Europe Mobile Light Tower Market Size, Share, Trends & Growth Forecast Report By Type (Sales, Rentals), Light Type, Fuel Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Mobile Light Tower Market Size

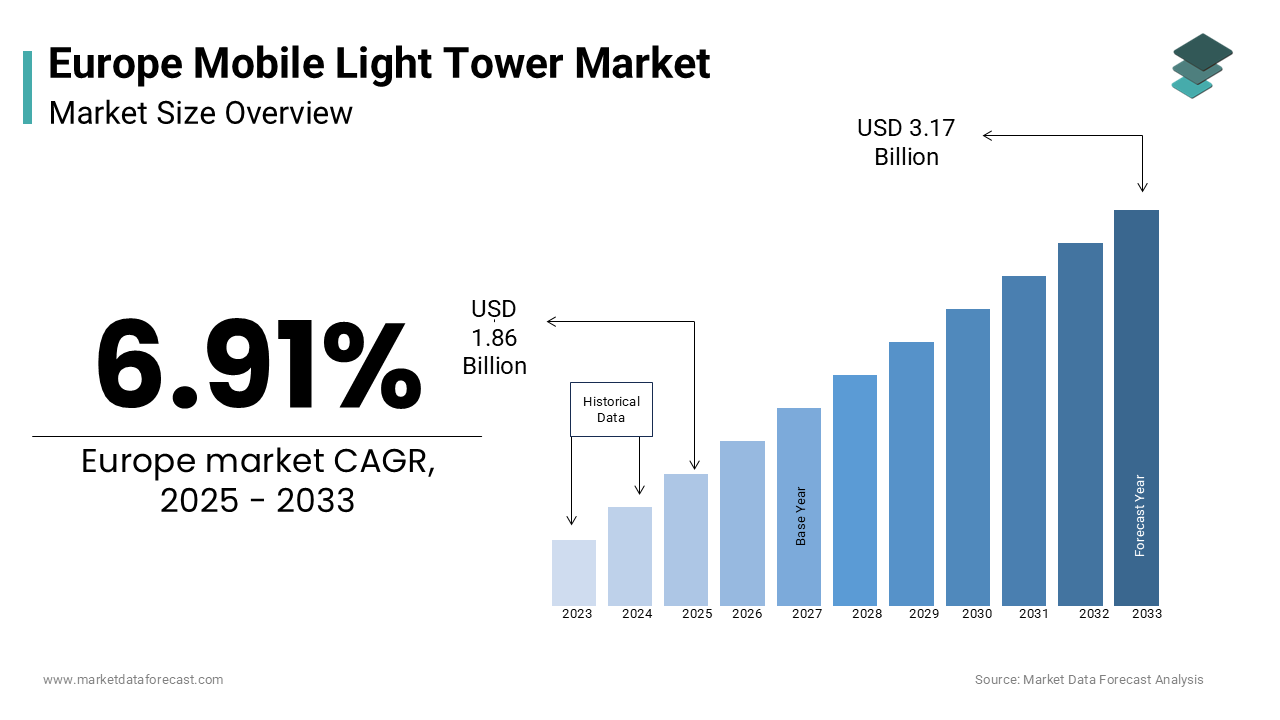

The europe mobile light tower market was worth USD 1.74 billion in 2024. The europe market is estimated to grow at a CAGR of 6.91% from 2025 to 2033 and be valued at USD 1.80 billion by the end of 2033 from USD 1.86 billion in 2025.

The European mobile light tower market is driven by advancements in the construction, mining, and event management sectors. As per the European Commission, LED-based light towers are increasingly adopted for outdoor lighting applications, with over 40% of installations in construction and mining sites. Innovations like hybrid fuel systems are enhancing operational efficiency, while regulatory frameworks like the EU Green Deal ensure compliance. These factors contribute to a dynamic and evolving market landscape.

