Europe Metal Casting Market Size, Share, Trends & Growth Forecast Report By Product (Carbon Steel Alloys, Stainless Steel Alloys, Aluminum Alloys, Grey Iron, and Ductile Iron), Process, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Metal Casting Market Size

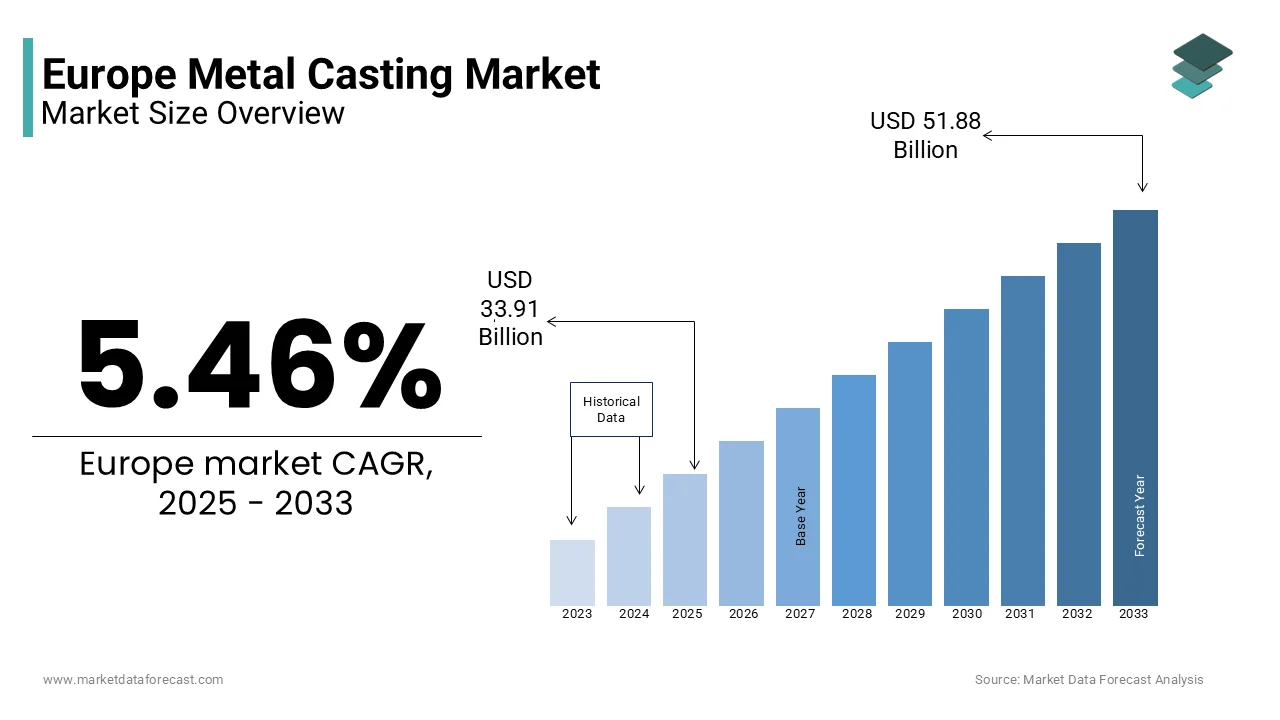

The Europe metal casting market size was valued at USD 32.15 billion in 2024. The European market is estimated to be worth USD 51.88 billion by 2033 from USD 33.91 billion in 2025, growing at a CAGR of 5.46% from 2025 to 2033.

Metal casting is a process followed to produce metal components through the casting method. This involves pouring molten metal into molds to create desired shapes and sizes, which are then cooled and solidified. The European metal casting market is characterized by a diverse range of materials, including ferrous and non-ferrous metals, with applications spanning various industries such as automotive, aerospace, construction, and machinery. Over the forecast period, the increasing demand for lightweight and durable components, particularly in the automotive and aerospace sectors to achieve performance and efficiency are boosting the growth of the European metal casting market. Additionally, advancements in casting technologies, such as 3D printing and automated processes, are enhancing production capabilities and reducing lead times. As industries continue to prioritize innovation and sustainability, the metal casting market in Europe is poised for substantial growth, driven by the ongoing demand for high-quality metal components.

