Europe Lubricant Packaging Market Size, Share, Trends & Growth Forecast Report By Material (Metal ,Plastic), Packaging Type, Lubricant, End-Use, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Lubricant Packaging Market Size

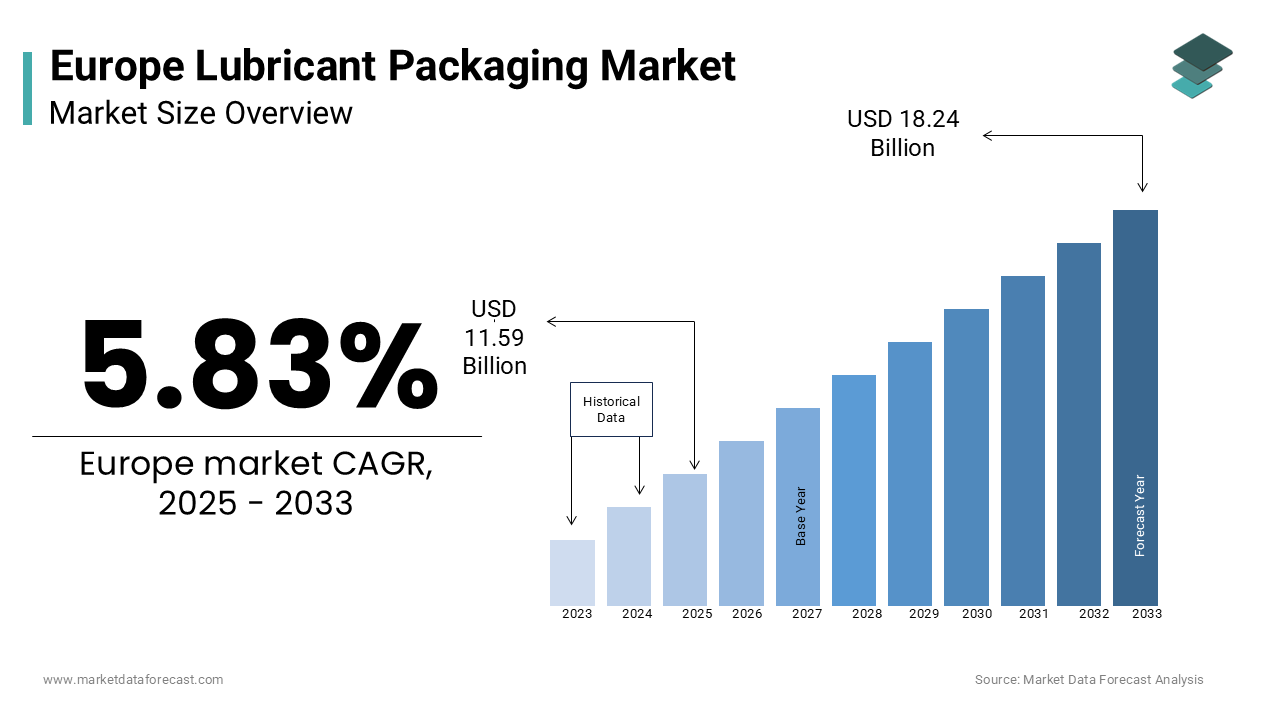

The Europe lubricant packaging market was worth USD 10.95 billion in 2024. The market is estimated to grow at a CAGR of 5.83% from 2025 to 2033 and be valued at USD 18.24 billion by the end of 2033 from USD 11.59 billion in 2025.

Lubricant packaging is crucial to ensure safe storage, transportation, and dispensing of essential fluids across diverse sectors. In Europe, Germany and France are leading the adoption of lubricant packaging due to their advanced manufacturing capabilities and stringent regulatory frameworks. The German Federal Ministry of Economics reports that over 60% of lubricant packaging solutions are designed to meet eco-friendly standards, aligning with EU mandates for sustainability. For instance, Sweden’s automotive sector has embraced recyclable plastic containers, reducing material waste by 35%, as stated by the Swedish Environmental Protection Agency. As industries increasingly prioritize efficiency and environmental responsibility, the demand for innovative and durable packaging solutions continues to grow, positioning lubricant packaging as a cornerstone of modern supply chains.

MARKET DRIVERS

Rising Demand for Sustainable Packaging Solutions in Europe

The rising demand for sustainable packaging solutions is propelling the Europe lubricant packaging market growth. According to the European Packaging Federation, recyclable and biodegradable materials account for 40% of the market share due to the consumer preferences for eco-friendly products. For instance, Italy’s metal fabrication sector has adopted reusable metal kegs, achieving a 25% reduction in packaging waste, according to the Italian Chamber of Commerce. Additionally, the French National Institute for Sustainable Development highlights that advancements in lightweight plastic formulations have increased adoption rates by 20% annually, ensuring compliance with EU environmental regulations. This trend underscores the pivotal role of sustainable lubricant packaging in addressing ecological concerns while meeting consumer expectations.

