Europe Minimally Invasive Surgery Market Size, Share, Trends & Growth Forecast Report By Product Type (Surgical Devices, Laparoscopy Devices, Monitoring and Visualization Devices), Application, End-User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Minimally Invasive Surgery Market Size

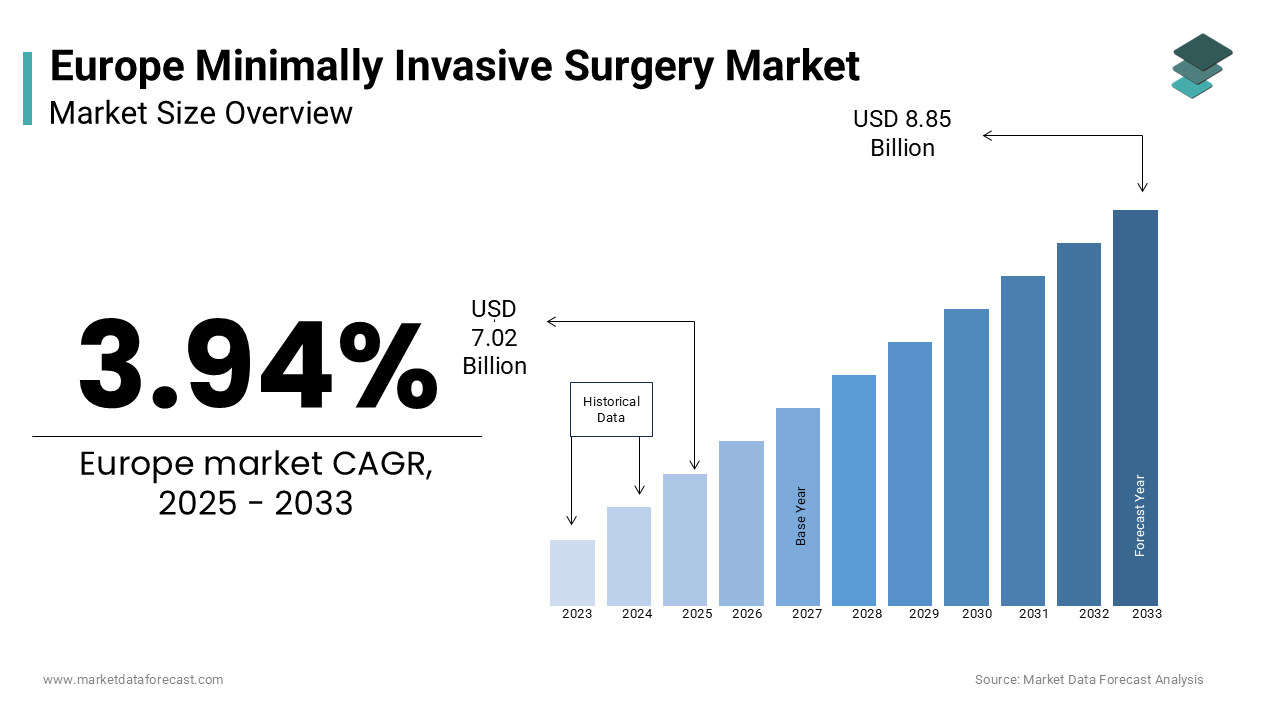

The europe minimally invasive surgery market was worth USD 6.75 billion in 2024. The European market is estimated to grow at a CAGR of 3.94% from 2025 to 2033 and be valued at USD 9.56 billion by the end of 2033 from USD 7.02 billion in 2025.

The Minimally invasive surgeries (MIS) involve the use of specialized devices and technologies to perform procedures through small incisions, reducing postoperative pain, hospital stays, and complications compared to traditional open surgeries. According to the European Commission, the MIS market has witnessed significant growth over the past decade, driven by technological advancements, increasing prevalence of chronic diseases, and rising patient awareness about safer surgical alternatives. This growth is further supported by favorable government initiatives aimed at modernizing healthcare infrastructure and promoting innovation in medical devices. However, challenges such as high initial costs, regulatory hurdles, and a shortage of skilled professionals continue to pose barriers to widespread adoption.

