Europe Marine Coatings Market Size, Share, Trends, & Growth Forecast Report By Resin Type (Epoxy, Alkyd, Polyurethane, and Others), Product Type, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Marine Coatings Market Size

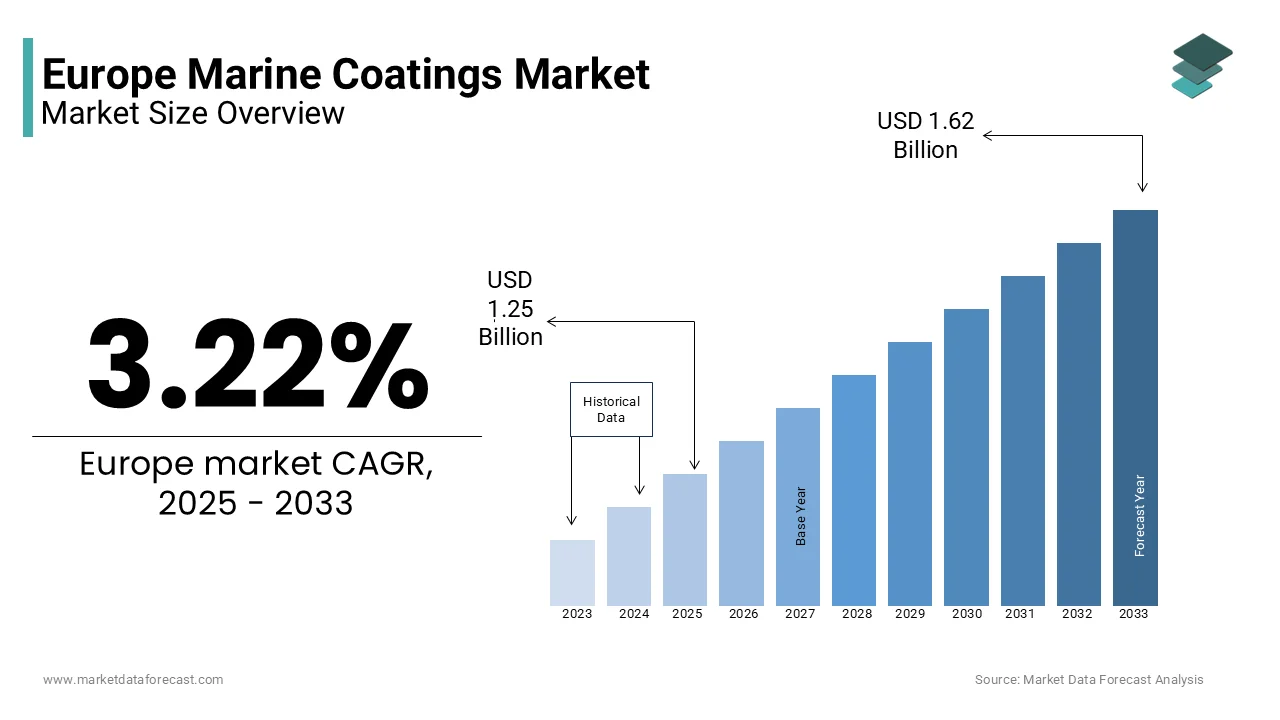

The Europe marine coatings market was worth USD 1.21 billion in 2024. The European market is expected to reach USD 1.62 billion by 2033 from USD 1.25 billion in 2025, rising at a CAGR of 3.22% from 2025 to 2033.

Marine coatings are coatings specifically designed for marine vessels and structures. These coatings serve multiple purposes, including protection against corrosion, fouling, and environmental degradation, while also enhancing the aesthetic appeal of ships and boats. The market encompasses a wide range of products, including anti-corrosion coatings, antifouling coatings, and specialty coatings, each tailored to meet the unique challenges posed by marine environments. The European marine coatings market is characterized by various application methods, including solvent-borne, water-borne, and powder coatings, each offering distinct advantages in terms of performance and environmental impact. The increasing focus on sustainability and regulatory compliance is propelling the demand for eco-friendly coating solutions, particularly water-borne and low-VOC coatings, which are becoming increasingly popular among manufacturers. As the marine industry continues to evolve, the demand for high-quality marine coatings is anticipated to rise, positioning this market for significant expansion in the coming years.

