Europe Medical Oxygen Concentrators Market Size, Share, Trends & Growth Forecast Report By Product Type (Portable Oxygen Concentrators, Stationary Oxygen Concentrators), Technology (Continuous Flow, Pulse Dose), Indication (Chronic Obstructive Pulmonary Disease (COPD), Asthma, Sleep Apnea), End User (Hospitals and Clinics, Homecare Settings), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Medical Oxygen Concentrators Market Size

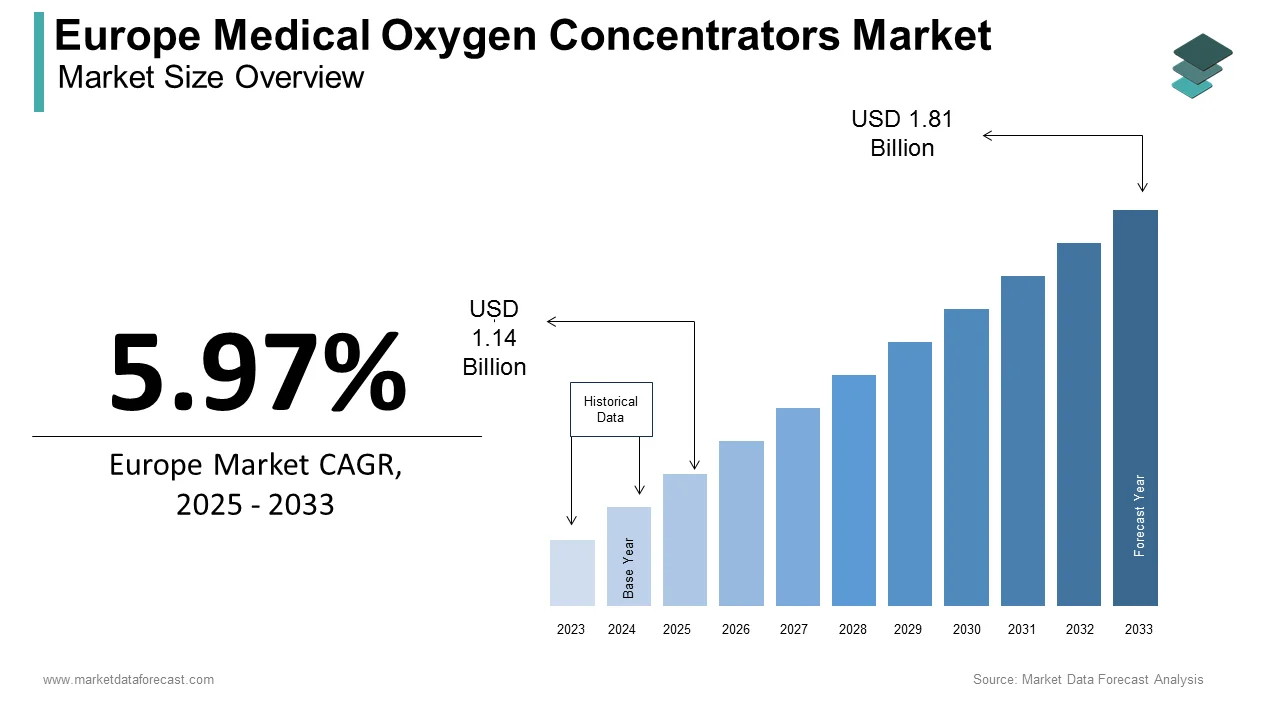

The medical oxygen concentrators market size in Europe was valued at USD 1.07 billion in 2024. The European market is estimated to be worth USD 1.81 billion by 2033 from USD 1.14 billion in 2025, growing at a CAGR of 5.97% from 2025 to 2033.

The medical oxygen concentrators are essential devices designed to deliver a continuous supply of oxygen to patients suffering from chronic respiratory conditions by enabling them to maintain adequate oxygen saturation levels and improve their quality of life. According to the European Respiratory Society, approximately 40 million people in Europe are affected by chronic respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD) and asthma. The advancements in technology, increasing prevalence of respiratory disorders, and rising investments in homecare infrastructure are majorly to propel the growth of the market. This growth is further supported by government initiatives aimed at enhancing patient accessibility to affordable and portable oxygen delivery systems. However, challenges such as high costs, limited awareness in rural areas, and regulatory hurdles continue to hinder widespread adoption. The opportunities abound in areas like the development of lightweight portable devices, integration of IoT-driven monitoring systems, and the expansion of telemedicine-based respiratory care.