MARKET DRIVERS

Technological Advancements in Surgical Devices

The rapid evolution of cutting-edge technologies has significantly propelled the growth of the minimally invasive surgery market in Europe. According to Eurostat, investments in medical device innovation have surged by 15% annually over the past five years. The robotic-assisted surgical systems, such as the da Vinci Surgical System that have revolutionized procedures by enhancing precision and reducing recovery times. These advancements have led to a 20% increase in patient preference for minimally invasive surgeries, as per the European Federation of Pharmaceutical Industries and Associations. Furthermore, the integration of artificial intelligence and machine learning into surgical devices has improved diagnostic accuracy and procedural outcomes. For instance, AI-driven imaging tools have reduced error rates by 30%, according to the World Health Organization. This technological leap has not only expanded the scope of treatable conditions but also attracted substantial funding from both public and private sectors.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases across Europe has emerged as a critical driver for the adoption of minimally invasive surgeries. According to the European Centre for Disease Prevention and Control, chronic conditions such as cardiovascular diseases, cancer, and diabetes account for over 70% of all deaths in the region. These ailments often necessitate surgical interventions, with minimally invasive techniques offering a viable solution due to their reduced invasiveness and quicker recovery times. Data from the Organisation for Economic Co-operation and Development reveals that the prevalence of obesity, a major risk factor for chronic illnesses, has doubled in certain European countries over the past two decades that further amplifies the need for bariatric surgeries. The Elderly patients, who are more susceptible to complications from traditional surgeries, benefit immensely from these advanced techniques. According to the European Society of Cardiology, minimally invasive cardiac surgeries have reduced hospital stays by 40% by making them a preferred choice for treating age-related heart conditions.

MARKET RESTRAINTS

High Initial Costs and Limited Accessibility

The prohibitive costs associated with minimally invasive surgical equipment and procedures present a significant barrier to widespread adoption across Europe. According to the European Commission, the average cost of robotic-assisted surgical systems can exceed €1.5 million, with additional expenses for maintenance and training. Such financial burdens are particularly challenging for smaller healthcare facilities and underfunded regions by limiting access to advanced technologies. According to a report by the European Hospital and Healthcare Federation, nearly 30% of hospitals in Eastern Europe lack the necessary infrastructure to support minimally invasive surgeries, exacerbating disparities in healthcare delivery. Moreover, the high costs are often passed on to patients, with procedures costing up to 50% more than traditional surgeries, as per the European Patients' Forum. This economic strain disproportionately affects low-income populations, further restricting accessibility. According to the World Health Organization, financial barriers contribute to a 25% lower utilization rate of minimally invasive techniques in rural areas compared to urban centers. Addressing this issue is crucial to ensuring equitable access to innovative surgical solutions and fostering inclusive growth within the healthcare sector.

Regulatory Hurdles and Stringent Approval Processes

Stringent regulatory requirements and prolonged approval timelines pose another significant restraint to the growth of the minimally invasive surgery market in Europe. According to the European Medicines Agency, the certification process for new surgical devices can take up to three years, delaying their introduction to the market. According to the European Association of Medical Devices Manufacturers, nearly 40% of companies cite regulatory hurdles as a primary challenge is leading to increased operational costs and stifled innovation. Furthermore, post-market surveillance mandates require continuous monitoring and reporting, which can be resource-intensive for smaller firms. A study by the European Policy Centre reveals that stringent regulations have resulted in a 15% reduction in the number of new device approvals over the past five years. While these measures are essential to ensure patient safety, they inadvertently hinder the timely adoption of groundbreaking technologies. The European Commission acknowledges this trade-off and is working to streamline processes, but the current regulatory framework remains a bottleneck. Balancing safety with innovation is imperative to overcoming this restraint and unlocking the full potential of minimally invasive surgical advancements.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Remote Surgical Assistance

The integration of telemedicine and remote surgical assistance presents a transformative opportunity for the minimally invasive surgery market in Europe. According to the European Union’s Digital Health Observatory, telemedicine adoption has grown by 60% since the onset of the COVID-19 pandemic by creating a robust foundation for remote surgical innovations. Advanced connectivity solutions, such as 5G networks enables real-time collaboration between surgeons and specialists, even across vast geographical distances. According to the European Telecommunications Network Operators’ Association, 5G coverage is expected to reach 80% of Europe’s population by 2025. This technological synergy is particularly beneficial for rural and underserved regions, where access to specialized surgical expertise is limited. A case in point is Sweden, where remote robotic surgeries have reduced travel time for patients by 70%, as per the Swedish National Board of Health and Welfare.

Rising Demand for Personalized Medicine

The burgeoning field of personalized medicine offers a promising avenue for growth in the minimally invasive surgery market. According to the European Alliance for Personalised Medicine, personalized approaches to treatment have gained significant traction, with a 25% increase in adoption over the past three years. Minimally invasive techniques, coupled with genomic insights by tailored interventions that address individual patient needs with unparalleled precision. According to the European Molecular Biology Laboratory, personalized surgical strategies have improved success rates by 35%, as evidenced by reduced complication rates and enhanced recovery outcomes. This trend is particularly evident in oncology, where minimally invasive procedures guided by genetic profiling have become a cornerstone of cancer treatment. According to the European Cancer Patient Coalition, personalized surgeries have led to a 40% reduction in postoperative complications among cancer patients. Additionally, advancements in biomarker detection and diagnostic tools have streamlined the identification of suitable candidates for minimally invasive interventions. Minimally invasive surgery market can achieve unprecedented levels of efficacy and patient satisfaction by paving the way for sustainable growth.

