Europe Mattress Market Size, Share, Trends & Growth Forecast Report By Type (innerspring Mattress, Memory Foam Mattress, Latex Mattress, and Others), End-User, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Mattress Market Size

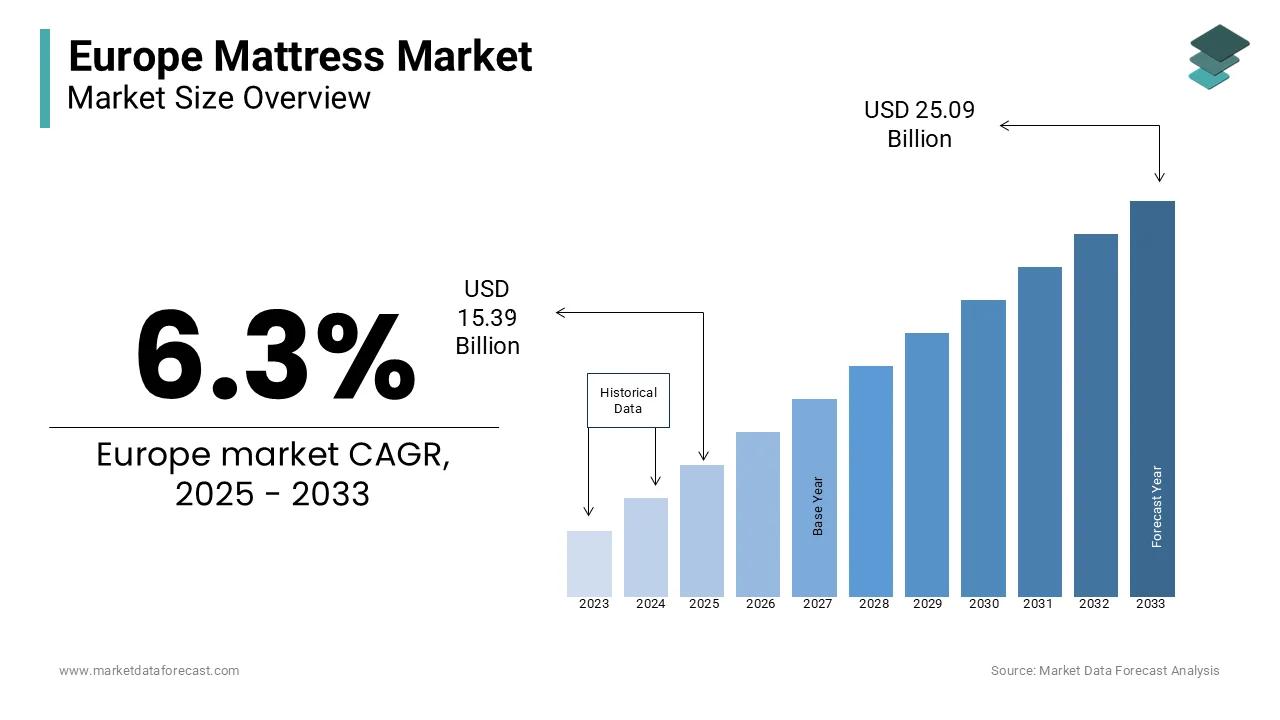

The mattress market size in Europe was valued at USD 11.21 billion in 2024. The European market is estimated to be worth USD 15.46 billion by 2033 from USD 11.62 billion in 2025, growing at a CAGR of 3.63% from 2025 to 2033.

With the growing disposable incomes, urbanization, and advancements in manufacturing technology, the demand for premium and customized mattresses has grown significantly across Europe. The growing emphasis on health and wellness, with consumers seeking mattresses that provide orthopedic benefits and ergonomic support, is further boosting the mattress market expansion in Europe. E-commerce has emerged as a significant growth driver, with online sales accounting for over 25% of mattress purchases in 2022, as reported by Eurostat. Innovative direct-to-consumer brands are capitalizing on this trend by offering convenience, competitive pricing, and trial periods. The Europe mattress market continues to evolve, aligning with trends in technology, health, and sustainability, making it a critical component of the region’s home goods sector.

