Europe Luxury Yacht Market Size, Share, Trends & Growth Forecast Report By Yacht Type (Sailing Luxury Yacht, Motorized Luxury Yacht, and Other Type), Size (Up to 20 Meters, 20 to 50 Meters, and Above 50 Meters), Application (Commercial and Private) and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis From 2025 to 2033.

Europe Luxury Yacht Market Size

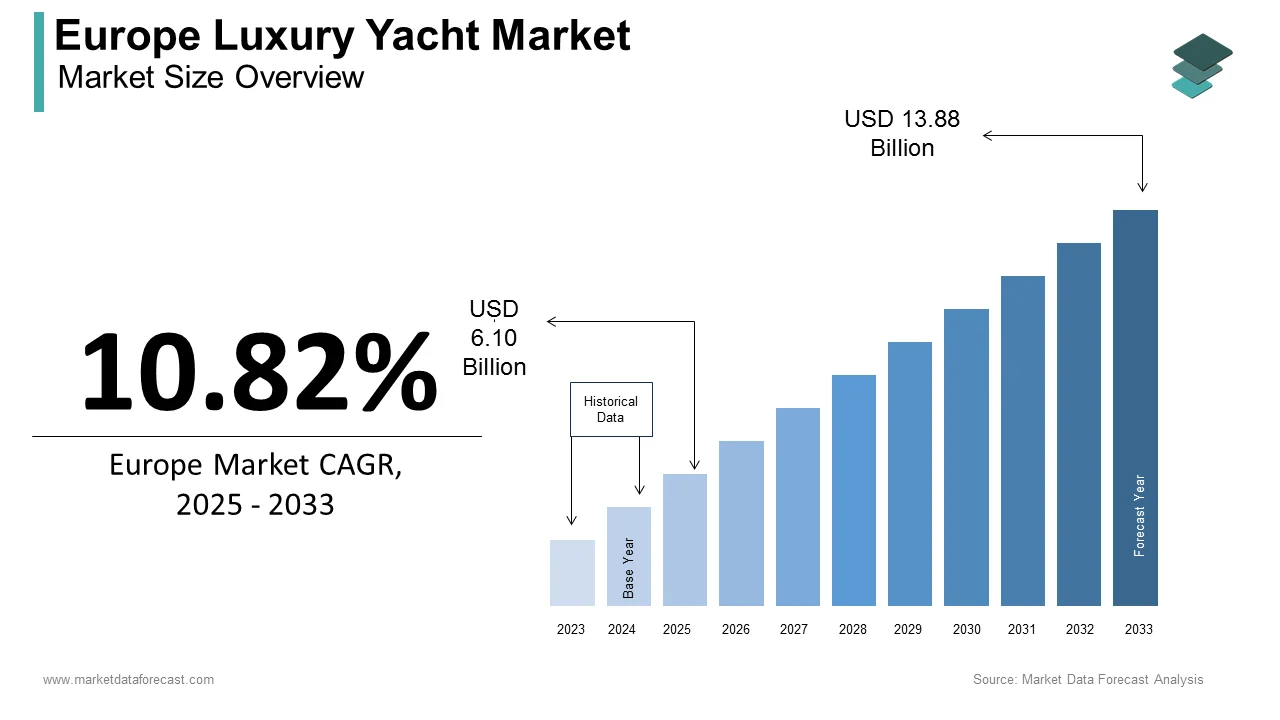

The luxury yacht market size in Europe was valued at USD 5.5 billion in 2024. The European market is estimated to be worth USD 13.88 billion by 2033 from USD 6.10 billion in 2025, growing at a CAGR of 10.82% from 2025 to 2033.

Luxury yachts, typically exceeding 80 feet in length, are equipped with state-of-the-art amenities, advanced navigation systems, and bespoke designs tailored to affluent consumers. According to the European Boating Industry, the luxury yacht sector contributes significantly to Europe’s blue economy, generating over €20 billion annually and supporting more than 320,000 jobs across manufacturing, maintenance, and tourism-related services. The Mediterranean region, including France, Italy, and Spain, serves as a hub for yacht production and charter operations.

According to the International Maritime Organization, Europe dominates the global yacht manufacturing landscape, with over 40% of the world’s superyachts produced in countries like the Netherlands, Germany, and Turkey. Rising disposable incomes among high-net-worth individuals (HNWIs) and growing interest in experiential luxury have fueled the demand for luxury yachts in Europe. As per the reports of the Eurostat, there are over 1.5 million HNWIs in Europe, many of whom invest in yachts as status symbols or for private use. Additionally, the rise of yacht chartering platforms has democratized access to luxury experiences, which is further expanding the European market. However, challenges such as stringent environmental regulations under the EU Green Deal and fluctuating raw material costs pose hurdles.