MARKET DRIVERS

Growing Demand for Sustainable Solutions in Europe

The growing demand for sustainable solutions in the marine industry is one of the key factors driving the growth of the Europe marine coatings market. As environmental concerns become more pronounced, shipbuilders and operators are increasingly seeking coatings that minimize ecological impact while maintaining high performance. The European Union has implemented stringent regulations aimed at reducing harmful emissions and promoting environmentally friendly practices within the maritime sector. According to the European Commission, the shipping industry is responsible for approximately 3% of global greenhouse gas emissions, prompting a shift towards more sustainable alternatives. This trend is particularly evident in the rising adoption of water-borne and low-VOC coatings, which offer reduced environmental impact compared to traditional solvent-borne options. The demand for sustainable marine coatings is projected to grow significantly due to the increasing emphasis on eco-friendly practices and compliance with environmental regulations. As manufacturers continue to innovate and develop sustainable coating solutions, the marine coatings market is expected to benefit significantly from this trend, positioning it for robust growth in the coming years.

Expansion of the Shipping and Maritime Industry

The expansion of the shipping and maritime industry is further boosting the expansion of the Europe marine coatings market. As global trade continues to grow, the demand for shipping services is increasing, leading to a rise in the construction and maintenance of marine vessels. According to the International Maritime Organization, the global shipping industry is projected to grow by 3% annually, with Europe being a key player in this expansion. This growth directly correlates with the demand for high-quality marine coatings, as each vessel requires multiple layers of protective coatings to ensure durability and performance. The importance of this driver is underscored by the increasing investments in shipbuilding and maintenance activities across Europe. As the shipping and maritime industry continues to evolve, the demand for advanced marine coatings is expected to rise, positioning this market for significant expansion.

MARKET RESTRAINTS

Stringent Regulatory Compliance

The stringent regulatory compliance associated with the production and application of marine coatings is hampering the growth of the European marine coatings market. The marine industry is subject to a myriad of regulations aimed at reducing environmental impact, particularly concerning volatile organic compounds (VOCs) and hazardous materials. Compliance with these regulations often requires extensive testing, certification, and documentation, which can be time-consuming and costly for manufacturers. According to industry experts, the process of obtaining necessary certifications can extend lead times for new marine coating products by up to 30%. Additionally, the evolving nature of regulations can create uncertainty for manufacturers as they must continuously adapt to new requirements and standards. This can hinder innovation and slow down the introduction of new coating technologies, ultimately impacting market growth. To navigate these challenges, stakeholders must stay informed about regulatory changes and invest in compliance strategies that ensure their products meet the necessary standards while fostering innovation.

High Raw Material Costs

The high raw material costs associated with the production of marine coatings is also hindering the growth of the European marine coatings market. The prices of key raw materials, such as resins, pigments, and solvents, have been subject to volatility due to fluctuations in global supply chains and geopolitical factors. According to industry data, the cost of certain raw materials has increased by as much as 15% over the past year, impacting the overall production costs for marine coatings. These elevated costs can pose challenges for manufacturers, particularly smaller companies with limited resources. As a result, some manufacturers may be hesitant to invest in advanced marine coating technologies, opting instead for more cost-effective alternatives. This reluctance can hinder the overall growth of the market, as the adoption of innovative marine coating solutions may be slower than anticipated. To overcome this challenge, manufacturers must explore cost-reduction strategies, such as optimizing production processes and leveraging economies of scale, to make high-quality coatings more accessible to a broader range of customers.

