Europe CRO Services Market Size, Share, Trends & Growth Forecast Report By Type, End-User, and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe CRO Services Market Size

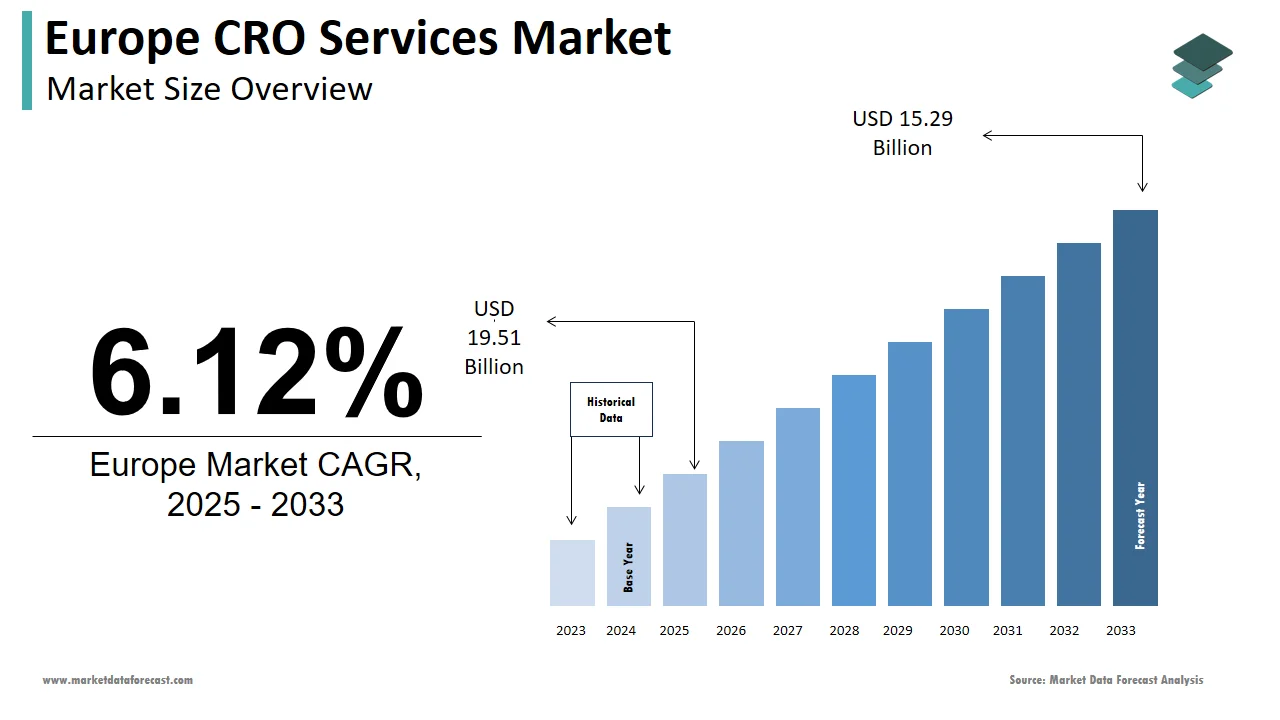

The contract research organization (CRO) services market size in Europe was valued at USD 9 billion in 2024. The European market is estimated to be worth USD 15.29 billion by 2033 from USD 9.51 billion in 2025, growing at a CAGR of 6.12% from 2025 to 2033.

The contract research organization (CRO) market in Europe is growing steadily, driven by the rising need for outsourced clinical research services. This trend is supported by strong pharmaceutical and biotech industries, especially in countries like Germany, the UK, and France. In 2022, Europe made up nearly 30% of all clinical trials worldwide, showing its key role in developing new medicines. The region follows strict regulations set by the European Medicines Agency (EMA), helping to maintain high standards in research. According to Deloitte, the use of advanced technologies like artificial intelligence and big data in clinical trials has made research more efficient is boosting market growth. Major CRO companies such as IQVIA and Parexel have a strong presence in Europe, further highlighting the region's importance in this field.

