Europe Marine Composites Market Size, Share, Trends, & Growth Forecast Report By Composite Type (Metal Matrix Composite (MMC), Ceramic Matrix Composite (CMC), and Polymer Matrix Composite (PMC)), Fiber Type, Resin Type, Vessel Type, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Marine Composites Market Size

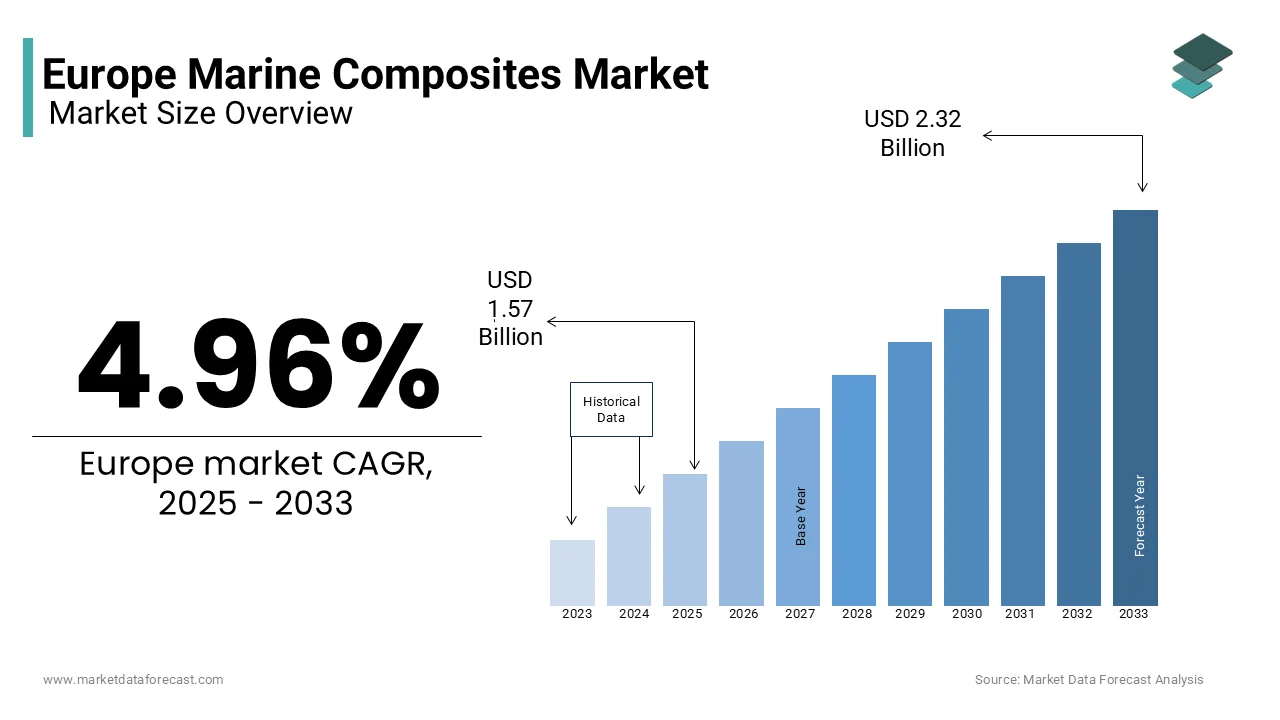

The Europe marine composites market was worth USD 1.50 billion in 2024. The European market is projected to reach USD 2.32 billion by 2033 from USD 1.57 billion in 2025, rising at a CAGR of 4.96% from 2025 to 2033.

Marine composites are advanced materials used in the construction of marine vessels and structures, offering superior strength-to-weight ratios, corrosion resistance, and durability. These materials are typically composed of a matrix (such as polymer, metal, or ceramic) reinforced with fibers like glass, carbon, or aramid. In Europe, the marine composites market is driven by increasing demand for lightweight and fuel-efficient vessels, advancements in material science, and stringent environmental regulations governing maritime emissions. According to the European Maritime Safety Agency, over 40% of new marine vessels in Europe incorporate composite materials, reflecting their widespread adoption. The European Commission's Green Deal initiative emphasizes reducing carbon footprints in the maritime sector, further amplifying demand for eco-friendly marine composites.

MARKET DRIVERS

Rising Demand for Lightweight Vessels in Europe

The growing demand for lightweight vessels is major factor driving the growth of the European marine composites market. According to the European Maritime Safety Agency, lightweight materials reduce vessel weight by up to 30%, resulting in improved fuel efficiency and reduced greenhouse gas emissions. Marine composites, particularly polymer matrix composites (PMCs), are extensively used in the construction of power boats, sailboats, and cruise ships due to their superior strength-to-weight ratio and corrosion resistance. According to the European Commission, over 60% of marine manufacturers in Europe have adopted composites to comply with emission reduction targets, reflecting their widespread adoption. This trend positions marine composites as a cornerstone of growth in the sustainable maritime sector.

