Europe Medical Cannabis Market Size, Share, Trends & Growth Forecast Report By Species, Derivatives, Application, Route of Administration and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Medical Cannabis Market Size

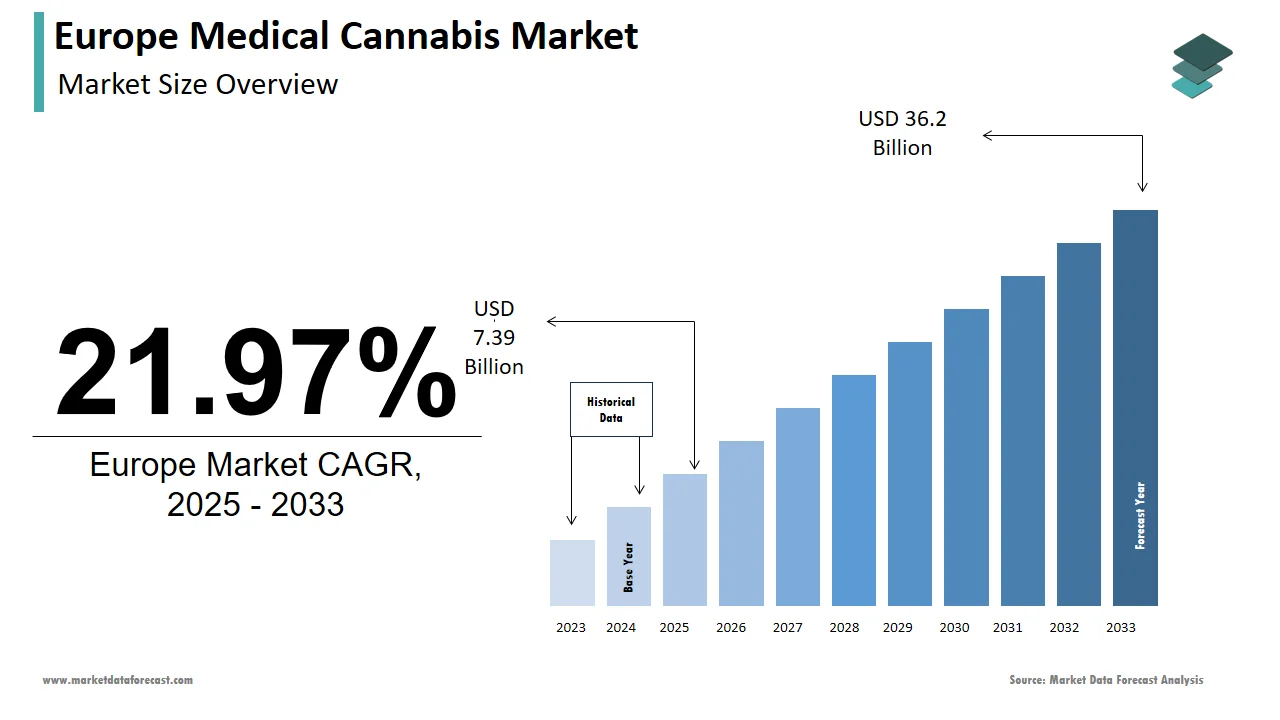

The size of the Europe medical cannabis market was valued at USD 6.06 billion in 2024. This market is expected to grow at a CAGR of 21.97% from 2025 to 2033 and be worth USD 36.2 billion by 2033 from USD 7.39 billion in 2025.

The Europe medical cannabis market is experiencing a transformative phase due to the evolving regulatory frameworks, increasing patient demand, and growing recognition of its therapeutic benefits. Germany, the UK, and Italy are leading the charge, with over 200,000 registered patients benefiting from medical cannabis prescriptions as per the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA). The approval of standardized cannabis-based medicines, such as Sativex and Epidiolex, has bolstered market credibility, particularly in treating chronic pain, epilepsy, and multiple sclerosis. Additionally, the rise of telemedicine platforms has streamlined access to prescriptions, with online consultations increasing by 35% in 2022. Despite regulatory progress, disparities in national laws and limited insurance coverage remain barriers. However, public awareness campaigns and clinical trials continue to validate the efficacy of medical cannabis, positioning Europe as a global leader in research and innovation.

