Europe Medical Gloves Market Size, Share, Trends & Growth Forecast Report By Type and Material (Powdered, Non-Powdered, Natural Rubber Gloves, Nitrile Gloves, Vinyl Gloves, Other Materials ), Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Medical Gloves Market Size

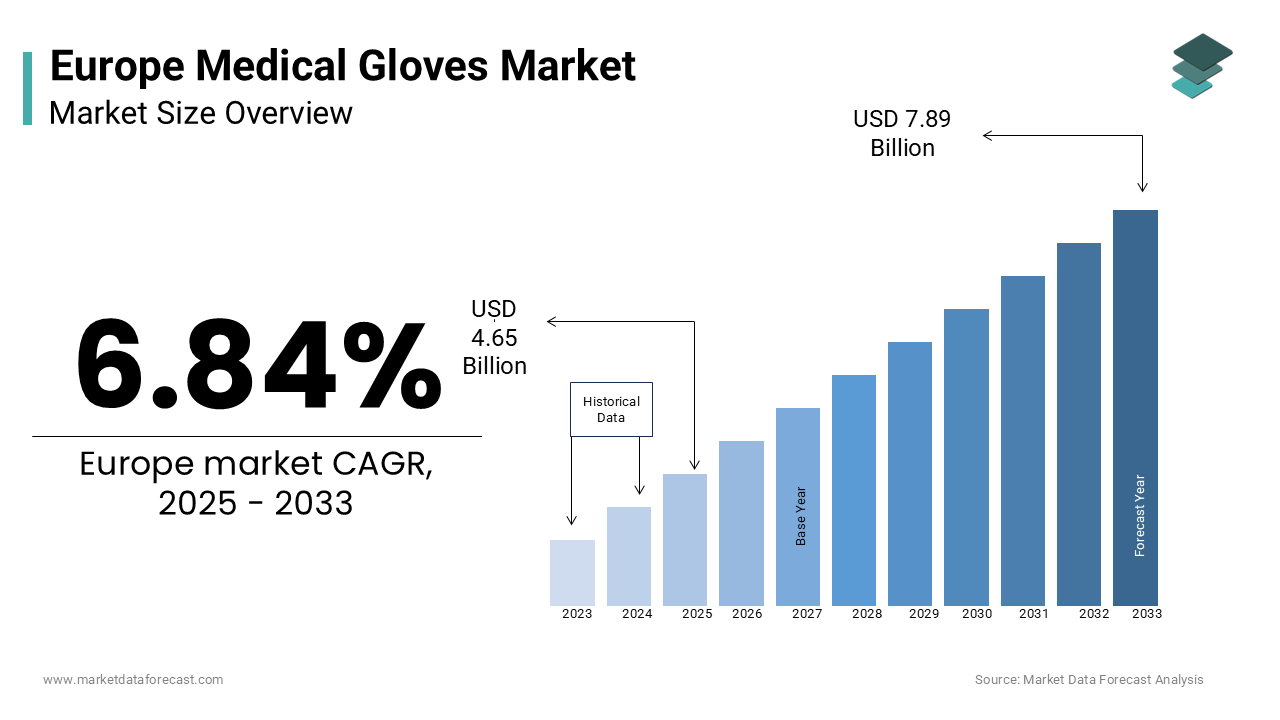

The europe medical gloves market was worth USD 4.35 billion in 2024. The European market is estimated to grow at a CAGR of 6.84% from 2025 to 2033 and be valued at USD 7.89 billion by the end of 2033 from USD 4.65 billion in 2025.

Introduction to the Europe Medical Gloves Market

The medical gloves are available in various materials such as natural rubber latex, nitrile, and vinyl, serve as essential protective equipment for healthcare professionals during surgeries, examinations, and other medical procedures. According to the European Centre for Disease Prevention and Control (ECDC), approximately 8.9 million healthcare-associated infections occur annually in Europe. The market has experienced significant growth due to heightened demand during the COVID-19 pandemic, which promoted the importance of personal protective equipment (PPE) in safeguarding both patients and healthcare workers.

The opportunities abound in the development of sustainable materials, technological innovations, and expanding applications beyond traditional healthcare settings are prompting the growth of the medical gloves market in Europe.