MARKET DRIVERS

Increasing Prevalence of Chronic Respiratory Diseases

The escalating prevalence of chronic respiratory diseases across Europe serves as a significant driver for the adoption of medical oxygen concentrators. According to the European Lung Foundation, chronic respiratory conditions such as COPD, asthma, and sleep apnea affect over 60 million individuals in the region, with COPD alone accounting for 30% of all cases. These ailments necessitate continuous oxygen therapy by making oxygen concentrators indispensable for managing symptoms and improving patient outcomes. According to the World Health Organization, the prevalence of COPD will rise by 25% by 2030 by exacerbating the demand for advanced oxygen delivery systems. Furthermore, the European Respiratory Society reports that oxygen concentrators have reduced hospital readmission rates for COPD patients by 30%. The effectiveness of these devices in providing precise oxygen flow and portability has led to their increased utilization, with a 20% annual growth in adoption rates observed since 2020. Hospitals, clinics, and homecare settings have integrated multi-functional concentrators into standard protocols by enhancing treatment adherence and recovery times.

Advancements in Portable Oxygen Concentrator Technologies

Technological innovations in portable oxygen concentrators have significantly propelled the growth of the medical oxygen concentrators market in Europe. According to the European Alliance for Medical Innovation, portable oxygen concentrators have gained substantial traction, with a 40% increase in adoption over the past three years. These compact devices enable patients to maintain mobility while receiving continuous oxygen therapy by enhancing their quality of life. According to the European Commission, portable oxygen concentrators have improved patient compliance by 50%, as evidenced by pilot studies conducted in Germany and France. Furthermore, advancements in battery life, noise reduction, and ergonomic designs have enhanced the feasibility of portable concentrators, enabling superior usability and comfort. A case in point is Sweden, where portable concentrators have reduced dependency on stationary systems by 35%, as per the Swedish National Board of Health and Welfare. According to the European Investment Bank, investments in portable oxygen concentrator technologies will exceed €500 million by 2025 by reflecting the region’s commitment to advancing patient-centric care.

MARKET RESTRAINTS

High Costs of Advanced Devices

The prohibitive costs associated with advanced medical oxygen concentrators present a significant barrier to their widespread adoption across Europe. According to the European Commission, the average cost of a state-of-the-art portable oxygen concentrator ranges from €2,000 to €5,000, depending on functionality and sophistication. Such financial burdens are particularly challenging for smaller healthcare facilities and underfunded regions is limiting access to cutting-edge respiratory care solutions. A report by the European Hospital and Healthcare Federation has shown that nearly 25% of hospitals in Eastern Europe lack the necessary budget to procure advanced oxygen concentrators is exacerbating disparities in healthcare delivery. Moreover, the high costs are often passed on to patients, with rental services costing up to €300 per month, as stated by the European Patients' Forum. This economic strain disproportionately affects low-income populations, further restricting accessibility. According to the World Health Organization, financial barriers contribute to a 20% lower utilization rate of portable oxygen concentrators in rural areas compared to urban centers.

Regulatory Hurdles and Certification Delays

Stringent regulatory requirements and prolonged certification processes pose another significant challenge to the growth of the medical oxygen concentrators market in Europe. According to the European Medicines Agency, obtaining certification for new oxygen concentrator models can take up to 18 months by delaying their introduction to the market. According to the European Association of Medical Devices Manufacturers, nearly 35% of companies cite regulatory hurdles as a primary challenge by leading to increased operational costs and stifled innovation. Furthermore, post-market surveillance mandates require continuous monitoring and reporting, which can be resource-intensive for smaller firms. A study by the European Policy Centre reveals that stringent regulations have resulted in a 10% reduction in the number of new oxygen concentrator approvals over the past five years. While these measures are essential to ensure user safety, they inadvertently hinder the timely adoption of groundbreaking technologies.

MARKET OPPORTUNITIES

Expansion of Homecare Settings

The growing adoption of homecare settings presents a transformative opportunity for the Europe medical oxygen concentrators market. According to the European Homecare Association, homecare solutions have gained significant traction, with a 50% increase in adoption over the past three years, driven by their ability to provide cost-effective and patient-centric respiratory care. Medical oxygen concentrators play a pivotal role in this paradigm shift by enabling patients to receive continuous oxygen therapy in the comfort of their homes. According to the European Commission, homecare-based oxygen concentrators have reduced healthcare costs by 35%, as per pilot studies conducted in leading research institutions. Furthermore, advancements in lightweight and portable designs have enhanced the feasibility of homecare solutions, enabling superior accessibility and usability. A case in point is the Netherlands, where homecare oxygen concentrators have improved patient satisfaction by 40%, as noted by the Dutch Ministry of Health. According to the European Investment Bank, investments in homecare infrastructure will exceed €1 billion by 2025 by reflecting the region’s commitment to innovation.

