Europe Location Analytics Market Size, Share, Trends, & Growth Forecast Report By Offering (Solutions and Services), Location Type, Application, Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Location Analytics Market Size

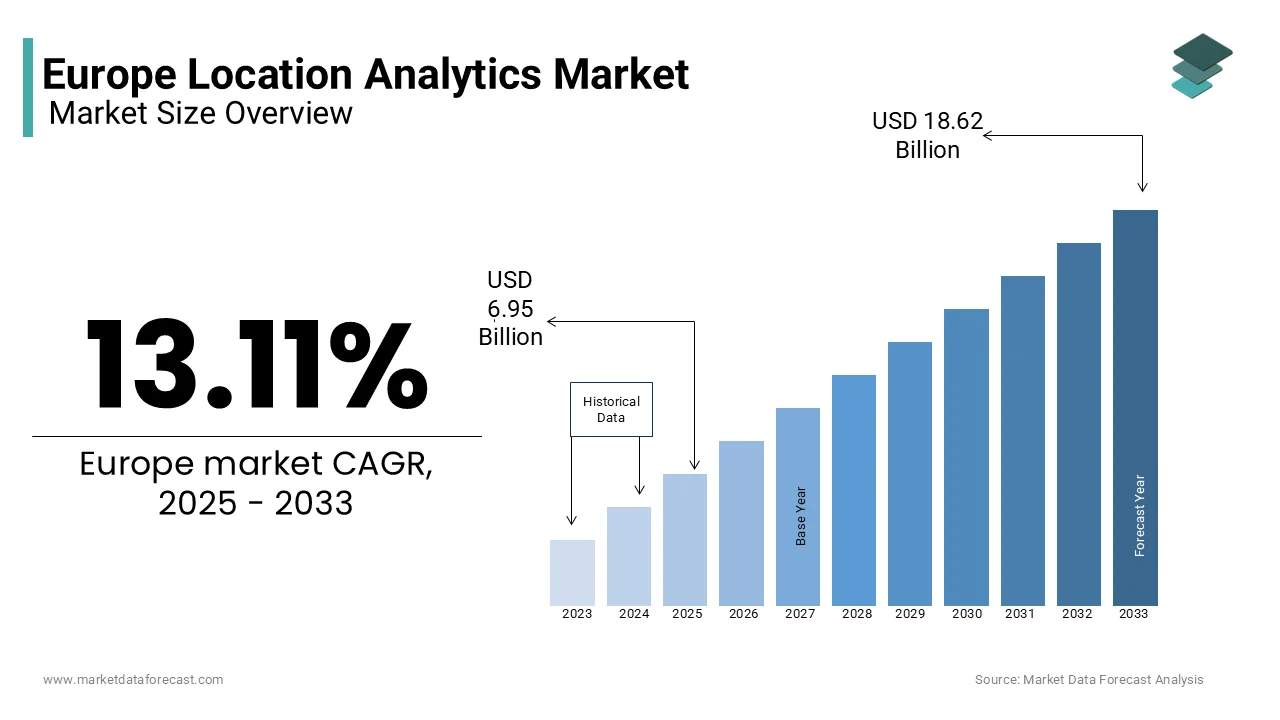

The Europe location analytics market was worth USD 6.14 billion in 2024. The European market is expected to reach USD 18.62 billion by 2033 from USD 6.95 billion in 2025, rising at a CAGR of 13.11% from 2025 to 2033.

The need for geospatial insights to enhance decision-making across various sectors is growing considerably in the European region, which is resulting in the growing demand for location analytics. Location analytics refers to the process of deriving meaningful patterns and actionable insights from geographic data, enabling organizations to optimize operations, improve customer experiences, and identify growth opportunities. According to Eurostat, over 70% of European businesses now leverage geospatial data in their operations, reflecting the growing recognition of its strategic importance. The market is fueled by advancements in technologies such as Geographic Information Systems (GIS), artificial intelligence (AI), and the Internet of Things (IoT), which have expanded the scope and accuracy of location-based insights.

