Europe Mass Flow Controller Market Research Report - Segmented By Material Type ( Introduction , Stainless Steel ) Flow Rate ( Low Flow (≤ 25 SLM) Mass Flow Controller , Medium Flow (>25 SLM – ≤1000 SLM) Mass Flow Controller ) Technology ( Thermal based Mass Flow Controller , Differential Pressure based Mass Flow Controller ) By Connectivity ( Analog , Digital ) End-user Industry ( Semiconductor ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts (2025 to 2033)

Europe Mass Flow Controller Market Size

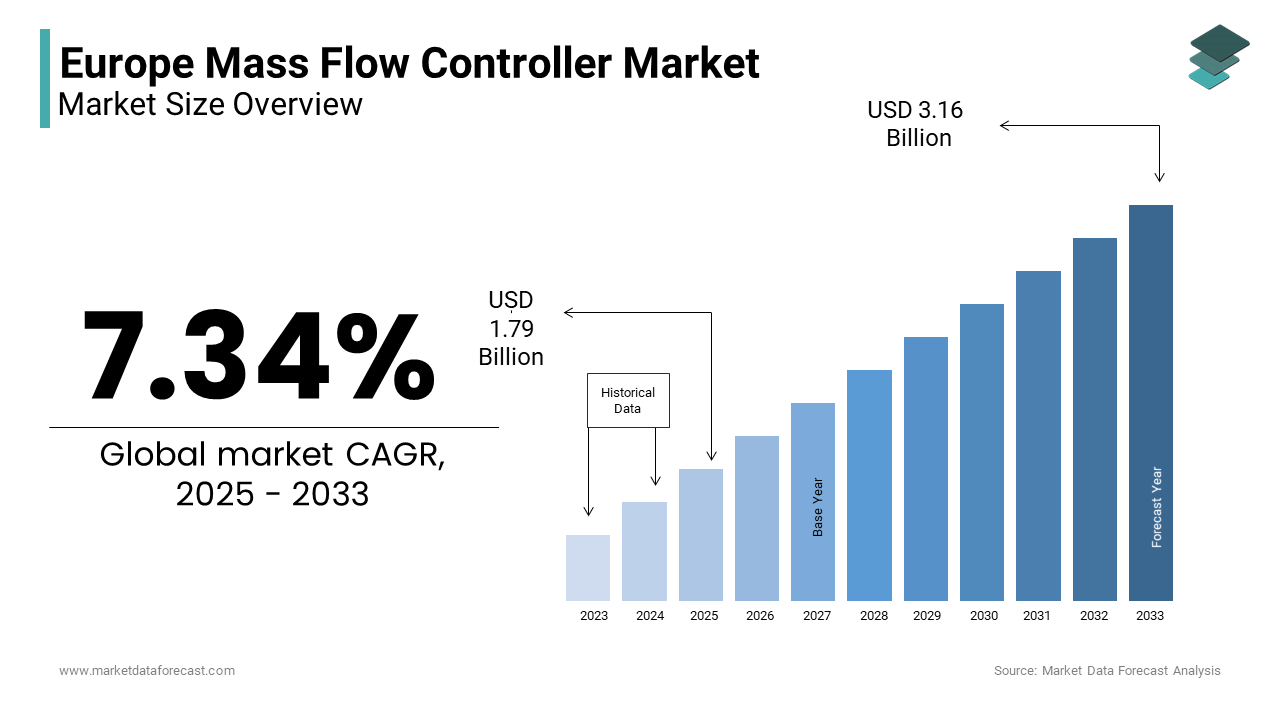

The europe mass flow controller market Size was valued at USD 1.67 billion in 2024. The europe mass flow controller market size is expected to have 7.34 % CAGR from 2025 to 2033 and be worth USD 3.16 billion by 2033 from USD 1.79 billion in 2025.