MARKET DRIVERS

Rising Health Awareness and Demand for Orthopedic Mattresses in Europe

The growing focus on health and wellness is a major driver of the Europe mattress market. Consumers increasingly recognize the link between quality sleep and overall well-being, leading to heightened demand for orthopedic and ergonomic mattresses. According to the European Sleep Research Society, approximately 30% of adults in Europe suffer from chronic sleep disorders, prompting investments in sleep-enhancing products. Mattresses with memory foam, latex, and hybrid technologies that provide spinal alignment and pressure relief are particularly popular. In 2022, sales of orthopedic mattresses grew by 12%, driven by health-conscious consumers seeking solutions to back pain and sleep issues. This trend underscores the importance of innovation in addressing the growing demand for sleep health products.

Expansion of E-Commerce Channels

The rise of e-commerce has transformed the Europe mattress market, providing consumers with easy access to a wide variety of options. Online platforms offer convenience, competitive pricing, and trial periods, making them a preferred choice for busy shoppers. Eurostat reports that online retail sales in Europe grew by 15% annually between 2020 and 2022, with mattresses being a key category. Direct-to-consumer brands like Emma and Eve have capitalized on this trend, leveraging digital marketing and flexible return policies to attract customers. The shift to e-commerce enables manufacturers to reach a broader audience while reducing overhead costs, driving significant market growth.

MARKET RESTRAINTS

High Cost of Premium Mattresses

The high cost of premium and technologically advanced mattresses presents a significant restraint in the Europe mattress market. Products incorporating memory foam, hybrid designs, and eco-friendly materials often come with elevated price points, making them less accessible to cost-sensitive consumers. According to the European Bedding Industries’ Association, the average price of a premium mattress in Europe exceeds €1,000, a figure out of reach for many households, particularly in Eastern European countries where disposable incomes are lower. This price sensitivity limits the adoption of high-end mattresses, forcing manufacturers to balance innovation with affordability to capture a broader market share.

Environmental Concerns and Disposal Challenges

The environmental impact of mattress production and disposal poses another restraint on the Europe mattress market. Many conventional mattresses are made with non-recyclable materials, contributing to landfill waste and environmental degradation. The European Environment Agency highlights that over 10 million mattresses are discarded annually in Europe, with only a small fraction being recycled due to the complexity and cost of the process. This growing awareness among consumers and regulatory bodies about sustainability issues pressures manufacturers to develop eco-friendly alternatives. However, transitioning to sustainable production methods often entails higher costs, which can deter widespread implementation and affect market growth.

MARKET OPPORTUNITIES

Growing Demand for Sustainable and Eco-Friendly Mattresses

The rising consumer preference for sustainable products presents a significant opportunity in the Europe mattress market. As environmental awareness grows, customers are increasingly seeking eco-friendly mattresses made from organic, biodegradable, or recycled materials. The European Commission reported a 20% annual growth in the sustainable bedding segment between 2020 and 2022, driven by regulatory pressures and consumer demand. Brands adopting certifications like OEKO-TEX and GOTS (Global Organic Textile Standard) are particularly appealing to environmentally conscious buyers. This trend offers manufacturers an opportunity to innovate with green materials and production processes, aligning with Europe’s broader sustainability goals while tapping into a rapidly expanding market segment.

Increased Adoption of Smart Mattresses

The integration of smart technologies into mattresses is another key growth opportunity in the Europe market. Smart mattresses equipped with features like sleep tracking, temperature control, and automatic firmness adjustments are gaining popularity among tech-savvy and health-conscious consumers. According to the European Sleep Research Society, the smart mattress market in Europe grew by 18% annually between 2021 and 2022, driven by advancements in IoT (Internet of Things) and growing interest in personalized sleep solutions. Countries like Germany and the UK are at the forefront of this trend, with consumers willing to invest in high-tech bedding. This shift enables manufacturers to capture premium segments and differentiate their offerings through innovation.

MARKET CHALLENGES

Intense Market Competition

The Europe mattress market faces significant challenges due to intense competition among established players, new entrants, and direct-to-consumer (D2C) brands. This competition drives pricing pressures and reduces profit margins, particularly in price-sensitive regions. According to the European Bedding Industries’ Association, over 2,500 brands operate in the European market, with many vying for consumer attention through aggressive marketing and promotional strategies. D2C brands like Emma and Simba leverage e-commerce channels and free trial periods to disrupt traditional retail models, increasing competition for legacy manufacturers. This crowded marketplace forces companies to invest heavily in differentiation and innovation, escalating costs and intensifying the challenge of maintaining profitability.