Key industries such as retail, transportation, healthcare, and urban planning are at the forefront of adoption. For instance, the European Commission notes that smart city initiatives across the region have increased the demand for location analytics to optimize traffic management, energy consumption, and public services. Additionally, McKinsey reports that retailers using location analytics have achieved a 20% improvement in customer engagement and site selection strategies. As Europe continues to embrace digital transformation and data-driven innovation, location analytics is becoming an indispensable tool for businesses and governments alike. With rising investments in IoT devices and 5G infrastructure, the market is poised for exponential growth, offering transformative solutions to address complex spatial challenges and drive sustainable development.

MARKET DRIVERS

Increasing Adoption of IoT and Smart City Initiatives

The proliferation of Internet of Things (IoT) devices and smart city initiatives is a major driver of the European location analytics market. Eurostat reports that over 60% of European cities are implementing smart city projects, leveraging geospatial data to optimize urban planning, traffic management, and energy consumption. The European Commission highlights that IoT device adoption has surged by 40% since 2020, generating vast amounts of location-based data for analysis. These technologies enable real-time monitoring and predictive insights, which are critical for addressing urban challenges. For instance, McKinsey notes that cities using location analytics have reduced traffic congestion by 25% and improved public service delivery. As governments prioritize sustainability and digital transformation, the demand for location analytics continues to grow, making it an essential tool for enhancing operational efficiency and fostering innovation in urban ecosystems.

Rising Demand for Location-Based Customer Insights

The growing demand for location-based customer insights in retail and marketing is another key driver of the European location analytics market. According to Statista, over 75% of European retailers now use geospatial data to enhance site selection strategies and improve customer engagement. A study by the European Retail Research Association highlights that businesses leveraging location analytics achieve a 20% increase in foot traffic and a 15% rise in sales conversions. Additionally, the International Data Corporation (IDC) reports that the integration of AI with location analytics has improved targeting accuracy by 30%, enabling personalized marketing campaigns. This trend is further amplified by the increasing use of mobile devices and GPS-enabled applications, which generate valuable consumer behavior data. As companies strive to remain competitive in a dynamic market, location analytics has become indispensable for understanding customer preferences and optimizing business strategies.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

High cost of implementation that poses challenges for small and medium-sized enterprises (SMEs) is hindering the growth of the European location analytics market. According to the European Commission, nearly 50% of SMEs cite budget limitations as a barrier to adopting advanced analytics solutions, including location analytics. According to Eurostat, the average investment required for integrating IoT devices, GIS software, and AI-driven analytics can exceed €100,000 annually, making it unaffordable for smaller organizations. A study by Deloitte notes that only 35% of SMEs in Europe have successfully implemented location analytics due to these financial constraints. Additionally, ongoing maintenance and training costs further strain budgets, limiting widespread adoption. While larger corporations can absorb these expenses, smaller players struggle to justify the return on investment, creating a disparity in market penetration and hindering overall growth.

Privacy Concerns and Regulatory Challenges

Growing concern over data privacy and regulatory compliance, particularly under frameworks like the General Data Protection Regulation (GDPR) is another factor hampering the growth of the European market. The European Data Protection Board reports that over 60% of businesses face challenges in ensuring compliance when handling geospatial data, which often includes sensitive personal information. A survey by PwC highlights that 45% of organizations delay or avoid implementing location analytics due to fears of non-compliance and potential fines. Furthermore, McKinsey notes that anonymizing location data while maintaining its utility is a complex process, reducing the accuracy of insights. As regulatory scrutiny intensifies, companies must invest heavily in data protection measures, increasing operational complexity. These privacy concerns create hesitancy among businesses, slowing the adoption of location analytics and limiting its full potential across industries.

