Europe Medical Transcription Software Market Size, Share, Trends, & Growth Forecast Report By Deployment (Cloud/Web-based and On Premises/Installed), End-user Facility, Type, End-user, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Medical Transcription Software Market Size

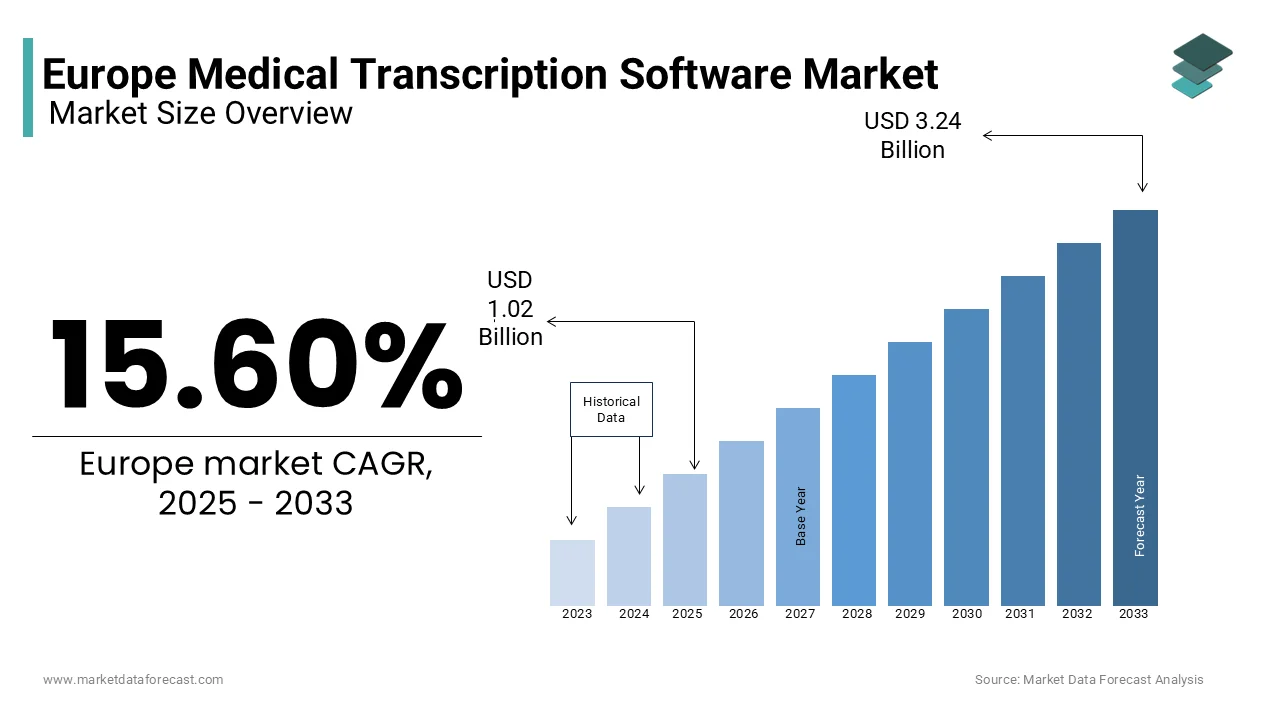

The Europe medical transcription software market was worth USD 0.88 billion in 2024. The European market is projected to reach USD 3.24 billion by 2033 from USD 1.02 billion in 2025, rising at a CAGR of 15.60% from 2025 to 2033.

Medical transcription software automates the process of converting voice-recorded medical reports dictated by healthcare professionals into structured text formats, ensuring precision and compliance with regulatory standards. This technology leverages advancements in artificial intelligence (AI), natural language processing (NLP), and speech recognition to streamline workflows, reduce manual errors, and enhance productivity in healthcare settings. According to Eurostat, over 70% of European healthcare providers have adopted digital documentation tools, underscoring the growing reliance on automated solutions.