Supply Chain Disruptions and Raw Material Costs

Supply chain disruptions and rising raw material costs represent another significant challenge for the Europe mattress market. Materials like memory foam, latex, and steel (used in springs) are subject to price volatility, exacerbated by geopolitical tensions and global supply chain disruptions. Eurostat reported a 15% increase in the cost of raw materials used in mattress production in 2022, driven by energy price surges and logistical bottlenecks. These factors inflate manufacturing costs and lead to delays, impacting the timely delivery of products. Smaller manufacturers, in particular, struggle to absorb these costs, hindering their ability to compete and meet growing consumer demand effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.63% |

|

Segments Covered |

By Type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Aquinos Group, BeCo Matratzen, bett1.de, Resident Home, Puffy Mattress, Spring Air, Kingsdown, King Koil, Tempur Sealy, Emma Sleep, Relyon Beds, Royal Auping, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The memory foam mattresses segment dominated the Europe mattress market by capturing 40.5% of share in 2024 owing to their superior comfort and pressure-relieving properties by appealing to consumers seeking ergonomic sleep solutions. For instance, in Germany, memory foam mattresses accounted for over 50% of all premium mattress sales, as per the German Sleep Association. A key factor behind the segment’s dominance is the growing trend of investing in health-focused products. According to Eurostat, memory foam mattresses are perceived as a long-term solution for alleviating back pain is driving demand among aging populations. Additionally, advancements in cooling technologies have addressed previous concerns about heat retention by enhancing their appeal.

The latex mattresses segment is swiftly emerging with an anticipated CAGR of 8.4% during the forecast period. This growth is fueled by their natural and hypoallergenic properties by appealing to health-conscious and eco-friendly consumers. For example, in Sweden, latex mattress sales surged by 35% in 2022, as per the Swedish Environmental Protection Agency. A significant driver of this segment’s rapid expansion is the increasing emphasis on sustainability. According to the European Environment Agency, latex mattresses are biodegradable and sourced from renewable plantations, aligning with consumer values. Additionally, the availability of certifications like GOLS (Global Organic Latex Standard) has enhanced brand credibility by attracting premium buyers. These innovations highlight the transformative potential of latex mattresses in reshaping the market landscape.

By End-User Insights

The residential applications was the largest and held significant share of the Europe mattress market in 2024 owing to the widespread adoption of mattresses in households, particularly among middle- and upper-income families. For instance, in the UK, over 80% of residential consumers prioritize comfort and durability when purchasing mattresses, as per the British Furniture Retailers Association. A key factor behind the segment’s dominance is the growing trend of home improvement projects, which gained momentum during the pandemic. Additionally, the rise of multi-functional furniture has created new opportunities for innovation by ensuring sustained demand. These attributes ensure that residential applications remain the primary driver of the Europe mattress market.

The commercial applications segment is estimated to exhibit a fastest CAGR of 9.4% from 2025 to 2033. This growth is fueled by the increasing demand for high-quality mattresses in hospitality and healthcare sectors, where comfort and hygiene are paramount. For example, in Switzerland, luxury hotels reported a 25% increase in demand for premium mattresses, as per the Swiss Hotel Association. A significant driver of this segment’s rapid expansion is the emphasis on guest experience and patient care. According to the European Hospitality Association, over 60% of hotels prioritize ergonomic mattresses to enhance guest satisfaction is creating a niche for specialized products. Additionally, the integration of antimicrobial coatings has improved hygiene standards, addressing concerns in healthcare facilities.

By Distribution Channel Insights

Th offline distribution channels segment was accounted in holding a dominant share of the Europe mattress market in 2024 by enduring preference for in-store experiences among elderly people who value tactile assessments before purchase. For instance, in Italy, over 70% of consumers visit physical stores to test mattresses before making a decision, as per the Italian Retail Federation. A key factor behind the segment’s dominance is the availability of expert advice and personalized recommendations in brick-and-mortar outlets. According to Eurostat, offline channels account for 80% of premium mattress sales is reflecting their effectiveness in driving conversions. Additionally, promotional activities, such as discounts and loyalty programs, have further strengthened their position.

