Europe Marine Propulsion Systems Market Size, Share, Trends & Growth Forecast Report – Segmented By Product, Power, Technology, Propulsion, Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Marine Propulsion Systems Market Size

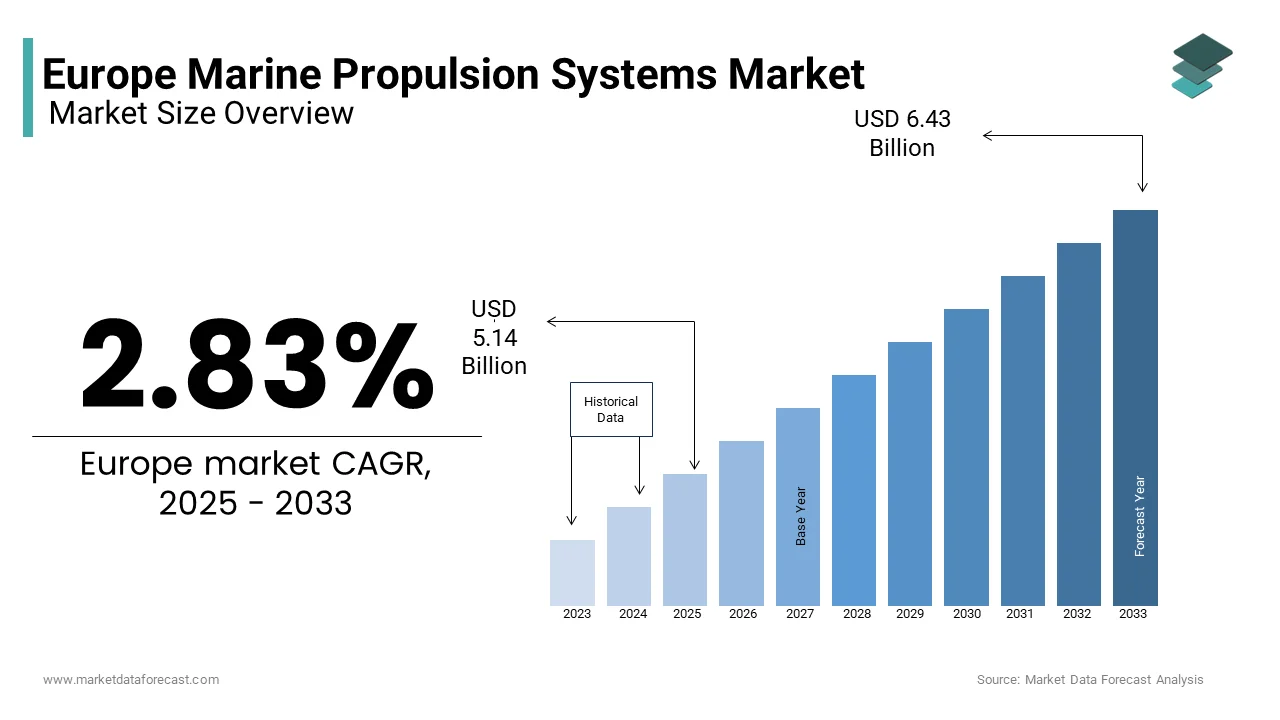

The Europe marine propulsion systems market size was valued at USD 5 billion in 2024 and is anticipated to reach USD 5.14 billion in 2025 from USD 6.43 billion by 2033, growing at a CAGR of 2.83% during the forecast period from 2025 to 2033.

Marine propulsion systems include engines, thrusters, turbines, and hybrid systems, which are integral to the operation of commercial ships, naval vessels, recreational boats, and offshore platforms. According to the European Maritime Safety Agency, the maritime sector contributes approximately €140 billion annually to Europe’s economy, with propulsion systems playing a pivotal role in ensuring operational efficiency and compliance with environmental regulations. According to the International Maritime Organization, over 70% of Europe’s trade is facilitated by maritime transport, which promotes the importance of advanced propulsion technologies.

According to the European Commission Directorate-General for Energy, the push toward decarbonization has accelerated the adoption of eco-friendly propulsion systems, such as LNG-powered engines and hybrid-electric solutions. According to Eurostat, the demand for cleaner fuels and energy-efficient systems has grown at a CAGR of 6.5% over the past five years, which is driven by stringent emission standards under the EU Green Deal. Countries like Germany, Norway, and the Netherlands are leading innovators by investing heavily in sustainable maritime technologies. The marine industry is poised for transformation with over 2,000 shipyards and 40,000 maritime enterprises across Europe. The marine propulsion systems market is evolving to meet the dual demands of sustainability and performance by shaping the future of Europe’s maritime landscape.