According to the European Commission, the healthcare sector contributes approximately 10% to the EU’s GDP, with administrative tasks accounting for nearly 25% of healthcare professionals' time. Medical transcription software addresses this inefficiency by reducing documentation time by up to 40%, as reported by the European Health Parliament. The integration of cloud-based platforms has further expanded accessibility, enabling real-time transcription and secure storage of sensitive patient information. As Europe prioritizes the transition to electronic health records (EHRs) and telemedicine, medical transcription software has become indispensable in ensuring seamless communication and data management across healthcare ecosystems, positioning it as a cornerstone of modern healthcare delivery.

MARKET DRIVERS

Increasing Adoption of Electronic Health Records (EHRs) in Europe

The widespread adoption of electronic health records (EHRs) is a major driver of the European medical transcription software market. As per European Commission, over 80% of healthcare facilities in the EU are transitioning to EHR systems to ensure compliance with digital health mandates under initiatives like the EU Digital Health Strategy. According to Eurostat, EHR implementation has reduced documentation errors by 35%, improving patient safety and operational efficiency. Medical transcription software plays a critical role in this transition by automating the conversion of voice data into structured text, ensuring seamless integration with EHR platforms. Additionally, the European Health Parliament notes that healthcare providers using transcription software have reduced administrative workload by up to 40%, allowing clinicians to focus more on patient care. With investments in digital health technologies projected to exceed €20 billion annually, the demand for transcription solutions is set to grow, reinforcing their importance in modern healthcare ecosystems.

Rising Demand for Telemedicine and Remote Healthcare Services

The rapid expansion of telemedicine and remote healthcare services is another key driver propelling the European medical transcription software market. Eurostat reports that telemedicine usage surged by 60% during the COVID-19 pandemic, with over 30% of consultations now conducted remotely. The European Commission emphasizes that accurate documentation is critical in telehealth, where real-time transcription ensures clarity and compliance with GDPR regulations. Medical transcription software enables healthcare providers to generate precise records during virtual consultations, reducing manual effort by 50%, as highlighted by the European Health Parliament. Furthermore, the telemedicine market in Europe is expected to grow exponentially over the forecast period and boost the demand for efficient transcription tools. This trend underscores the importance of transcription software in supporting scalable, secure, and patient-centric remote healthcare delivery across Europe.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

The high implementation costs of medical transcription software is a notable restraint to its adoption, particularly for smaller healthcare providers. The European Commission highlights that the initial investment required for advanced transcription systems, including AI-driven solutions and cloud integration, can exceed €50,000 per facility. Eurostat reports that over 60% of small and medium-sized healthcare practices in Europe face budgetary limitations, hindering their ability to adopt such technologies. Additionally, the European Investment Bank notes that the lack of dedicated funding for digital health initiatives in rural and underserved regions exacerbates disparities in technology access. These financial barriers slow the market’s growth potential, as many providers struggle to balance the upfront costs with long-term benefits. Furthermore, ongoing expenses for software updates and staff training add to the financial burden, making it challenging for smaller institutions to compete with larger, well-funded organizations.

Data Privacy and Security Concerns

Data privacy and security concerns are further hindering the growth of the European medical transcription software market. The European Union Agency for Cybersecurity (ENISA) reports that cyberattacks on healthcare systems have increased by 45% over the past three years, with transcription software being a potential vulnerability if not adequately protected. Eurostat highlights that 55% of healthcare providers consider data breaches a significant barrier to adopting cloud-based transcription solutions. Under the General Data Protection Regulation (GDPR), non-compliance with data protection standards can result in fines of up to €20 million or 4% of annual global turnover, as emphasized by the European Data Protection Board. These stringent regulations, while essential for safeguarding sensitive patient information, increase operational complexity and deter some institutions from fully embracing transcription technologies, slowing market expansion despite their proven benefits.

