Europe Managed Services Market Size, Share, Trends, & Growth Forecast Report Segmented By Solution (Managed Data Center, Managed Network, Managed Mobility, Managed Infrastructure, Managed Backup and Recovery, Managed Communication, Managed Information, and Managed Security), Managed Information Service, Deployment, Enterprise Size, and End Use, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Managed Services Market Size

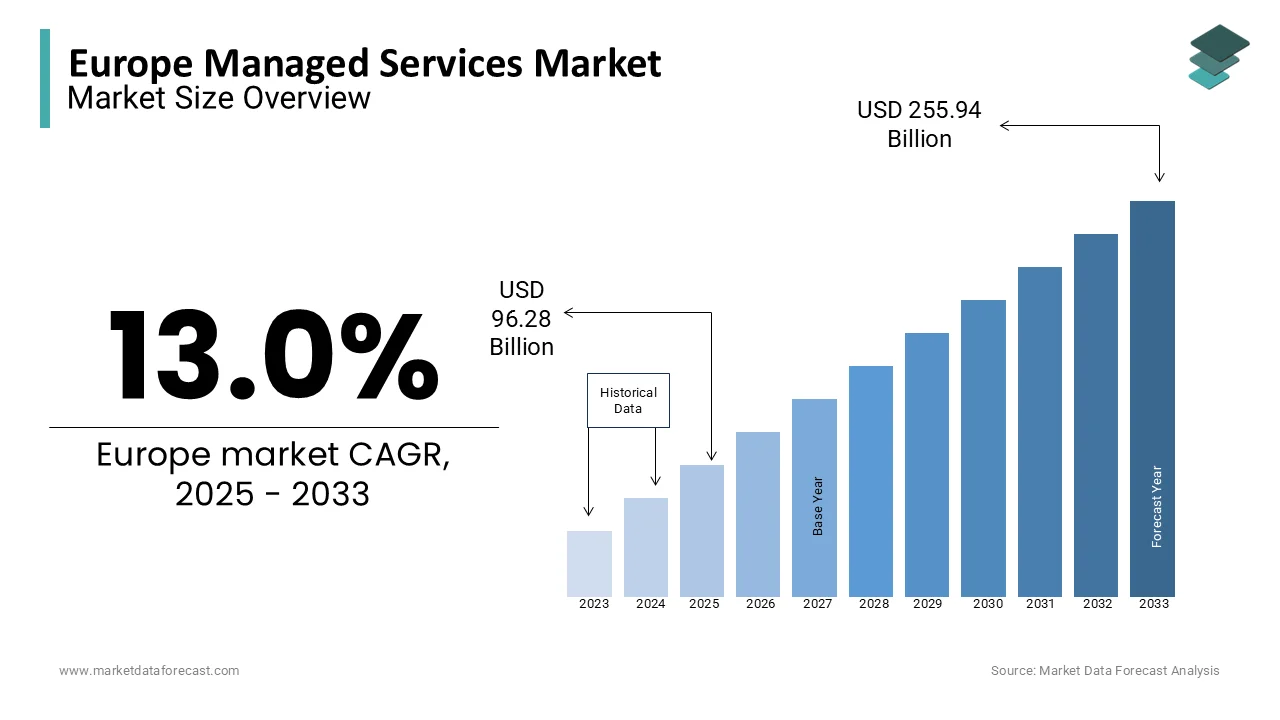

The Europe managed services market was worth USD 85.20 billion in 2024. The European market is projected to reach USD 255.94 billion by 2033 from USD 96.28 billion in 2025, growing with a CAGR of 13.0% from 2025 to 2033.