Market Drivers

Increasing Demand for Energy-Efficient Solutions

The push for energy-efficient and environmentally friendly marine propulsion systems is a key driver of the Europe marine propulsion systems market. According to the European Environment Agency, maritime transport contributes approximately 13% of global greenhouse gas emissions from transportation, which is prompting regulatory bodies like the International Maritime Organization (IMO) to enforce stricter emission standards. By 2030, the IMO aims to reduce carbon intensity by at least 40% compared to 2008 levels. This has accelerated the adoption of hybrid and electric propulsion technologies, particularly in countries like Germany and Norway. As per Eurostat, over €1 billion was invested in green shipping technologies in 2022 is reflecting the marine industry’s commitment to sustainability and compliance with environmental regulations.

Expansion of Maritime Trade Routes and Port Infrastructure

The growth of maritime trade routes and port infrastructure across Europe is significantly influences the Europe marine propulsion systems market. According to the European Commission, major ports such as Rotterdam, Hamburg, and Antwerp handle more than 500 million tons of cargo annually is driving demand for advanced propulsion solutions. As per the United Nations Conference on Trade and Development, powered engines and retrofitting older vessels are rising to meet sulfur emission limits enforced since 2020. These trends demonstrate how economic expansion and logistical requirements anticipate the adoption of innovative propulsion technologies.

MARKET RESTRAINTS

High Initial Costs of Advanced Propulsion Systems

The high initial investment required for advanced technologies is one of the restraints in the European marine propulsion systems market. According to the European Maritime Safety Agency, retrofitting vessels with hybrid or LNG-powered engines can cost up to €10 million per ship, depending on size and specifications. These costs are prohibitive for small and medium-sized shipping companies, limiting widespread adoption. According to the International Renewable Energy Agency (IRENA), only 20% of European shipping firms have allocated budgets for green technologies as of 2022. This economic barrier is further compounded by longer payback periods. These remain insufficient to address the scale of investment needed while governments offer subsidies, such as the EU’s €800 million Green Deal funding is hindering the rapid market growth.

Stringent Regulatory Compliance Challenges

The complexity and cost of adhering to stringent environmental regulations is hampering the growth rate of the Europe marine propulsion systems market. According to the European Environment Agency, compliance with the IMO’s sulfur cap, which limits sulfur content in marine fuels to 0.5%, has increased operational costs by 20-30% for shipping companies. Furthermore, according to the Eurostat, over 40% of European fleet operators struggle with meeting deadlines for emission reduction targets due to technical and financial limitations. Non-compliance risks penalties, but achieving full compliance requires extensive modifications, such as installing scrubbers or switching to cleaner fuels, which disrupt operations. According to the European Commission, nearly 15% of vessels inspected in 2021 failed to meet environmental standards with the challenges posed by regulatory pressures on the industry.

Market Opportunities

Growth of Offshore Renewable Energy Projects

The expansion of offshore renewable energy projects presents a significant opportunity for the European marine propulsion systems market. The European Commission reports that offshore wind capacity in Europe is expected to grow from 16 GW in 2021 to over 300 GW by 2050 is driven by ambitious climate goals under the European Green Deal. This growth necessitates specialized vessels equipped with advanced propulsion systems for installation, maintenance, and logistics. According to WindEurope, investments in offshore wind projects reached €43 billion in 2022 alone is creating demand for hybrid and electric propulsion technologies. These systems offer enhanced fuel efficiency and reduced emissions with sustainability targets.

Rising Demand for Autonomous and Smart Shipping Solutions

The increasing focus on autonomous and smart shipping solutions offers another opportunity for the European marine propulsion systems market. According to the European Maritime Safety Agency, autonomous vessels could reduce operational costs by up to 20% eventually to drive interest in advanced propulsion systems tailored for unmanned operations. Norway, for instance, launched the world’s first autonomous container ship, Yara Birkeland, in 2021 by showcasing the potential of integrated propulsion systems. Additionally, the European Commission emphasizes that digitalization initiatives under the EU’s Blue Economy Strategy will further boost investments in smart propulsion technologies, which is fostering market growth.

