (Samsung Pay), and Visa, Inc. are some of the key players in the Europe mobile payment market.

By Technology

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

By Payment Type

- B2B

- B2C

- B2G

- Others

By Location

- Remote Payment

- Proximity Payment

By End-use

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Transportation

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe mobile payment market?

The growth of the Europe mobile payment market is driven by increasing smartphone penetration, the rise of contactless payment adoption, government initiatives for cashless economies, and growing consumer preference for digital transactions.

What are the most popular mobile payment methods in Europe?

Popular mobile payment methods include digital wallets like Apple Pay, Google Pay, and PayPal, as well as bank-supported payment solutions such as Swish (Sweden), Paylib (France), and iDEAL (Netherlands).

Which industries are driving mobile payment adoption in Europe?

The retail, e-commerce, transportation, and hospitality sectors are major contributors to mobile payment adoption, as businesses increasingly integrate digital payment solutions for seamless transactions.

What is the future outlook for the Europe mobile payment market?

The market is expected to grow steadily with innovations in NFC, blockchain, and biometric authentication, along with increasing partnerships between banks, fintech firms, and retailers to enhance digital payment experiences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]