MARKET DRIVERS

Increasing Patient Demand and Therapeutic Applications

The rising demand for alternative treatments in chronic conditions is majorly driving the growth of the Europe medical cannabis market. According to the European Pain Federation, over 20% of Europeans suffer from chronic pain, creating a substantial need for non-opioid therapies. Medical cannabis has emerged as a viable option, with cannabinoids like CBD and THC showing efficacy in managing pain, anxiety, and neurological disorders. For instance, GW Pharmaceuticals’ Epidiolex, a CBD-based medication, saw a 40% increase in prescriptions across Europe in 2022, reflecting strong patient adoption. Governments like Germany have responded by expanding reimbursement policies, enabling over 100,000 patients to access subsidized treatments. Furthermore, advocacy groups and patient testimonials have amplified awareness, encouraging healthcare providers to explore cannabis-based solutions. Retail pharmacies and specialized dispensaries have capitalized on this trend, achieving steady revenue growth in regions with progressive regulations.

Progressive Regulatory Frameworks

Gradual liberalization of cannabis laws across Europe is creating a conducive environment for market expansion. According to the European Parliament, over 80% of EU member states now permit the use of medical cannabis under strict guidelines. Countries like Malta and Luxembourg have legalized recreational cannabis, signaling a broader cultural shift toward acceptance. This regulatory momentum has encouraged investment in R&D, with pharmaceutical companies launching innovative formulations tailored to specific conditions. For example, Bedrocan International introduced strain-specific products targeting epilepsy and PTSD, achieving a 25% revenue boost in 2022. Additionally, cross-border collaborations between researchers and policymakers have accelerated clinical trials, validating the safety and efficacy of cannabis-based treatments. These developments not only enhance market legitimacy but also position Europe as a hub for medical cannabis innovation.

MARKET RESTRAINTS

Fragmented Regulatory Landscape

The fragmented regulatory landscape across Europe is majorly hampering the growth of the European medical cannabis market. According to the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA), while countries like Germany and the Netherlands have established robust frameworks, others like Hungary and Poland impose stringent restrictions, limiting market penetration. This inconsistency creates operational complexities for manufacturers and distributors, who must navigate varying compliance requirements. For instance, THC content limits differ widely, forcing companies to produce region-specific formulations that increase production costs by up to 30%. Additionally, the lack of harmonized standards hinders cross-border trade, reducing economies of scale and stifling innovation. Smaller players, in particular, face difficulties in scaling operations due to these regulatory hurdles, which can delay product launches and erode profitability.

Limited Insurance Coverage and High Costs

Limited insurance coverage for medical cannabis is further impeding the expansion of the Europe medical cannabis market. According to the European Health Insurance Federation, fewer than 40% of patients receive reimbursement for cannabis-based treatments, leaving many to bear the high out-of-pocket costs. A single prescription can cost up to €300 monthly, making it inaccessible for low-income households. This financial burden disproportionately affects elderly patients, who often rely on cannabis for chronic conditions like arthritis and neuropathy. Furthermore, economic uncertainty and inflationary pressures have exacerbated affordability issues, reducing adoption rates in regions with weak social safety nets. Without widespread insurance integration, patient accessibility remains constrained, hindering the market’s ability to achieve its full potential.

MARKET OPPORTUNITIES

Expansion into Rare Disease Treatments

The growing focus on rare diseases is a significant opportunity for the Europe medical cannabis market to carve out a niche in underserved segments. According to the European Organisation for Rare Diseases (EURORDIS), over 30 million Europeans live with rare conditions, many of which lack effective treatments. Cannabinoids like CBD and CBG have shown promise in alleviating symptoms of Dravet syndrome, Lennox-Gastaut syndrome, and other orphan diseases. Companies like GW Pharmaceuticals have capitalized on this trend by securing orphan drug designations, achieving a 50% revenue boost in niche markets. Additionally, partnerships with patient advocacy groups have enabled brands to gain insights into unmet needs, fostering trust and loyalty. By investing in targeted R&D and leveraging EU incentives for rare disease treatments, Europe can position itself as a leader in cannabinoid-based therapies.

