Europe Membrane Bioreactor (MBR) Market Size, Share, Trends, & Growth Forecast Report By System (Submerged and Side Stream), Type, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Membrane Bioreactor (MBR) Market Size

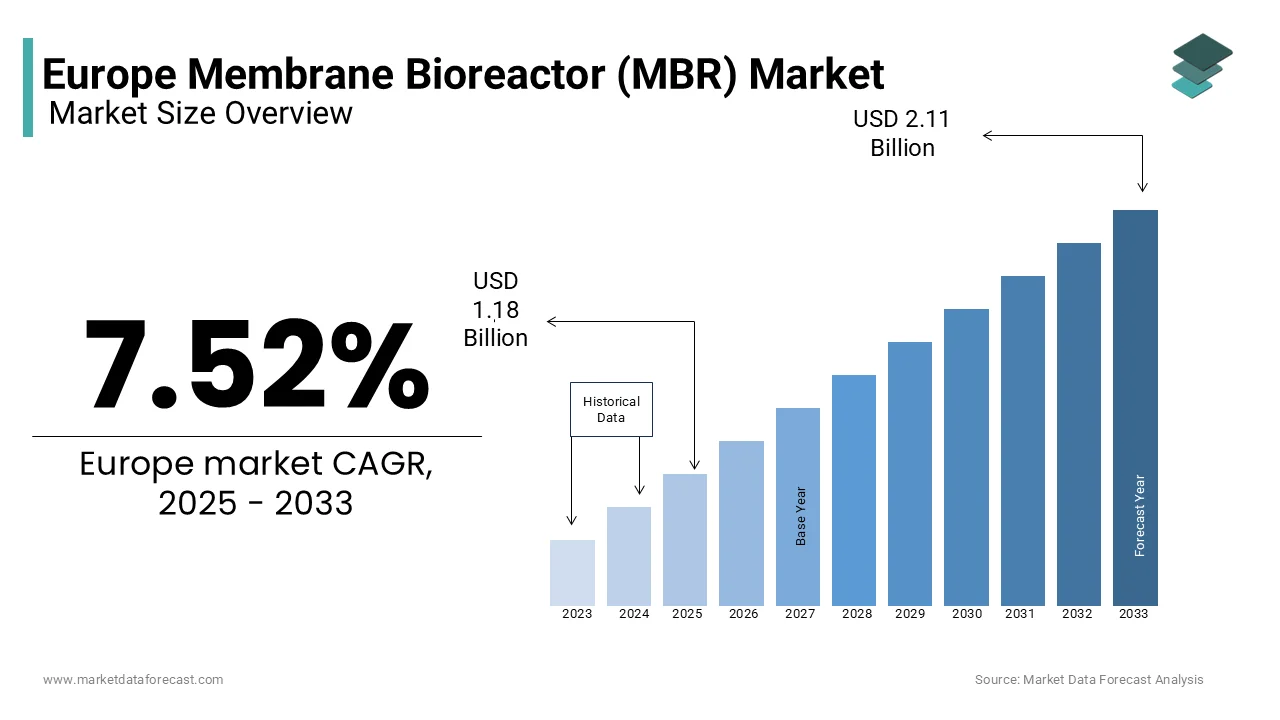

The Europe membrane bioreactor (MBR) market was worth USD 1.10 billion in 2024. The European market is projected to reach USD 2.11 billion by 2033 from USD 1.18 billion by 2025, growing at a CAGR of 7.52% from 2025 to 2033.

Membrane bioreactor MBR systems are widely regarded as a sustainable solution for addressing the growing challenges of water scarcity, urbanization, and stringent environmental regulations. According to the European Environment Agency, over 20% of Europe’s population is affected by water stress, which is driving the adoption of efficient wastewater treatment technologies like MBRs. These systems offer advantages such as compact design, high effluent quality, and the ability to treat industrial and municipal wastewater effectively.

In 2023, the Europe MBR market was valued at approximately €1.8 billion, with Germany leading the region due to its robust infrastructure investments, as per the German Federal Ministry for the Environment. According to the UK Department for Environment, Food & Rural Affairs, MBR installations have increased by 15% annually since 2020 which is driven by urban expansion and regulatory mandates under the EU Water Framework Directive. Furthermore, France’s National Institute for Industrial Environment and risks notes that industries such as pharmaceuticals and food processing are adopting MBRs to meet zero-liquid discharge goals. The Europe mamebrane bioreactor mbr market is poised for significant growth, supported by advancements in membrane materials and energy-efficient designs. MBRs are becoming indispensable for ensuring sustainable water management across the continent as climate change exacerbates water resource challenges.

