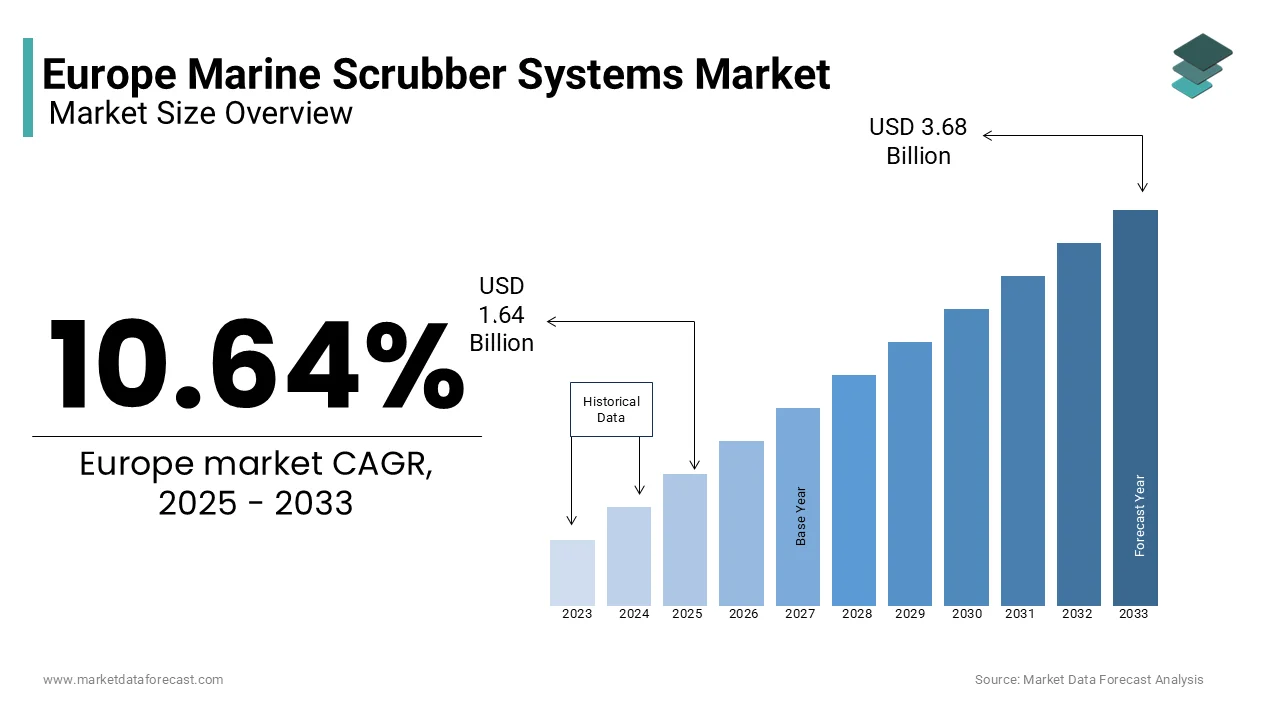

Europe Marine Scrubber Systems Market Size, Share, Trends, & Growth Forecast Report By Type (Wet Scrubber and Dry Scrubber), Installation, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Marine Scrubber Systems Market Size

The Europe marine scrubber systems market was worth USD 1.48 billion in 2024. The European market is projected to reach USD 3.68 billion by 2033 from USD 1.64 billion in 2025, growing at a CAGR of 10.64% from 2025 to 2033.

Marine scrubber systems, also known as exhaust gas cleaning systems (EGCS), are advanced technologies designed to remove harmful pollutants from ship exhaust gases by using water-based processes. These systems enable vessels to comply with the International Maritime Organization’s (IMO) global sulfur cap of 0.5% on marine fuels which came into effect in January 2020, and stricter limits of 0.1% in Sulphur Emission Control Areas (SECAs). According to the European Maritime Safety Agency, over 30% of ships operating in European waters have adopted scrubber systems as a cost-effective alternative to switching to low-sulfur fuels.

The European Union has been at the forefront of enforcing environmental standards, with its Monitoring, Reporting, and Verification (MRV) regulation mandating emission tracking for large vessels. As per the European Environment Agency, maritime transport accounts for approximately 13% of the EU’s total SOx emissions. As of 2023, countries like Norway, Germany, and the Netherlands lead in scrubber installations, driven by robust port infrastructure and government incentives. According to the International Energy Agency, open-loop scrubbers dominate the market due to their lower installation costs, although concerns about wastewater discharge have spurred innovations in hybrid and closed-loop systems. The marine scrubber systems market in Europe is poised for steady growth with the regulatory compliance and technological advancements.