MARKET OPPORTUNITIES

Expansion of Location Analytics in Healthcare

The application of location analytics within the healthcare sector due to the need for optimized resource allocation and improved patient care is a significant opportunity to the European market. According to the European Commission, over 60% of healthcare providers are exploring geospatial tools to enhance emergency response systems and hospital logistics. According to Eurostat, hospitals using location analytics have reduced ambulance response times by 30%, significantly improving patient outcomes. A study by McKinsey notes that location-based insights enable better planning of healthcare facilities, with a 25% increase in accessibility to underserved regions. Additionally, the World Health Organization (WHO) emphasizes that location analytics supports disease surveillance and outbreak management, particularly during public health crises like the COVID-19 pandemic. As Europe’s aging population increases demand for efficient healthcare services, location analytics offers transformative solutions to address spatial challenges and deliver equitable care.

Growing Adoption in Retail and E-commerce

The rapid adoption of location analytics in retail and e-commerce owing to the need for enhanced customer experiences and operational efficiency is another notable opportunity in the European market. According to Statista, over 75% of European retailers now use geospatial data to optimize site selection and supply chain logistics. The European Retail Research Association highlights that businesses leveraging location analytics achieve a 20% improvement in customer engagement and a 15% reduction in operational costs. Furthermore, Deloitte notes that integrating AI with location analytics has increased targeting accuracy by 30%, enabling hyper-personalized marketing strategies. With the rise of mobile commerce and GPS-enabled applications, retailers can track consumer behavior in real-time, driving sales conversions. As competition intensifies, location analytics provides retailers with actionable insights to stay ahead, making it a pivotal tool for growth in this dynamic industry.

MARKET CHALLENGES

Limited Awareness and Technical Expertise

Limited awareness and technical expertise among businesses, particularly smaller enterprises is a significant challenge to the European location analytics market. The European Commission reports that nearly 50% of small and medium-sized enterprises (SMEs) lack the knowledge to effectively implement and utilize geospatial technologies. According to Eurostat, only 40% of SMEs have access to skilled personnel trained in GIS and data analytics, creating a significant barrier to adoption. A study by Deloitte highlights that this skills gap results in underutilization of location analytics tools, with 35% of organizations failing to achieve their desired outcomes. Additionally, McKinsey notes that the complexity of integrating these systems into existing workflows often discourages adoption, particularly for businesses without dedicated IT teams. As a result, many organizations miss out on the transformative potential of location analytics, limiting its broader market penetration and slowing overall growth.

Data Fragmentation and Interoperability Issues

Fragmentation of geospatial data and interoperability issues across platforms and industries is another major challenge to the market expansion. The European Data Protection Supervisor highlights that over 60% of organizations face difficulties in consolidating data from disparate sources, such as IoT devices, GPS systems, and public datasets. A report by the International Data Corporation (IDC) notes that inconsistent data formats and standards reduce the accuracy of location analytics by 25%, hindering decision-making processes. Furthermore, PwC emphasizes that integrating location analytics with legacy systems remains a complex and costly endeavor, deterring widespread adoption. This challenge is particularly pronounced in cross-border applications, where differences in national regulations and data-sharing practices create additional barriers. As businesses strive to harness the full potential of location analytics, addressing these interoperability issues is critical to ensuring seamless and scalable solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.11% |

|

Segments Covered |

By Offering, Location Type, Application, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Zebra Technologies (US), Alteryx (US), HERE (US), Purple (UK), Galigeo (France), GeoMoby (Australia), Quuppa (Finland), CleverMaps (Czech Republic), IndoorAtlas (Finland), Lepton Software (India), CARTO (US), TIBCO (US), Sparkgeo (Canada), Ascent Cloud (US), Foursquare (US), MapLarge (US), SedimentIQ (US), Ariadne Maps (Germany), Locale.ai (India), Geoblink (Spain), Nrby (US), Mapidea (Portugal), GapMaps (Australia), and LocationsCloud (US). |

SEGMENTAL ANALYSIS

By Offering Insights

The reporting and visualization segment had the leading share of 25.5% in the European market in 2024 due to its ability to transform complex geospatial data into intuitive dashboards, maps, and charts, enabling faster decision-making. The European Commission highlights that organizations using advanced visualization tools achieve a 40% improvement in decision-making speed. These solutions are widely adopted across industries like retail, urban planning, and transportation, where visual insights drive strategic actions.