A mass flow controller is a device used to measure and regulate the flow of gases and liquids in various applications with high precision by ensuring optimal performance across diverse sectors such as semiconductor manufacturing, pharmaceuticals, chemical processing, and energy production. In 2023, the European MFC market has demonstrated robust growth, which is driven by increasing demand for advanced manufacturing technologies, stringent environmental regulations, and the rapid expansion of industries reliant on precise gas and liquid delivery systems.

Europe’s dominance in the semiconductor and electronics sector has been a key contributor to the rising adoption of MFCs. For instance, countries like Germany, France, and the Netherlands have emerged as hubs for semiconductor fabrication facilities, which heavily rely on MFCs for maintaining accurate gas flows during chip production. Additionally, the European Union’s commitment to achieving carbon neutrality by 2050 has spurred investments in renewable energy projects that further boosting demand for MFCs in hydrogen fuel cell technologies and biogas processing. According to the International Energy Agency, Europe is leading the global transition to clean energy with hydrogen production capacity expected to grow exponentially over the next decade. These factors collectively elevates the pivotal role of mass flow controllers in shaping Europe’s industrial landscape while driving innovation and sustainability across multiple verticals.

MARKET DRIVERS

Increasing Demand for Semiconductor Manufacturing Equipment

The rising demand for semiconductor manufacturing equipment, which is essential for producing advanced electronics is one of the major driving factors for the Europe mass flow controller market growth. This growth is fueled by the increasing adoption of IoT devices, artificial intelligence, and 5G technologies, all of which require precise gas flow control during chip fabrication. Mass flow controllers are critical in ensuring accurate delivery of process gases in semiconductor production lines. Furthermore, the European Union’s Chips Act aims to double the continent’s global semiconductor market share to 20% by 2030 which is driving substantial investments in semiconductor facilities. These initiatives are expected to boost the demand for MFCs, as they are indispensable for achieving high precision and efficiency in semiconductor manufacturing processes.

Growing Focus on Renewable Energy and Hydrogen-Based Solutions

Another major driver of the Europe mass flow controller market is the growing emphasis on renewable energy and hydrogen-based solutions which is spurred by the region’s commitment to achieving climate neutrality. The European Commission’s Hydrogen Strategy outlines plans to install at least 40 gigawatts of renewable hydrogen electrolysers by 2030 by creating a strong demand for advanced flow control systems. Mass flow controllers are integral to hydrogen production, storage, and distribution by ensuring precise management of gas flows in electrolyzers and fuel cells. According to the International Energy Agency, Europe accounted for nearly 40% of global hydrogen project announcements in 2022 due to its leadership in this domain. Additionally, stringent environmental regulations mandating reductions in greenhouse gas emissions have accelerated the adoption of clean energy technologies that further propel the need for MFCs. This transition towards sustainable energy solutions not only strengthens Europe’s position as a global leader in green innovation but also creates significant opportunities for the mass flow controller market in the region.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

The high initial cost associated with advanced MFC systems can deter small and medium-sized enterprises from adopting these technologies is solely hindering the growth rate of the Europe mass flow controller market. According to the European Investment Bank, SMEs, which form the backbone of Europe’s industrial sector, often face budget constraints when investing in high-precision equipment. For instance, a single high-end mass flow controller can cost between EUR 1,000 to EUR 5,000, depending on its specifications by making it a substantial financial burden for smaller players. Additionally, the integration of MFCs into existing systems often requires additional investments in infrastructure upgrades is increasing costs. This financial barrier limits the widespread adoption of MFCs, particularly in price-sensitive industries such as food processing and water treatment. While larger corporations may absorb these costs more easily, the affordability issue remains a key challenge for broader market penetration across Europe.