MARKET CHALLENGES

Shortage of Skilled Healthcare Professionals

A critical challenge facing the minimally invasive surgery market in Europe is the acute shortage of skilled healthcare professionals capable of operating advanced surgical systems. According to the European Health Parliament, there is a projected shortfall of 400,000 medical specialists by 2030 due to the rising number of aging workforce and insufficient training programs. According to the European Society for Surgical Research, only 30% of surgeons in the region are adequately trained in robotic-assisted techniques by limiting the scalability of minimally invasive procedures. This skills gap is particularly pronounced in Eastern Europe, where access to specialized training facilities remains limited. A report by the European Training Foundation reveals that less than 10% of surgical residents receive hands-on experience with cutting-edge technologies during their training. Consequently, hospitals often face delays in adopting new systems due to a lack of qualified personnel. According to the World Health Organization, inadequate training not only impedes innovation but also increases the risk of surgical errors. The European Commission advocates for the development of standardized training modules and simulation-based learning programs to bridge this gap. However, without immediate intervention, the shortage of skilled professionals threatens to impede the market’s growth trajectory.

Cybersecurity Risks in Connected Surgical Systems

The increasing reliance on connected surgical systems exposes the minimally invasive surgery market to significant cybersecurity risks by posing a formidable challenge to its advancement. According to the European Union Agency for Cybersecurity, cyberattacks on healthcare systems have surged by 45% in the past two years, with surgical devices being a prime target due to their interconnected nature. The European Cybersecurity Organization warns that vulnerabilities in robotic-assisted systems could lead to unauthorized access, data breaches, and even manipulation of surgical procedures, endangering patient lives. A notable incident in Germany, reported by the Federal Office for Information Security, involved a ransomware attack that disrupted surgical schedules, resulting in a 20% decline in procedure volumes during the affected period. According to the European Data Protection Board, inadequate encryption protocols and outdated software exacerbate these risks, leaving systems susceptible to exploitation. The strengthening cybersecurity frameworks is imperative to safeguard sensitive patient data and ensure the uninterrupted operation of surgical systems. According to the European Commission, need for harmonized regulations and robust security protocols to mitigate these threats.

SEGMENTAL ANALYSIS

By Product Type Insights

The surgical devices segment was the largest and held 45.1% of the Europe minimally invasive surgery market share in 2024 owing to the versatility and indispensability of these devices across various surgical applications, ranging from laparoscopic procedures to robotic-assisted surgeries. Their widespread adoption is attributed to their ability to enhance precision, reduce recovery times, and minimize complications, as per the European Society of Minimally Invasive Surgery. Furthermore, the increasing prevalence of chronic diseases has amplified the demand for these devices, with a 12% annual growth rate observed in their utilization. According to the European Investment Bank, significant investments in research and development have led to the creation of next-generation devices. For instance, the integration of AI and machine learning into surgical tools has improved procedural accuracy by 25%. This segment's importance lies in its foundational role in enabling minimally invasive techniques by making it a linchpin for market expansion.

The monitoring and visualization devices segment is anticipated to witness a CAGR of 18.1% during the forecast period. This rapid expansion is fueled by the increasing adoption of advanced imaging technologies, such as 3D visualization systems and augmented reality platforms. According to the European Radiology Society, these devices have improved surgical accuracy by 30% by enabling surgeons to perform complex procedures with greater confidence. According to the European Commission, investments in imaging technologies have surged by 20% annually is driven by the need for real-time data and enhanced visualization capabilities. The integration of AI-driven analytics has further bolstered this segment by reducing diagnostic errors by 25% and optimizing procedural outcomes.

By Application Insights

The gynaecological surgery segment dominated the Europe minimally invasive surgery market by occupying 30.1% of share in 2024. According to the European Commission, minimally invasive techniques, including laparoscopic hysterectomies, have reduced hospital stays by 40% by making them a preferred choice for patients and healthcare providers alike. Furthermore, the rising awareness of reproductive health and the increasing demand for fertility-preserving surgeries have amplified the segment's growth. According to the European Federation of Obstetrics and Gynaecology, minimally invasive procedures have improved patient outcomes by 25%, with reduced pain and faster recovery times. Investments in advanced surgical tools, such as robotic-assisted systems, have further enhanced the precision and safety of gynaecological surgeries.