MARKET DRIVERS

Stringent Environmental Regulations

One of the primary drivers of the Europe marine scrubber systems market is the implementation of stringent environmental regulations aimed at curbing sulfur oxide (SOx) emissions from maritime transport. The International Maritime Organization’s global sulfur cap of 0.5% on marine fuels, enforced since January 2020, has compelled shipowners to adopt compliance technologies like scrubber systems. According to the European Maritime Safety Agency, over 30% of ships operating in European waters have installed scrubbers to meet these regulatory requirements. Additionally, the Sulphur Emission Control Areas (SECAs) in Northern Europe enforce even stricter limits of 0.1%, further accelerating scrubber adoption. According to the European Environment Agency, maritime transport contributes approximately 13% of the EU’s total SOx emissions with the need for effective solutions. These regulations have created a robust demand for scrubber systems which is positioning them as a key enabler of sustainable shipping practices.

Economic Advantages Over Low-Sulfur Fuels

The economic advantage of marine scrubber systems compared to using low-sulfur fuels that is driving the growth rate of the market. According to the International Energy Agency, high-sulfur fuel oil (HSFO) remains significantly cheaper than low-sulfur alternatives, with price differences often exceeding $200 per ton. Shipowners can continue using HSFO while complying with emission regulations, resulting in substantial cost savings. According to the European Commission, retrofitting a vessel with a scrubber system typically costs between $2 million and $5 million, which can be recovered within 1-2 years through fuel savings. As per European Maritime Safety Agency, over 4,000 vessels globally have adopted scrubbers as of 2023 is driven with this financial incentive. This economic feasibility, coupled with long-term operational benefits, makes scrubber systems an attractive choice for shipowners seeking both compliance and profitability.

MARKET RESTRAINTS

Environmental Concerns Over Open-Loop Scrubber Discharge

The growing environmental concerns surrounding the discharge of wastewater from open-loop scrubbers is one of the key restraining factors for the market to growth. The European Environment Agency has raised alarms about the potential ecological impact of untreated washwater, which contains sulfur compounds, heavy metals, and particulate matter. Several European ports, including those in Germany and Belgium, have banned the use of open-loop scrubbers by forcing shipowners to adopt more expensive hybrid or closed-loop systems. According to the International Maritime Organization, approximately 80% of installed scrubbers are open-loop systems with these regulatory restrictions as a significant challenge. According to the European Commission, retrofitting vessels with alternative systems can cost an additional $1 million to $3 million per ship, which is creating financial burdens for operators. These environmental and regulatory pressures threaten the widespread adoption of scrubber technologies.

High Initial Investment Costs

The high initial investment required for installing marine scrubber systems is posing a barrier for smaller shipping companies that is ascribed to hinder the growth rate of the market. According to the European Maritime Safety Agency, retrofitting a single vessel with a scrubber system costs between $2 million and $5 million by depending on the ship's size and system type. For small and medium-sized enterprises (SMEs) in the maritime sector, this upfront expenditure is often prohibitive. Additionally, the International Energy Agency notes that financing such projects becomes even more challenging during economic downturns, as seen during the post-pandemic recovery phase in 2021-2022. According to the European Commission, many shipowners opt for low-sulfur fuels instead by citing lower capital requirements. This financial hurdle limits the broader adoption of scrubber systems across Europe’s diverse maritime fleet.

MARKET OPPORTUNITIES

Expansion of Hybrid and Closed-Loop Scrubber Technologies

The Europe marine scrubber systems market is posing various opportunities with the growing adoption of hybrid and closed-loop scrubber technologies which is driven by stricter environmental regulations. As per the European Environment Agency, these advanced systems address concerns over open-loop scrubber wastewater discharge by making them more acceptable in regulated zones like the Baltic and North Seas. According to the International Maritime Organization, hybrid scrubbers account for approximately 20% of global installations as of 2023, with projections indicating a steady rise due to their flexibility and compliance capabilities. According to the European Commission, ports in Germany and Sweden are incentivizing hybrid systems through subsidies. The demand for hybrid and closed-loop scrubbers presents a lucrative growth avenue with over 40% of European vessels expected to upgrade their systems by 2030.

Increasing Focus on Decarbonization and Green Shipping

Europe’s commitment to decarbonization and green shipping initiatives are driving investments in emission-reducing technologies like marine scrubbers which is adding fuel to the growth rate of the Europe marine scrubber systems market. As per the European Maritime Safety Agency, maritime transport accounts for nearly 13% of the EU’s sulfur oxide emissions is prompting governments to prioritize cleaner solutions. According to the European Commission’s Green Deal, reducing greenhouse gas emissions by 55% by 2030 is encouraging shipowners to adopt scrubbers alongside other low-carbon technologies. This focus on sustainability, coupled with rising investments in eco-friendly maritime infrastructure, positions scrubber systems as a key enabler of Europe’s transition to greener shipping practices.