MARKET DRIVERS

Rising Wealth Among High-Net-Worth Individuals

The growing wealth among high-net-worth individuals (HNWIs) for who form the primary consumer base for these exclusive vessels is majorly propelling the growth of the European luxury yachts market. According to Eurostat, there are over 1.5 million HNWIs in Europe, with their combined wealth exceeding €10 trillion. As per the European Central Bank, the top 1% of earners in Europe account for nearly 20% of total financial assets that enables significant discretionary spending on luxury goods like yachts. Countries such as Switzerland, Germany, and the UK lead this trend, with affluent consumers viewing yachts as both status symbols and investments. According to the International Maritime Organization, the global superyacht fleet has grown by 15% over the past decade due to the European demand. This rising affluence ensures sustained growth in the luxury yacht market, as manufacturers cater to the evolving preferences of wealthy clientele seeking exclusivity and customization.

Growth of Experiential Luxury and Yacht Chartering

The rising popularity of experiential luxury, with yacht chartering platforms transforming how consumers access high-end maritime experiences is further expanding the European luxury yachts market. According to the European Boating Industry, the yacht charter market has expanded at a CAGR of 8.5% over the past five years owing to the millennials and younger HNWIs prioritizing unique experiences over material possessions. France, Italy, and Spain dominate this trend by leveraging their Mediterranean coastlines to attract tourists and enthusiasts. As per the International Maritime Organization, more than 30% of luxury yacht usage is now linked to charter operations, up from 20% a decade ago. Additionally, advancements in digital platforms have made chartering more accessible, with companies offering flexible packages. This shift not only boosts sales but also enhances Europe’s tourism sector, generating over €5 billion annually from yacht-related activities, according to Eurostat.

MARKET RESTRAINTS

Stringent Environmental Regulations

The implementation of stringent environmental regulations under the EU Green Deal aims to reduce carbon emissions and promote sustainability. As per the European Environment Agency, maritime activities are contributing approximately 15% of global shipping emissions which is prompting stricter emission standards for vessels. Compliance with these regulations requires manufacturers to adopt eco-friendly technologies, such as hybrid propulsion systems and sustainable materials, which increase production costs by up to 30%. The International Maritime Organization notes that retrofitting existing yachts to meet new standards can cost €500,000 or more per vessel, deterring some buyers. These regulatory pressures create financial and operational challenges for manufacturers and consumers alike is slowing market growth while the industries are shifting towards the adoption of the eco-friendly practises.

Economic Uncertainty and Geopolitical Tensions

Economic uncertainty and geopolitical tensions are also one of the common factors to degrade the Europe luxury yachts markets’ growth rate due to the impact consumer confidence and discretionary spending among high-net-worth individuals (HNWIs). As per the European Central Bank, inflation rates across Europe reached 8.5% in 2022, which is reducing disposable incomes and affecting luxury purchases. Additionally, geopolitical conflicts, such as those involving Russia-Ukraine have disrupted supply chain by causing raw material prices like steel and aluminum to surge by over 25%, according to Eurostat. The European Boating industry reported that factors have led to a 10% decline in new yacht orders in certain regions. Economic instability also affects charter operations, as reduced tourism impacts demand. These challenges are majorly hindering the growth rate of the Europe luxury yachts market growth rate in the forecast period.

MARKET OPPORTUNITIES

Adoption of Sustainable and Eco-Friendly Technologies

The adoption of sustainable technologies which are driven by the EU’s push for greener maritime solutions is significantly one of the major opportunities for the Europe luxury yachts market growth. As per the European Environment Agency, the maritime industry must reduce carbon emissions by 50% by 2050, which is promoting the manufacturers to innovate with hybrid and electric propulsion systems. According to the International Maritime Organization, over 20% of new yacht designs now incorporate eco-friendly features, such as solar panels and energy-efficient engines which is appealing to environmentally conscious buyers. As per the Eurostat reports, investments in green technologies have grown by 12% annually, with countries like the Netherlands leading in sustainable yacht production. These advancements not only align with regulatory requirements but also attract a new demographic of eco-aware HNWIs by ensuring long-term market growth while positioning Europe as a pioneer in sustainable luxury yachting.