Adoption of Telemedicine and Digital Platforms

The integration of telemedicine and digital platforms is another major opportunity for the Europe medical cannabis market. According to McKinsey & Company, telemedicine consultations for medical cannabis increased by 60% in 2022, driven by convenience and reduced stigma. Platforms like Aurora Cannabis Connect have partnered with healthcare providers to streamline prescriptions, achieving a 35% increase in patient registrations. Additionally, blockchain-enabled supply chain solutions have enhanced traceability and transparency, ensuring compliance with stringent EU regulations. These technologies not only improve patient accessibility but also reduce operational costs, enabling smaller players to compete effectively. By embracing digital transformation, Europe can future-proof its medical cannabis industry and maintain its competitive edge globally.

MARKET CHALLENGES

Stigma and Public Perception

Stigma surrounding cannabis use is a significant barrier to the Europe medical cannabis market, particularly among older demographics and conservative communities. According to a survey conducted by the European Society of Clinical Pharmacology, over 50% of respondents associate cannabis with recreational use, undermining its credibility as a legitimate medical treatment. Media portrayals and misinformation further perpetuate this perception, deterring healthcare providers from prescribing cannabis-based therapies. For instance, less than 10% of general practitioners in rural areas actively recommend medical cannabis, citing insufficient training and fear of backlash. Educational campaigns and clinical trials have sought to address these concerns, but progress remains slow. Without a cultural shift in attitudes, patient adoption and market growth will continue to face resistance.

Supply Chain Vulnerabilities and Quality Control

Supply chain vulnerabilities and inconsistent quality control are further challenging the growth of the Europe medical cannabis market. According to the European Medicines Agency, fluctuations in raw material availability have disrupted production schedules, particularly for imported hemp and cannabis extracts. Geopolitical tensions and trade restrictions have further compounded the issue, creating uncertainty for manufacturers. Additionally, discrepancies in cultivation practices and testing standards often result in batch inconsistencies, undermining consumer trust. For example, a 2022 audit revealed that 25% of tested samples failed to meet EU pharmacopeia standards, highlighting the prevalence of substandard products. These challenges not only impact domestic production but also hinder Europe’s ability to meet international export demands, posing long-term risks to market stability.

SEGMENTAL ANALYSIS

By Species Insights

The indica segment led the medical cannabis market in Europe by accounting for 44.7% of the European market share in 2024. The dominance of the Indica strain is primarily driven by its therapeutic properties, particularly in pain management and anxiety relief. According to a report by the European Cannabis Report, Indica strains are preferred by patients seeking relief from chronic pain, insomnia, and anxiety disorders, which are prevalent in the European population. The increasing acceptance of medical cannabis for therapeutic use has led to a surge in demand for Indica strains, particularly in countries like Germany and the Netherlands, where medical cannabis regulations are more established. Furthermore, the growing body of clinical research supporting the efficacy of Indica strains in treating various medical conditions has bolstered their popularity among healthcare providers and patients alike. The trend towards personalized medicine, where treatments are tailored to individual patient needs, has also contributed to the preference for Indica strains, as they are often perceived to provide more effective symptom relief for specific conditions.

However, the Hybrid segment is anticipated to register a CAGR of 25.5% over the forecast period in the European market owing to its versatility and the increasing demand for customized cannabis products that cater to individual patient needs. Hybrid strains, which combine characteristics of both Indica and Sativa, offer a balanced effect that appeals to a broader range of patients. According to a study published in the Journal of Cannabis Research, patients often prefer Hybrid strains for their ability to provide both relaxation and mental clarity, making them suitable for various medical conditions. Additionally, the rise of cannabis-infused products, such as edibles and oils, has further fueled the demand for Hybrid strains, as manufacturers seek to create products that offer a balanced experience. The increasing legalization of medical cannabis across Europe has also opened up new markets for Hybrid products, driving innovation and product development in this segment. As more patients seek tailored solutions for their health issues, the Hybrid segment is expected to continue its rapid growth in the coming years.