Market Challenges

Limited Infrastructure for Alternative Fuels

A significant challenge for the European marine propulsion systems market is the lack of widespread infrastructure to support alternative fuels like LNG, hydrogen, and biofuels. According to the European Environment Agency, only 10% of European ports currently have LNG bunkering facilities, despite the growing adoption of LNG-powered vessels. This infrastructure gap hinders the transition to cleaner propulsion technologies, as ships cannot efficiently refuel during operations. According to the International Energy Agency (IEA), investments in hydrogen fueling stations and biofuel production remain insufficient, with only €2 billion allocated across Europe in 2022. Without adequate infrastructure, shipping companies face operational uncertainties and higher costs. The European Commission acknowledges this issue but notes that scaling up alternative fuel networks requires coordinated efforts and long-term funding.

Technological Integration and Skill Gaps

The difficulty in integrating advanced propulsion technologies with existing vessel designs is coupled with a shortage of skilled personnel, which is a key challenge for the market players. According to the European Maritime Safety Agency, over 35% of maritime operators struggle with retrofitting older ships due to compatibility issues by leading to increased downtime and costs. According to Eurostat, the maritime sector faces a skills gap, with only 20% of current workforce trained in operating hybrid or electric propulsion systems as of 2022. This lack of expertise slows down technology adoption and increases reliance on external consultants. These challenges requires targeted training programs and standardized integration frameworks.

SEGMENTAL ANALYSIS

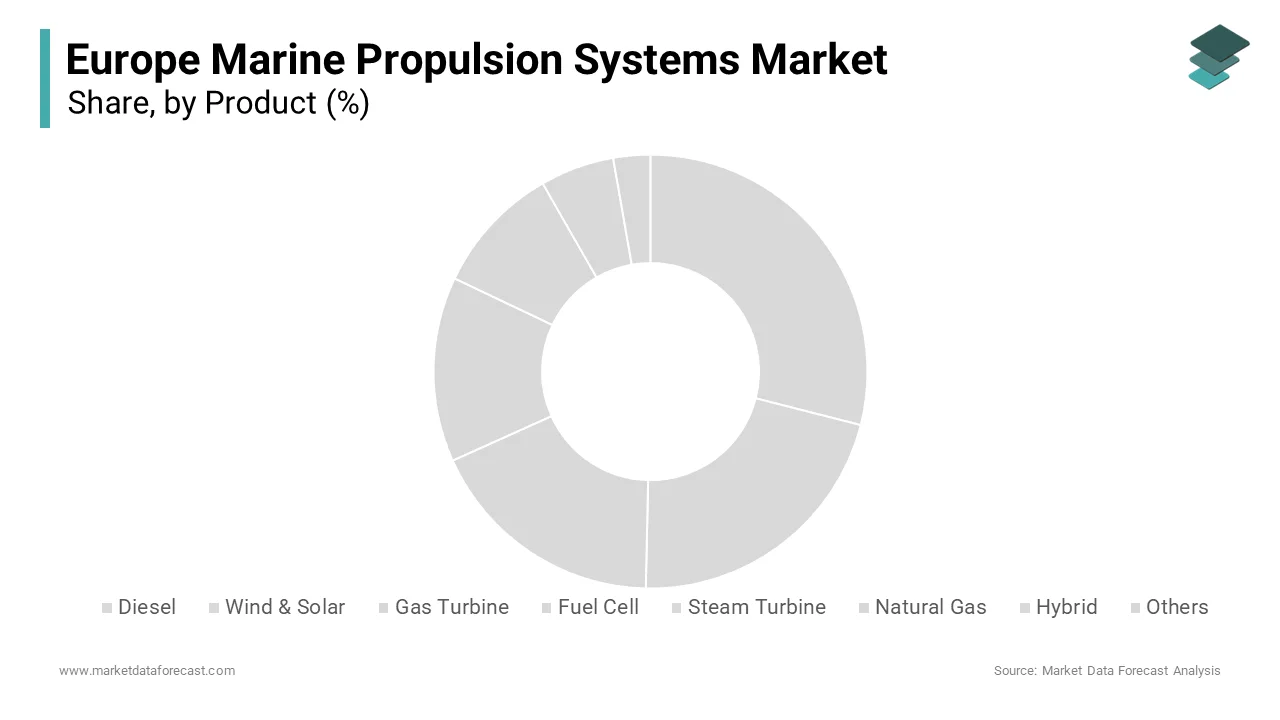

By Product

The Diesel propulsion systems segment dominated the market by capturing 75% of the share in the European marine propulsions systems market in 2024. According to the European Environment Agency, diesel remains integral to commercial shipping despite environmental concerns. Its importance lies in supporting Europe’s vast maritime trade network, where ports like Rotterdam handle 500 million tons of cargo annually. However, regulatory pressures are promoting for cleaner variants, such as low-sulfur diesel by ensuring its continued relevance while driving innovation.