MARKET OPPORTUNITIES

Integration of AI and NLP for Enhanced Accuracy and Efficiency

The integration of artificial intelligence (AI) and natural language processing (NLP) is a lucrative opportunity for the European medical transcription software market. The European Commission highlights that AI-driven transcription tools can reduce documentation errors by up to 50%, ensuring higher accuracy in patient records. Eurostat reports that over 70% of healthcare providers are investing in AI-based solutions to streamline workflows, with transcription software being a key focus area. Additionally, the European Health Parliament notes that AI-enhanced systems can process voice data 30% faster than traditional methods, significantly improving productivity. With the global AI in healthcare market projected to grow at a CAGR of 41.8% through 2030, according to Statista, Europe is well-positioned to leverage these advancements. By adopting AI-powered transcription solutions, healthcare facilities can enhance operational efficiency, comply with regulatory standards, and deliver better patient outcomes.

Expansion of Cloud-Based Solutions for Scalability and Accessibility

The growing adoption of cloud-based medical transcription software is another promising opportunity for the European market. The European Commission reports that cloud solutions enable real-time transcription and secure storage of patient data, reducing administrative delays by 40%. Eurostat highlights that over 65% of healthcare institutions are transitioning to cloud platforms to improve accessibility and scalability, particularly for telemedicine services. Furthermore, the European Data Protection Board emphasizes that GDPR-compliant cloud systems ensure robust data security, addressing privacy concerns while fostering innovation. Statista projects that the European healthcare cloud computing market will reach €12 billion by 2025, driven by increasing demand for remote documentation tools. This shift toward cloud-based transcription not only supports seamless collaboration across healthcare ecosystems but also aligns with Europe’s digital transformation goals, making it a cornerstone of future growth.

MARKET CHALLENGES

Resistance to Technological Adoption Among Healthcare Professionals

Resistance to adopting new technologies is a significant challenge for the European medical transcription software market. The European Health Parliament reports that over 45% of healthcare professionals express hesitation in transitioning from traditional dictation methods to automated transcription tools, citing concerns about accuracy and workflow disruptions. Eurostat highlights that training staff to use advanced software can take up to 20 hours per individual, creating additional time and cost burdens for healthcare facilities. Furthermore, the European Commission notes that the lack of standardized protocols for integrating transcription software with existing systems exacerbates implementation challenges. This resistance is particularly pronounced in smaller clinics, where 60% of practitioners rely on manual documentation due to limited technical expertise. Such barriers hinder the widespread adoption of transcription technologies, slowing market growth despite their proven benefits in enhancing efficiency and reducing errors.

Interoperability Issues with Legacy Healthcare Systems

Interoperability challenges with legacy healthcare systems is also major obstacle for the European medical transcription software market. The European Commission highlights that over 50% of healthcare institutions still operate on outdated IT infrastructure, which often lacks compatibility with modern transcription solutions. Eurostat reports that integrating transcription software with legacy systems can increase implementation costs by 30%, deterring many organizations from upgrading. Additionally, the European Health Parliament emphasizes that data silos created by incompatible systems lead to inefficiencies, with 25% of patient records requiring manual reconciliation. These interoperability issues not only compromise the seamless flow of information but also hinder compliance with digital health mandates like the EU Digital Health Strategy. As Europe strives to achieve a unified healthcare ecosystem, addressing these technical barriers is critical to unlocking the full potential of medical transcription software.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.60% |

|

Segments Covered |

By Deployment, End-user Facility, Type, End-user, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Nuance Communications, Inc. (U.S.), Speech Processing Solutions GmbH (Austria), BigHand (U.K.), Tyger Valley Systems (U.K.), Lexacom (U.K.), Scribetech (U.K.) Ltd. (U.K.), Prescribe Digital (InventAsia Ltd.) (Spain), MEDISEC SOFTWARE LTD (U.K.), DScribe Ltd. (U.K.), and Olympus Corporation (Japan). |

SEGMENTAL ANALYSIS

By Deployment Insights

The cloud/web-based segment accounted for 65.5% of the European market share in 2024. The dominating position of cloud segment in the European market is driven by its scalability, cost-effectiveness, and real-time accessibility, which are critical for modern healthcare workflows. The European Commission highlights that cloud-based solutions reduce administrative delays by 40%, while ensuring GDPR compliance through robust data encryption. The demand for healthcare cloud computing is growing remarkably in the European and boosting the telemedicine expansion. The ability of cloud or web based deployment to support remote documentation and seamless integration with EHR systems underscores its importance in enhancing efficiency and accessibility across Europe’s healthcare ecosystem.