MARKET DRIVERS

Stringent Environmental Regulations and Water Quality Standards

Stringent environmental regulations and water quality standards are significant drivers of the Europe membrane bioreactor (MBR) market. According to the European Environment Agency, the EU Water Framework Directive mandates member states to achieve "good status" for all water bodies by 2027 by enabling industries and municipalities to adopt advanced wastewater treatment technologies like MBRs. According to the Germany’s Federal Ministry for the Environment, over 60% of industrial facilities have upgraded their treatment systems to comply with these regulations, with MBRs being a preferred choice due to their ability to produce high-quality effluent. As per France’s National Institute for Industrial Environment and Risks, MBR adoption has increased by 25% in regions facing non-compliance penalties. These regulatory pressures ensure sustained demand for MBR systems, as they enable compliance with strict discharge limits while supporting Europe’s commitment to sustainable water management.

Growing Urbanization and Water Scarcity Challenges

Rapid urbanization and increasing water scarcity are propelling the adoption of MBR systems across Europe. The European Commission estimates that urban populations will grow by 10% by 2030 with the demand for efficient wastewater treatment solutions. Italy’s National Institute for Environmental Protection and Research states that cities like Milan and Rome have integrated MBR systems into municipal treatment plants to address rising water demands and reuse treated water for irrigation and industrial purposes. According to the Spain’s Ministry for Ecological Transition, regions such as Andalusia, affected by severe water stress, have witnessed a 40% increase in MBR installations since 2020. MBRs provide a reliable solution for producing reusable water by ensuring water security while promoting circular economy principles across the continent.

MARKET RESTRAINTS

High Capital and Operational Costs

The high capital and operational costs associated with these systems is one of the major restraints in the Europe membrane bioreactor (MBR) market. According to the European Environment Agency, MBR installations can cost up to 30% more than conventional wastewater treatment systems, primarily due to the advanced membrane technology and energy-intensive processes involved. Germany’s Federal Ministry for Economic Affairs and Climate Action reports that energy consumption for MBR systems is approximately 1.5 to 2 times higher than traditional systems by making them less attractive for small-scale applications. According to the UK Department for Environment, Food & Rural Affairs, maintenance costs, including membrane replacement, can account for 20-25% of the total operational expenses over a system’s lifespan. These financial barriers limit widespread adoption among smaller municipalities and industries operating under tight budgets.

Membrane Fouling and Technical Challenges

Membrane fouling remains a significant technical challenge by hindering the efficiency and scalability of MBR systems in Europe. According to the France’s National Institute for Industrial Environment and Risks, fouling can reduce membrane performance by up to 50% by necessitating frequent cleaning and maintenance, which further escalates operational costs. As per Italy’s National Institute for Environmental Protection and Research, fouling issues are more pronounced in industrial wastewater treatment, where complex contaminants accelerate membrane degradation. According to the Sweden’s Innovation Agency, despite advancements in anti-fouling coatings, the issue persists, particularly in regions with high organic loads in wastewater. These technical challenges not only increase operational complexity but also discourage potential adopters by slowing the overall growth of the MBR market across Europe.

MARKET OPPORTUNITIES

Increasing Focus on Water Reuse and Circular Economy

The growing emphasis on water reuse and circular economy principles presents a significant opportunity for the Europe membrane bioreactor (MBR) market. According to the European Commission, 80% of treated wastewater in Europe is currently discharged into rivers by leaving immense potential for reuse. According to Spain’s Ministry for Ecological Transitio, regions like Catalonia have adopted MBR systems to treat urban wastewater for agricultural irrigation is achieving a 30% increase in water reuse since 2020. As per Germany’s Federal Ministry for the Environment, industries such as food processing and pharmaceuticals are integrating MBRs to meet zero-liquid discharge goals, with water reuse rates projected to grow by 25% annually. As Europe aims to halve its water use by 2030 under the EU Green Deal, MBRs are poised to play a pivotal role in enabling sustainable water management and supporting resource-efficient practices across sectors.

Advancements in Membrane Technology and Energy Efficiency

Technological advancements in membrane materials and energy-efficient designs offer another major opportunity for the Europe MBR market. As per the Netherlands Organisation for Applied Scientific Research, innovations in anti-fouling membranes have reduced maintenance costs by up to 15% by making MBR systems more economically viable. Furthermore, France’s National Institute for Industrial Environment and Risks reports that energy-efficient MBR systems is equipped with advanced aeration technologies that have lowered energy consumption by 20% compared to traditional models. According to the Italy’s National Institute for Environmental Protection and Research, that these advancements are driving adoption in municipalities and industrial facilities seeking cost-effective solutions. The development of durable, high-performance membranes aligns with sustainability goals by ensuring long-term growth for the MBR market while addressing operational challenges.