The cloud deployment segment is anticipated to be fastest growing segment and grow at a CAGR of 15.9% over the forecast period owing to the increasing demand for scalable and cost-effective solutions, particularly among SMEs. The European Commission notes that cloud-based tools reduce infrastructure costs by 30% while improving accessibility and collaboration. Advancements in cloud security have addressed data protection concerns, accelerating adoption. As businesses prioritize agility and real-time analytics, cloud deployment is becoming indispensable, making it a pivotal driver of innovation and transformation in the location analytics market.

By Location Type Insights

The outdoor location segment held 65.7% of the European market share in 2024. The domination of outdoor location segment is driven by its widespread applications in transportation, logistics, and smart city initiatives. The European Environment Agency highlights that outdoor location analytics has reduced traffic congestion by 20% and improved delivery efficiency by 40% in logistics. These solutions leverage GPS and IoT technologies to provide real-time insights, optimizing large-scale operations like route planning and urban development.

The indoor location segment is predicted to witness a CAGR of 18.8% over the forecast period owing to the rising demand for personalized services and operational efficiency in retail, healthcare, and warehousing. The European Commission notes that indoor location analytics has improved inventory accuracy by 35% and reduced patient wait times by 25%. Technologies like BLE beacons and Wi-Fi positioning enable precise tracking, enhancing space utilization and customer experiences. As urbanization increases and industries focus on enclosed-space optimization, indoor location analytics is becoming vital for delivering tailored solutions, driving its rapid adoption across sectors.

By Application Insights

The customer experience management segment had the major share of 25.8% of the European market share in 2024. The leading position of the customer experience management segment is driven by the growing demand for personalized customer interactions, with the European Retail Research Association reporting a 20% increase in foot traffic and a 15% rise in sales conversions for businesses using location analytics. These tools enable targeted marketing, optimized site selection, and enhanced consumer behavior insights, which is driving the segmental growth.

The remote location analytics segment is estimated to register a CAGR of 20.7% over the forecast period owing to the increasing investments in IoT and satellite technologies, enabling analysis of hard-to-reach areas. The European Space Agency highlights that remote location analytics has improved environmental monitoring and infrastructure assessment in rural regions by 35%. Applications span agriculture, mining, and disaster management, where real-time data is critical. As Europe prioritizes sustainability and digital transformation, remote location analytics is becoming vital for addressing spatial challenges in underserved areas, solidifying its position as a key driver of innovation in the location analytics market.

By Vertical Insights

The retail & eCommerce segment captured the leading share of 22.9% of the European market share in 2024. The growth of the retail and eCommerce segment is attributed to the growing demand for optimized site selection, inventory management, and personalized marketing. The European Retail Research Association highlights that businesses using location analytics achieve a 20% increase in foot traffic and a 15% rise in sales conversions. These tools enable retailers to analyze consumer behavior, optimize supply chains, and deliver hyper-personalized offers.

The BFSI segment is anticipated to showcase a notable CAGR of 18.9% over the forecast period owing to the increasing need for risk assessment, fraud detection, and customer service optimization. Eurostat highlights that location analytics has reduced operational losses by 25%, while McKinsey notes a 30% improvement in customer targeting. As financial institutions prioritize regulatory compliance and operational resilience, location analytics has become vital for analyzing regional risks and enhancing decision-making. Its importance lies in ensuring competitiveness, mitigating risks, and delivering tailored services, positioning BFSI as a key growth driver in the location analytics market.

REGIONAL ANALYSIS

Germany led the location analytics market in Europe by accounting for 25.9% of the European market share in 2024. The dominating position of Germany in the European market is attributed to its robust industrial base, particularly in automotive, logistics, and manufacturing, where location analytics optimizes supply chains and operational efficiency. The German government’s focus on smart city initiatives, supported by investments exceeding €1 billion annually, has further accelerated adoption. According to Eurostat, over 60% of German enterprises leverage geospatial tools for urban planning and transportation management. Additionally, the Federal Ministry for Economic Affairs highlights that IoT integration with location analytics has improved logistics efficiency by 30%. Germany’s strong emphasis on innovation and digital transformation solidifies its position as a leader in adopting advanced spatial technologies.