MARKET DRIVERS

Rising Demand for Outsourcing Clinical Trials

The surge in demand for outsourcing clinical trials is a key driver of the European CRO market. Pharmaceutical companies are increasingly relying on CROs to manage their clinical trials due to cost efficiencies and specialized expertise. As per a report by BioMed Central, outsourcing clinical trials can reduce costs by up to 30% is making it an attractive option for drug developers. In 2022, over 60% of clinical trials in Europe were outsourced to CROs, as per the European Federation of Pharmaceutical Industries and Associations (EFPIA). This trend is further amplified by the complexity of modern trials which require advanced infrastructure and regulatory compliance. For instance, oncology trials, which account for nearly 40% of all clinical trials in Europe, often involve intricate protocols that benefit from CRO expertise. The ability of CROs to streamline operations and accelerate timelines has made them indispensable to the pharmaceutical industry.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in Europe is another significant driver of the CRO market. Cardiovascular diseases, cancer, and diabetes collectively account for over 70% of deaths in Europe, as per the World Health Organization (WHO). This has led to an increased focus on drug development for these conditions, driving demand for CRO services. For example, oncology research alone represented 38% of the total clinical trial activity in Europe in 2022, as stated by ClinicalTrials.gov. The need for innovative therapies has prompted pharmaceutical companies to collaborate with CROs, who provide end-to-end solutions from preclinical to post-marketing studies. Also, government initiatives aimed at improving healthcare outcomes, such as the EU’s Horizon Europe program, have further stimulated investment in R&D, indirectly benefiting the CRO market.

MARKET RESTRAINTS

Stringent Regulatory Framework

One of the primary restraints in the European CRO market is the stringent regulatory framework governing clinical trials. The European Medicines Agency (EMA) mandates rigorous compliance with Good Clinical Practice (GCP) guidelines, which can lead to delays and increased costs for CROs. Based on a study published in Nature Reviews Drug Discovery, nearly 45% of clinical trials in Europe face delays due to regulatory hurdles. These challenges are exacerbated by variations in national regulations across EU member states, which complicate cross-border trials. For instance, a survey by the European Clinical Research Infrastructure Network (ECRIN) revealed that 30% of multi-country trials experience delays exceeding six months due to differing regulatory requirements. Such complexities can deter smaller CROs from entering the market and thereby limiting competition and innovation.

Data Privacy Concerns

Data privacy concerns pose another significant restraint for the European CRO market. The General Data Protection Regulation (GDPR), implemented in 2018, imposes strict rules on the collection, storage, and processing of patient data. According to a report by McKinsey, GDPR compliance costs can increase operational expenses for CROs by up to 15%. Moreover, the penalties for non-compliance, which can reach €20 million or 4% of global turnover, create additional financial risks. A study by the European Alliance for Patient Access highlighted that 25% of clinical trials in Europe faced disruptions due to data privacy issues in 2022. These challenges are particularly pronounced in multinational trials, where aligning data protection protocols across jurisdictions becomes a complex task.

MARKET OPPORTUNITIES

Adoption of Decentralized Clinical Trials

The adoption of decentralized clinical trials (DCTs) presents a significant opportunity for the European CRO market. DCTs leverage digital tools such as telemedicine, wearable devices, and electronic health records to conduct trials remotely, reducing the need for physical site visits. In 2022, over 20% of clinical trials in Europe incorporated some form of decentralization, as per Clinical Research News. This shift is driven by the need for greater patient convenience and faster recruitment rates. For instance, a study by the Tufts Center for the Study of Drug Development found that DCTs can reduce trial timelines by up to 30%. CROs that invest in digital infrastructure and expertise stand to gain a competitive edge in this evolving landscape.

Expansion into Emerging Therapeutic Areas

The expansion into emerging therapeutic areas, such as gene therapy and rare diseases, offers substantial growth potential for the European CRO market. Rare disease research is particularly promising, as over 7,000 rare diseases lack approved treatments, creating immense unmet medical needs. A report by the European Organisation for Rare Diseases (EURORDIS) states that 95% of rare diseases do not have FDA-approved therapies, underscoring the urgency for innovation. Also, advancements in gene editing technologies like CRISPR have spurred interest in gene therapy trials, with Europe hosting 25% of global gene therapy trials in 2022, as per Pharma Intelligence. CROs that specialize in these niche areas can capitalize on the growing demand for specialized services.

MARKET CHALLENGES

Intense Price Competition

Intense price competition poses a significant challenge to the European CRO market. The market is highly fragmented, with numerous players vying for contracts from pharmaceutical and biotech companies. A report by PwC states that price pressures have reduced profit margins for mid-sized CROs by an average of 10% over the past five years. This issue is compounded by the increasing consolidation within the pharmaceutical industry, where larger companies negotiate bulk contracts at lower rates. For instance, a survey by the Association of Clinical Research Organizations (ACRO) revealed that 40% of CROs reported declining profitability due to aggressive pricing strategies. Smaller CROs, in particular, struggle to compete with larger firms that offer economies of scale is making it difficult for them to sustain long-term growth.