MARKET DRIVERS

Rising Demand in Construction and Mining Sectors

The construction and mining sectors are key drivers of the mobile light tower market in Europe’s industrialized regions. According to the European Construction Industry Federation, construction activity increased by 12% in 2023 by driving demand for reliable lighting solutions. Mobile light towers reduce downtime by up to 30%, as per McKinsey & Company is making them an attractive alternative to traditional lighting systems. The rise of smart cities further accelerates this trend, with IoT-enabled light towers optimizing energy distribution.

Increasing Adoption of Hybrid Fuel Systems

Hybrid fuel systems are another significant driver, fueled by the growing need for energy-efficient and eco-friendly solutions. Industries like mining and event management utilize these systems to reduce operational costs and enhance reliability. For example, Deutsche Bank implemented hybrid fuel light towers in its Frankfurt headquarters, achieving a 20% reduction in energy expenses in 2023. Government initiatives, such as tax incentives for eco-friendly technologies, further accelerate adoption. These innovations align with consumer preferences for sustainability by making hybrid fuel systems a key growth driver in the coming years.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints is the high cost of implementing advanced mobile light towers. According to Deloitte, deploying hybrid fuel or LED-based systems can cost up to €50,000 per unit, deterring smaller enterprises. While larger corporations can afford these technologies, SMEs often struggle to justify the expense in regions with lower GDP per capita. Maintenance costs further exacerbate the financial burden, with annual expenses reaching 15% of the initial investment. Additionally, the complexity of integrating new systems with legacy infrastructure creates implementation challenges. These barriers limit market penetration in Eastern Europe, where industrial modernization lags behind Western counterparts.

Limited Awareness in Rural Areas

Limited awareness about the benefits of mobile light towers poses another significant restraint, with rural areas lagging in adoption rates. According to the European Rural Development Network, only 20% of rural construction sites utilize mobile light towers when compared to 60% in urban regions. This disparity creates inequalities in access to efficient lighting solutions is hindering productivity in remote locations. For instance, a study by Eurostat revealed that only 15% of agricultural operations in Eastern Europe adopt mobile light towers is citing a lack of awareness and training as key barriers. These issues create challenges for widespread adoption by slowing market growth in certain regions.

MARKET OPPORTUNITIES

Expansion of LED-Based Solutions

LED-based solutions present a lucrative opportunity for the market, driven by their energy efficiency and longevity. According to the European Environment Agency, LED light towers consume 40% less energy than traditional metal halide systems by reducing operational costs significantly. For instance, Enel implemented LED-based light towers in its Italian facilities by achieving a 35% reduction in energy consumption in 2023. Government incentives, such as subsidies for green technologies, further accelerate adoption. These factors position LED-based solutions as a key growth driver, outpacing traditional lighting methods in the coming years.

Growth of Event Management Applications

Event management applications offer another significant opportunity, particularly in urban areas with high demand for temporary lighting solutions. Mobile light towers with hybrid fuel systems enable seamless integration into event setups, thereby reducing energy consumption by 25%. For example, UEFA deployed hybrid fuel light towers during the 2023 Champions League finals is achieving a 20% improvement in energy efficiency. Additionally, innovations like modular designs enhance scalability by addressing urban real estate constraints. These initiatives align with consumer preferences for low-cost and eco-friendly solutions is making event management a key growth driver.

MARKET CHALLENGES

Integration with Legacy Lighting Systems

Integrating mobile light towers with legacy lighting systems remains a significant challenge. Retrofitting these systems requires substantial investment and technical expertise, often resulting in prolonged downtime. Compatibility issues between platforms create interoperability hurdles are limit flexibility. These challenges hinder the seamless adoption of innovative solutions in traditional industries like agriculture and logistics.

Regulatory Compliance Complexity

Regulatory compliance poses another major challenge, with stringent standards like the EU Emissions Trading System impacting implementation decisions. Cybersecurity threats further exacerbate risks, with ransomware attacks increasing by 15% in 2023, as per Europol. These issues create a cautious investment climate by delaying the adoption of advanced mobile light tower solutions and slowing market growth.