The online distribution segment is growing with a projected CAGR of 12.5% from 2025 to 2033. This growth is fueled by the increasing adoption of e-commerce platforms and the convenience of doorstep delivery. For example, in the Netherlands, online mattress retailers reported a 40% increase in sales in 2022, as per the Dutch E-Commerce Association. A significant driver of this segment’s rapid expansion is the integration of advanced technologies, such as augmented reality (AR) and virtual try-on tools, which enhance the online shopping experience. According to McKinsey & Company, over 50% of European consumers now prefer online platforms for their ability to offer detailed product comparisons and customer reviews. Additionally, subscription-based models and flexible return policies have further boosted consumer confidence in purchasing mattresses online.

REGIONAL ANALYSIS

Germany was the top performer in the Europe mattress market with an estimated share of 28.9% in 2024. The country’s robust manufacturing base and emphasis on innovation have positioned it as a leader in the region. For instance, German brands like Tempur and Dunlopillo are renowned globally for their high-quality memory foam and latex mattresses, catering to both domestic and international markets.

A key factor driving Germany’s success is its proactive adoption of sustainable practices. According to the German Sustainability Council, over 60% of mattress manufacturers prioritize eco-friendly materials and production methods by aligning with consumer values. Additionally, the rise of online retail platforms has enabled German brands to reach a broader audience. These initiatives enhances the Germany’s pivotal role in advancing the Europe mattress market.

The United Kingdom is more likely to register a CAGR of 13.4% in the next coming years. The country’s strong retail infrastructure and consumer preference for premium products have significant position as a key player. For instance, British brands like Silentnight dominate the mid-tier segment, appealing to cost-conscious yet quality-focused consumers.

A significant driver of the UK’s dominance is its focus on digital transformation and personalized marketing strategies. According to the British Retail Consortium, online mattress sales in the UK grew by 35% in 2022, driven by the integration of virtual try-on tools and AI-driven recommendations. Additionally, as per Deloitte, over 70% of UK consumers prioritize unique and meaningful designs by encouraging local brands to offer bespoke solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Aquinos Group, BeCo Matratzen, bett1.de, Resident Home, Puffy Mattress, Spring Air, Kingsdown, King Koil, Tempur Sealy, Emma Sleep, Relyon Beds, and Royal Auping are playing dominating role in the Europe mattress market.

The Europe mattress market is characterized by intense competition, with established brands and emerging startups vying for market share. Key players like Tempur and Emma Mattress dominate the premium segment, while IKEA competes aggressively on affordability and accessibility. Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like Casper and Simba are pioneering direct-to-consumer online sales, challenging incumbents in the e-commerce segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants is prompting the market’s evolution.

TOP PLAYERS IN THE EUROPE MATTRESS MARKET

Emma Mattress

Emma Mattress has emerged as one of the leading players in the European mattress market, renowned for its innovative approach to sleep technology and customer-centric business model. The company focuses on providing high-quality, affordable mattresses that cater to a wide range of sleep preferences. Emma’s product line often incorporates advanced materials such as Airgocell foam and cold foam, which are designed to enhance breathability and comfort.

Nectar Sleep

Nectar Sleep has established itself as a major player in both the European and global mattress markets by offering luxury memory foam mattresses at accessible price points. Known for its emphasis on comfort and durability, Nectar’s mattresses are designed to provide optimal support and pressure relief, making them popular among consumers seeking a restorative night's sleep. One of the key factors behind Nectar’s success is its generous trial period and lifetime warranty, which have helped build trust and loyalty among customers.