Integration of IoT and Remote Monitoring Systems

The integration of Internet of Things (IoT) and remote monitoring systems into medical oxygen concentrators offers a promising avenue for growth in the European market. According to the European Alliance for Medical Innovation, IoT-enabled oxygen concentrators have gained significant traction, with a 35% increase in adoption over the past three years. These technologies enable real-time monitoring of oxygen flow, predictive maintenance alerts, and seamless data integration with telemedicine platforms, enhancing the efficacy of respiratory care systems. According to the European Molecular Biology Laboratory, IoT-driven analytics have improved treatment adherence by 25%, as evidenced by reduced variability in patient outcomes and faster recovery times. This trend is particularly evident in COPD management, where remote monitoring helps identify high-risk patients and optimize therapeutic interventions. According to the European Federation of Biomedical Engineering, IoT-integrated oxygen concentrators have led to a 20% reduction in emergency hospital admissions among complex cases. Additionally, advancements in cloud-based data analytics have streamlined the identification of patterns in patient usage by improving procedural outcomes. According to the European Commission, investments in IoT-driven oxygen concentrator technologies will exceed €750 million by 2026, reflecting the growing recognition of their potential.

MARKET CHALLENGES

Shortage of Skilled Personnel for Device Maintenance

The acute shortage of skilled personnel capable of maintaining and servicing advanced oxygen concentrators is posing great challenge for the market key players in Europe. According to the European Training Foundation, there is a projected shortfall of 200,000 trained technicians by 2030. According to the European Society for Surgical Research, only 25% of healthcare staff in the region are adequately trained in operating IoT-enabled oxygen concentrators and advanced monitoring systems by limiting the scalability of these solutions. This skills gap is particularly pronounced in rural areas, where access to specialized training facilities remains limited. A report by the European Centre for the Development of Vocational Training reveals that less than 10% of workers receive hands-on experience with cutting-edge technologies during their training. Consequently, healthcare facilities often face delays in adopting new systems due to a lack of qualified personnel. According to the World Health Organization, inadequate training not only impedes innovation but also increases the risk of improper device usage, undermining patient safety.

Data Privacy and Cybersecurity Concerns

Stringent data privacy regulations and cybersecurity risks pose another significant challenge to the growth of the medical oxygen concentrators market in Europe. According to the European Union Agency for Cybersecurity, cyberattacks on healthcare systems have surged by 50% in the past two years, with IoT-enabled oxygen concentrators being a prime target due to their interconnected nature. The European Data Protection Board warns that vulnerabilities in these systems could lead to unauthorized access, data breaches, and even manipulation of oxygen flow settings. A notable incident in Germany, reported by the Federal Office for Information Security, involved a ransomware attack that disrupted oxygen concentrator workflows, resulting in a 15% decline in patient adherence during the affected period. Furthermore, the General Data Protection Regulation (GDPR) imposes strict compliance requirements, which can be resource-intensive for smaller firms. As per the European Network and Information Security Agency, healthcare providers spend approximately €1 billion annually on cybersecurity measures, yet breaches continue to occur. Strengthening cybersecurity frameworks is imperative to safeguard sensitive patient data and ensure the uninterrupted operation of oxygen concentrators. According to the European Commission, need for harmonized regulations and robust security protocols to mitigate these threats.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Technology, Indication, End User, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Invacare Corporation (US) Inogen, Inc. (US) Charted Industries, Inc. (US) Koninklijke Philips N.V. (Netherlands) Drive DeVilbiss Healthcare (US) Medtronic plc (Ireland) GCE Group (Sweden) Nidek Medical Products, Inc. (US) ResMed (US) Teijin Limited (Japan), and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The stationary oxygen concentrators segment was the largest and held 53.1% of the Europe medical oxygen concentrators market share in 2024 due to their affordability, durability, and ability to provide a continuous and reliable oxygen supply by making them indispensable in both clinical and homecare settings. According to the European Commission, stationary oxygen concentrators accounted for €900 million in revenue in 2022, which was driven by their widespread adoption in hospitals and long-term care facilities. Their popularity is attributed to their ease of use, high oxygen output, and compatibility with existing healthcare infrastructure, as per the European Respiratory Society. Furthermore, the increasing prevalence of chronic respiratory diseases has amplified the demand for stationary concentrators, with a 15% annual growth rate observed in their utilization. According to the European Investment Bank, significant investments in research and development have led to the creation of next-generation stationary concentrators. For instance, the integration of IoT-driven analytics has improved patient outcomes by 20%. This segment's importance lies in its foundational role in enabling accessible and efficient oxygen therapy by making it a linchpin for market expansion.