MARKET DRIVERS

Rising Demand in the Automotive Sector in Europe

The rising demand in the automotive sector is one of the key factors driving the growth of the Europe metal casting market. As the automotive industry evolves, there is an increasing need for lightweight, durable components that enhance vehicle performance and fuel efficiency. Metal casting plays a crucial role in producing various automotive parts, including engine blocks, transmission housings, and structural components. According to the European Automobile Manufacturers Association, the production of vehicles in Europe is expected to reach 20 million units by 2025, reflecting a steady growth trajectory. This growth in vehicle production is driving the demand for metal casting, as manufacturers seek to develop innovative solutions that meet stringent regulatory requirements and consumer expectations for sustainability and performance. Furthermore, the automotive industry's focus on reducing emissions and improving energy efficiency is propelling the adoption of advanced materials produced through metal casting. As the automotive sector continues to prioritize performance and sustainability, the metal casting market is expected to benefit significantly from these trends, ensuring its relevance in the manufacturing landscape.

Growth in the Aerospace Industry

The growth in the aerospace industry is further fuelling the growth of the Europe metal casting market. The aerospace sector requires high-performance materials that can withstand extreme conditions, making metal casting an essential process for producing critical components such as turbine blades, structural frames, and landing gear. According to the European Aerospace Industry Association, the aerospace market in Europe is projected to grow at a CAGR of 5% from 2021 to 2026 owing to the increasing air travel demand and advancements in aircraft technology. This growth is propelling the demand for metal casting, as manufacturers seek to produce lightweight and durable components that enhance aircraft performance and safety. As the aerospace industry continues to innovate and expand, the demand for metal casting is expected to rise significantly, reinforcing its importance in the overall market.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Issues

Regulatory challenges and compliance issues are the significant restraints of the Europe metal casting market. The production and use of metals are subject to stringent regulations regarding environmental and health safety standards. The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes rigorous requirements on the registration and assessment of chemical substances, which can complicate the formulation and approval processes for new products. According to industry estimates, approximately 30% of metal casting manufacturers face delays in product approvals due to regulatory hurdles, impacting their ability to bring innovative solutions to market. Additionally, the evolving regulatory landscape, including potential changes in safety standards and restrictions on certain substances, adds further complexity for manufacturers. As companies navigate these regulatory challenges, the potential for increased operational costs and delays in product launches may hinder growth in the metal casting market.

Market Volatility and Price Fluctuations

Market volatility and price fluctuations are further hindering the growth of the Europe metal casting market. The prices of raw materials used in metal casting, such as aluminum, steel, and iron, are influenced by various factors, including geopolitical tensions, supply chain disruptions, and changes in global demand. According to market analyses, the price of aluminum has experienced fluctuations of up to 20% over the past two years due to these factors. This volatility can create uncertainty for manufacturers, making it difficult to budget and plan production effectively. Additionally, rising costs of energy and transportation can further exacerbate price fluctuations, impacting the overall profitability of metal casting producers. As the market grapples with these challenges, stakeholders must develop strategies to mitigate risks associated with price volatility, such as long-term contracts and diversified sourcing strategies, to ensure stability and sustainability in their operations.

MARKET OPPORTUNITIES

Technological Advancements in Casting Processes

Technological advancements in casting processes are a major opportunity for the Europe metal casting market. Innovations such as 3D printing, computer-aided design (CAD), and automated casting techniques are revolutionizing the way metal components are produced. These advancements enable manufacturers to create complex geometries with greater precision and reduced lead times. The adoption of advanced casting technologies is growing significantly owing to the increasing demand for customized and high-performance components. The importance of this opportunity lies in its potential to enhance production efficiency and reduce waste, ultimately leading to cost savings for manufacturers. As companies continue to invest in research and development to improve casting technologies, the metal casting market is well-positioned to capitalize on this growth. Embracing these technological advancements not only enhances competitiveness but also aligns with the industry's broader goals of sustainability and efficiency.