Stringent Regulatory Standards and Compliance Challenges

Another restraint is the complexity posed by stringent regulatory standards governing industrial equipment, which can hinder the seamless adoption of mass flow controllers. The European Environment Agency emphasizes that manufacturers must comply with rigorous environmental and safety regulations, such as the REACH and RoHS directives, which mandate the use of eco-friendly materials and energy-efficient designs. Achieving compliance often requires extensive testing, certification, and modifications is leading to increased development timelines and costs for MFC manufacturers. Furthermore, frequent updates to these regulations create uncertainty and additional expenses for companies striving to keep up with evolving requirements. According to Eurostat, nearly 20% of European manufacturers reported challenges in adapting to changing regulatory frameworks in 2022. These compliance-related hurdles not only increase operational complexities but also slow down innovation and market growth is posing a significant restraint for the mass flow controller market in Europe.

MARKET OPPORTUNITIES

Expansion of Hydrogen Economy and Clean Energy Initiatives

The rapid expansion of Europe’s hydrogen economy presents a significant opportunity for the mass flow controller market which is driven by ambitious clean energy goals. According to the European Commission’s Hydrogen Strategy, plans to produce 10 million tonnes of renewable hydrogen annually by 2030 with substantial investments in hydrogen production and infrastructure. Mass flow controllers are critical for managing gas flows in electrolyzers, fuel cells, and hydrogen refueling stations by making them indispensable in this transition. According to the International Energy Agency, Europe leads globally in hydrogen project development, with over 150 projects announced as of 2022. This surge in hydrogen initiatives is expected to create a robust demand for MFCs in Germany, France, and Spain, which are at the forefront of hydrogen adoption. The growing hydrogen economy offers lucrative opportunities for MFC manufacturers to innovate and expand their market presence.

Advancements in Industrial Automation and Smart Manufacturing

The increasing adoption of industrial automation and smart manufacturing technologies across Europe provides another key opportunity for the mass flow controller market. According to the European Association for Automation and Robotics, the region’s industrial automation market is projected to grow at a CAGR of 7.5% from 2023 to 2030, which is driven by Industry 4.0 initiatives. Mass flow controllers play a vital role in automated systems by ensuring precise control of gases and liquids in applications such as chemical processing, pharmaceuticals, and food production. According to the Eurostat, over 60% of European manufacturers are investing in smart technologies to enhance efficiency and reduce operational costs. This trend toward automation creates a growing need for high-precision MFCs, particularly in sectors like biotechnology and advanced materials. As Europe continues to embrace digital transformation, the demand for innovative and reliable mass flow controllers is set to rise by offering significant growth potential for the market.

MARKET CHALLENGES

Supply Chain Disruptions and Dependency on Imports

The vulnerability to supply chain disruptions, that are exacerbated by the region's dependency on imported components is one of the major challenges for the Europe mass flow controller market growth rate. According to the European Central Bank, over 60% of critical industrial components, including sensors and electronic parts used in MFCs, are sourced from non-EU countries by making the supply chain susceptible to geopolitical tensions and logistical bottlenecks. For instance, the global semiconductor shortage in 2022 severely impacted industries reliant on MFCs by causing delays in production and increased costs. According to the Eurostat, nearly 30% of European manufacturers faced significant disruptions in their supply chains during the same year. These challenges not only hinder timely delivery but also inflate operational costs for MFC manufacturers. As a result, ensuring a resilient and localized supply chain remains a pressing concern for the European market.

Intense Competition and Market Fragmentation

The intense competition and market fragmentation within the Europe mass flow controller market, which complicates efforts to achieve economies of scale is another factor that may slow down the growth rate of the Europe mass flow controller market. According to the European Commission’s Industrial Policy, with numerous small and medium-sized players competing alongside global giants often leads to price wars and reduced profit margins by making it difficult for smaller companies to invest in research and development. As per International Trade Administration, European MFC manufacturers face stiff competition from Asian firms, which offer lower-cost alternatives by capturing nearly 40% of the regional market share in 2022. This competitive pressure forces European companies to continually innovate while managing cost constraints. Balancing innovation with affordability in such a fragmented and competitive landscape poses a significant challenge for sustained growth in the European MFC market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.34% |

|

Segments Covered |

By Product Specification, Material Type, Flow Rate, Technology, Connectivity, End-user Industry and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

HORIBA, Ltd. (Japan),Sensirion AG (Switzerland),MKS Instruments (US),Teledyne Technologies Incorporated (US) |

SEGMENT ANALYSIS

By Product Specification Insights

The MFCs with elastomer seals segment dominated the market by capturing 60% of the Europe mass flow controller market share in 2024. Their widespread adoption stems from cost-effectiveness and versatility by making them ideal for industries like food processing and water treatment. These seals are compatible with non-corrosive gases and liquids by catering to 40% of industrial applications.