By Type Insights

The flower buds segment captured 56.7% of the European medical cannabis market share in 2024. The dominating position of flower buds segment in the European market can be attributed to their traditional use and the preference of patients for natural, unprocessed cannabis. According to a report by Prohibition Partners, flower buds are favored for their versatility and ease of use, allowing patients to consume them through various methods such as smoking, vaporizing, or infusing into edibles. The growing acceptance of medical cannabis in Europe has led to an increase in the number of dispensaries and retail outlets offering flower buds, making them more accessible to patients. Additionally, the rich variety of strains available in the flower bud segment allows patients to choose products that best suit their therapeutic needs, further driving demand. The trend towards organic and sustainably grown cannabis has also contributed to the popularity of flower buds, as consumers increasingly seek high-quality, natural products.

The concentrates segment is another major segment and is predicted to grow at a promising CAGR over the forecast period. The increasing popularity of cannabis extracts that offer higher potency and a more concentrated form of cannabinoids is driving the growth of the concentrates segment in the European market. The demand for concentrates is rising due to their effectiveness in delivering therapeutic benefits in smaller doses, making them appealing to patients seeking efficient treatment options. The development of innovative products such as oils, waxes, and shatter has also contributed to the growth of this segment, as manufacturers continue to create diverse and appealing options for consumers. Furthermore, the increasing trend of cannabis consumption through vaping has boosted the concentrates market, as many patients prefer this method for its discreetness and reduced health risks compared to smoking. As the medical cannabis market continues to evolve, the concentrates segment is expected to experience significant growth, driven by consumer preferences for potency and convenience.

By Derivatives Insights

The cannabidiol (CBD) segment occupied 51.1% of the European market share in 2024 and emerged as the leading performer in the regional market. The dominance of CBD segment in the European market can be attributed to its non-psychoactive properties and its growing recognition for therapeutic benefits, particularly in managing anxiety, chronic pain, and inflammation. The increasing legalization of CBD across various European countries has also contributed to its popularity, as consumers seek natural alternatives to pharmaceuticals. Additionally, the rise of wellness trends and the incorporation of CBD into various products, including cosmetics, food, and beverages, have further fueled its growth. The expanding body of research supporting the health benefits of CBD has also played a crucial role in its acceptance among consumers and healthcare professionals alike, solidifying its position

By Application Insights

The cancer segment captured 41.4% of the European medical cannabis market share in 2024. The leading position of cancer segment in the European market is primarily driven by the increasing prevalence of cancer across Europe. According to the European Cancer Information System, there were over 3.7 million new cancer cases reported in 2018, and this number is expected to rise by 24% by 2035. Medical cannabis has gained recognition for its potential to alleviate symptoms associated with cancer treatments, such as nausea, pain, and loss of appetite. A study published in the Journal of Pain and Symptom Management found that 70% of cancer patients reported improved quality of life when using medical cannabis. Additionally, the growing body of clinical research supporting the efficacy of cannabinoids in cancer care has led to increased acceptance among healthcare providers. The push for more holistic treatment options and the ongoing legalization of medical cannabis in various European countries further bolster the demand for cannabis products in cancer treatment, solidifying its position as the largest application segment in the market.

The epilepsy segment is anticipated to witness the fastest CAGR of 31.3% over the forecast period in the European medical cannabis market. The growing recognition of the effectiveness of cannabidiol (CBD) in managing epilepsy, particularly in treatment-resistant cases is propelling the growth of the epilepsy segment in the European market. The approval of Epidiolex, a CBD-based medication for epilepsy, has significantly influenced this trend. According to a report by the World Health Organization, approximately 50 million people worldwide suffer from epilepsy, with a substantial portion of these cases occurring in Europe. The growing awareness of the therapeutic benefits of CBD, coupled with the rising number of clinical trials investigating its efficacy, has led to increased demand for medical cannabis products specifically targeting epilepsy. Furthermore, the advocacy for patient access to alternative treatments has prompted many countries to adopt more favorable regulations regarding medical cannabis, further driving growth in this segment. As more patients and healthcare providers recognize the potential of cannabis in epilepsy management, this segment is expected to continue its rapid expansion in the European market.