Stringent Environmental Regulations

Stringent environmental regulations governing maritime emissions is another major factor propelling the growth of the European marine composites market. According to the International Maritime Organization (IMO), the global shipping industry must reduce sulfur emissions by 85% under the IMO 2020 regulation, driving demand for eco-friendly materials like marine composites. The European Commission's Horizon Europe program emphasizes innovation in sustainable maritime technologies, further boosting demand for marine composites.

MARKET RESTRAINTS

High Production Costs

High production costs associated with marine composites is a significant restraint for the European market growth. According to the European Federation of Chemical Industries, the cost of producing marine composites is approximately 40-50% higher than traditional materials like steel and aluminum, limiting their affordability for small-scale manufacturers. The European Maritime Safety Agency notes that over 60% of shipbuilders cite affordability as a primary barrier to adopting marine composites, particularly in low-budget projects. Additionally, fluctuations in raw material prices, particularly resins and fibers, exacerbate this issue. According to the European Plastics Converters Association, the cost of these materials surged by 25% in 2022 due to supply chain disruptions, impacting profit margins. These financial barriers not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios.

Limited Awareness Among Small-Scale Manufacturers

Limited awareness among small-scale manufacturers regarding the benefits of marine composites is hindering the growth of the Europe marine composites market. According to the European Shipbuilders' Association, less than 40% of small and medium-sized enterprises (SMEs) in Europe utilize marine composites in their vessel construction projects, creating a significant knowledge gap. The European Commission highlights that over 50% of SMEs struggle to adopt advanced materials due to insufficient training and education. This lack of awareness not only slows the adoption of marine composites but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive awareness initiatives.

MARKET OPPORTUNITIES

Advancements in Sustainable Resin Technologies

Advancements in sustainable resin technologies is a lucrative opportunity for the European marine composites market. According to the European Commission's Green Deal initiative, over 30% of marine manufacturers in Europe are transitioning to eco-friendly resins, such as bio-based epoxies and thermoplastics, driving demand for sustainable marine composites. Additionally, the European Technology Platform for Sustainable Chemistry highlights the increasing use of marine composites in green vessel construction, further amplifying demand. This opportunity positions marine composites as a critical enabler of Europe's sustainability goals, aligning with the region's commitment to reducing carbon footprints in the maritime sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.96% |

|

Segments Covered |

By Composite Type, Fiber Type, Resin Type , Vessel Type, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Toray Industries, Inc., Owens Corning, Nippon Electric Glass Co., Ltd., Huntsman International LLC, SGL Carbon SE, Hexcel Corporation, DowDuPont Inc., Compagnie de Saint-Gobain S.A., Weyerhaeuser Company, Momentive Performance Materials, Inc., Solvay SA, China Jushi Co., Ltd., 3A Composites GmbH (Schweiter Technologies), GMS Composites, Gurit AG, Hyosung Marine Co. Ltd., Teijin Limited, and Zoltek Corporation (Toray Industries). |

SEGMENTAL ANALYSIS

By Composite Type Insights

The polymer matrix composites segment captured the leading share of 60.8% of the European market share in 2024. The leading position of polymer matrix composites segment in the European market is attributed to their widespread use in marine vessel construction, where they provide superior strength-to-weight ratios and corrosion resistance. According to the European Commission, more than 70% of PMCs consumed in Europe are utilized in power boats and sailboats, reflecting their widespread adoption. The versatility and reliability of PMCs ensure their sustained dominance in the market, particularly for applications requiring compliance with stringent performance standards.

The ceramic matrix composites segment is anticipated to register a notable CAGR of 12.2% over the forecast period owing to the increasing adoption in high-performance marine applications, such as offshore wind energy platforms and naval vessels, where they provide superior thermal stability and durability. Additionally, the European Commission's Green Deal initiative supports the development of sustainable marine solutions, amplifying the need for advanced materials like CMCs. This trend positions CMCs as a key driver of innovation in the European market.

By Fiber Type Insights

The glass fiber segment had the largest share of 50.9% of the European market in 2024. The extensive use of glass fiber in marine vessel construction, where it provides superior strength, flexibility, and cost-effectiveness is primarily boosting the growth of the European market. According to the European Commission, more than 60% of glass fibers consumed in Europe are utilized in power boats and sailboats, reflecting their widespread adoption. The versatility and reliability of glass fibers ensure their sustained dominance in the marine composites sector.

The carbon fiber segment is anticipated to register a promising CAGR of 15.5% over the forecast period owing to the increasing demand for lightweight and high-strength materials in luxury yachts and cruise ships, where carbon fiber provides superior performance and aesthetics. Additionally, the European Commission's Green Deal initiative supports the development of sustainable marine solutions, amplifying the need for advanced materials like carbon fiber. This trend positions carbon fiber as a key driver of innovation in the European market.

By Resin Type Insights

The polyester resins segment occupied 45.7% of the European market share in 2024. The growth of the polyester resins segment in the European market is attributed to their widespread use in marine vessel construction, where they provide superior durability, chemical resistance, and cost-effectiveness. According to the European Commission, over 60% of polyester resins consumed in Europe are utilized in power boats and sailboats, reflecting their widespread adoption. The versatility and reliability of polyester resins ensure their sustained dominance in the market.

