Europe Lubricant Market Size, Share, Trends & Growth Forecast Research Report – Segmented By Product Type, End – User And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Lubricant Market Size

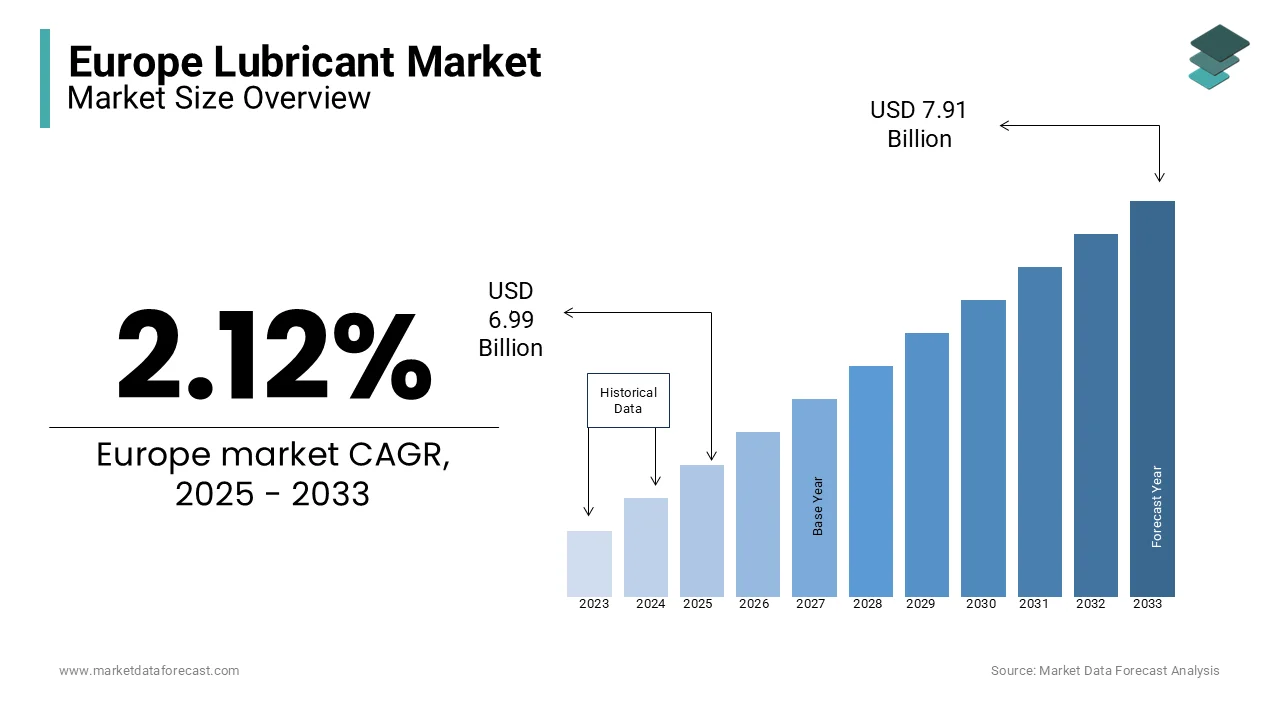

The European lubricant market size was valued at USD 6.55 billion in 2024 and is anticipated to reach USD 6.69 billion in 2025 from USD 7.91 billion by 2033, growing at a CAGR of 2.12% from 2025 to 2033.

Lubricants are integral to a variety of applications, including automotive, industrial machinery, marine operations, and aviation. They consist primarily of base oils and additives, tailored to meet specific performance requirements such as temperature stability, wear resistance, and corrosion protection. The lubricant market in Europe is primarily driven by a diverse industrial landscape, stringent environmental regulations, and technological advancements in lubrication technology. The automotive sector is a significant contributor to the European lubricant market owing to the strong automotive manufacturing base of Europe, particularly in Germany, France, and Italy. According to the European Automobile Manufacturers Association, over 9.2 million vehicles were produced in Europe in 2022, underscoring the critical role of automotive lubricants. The transition of Europe toward sustainable practices, with increasing demand for bio-based and synthetic lubricants, is also favoring the European lubricant market growth.