MARKET OPPORTUNITIES

Growth in the Recreational Boating Sector

The growth in the recreational boating sector presents a significant opportunity for the Europe Marine Coatings Market. As leisure activities on water gain popularity, the demand for recreational boats and yachts is surging. According to the European Boating Industry, the number of registered recreational boats in Europe has increased by approximately 5% annually, reflecting a growing interest in boating as a leisure activity. This trend directly correlates with the demand for high-quality marine coatings, as boat owners seek durable and aesthetically pleasing finishes to protect their investments. Manufacturers that focus on developing innovative marine coatings tailored for the recreational boating market can capitalize on this growing opportunity, positioning themselves as leaders in the marine coatings sector.

Technological Advancements in Coating Solutions

Technological advancements in coating solutions is another significant opportunity for the Europe Marine Coatings Market. Innovations in manufacturing techniques, such as the development of self-cleaning and anti-fouling coatings, are enhancing the performance and longevity of marine coatings. These advancements enable manufacturers to produce coatings that not only protect against corrosion and fouling but also reduce maintenance costs for vessel owners. As manufacturers invest in research and development to create cutting-edge coating technologies, the demand for innovative marine coatings is anticipated to rise. Companies that focus on leveraging these technological advancements to improve their product offerings can capture a significant share of the growing market, positioning themselves for long-term success in the competitive marine coatings landscape.

MARKET CHALLENGES

Supply Chain Disruptions

One of the major challenges facing the Europe Marine Coatings Market is the vulnerability of supply chains. The production of marine coatings relies on a complex network of suppliers for various raw materials, including resins, pigments, and solvents. Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have highlighted the fragility of supply chains, leading to delays and increased costs. According to industry analysts, supply chain disruptions have resulted in a 20% increase in lead times for marine coatings. These disruptions can hinder manufacturers' ability to meet production schedules and fulfill customer orders, ultimately impacting revenue and market share. Additionally, fluctuations in the availability and cost of raw materials can further complicate the supply chain, as manufacturers may struggle to source the necessary components for their coatings. To mitigate this challenge, companies must develop robust supply chain strategies, including diversifying suppliers and investing in inventory management systems to ensure continuity in production.

Competition from Alternative Coating Technologies

The competition from alternative coating technologies is further challenging the growth of the Europe marine coatings market. As the marine industry evolves, various technologies are emerging that can perform similar functions to traditional coatings, such as nanocoatings and self-healing coatings. These alternatives may offer unique advantages, such as enhanced durability, reduced maintenance, and improved aesthetics. According to market research, approximately 30% of marine manufacturers are exploring alternative coating technologies to enhance vessel performance and efficiency. This competitive landscape can make it difficult for traditional marine coating manufacturers to maintain market share, particularly as companies seek innovative solutions to enhance their products. To address this challenge, manufacturers must focus on differentiating their products by emphasizing the unique benefits of marine coatings, such as their reliability, durability, and ability to support advanced vessel technologies. Additionally, investing in research and development to enhance the performance of marine coatings can help manufacturers stay competitive in a rapidly evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.22% |

|

Segments Covered |

By Resin Type, Product Type, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

AkzoNobel N.V., Jotun A/S, Hempel A/S, Chugoku Marine Paints Ltd., PPG Industries Inc., The Sherwin-Williams Company, BASF SE, Nippon Paint Marine Coatings Co. Ltd., Kansai Paint Marine Co., Ltd., and KCC Corporation. |

SEGMENTAL ANALYSIS

By Resin Type Insights

The epoxy resin dominated the market by holding 41.7% of the European marine coatings market share in 2024. The dominance of epoxy resin segment in the European market is primarily due to the excellent adhesion, chemical resistance, and durability offered by epoxy coatings, making them ideal for various marine applications, including hull coatings and protective finishes. Epoxy coatings are particularly favored in the marine industry for their ability to withstand harsh environmental conditions, including saltwater exposure and UV radiation. The growing demand for high-performance coatings that can enhance the longevity and performance of marine vessels is further boosting the expansion of the epoxy segment in the European market. As manufacturers continue to innovate and develop advanced epoxy coatings with improved properties, this segment is expected to remain a key driver of growth in the marine coatings market.