MARKET DRIVERS

Rising Incidence of Infectious Diseases and Healthcare-Associated Infections

According to the European Centre for Disease Prevention and Control (ECDC), healthcare-associated infections (HAIs) affect approximately 4.5 million patients annually across Europe, with surgical site infections accounting for 20% of all cases. This alarming statistics play a critical role of medical gloves in preventing cross-contamination and ensuring patient safety. According to the World Health Organization, proper use of gloves reduces the risk of HAIs by up to 50% by making them indispensable in healthcare settings. Furthermore, the growing prevalence of infectious diseases such as tuberculosis, hepatitis, and HIV has amplified the demand for medical gloves. According to the Germany’s Federal Statistical Office, glove usage in hospitals increased by 30% between 2018 and 2022, driven by stricter hygiene protocols. The ongoing threat of emerging pathogens, coupled with the lessons learned from the COVID-19 pandemic is likely to promote the growth of the medical gloves market to the extent.

Stringent Regulatory Standards and Hygiene Protocols

The stringent regulatory standards and hygiene protocols have significantly bolstered the adoption of medical gloves across Europe. According to the European Medicines Agency, the implementation of the Medical Devices Regulation (MDR) in 2021 has mandated higher quality and safety benchmarks for medical gloves by ensuring their efficacy in clinical settings. A study by the British National Health Service reveals that compliance with these regulations has led to a 25% increase in glove procurement by healthcare facilities in the UK alone. According to the European Federation of Nurses Association, over 90% of healthcare workers now adhere to mandatory glove usage policies during patient interactions. These protocols are particularly critical in high-risk environments such as operating theaters and intensive care units, where contamination risks are elevated.

MARKET RESTRAINTS

Environmental Concerns and Sustainability Challenges

Environmental concerns associated with the disposal of medical gloves pose a significant restraint to market growth in Europe. According to the European Environment Agency, over 15 billion medical gloves are discarded annually in Europe, contributing to mounting plastic waste. The majority of these gloves are made from non-biodegradable materials such as nitrile and vinyl, which persist in landfills for decades. As per France’s Ministry of Ecology, medical waste, including gloves, accounts for 3% of total municipal waste by exacerbating ecological challenges. While natural rubber gloves are biodegradable, they raise concerns about latex allergies by limiting their widespread adoption. Furthermore, recycling initiatives for medical gloves remain underdeveloped due to contamination risks, as noted by the German Federal Environmental Agency.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages have emerged as major challenges for the Europe medical gloves market. According to the European Commission, the global shortage of nitrile and latex raw materials during the COVID-19 pandemic led to a 40% spike in glove prices across Europe. As per Netherlands Institute for Public Health, over 60% of medical gloves used in Europe are imported, primarily from Asia Pacific. Additionally, transportation delays caused by port congestion and labor shortages further exacerbated supply constraints. A study by Italy’s National Health Institute revealed that nearly 20% of healthcare facilities faced glove shortages in 2021, impacting routine medical procedures. These disruptions not only increase operational costs but also undermine healthcare preparedness by posing significant challenges to market stability and growth.

MARKET OPPORTUNITIES

Growing Adoption of Sustainable and Biodegradable Gloves

The growing emphasis on sustainability presents a lucrative opportunity for the Europe medical gloves market. According to the European Green Deal, over 70% of European consumers prioritize eco-friendly products by driving demand for biodegradable and recyclable gloves. According to the Sweden’s Environmental Protection Agency, the adoption of plant-based nitrile gloves, derived from renewable resources, grew by 25% annually between 2020 and 2022. These gloves offer comparable durability and performance to traditional options while reducing environmental impact. Furthermore, advancements in manufacturing technologies have enabled the production of gloves with reduced carbon footprints, as per the Danish Technological Institute. Countries like Switzerland and Denmark have introduced subsidies to encourage the use of sustainable medical gloves in healthcare facilities.

Expansion of Applications Beyond Traditional Healthcare Settings

The expansion of medical gloves into non-traditional applications offers significant growth potential for the market. According to the European Industrial Safety Alliance, the use of medical gloves in industrial and laboratory settings increased by 35% annually between 2019 and 2022. According to the Netherlands’ Occupational Safety Board, over 80% of chemical laboratories now mandate glove usage to prevent exposure to hazardous substances. Similarly, the food processing industry in Italy has witnessed a 40% rise in glove adoption, as per the Italian Food Safety Authority, to ensure hygiene and compliance with EU regulations. These applications extend the market’s reach beyond hospitals and clinics by creating new revenue streams for manufacturers.