MARKET DRIVERS

Growing Automotive Industry in Europe

The robust automotive manufacturing sector in Europe is a significant driver of the lubricant market. According to the European Automobile Manufacturers Association, Europe produced over 9.2 million motor vehicles in 2022, making it one of the leading automotive production regions globally. These vehicles require high-quality lubricants for engine performance, transmission, and other mechanical components. Additionally, the growing demand for electric vehicles (EVs), which use specialized lubricants, further supports market growth. As Europe leads the global EV transition, with EV sales accounting for nearly 12% of total vehicle sales in 2022, the need for advanced lubricants tailored for EV applications is rising, driving innovation in the sector.

Industrial Growth and Machinery Use

Europe’s diverse industrial base drives substantial demand for industrial lubricants used in manufacturing, power generation, and heavy machinery. Data from Eurostat shows that the industrial production index for the EU increased steadily in 2022, reflecting a rebound in manufacturing activity post-pandemic. High-performance lubricants are essential in reducing friction, enhancing energy efficiency, and prolonging machinery life, which are critical for cost-effective industrial operations. Additionally, advancements in automation and precision manufacturing technologies have elevated the need for lubricants with superior thermal stability and wear resistance, further fueling market expansion in industrial applications.

MARKET RESTRAINTS

Stringent Environmental Regulations

Tight environmental regulations in Europe act as a significant restraint on the lubricant market. The European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations and sustainability directives impose strict standards on the formulation, use, and disposal of lubricants. These regulations require manufacturers to reduce volatile organic compounds (VOCs) and eliminate hazardous substances in lubricant formulations. According to the European Environment Agency, non-compliance with such standards can lead to significant fines and restricted market access. This regulatory pressure drives up production costs for manufacturers, particularly those transitioning to bio-based and eco-friendly lubricants, and limits market expansion.

Volatility in Crude Oil Prices

The dependency of lubricant production on crude oil-derived base oils exposes the market to price fluctuations in the global oil industry. According to the European Commission’s energy market reports, crude oil prices experienced sharp volatility in recent years, primarily due to geopolitical tensions and fluctuating demand. Such instability directly impacts the cost structure of lubricant manufacturers, as base oils constitute a significant portion of production expenses. Small and medium-sized enterprises (SMEs) in the lubricant sector face challenges in absorbing these costs, reducing their competitiveness and constraining market growth across the region.

MARKET OPPORTUNITIES

Demand for Bio-Based and Sustainable Lubricants

The increasing emphasis on environmental sustainability in Europe presents a significant opportunity for the lubricant market. Bio-based lubricants, derived from renewable sources, are gaining traction as eco-friendly alternatives to traditional mineral-based lubricants. The European Commission’s Green Deal, aiming to achieve carbon neutrality by 2050, supports this transition by promoting sustainable industrial practices. Reports from the European Environment Agency highlight that sustainable lubricants can reduce carbon emissions by up to 80% compared to conventional options. This growing preference for eco-friendly products opens avenues for innovation and market expansion in sustainable lubricant formulations.

Growth in Electric Vehicle (EV) Adoption

The rapid growth of the electric vehicle (EV) market in Europe creates a burgeoning opportunity for specialized lubricants designed for EV applications. According to the European Automobile Manufacturers Association, EVs accounted for approximately 12% of new car registrations in Europe in 2022, a figure expected to rise significantly in the coming years. EVs require advanced lubricants for thermal management and efficient operation of electric motors and drivetrains. This growing adoption of EVs provides lubricant manufacturers with an opportunity to develop tailored solutions, catering to the specific needs of the evolving automotive industry and aligning with Europe’s push for cleaner transportation technologies.