Saatva

Saatva stands out in the European mattress market with its unique hybrid mattress designs and a focus on luxury without the premium price tag. Unlike many competitors, Saatva operates on a virtual storefront model, offering personalized customer service through non-commissioned sleep guides who assist buyers in selecting the right mattress. This approach enhances the overall purchasing experience and builds strong relationships with consumers. Saatva’s hybrid mattresses combine layers of foam, latex, and individually wrapped coils to deliver exceptional support, breathability, and motion isolation.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Product Innovation and Customization

One of the most prominent strategies is the focus on product innovation. Leading mattress brands invest heavily in research and development to create advanced materials and designs that cater to diverse sleep needs. For example, companies like Emma and Nectar incorporate cutting-edge foam technologies, such as memory foam, gel-infused layers, and breathable fabrics, to improve comfort and temperature regulation. Additionally, customization has become a key differentiator, with brands offering modular designs or adjustable firmness levels to suit individual preferences.

Direct-to-Consumer (DTC) Sales Models

Many top players in the European mattress market have embraced direct-to-consumer sales through e-commerce platforms. This strategy eliminates intermediaries, allowing brands to offer high-quality products at lower prices while maintaining higher profit margins. Companies like Nectar and Puffy leverage online channels to streamline the purchasing process, providing customers with detailed product information, virtual consultations, and hassle-free returns. The DTC model also enables brands to gather valuable customer data, which can be used to refine marketing strategies and improve product offerings.

Sustainability and Eco-Friendly Practices

As environmental concerns gain prominence, sustainability has become a cornerstone of many mattress brands' strategies. Companies like Emma and Awara emphasize the use of eco-friendly materials, such as organic cotton, natural latex, and recycled components, in their products. They also adopt sustainable manufacturing processes to minimize waste and carbon footprints. This commitment to sustainability not only enhances brand loyalty but also positions them as forward-thinking leaders in the marketplace.

Customer-Centric Policies and Services

To build trust and foster long-term relationships, leading mattress brands implement customer-centric policies, such as extended trial periods, lifetime warranties, and easy return processes. For instance, Nectar offers a year-long trial period, allowing customers to test their mattresses risk-free. Similarly, Saatva provides white-glove delivery and setup services, ensuring a seamless experience for buyers. These initiatives address common pain points associated with mattress purchases, such as uncertainty about comfort and the inconvenience of transportation.

Brand Positioning and Marketing Campaigns

Effective branding and marketing play a crucial role in strengthening market position. Key players invest in storytelling and emotional appeals to connect with consumers on a deeper level. For example, DreamCloud emphasizes luxury and indulgence in its messaging, positioning its products as premium yet affordable options. Similarly, Brooklyn Bedding highlights its American craftsmanship heritage to appeal to quality-conscious buyers. Social media campaigns, influencer partnerships, and content marketing are also widely used to engage audiences and build brand awareness.

Expansion into New Markets and Product Lines

To sustain growth, many mattress brands expand beyond their core markets and product offerings. For instance, European companies like Emma and Nolah have successfully entered international markets, adapting their strategies to local preferences and regulations. Additionally, diversification into complementary product lines, such as pillows, bed frames, and bedding accessories, allows these brands to capture more value from existing customers.

Partnerships and Collaborations

Strategic partnerships and collaborations are another effective way for mattress brands to enhance their market position. For example, some companies collaborate with sleep experts, wellness organizations, or technology firms to develop innovative solutions that address broader health and lifestyle needs. Others partner with retailers or third-party platforms to expand distribution channels and increase accessibility. These alliances enable brands to leverage external expertise and resources by accelerating growth and staying ahead of industry trends.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Tempur acquired a Swiss startup specializing in smart mattress technologies. This acquisition aimed to integrate IoT features into its product range, enhancing sleep tracking capabilities.

- In May 2024, Emma Mattress partnered with a German logistics provider to enhance its delivery network. This initiative aimed to reduce shipping times and improve customer satisfaction.

- In July 2024, IKEA introduced a line of modular mattresses targeting urban consumers. This move aimed to cater to the growing demand for space-efficient solutions in compact living spaces.

- In September 2024, Simba secured USD 20 million in funding from European investors to scale its sustainable mattress initiatives. This investment aimed to align with consumer values and boost brand loyalty.

- In November 2024, Casper launched a campaign promoting its zero-waste packaging initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious buyers.

MARKET SEGMENTATION

This research report on the European mattress market is segmented and sub-segmented into the following categories.

By Type

- Innerspring

- Memory Foam

- Latex

- Others

By End User

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com