MARKET CHALLENGES

Limited Awareness and Technical Expertise

The limited awareness and technical expertise among potential adopters, particularly in smaller municipalities and developing regions is a major challenging factor for the Europe membrane bioreactor mbr market key players. According to the European Environment Agency, nearly 40% of small-scale wastewater treatment facilities lack the knowledge to implement advanced systems like MBRs is leading to slower adoption rates. As per Poland’s Ministry of Infrastructure, only 15% of rural areas have access to advanced treatment technologies, primarily due to insufficient training and awareness programs. As per Italy’s National Institute for Environmental Protection and Research misconceptions about high operational complexity further deter investments in MBR systems. This gap in technical understanding not only restricts market penetration but also delays the transition to sustainable water management practices, particularly in underserved regions across Europe.

Competition from Conventional Treatment Technologies

Another major challenge is the intense competition from conventional wastewater treatment technologies, which are often perceived as more cost-effective and easier to implement. The UK Department for Environment, Food & Rural Affairs states that traditional systems still dominate 70% of the European wastewater treatment market, driven by their lower upfront costs and established operational frameworks. According to the Germany’s Federal Ministry for Economic Affairs and Climate Action, retrofitting existing plants with MBR technology can increase costs by up to 50%, making it less appealing for budget-constrained operators. Furthermore, France’s National Institute for Industrial Environment and Risks emphasizes that industries with less stringent effluent requirements often opt for conventional systems by limiting MBR adoption. This competitive pressure poses a barrier to scaling MBR solutions despite their superior performance and sustainability benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.52% |

|

Segments Covered |

By System, Type, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

SUEZ Water Technologies & Solutions, Kubota Corporation, Evoqua Water Technologies LLC, Mitsubishi Chemical Corporation, TORAY INDUSTRIES, INC., Veolia Water Solutions & Technologies, Koch Membrane Systems, Inc., Asahi Kasei Corporation, Alfa Laval AB, and Pall Corporation. |

SEGMENTAL ANALYSIS

By System Insights

The submerged systems dominated the market and held 65% of Europe membrane bioreactor mbr market owing to its cost-effectiveness and suitability for municipal wastewater treatment by reducing energy consumption by up to 20%. According to the Germany’s Federal Ministry for the Environment, cities like Berlin have adopted submerged systems for their compact design and high effluent quality, addressing urban water management challenges. These systems are ideal for space-constrained areas and require less maintenance compared to side stream systems. Submerged systems play a critical role in achieving efficient wastewater treatment with Europe focusing on sustainable urbanization by making them indispensable for municipalities striving to meet stringent environmental regulations.

The Side stream systems segment is experiencing a fastest CAGR of 8.5% during 2025-2033. This growth is driven by their ability to handle high-contaminant industrial wastewater in sectors like pharmaceuticals and textiles. According to the Netherlands Organisation for Applied Scientific Research, side stream systems operate at higher flux rates by ensuring robust performance in demanding environments. Despite being 30% more expensive to operate, their adoption is rising due to increasing industrial sustainability mandates. As Europe prioritizes zero-liquid discharge goals, side stream systems are critical for industries seeking advanced treatment solutions by positioning them as a key driver of innovation in the MBR market.

By Type Insights

The hollow fiber membranes segment led the market by capturing 55% of Europe membrane bioreactor mbr market in 2024. The high surface area-to-volume ratio by enabling efficient filtration and superior effluent quality. According to the Germany’s Federal Ministry for the Environment, hollow fiber systems reduce operational costs by up to 15% by making them ideal for large-scale municipal wastewater treatment. These membranes are also less prone to fouling, ensuring consistent performance in high organic load applications. Hollow fiber membranes play a critical role in delivering cost-effective and sustainable water management solutions as Europe faces urbanization challenges.

Flat sheet membranes are the fastest-growing segment, with a CAGR of 9.1% during the forecast period. This growth is fueled by their increasing adoption in industries like pharmaceuticals and food processing, where reliability and ease of maintenance are paramount. According to the UK Department for Environment, Food & Rural Affairs, a 20% rise in demand since 2020 which is driven by their modular design and adaptability to varying flow rates. As Europe prioritizes industrial sustainability and zero-liquid discharge goals, flat sheet membranes are becoming indispensable for treating complex industrial wastewater, positioning them as a key driver of innovation in the MBR market.