Growing Adoption in the Automotive Sector

The growing adoption of lubricant packaging in the automotive sector is another major driver boosting the regional market expansion. As per the European Automobile Manufacturers Association, engine oils account for 50% of lubricant consumption, which is driving the demand for efficient and durable packaging solutions. For example, Germany’s automotive industry has achieved a 30% improvement in supply chain efficiency by utilizing intermediate bulk containers (IBCs) for bulk lubricant transport, as stated by the German Federal Ministry of Transportation. Furthermore, the UK Automotive Trade Association highlights that advancements in tamper-proof packaging have increased consumer confidence in product safety, boosting sales by 15%. As the automotive sector continues to expand, the adoption of specialized lubricant packaging is set to grow significantly, ensuring its continued relevance in modern logistics.

MARKET RESTRAINTS

High Initial Costs and Limited Awareness

High initial costs and limited awareness among stakeholders are hampering the growth of the Europe lubricant packaging market, particularly in developing regions. As per the estimations of the European Industrial Packaging Association, transitioning to eco-friendly packaging systems can increase production costs by 25%, deterring smaller manufacturers from adopting advanced solutions. For instance, rural areas in Eastern Europe report that only 10% of companies are familiar with the benefits of recyclable packaging, as per the Czech Business Confederation. Additionally, misinformation spread through unverified sources exacerbates the problem, undermining broader adoption. Without targeted educational campaigns and financial incentives, these barriers will continue to limit market penetration.

Stringent Regulatory Compliance Requirements

Stringent regulatory compliance requirements are also hindering the growth of the Europe lubricant packaging market, particularly for manufacturers seeking to innovate. According to the mandates of the European Chemicals Agency, rigorous testing under REACH regulations, requiring companies to invest heavily in certification processes. For instance, the German Federal Ministry of Economics reports that obtaining approvals for new packaging designs can take up to 18 months, delaying product launches and increasing costs by 30%. Additionally, the French National Institute for Environmental Research highlights that non-compliance penalties, which can exceed €2 million per violation, create financial risks for companies operating on thin margins. While these regulations aim to promote safety and sustainability, their complexity often hinders innovation and market expansion.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion of lubricant packaging into emerging markets is a major opportunity for market players seeking to diversify their portfolios. As per the forecasts of the European Trade Association, demand for lubricant packaging in Eastern Europe will grow significantly through 2030 due to the industrialization and infrastructure development. For instance, Turkey’s construction sector has adopted durable plastic pails, achieving a 40% improvement in operational efficiency, as stated by the Turkish Ministry of Industry. Similarly, Russia’s oil & gas industry has embraced metal drums for bulk lubricant storage, enhancing supply chain reliability. As emerging economies prioritize modernization, the role of lubricant packaging in enabling efficient logistics is set to expand, unlocking new revenue streams for manufacturers.

Adoption of Smart Packaging Technologies

The adoption of smart packaging technologies is another promising opportunity for the European market. According to the European Smart Packaging Council, IoT-enabled sensors integrated into lubricant packaging account for 15% of the market share, valued at €700 million annually. For example, France’s chemical industry has pioneered the use of smart pails equipped with RFID tags, achieving a 25% reduction in inventory management costs, as stated by the French Chemical Manufacturers Association. Additionally, the Swiss Innovation Agency highlights that advancements in digital printing have increased customization options, allowing brands to create visually appealing and interactive packaging designs. As Europe continues to invest in intelligent supply chains, the adoption of smart lubricant packaging is poised to accelerate, positioning it as a cornerstone of future-ready logistics.

MARKET CHALLENGES

Resistance to Change in Traditional Industries

Resistance to change in traditional industries is a major challenge to the Europe lubricant packaging market, particularly among established manufacturers. The European Federation of Industrial Packaging reports that over 60% of firms in Central Europe remain hesitant to adopt advanced packaging solutions due to concerns about perceived risks and lack of familiarity. For instance, Spain’s metalworking sector has reported that only 5% of projects utilize recyclable packaging, as stated by the Spanish Metalworkers Association. Additionally, cultural biases favoring conventional materials further exacerbate this issue, limiting innovation and market growth. To overcome these barriers, stakeholders must focus on demonstrating the long-term benefits of advanced packaging through pilot projects and industry collaborations.