The high-accuracy MFCs segment is likely to experience the fastest CAGR of 8.5% in the coming years. This growth is driven by increasing demand in precision-dependent industries like semiconductors and pharmaceuticals, where accuracy levels of ±0.5% or better are critical. According to the International Energy Agency, Europe’s semiconductor sector, valued at EUR 45 billion in 2022, heavily relies on these MFCs. High-accuracy MFCs are pivotal for ensuring efficiency and reliability as industries adopt advanced manufacturing technologies that is anticipated to leverage the growth rate of the market.

By Material Type Insights

The stainless steel segment led the market by occupying 60% of the Europe mass flow controller share in 2024. The segment’s growth is driven by its exceptional corrosion resistance, mechanical strength, and compatibility with high-purity applications like semiconductor manufacturing. As per e European Semiconductor Industry Association, over 70% of MFCs in semiconductor fabs use stainless steel due to their ability to maintain ultra-high purity standards. These properties make stainless steel MFCs indispensable in industries requiring precision and reliability, such as pharmaceuticals and chemical processing by ensuring consistent performance in critical operations.

The Alloy-based MFCs segment is anticipated to experience significant CAGR of 9.2% during the forecast period. This growth is fueled by their superior resistance to extreme temperatures and aggressive chemicals by making them ideal for hydrogen fuel cells and renewable energy projects. Alloys like Hastelloy and Inconel are increasingly used in handling reactive gases by driving demand in niche markets. Alloy MFCs are pivotal in enabling sustainable technologies by positioning them as a key growth driver in specialized industrial applications.

By Media Type Insights

The gas mass flow controllers segment dominated the market and held 70% of Europe mass flow controller market. Their critical role in high-precision industries like semiconductor manufacturing, where they are used in 80% of production processes is escalating the growth rate of the market. Additionally, the growing hydrogen economy has further amplified demand, with gas MFCs being essential for hydrogen fuel cells and electrolyzers. These controllers ensure accurate gas flow control by making them indispensable in applications requiring reliability and precision, such as chemical processing and energy production.

The liquid mass flow controllers segment is likely to register the fastest CAGR of 10.2% in the foreseen years. Rising demand in pharmaceuticals, biotechnology, and food processing is sophisticated to gear up the segment’s growth rate. For instance, liquid MFCs are crucial for accurate dosing in drug formulation and managing corrosive chemicals in biotech applications. Liquid MFCs are becoming increasingly important as Europe invests heavily in biotechnology and sustainable manufacturing. Their ability to meet stringent hygiene and accuracy requirements positions them as a key driver of innovation in specialized industrial sectors.

By Flow Rate Insights

The low-flow (≤ 25 SLM) Mass Flow Controller segment led the market by occupying share of 70% in the Europe mass flow controller market. Its role in precision-driven industries like semiconductor manufacturing where they are used in 70% of processes according to the European Semiconductor Industry Association. These MFCs ensure accurate control of small gas volumes, those are essential for applications such as etching, deposition, and pharmaceutical dosing. Their compact design and high precision make them indispensable in advanced manufacturing and biotechnology, where even minor deviations can impact product quality.

The high-flow mass flow controllers segment is attributed to witness a CAGR of 12.3% during the forecast period. This growth is fueled by Europe’s hydrogen economy, with the EU targeting 40 gigawatts of renewable hydrogen electrolysers by 2030. High-flow MFCs are vital for managing large gas volumes in hydrogen refueling stations and industrial-scale electrolyzers. These MFCs enable efficient handling of gases in power generation and oil refining as Europe accelerates its clean energy transition as key enablers of sustainable industrial innovation. Their scalability and adaptability drive their rapid expansion.