Talent Shortages in Specialized Roles

Talent shortages in specialized roles represent another critical challenge for the European CRO market. The demand for skilled professionals in areas such as biostatistics, regulatory affairs, and clinical data management has outpaced supply. As per a report by the European Biopharmaceutical Enterprises (EBE), the shortage of qualified personnel could result in a 20% reduction in clinical trial capacity by 2025. This issue is particularly acute in niche areas like gene therapy and rare disease research, where expertise is limited. For example, a study by the European Federation of Pharmaceutical Industries and Associations (EFPIA) found that 60% of CROs struggle to recruit specialists for advanced therapeutic trials. The lack of skilled talent not only hampers operational efficiency but also increases reliance on external consultants, further escalating costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Therapeutic Area, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leader Profiled |

Quintiles Transnational Holdings Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, PAREXEL International Corporation, ICON Plc, PRA Health Sciences Inc., InVentiv Health Inc., Charles River Laboratories International Inc., INC Research Holdings Inc., and Wuxi PharmaTech. |

SEGMENTAL ANALYSIS

By Type Insights

Clinical research services dominated the European CRO market by accounting for 45.9% of the total market share in 2024. This segment’s rise is driven by the increasing complexity of clinical trials, which require specialized expertise and infrastructure. For instance, the rise in adaptive trial designs, which allow modifications to trial parameters mid-study, has bolstered demand for clinical research services. According to the European Medicines Agency (EMA), adaptive trials made up 25% of all clinical trials in Europe in 2022. Additionally, the growing emphasis on patient-centric trials, which prioritize patient engagement and retention, has further fueled the demand for clinical research services. A study by the Clinical Trials Transformation Initiative revealed that patient-centric trials improve recruitment rates by 30%, showcasing the value of CRO expertise in this area.

The phase I clinical research services are the fastest-growing segment, with a projected CAGR of 9.5% from 2025 to 2033. This growth is attributed to the increasing number of early-phase trials for novel therapies, particularly in oncology and rare diseases. For example, a study by Pharma Intelligence found that Phase I trials accounted for 35% of all clinical trials initiated in Europe in 2022. The rapid advancement of biologics and biosimilars has also contributed to this trend, as these therapies often require extensive early-phase testing. Additionally, regulatory incentives, such as the EMA’s Priority Medicines (PRIME) scheme, have encouraged drug developers to initiate Phase I trials earlier in the development process. These factors have positioned Phase I clinical research services as a key growth driver in the European CRO market.

By Therapeutic Area Insights

The Oncology segment represented the largest therapeutic area in the European CRO market by capturing 40.1% of the total market share in 2024. This is propelled by the high prevalence of cancer in Europe, with over 4 million new cases diagnosed annually, according to the European Cancer Information System (ECIS). The complexity of oncology trials, which often involve targeted therapies and combination regimens, necessitates the expertise of CROs. For instance, a study by the American Society of Clinical Oncology (ASCO) revealed that oncology trials require 30% more resources than trials in other therapeutic areas. Also, the increasing focus on personalized medicine, which tailors treatments to individual patients, has further amplified demand for oncology-specific CRO services.

Central nervous system (CNS) disorders are the quickest expanding therapeutic area, with a calculated CAGR of 8.2% in the coming years. This progress is influenced by the rising incidence of neurological disorders such as Alzheimer’s disease and Parkinson’s disease. As per the European Brain Council, neurological disorders affect over 179 million people in Europe, creating a significant unmet medical need. The complexity of CNS trials which often involve subjective endpoints and long follow-up periods requires specialized expertise from CROs. For example, a study by the International Society for CNS Clinical Trials and Methodology found that CNS trials have a 20% higher failure rate than trials in other therapeutic areas, highlighting the need for experienced CROs.

By End-User Insights

The pharmaceutical companies segment constituted the largest end-user segment and accounted for 60.6% of the European CRO market in 2024. This is linked to the increasing outsourcing of clinical trials by large pharmaceutical firms to reduce costs and enhance efficiency. For instance, a study by the Tufts Center for the Study of Drug Development found that outsourcing clinical trials can reduce timelines by up to 25%. Besides these, the growing pipeline of novel therapies, particularly in oncology and rare diseases, has increased the demand for CRO services among pharmaceutical companies.