By Route of Administration Insights

The oral segment captured the leading share of the European medical cannabis market in 2024. The leading status of oral administration can be attributed to its ease of use and the variety of product forms available, including oils, capsules, and edibles. According to a report by Prohibition Partners, oral consumption methods are preferred by many patients due to their convenience and the ability to accurately dose the medication. Additionally, oral administration allows for a longer duration of effect compared to other methods, making it suitable for patients seeking sustained relief from symptoms. The increasing availability of high-quality oral cannabis products in pharmacies and dispensaries across Europe has also contributed to the growth of this segment. Furthermore, the rising trend of incorporating cannabis into food and beverages has expanded the market for oral administration, appealing to a broader consumer base. As the acceptance of medical cannabis continues to grow, the oral segment is expected to maintain its leading position in the European market.

The vapor segment is projected to register a healthy CAGR in the European medical cannabis market over the forecast period due to the increasing popularity of vaping as a preferred method of cannabis consumption, particularly among younger demographics. According to a study published in the Journal of Cannabis Research, vaporization is perceived as a healthier alternative to smoking, as it reduces the harmful byproducts associated with combustion. The convenience and discreetness of vaporizing cannabis products have also contributed to its appeal, especially for patients who require on-the-go relief from symptoms. Additionally, the development of advanced vaporization devices and a wide range of vape products, including oils and cartridges, has further fueled the growth of this segment. The increasing legalization of cannabis across Europe has also led to a surge in the availability of vapor products, making them more accessible to consumers. As awareness of the benefits of vaporization continues to rise, this segment is expected to experience significant growth in the coming years.

REGIONAL ANALYSIS

Germany is a frontrunner in the European medical cannabis market and holding the major share of the European market. The country has established a comprehensive regulatory framework that allows for the cultivation, distribution, and prescription of medical cannabis. As of 2021, over 100,000 patients were registered to use medical cannabis, according to the German Federal Institute for Drugs and Medical Devices. The demand is primarily driven by its applications in pain management, cancer treatment, and neurological disorders. The increasing number of healthcare professionals prescribing cannabis and the expansion of pharmacies offering cannabis products have further bolstered the market. Germany's strong pharmaceutical industry and commitment to research and development also contribute to its leadership in the medical cannabis sector.

The United Kingdom had a substantial share of the European market in 2024 and is predicted to grow at a prominent CAGR over the forecast period. The UK has seen a gradual shift in public perception and regulatory acceptance of medical cannabis, particularly since the legalization of cannabis-based products for medicinal use in 2018. According to the Office for National Statistics, the number of prescriptions for medical cannabis has increased significantly, with thousands of patients now accessing these treatments. The UK market is driven by the demand for cannabis in treating chronic pain, epilepsy, and mental health disorders. The growing number of licensed producers and dispensaries is also enhancing accessibility for patients, further solidifying the UK's position in the market.

France is emerging as a key player in the European medical cannabis market. The French government has initiated pilot programs to assess the efficacy and safety of medical cannabis, with plans to expand access to patients suffering from various conditions, including chronic pain and epilepsy. According to the French Ministry of Health, around 3,000 patients participated in the initial trial phase, indicating a growing acceptance of medical cannabis. The demand is driven by the increasing recognition of cannabis as a legitimate treatment option, coupled with the country’s strong healthcare system. The expansion of research and development initiatives in France is also expected to enhance the market's growth potential.

Italy holds a notable share of the European medical cannabis market. The Italian government has implemented a legal framework for the cultivation and distribution of medical cannabis, allowing patients to access cannabis for various medical conditions, including chronic pain and multiple sclerosis. According to the Italian Ministry of Health, the number of patients using medical cannabis has steadily increased, with thousands of prescriptions issued annually. The demand for medical cannabis in Italy is driven by the growing awareness of its therapeutic benefits and the increasing number of healthcare professionals willing to prescribe it. Additionally, Italy's strong pharmaceutical industry and commitment to research are expected to further enhance the market's growth.