By End-user Facility Insights

The hospitals segment dominates the European medical transcription software market by occupying a share of 53.8% of the European market share in 2024. The domination of hospitals segment in the European market is driven by the high volume of patient data they handle daily, necessitating efficient documentation tools. The European Commission highlights that hospitals using transcription software reduce documentation errors by 35% and administrative costs by 25%. Additionally, the European Health Parliament notes that AI-driven solutions have streamlined workflows, enabling faster EHR integration and compliance with GDPR. With hospitals being central to healthcare delivery, their demand for scalable, secure transcription tools is critical. This segment’s dominance underscores its pivotal role in driving technological adoption to enhance operational efficiency and patient safety across Europe’s healthcare ecosystem.

The clinics segment is projected to hit the highest CAGR of 12.5% over the forecast period owing to the rising adoption of telemedicine and EHR systems, particularly among smaller clinics. Eurostat highlights that clinics using transcription software have reduced manual documentation efforts by 40%, allowing practitioners to focus more on patient care. The European Commission notes that cloud-based solutions have made advanced transcription tools accessible to clinics, ensuring GDPR compliance. With telehealth usage in clinics increasing by 50% since 2020, as per the European Health Parliament, this segment’s reliance on transcription software is set to surge. Its rapid growth underscores its importance in supporting accessible, patient-centric healthcare and addressing the documentation needs of outpatient services.

By Type Insights

The voice capture segment occupied 57.7% of the European market share in 2024. The leading position of voice capture segment in the European market is attributed to its widespread adoption as a foundational tool for recording dictations, particularly in hospitals and diagnostic centers. The European Commission highlights that voice capture systems reduce manual documentation errors by 30%, while advancements in noise-canceling technologies have improved audio clarity, enhancing transcription accuracy. Additionally, these systems are cost-effective and easy to implement, making them accessible to smaller clinics. Despite the rise of advanced technologies, voice capture remains critical for facilities transitioning to digital workflows. Its importance lies in providing a reliable starting point for accurate and compliant healthcare documentation across Europe.

The voice recognition segment is anticipated to progress at a CAGR of 16.8% over the forecast period due to the AI and NLP advancements that enable real-time transcription with 95% accuracy, as reported by the European Health Parliament. Eurostat highlights that voice recognition reduces documentation time by 45%, allowing clinicians to focus more on patient care. The European Commission notes that large healthcare facilities adopting this technology have cut administrative costs by 20%. Furthermore, GDPR-compliant cloud integration ensures secure data handling, addressing privacy concerns. With telemedicine and EHR adoption surging, voice recognition’s ability to streamline workflows and enhance efficiency makes it indispensable for modern healthcare systems, solidifying its transformative role in the market.

By End-User Insights

The clinicians occupied 46.3% of the European market share in 2024 due to the high volume of patient interactions and documentation requirements, with clinicians spending up to 25% of their time on administrative tasks. The European Health Parliament highlights that transcription tools reduce documentation time by 35%, allowing clinicians to focus more on patient care. Additionally, cloud-based solutions ensure seamless EHR integration and GDPR compliance, as emphasized by the European Commission. With telemedicine adoption rising, clinicians increasingly rely on these tools for remote consultations. This segment’s dominance underscores its critical role in streamlining workflows and enhancing healthcare efficiency across Europe.

The radiologists segment is predicted to register the highest CAGR of 14.2% over the forecast period. Factors such as the increasing volume of diagnostic imaging procedures is propelling the expansion of the radiologists segment in the European market. The European Society of Radiology notes that AI-driven transcription tools have reduced reporting times by 40%, enabling faster diagnosis and treatment planning. Furthermore, advancements in voice recognition systems have improved transcription accuracy to 95%, minimizing errors in imaging reports. The European Commission emphasizes that secure cloud-based solutions ensure GDPR compliance, addressing privacy concerns. As diagnostic imaging becomes integral to modern healthcare, radiologists’ reliance on transcription software is set to surge, highlighting its importance in improving precision and operational efficiency.