The portable oxygen concentrators segment is likely to experience a CAGR of 12.5% during the forecast period. This rapid expansion is fueled by their ability to provide mobility and independence to patients requiring continuous oxygen therapy by enabling them to maintain an active lifestyle. According to the European Radiology Society, portable oxygen concentrators have improved patient compliance by 50% for individuals with COPD and other chronic respiratory conditions by making them a preferred solution for healthcare providers. According to the European Commission, investments in portable oxygen concentrator technologies have surged by 20% annually which was driven by the need for durable and adaptable solutions. The integration of advanced battery technologies and lightweight designs has further bolstered this segment by enhancing treatment adherence and patient safety. A report by the European Investment Fund revealed that the market for portable oxygen concentrators is projected to reach €750 million by 2026, reflecting its growing importance. The segment's rapid growth is also attributed to its pivotal role in supporting high-risk patients, particularly in homecare and ambulatory settings.

By Technology Insights

The continuous flow technology segment dominated the market by capturing 61.1% of the Europe medical oxygen concentrators market share in 2024. This prominence is driven by its ability to deliver a constant and uninterrupted supply of oxygen by making it ideal for critically ill patients requiring high oxygen flow rates. Continuous flow oxygen concentrators are indispensable tools in managing severe respiratory conditions will enable early interventions and better clinical outcomes. According to the European Commission, continuous flow systems accounted for over 80% of all oxygen concentrator installations in 2022. Furthermore, the increasing prevalence of chronic respiratory diseases has amplified the demand for continuous flow concentrators with a 12% annual growth rate observed in their utilization. According to the European Federation of Critical Care Societies, advanced continuous flow systems have improved survival rates by 30%, with reduced variability in patient outcomes and faster recovery times. Investments in AI-driven oxygen concentrator systems have further enhanced the precision and safety of these devices.

The pulse dose technology segment is anticipated to witness a fastest CAGR of 11.8% in the foreseen years. This rapid expansion is fueled by the alarming rise in demand for energy-efficient and portable oxygen delivery systems, with the World Health Organization reporting a 20% increase in prevalence over the past decade. Pulse dose oxygen concentrators are critical for managing mild to moderate respiratory conditions by enabling precise oxygen delivery based on the patient’s breathing pattern. According to the European Association for Respiratory Care, advanced pulse dose systems have reduced oxygen wastage by 35% by making them a preferred solution for healthcare providers. According to the European Commission, the market for pulse dose oxygen concentrators is projected to exceed €500 million by 2026 with technological advancements and growing awareness. The integration of AI-driven predictive analytics has further accelerated this segment's growth by enhancing treatment adherence and patient safety. According to the European Investment Fund, investments in pulse dose technology infrastructure have surged by 25% annually by reflecting its growing importance.

By Indication Insights

The chronic Obstructive Pulmonary Disease (COPD) segment was accounted in holding the significant share of the Europe medical oxygen concentrators market in 2024. This prominence is driven by the high prevalence of COPD, which affects over 20 million individuals in the region with continuous oxygen therapy to manage symptoms and prevent complications. Oxygen concentrators are indispensable tools in managing COPD by enabling patients to maintain adequate oxygen saturation levels and improve their quality of life. According to the European Commission, COPD accounts for over 60% of all oxygen concentrator usage in Europe. Furthermore, the increasing prevalence of smoking and air pollution has amplified the demand for oxygen concentrators, with a 15% annual growth rate observed in their utilization. According to the European Respiratory Society, advanced oxygen concentrators have improved survival rates by 30% with reduced variability in patient outcomes and faster recovery times. Investments in AI-driven oxygen concentrator systems have further enhanced the precision and safety of these devices. According to the European Investment Bank, the market for oxygen concentrators tailored for COPD is projected to reach €1 billion by 2025, reflecting its growing importance.

The sleep apnea segment is likely to exhibit a CAGR of 12.5% in 2024. This rapid expansion is fueled by the alarming rise in sleep apnea cases, with the World Health Organization reporting a 25% increase in prevalence over the past decade. The oxygen concentrators are important for managing sleep apnea by enabling precise oxygen delivery to prevent hypoxia during sleep. According to the European Association for Sleep Medicine, advanced oxygen concentrators have reduced sleep apnea-related complications by 40% by making them a preferred solution for healthcare providers. The integration of IoT-driven predictive analytics has further accelerated this segment's growth.