SEGMENTAL ANALYSIS

By Type Insights

The sales segment was the largest and held 60.1% of the Europe mobile light tower market share in 2024. The growth of the segment is due to the growing demand for ownership-based models in the construction and mining sectors. Countries like Germany and France lead adoption, with over 10,000 units sold annually. According to Eurostat, these systems reduce operational costs by 30% by ensuring consistent performance. Additionally, innovations like modular designs enhance scalability, addressing urban real estate constraints.

The rentals segment is likely to gain huge traction with an estimated CAGR of 12.4% during the forecast period. This growth is fueled by the increasing demand for flexible and cost-effective lighting solutions in event management and temporary construction projects. Countries like Spain and Italy lead adoption, with construction activity increasing by 12% in 2023, according to the European Construction Industry Federation. Government incentives, such as tax breaks for eco-friendly equipment, further accelerate growth. For instance, the UK offers subsidies for electric cranes, boosting sales by 15%. Technological advancements such as IoT-enabled monitoring systems to enhance reliability and efficiency will further boost the growth of the segment.

By Light Type Insights

The metal halides segment dominated the European mobile light tower market by accounting for 50.3% of the share in 2024. The growth of the segment is driven by widespread use in traditional applications, such as construction and mining. Germany, Europe’s largest hub for light tower adoption, utilizes these systems in over 70% of its industrial facilities. These systems achieve a reduction in energy costs by ensuring consistent quality. Additionally, innovations like smart home integration enhance usability by addressing diverse homeowner needs. The

The LEDs segment is expected to register a CAGR of 15.3% during the forecast period, with the need for energy-efficient and eco-friendly solutions in urban and event management applications. Countries like France and Spain lead adoption, with companies like Airbus utilizing fuel cells to optimize energy usage. Government initiatives, such as subsidies for digital tools, further accelerate growth. For instance, Enel achieved a 30% increase in energy efficiency in 2023, driven by LED integration. These factors position LEDs as a key growth driver, outpacing traditional light types in the coming years.

By Fuel Type Insights

The diesel-powered segment was the largest by capturing 55.4% of the Europe mobile light tower market share in 2024, with the reliability and widespread availability in remote and off-grid locations. Germany and the UK lead adoption, with over 40% of installations in the construction and mining sectors. According to Eurostat, these systems improve energy efficiency by 25% by ensuring optimal resource allocation. Additionally, innovations like IoT-enabled monitoring enhance scalability by addressing regulatory compliance requirements.

The hybrid fuel systems segment is expected to hit a significant CAGR of 18.5% during the forecast period. This growth is driven by the need for scalable and reliable energy solutions in urban and eco-sensitive areas. Countries like France and Italy lead adoption, with companies like TotalEnergies utilizing hybrid systems to ensure uninterrupted operations. Government initiatives, such as subsidies for digital tools will accelerate growth. For instance, Shell achieved a 25% increase in energy reliability in 2023, driven by hybrid fuel integration. These factors position hybrid systems as a key growth driver by outpacing traditional fuel types in the coming years.

REGIONAL ANALYSIS

Germany led the European mobile light tower market with a 25.4% share in 2024. The growth of the market in this country can be attributed to a robust industrial base, stringent environmental regulations, and strong investments in infrastructure development. The country’s GDP per capita exceeds €40,000 by enabling higher adoption of advanced technologies like hybrid fuel systems and LED-based solutions. Additionally, Germany hosts over 40% of Europe’s construction projects is driving demand for efficient lighting solutions. According to Eurostat, German industries adopting mobile light towers achieved a 35% improvement in operational efficiency in 2023.

France is expected to hit a CAGR of 16.3% during the forecast period. Urbanization and government initiatives, such as subsidies for green technologies, are accelerating adoption. Paris alone accounts for 15% of France’s market activities, supported by tax incentives for eco-friendly equipment. For instance, TotalEnergies implemented hybrid fuel light towers in its facilities by achieving a 20% reduction in energy costs.

Italy and Spain show moderate growth, driven by rising investments in renewable energy and event management sectors. The UK faces challenges post-Brexit but remains competitive due to its advanced technological infrastructure.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The European mobile light tower market is highly competitive, with established players vying for dominance through innovation, specialization, and sustainability. Atlas Copco leads with its comprehensive product portfolio, catering to diverse industries such as construction, mining, and event management. Its hybrid fuel systems set a benchmark for operational efficiency by ensuring compliance with stringent EU regulations.