The Hybrid propulsion systems segment is likely to experience a CAGR of 12.5% during the forecast period. This growth is fueled by stringent emission regulations such as the IMO’s sulfur cap, and rising demand for energy-efficient solutions. Norway leads adoption, with hybrid systems integrated into 25% of its domestic fleet, as per the Norwegian Maritime Authority. Investments in hybrid technologies exceeded €500 million in 2022 due to their ability to reduce fuel consumption by up to 30%. Their rapid growth rate is attributed to Europe’s shift toward sustainable shipping, which is making hybrids pivotal for achieving decarbonization goals under the EU Green Deal.

By Power

The 5,000 - 10,000 HP power range segment was the largest and held 40% of the European marine propulsion market. This range is widely used in medium-sized cargo vessels and ferries, which dominate regional trade routes. As per the European Maritime Safety Agency, this segment balances power and fuel efficiency by making it ideal for vessels operating in busy ports like Rotterdam, which handles over 500 million tons of cargo annually. Its importance lies in supporting Europe’s intra-regional shipping needs while adapting to emission regulations.

The > 20,000 HP segment is predicted to witness the fastest CAGR of 9.8% from 2025 to 2033. This growth is fueled by demand for large container ships and LNG carriers required for long-haul voyages. According to the European Commission, Europe’s share of global container traffic rose to 16% in 2021 by driving investments in high-power propulsion systems. Additionally, over €1 billion was invested in LNG-powered engines in 2022 by ensuring compliance with sulfur emission limits.

By Technology

The low-speed segment led the market by occupying 60% of the European marine propulsion systems market share in 2024. This segment is primarily used in large cargo ships and tankers operating on long-haul routes, where fuel efficiency is most important. As per the European Maritime Safety Agency, low-speed engines consume up to 30% less fuel than other types by making them cost-effective for global trade. Ports like Rotterdam, handling over 500 million tons of cargo annually and rely heavily on these vessels. Their importance lies in supporting Europe’s international trade while meeting IMO emission standards, as many are now compatible with LNG by ensuring compliance with decarbonization goals under the EU Green Deal.

The Medium-speed marine propulsion technology is expected to exhibit a noteworthy CAGR of 8.5% during the forecast period. This growth is driven by its versatility for regional shipping, including ferries and offshore support vessels. According to the European Commission, investments in hybrid medium-speed engines exceeded €700 million in 2022 by enabling compliance with stricter emission regulations. Norway’s adoption of medium-speed hybrid systems in 25% of its domestic fleet demonstrates their potential for sustainable shipping.

By Propulsion

The 2-stroke propulsion segment dominated the market by capturing 70% of the European marine propulsion market share in 2024. The large cargo ships and tankers operating on long-haul routes, where fuel efficiency is highly important, are ascribed to fuel the growth rate of this segment. According to the European Maritime Safety Agency, 2-stroke engines consume up to 25% less fuel than 4-stroke alternatives by making them cost-effective for global trade. Their importance lies in supporting Europe’s international trade while meeting IMO emission standards, as many are now compatible with LNG by ensuring alignment with decarbonization goals under the EU Green Deal.

The 4-stroke propulsion segment is significantly to grow with a projected CAGR of 10.2% in the foreseen years. This growth is fueled by its use in medium-sized vessels like ferries and offshore support ships, which require higher speed and adaptability. As per European Commission, investments in hybrid 4-stroke engines exceeded €600 million in 2022 with stricter emission regulations. Norway’s adoption of 4-stroke hybrid systems in 20% of its domestic fleet demonstrates their potential for sustainable shipping. Its rapid growth rate is due to its role in balancing performance, versatility, and environmental compliance that makes it pivotal for Europe’s transition to greener maritime technologies.

By Application

The merchant application segment was the largest and held 65% of the total Europe marine propulsion systems market share in 2024. This dominance is driven by the widespread use of container vessels, tankers, and bulk carriers, which form the backbone of global trade. According to the European Maritime Safety Agency, ports like Rotterdam and Hamburg handle over 500 million tons of cargo annually, primarily transported by merchant vessels. Container ships alone account for 40% of this segment by reflecting their critical role in Europe’s supply chain. The importance of merchant applications lies in supporting international trade while adapting to IMO emission standards, with increasing investments in LNG-powered and hybrid propulsion systems by ensuring compliance with decarbonization goals.