MARKET CHALLENGES

Port Restrictions and Regulatory Uncertainty

Restrictions on open-loop scrubbers is creating regulatory uncertainty for shipowners that is a key challenge for the market growth in the coming years. According to the European Environment Agency, several major European ports, including those in Germany, Belgium, and Norway, have banned open-loop scrubber discharge due to environmental concerns over wastewater contaminants. These restrictions force shipowners to either switch to closed-loop or hybrid systems, which require significant investment, or avoid certain ports altogether. According to the International Maritime Organization, approximately 80% of installed scrubbers are open-loop systems are making these bans a substantial operational hurdle. As per the European Commission inconsistent regulations across ports create additional compliance challenges is complicating route planning and increasing costs for operators, thereby hindering market growth.

High Maintenance and Operational Costs

The high maintenance and operational costs associated with marine scrubber systems for closed-loop and hybrid variants is limiting the growth rate of the Europe marine scrubber systems market. As pet the European Maritime Safety Agency, maintaining closed-loop systems involves additional expenses for chemical additives and waste disposal, which can increase operational costs by up to 20%. Furthermore, the International Energy Agency estimates that annual maintenance costs for scrubber systems range between $100,000 and $300,000 per vessel, by depending on system complexity. For smaller shipping companies, these ongoing expenses can strain financial resources, especially during periods of economic volatility. The European Commission also notes that technical issues, such as corrosion and system malfunctions, further escalate maintenance burdens. These cost barriers limit the feasibility of scrubber adoption, particularly for older vessels or fleets operating on tight budgets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.64% |

|

Segments Covered |

By Type, Installation, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Alfa Laval AB, ANDRITZ, DuPont Clean Technologies, Damen Shipyards Group, Ecospray Technologies S.r.l., EGCSA Engineering Corp., Fuji Electric Co., Ltd., Green Tech Marine Engineering, Hug Engineering AG, KwangSung, Langh Tech Oy Ab, MITSUBISHI HEAVY INDUSTRIES, LTD., SAACKE GmbH, Valmet Corporation, and Wartsila Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

The wet scrubbers segment dominated the market by capturing 85% of the Europe marine scrubber systems market in 2024. Lower installation costs, ranging from $2 million to $4 million per vessel, and their effectiveness in reducing sulfur oxide (SOx) emissions are driving the growth rate of the segment. According to the International Energy Agency, wet scrubbers enable ships to use cost-effective high-sulfur fuel oil (HSFO) by saving operators up to $200 per ton compared to low-sulfur alternatives. Despite environmental concerns over wastewater discharge, their widespread adoption promotes their importance in ensuring regulatory compliance and maintaining economic viability for shipowners by making them a cornerstone of Europe’s emission reduction efforts.

The dry scrubbers segment is projected to witness a CAGR of 10.1% during the forecast period. This growth is driven by increasing restrictions on open-loop wet scrubbers, particularly in environmentally sensitive ports like those in Germany and Belgium. Dry scrubbers, which use alkaline sorbents to neutralize emissions, eliminate wastewater discharge concerns by aligning with stricter environmental regulations. According to the International Maritime Organization, dry scrubbers are gaining traction for smaller vessels and inland waterways, where space and environmental constraints are critical. Their rapid adoption leverages their importance in addressing sustainability challenges and offering eco-friendly alternatives in the Europe marine scrubber systems market.

By Installation Insights

The retrofit installations segment dominates the market and held 70% of Europe marine scrubber systems market in 2024. The urgent need to retrofit existing vessels to comply with International Maritime Organization (IMO) sulfur regulations without replacing entire fleets. According to the International Maritime Organization, retrofitting costs range from $2 million to $5 million per vessel, by making it a cost-effective solution compared to new builds. Despite challenges like operational downtime, this segment is critical for achieving short-term emission reductions among cargo and tanker vessels. Its dominance surges its importance in enabling Europe’s existing maritime fleet to meet environmental targets while optimizing economic feasibility.

The new builds segment is on the rise and is expected to be the fastest growing segment in the market by witnessing a CAGR of 12.4% during the forecast period. This growth is driven by the integration of advanced scrubber technologies during ship construction by ensuring compliance with stringent sulfur emission regulations from the outset. As per the International Energy Agency, installing scrubbers in new builds is $1 million to $2 million cheaper per vessel than retrofitting by making it an attractive option for shipbuilders. Additionally, new builds are increasingly adopting hybrid or closed-loop systems with Europe’s sustainability goals. This rapid expansion evaluates the segment’s role in shaping a future-ready, eco-friendly maritime fleet by supporting long-term decarbonization efforts in the shipping industry.