By Technology Insights

The thermal-based mass flow controllers dominate the market and held 69% of Europe mass flow controller market share. According to the European Semiconductor Industry Association reports that thermal-based MFCs are used in over 80% of semiconductor fabs by ensuring reliable performance in critical processes such as etching and deposition. Their ability to measure flow rates in real-time and compatibility with various gases further enables their role in advanced manufacturing. This widespread adoption escalates their importance in high-tech industries that is contributing for the segment’s growth rate.

The coriolis-based mass flow controllers segment is likely to experience the fastest CAGR of 11.5% during the forecast period. This growth is fueled by their exceptional accuracy in handling both gases and liquids by making them ideal for specialized applications in biotechnology, food processing, and oil refining. Coriolis-based MFCs are increasingly adopted for precise flow measurement in challenging environments as Europe prioritizes sustainability and innovation. Their adaptability and reliability position them as key enablers of advanced industrial solutions by driving their rapid expansion in niche markets across the region.

By Connectivity Insights

The analog mass flow controllers segment dominated the market by capturing 45% share of Europe mass flow controller market. Their leadership stems from their simplicity, reliability, and cost-effectiveness by making them ideal for small-scale or less complex applications like food processing and water treatment. Analog MFCs are widely used in industries where advanced connectivity is not critical by ensuring consistent performance at a lower cost. Despite the rise of digital alternatives, their affordability and ease of maintenance sustain their demand. According to the European Chemical Industry Council, analog MFCs remain integral to operations in price-sensitive sectors with their continued importance in Europe’s industrial landscape.

The Digital segment is anticipated to experience the fastest CAGR of 13.2% during the forecast period. This growth is driven by the adoption of Industry 4.0 technologies, where EtherCAT’s high-speed data transfer and real-time monitoring capabilities excel. EtherCAT-enabled MFCs are pivotal in applications like semiconductor fabrication and hydrogen fuel cells as Europe invests in smart manufacturing. Their ability to integrate seamlessly with automated systems ensures precise control and efficiency by positioning them as a key enabler of advanced industrial innovation and sustainable manufacturing practices.

By End-user Industry Insights

The semiconductor segment dominated the market and held 35% Europe mass flow controller market share in 2024. Over 80% of semiconductor fabs rely on MFCs to ensure accuracy in chip fabrication. The growing demand for IoT devices, AI, and 5G technologies has further amplified their importance. Increasing awareness and rising demand for the high quality products manufacturing with the innovative technologies are prompting the growth rate of the market.

The oil & gas segment is witness a fastest CAGR of 9.8% throughout the forecast period. This growth is driven by the increasing use of MFCs in renewable energy applications, such as biogas odorization and hydrogen production. MFCs are essential for precise gas flow management in clean energy projects as Europe targets 40 gigawatts of renewable hydrogen electrolysers by 2030. Their ability to handle aggressive gases ensures safety and efficiency is positioning them as key enablers of Europe’s transition to sustainable energy solutions and reducing reliance on fossil fuels.

Country Level Analysis

Germany led the Europe mass flow controller market with 25% of share i9n 2024. Its dominance is driven by the country’s robust industrial base in semiconductor manufacturing and automotive industries, which heavily rely on MFCs for precision gas control. Germany is also at the forefront of Europe’s hydrogen economy. According to the Federal Ministry for Economic Affairs and Energy, the country plans to invest EUR 9 billion in hydrogen technologies by 2030. This focus on clean energy and advanced manufacturing has bolstered demand for MFCs. Additionally, Germany’s market growth is attributed with industry 4.0 initiatives ensures widespread adoption of smart manufacturing systems.