Growing Demand for Lightweight Materials

The growing demand for lightweight materials in various industries is another promising opportunity for the Europe metal casting market. As industries such as automotive and aerospace increasingly prioritize fuel efficiency and performance, there is a rising need for lightweight components that do not compromise strength or durability. Metal casting plays a crucial role in producing lightweight alloys and components that meet these requirements. According to the European Lightweight Materials Association, the demand for lightweight materials is growing exponentially due to the increasing need for sustainable and efficient solutions. The importance of this opportunity lies in its ability to support the development of innovative products that enhance performance while reducing environmental impact. As manufacturers seek to meet the growing demand for lightweight materials, the metal casting market is expected to benefit significantly from this trend, positioning itself for substantial growth in the coming years.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the Europe metal casting market, particularly in the wake of the COVID-19 pandemic. The pandemic has exposed vulnerabilities in global supply chains, leading to delays in the delivery of essential raw materials and increased costs. According to a survey conducted by the European Foundry Association, approximately 70% of metal casting manufacturers reported experiencing supply chain issues in 2021, with many citing difficulties in sourcing key materials for production. These disruptions can hinder production schedules, increase operational costs, and ultimately impact the overall growth of the metal casting market. Furthermore, geopolitical tensions and trade restrictions can exacerbate supply chain challenges, leading to further uncertainty in the availability of essential materials. As the industry grapples with these supply chain issues, stakeholders must develop strategies to mitigate risks and ensure a stable supply of materials to support ongoing and future projects.

Consumer Awareness and Education

Consumer awareness and education is another major challenge for the Europe metal casting market. As consumers become more informed about manufacturing processes and the environmental impact of materials, there is an increasing demand for transparency regarding the sourcing and production of metal components. According to a survey by the European Consumer Organisation, approximately 65% of consumers express concern about the sustainability of products they purchase, including those made from metal casting. This heightened scrutiny can lead to skepticism regarding the environmental impact of certain metal casting processes, particularly those that are energy-intensive or involve harmful emissions. As a result, manufacturers must invest in consumer education and transparency initiatives to build trust and demonstrate their commitment to sustainable practices. Additionally, the growing trend towards eco-friendly materials may further challenge the acceptance of traditional metal casting products, necessitating a shift towards more sustainable formulations and processes. As the market navigates these challenges, companies must prioritize consumer education and transparency to ensure the continued growth and acceptance of metal casting products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.46% |

|

Segments Covered |

By Product, Process, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

MEDEKO CAST Sro, Alcoa Corp, Allard-Europe NV, ArcelorMittal SA, FONDERIA AUGUSTA Srl, Novacast Ltd, Posco Holdings Inc, RYOBI Aluminium Casting (UK) Ltd, and Tycon Alloy Industries (HongKong) Co Ltd, Lucchini RS SpA, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The carbon steel alloys segment occupied the major share of 36.3% of the European market in 2024. Carbon steel alloys are widely utilized in various applications due to their excellent mechanical properties, durability, and cost-effectiveness. They are commonly used in the automotive, construction, and machinery sectors, where strength and resilience are paramount. According to industry estimates, the demand for carbon steel alloys is growing significantly in the European market due to the increasing demand for high-performance materials in these industries. The importance of this segment lies in its ability to provide reliable solutions for a wide range of applications, ensuring the continued growth of the metal casting market. As industries increasingly prioritize efficiency and performance, the demand for carbon steel alloys is expected to remain strong, reinforcing their position as the largest segment in the market.