MARKET CHALLENGES

Rising Costs and Budget Constraints in Healthcare Systems

The rising costs and budget constraints in healthcare systems present a significant challenge to the Europe medical gloves market. According to the Organisation for Economic Co-operation and Development (OECD), healthcare expenditure in Europe accounts for an average of 9% of GDP, whereas many countries face funding gaps due to economic uncertainties. According to the Spain’s Ministry of Health, glove procurement budgets were reduced by 15% in 2022 by forcing hospitals to prioritize essential supplies. Additionally, the high cost of premium gloves, such as those made from synthetic materials, limits accessibility in low-income regions. As per Romania’s National Health Institute, only 40% of rural healthcare facilities have access to adequate glove supplies by exacerbating disparities in infection control.

Increasing Prevalence of Latex Allergies and Material Limitations

The increasing prevalence of latex allergies and material limitations pose another major challenge for the Europe medical gloves market. According to the European Academy of Allergy and Clinical Immunology, latex allergies affect approximately 1-6% of the general population, with higher rates among healthcare workers. According to the French National Health Authority, allergic reactions to latex gloves account for 20% of occupational dermatitis cases in medical settings. While nitrile and vinyl gloves offer alternatives, they come with trade-offs such as reduced tactile sensitivity and higher costs. Furthermore, the durability of vinyl gloves is often inferior to natural rubber, as per the German Society for Hospital Hygiene. These material limitations restrict the versatility of gloves, creating challenges for manufacturers to develop universally suitable products.

SEGMENTAL ANALYSIS

By Type and Material Insights

The non-powdered gloves segment was accounted in holding a dominant share of 58.1% in the Europe medical gloves market. The ban on powdered gloves by the European Medicines Agency in 2016 due to health risks such as respiratory issues and skin irritation is propelling the growth of the market. According to the UK National Health Service, over 95% of healthcare facilities in Europe have transitioned to non-powdered alternatives. The importance of non-powdered gloves lies in their superior safety profile by ensuring minimal contamination risks during sensitive procedures. Advances in manufacturing technologies, such as chlorination and polymer coatings, have enhanced their ease of use and durability, as per the Swiss Federal Office of Public Health. Additionally, favorable reimbursement policies and stringent regulatory standards promote their adoption by driving demand across hospitals and clinics.

The nitrile gloves segment is expected to register a fastest CAGR of 12.5% during the forecast period. This rapid growth is fueled by their superior chemical resistance and hypoallergenic properties making them ideal for diverse applications. According to the Netherlands Institute for Public Health, a 40% annual increase in nitrile glove usage in chemical laboratories and industrial settings. The segment's importance lies in its ability to address the limitations of latex and vinyl gloves by offering enhanced durability and tactile sensitivity. Technological advancements, such as the development of thinner yet stronger formulations, have further bolstered their appeal. According to the Spain’s Ministry of Health, nitrile gloves reduce glove-related allergic reactions by 30% by making them a preferred choice for healthcare workers.

By Application Insights

The medical examination gloves segment was the largest and held 50.1% of the Eurpope medical gloves market share in 2024. This dominance is attributed to their widespread use in routine patient care, diagnostic procedures, and outpatient settings. According to the German Federal Statistical Office, over 60% of healthcare workers use examination gloves daily. The importance of medical examination gloves lies in their ability to provide a cost-effective and reliable barrier against pathogens by ensuring patient and provider safety. Advances in glove design, such as textured surfaces for improved grip that have further enhanced their functionality, as per the Italian Society of Hospital Hygiene. Additionally, favorable pricing and availability make them accessible across diverse healthcare facilities.

