Europe Maritime Information Market Size, Share, Trends, & Growth Forecast Report By Application (Maritime Information Analytics, Maritime Information Provision, Vessel Tracking, and AIS (Automatic Identification System)), End User (Government and Commercial), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Maritime Information Market Size

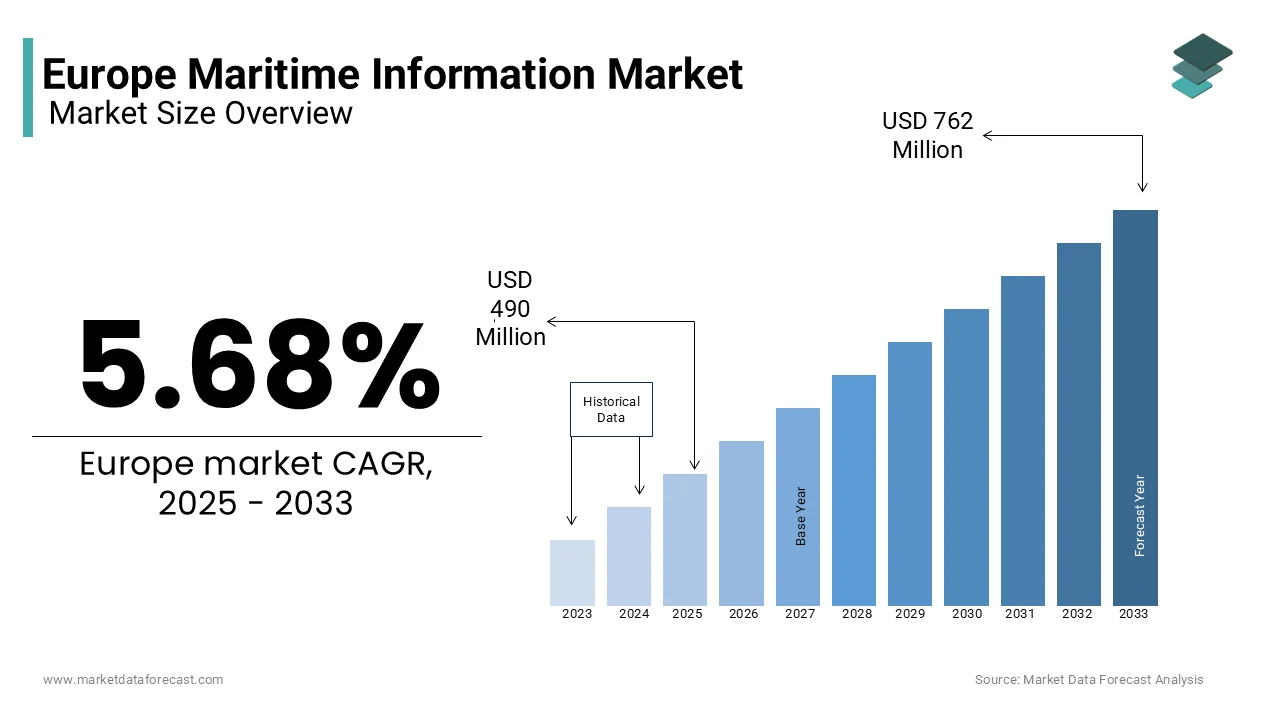

The Europe maritime information market was worth USD 464 million in 2024. The European market is projected to reach USD 762 million by 2033 from USD 490 million in 2025, rising at a CAGR of 5.68% from 2025 to 2033.

Maritime information refers to the collection, analysis, and dissemination of data related to marine activities, including vessel tracking, weather forecasting, port operations, and oceanographic research. The maritime information market leverages advanced technologies such as satellite-based Automatic Identification Systems (AIS), Geographic Information Systems (GIS), and Internet of Things (IoT) sensors to provide real-time insights into maritime operations. According to Eurostat, the maritime sector contributes approximately €500 billion annually to the EU economy, accounting for over 2% of its GDP and employing more than 4 million people.