Expansion of Emerging Markets and Tourism Integration

The expansion into emerging markets and integration with Europe’s booming tourism sector is also ascribed to boost the new opportunities for the Europe luxury yachts market to grow in the coming years. As per the European Boating Industry, Mediterranean countries like Greece, Croatia, and Turkey are witnessing a surge in luxury yacht tourism, with charter revenues growing at a CAGR of 9% since 2020. Eurostat reports that over 200 million tourists visited coastal regions in 2022 whereas many seeking exclusive yacht experiences. Additionally, partnerships with luxury travel agencies and digital charter platforms have expanded accessibility which are attracting younger affluent consumers. The International Maritime Organization emphasizes that Europe’s diverse coastlines and cultural heritage make it a global hotspot for yacht tourism. The luxury yacht market can diversify its revenue streams and strengthen its foothold in both established and emerging markets across the continent.

MARKET CHALLENGES

High Initial Costs and Maintenance Expenses

The high initial cost and ongoing maintenance expenses can limit accessibility for a broader audience. As per the European Boating Industry, the average price of a superyacht exceeds €10 million with annual maintenance costs ranging from 10% to 15% of the purchase price, or approximately €1-1.5 million. Eurostat reports that rising inflation and interest rates have further strained affordability for mid-tier HNWIs. Additionally, the International Maritime Organization notes that compliance with environmental regulations often requires costly upgrades such as retrofitting vessels with hybrid systems which can exceed €500,000 per yacht. These financial barriers create challenges for manufacturers aiming to expand their customer base during periods of economic uncertainty when discretionary spending on luxury goods declines significantly.

Limited Accessibility for New Buyers

The limited accessibility for new buyers due to the exclusivity and complexity is likely to decline the growth rate of the Europe luxury yacht market. The European Central Bank reports that only 1% of Europe’s population qualifies as high-net-worth individuals (HNWIs) is creating a narrow target audience for manufacturers. Additionally, the International Maritime Organization studies reports show that the lack of standardized pricing and transparency in yacht transactions often deters first-time buyers. Eurostat notes that over 60% of luxury yacht sales occur through private brokers is making it difficult for newcomers to navigate the market. Furthermore, the logistical challenges of yacht ownership, including mooring fees and crew salaries, which can exceed €300,000 annually, add to the barriers. This exclusivity limits market expansion and restricts growth potential among emerging affluent demographics seeking entry into the luxury yachting lifestyle.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Yacht Type, Size, Application, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Fr. Lürssen Werft GmbH & Co.KG, S.p.A., Sanlorenzo, Azimut Benetti, Feadship, and Others. |

SEGMENTAL ANALYSIS

By Yacht Type Insights

The motorized luxury yachts segment led the market by accounting for 70.7% of European market share in 2024. The growth of the segment is majorly driven by the superior speed, comfort, and versatility which is making them ideal for both private use and charter operations. According to the Eurostat, motorized yachts are produced predominantly in Italy, Germany, and the Netherlands, which together account for over 50% of global production. According to the International Maritime Organization, advanced features of motorized luxury yacts such as hybrid propulsion systems, appeal to affluent buyers is contributing to their demand in the European market. Motorized yachts play a pivotal role in driving innovation and sales by ensuring their dominance in the market.

The sailing luxury yachts segment is likely to witness a projected CAGR of 6.8% during the forecast period. The growing consumer interest in sustainable and eco-friendly options as sailing yachts produce significantly lower emissions compared to motorized alternatives are fuelling the growth of the sailing luxury yachts segment in the European market. As per the International Maritime Organization, their alignment with EU Green Deal targets is boosting adoption among environmentally conscious buyers. Eurostat reports that Mediterranean countries like France and Spain are witnessing rising demand due to favorable weather conditions. Their blend of tradition, sustainability, and exclusivity positions sailing yachts as a key driver of niche market expansion in Europe.

By Size Insights

The up to 20 meters segment led the Europe luxury yacht market by holding 45.3% of the European market share in 2024. The domination of the segment in the European market is driven by affordability and accessibility is appealing to first-time buyers and younger high-net-worth individuals (HNWIs). Eurostat reports that annual maintenance costs for these yachts range between €100,000 and €200,000 which is significantly lower than larger vessels. The International Maritime Organization notes their growing adoption of eco-friendly technologies, such as hybrid engines, aligns with EU Green Deal targets. Their versatility for coastal cruising and day trips makes them ideal for entry-level luxury by ensuring strong demand and serving as a gateway for expanding the market’s consumer base.

The above 50 meters segment is anticipated to showcase a CAGR of 7.5% from 2025 to 2033 owing to increasing preference from ultra-high-net-worth individuals (UHNWIs) for exclusivity and customization. According to the reports of the Eurostat, these superyachts costs over €50 million that lead in adopting advanced technologies like AI navigation and hybrid propulsion systems b aligning with sustainability goals. The European Boating Industry highlights their role in showcasing innovation and prestige in affluent regions like Monaco. Their ability to cater to bespoke demands ensures they remain critical for driving technological advancements and enhancing the luxury yacht market's global reputation.