Biopharmaceutical companies segment is moving ahead quickly in the end-user category, with a calculted CAGR of 10.5% from 2025 to 2033. This development is caused by the increasing focus on biologics and biosimilars, which require specialized expertise for clinical development. For example, a research by the Biotechnology Innovation Organization (BIO) revealed that biologics accounted for 30% of all new drug approvals in Europe in 2022. The complexity of biologics, which often involve novel mechanisms of action and unique manufacturing processes, necessitates the involvement of CROs. Also, regulatory incentives, such as the EMA’s Accelerated Assessment pathway, have encouraged biopharmaceutical companies to initiate clinical trials earlier in the development process.

COUNTRY LEVEL ANALYSIS

The UK dominated the European CRO space in 2024, with an estimated 27.4% market share in 2024. The UK’s prominence is driven by its robust pharmaceutical industry and favorable regulatory environment. For instance, the Medicines and Healthcare products Regulatory Agency (MHRA) has streamlined approval processes are reducing trial initiation timelines by 15%. Additionally, the UK government’s commitment to life sciences exemplified by the Life Sciences Vision 2030 initiative and has fostered innovation and investment in the sector. According to the Association of the British Pharmaceutical Industry (ABPI), the UK hosts over 1,000 clinical trials annually, making it a hub for CRO activity.

Germany remains vital for trials involving complex biologics, medical devices, and diagnostics. The country’s strong industrial base and advanced healthcare infrastructure have positioned it as a leader in clinical research. For example, Germany accounts for 25% of all clinical trials conducted in Europe, as per the German Association of Research-Based Pharmaceutical Companies (vfa). The country’s emphasis on precision medicine and digital health has further propelled demand for CRO services. Also, initiatives like the National Decade Against Cancer have prioritized oncology research, creating opportunities for CROs specializing in this area.

France is seeing steady growth in this market. The country’s progress is caused by its strong academic institutions and research networks, which facilitate collaboration between academia and industry. For instance, the French National Cancer Institute (INCa) has launched several initiatives to accelerate oncology research, driving demand for CRO services. According to the French Association for the Promotion of Research-Based Medicine (Leem), France hosts over 800 clinical trials annually. The focus on rare diseases, supported by the French National Plan for Rare Diseases, has also created a niche market for specialized CROs.

Spain is recording the highest growth momentum, with a CAGR of 7.1% in 2024. The nation’s strategic location and diverse patient population make it an attractive destination for multinational trials. For example, Spain accounts for 10% of all clinical trials conducted in Europe, as per the Spanish Society of Clinical Research (SEFC). The country’s emphasis on public-private partnerships has facilitated the growth of the CRO sector. According to the Spanish Federation of Pharmaceutical Laboratories (FENIN), collaborations between hospitals and CROs have improved trial efficiency by 20%. Besides these, Spain’s focus on infectious diseases, supported by the Carlos III Health Institute and has created opportunities for CROs in this therapeutic area.

Italy is steadily moving forward as a CRO destination. The country’s strong pharmaceutical industry and advanced healthcare system have positioned it as a key player in clinical research. For instance, Italy makes up 15% of all clinical trials conducted in Europe, as per the Italian Medicines Agency (AIFA). The country’s emphasis on cardiovascular research, supported by the Italian Society of Cardiology, has driven demand for CRO services. According to the Italian Association of Pharmaceutical Companies (Farmindustria), collaborations between universities and CROs have accelerated trial timelines by 25%. Further, Italy’s focus on rare diseases, supported by the National Rare Diseases Registry, has created a niche market for specialized CROs.

KEY MARKET PLAYERS

Companies playing a promising role in the Europe contract research organization (CRO) services market profiled in this report are Quintiles Transnational Holdings Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, PAREXEL International Corporation, ICON Plc, PRA Health Sciences Inc., InVentiv Health Inc., Charles River Laboratories International Inc., INC Research Holdings Inc., and Wuxi PharmaTech.

TOP LEADING PLAYERS IN THE MARKET

IQVIA

IQVIA is a global leader in the CRO market and is offering a comprehensive suite of services ranging from clinical trials to real-world evidence generation. The company’s advanced analytics platform, powered by artificial intelligence, enables clients to optimize trial design and execution. IQVIA’s strong presence in Europe is bolstered by its partnerships with leading pharmaceutical companies, facilitating the development of innovative therapies.

Parexel

Parexel is renowned for its expertise in early-phase clinical trials and regulatory consulting services. The company’s patient-centric approach and focus on digital health solutions have positioned it as a preferred partner for biopharmaceutical companies. Parexel’s extensive network of clinical sites across Europe enhances its ability to deliver high-quality services.

