Europe Marine Lubricants Market Size, Share, Trends & Growth Forecast Report By Base Stock (Mineral Oil, Synthetic Oil, Bio-Based Oils), Product Type, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Marine Lubricants Market Size

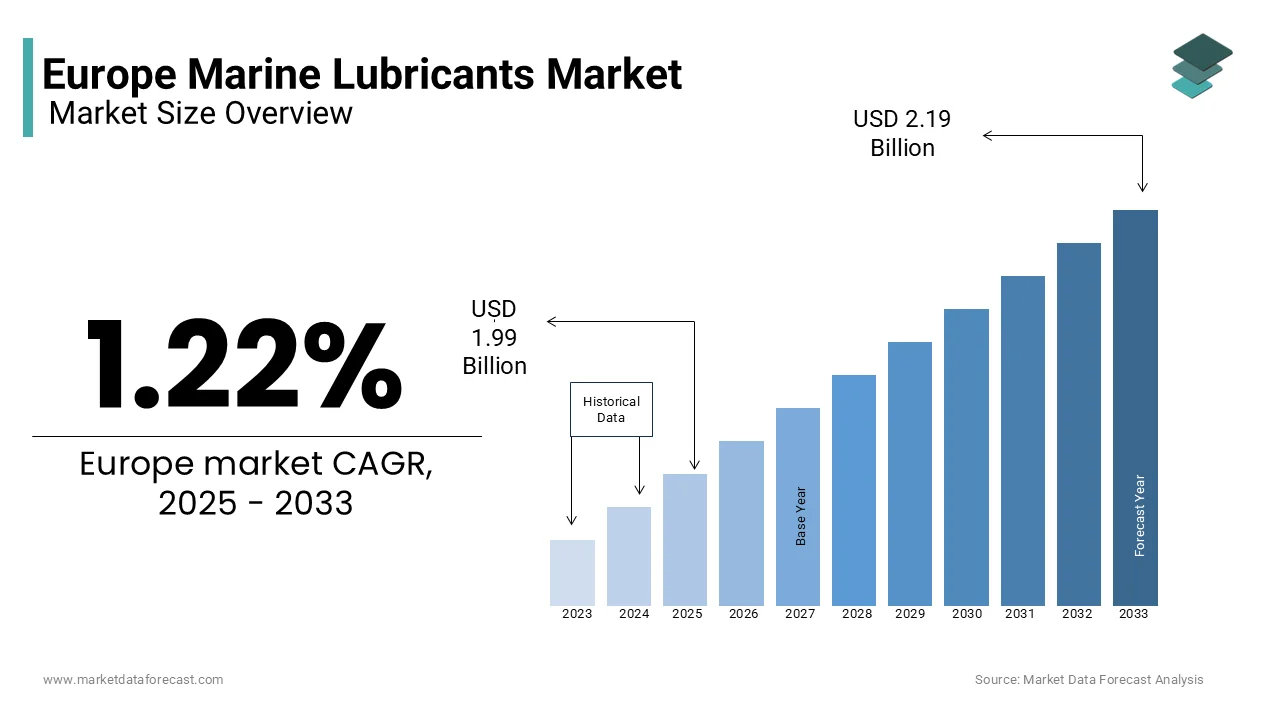

The Europe marine lubricants market size was valued at USD 1.97 billion in 2024. The European market is estimated to be worth USD 2.19 billion by 2033 from USD 1.99 billion in 2025, growing at a CAGR of 1.22% from 2025 to 2033.

Marine lubricants are specialized fluids designed to reduce friction, prevent wear, and enhance the performance of marine engines and machinery. These lubricants play a critical role in ensuring the efficient operation of vessels while minimizing maintenance costs and environmental impact. In Europe, the marine lubricants market is driven by stringent environmental regulations, increasing maritime trade, and advancements in vessel technology. According to the European Maritime Safety Agency, over 40% of European ports have adopted eco-friendly lubricants to comply with sulfur emission limits under the IMO 2020 regulation. The European Commission's Green Deal initiative emphasizes reducing carbon footprints in the maritime sector, further amplifying demand for sustainable marine lubricants.

MARKET DRIVERS

Stringent Environmental Regulations

Stringent environmental regulations governing maritime emissions is one of the key factors propelling the growth of the European marine lubricants market. According to the International Maritime Organization (IMO), the global shipping industry must reduce sulfur emissions by 85% under the IMO 2020 regulation, driving demand for low-sulfur and eco-friendly lubricants. Marine lubricants, particularly synthetic and bio-based oils, are extensively used in compliance with these regulations, ensuring reduced environmental impact. The European Commission reports that over 60% of European ports have transitioned to using advanced lubricants, reflecting their widespread adoption. This trend positions marine lubricants as a cornerstone of growth in the sustainable maritime sector, particularly for applications requiring compliance with stringent environmental standards.