By Application Insights

The private application segment dominated the Europe luxury yacht market with 65.4% of the total share in 2024. The growth of the private segment is driven by high-net-worth individuals (HNWIs) seeking exclusivity and customization, with over 1.5 million HNWIs in Europe investing in luxury yachts, according to Eurostat. The International Maritime Organization highlights that private yachts are increasingly adopting eco-friendly technologies, such as hybrid propulsion systems with sustainability goals. Their role as status symbols and tools for personalized leisure ensures their prominence. Private ownership not only drives market growth but also fosters innovation in bespoke designs.

The commercial application segment is esteemed to have a CAGR of 8.2% during the forecast period due to the factors such as the rising popularity of yacht chartering among millennials and tourists seeking experiential luxury. Eurostat reports that Mediterranean countries generate over €5 billion annually from charter operations with digital platforms expanding accessibility. The International Maritime Organization notes that flexible charter packages and sustainable practices attract new customers. Commercial applications play a pivotal role in diversifying revenue streams and promoting Europe’s maritime tourism sector.

REGIONAL ANALYSIS

Italy held the dominating position in the Europe luxury yacht market with a 25.3% of the European market share in 2024 owing to its reputation as a global hub for yacht manufacturing and design. As per the European Boating Industry, regions like Liguria and Tuscany are home to world-renowned shipyards such as Ferretti and Azimut, which dominate global production. Italy’s strategic location along the Mediterranean Sea makes it a hotspot for both manufacturing and tourism-related yacht activities. Eurostat reports that Italy accounts for over 30% of global superyacht production, with exports generating €2 billion annually. The International Maritime Organization notes that Italian manufacturers are at the forefront of integrating eco-friendly technologies with EU Green Deal targets. This combination of craftsmanship, innovation, and geographic advantage is deemed to expand the growth rate of the market in Italy.

France is one of the prominent regional markets for luxury yachts in Europe and is estimated to register a CAGR of 7.2% during the forecast period. The French Riviera, particularly cities like Cannes and Saint-Tropez, attracts affluent tourists and charter enthusiasts by generating over €3 billion annually, according to Eurostat. As per the European Boating Industry, that France’s extensive coastline and marinas make it a prime destination for luxury yacht experiences. Additionally, the International Maritime Organization notes that French shipyards, such as Beneteau, are innovating in sustainable yacht designs by appealing to environmentally conscious buyers. The richness of cultural heritage is also to fuel the growth rate of the market in France.

Germany is esteemed to have the significant growth opportunities in the coming years with excellence in engineering and bespoke yacht production. The German Federal Ministry for Economic Affairs emphasizes that German shipyards, such as Lürssen, are globally recognized for building ultra-luxurious and technologically advanced superyachts. Eurostat reports that Germany’s focus on precision engineering and customization attracts ultra-high-net-worth individuals (UHNWIs) seeking exclusivity. The International Maritime Organization highlights that German manufacturers are also adopting hybrid propulsion systems with sustainability goals. This commitment to quality, innovation, and tailored solutions ensures Germany’s prominence in the luxury yacht market for high-end clientele.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe luxury yacht market profiled in this report are Fr. Lürssen Werft GmbH & Co.KG, S.p.A., Sanlorenzo, Azimut Benetti, Feadship, and Others.

MARKET SEGMENTATION

This Europe luxury yacht market research report is segmented and sub-segmented into the following categories.

By Yacht Type

- Sailing Luxury Yacht

- Motorized Luxury Yacht

- Other Type

By Size

- Up to 20 Meters

- 20 to 50 Meters

- Above 50 Meters

By Application

- Commercial

- Private

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth of the Europe luxury yacht market?

The Europe luxury yacht market is expected to grow from USD 6.10 billion in 2025 to USD 13.88 billion by 2033, at a CAGR of 10.82%.

2. What are key growth drivers for the luxury yacht industry in Europe?

Wealth accumulation among high-net-worth individuals and yacht chartering services expansion.

3. What are the primary challenges in this europe luxury yacht market?

Economic uncertainty and evolving environmental regulations.

4. What innovations are shaping the luxury yacht market?

Sustainability through hybrid propulsion and eco-friendly yacht features.

5. Which regions present the most growth potential?

Mediterranean countries offer significant opportunities for the luxury yacht sector.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]