The Europe managed services market has grown significantly over the past decade owing to the increasing digital transformation and the rising adoption of cloud computing of Europe. According to the Digital Economy and Society Index (DESI) of European Commission, over 65% of EU businesses have integrated digital technologies into their operations. This is creating a robust demand for managed services to support this shift. Additionally, the growing prevalence of cyber threats necessitates advanced security solutions, with the European Union Agency for Cybersecurity (ENISA) reporting a 150% increase in ransomware incidents. Moreover, the managed services market benefits from the adoption of hybrid and remote work models in Europe, which require efficient IT support and secure infrastructure. According to the data of Eurostat, 30% of EU employees worked remotely in 2022. This is fuelling the need for MSPs to manage and safeguard distributed IT environments.

MARKET DRIVERS

Rising Adoption of Cloud Computing in Europe

The increasing shift toward cloud-based solutions is a key driver of the managed services market in Europe. As businesses migrate their operations to the cloud, there is a growing need for managed service providers (MSPs) to ensure seamless integration, scalability, and security. According to the European Commission, 41% of enterprises in the EU used cloud computing in 2022, with over half of these organizations leveraging cloud services for hosting applications and storing sensitive data. This growing reliance on cloud technology creates a demand for MSPs to manage complex cloud environments, optimize performance, and ensure compliance with data protection regulations like GDPR.

Escalating Cybersecurity Threats

The rising frequency and sophistication of cyberattacks are driving the demand for managed security services across Europe. The European Union Agency for Cybersecurity (ENISA) reported a 150% increase in ransomware incidents in 2022, significantly impacting both public and private organizations. Managed service providers offer critical cybersecurity solutions, including threat detection, incident response, and vulnerability management, enabling businesses to safeguard their IT infrastructure. This heightened threat landscape has made security services an essential component of managed offerings, propelling the market forward as organizations prioritize protecting sensitive data and ensuring business continuity.

MARKET RESTRAINTS

High Initial Investment and Operational Costs

The significant upfront costs associated with adopting managed services pose a restraint to market growth in Europe. Many organizations, particularly small and medium-sized enterprises (SMEs), find it challenging to allocate budgets for outsourcing IT operations. According to the European Investment Bank, SMEs account for 99% of businesses in the EU, with limited financial resources often cited as a barrier to adopting advanced technologies. Additionally, ongoing subscription fees for managed services can strain budgets further, particularly for enterprises operating on tight margins. These cost-related challenges hinder the widespread adoption of managed services, particularly among smaller organizations.

Data Privacy and Compliance Complexities

Strict data protection regulations in Europe, such as the General Data Protection Regulation (GDPR), create compliance challenges for managed service providers and their clients. GDPR mandates stringent requirements for handling, processing, and storing personal data, with non-compliance leading to penalties of up to €20 million or 4% of global turnover. According to the European Commission, enforcement actions related to GDPR compliance have increased significantly, with fines exceeding €1.25 billion as of 2022. These regulatory complexities create additional responsibilities for MSPs, increasing operational costs and complicating their service delivery, especially when managing cross-border data flows within Europe.

MARKET OPPORTUNITIES

Increasing Adoption of Hybrid Work Models

The shift towards hybrid and remote work environments presents a significant opportunity for the managed services market in Europe. As organizations embrace distributed work models, there is a growing demand for managed service providers (MSPs) to ensure secure and efficient IT infrastructure. Eurostat reported that 30% of EU employees worked remotely in 2022, a figure expected to grow as flexible work arrangements become a permanent feature. MSPs are well-positioned to provide tailored solutions for managing remote endpoints, enhancing cybersecurity, and optimizing cloud services, thereby supporting businesses in maintaining productivity and compliance in a hybrid work landscape.

Advancements in 5G and IoT Technologies

The expansion of 5G networks and the proliferation of Internet of Things (IoT) devices across Europe create lucrative opportunities for MSPs. The European Commission’s 5G Action Plan aims for full 5G coverage across member states by 2030, driving the integration of connected devices in industries such as manufacturing, healthcare, and transportation. IoT adoption is projected to surpass 29 billion devices globally by 2025, with Europe accounting for a significant share. MSPs can capitalize on this growth by offering specialized services for IoT device management, network optimization, and real-time analytics, addressing the complex needs of businesses adopting these transformative technologies.