Supply Chain Disruptions and Material Scarcity

Supply chain disruptions and material scarcity are also challenging the growth of the Europe lubricant packaging market, particularly amid global uncertainties. According to the European Petrochemical Association, shortages of key materials like polyethylene have led to a 20% increase in production costs since 2022, severely impacting manufacturers in countries like Germany and Belgium. For example, Russia’s export restrictions on raw materials have forced European suppliers to seek alternative sources, increasing lead times by 40%. The French National Institute for Energy Research also highlights that logistical bottlenecks further compound these challenges, reducing overall market capacity. Without strategic investments in diversified sourcing strategies, the market risks stagnation amid growing demand.

SEGMENTAL ANALYSIS

By Material Insights

The plastic segment led the Europe lubricant packaging market by holding for 61.2% of the European market share in 2024. The prominence of plastic segment in the European market is attributed to its lightweight, cost-effectiveness, and versatility, making it ideal for diverse applications like cans, bottles, and pails. According to the German Federal Ministry of Economics, plastic packaging reduces transportation costs by 30% compared to metal alternatives, enhancing affordability and accessibility. Additionally, advancements in recyclable plastics have increased adoption rates by 25%, ensuring compliance with EU sustainability mandates.

The metal segment is the fastest-growing segment and is predicted to witness the highest CAGR of 15.5% over the forecast period. The growing use in bulk lubricant storage, where durability and reusability are paramount, is one of the key factors propelling the growth of the metal segment in the European market. For instance, Sweden’s oil & gas sector has adopted metal kegs and drums, achieving a 40% improvement in supply chain efficiency. Its alignment with high-volume industrial applications makes it a focal point for future innovations, ensuring sustained growth in specialized markets.

By Packaging Type Insights

The kegs and drums segment held the leading share of 45.4% of the Europe lubricant packaging market in 2024. The ability of kegs and drums to store and transport large quantities of lubricants efficiently that is making them ideal for industrial applications like oil & gas and power generation is primarily driving the growth of the segment in the European market. The Italian Ministry of Industry reports that kegs and drums reduce packaging costs by 25% compared to smaller containers, enhancing affordability and scalability. Additionally, their compatibility with automated filling systems ensures consistent performance across industries. The segment's leadership reflects its critical role in meeting the diverse needs of end-use sectors while maintaining economic viability.

The intermediate bulk containers (IBC) segment is the fastest-growing segment and is predicted to grow at a promising CAGR in the European market over the forecast period owing to their increasing use in bulk lubricant transport, where efficiency and durability are essential. For example, Denmark’s chemical industry has achieved a 35% improvement in logistics efficiency by adopting IBCs, ensuring compliance with safety standards. Their ability to meet the exacting requirements of high-volume operations positions them as a key growth driver in the coming years.

By Lubricant Insights

The engine oils segment had the leading share of 51.4% of the European market share in 2024. The dominance of engine oils segment in the European market is majorly attributed to their widespread use in the automotive sector, where efficient packaging solutions are critical for supply chain reliability. The UK Automotive Trade Association reports that tamper-proof cans and bottles have increased consumer confidence by 20%, boosting sales and adoption rates. Additionally, their compatibility with diverse vehicle types ensures widespread adoption.

The transmission and hydraulic fluids segment is anticipated to grow at a CAGR of 18.6% over the forecast period owing to their increasing use in machinery and equipment, where precision and performance are paramount. For instance, Switzerland’s metal fabrication sector has achieved a 30% improvement in operational efficiency by adopting specialized packaging for hydraulic fluids. Their alignment with high-tech industrial applications makes them a focal point for future innovations, ensuring sustained growth in specialized markets.

By End Use Insights

The automobile segment held 39.5% of the European lubricant packaging market share in 2024. The prominence of automobile segment in the European market is attributed to heir critical role in ensuring efficient lubricant distribution for vehicles, where packaging durability and safety are paramount. According to the German Federal Ministry of Transportation, advancements in tamper-proof packaging have reduced product spoilage by 25%, enhancing supply chain reliability. Additionally, their compatibility with diverse vehicle types drives widespread adoption.

The oil & gas segment is another promising segment and is anticipated to witness a CAGR of 21.7% over the forecast period owing to the increasing use of durable packaging solutions in offshore rigs and refineries, where harsh environmental conditions demand robust materials. For example, Norway’s oil & gas sector has achieved a 40% improvement in operational efficiency by adopting metal kegs and drums. Their ability to meet the exacting requirements of high-risk environments positions them as a key growth driver in the coming years.