The polyurethane resin segment is another significant segment and is projected to expand at a CAGR of 5.8% over the forecast period owing to the increasing demand for polyurethane coatings in marine applications, particularly for their excellent flexibility, abrasion resistance, and aesthetic appeal. Polyurethane coatings are commonly used for topcoats and finishes, providing a high-gloss appearance while offering protection against environmental factors. The rising consumer preference for durable and visually appealing marine finishes is also contributing to the growth of the polyurethane segment in the European market. As the recreational boating sector continues to expand, the demand for polyurethane coatings is expected to rise. Manufacturers that focus on developing innovative polyurethane solutions tailored for marine applications can capitalize on this growing market opportunity, positioning themselves for success in the competitive marine coatings landscape.

By Product Type Insights

The anti-corrosion coatings segment accounted for the dominating share of the European market in 2024. The dominating position of anti-corrosion coatings segment in the European market is primarily due to the critical need for protecting marine vessels from corrosion caused by saltwater, humidity, and other environmental factors. Anti-corrosion coatings are essential for maintaining the structural integrity and longevity of ships, boats, and offshore structures. The growing investments in shipbuilding and maintenance activities across Europe is further boosting the expansion of anti-corrosion coating segment in the European market. As manufacturers continue to innovate and develop advanced anti-corrosion coatings, this segment is expected to remain a key driver of growth in the marine coatings market.

The antifouling coatings segment is predicted to expand at a CAGR of 7.12% over the forecast period owing to the increasing need for effective solutions to prevent the accumulation of marine organisms on vessel hulls, which can significantly impact fuel efficiency and performance. Antifouling coatings are designed to inhibit the growth of barnacles, algae, and other fouling organisms, thereby enhancing the operational efficiency of marine vessels. As the shipping industry continues to prioritize sustainability and efficiency, the demand for antifouling coatings is expected to rise. Companies that focus on developing innovative antifouling solutions can capitalize on this growing market opportunity, positioning themselves as leaders in the marine coatings sector.

By Application Insights

The cargo ships segment held 39.9% of the European market share in 2024. The leading position of cargo ships segment in the European market is primarily due to the extensive use of marine coatings in the construction and maintenance of cargo vessels, which are critical for global trade. Cargo ships require robust coatings to protect against corrosion, fouling, and harsh marine environments, ensuring their longevity and operational efficiency. The growing volume of goods transported by sea that has been steadily rising is further aiding the expansion of cargo ships segment in the European market. As the cargo shipping industry continues to expand, the demand for high-quality marine coatings is expected to remain strong, positioning this segment for sustained growth.

The passenger ships segment is predicted to exhibit a notable CAGR in the European market over the forecast period due to the increasing popularity of cruise tourism and the rising number of passenger vessels being constructed and refurbished. Passenger ships require coatings that not only provide protection against corrosion and fouling but also enhance the aesthetic appeal of the vessels. The ability of passenger ships to cater to the growing consumer demand for luxurious and visually appealing cruise experiences is further boosting the expansion of passenger ships segment in the European market. As the cruise industry continues to expand, the demand for marine coatings in passenger ship applications is expected to rise. Manufacturers that focus on developing innovative coating solutions tailored for passenger vessels can capitalize on this growing market opportunity, positioning themselves for success in the competitive marine coatings landscape.

REGIONAL ANALYSIS

Germany captured 24.9% of the Europe marine coatings market share in 2024. The dominance of Germany in the European market is largely due to its robust maritime industry, which includes significant applications of marine coatings in shipbuilding and maintenance. With a strong focus on innovation and sustainability, German manufacturers are increasingly adopting advanced marine coating solutions to meet the growing demand for effective protective coatings. The growing investments in shipping infrastructure and rising need for high-quality coatings are further aiding the German market growth. The presence of major manufacturers and suppliers in Germany further bolsters the market's growth, as these companies seek to enhance vessel performance and sustainability through effective coating solutions.