By Application Insights

The container ships segment was the largest and held 35% of total Europe marine scrubber systems market share in 2024. High fuel consumption and frequent operation in Sulphur Emission Control Areas (SECAs), where strict emission limits apply is attributed to fuel the growth rate of the market. According to the International Maritime Organization, container ships consume vast amounts of fuel, making scrubbers a cost-effective solution compared to switching to low-sulfur fuels, which can save operators up to $1 million annually per vessel. The adoption of scrubber systems is increasing as container ships handle over 40% of global trade volumes.

The cruisers segment is expected to exhibit a CAGR of 8.2% during the forecast period. The segment’s rapid growth is fueled by increasing regulatory scrutiny on passenger vessels and rising demand for eco-friendly tourism. According to the International Energy Agency, scrubber systems enable cruise operators to reduce sulfur emissions while avoiding the high costs of low-sulfur fuels by saving up to $200,000 annually per vessel. Scrubber adoption is vital for balancing environmental responsibility with expanding tourism demands. This segment’s growth elevates its importance in promoting sustainable practices within Europe’s maritime tourism sector with broader decarbonization goals.

REGIONAL ANALYSIS

Germany held 20% of Europe marine scrubber systems market in 2024. The country’s strategic focus on decarbonizing its maritime sector and its robust port infrastructure by including major hubs like Hamburg and Bremerhaven. According to the European Environment Agency, Germany has implemented stringent emission regulations by encouraging shipowners to adopt scrubber technologies. Additionally, government incentives for retrofitting vessels and investments in hybrid scrubber systems have accelerated adoption. Germany’s proactive approach to aligning with International Maritime Organization (IMO) standards leverages its commitment to sustainability by making it a key player in advancing eco-friendly shipping practices across Europe.

Sweden is expected to experience a CAGR of 8.6% during the forecast period. The innovative use of advanced scrubber technologies closed-loop and hybrid systems which address environmental concerns over wastewater discharge. According to the International Maritime Organization, Sweden’s ports, such as Gothenburg, have set strict emission standards that is driving scrubber adoption among vessels operating in the Baltic Sea. Furthermore, Sweden’s strong emphasis on renewable energy integration and sustainable maritime practices has fostered rapid market growth. As per European Commission, Sweden’s focus on green shipping aligns with broader EU decarbonization goals with its position as a pioneer in environmentally responsible maritime solutions.

The Netherlands is likely to grow at steady pace throughout the forecast period. The country’s dominance is supported by its world-class port infrastructure, the Port of Rotterdam, which is one of Europe’s busiest maritime hubs. According to the European Maritime Safety Agency, the Netherlands has implemented rigorous emission control measures, incentivizing scrubber installations to comply with Sulphur Emission Control Area (SECA) regulations. Additionally, the Dutch government provides subsidies for eco-friendly shipping technologies. The Netherlands’ strategic role in global trade and its commitment to reducing sulfur emissions gears up its importance in driving sustainable innovations within Europe’s maritim.

KEY MARKET PLAYERS

The major players in the Europe marine scrubber systems market include Alfa Laval AB, ANDRITZ, DuPont Clean Technologies, Damen Shipyards Group, Ecospray Technologies S.r.l., EGCSA Engineering Corp., Fuji Electric Co., Ltd., Green Tech Marine Engineering, Hug Engineering AG, KwangSung, Langh Tech Oy Ab, MITSUBISHI HEAVY INDUSTRIES, LTD., SAACKE GmbH, Valmet Corporation, and Wartsila Corporation.

MARKET SEGMENTATION

This research report on the Europe marine scrubber systems market is segmented and sub-segmented into the following categories.

By Type

- Wet Scrubber

- Dry Scrubber

By Installation

- New Builds

- RetroFit

By Application

- Bulk Containers

- Container Shio

- Oil Tankers

- Chemical Tankers

- Cruisers

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What types of marine scrubber systems are commonly used in the European market?

The most common types are open-loop, closed-loop, and hybrid scrubbers. Open-loop systems use seawater to clean emissions, closed-loop systems use chemicals and freshwater, while hybrid scrubbers can switch between both modes.

How do European environmental regulations impact the marine scrubber market?

Regulations such as the IMO 2020 sulfur cap, EU directives on air pollution, and country-specific bans on open-loop scrubbers significantly shape the market by influencing shipowners' decisions on compliance methods.

What is the expected growth trend of the marine scrubber systems market in Europe?

The market is expected to grow steadily due to rising demand for cleaner shipping operations, fleet retrofitting, and new ship orders complying with emissions standards.

What alternatives exist to marine scrubber systems for compliance in Europe?

Alternatives include switching to low-sulfur fuel oil (LSFO), using liquefied natural gas (LNG) as a marine fuel, and adopting advanced emission-reduction technologies such as hydrogen-based propulsion systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]