The aluminum alloys segment is anticipated to witness the fastest CAGR of 6.5% over the forecast period. The demand for aluminum alloys is driven by their lightweight nature, corrosion resistance, and excellent thermal and electrical conductivity, making them ideal for applications in the automotive, aerospace, and consumer goods sectors. According to market analyses, the aluminum alloys segment is expected to capture a larger share of the overall metal casting market as manufacturers recognize the benefits of incorporating these materials into their products. The importance of this segment lies in its ability to enhance the performance characteristics of various applications, contributing to the overall quality and efficiency of end products. As the industry continues to innovate and develop specialized aluminum casting solutions, this segment is well-positioned for significant growth in the coming years.

By Process Insights

The sand-casting segment held 41.5% of the European metal casting market in 2024. Sand casting is a widely used method due to its versatility, cost-effectiveness, and ability to produce complex shapes with high precision. This process involves creating a mold from sand and then pouring molten metal into the mold to form the desired component. The rising demand for customized metal components in various industries, including automotive, aerospace, and construction is propelling the growth of the sand-casting segment in the European market. The ability of sand casting to accommodate a wide range of materials and sizes, which is making it suitable for both small-scale and large-scale production and is one of the key factors driving the expansion of the sand-casting segment in the European market. As industries continue to prioritize efficiency and flexibility in manufacturing, the sand-casting segment is expected to maintain its leading position in the metal casting market.

The investment casting segment is predicted to showcase a CAGR of 7.12% over the forecast period. Investment casting is also known as lost-wax casting and is gaining popularity due to its ability to produce high-precision components with excellent surface finishes and intricate geometries. This process is particularly beneficial in industries such as aerospace and medical, where precision and quality are critical. According to market analyses, the investment casting market is expected to expand significantly as manufacturers seek to develop complex parts that meet stringent industry standards. The importance of this segment lies in its ability to reduce material waste and improve production efficiency, making it an attractive option for manufacturers. As the industry continues to innovate and develop advanced investment casting techniques, this segment is well-positioned for substantial growth in the coming years.

By Application Insights

The automotive segment captured 31.3% of the European market share in 2024. The automotive industry is a significant consumer of metal castings, utilizing them for various components such as engine blocks, transmission housings, and structural parts. According to the European Automobile Manufacturers Association, the production of vehicles in Europe is projected to reach 20 million units by 2025, driving the demand for high-quality metal castings. The importance of this segment lies in its ability to provide durable and lightweight components that enhance vehicle performance and safety. As the automotive sector continues to innovate and prioritize sustainability, the demand for metal castings in this application is expected to grow, reinforcing its position as the largest segment in the market.

The aerospace segment is another notable segment and is likely to exhibit a CAGR of 6.5% over the forecast period. The aerospace industry requires high-performance materials that can withstand extreme conditions, making metal casting an essential process for producing critical components such as turbine blades, structural frames, and landing gear. According to the European Aerospace Industry Association, the aerospace market in Europe is projected to grow at a rate of 5% annually, further boosting the demand for metal castings. The importance of this segment lies in its ability to provide reliable and efficient solutions for aerospace applications, ensuring the safety and efficacy of aircraft systems. As the aerospace industry continues to innovate and expand, the demand for metal castings is expected to rise significantly, positioning this segment for substantial growth in the coming years.

REGIONAL ANALYSIS

Germany dominated the metal casting market in Europe by holding the leading share of the regional market in 2024. The robust chemical and manufacturing sectors in Germany significantly contribute to this dominance, with a strong focus on automotive, aerospace, and industrial applications. According to the German Foundry Association, the production of castings in Germany reached over 5 million tons in 2021, underscoring the critical role of metal casting in various industries. Additionally, Germany's commitment to sustainability and innovation is driving the adoption of high-performance materials that meet the evolving needs of manufacturers. The increasing demand for lightweight and durable components in the automotive sector is further propelling the growth of this market. As the demand for high-quality metal castings continues to rise, Germany's position as a market leader is expected to remain strong, reinforcing its influence in the European metal casting market.