REGIONAL ANALYSIS

Germany commanded the largest share of the European medical transcription software market in 2024, accounting for 24.8%. The dominating position of Germany in the European market is driven by its robust healthcare infrastructure, including over 1,900 hospitals that generate vast amounts of patient data daily. The European Commission highlights that Germany’s strong focus on digital health initiatives, such as the Digital Healthcare Act, has accelerated the adoption of transcription tools. Eurostat reports that German healthcare providers have reduced documentation errors by 35% through AI-driven transcription systems. Additionally, the country’s emphasis on GDPR compliance ensures secure handling of sensitive patient data. With investments in healthcare digitization exceeding €5 billion annually, Germany’s proactive approach to integrating advanced technologies solidifies its position as a leader in this market.

The UK held a prominent share of the European market in 2024 and is expected to hold a notable CAGR over the forecast period owing to the rapid adoption of cloud-based transcription solutions. The National Health Service (NHS) emphasizes that transcription software has reduced administrative workloads by 40%, enabling clinicians to focus more on patient care. Eurostat highlights that telemedicine adoption surged by 60% during the pandemic, further boosting demand for real-time transcription tools. Additionally, the UK’s stringent data protection laws under GDPR ensure secure and compliant documentation practices. This focus on innovation and efficiency positions the UK as a key player in advancing medical transcription technologies.

France is predicted to register a promising CAGR in the European medical transcription software market over the forecast period. The notable position of France in the European market is fueled by its strong emphasis on AI and natural language processing (NLP) technologies, which the European Commission highlights as critical for enhancing transcription accuracy. Eurostat reports that French healthcare facilities using AI-driven transcription tools have improved documentation efficiency by 45%. Furthermore, the French government’s "Health Innovation 2030" strategy allocates over €1 billion annually to digital health solutions, including transcription software. The European Health Parliament notes that France’s proactive approach to integrating transcription tools with electronic health records (EHRs) ensures seamless workflows and regulatory compliance. This strategic focus on AI and interoperability makes France a frontrunner in transforming healthcare documentation across Europe.

KEY MARKET PLAYERS

The major players in the European medical transcription software market include Nuance Communications, Inc. (U.S.), Speech Processing Solutions GmbH (Austria), BigHand (U.K.), Tyger Valley Systems (U.K.), Lexacom (U.K.), Scribetech (U.K.) Ltd. (U.K.), Prescribe Digital (InventAsia Ltd.) (Spain), MEDISEC SOFTWARE LTD (U.K.), DScribe Ltd. (U.K.), and Olympus Corporation (Japan).

MARKET SEGMENTATION

This research report on the Europe medical transcription software market is segmented and sub-segmented into the following categories.

By Deployment

- Cloud/Web-based

- On Premises/Installed

By End-user Facility

- Hospitals

- Diagnostic Centers

- Clinics

- Others

By Type

- Voice Capture

- Voice Recognition

By End-user

- Radiologists

- Clinicians

- Surgeons

- Others (Allied Health Professionals)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe medical transcription software market?

The growth is driven by increasing adoption of electronic health records (EHRs), rising demand for accurate medical documentation, and the need to reduce administrative burden on healthcare professionals.

What types of medical transcription software are most commonly used in Europe?

Cloud-based medical transcription software is the most commonly used due to its scalability, remote accessibility, and reduced infrastructure costs.

How is artificial intelligence (AI) influencing the medical transcription software market in Europe?

AI is improving accuracy, reducing transcription time, and enabling voice recognition features that enhance efficiency and minimize human intervention.

What are the latest trends in the Europe medical transcription software market?

The latest trends include the adoption of AI-driven speech recognition, cloud-based transcription services, and integration with EHR systems for seamless documentation.

How does the pricing of medical transcription software vary in Europe?

Pricing varies based on deployment type, features, and licensing models, with cloud-based solutions often offering subscription plans while on-premise solutions require higher upfront costs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]