The UK held a substantial share of the European market in 2024 and is expected to hold a notable share of the European market over the forecast period owing to its thriving retail and eCommerce sector, which extensively uses location analytics for customer experience management and site optimization. The UK Office for National Statistics reports that businesses leveraging these tools achieve a 20% increase in sales conversions. Furthermore, the UK’s focus on smart infrastructure, including £40 million allocated to geospatial data projects in 2022, drives adoption. The British Retail Consortium highlights that location analytics has enhanced supply chain visibility by 25%. As the UK prioritizes sustainability and urban development, its advanced use of geospatial technologies positions it as a key player in the market.

France is another notable player in the European market and is likely to account for a substantial share of the European market over the forecast period owing to the strong investments in smart city projects and healthcare applications. Deloitte reports that over 70% of French municipalities use location analytics for traffic management and energy optimization, reducing congestion by 20%. Additionally, the French National Centre for Scientific Research highlights that hospitals using geospatial tools have improved emergency response times by 35%. France’s "France 2030" initiative, which allocates €54 billion to digital innovation, further accelerates adoption. The country’s focus on sustainability, healthcare modernization, and urban planning reinforces its role as a leader in leveraging location analytics for transformative solutions.

KEY MARKET PLAYERS

The major players in the European location analytics market include IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Zebra Technologies (US), Alteryx (US), HERE (US), Purple (UK), Galigeo (France), GeoMoby (Australia), Quuppa (Finland), CleverMaps (Czech Republic), IndoorAtlas (Finland), Lepton Software (India), CARTO (US), TIBCO (US), Sparkgeo (Canada), Ascent Cloud (US), Foursquare (US), MapLarge (US), SedimentIQ (US), Ariadne Maps (Germany), Locale.ai (India), Geoblink (Spain), Nrby (US), Mapidea (Portugal), GapMaps (Australia), and LocationsCloud (US).

MARKET SEGMENTATION

This research report on the Europe location analytics market is segmented and sub-segmented into the following categories.

By Offering

- Solutions

- By Type

- Geocoding & Reverse Geocoding

- Data Integration & ETL

- Reporting & Visualization

- Thematic Mapping & Spatial Analysis

- Others

- By Deployment

- Cloud

- On-premises

- By Type

- Services

- Professional Service

- Consulting Services

- Deployment & Integration

- Training, Support, and Maintenance

- Managed Service

- Professional Service

By Location Type

- Indoor Location

- Outdoor Location

By Application

- Risk Management

- Emergency & Response Management

- Customer Experience Management

- Remote Location Analytics

- Supply Chain Planning & Optimization

- Sales & Marketing Optimization

- Others

By Vertical

- BFSI

- Retail & eCommerce

- Government & Defense

- Media & Entertainment

- Automotive, Transportation & Logistics

- Energy & Utilities

- Telecom

- Healthcare & Life Sciences

- IT/ITeS

- Tourism & Hospitality

- Manufacturing

- Agriculture

- Other Verticals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe location analytics market?

The increasing adoption of IoT, the growing demand for real-time location-based data, and the rising use of geospatial data for business intelligence are key factors driving the market.

Which industries are the primary users of location analytics in Europe?

Major industries using location analytics include retail, transportation, logistics, healthcare, real estate, and government sectors for urban planning and disaster management.

What role does AI and machine learning play in the Europe location analytics market?

AI and machine learning enhance location analytics by improving predictive analytics, automating data processing, and delivering more accurate real-time insights.

What is the future outlook for the Europe location analytics market?

The market is expected to grow with advancements in AI, the expansion of smart city projects, and increased adoption of cloud-based location analytics solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]