MARKET CHALLENGES

Shift Toward Electric Vehicles (EVs)

The increasing adoption of electric vehicles in Europe poses a challenge for the lubricant market. EVs require fewer lubricants compared to internal combustion engine (ICE) vehicles due to the absence of traditional engines and transmissions. The European Automobile Manufacturers Association reports that EV sales accounted for 12% of new car registrations in 2022, a number expected to rise significantly with the EU’s goal to phase out ICE vehicles by 2035. This transition reduces demand for conventional automotive lubricants, compelling manufacturers to adapt their product portfolios and invest in developing specialized fluids for EV components, increasing competitive pressure and R&D costs.

Dependence on Crude Oil-Derived Base Oils

The reliance on crude oil for the production of base oils—a primary component of lubricants—poses a challenge due to volatile oil prices and supply disruptions. The European Commission’s energy market reports indicate that oil price volatility surged by over 40% in 2022 due to geopolitical tensions and fluctuating global demand. This instability directly impacts production costs, leading to pricing challenges for lubricant manufacturers. Moreover, the push toward reducing fossil fuel dependency in Europe adds to the uncertainty, creating a dual challenge for the industry to secure consistent raw material supplies while transitioning to sustainable alternatives.

REGIONAL ANALYSIS

Germany dominated the lubricant market in Europe in 2023. The domination of Germany in the European lubricant market is majorly attributed to its strong industrial base and advanced automotive manufacturing sector. According to the Federal Statistical Office of Germany, the country produces over 3 million vehicles annually, making it one of Europe’s largest automotive markets. This robust automotive production drives significant demand for high-performance lubricants for engines and transmissions. Additionally, Germany’s industrial sector heavily relies on lubricants to optimize machinery and reduce operational downtime, contributing to its dominant position in the market.

The UK also plays a major role in the European lubricant market. The growing aerospace and automotive industries in the UK are driving the UK lubricant marker growth. The UK Civil Aviation Authority highlights the importance of aviation maintenance, where specialty lubricants play a critical role. Furthermore, the UK’s focus on sustainability fosters the adoption of bio-based lubricants, aligning with its stringent environmental goals. This dual focus on industrial and sustainable applications strengthens the UK’s market presence.

France is another major player for lubricants in Europe. The robust transportation and energy sectors of France are boosting the lubricant market growth in this country. The French Ministry for the Ecological Transition underscores the growing adoption of renewable energy projects, where lubricants ensure efficient turbine and equipment operations. Additionally, the automotive industry remains a significant contributor, with France producing over 1 million vehicles annually, requiring substantial volumes of automotive lubricants.

KEY MARKET PLAYERS

BP Plc (Castrol), Lukoil, Royal Dutch Shell Plc, ExxonMobil Corporation, Total Energies, FUCHS Petrolub SE, Chevron Corporation, Repsol, LUKOIL, Petro-Canada Lubricants. These are the market players that are dominating the Europe lubricant market.

MARKET SEGMENTATIONS

This research report on the European lubricant market is segmented and sub-segmented into the following categories.

By Product Type

- Engine Oil

- Greases

- Hydraulic Fluids

- Metal Working Fluids

- Transmissions & Gear Oils

- Others

By End-User

- Automotive

- Heavy Equipment

- Metallurgy & Metalworking

- Power Generation

- Others

By Region

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe lubricant market?

The current market size of the Europe lubricant market is valued at USD 6.55 billion in 2024

How big is the Europe lubricant market?

The European lubricant market size is expected to reach USD 6.69 billion in 2025 from USD 7.91 billion by 2033 at a CAGR of 2.12% from 2025 to 2033.

Who are the market players dominating the Europe lubricant market?

BP Plc (Castrol), Lukoil, Royal Dutch Shell Plc, ExxonMobil Corporation, Total Energies, FUCHS Petrolub SE, Chevron Corporation, Repsol, LUKOIL, Petro-Canada Lubricants. These are the market players that are dominating the Europe lubricant market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]