The chemotherapy gloves segment is expected to witness a prominent CAGR of 14.2% from 2025 to 2033. This growth is driven by the increasing incidence of cancer and the need for specialized gloves to handle cytotoxic drugs safely. According to the Sweden’s National Cancer Registry, a 25% annual increase in chemotherapy procedures with advanced protective equipment. The segment's importance lies in its ability to mitigate exposure risks to hazardous chemicals by ensuring the safety of oncology nurses and pharmacists. Advances in material technology, such as double-layered nitrile gloves, have improved permeation resistance, as per the Danish Cancer Society. Furthermore, the growing adoption of personalized medicine and targeted therapies has expanded the scope of chemotherapy by driving demand for high-performance gloves.

REGIONAL ANALYSIS

Germany led the Europe medical gloves market with a 22.4% of share in 2024 with the robust healthcare infrastructure and high prevalence of infectious diseases. Germany sets a benchmark for glove usage in clinical settings with over 2,000 hospitals and 1.5 million healthcare workers. The nation's emphasis on innovation is evident in its adoption of advanced gloves, such as antimicrobial-coated variants, which account for 15% of all gloves, according to the German Society of Hospital Hygiene. Additionally, favorable reimbursement policies ensure widespread accessibility by driving demand for premium gloves. Germany's prominence is further reinforced by its strong manufacturing base, with several global leaders headquartered within the country. Germany's dominance in the market is expected to strengthen as the population ages and healthcare spending increases.

The United Kingdom is gearing up to witness a CAGR of 6.8% during the forecast period in Europe medical gloves market. The presence of advanced healthcare system and high awareness of infection control practices are majorly propelling the growth of the market in this country. The NHS conducted approximately 150 million medical procedures in 2022 with the segment's significance. The UK's commitment to innovation is reflected in its adoption of sustainable gloves, which grew by 30% annually, according to the British Medical Association. Furthermore, government initiatives to modernize healthcare infrastructure have enhanced accessibility in urban areas.

France medical gloves market is attributed in ensuring the significant growth opportunities with the advanced healthcare system and proactive approach to infection control. The country performs over 120 million medical procedures annually, with a particular emphasis on surgical and examination gloves. France's market is additionally bolstered by its adoption of cutting-edge technologies, such as biodegradable gloves, which increased by 25% in 2022, according to the French Society of Hospital Hygiene. The government's investment in healthcare infrastructure, including the construction of specialized infection control units, has improved accessibility and patient outcomes. Additionally, favorable reimbursement policies ensure affordability by encouraging the adoption of advanced gloves.

Italy performs over 100 million medical procedures annually, with a focus on surgery and chemotherapy gloves. Italy's medical gloves market growth is driven by its adoption of innovative solutions, such as antimicrobial gloves, which grew by 20% in 2022. According to the Italian Ministry of Health, importance of glove usage in reducing HAIs by achieving a 30% reduction in infection rates. Furthermore, the country's robust healthcare infrastructure ensures widespread accessibility in regions like Lombardy and Tuscany.

Spain medical gloves market is driven by its expanding healthcare infrastructure and rising awareness of infection control. The country performs over 80 million medical procedures annually, with a particular focus on examination gloves. The government's investment in modernizing healthcare facilities has improved accessibility in urban centers like Madrid and Barcelona is anticipated to fuel the growth of the market in Spain. Additionally, favorable reimbursement policies ensure affordability by encouraging the adoption of innovative gloves. Spain remains a significant contributor to the European market with a growing aging population and increasing awareness of hygiene practices.

MARKET SEGMENTATION

This research report on the europe medical gloves market is segmented and sub-segmented based on categories.

By Type and Material

- Powdered

- Non-Powdered

- Natural Rubber Gloves

- Nitrile Gloves

- Vinyl Gloves

- Other Materials

By Application

- Medical Examination

- Surgery

- Chemotherapy

- Other Applications

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges faced by the Europe medical gloves market?

Challenges include fluctuating raw material prices, supply chain disruptions, especially during the COVID-19 pandemic, and concerns about the environmental impact of single-use gloves.

What are the latest trends in the Europe medical gloves market?

Recent trends include the growing preference for nitrile gloves due to their durability and resistance to chemicals, the adoption of powder-free gloves, and a focus on sustainability with the development of biodegradable gloves.

What is the future outlook for the Europe medical gloves market?

The market is expected to continue growing due to ongoing health concerns, stringent hygiene practices, and increasing healthcare activities, along with a shift toward more sustainable and eco-friendly glove options.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]