The demand for accurate and actionable maritime information has surged due to increasing global trade volumes and stringent regulatory requirements. According to the European Maritime Safety Agency, more than 90% of Europe’s external trade is facilitated by maritime transport, underscoring the critical need for efficient data solutions. Furthermore, as per Statista, investments in maritime surveillance technologies are projected to grow significantly owing to the rising concerns over illegal fishing, piracy, and environmental protection. As per a report by the European Commission, digitalization initiatives, such as the EU’s Blue Economy Strategy, have accelerated the adoption of AI-driven analytics and predictive modeling in maritime operations. These innovations not only enhance operational efficiency but also support sustainable practices, aligning with Europe’s Green Deal objectives. As Europe continues to prioritize maritime safety, security, and sustainability, the maritime information market stands as a cornerstone of innovation, enabling smarter decision-making across diverse sectors.

MARKET DRIVERS

Growing Demand for Maritime Safety and Security Solutions in Europe

The increasing demand for maritime safety and security solutions is a significant driver of the European maritime information market. According to the European Maritime Safety Agency, over 80% of maritime accidents are linked to human error, which is underscoring the need for advanced data-driven systems to enhance situational awareness. With illegal activities such as smuggling and piracy costing Europe an estimated €10 billion annually, governments are investing heavily in surveillance technologies like satellite-based AIS and radar systems. Eurostat highlights that the EU has allocated over €2 billion to maritime security initiatives under programs like the Integrated Maritime Policy. Furthermore, the European Defence Agency notes that real-time vessel tracking systems have reduced response times to maritime threats by 35%. These advancements not only ensure compliance with international regulations but also safeguard Europe’s extensive coastline, which spans over 65,000 kilometers, making maritime safety a top priority.

Expansion of Global Trade and Port Digitalization Efforts

The expansion of global trade and the digital transformation of ports are further propelling the European maritime information market growth. According to Eurostat, maritime transport accounts for 74% of goods entering or leaving the EU, highlighting its critical role in global supply chains. To meet growing trade volumes, European ports are adopting smart port technologies, with investments exceeding €5 billion annually, as reported by the European Commission. The Port of Rotterdam, Europe’s largest port, has implemented IoT-based systems to optimize logistics, reducing vessel turnaround times by 20%. Additionally, the adoption of predictive analytics for port operations in Europe is anticipated to grow exponentially over the forecast period. These innovations improve operational efficiency, reduce congestion, and lower carbon emissions, aligning with Europe’s sustainability goals while addressing the rising complexity of global trade networks.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

High implementation costs of advanced maritime information systems is a significant restraint to the European maritime information market. According to the European Commission, the initial investment required for deploying satellite-based AIS, IoT sensors, and data analytics platforms can exceed €10 million per port or maritime authority. Such costs are particularly burdensome for smaller ports and regional operators, with Eurostat reporting that over 60% of European ports face budgetary limitations in adopting cutting-edge technologies. Additionally, the European Investment Bank notes that the lack of dedicated funding for small-scale digitalization projects has slowed progress in less-developed regions. These financial barriers hinder the widespread adoption of maritime information solutions, especially among SMEs operating in the sector. As a result, disparities in technological capabilities persist, limiting the overall efficiency and competitiveness of Europe’s maritime ecosystem.

Data Privacy and Cybersecurity Concerns

Data privacy and cybersecurity concerns are further hindering the growth of the European maritime information market. As per the European Union Agency for Cybersecurity (ENISA), cyberattacks on maritime infrastructure have increased by 40% over the past three years, targeting critical systems such as vessel tracking and port logistics. With the General Data Protection Regulation (GDPR) imposing strict rules on data handling, organizations face challenges in ensuring compliance while managing sensitive maritime information. Eurostat reveals that 55% of maritime stakeholders consider cybersecurity risks a barrier to adopting cloud-based data solutions. Furthermore, the European Maritime Safety Agency warns that inadequate protection of AIS data could lead to misuse, endangering maritime safety. These concerns not only increase operational complexity but also deter investments in digitalization, slowing the market’s growth potential.

MARKET OPPORTUNITIES

Integration of AI and Predictive Analytics for Sustainable Operations

The integration of artificial intelligence (AI) and predictive analytics is a lucrative opportunity for the European maritime information market. The European Commission highlights that AI-driven solutions can reduce fuel consumption by up to 15% through optimized route planning and vessel performance monitoring, aligning with the EU’s Green Deal objectives. Eurostat reports that the adoption of predictive maintenance systems in maritime operations could save €3 billion annually by minimizing equipment downtime and repair costs. Furthermore, the European Maritime Safety Agency emphasizes that AI-powered weather forecasting and oceanographic data analysis enhance safety and efficiency, particularly in offshore energy and fisheries. With investments in AI technologies projected to grow at a CAGR of 20% through 2030, according to Statista, the maritime sector is poised to leverage these innovations for sustainable practices. This shift not only supports environmental goals but also strengthens Europe’s leadership in green maritime solutions.