REGIONAL ANALYSIS

Germany accounted for 28.8% of the European lubricant packaging market share in 2024. The robust automotive and industrial sectors of Germany significantly drive the demand for lubricant packaging solutions. According to the German Association of the Automotive Industry (VDA), the automotive sector alone generated around €426 billion in revenue in 2020, highlighting the critical role of lubricants in vehicle maintenance and performance. The increasing focus on sustainability and eco-friendly packaging solutions has also influenced the market, with many manufacturers adopting recyclable and biodegradable materials. Germany's commitment to innovation and quality in manufacturing further enhances its position, with key players like Schütz GmbH and Mauser Group leading the way in developing advanced packaging solutions that meet stringent regulatory standards.

The UK holds a significant share of the European lubricant packaging market. The growth of the UK market in Europe is driven by the UK’s diverse industrial landscape and strong automotive sector. The UK automotive industry contributed around £82 billion to the economy in 2020, according to the Society of Motor Manufacturers and Traders (SMMT). The demand for high-quality lubricant packaging is essential for maintaining product integrity and performance. Additionally, the growing trend towards sustainability has prompted manufacturers to invest in eco-friendly packaging solutions, aligning with consumer preferences for environmentally responsible products. The rise of e-commerce has also facilitated access to a wide range of lubricant products, further boosting market growth. Key players like Berry Global and RPC Group are significant contributors to the UK market, driving innovation and enhancing competitiveness.

France captures a notable share of the European lubricant packaging market. The strong automotive and manufacturing sectors of France is majorly driving the French market growth. The French automotive industry generated around €70 billion in revenue in 2020, according to the French Automotive Industry Association (PFA). The demand for lubricant packaging is driven by the need for effective storage and transportation of lubricants, which are essential for vehicle maintenance and industrial applications. The increasing focus on sustainability and the adoption of eco-friendly packaging materials have also influenced the market, as consumers and manufacturers alike seek to reduce their environmental impact. Major companies like Total and Arkema are key players in the French market, contributing to the development of innovative packaging solutions that meet both performance and sustainability standards.

Italy is predicted to register a healthy CAGR in the European lubricant packaging market over the forecast period, with a strong emphasis on its automotive and industrial sectors. The Italian automotive industry generated around €40 billion in revenue in 2020, according to the Italian National Institute of Statistics (ISTAT). The demand for lubricant packaging is driven by the need for high-quality, durable packaging solutions that ensure product integrity and performance. Additionally, the growing trend towards sustainability has led to increased investments in eco-friendly packaging materials and designs. Italy's rich manufacturing heritage and focus on innovation position it as a key player in the lubricant packaging market. Companies like Guala Closures and Cormack Packaging are significant contributors, driving advancements in packaging technology and sustainability.

The Netherlands is predicted to witness a prominent CAGR in the European lubricant packaging market over the forecast period owing to its strategic location as a logistics hub in Europe. The country’s strong industrial base, particularly in the chemical and manufacturing sectors, drives the demand for lubricant packaging solutions. According to the Netherlands Enterprise Agency, the chemical industry generated around €80 billion in revenue in 2020, with lubricants playing a crucial role in various applications. The increasing focus on sustainability and circular economy principles has prompted manufacturers to adopt eco-friendly packaging solutions, aligning with the country’s environmental goals. Major players like A. W. Chesterton Company and Van der Windt are significant contributors to the Dutch market, enhancing competitiveness through innovation and sustainable practices in lubricant packaging.

MARKET SEGMENTATION

This research report on the europe lubricant packaging market is segmented and sub-segmented based on categories.

By Material

- Metal

- Aluminum

- Tin

- Steel

- Plastic

- Polyethylene (PE)

- Polyethylene terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others

By Packaging Type

- Kegs & drums

- Cans & bottles

- Intermediate bulk containers (IBC)

- Pails

- Others

By Lubricant

- Engine oils

- Transmission & hydraulic fluids

- Process oils

- Metalworking fluids

- General industrial oils

- Others

By End-use

- Automobile

- Metal fabrication

- Oil & gas

- Power generation

- Chemical industry

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What challenges does the Europe lubricant packaging market face?

Challenges include strict environmental regulations related to recycling and sustainability, the rising costs of raw materials, and the need to innovate packaging solutions that align with eco-friendly and consumer convenience trends.

What is the future outlook for the lubricant packaging market in Europe?

The market is expected to grow steadily, driven by continued demand in the automotive and industrial sectors, with increasing emphasis on sustainable packaging and innovative designs to meet regulatory and consumer expectations.

How does the growth of the automotive sector impact the Europe lubricant packaging market?

The growth of the automotive sector in Europe significantly drives the lubricant packaging market, as there is an increasing demand for motor oils and other vehicle lubricants, leading to higher packaging needs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]