The epoxy resins segment is estimated to register a CAGR of 10.7% over the forecast period due to the increasing adoption in high-performance marine applications, such as luxury yachts and offshore structures, where they provide superior adhesion and mechanical properties. Additionally, the European Commission's Green Deal initiative supports the development of sustainable marine solutions, amplifying the need for advanced materials like epoxy resins. This trend positions epoxy resins as a key driver of innovation in the European market.

By Vessel Type Insights

The power boats segment accounted for 40.7% of the European market share in 2024. The growth of the power boats segment is majorly driven by the extensive use of marine composites in power boat construction, where they provide superior strength-to-weight ratios, corrosion resistance, and fuel efficiency. The European Commission reports that over 60% of power boats manufactured in Europe incorporate advanced composites, reflecting their widespread adoption. The versatility and reliability of marine composites ensure their sustained dominance in the power boat sector, particularly for applications requiring compliance with stringent performance standards.

The cruise ships segment is predicted to register a CAGR of 8.8% over the forecast period due to the increasing demand for large-scale, eco-friendly vessels in the tourism industry, where marine composites are extensively used to reduce weight and improve fuel efficiency. The European Commission's Green Deal initiative supports the development of sustainable cruise ship technologies, further amplifying demand for marine composites. This trend positions cruise ships as a key driver of innovation in the European market, particularly for applications requiring compliance with stringent environmental regulations.

REGIONAL ANALYSIS

Germany dominated the marine composites market in Europe by accounting for the leading share of the regional market in 2024. The prominence of Germany in the European market is attributed to the country's robust shipbuilding industry and strong emphasis on sustainable maritime practices. The German Federal Ministry for Economic Affairs and Climate Action reports that over 60% of German shipyards utilize marine composites in vessel construction, reflecting the region's leadership in adopting advanced materials. Additionally, Germany's strategic investments in green maritime technologies create a favorable environment for market growth, aligning with the European Green Deal initiative.

France is another prominent regional segment for marine composites and occupied a significant share of the European market in 2024. The presence of France in the luxury yacht and cruise ship manufacturing sectors drives marine composite adoption in France. According to the French Ministry of Ecology, the growing use of marine composites in sustainable vessel construction, while the French Environment Agency reports a 15% annual increase in their use in high-performance applications. Furthermore, France's focus on eco-friendly solutions boosts the use of advanced marine composite technologies, underscoring the segment's importance.

The UK is expected to register a notable CAGR in the European market over the forecast period. The growing maritime sector and the robust recreational boating and commercial shipping industries are promoting the demand for marine composites in the UK. The UK government's commitment to sustainable shipping supports the use of high-performance marine composites, ensuring steady market growth. Additionally, the UK's investment in advanced maritime technologies amplifies its leadership in producing eco-friendly marine composite solutions, aligning with global trends toward sustainability.

KEY MARKET PLAYERS

The major players in the Europe marine composites market include Toray Industries, Inc., Owens Corning, Nippon Electric Glass Co., Ltd., Huntsman International LLC, SGL Carbon SE, Hexcel Corporation, DowDuPont Inc., Compagnie de Saint-Gobain S.A., Weyerhaeuser Company, Momentive Performance Materials, Inc., Solvay SA, China Jushi Co., Ltd., 3A Composites GmbH (Schweiter Technologies), GMS Composites, Gurit AG, Hyosung Marine Co. Ltd., Teijin Limited, and Zoltek Corporation (Toray Industries).

MARKET SEGMENTATION

This research report on the Europe marine composites market is segmented and sub-segmented into the following categories.

By Composite Type

- Metal Matrix Composite (MMC)

- Ceramic Matrix Composite (CMC)

- Polymer Matrix Composite (PMC)

By Fiber Type

- Glass Fiber

- Carbon Fiber

- Aramid Fiber

- Natural Fiber

- Others

By Resin Type

- Polyester

- Vinyl Ester

- Epoxy

- Thermoplastic

- Phenolic

- Acrylic

- Others

By Vessel Type

- Power Boats

- Sailboats

- Cruise Ships

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe marine composites market?

The market is driven by increasing demand for lightweight, corrosion-resistant materials in shipbuilding, growing adoption of composites in recreational boating, and stringent environmental regulations promoting fuel efficiency.

What are the major applications of marine composites in Europe?

Marine composites are used in applications such as hulls, decks, bulkheads, masts, propellers, and interior components of boats, yachts, naval vessels, and commercial ships.

What are the advantages of using marine composites over traditional materials like steel and aluminum?

Marine composites offer advantages such as high strength-to-weight ratio, corrosion resistance, lower maintenance costs, improved fuel efficiency, and design flexibility compared to steel and aluminum.

What are the latest trends shaping the Europe marine composites market?

Key trends include the rising adoption of carbon fiber composites in high-performance boats, increasing research into bio-composites, advancements in automated composite manufacturing, and the development of hybrid composite materials for enhanced durability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com