By Application Insights

The municipal waste-water treatment segment dominated the market by capturing 60% of Europe membrane bioreactor market share in 2024. Rapid urbanization and stringent EU water quality regulations, such as the Water Framework Directive are majorly proplelling the growth rate of this segment. According to the Germany’s Federal Ministry for the Environment, cities like Berlin have adopted MBR systems to combat water scarcity, by enabling up to 80% of treated water to be reused for irrigation and industrial purposes. These systems are compact, energy-efficient, and produce high-quality effluent, by making them ideal for densely populated areas. Municipal applications remain critical for sustainable urban water management and environmental compliance as Europe strives to enhance water reuse under the EU Green Deal.

The Industrial waste-water treatment segment is anticipated to register a CAGR of 10.2% throughout the forecast period. The segment’s growth rate is driven by stricter discharge limits and the adoption of zero-liquid discharge practices. According to the France’s National Institute for Industrial Environment and Risks, 18% annual increase in MBR adoption since 2020 in sectors like pharmaceuticals and textiles. Industries favor MBRs for their ability to handle complex effluents and reduce environmental impact. Industrial MBR systems are pivotal for achieving regulatory compliance and promoting sustainable water management by positioning them as a key innovation driver in wastewater treatment.

REGIONAL ANALYSIS

Germany outperformed the other countries in the Europe membrane bioreactor mbr market in 2024 by accounting for 28% share owing to its robust infrastructure investments and stringent environmental regulations. As per the German Federal Ministry for the Environment cities like Berlin and Munich have adopted MBR systems to address urban water scarcity and comply with the EU Water Framework Directive. Additionally, Germany’s strong industrial base, particularly in pharmaceuticals and food processing, has fueled demand for advanced wastewater treatment solutions. According to the Netherlands Organisation for Applied Scientific Research, Germany accounts for over 30% of industrial MBR installations in Europe. Germany is at the forefront of integrating MBR technology into both municipal and industrial sectors by ensuring efficient water management and regulatory compliance.

France is esteemed to register a CAGR of 8.2% during the foreseen years. According to the France’s National Institute for Industrial Environment and Risks, regions like Provence have implemented MBR systems to combat water stress are achieving a 25% increase in water reuse since 2020. The French government’s push for zero-liquid discharge in industries such as textiles and chemicals has further accelerated MBR adoption. According to the European Environment Agency, France’s investment in eco-friendly urban projects has positioned it as a leader in municipal wastewater treatment. France continues to drive innovation and scalability in the MBR market by prioritizing green technologies.

The United Kingdom is deemed to have significant growth opportunities in Europe membrane bioreactor mbr market owing to its focus on urban wastewater treatment and industrial sustainability. According to the UK Department for Environment, Food & Rural Affairs, cities like London have integrated MBR systems to meet rising water demands and achieve compliance with EU-derived environmental standards post-Brexit. Furthermore, the UK’s industrial sector, particularly pharmaceuticals, has adopted MBRs to treat complex effluents by reducing environmental impact. According to the Italy’s National Institute for Environmental Protection and Research, the UK’s investment in smart city initiatives has boosted MBR adoption by 20% annually since 2020.

KEY MARKET PLAYERS

The major players in the Europe membrane bioreactor (MBR) market include SUEZ Water Technologies & Solutions, Kubota Corporation, Evoqua Water Technologies LLC, Mitsubishi Chemical Corporation, TORAY INDUSTRIES, INC., Veolia Water Solutions & Technologies, Koch Membrane Systems, Inc., Asahi Kasei Corporation, Alfa Laval AB, and Pall Corporation.

MARKET SEGMENTATION

This research report on the Europe membrane bioreactor (MBR) market is segmented and sub-segmented into the following categories.

By System

- Submerged

- Side Stream

By Type

- Hollow Fiber

- Flat Sheet

- Multi-Tubular

- Others

By Application

- Municipal Waste-Water Treatment

- Industrial Waste-Water Treatment

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Membrane Bioreactor (MBR) market?

The growth is driven by increasing wastewater treatment regulations, rising environmental concerns, and advancements in membrane filtration technology.

What are the key applications of membrane bioreactors in Europe?

They are widely used in municipal wastewater treatment, industrial wastewater treatment, and water recycling in sectors like pharmaceuticals and food processing.

How is technological innovation impacting the Europe MBR market?

Advancements in membrane materials, automation, and energy-efficient designs are improving performance and reducing operational costs.

What is the future outlook for the Europe Membrane Bioreactor market?

The market is expected to grow steadily, driven by stricter environmental policies, increasing water scarcity, and advancements in filtration technology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]