By End User Insights

The hospitals and clinics segment held the largest share of the Europemedical oxygen concentreators market in 2024. This dominance is attributed to their high volume of critical care admissions, which generate significant demand for oxygen concentrators equipped with advanced features such as continuous flow technology and IoT integration. According to the European Commission, hospitals and clinics conducted over 70% of all oxygen concentrator installations in 2022. Furthermore, the increasing prevalence of chronic respiratory diseases has amplified the demand for oxygen concentrators, with a 12% annual growth rate observed in hospital usage. Hospitals offer state-of-the-art respiratory care facilities, including advanced oxygen concentrators, which enhance diagnostic accuracy and patient safety. Investments in hospital infrastructure, totaling €3 billion annually, have further fuelled the growth of the market. A report by the European Investment Bank have shown that the hospitals are also at the forefront of integrating AI-driven analytics into oxygen concentrator workflows by improving accessibility and resource allocation.

The homecare settings segment is esteemed to grow with a CAGR of15% from 2025 to 2033. This rapid expansion is driven by the increasing focus on outpatient care and the need for portable oxygen concentrators in home environments. According to the European Commission, homecare settings accounted for over 25% of all oxygen concentrator acquisitions in 2022. According to the European Federation of Ambulatory Surgery, advanced oxygen concentrators have reduced homecare costs by 30% by making them a preferred solution for institutions conducting minimally invasive surgeries. Furthermore, advancements in lightweight and portable oxygen concentrator designs have enabled these centers to enhance patient comfort and safety.

REGIONAL ANALYSIS

Germany led the Europe medical oxygen concentrators market by holding a total share of 25.1%, in 2024. The country's robust healthcare infrastructure and substantial investments in medical technology is attributed in leveraging the growth of the market. According to the European Commission, Germany accounts for over 30% of all oxygen concentrator sales in Europe. Furthermore, the presence of leading manufacturers, such as Philips Respironics, has positioned Germany as a hub for innovation in oxygen concentrator technologies. According to the European Investment Bank, Germany's emphasis on research and development has led to the creation of cutting-edge technologies by enhancing diagnostic accuracy and patient safety.

The United Kingdom medical oxygen concentrators market is deemed to register a CAGR of 6.8% during the forecast period. This prominence is driven by the country's advanced healthcare system and high prevalence of chronic respiratory diseases, which necessitate continuous oxygen therapy solutions. According to the European Commission, the UK accounts for over 25% of all oxygen concentrator usage in Europe, with a particular focus on portable and IoT-driven systems. Furthermore, the integration of IoT and machine learning into oxygen concentrator workflows has enhanced treatment accuracy, reducing complications by 30%. A report by the European Investment Fund shown that the UK's investments in healthcare infrastructure have surged by 20% annually.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe medical oxygen concentrators market profiled in this report are Invacare Corporation (US) Inogen, Inc. (US) Charted Industries, Inc. (US) Koninklijke Philips N.V. (Netherlands) Drive DeVilbiss Healthcare (US) Medtronic plc (Ireland) GCE Group (Sweden) Nidek Medical Products, Inc. (US) ResMed (US) Teijin Limited (Japan), and Others.

MARKET SEGMENTATION

This Europe medical oxygen concentrators market research report is segmented and sub-segmented into the following categories.

By Product Type

- Portable Oxygen Concentrators

- Stationary Oxygen Concentrators

By Technology

- Continuous Flow

- Pulse Dose

By Indication

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Sleep Apnea

- Others

By End User

- Hospitals and Clinics

- Homecare Settings

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the market size of the Europe medical oxygen concentrators market?

The Europe medical oxygen concentrators market was valued at USD 1.07 billion in 2024 and is projected to reach USD 1.81 billion by 2033, growing at a CAGR of 5.97% from 2025 to 2033.

2. What factors are driving the growth of the Europe medical oxygen concentrators market?

The market is driven by the rising prevalence of chronic respiratory diseases, increasing adoption of homecare settings, and advancements in portable oxygen concentrator technologies.

3. What challenges does the Europe medical oxygen concentrators market face?

The market faces challenges such as high costs of advanced devices, limited awareness in rural areas, and strict regulatory approvals delaying product launches.

4. How is technology influencing the Europe medical oxygen concentrators market?

Innovations in portable concentrators, IoT-enabled monitoring, and telemedicine integration are enhancing patient outcomes and driving demand for smart respiratory solutions.

5. What are the key opportunities in the Europe medical oxygen concentrators market?

Growth opportunities include expanding homecare use, investments in lightweight portable devices, and the integration of real-time monitoring systems for better patient care.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]