The Netherlands is likely to experience a CAGR of 7.8% during the forecast period. The presence of advanced semiconductor technologies with global giants like ASML driving innovation in chip fabrication is attributed in elevating the growth rate of the market. According to the Netherlands Enterprise Agency, the country accounts for 15% of global semiconductor exports by creating a strong demand for high-precision MFCs. Furthermore, the Netherlands’ strategic focus on renewable energy, particularly green hydrogen production is amplifying the need for MFCs in electrolyzers and fuel cells. Its well-established infrastructure and commitment to sustainability make it a hub for cutting-edge technologies by positioning the Netherlands as a leader in the European MFC market.

France mass flow controller market is likely to have a steady pace throughout the forecast period owing to its growing pharmaceutical and chemical industries, where MFCs are essential for precise flow control in processes like pill coating and catalyst research. France’s emphasis on renewable energy, including hydrogen production, further drives demand for MFCs, with the government aiming to produce 6.5 gigawatts of green hydrogen by 2030. According to the French Environment and Energy Management Agency, the country is investing heavily in clean energy projects by ensuring steady growth for MFC applications. France’s strong industrial policies and focus on innovation reinforce its leading position in the European MFC market.

KEY MARKET PLAYERS

Key players operating in the Europe Mass Flow Controller Market profiled in this report are HORIBA, Ltd. (Japan),Sensirion AG (Switzerland),MKS Instruments (US),Teledyne Technologies Incorporated (US),Bronkhorst (Netherlands),Brooks Instrument. (US),Christian Bürkert GmbH & Co. KG (Germany),Sierra Instruments, Inc. (US),Alicat Scientific, Inc. (US),PASKER HANNIFIN CORP (US),TOKYO KEISO CO., LTD. (Japan),Vögtlin Instruments GmbH (Switzerland),Azbil Corporation (China).

MARKET SEGMENTATION

This research report on the Europe Mass Flow Controller Market has been segmented and sub-segmented into the following categories.

By Product Specification

- Introduction

- Display

- MFC with Display

- MFC without Display

- Seals

- MFC with Metal Seals

- MFC with Elastomers Seals

- Accuracy

- Standard Accuracy

- High Accuracy

By Material Type

- Introduction

- Stainless Steel

- Alloy

- Others

By Flow Rate

- Low Flow (≤ 25 SLM) Mass Flow Controller

- Medium Flow (>25 SLM – ≤1000 SLM) Mass Flow Controller

- High Flow (>1000 SLM) Mass Flow Controller

By Technology

- Thermal based Mass Flow Controller

- Differential Pressure based Mass Flow Controller

- Coriolis based Mass Flow Controller

By Connectivity

- Analog

- Digital

- Profibus

- RS-485

- ProfiNet

- EtherCAT

- Ethernet IP

- Modbus RTU

- Modbus TCP/IP

- DeviceNet

- Foundation Fieldbus

By End-user Industry

- Semiconductor

- Wafer Cleaning

- Thin Film Deposition

- Spray Coating

- Plasma Etching

- Vacuum Sputtering

- Oil & Gas

- Odorization of Biogas

- Heavy Fuel Oil Additive Dosing

- Fracking

- Chemicals

- Catalyst Research

- Liquefied Gas Dosing

- Pharmaceuticals

- Pill Coating

- Continuous Manufacturing

- Metals & Mining

- Selective Laser Melting

- Smelting

- Water & Wastewater Treatment

- pH Control

- Food & Beverages

- Aeration

- Aseptic Packaging

- Others

- Lambda Probe Testing

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the mass flow controller market in Europe?

The growth in Europe is driven by the rising adoption of mass flow controllers in renewable energy applications, as industries focus on efficiency and precision

What challenges does the Europe Mass Flow Controller Market face?

Challenges include high initial costs associated with advanced mass flow controllers and the need for continuous technological upgrades to meet the evolving demands of various industries.

What is the role of mass flow controllers in renewable energy applications in Europe?

Mass flow controllers are crucial in renewable energy sectors such as hydrogen production, biogas, and fuel cells, where they ensure precise regulation of gas flows, enhancing efficiency and safety.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]