Rising Demand for Sustainable Shipping Solutions

The escalating demand for sustainable shipping solutions is further boosting the growth of the European marine lubricants market. According to the European Maritime Safety Agency, the demand for bio-based and synthetic marine lubricants grew by 12% in 2022, driven by their ability to reduce greenhouse gas emissions and improve engine efficiency. Marine lubricants are pivotal in enabling the transition to eco-friendly shipping practices, particularly in regions with strict emission limits. The European Commission's Horizon Europe program emphasizes innovation in sustainable maritime technologies, further boosting demand for advanced marine lubricants. Additionally, the European Investment Bank projects that investments in green shipping technologies will reach €50 billion by 2030, underscoring the critical role of marine lubricants in enabling innovative and eco-friendly marine solutions.

MARKET RESTRAINTS

High Production Costs

High production costs associated with advanced marine lubricants is hampering the growth of the European market. According to the European Federation of Chemical Industries, the cost of producing synthetic and bio-based marine lubricants is approximately 30-40% higher than traditional mineral oils, limiting their affordability for small-scale operators. The European Maritime Safety Agency notes that over 60% of shipowners cite affordability as a primary barrier to adopting advanced lubricants, particularly in developing regions. Additionally, fluctuations in raw material prices, particularly base oils and additives, exacerbate this issue. According to the European Plastics Converters Association, the cost of these materials surged by 25% in 2022 due to supply chain disruptions, impacting profit margins. These financial barriers not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios.

Limited Awareness Among Small-Scale Operators

Limited awareness among small-scale operators regarding the benefits of advanced marine lubricants is another major restraint for the European market. According to the European Shipowners' Association, less than 40% of small and medium-sized enterprises (SMEs) in Europe utilize synthetic or bio-based marine lubricants in their vessels, creating a significant knowledge gap. The European Commission highlights that over 50% of SMEs struggle to adopt advanced lubricants due to insufficient training and education. Furthermore, the European Investment Bank reports that investments in workforce training programs for marine lubricant technologies remain insufficient, with only €5 billion allocated annually across the region. This lack of awareness not only slows the adoption of advanced marine lubricants but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive awareness initiatives.

MARKET OPPORTUNITIES

Advancements in Bio-Based Lubricants

Advancements in bio-based lubricants is a lucrative opportunity for the European marine lubricants market. According to the European Commission's Green Deal initiative, over 30% of marine manufacturers in Europe are transitioning to eco-friendly lubricants, driving demand for bio-based alternatives. Additionally, the European Technology Platform for Sustainable Chemistry highlights the increasing use of bio-based lubricants in green vessel construction, further amplifying demand. This opportunity positions bio-based marine lubricants as a critical enabler of Europe's sustainability goals, aligning with the region's commitment to reducing carbon footprints in the maritime sector.

Expansion into Emerging Markets

The growing focus on emerging markets is another promising opportunity for the European marine lubricants market. According to the European Maritime Safety Agency, the demand for advanced marine lubricants in the Mediterranean and Baltic Sea regions grew by 15% in 2022, driven by rapid urbanization and government initiatives to modernize maritime infrastructure. Marine lubricants are extensively used in ferry and inland vessel operations, where they provide reliable and eco-friendly solutions. Additionally, the European Commission supports the development of sustainable maritime solutions in emerging economies, amplifying the need for advanced marine lubricants. This opportunity underscores the immense potential for market expansion in high-growth regions.

MARKET CHALLENGES

Technological Limitations

Technological limitations surrounding the recyclability and disposal of marine lubricants pose a major challenge to the European market. According to the European Environment Agency, over 40% of marine lubricant projects face delays due to issues such as limited recycling infrastructure and end-of-life disposal concerns. The European Commission reports that compliance costs for advanced recycling technologies have risen by 20% over the past three years, limiting affordability for small-scale operators. These technological hurdles not only hinder market growth but also deter new entrants, constraining overall expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.22% |

|

Segments Covered |

By Base Stock, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

BP plc, Total S.A., Royal Dutch Shell plc, Chevron Corporation, and Exxon Mobil Corporation. The other players in the value chain (and not in the report) include Valvoline Inc., Sinopec, Synforce Lubricants, Castrol, and Lukoil, and others. |

SEGMENTAL ANALYSIS

By Base Stock Insights

The mineral oil segment dominated the market by accounting for 51.7% of the European market share in 2024. The leading position of mineral oil segment in the European market is attributed to its widespread use in traditional marine engines, where it provides cost-effective and reliable lubrication. The European Commission reports that over 60% of mineral oils consumed in Europe are utilized in cargo vessels and tankers, reflecting their widespread adoption. The versatility and affordability of mineral oils ensure their sustained dominance in the market, particularly for applications requiring compliance with basic performance standards.