Expansion of Blue Economy Initiatives and Ocean Data Services

The expansion of blue economy initiatives is another major opportunity for the European maritime information market. The European Commission estimates that the blue economy contributes €650 billion annually to the EU GDP, with maritime data playing a crucial role in sectors like aquaculture, renewable energy, and coastal tourism. Eurostat highlights that over 40% of Europe’s population lives in coastal regions, driving demand for advanced ocean data services such as marine spatial planning and environmental monitoring. Additionally, the European Marine Observation and Data Network (EMODnet) reports that improved access to standardized maritime data has increased investment in sustainable projects by 25%. Statista projects that the global ocean data market will reach €2.8 billion by 2025, offering immense potential for European stakeholders. By capitalizing on these opportunities, the maritime information market can foster innovation and economic growth while addressing ecological challenges.

MARKET CHALLENGES

Fragmentation of Maritime Data Systems Across Regions

Fragmentation of maritime data systems across European regions is a major challenge to the maritime information market in Europe. The European Commission highlights that inconsistent data standards and interoperability issues hinder seamless information sharing between member states, particularly in cross-border operations. Eurostat reports that over 40% of maritime stakeholders face difficulties integrating data from multiple sources, leading to inefficiencies in logistics and surveillance. Additionally, the European Maritime Safety Agency notes that fragmented systems increase response times during emergencies, such as oil spills or search-and-rescue missions, by up to 30%. With 22 coastal member states operating under varying regulatory frameworks, achieving a unified approach remains a persistent obstacle. This lack of cohesion not only complicates compliance with international maritime laws but also limits the scalability of innovative solutions, undermining Europe’s potential to lead in global maritime digitalization efforts.

Environmental and Regulatory Pressures on Maritime Operations

Stringent environmental regulations and the increasing complexity of compliance requirements are further challenging the growth of the European maritime information market. The European Environment Agency reports that maritime activities contribute to 3% of global greenhouse gas emissions, prompting stricter emission control measures under the EU Green Deal. Eurostat reveals that 65% of shipping companies struggle to meet these evolving standards due to the high costs of adopting cleaner technologies and monitoring systems. Furthermore, the European Commission emphasizes that non-compliance with regulations, such as the International Maritime Organization’s sulfur cap, can result in fines exceeding €1 million per violation. These pressures are compounded by the need for real-time environmental monitoring, which requires significant investment in advanced sensors and data analytics. As regulatory scrutiny intensifies, balancing operational efficiency with sustainability remains a critical challenge for the maritime sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.68% |

|

Segments Covered |

By Application, End User, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Kpler, Spire Maritime, Spinergie, Kongsberg Maritime, Wärtsilä, StormGeo, Frequentis, and Windward. |

SEGMENTAL ANALYSIS

By Application Insights

The maritime information analytics segment accounted for the leading share of 35.7% of the European market in 2024. The growth of the maritime information analytics segment is driven by its ability to optimize operations and enhance decision-making through advanced data insights. According to Eurostat, 70% of large shipping companies use analytics for predictive maintenance, reducing operational costs by 25%. The European Maritime Safety Agency notes that analytics has improved weather forecasting accuracy by 30%, boosting navigation safety. With €5 billion in potential annual savings, this segment is critical for driving efficiency and sustainability. Its dominance underscores its pivotal role in transforming raw maritime data into strategic value, making it indispensable for Europe’s digitalized maritime ecosystem.

The AIS segment is anticipated to grow at the fastest CAGR of 14.2% over the forecast period owing to the regulatory mandates and increasing concerns over maritime security. The European Commission reports that AIS is used by 85% of maritime authorities to monitor vessel movements and prevent collisions. Eurostat highlights that AIS systems have reduced response times to emergencies by 35%, enhancing safety and compliance. Additionally, the European Defence Agency notes that AIS flagged over 10,000 suspicious vessels annually, combating illegal activities like piracy and smuggling. This segment’s importance lies in its dual role of ensuring transparency and safeguarding Europe’s maritime borders, making it a cornerstone of modern maritime operations.