ICON plc

ICON plc specializes in full-service clinical research solutions, with a strong emphasis on oncology and rare diseases. The company’s innovative trial designs and advanced data analytics capabilities enable clients to achieve faster and more efficient drug development. ICON’s strategic acquisitions have expanded its service offerings and strengthened its market position in Europe.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Acquisitions

Key players in the European CRO market have adopted strategic acquisitions to expand their service portfolios and geographic reach. For instance, ICON plc acquired PRA Health Sciences in 2021, enhancing its capabilities in data-driven clinical research. This strategy allows companies to consolidate their market position and offer integrated solutions to clients.

Technological Innovation

Investment in technological innovation is another major strategy employed by CROs. Companies like IQVIA have developed AI-powered platforms to streamline clinical trial operations and improve data accuracy. These innovations not only enhance operational efficiency but also differentiate CROs in a competitive market.

Collaborative Partnerships

Collaborative partnerships with pharmaceutical companies and academic institutions have enabled CROs to access cutting-edge research and development opportunities. For example, Parexel’s partnership with the University of Oxford has facilitated the development of novel therapies in rare diseases, strengthening its market presence.

COMPETITION OVERVIEW

The European CRO market is characterized by intense competition, with a mix of global giants and regional players vying for market share. Companies like IQVIA, Parexel, and ICON plc dominate the landscape, leveraging their extensive expertise and technological capabilities to maintain their leadership positions. However, the market also features mid-sized and niche players, such as Medpace and Syneos Health, which cater to specific therapeutic areas or service segments. The competitive dynamics are shaped by factors such as technological innovation, strategic acquisitions, and collaborative partnerships. For instance, the adoption of AI and big data analytics has become a key differentiator, enabling CROs to offer more efficient and cost-effective solutions. Additionally, regulatory changes, such as the implementation of the EU Clinical Trials Regulation, have heightened the need for compliance expertise, further intensifying competition. The market’s fragmentation and the presence of numerous players underscore the importance of differentiation and specialization in achieving sustainable growth.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In April 2024, IQVIA announced the acquisition of a leading AI-driven data analytics firm, enabling the company to enhance its predictive modeling capabilities for clinical trials. This move is anticipated to strengthen IQVIA’s position as a leader in data-driven clinical research solutions.

- In June 2023, Parexel partnered with a major European university to establish a center of excellence for rare disease research. This collaboration aims to accelerate the development of therapies for underserved patient populations.

- In September 2022, ICON plc launched a new digital platform for decentralized clinical trials, allowing sponsors to conduct trials remotely and improve patient engagement. This innovation has positioned ICON as a pioneer in patient-centric trial designs.

- In March 2023, Medpace invested in expanding its laboratory services infrastructure in Germany, enhancing its ability to support complex clinical trials in oncology and immunology.

- In November 2022, Syneos Health acquired a specialized CRO focused on CNS disorders, broadening its therapeutic expertise and strengthening its market presence in Europe.

MARKET SEGMENTATION

This Europe contract research organization (CRO) services market research report is segmented and sub-segmented into the following categories.

By Type

- Clinical Research Services

- Phase I Clinical Research Services

- Phase II Clinical Research Services

- Phase III Clinical Research Services

- Phase IV Clinical Research Services

- Early-Phase Development Services

- Discovery Studies

- Chemistry, Manufacturing, & Control (CMC)

- Preclinical Services

- Pharmacokinetics/Pharmacodynamics (PK/PD)

- Toxicology Testing Services

- Other Preclinical Services

- Laboratory Services

- Bioanalytical Testing Services

- Analytical Testing Services

- Physical Characterization

- Raw Material Testing

- Batch-Release Testing

- Stability Testing

- Other Analytical Testing Services

- Consulting Services

By Therapeutic Area

- Oncology

- CNS

- Cardiovascular

By End-User

- Pharmaceutical

- Biopharmaceutical

- Medical Device Companies

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the companies playing a key role in the Europe CRO services market?

Quintiles Transnational Holdings Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, PAREXEL International Corporation, ICON Plc, PRA Health Sciences Inc., InVentiv Health Inc., Charles River Laboratories International Inc., INC Research Holdings Inc., and Wuxi PharmaTech are some of the notable presence in the Europe CRO services market.

Which country from Europe is expected to lead the Europe CRO services market?

Countries such as UK and Germany have higher chances to register the domination in the European CRO services market during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com