France held a substantial share of the European metal casting market in 2024. The French metal casting industry is characterized by significant investments in automotive and aerospace applications, driven by the growing demand for high-quality components. According to the French Ministry of Economy and Finance, the production of castings in France reached around 3 million tons in 2021, reflecting a robust market for these materials. The emphasis on improving product performance and sustainability is driving French manufacturers to adopt advanced casting techniques that meet regulatory requirements and consumer expectations. Furthermore, France's focus on innovation and research in the metal casting sector is influencing the development of specialized applications. As the French market continues to evolve, the demand for metal castings is expected to grow, reinforcing France's position as a key player in the European market.

Italy is another prominent market for metal casting in Europe. The Italian metal casting industry is diverse, with significant production in automotive, construction, and machinery applications. According to the Italian National Institute of Statistics, the production of castings in Italy reached over 2 million tons in 2021, highlighting the importance of these materials in various sectors. The increasing focus on high-quality materials and sustainable practices is driving the demand for metal castings in Italy. Additionally, Italy's strategic location within Europe facilitates trade and distribution, further enhancing its position in the metal casting market. As the country continues to invest in modernization and innovation, the demand for metal castings is expected to rise, contributing to the overall growth of the market.

The United Kingdom is projected to hold a prominent share of the European market over the forecast period. The UK metal casting industry is characterized by a diverse range of applications, including automotive, aerospace, and industrial machinery. According to the UK Foundry Association, the production of castings in the UK reached around 1.5 million tons in 2021, reflecting a strong demand for these materials. The emphasis on improving product performance and sustainability is driving UK manufacturers to invest in high-quality metal castings that meet regulatory requirements. Furthermore, the UK's commitment to innovation and research in the metal casting sector is influencing the development of advanced casting techniques. As the UK navigates post-Brexit challenges, the metal casting market is expected to adapt and evolve, presenting opportunities for growth.

Spain is anticipated to register a healthy CAGR in the European metal casting market during the forecast period. The Spanish metal casting industry is experiencing significant growth, driven by a resurgence in automotive and construction applications. According to the Spanish Ministry of Industry, Trade and Tourism, the production of castings in Spain reached over 1 million tons in 2021, highlighting the importance of these materials in various applications. The increasing focus on sustainable practices and the demand for high-quality products are propelling the growth of the metal casting market in Spain. Additionally, Spain's growing e-commerce sector is driving the need for innovative solutions that enhance product performance. As the country continues to develop its industrial capabilities and invest in sustainable practices, the demand for metal castings is anticipated to rise, reinforcing its position in the European market.

KEY MARKET PLAYERS

The major key players in Europe metal casting market are MEDEKO CAST Sro, Alcoa Corp, Allard-Europe NV, ArcelorMittal SA, FONDERIA AUGUSTA Srl, Novacast Ltd, Posco Holdings Inc, RYOBI Aluminium Casting (UK) Ltd, and Tycon Alloy Industries (HongKong) Co Ltd, Lucchini RS SpA, and others.

MARKET SEGMENTATION

This research report on the Europe metal casting market is segmented and sub-segmented into the following categories.

By Product

- Carbon Steel Alloys

- Stainless Steel Alloys

- Aluminum Alloys

- Grey Iron

- Ductile Iron

By Process

- Sand Casting

- Investment Casting

- Gravity Die Casting

By Application

- Automotive

- Aerospace

- Marine

- Textile

- Building and Construction

- Oil and Gas

- Industrial Machinery

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the estimated market value for the European Metal Casting market by 2033?

The European Metal Casting market is estimated to be worth USD 51.88 billion by 2033.

2. What challenges does the European Metal Casting industry face?

The industry faces challenges related to high energy costs and the need to transition to renewable energy sources while maintaining production efficiency.

3. Which industries primarily utilize metal castings in Europe?

Metal castings are widely used in industries such as automotive, aerospace, construction, and energy.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]