The cruise & ferry application segment is likely to experience a CAGR of 9.3% during the forecast period. This growth is fueled by rising demand for sustainable tourism and regional passenger transport. The European Commission notes that investments in hybrid and electric propulsion systems for ferries exceeded €500 million in 2022 due to Norway’s leadership in adopting zero-emission technologies. For instance, Norway’s fleet includes over 70 electric or hybrid ferries by showcasing their potential for green shipping. The demand in balancing passenger comfort, operational efficiency, and environmental compliance is expected to boost the growth rate of this segment.

COUNTRY LEVEL ANALYSIS

Germany marine propulsions systems market was the outperformer with 25% of share in 2024. According to the German Maritime Center, the country is a pioneer in hybrid and LNG-powered propulsion systems, with over €1 billion invested in R&D in 2022. Germany’s strategic focus on decarbonization aligns with EU Green Deal targets is driving innovation. Additionally, its advanced manufacturing capabilities and partnerships with global shipping companies enhance its dominance. The European Commission notes that Germany’s ports, like Hamburg, handle 140 million tons of cargo annually.

Norway is expected to be the most lucrative regions for Europe marine propulsions systems market and is predicted to expand with a CAGR of 9.5% throughput the forecast period. This country’s commitment to sustainable shipping, with over 70 electric or hybrid ferries already operational. As per International Energy Agency (IEA), Norway allocates €300 million annually to green shipping initiatives by fostering innovation in zero-emission propulsion systems. Norway’s fjords, designated as zero-emission zones by 2026 that further accelerate adoption of innovative technologies. The country’s expertise in offshore energy and partnerships with technology firms position it as a global leader. The European Environment Agency emphasizes Norway’s role in setting benchmarks for clean maritime solutions by making it a model for Europe’s transition to sustainable shipping.

The Netherlands marine propulsion systems market is esteemed to grow steadily during the forecast period. Its prominence is attributed to Rotterdam, Europe’s largest port, which handles over 500 million tons of cargo annually, which is driving demand for advanced propulsion systems. According to the Dutch Maritime Network, the country invests heavily in LNG and hybrid technologies, with €800 million allocated in 2022 for sustainable shipping projects. The Netherlands’ strategic location and robust infrastructure make it a key player in global trade. As per the European Commission its proactive approach to regulatory compliance by ensuring alignment with IMO standards.

KEY MARKET PLAYERS

AB Volvo Penta, ABB, Anglo Belgian Corporation, Caterpillar, Cummins, DAIHATSU DIESEL MFG.CO., DEUTZ AG, HHI Engine & Machinery, IHI Power Systems Co., Kawasaki Heavy Industries, MAN Energy Solutions, Mitsubishi Heavy Industries, Rolls-Royce, Scania. These are the market players that are dominating the Europe marine propulsion systems market.

MARKET SEGMENTATION

This research report on the Europe marine propulsion systems market is segmented and sub-segmented into the following categories.

By Product

- Diesel

- Wind & Solar

- Gas Turbine

- Fuel Cell

- Steam Turbine

- Natural Gas

- Hybrid

- Others

By Power

- 1,000 HP

- 1,000 - 5,000 HP

- 5,000 - 10,000 HP

- 10,000 - 20,000 HP

- > 20,000 HP

By Technology

- Low Speed

- Medium Speed

- High Speed

By Propulsion

- 2-Stroke

- 4-Stroke

By Application

- Merchant

- Container Vessels

- Tankers

- Bulk Carriers

- Roll On/Roll Off

- Others

- Offshore

- Drilling RIGS & Ships

- Anchor Handling Vessels

- Offshore Support Vessels

- Floating Production Units

- Platform Supply Vessels

- Cruise & Ferry

- Cruise Vessels

- Passenger Vessels

- Passenger/Cargo Vessels

- Others

- Nav

- Others

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe marine propulsions systems market?

The current market size of the Europe marine propulsion systems market was valued at USD 5.14 billion in 2025.

What are the market drivers that are driving the Europe marine propulsions systems market?

The Increasing demand for energy-efficient solutions and Expansion of maritime trade routes and port infrastructure are the market drivers that are driving the Europe marine propulsions systems market.

what challenges are faced by the Europe marine propulsions systems market?

Limited infrastructure for alternative fuels and Technological integration and skill gaps are the major challenges that are facing the Europe marine propulsions systems market.

Who are the market players that are dominating the Europe marine propulsions systems market?

AB Volvo Penta, ABB, Anglo Belgian Corporation, Caterpillar, Cummins, DAIHATSU DIESEL MFG.CO., DEUTZ AG, HHI Engine & Machinery, IHI Power Systems Co., Kawasaki Heavy Industries, MAN Energy Solutions, Mitsubishi Heavy Industries, Rolls-Royce, Scania.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com