Spain is projected to account for a notable share of the European medical cannabis market over the forecast period. The country has a unique position due to its historical use of cannabis and the growing acceptance of its medicinal properties. While Spain has not fully legalized medical cannabis, various regions have implemented pilot programs to assess its efficacy in treating conditions such as chronic pain and epilepsy. According to a report by Prohibition Partners, the demand for medical cannabis in Spain is driven by the increasing number of patients seeking alternative treatments and the growing awareness of cannabis's therapeutic benefits. The potential for future legalization and the establishment of a regulatory framework could further enhance Spain's position in the European medical cannabis market.

KEY MARKET PLAYERS

A few of the notable players operating in the European medical cannabis market profiled in the report are BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Inc., Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited, GW Pharmaceuticals, plc., and Others.

TOP PLAYERS IN THE MARKET

Aurora Cannabis is a leading player in the European medical cannabis market, known for its extensive portfolio of cannabis products. The company has established a strong presence in several European countries, including Germany and Italy, through strategic partnerships and acquisitions. Aurora focuses on research and development to create innovative cannabis-based products tailored to meet the needs of patients. Their commitment to quality and compliance with regulatory standards has positioned them as a trusted provider in the medical cannabis sector.

Tilray is another significant player in the European medical cannabis market, recognized for its diverse range of medical cannabis products. The company has made substantial investments in European operations, including cultivation and distribution facilities. Tilray emphasizes the importance of clinical research and education to promote the therapeutic benefits of cannabis. Their strategic collaborations with healthcare professionals and organizations further enhance their market presence and credibility in the medical cannabis landscape.

Canopy Growth Corporation is a prominent player in the European medical cannabis market, leveraging its extensive experience in the cannabis industry. The company has established a strong foothold in Europe through strategic acquisitions and partnerships. Canopy Growth focuses on developing high-quality cannabis products and conducting research to support the medical use of cannabis. Their commitment to innovation and patient education has positioned them as a leader in the European medical cannabis market, catering to the growing demand for effective treatment options.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the European medical cannabis market is strategic partnerships and collaborations. Companies are increasingly forming alliances with local producers, healthcare providers, and research institutions to enhance their market presence and access new distribution channels. These partnerships enable companies to leverage local expertise and navigate regulatory landscapes more effectively.

COMPETITION OVERVIEW

The competition in the European medical cannabis market is intensifying as more players enter the space, driven by the increasing acceptance of cannabis for medicinal use. Established companies like Aurora Cannabis, Tilray, and Canopy Growth are competing alongside emerging startups, creating a dynamic landscape characterized by innovation and rapid growth. The regulatory environment varies significantly across countries, leading to a patchwork of market conditions that companies must navigate. This complexity encourages collaboration and partnerships, as firms seek to leverage local expertise and comply with diverse regulations.

Additionally, the focus on research and development is fostering competition, with companies investing heavily in clinical trials to validate the efficacy of their products. As patient demand for medical cannabis continues to rise, companies are also competing on product quality, variety, and accessibility. The growing trend of personalized medicine is further driving competition, as firms aim to develop tailored solutions for specific medical conditions. Overall, the European medical cannabis market is characterized by a competitive landscape that is rapidly evolving, with companies striving to establish themselves as leaders in this burgeoning industry.

MARKET SEGMENTATION

This research report on the Europe medical cannabis market is segmented and sub-segmented into the following categories.

By Species

- Indica

- Sativa

- Hybrid

By Type

- Flowers Buds

- Concentrates

By Derivatives

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Balanced

By Application

- Cancer

- Arthritis

- Epilepsy

- Migraine

By Route of Administration

- Oral

- Vapor

- Topicals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Who are the major players in the Europe medical cannabis market?

BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Inc., Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited, GW Pharmaceuticals, plc. are some of the key players in the Europe medical cannabis market.

Which countries in Western Europe have legalized medical cannabis?

Currently, countries such as Germany, the Netherlands, Italy, and Portugal have legalized medical cannabis, contributing significantly to the market's growth.

How has the COVID-19 pandemic impacted the medical cannabis market in Italy?

The COVID-19 pandemic initially led to disruptions, but the medical cannabis market in Italy has shown resilience, adapting to challenges and continuing its growth trajectory.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]