The synthetic oil segment is expected to progress at a CAGR of 12.7% over the forecast period owing to the increasing adoption in high-performance marine applications, such as luxury yachts and cruise ships, where it provides superior thermal stability and durability. Additionally, the European Commission's Green Deal initiative supports the development of sustainable marine solutions, amplifying the need for advanced materials like synthetic oils. This trend positions synthetic oils as a key driver of innovation in the European market.

By Product Type Insights

The system oil segment accounted for 40.3% of the European market share in 2024. The leading position of system oil segment in the European market is driven by its extensive use in marine diesel engines, where it provides superior lubrication and reduces wear and tear. The European Commission reports that over 60% of system oils consumed in Europe are utilized in cargo vessels and tankers, reflecting their widespread adoption. The versatility and reliability of system oils ensure their sustained dominance in the marine lubricants sector.

The marine cylinder lubricants segment is predicted to witness a CAGR of 9.88% over the forecast period owing to the increasing demand for advanced lubricants in large-scale vessels, such as container ships and bulk carriers, where they provide superior protection against corrosion and wear. Additionally, the European Commission's Green Deal initiative supports the development of sustainable marine solutions, amplifying the need for advanced materials like marine cylinder lubricants. This trend positions marine cylinder lubricants as a key driver of innovation in the European market.

REGIONAL ANALYSIS

Germany led the European marine lubricants market in 2024 by capturing 26.7% of the regional market share. The robust shipbuilding industry and strong emphasis on sustainable maritime practices of Germany are majorly driving the German marine lubricants market growth. The German Federal Ministry for Economic Affairs and Climate Action reports that over 60% of German shipyards utilize advanced marine lubricants, reflecting the region's leadership in adopting eco-friendly solutions. Additionally, Germany's strategic investments in green maritime technologies create a favorable environment for market growth, aligning with the European Green Deal initiative.

France accounted for the second largest share of the European marine lubricants market in 2024 and is anticipated to witness a healthy CAGR over the forecast period. The solid presence of France in the luxury yacht and cruise ship manufacturing sectors is boosting the adoption of marine lubricants in France and contributing to the French market expansion. As per the French Ministry of Ecology, the growing use of advanced lubricants in sustainable vessel construction, while the French Environment Agency reports a 15% annual increase in their use in high-performance applications. Furthermore, France's focus on eco-friendly solutions boosts the use of advanced marine lubricant technologies are driving the French market growth.

The marine lubricants market in the UK is expected to account for a prominent share of the European market over the forecast period. The growing maritime sector of the UK is one of the major factors boosting the UK market expansion. The UK government's commitment to sustainable shipping supports the use of high-performance marine lubricants, ensuring steady market growth. Additionally, the UK's investment in advanced maritime technologies amplifies its leadership in producing eco-friendly

KEY MARKET PLAYERS

The major key players in Europe marine lubricants market are BP plc, Total S.A., Royal Dutch Shell plc, Chevron Corporation, and Exxon Mobil Corporation. The other players in the value chain (and not in the report) include Valvoline Inc., Sinopec, Synforce Lubricants, Castrol, and Lukoil.

MARKET SEGMENTATION

This research report on the Europe marine lubricants market is segmented and sub-segmented into the following categories.

By Base Stock

- Mineral Oil

- Synthetic Oil

- Bio-Based Oils

By Product Type

- System Oil

- Marine Cylinder Lubricants

- Trunk Piston Engine Oil

- Gear Oil

- Greases Hydraulic Fluids

- Other Product Types (Compressor and Refrigeration Oils, Steam Turbine Oils, etc.)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth rate of the Europe marine lubricants market from 2025 to 2033?

The European marine lubricants market is expected to grow at a CAGR of 1.22% from 2025 to 2033.

2. What are the primary drivers of the Europe marine lubricants market?

The market is driven by the increasing demand for maritime transport and the need for efficient vessel operations. However, it faces challenges such as the rise in idle ships and fluctuating raw material prices

3. Which countries are leading the marine lubricants market in Europe?

Germany is expected to dominate the market due to its robust shipbuilding industry

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]