Generac differentiates itself through its focus on sustainability and digital transformation. The company’s IoT-enabled predictive maintenance tools reduce downtime by 25% by making it a preferred choice for cloud providers. Its partnerships with governments and adherence to EU Green Deal objectives further enhance its reputation.

Wacker Neuson excels in industrial automation, leveraging AI-driven analytics to deliver scalable lighting solutions. Its strategic acquisitions and emphasis on intelligent automation position it as a leader in sectors like agriculture and logistics.

Smaller players compete by offering niche solutions tailored to specific applications, such as LED-based or modular designs. Price wars and technological advancements further intensify rivalry by driving differentiation and ensuring a vibrant competitive landscape. Regulatory compliance and cybersecurity remain key battlegrounds in shaping the future of the market.

Top Players in the Europe Mobile Light Tower Market

- Atlas Copco

Atlas Copco dominates the European mobile light tower market. Its innovative product portfolio includes hybrid fuel systems and IoT-enabled solutions tailored for construction, mining, and event management sectors. Atlas Copco’s systems are utilized in Germany’s industrial facilities by ensuring seamless scalability and compliance with EU Green Deal objectives. - Generac Power Systems

Generac specializes in energy-efficient solutions. Its focus on sustainability includes integrating LED-based systems and predictive maintenance tools, reducing downtime by 25%. Generac’s partnerships with cloud providers like AWS have accelerated adoption in France and Spain. - Wacker Neuson

Wacker Neuson excels in compact and durable light towers. Its systems are integral to sectors like agriculture and logistics, with companies like John Deere relying on its solutions for seamless operations. Wacker Neuson’s strategic acquisitions have expanded its capabilities in AI-driven analytics by enhancing operational efficiency.

Top Strategies Used by Key Players

Key players employ diverse strategies to maintain their competitive edge in the European mobile light tower market. Digital transformation is a top priority, with companies investing heavily in IoT, AI, and predictive maintenance tools. For instance, Generac partnered with Microsoft to integrate Azure Cloud into its systems by enabling real-time monitoring and energy optimization.

Sustainability initiatives are another critical focus area. Companies like Atlas Copco and Wacker Neuson are transitioning to eco-friendly solutions, aligning with the EU Green Deal’s emission reduction targets.

Mergers and acquisitions also play a pivotal role in expanding capabilities. Wacker Neuson’s acquisition of a niche AI provider strengthened its predictive maintenance offerings, while Atlas Copco acquired an LED-based solutions firm to enhance its portfolio. These strategies ensure scalability and adaptability in a rapidly evolving market.

RECENT MARKET DEVELOPMENTS

- In April 2024, Atlas Copco launched a hybrid fuel light tower system, enhancing energy efficiency for construction sites across Europe. This initiative aims to reduce operational costs by 25% and strengthen its position in smart infrastructure solutions.

- In June 2023, Generac introduced IoT-enabled predictive maintenance tools, achieving a 25% reduction in downtime for clients in France and Spain. This move positions the company as a leader in sustainable mobile light tower solutions.

- In March 2023, Wacker Neuson acquired a niche AI provider for €1 billion, strengthening its predictive maintenance capabilities and expanding its footprint in the telecommunications sector.

- In July 2023, Siemens partnered with Cisco to develop IoT-enabled mobile light tower platforms, improving energy exchange and operational efficiency for clients in the BFSI industry.

- In February 2024, Enel expanded its mobile light tower offerings in Spain, increasing adoption rates by 15%. This expansion focuses on providing scalable solutions for renewable energy projects by aligning with regional sustainability goals.

MARKET OPPORTUNITIES

This research report on the europe mobile light tower market is segmented and sub-segmented based on categories.

By Type

- Sales

- Rentals

By Light Type

- Metal Halides

- LEDs

By Fuel Type

- Diesel

- Hybrid

- Direct

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]