By End User Insights

The commercial shipping segment occupied 31.9% of the European market share in 2024. The domination of the segment is attributed to its critical role in global trade, with maritime transport accounting for 74% of Europe’s external trade. The European Commission highlights that predictive analytics and AIS systems have reduced fuel consumption by 15%, enhancing sustainability. Additionally, 90% of large vessels use AIS for navigation safety and regulatory compliance, reducing accidents by 40%. With investments in digital solutions growing, this segment ensures efficient logistics and environmental alignment.

The business intelligence (BI) segment is estimated to showcase the fastest CAGR of 12.3% over the forecast period owing to the increasing need for data-driven decision-making in maritime operations. Eurostat reports that 60% of shipping companies use BI tools to optimize routes, predict maintenance, and reduce costs by 25%. The European Commission notes that BI enhances fleet utilization and profitability, aligning with sustainability goals. As global trade complexities rise, BI empowers stakeholders to analyze trends and improve competitiveness.

REGIONAL ANALYSIS

Germany led the maritime information market in 2024 by capturing 22.9% of the European market share in 2024. The growth of Germany in the European market is attributed to its robust maritime infrastructure, including the Port of Hamburg, which handles over 8 million TEUs annually, as highlighted by Eurostat. Germany’s emphasis on digitalization, supported by initiatives like the National AI Strategy, has accelerated the adoption of IoT and predictive analytics in port management and vessel tracking. The European Maritime Safety Agency notes that German ports have reduced operational inefficiencies by 25% through smart technologies. Furthermore, Germany’s strong manufacturing base drives demand for maritime data solutions in logistics and shipping. This strategic focus on innovation and efficiency solidifies Germany’s position as a leader in advancing maritime information technologies.

The Netherlands is another notable market for maritime information in Europe. The growth of Netherlands is driven by its world-class ports, such as Rotterdam, which processes over 460 million tons of cargo annually, making it Europe’s largest port. Eurostat highlights that Dutch investments in smart port technologies exceed €1 billion annually, enabling real-time vessel tracking and optimized logistics. The European Commission emphasizes that the Netherlands’ proactive approach to sustainability aligns with the EU Green Deal, reducing port emissions by 20%. Additionally, the Netherlands Maritime Technology Association reports a 30% increase in AI-driven maritime solutions over the past five years. These advancements underscore the country’s pivotal role in shaping Europe’s digital maritime landscape.

France is anticipated to account for a prominent share of the European market over the forecast period. The growth of France in the European market is fueled by its extensive coastline and strategic focus on maritime security and environmental protection. The European Defence Agency reports that France utilizes AIS and satellite systems to monitor over 11 million square kilometers of maritime zones, enhancing safety and countering illegal activities. Eurostat highlights that France’s investments in oceanographic research exceed €500 million annually, supporting applications like hydrographic charting and climate modeling. Furthermore, the French government’s Blue Economy initiative promotes sustainable practices, driving demand for advanced maritime data solutions. This dual focus on security and sustainability positions France as a key innovator in the maritime information market.

KEY MARKET PLAYERS

The major players in the Europe maritime information market include Kpler, Spire Maritime, Spinergie, Kongsberg Maritime, Wärtsilä, StormGeo, Frequentis, and Windward.

MARKET SEGMENTATION

This research report on the Europe maritime information market is segmented and sub-segmented into the following categories.

By Application

- Maritime Information Analytics

- Maritime Information Provision

- Vessel Tracking

- AIS (Automatic Identification System)

By End User

- Government

- Defense

- Intelligence and Security

- Search and Rescue

- Government Agency

- Others

- Commercial

- Port Management

- Business Intelligence

- Commercial Fishing

- Commercial Shipping

- Hydrographic and Charting

- Commercial Offshore

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the main applications of maritime information in Europe?

It is used for vessel tracking, fleet management, maritime security, environmental monitoring, logistics optimization, regulatory compliance, and risk assessment.

What technologies are driving the Europe Maritime Information Market?

AI, big data analytics, blockchain, cloud computing, and satellite-based tracking are transforming the way maritime information is collected, processed, and utilized.

How does maritime information contribute to sustainability efforts?

It enables fuel consumption optimization, emissions tracking, route efficiency planning, and compliance with EU green shipping regulations to reduce environmental impact.

What is the future outlook for the Europe Maritime Information Market?

The market is expected to grow with increased digitalization, enhanced real-time analytics, stronger cybersecurity measures, and greater integration with AI-driven automation for smarter maritime operations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]