The bariatric surgery segment is esteemed to exhibit a CAGR of 21.3% during the forecast period. This rapid expansion is fueled by the alarming rise in obesity rates, with the World Health Organization reporting a 50% increase in obesity prevalence across Europe over the past decade. Minimally invasive bariatric procedures, such as sleeve gastrectomies and gastric bypasses, have gained traction due to their effectiveness in achieving significant weight loss and improving comorbid conditions. According to the European Society for Clinical Nutrition and Metabolism, these surgeries have reduced postoperative complications by 35% by making them a viable option for obese patients. The integration of robotic-assisted systems has further accelerated this segment's growth, enhancing procedural accuracy and patient safety. As per the European Investment Fund, investments in bariatric surgery infrastructure have surged by 25% annually by reflecting its growing importance.

By End User Insights

The hospitals segment was accounted in holding the significant share of the Europe minimally invasive surgery market in 2024. This dominance is attributed to the comprehensive infrastructure and specialized expertise available in hospital settings, which are essential for performing complex minimally invasive procedures. According to the European Commission, hospitals conducted over 80% of all robotic-assisted surgeries in 2022. According to the European Society of Minimally Invasive Surgery, hospitals offer state-of-the-art facilities, including advanced imaging and monitoring systems, which enhance procedural accuracy and patient safety. According to the European Investment Bank, hospitals are also at the forefront of integrating AI and machine learning into surgical workflows by improving diagnostic and therapeutic outcomes.

The Clinics segment is expected to register a CAGR of 20.4% in the next coming years. This rapid expansion is driven by the increasing demand for outpatient surgeries, which offer cost-effective and convenient alternatives to hospital-based procedures. According to the European Federation of Ambulatory Surgery, clinics have reduced procedure costs by 25% by making them an attractive option for patients seeking affordable care. Furthermore, advancements in portable surgical devices and telemedicine have enabled clinics to deliver high-quality services, even in remote areas. According to the European Investment Fund, investments in clinic infrastructure have surged by 30% annually, reflecting their growing importance

REGIONAL ANALYSIS

Germany led the Europe minimally invasive surgery market with 25.4% of the total share in 2024 owing to the country's robust healthcare infrastructure and substantial investments in medical technology. According to the European Commission, Germany accounts for over 30% of all robotic-assisted surgeries in Europe due to the widespread adoption of advanced surgical systems. Furthermore, the presence of leading manufacturers, such as Siemens Healthineers, has positioned Germany as a hub for innovation in minimally invasive techniques. As per European Investment Bank, Germany's emphasis on research and development has led to the creation of cutting-edge technologies by enhancing procedural accuracy and patient safety.

The United Kingdom is lucratively to witness a fastest CAGR of 6.8% during the forecast period. This prominence is driven by the country's advanced healthcare system and high prevalence of chronic diseases, which necessitate surgical interventions. According to the European Commission, the UK accounts for over 25% of all minimally invasive procedures in Europe, with a particular focus on gynaecological and bariatric surgeries. The UK's investments in healthcare infrastructure have surged by 20% annually, as per European Investment Fund.

France minimally invasive surgery market is expected to gear up the fastets growth rate in the next coming years due to the country's strong emphasis on healthcare innovation and its well-established network of hospitals and clinics. According to the European Commission, France accounts for over 20% of all minimally invasive surgeries in Europe, with a particular focus on cardiovascular and orthopedic procedures.

MARKET SEGMENTATION

This research report on the minimally invasive surgery market is segmented and sub-segmented based on categories.

By Product Type

- Surgical Devices

- Laparoscopy Devices

- Monitoring and Visualization Devices

By Application

- Bariatric Surgery

- Breast Surgery

- Cardiac Surgery

- Cosmetic Surgery

- Gastrointestinal Surgery

- Gynecological Surgery

- Orthopedics and Spine Surgery

- Thoracic Surgery

- Others

By End User

- Hospitals

- Clinics

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges in the European Minimally Invasive Surgery market?

Challenges include the high cost of advanced surgical equipment, the need for specialized training, and the complexity of integrating new technologies into existing healthcare systems.

What technologies are being used in Minimally Invasive Surgery in Europe?

Key technologies include robotic surgery systems, laparoscopes, endoscopes, advanced imaging systems, and 3D visualization technologies for improved precision and control during surgery.

. What is the future outlook for the Minimally Invasive Surgery market in Europe?

The market is expected to grow significantly due to ongoing technological advancements, increasing healthcare access, and rising patient preference for minimally invasive procedures.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]