MARKET CHALLENGES

Shortage of Skilled IT Professionals

The lack of qualified IT professionals in Europe presents a significant challenge for the managed services market. According to the European Commission’s Digital Skills and Jobs Platform, Europe faces a shortfall of approximately 500,000 IT specialists, with many businesses struggling to fill critical roles. This talent gap limits the capacity of managed service providers (MSPs) to scale operations and deliver high-quality services. Smaller MSPs are particularly affected, as they compete with larger enterprises for a limited pool of skilled professionals. This shortage also drives up labor costs, which can negatively impact the profitability of MSPs across the region.

Complexity in Managing Multicloud Environments

The growing adoption of multicloud strategies by European businesses creates operational complexity for managed service providers. A report from the European Union Agency for Cybersecurity (ENISA) highlights that multicloud environments require robust integration, data migration, and security protocols, making them challenging to manage effectively. Additionally, ensuring compliance with regional regulations, such as the General Data Protection Regulation (GDPR), across multiple cloud platforms adds further complexity. These challenges increase costs for MSPs and demand a high level of expertise, limiting the ability of smaller providers to compete effectively in the market.

REGIONAL ANALYSIS

The UK holds the dominating position in the European managed services market. The advanced IT infrastructure and strong emphasis on digital transformation of the UK are propelling the managed services market growth in the UK. The UK Department for Digital, Culture, Media & Sport reports that 50% of UK businesses rely on external IT providers for cybersecurity and cloud services. The country’s proactive approach to adopting emerging technologies, such as artificial intelligence and cloud computing, has fueled the growth of managed services, making it a top performer in the region.

Germany is another leading market for managed services in Europe. The industrial strength of Germany and focus on automation position it as a leading market for managed services. The Federal Ministry for Economic Affairs and Energy highlights that over 60% of German companies utilize managed IT services to support Industry 4.0 initiatives. These services are critical for optimizing operations and managing the digital transformation of manufacturing and logistics sectors.

France has emerged as a key player in the managed services market in Europe. The growth of French market is primarily driven by its investments in cybersecurity and cloud services. The French Ministry of Economy and Finance emphasizes that 70% of French businesses have adopted cloud services, requiring advanced managed solutions to ensure data protection and operational continuity. This strong adoption of digital technologies underpins France’s leadership in the market.

KEY MARKET PLAYERS

ScalePad, Atera, BMC Software, HP Inc, AT&T, Aryaka, Telefonaktiebolaget L M Ericsson ADR, and HCL Technologies are some of the major players in the European managed services market.

MARKET SEGMENTATION

This research report on the Europe managed services market is segmented and sub-segmented into the following categories.

By Solution

- Managed Data Center

- Managed Network

- Managed Mobility

- Managed Infrastructure

- Managed Backup and Recovery

- Managed Communication

- Managed Information

- Managed Security

By Managed Information Service

- Business Process Outsourcing (BPO)

- Business Support Systems

- Project & Portfolio Management

- Others

By Deployment

- On-premise

- Hosted

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End Use

- Financial Services

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are managed services in the context of the European market?

Managed services refer to outsourcing specific IT and business functions, such as network management, cloud services, and security operations, to third-party providers. These services help organizations focus on their core operations while improving efficiency and reducing operational risks.

What industries in Europe are adopting managed services the most?

Industries like banking and financial services, healthcare, retail, IT and telecom, and manufacturing are among the largest adopters of managed services in Europe due to their high reliance on technology and need for robust cybersecurity and compliance.

What are the key drivers for the growth of managed services in Europe?

The increasing complexity of IT systems, growing cybersecurity threats, and the demand for cost optimization are the primary drivers. Additionally, the rapid adoption of cloud computing and remote working models has further fueled the need for managed services.

How are managed services providers addressing Europe’s focus on sustainability?

Providers are adopting green IT practices, such as energy-efficient data centers, virtualization, and sustainable supply chains, to align with Europe’s environmental goals and meet client expectations for eco-friendly services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]