France accounted for the second largest share of the European marine coatings market in 2024. The French maritime sector is characterized by a diverse range of applications for marine coatings, particularly in shipbuilding and maintenance. The country has a well-developed infrastructure for marine coating production, supporting the growth of the marine coatings market. The rising trend of sustainable practices and the increasing demand for effective marine coatings are driving the French marine coatings market. The French government has also been proactive in promoting environmental initiatives, which further supports the growth of the marine coatings market. As industries invest in modernizing their processes, the demand for marine coatings is anticipated to rise, positioning France as a key player in the European marine coatings landscape.

The United Kingdom is another significant player in the European marine coatings market and is projected to grow at a healthy CAGR over the forecast period. With a strong focus on maritime activities, the UK market is characterized by a growing demand for high-quality marine coatings. British manufacturers are increasingly investing in advanced coating technologies to meet the evolving needs of various marine applications. The UK’s diverse maritime landscape, combined with a growing awareness of the benefits of advanced coatings, positions it as a vital market within the European marine coatings sector.

Italy holds a notable share of the European marine coatings market. The Italian maritime industry is known for its strong presence of manufacturers producing specialized marine coatings. With a focus on shipbuilding and maintenance, Italian consumers and industries are increasingly investing in marine coatings to enhance their operational efficiency. A recent study indicated that around 65% of Italian manufacturers are investing in modern marine coating technologies to improve their production capabilities. The combination of a rich maritime heritage and a growing emphasis on sustainability positions Italy as a key market in the European marine coatings landscape.

Spain is estimated to exhibit a healthy CAGR in the European market during the forecast period. With a growing interest in marine coatings across various industries, including shipbuilding and recreational boating, the Spanish market is characterized by an increasing demand for high-quality coatings. The combination of a strong maritime culture and a growing awareness of the benefits of high-quality coatings positions Spain as an important player in the European marine coatings market. As the marine industry continues to evolve, the demand for innovative coating solutions in Spain is expected to rise, further solidifying its position in the market.Top of Form

KEY MARKET PLAYERS

The major players in the Europe marine coatings market include AkzoNobel N.V., Jotun A/S, Hempel A/S, Chugoku Marine Paints Ltd., PPG Industries Inc., The Sherwin-Williams Company, BASF SE, Nippon Paint Marine Coatings Co. Ltd., Kansai Paint Marine Co., Ltd., and KCC Corporation.

MARKET SEGMENTATION

This research report on the Europe marine coatings market is segmented and sub-segmented into the following categories.

By Resin Type

- Epoxy

- Alkyd

- Polyurethane

- Others

By Product Type

- Anti-Corrosion Coatings

- Antifouling Coatings

- Others

By Application

- Cargo Ships

- Passenger Ships

- Boats

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe marine coatings market?

The growth of the Europe marine coatings market is primarily driven by increasing shipbuilding activities, rising maintenance and repair operations for vessels, and stringent environmental regulations promoting eco-friendly coatings.

How do environmental regulations impact the marine coatings market in Europe?

Environmental regulations in Europe, such as the ban on harmful biocides in anti-fouling coatings, are pushing manufacturers to develop eco-friendly, low-VOC, and sustainable coating solutions for ships.

How is technology influencing the development of marine coatings in Europe?

Advancements in nanotechnology, self-healing coatings, and silicone-based foul-release coatings are improving the performance and durability of marine coatings, reducing maintenance needs.

What are the future trends expected in the Europe marine coatings market?

Future trends include the development of graphene-based coatings, increased investment in green shipping initiatives, and a shift towards digital monitoring systems that optimize coating performance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com