Europe Lobster Market Size, Share, Trends & Growth Research Report By Species (American Lobster, Spiny Lobster, Rock Lobster, European Lobster), Product Type (Whole Lobster, Lobster Tail, Lobster Meat, Lobster Claw), Distribution Channel (Food Service, Retail) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 to 2033

Europe Lobster Market Size

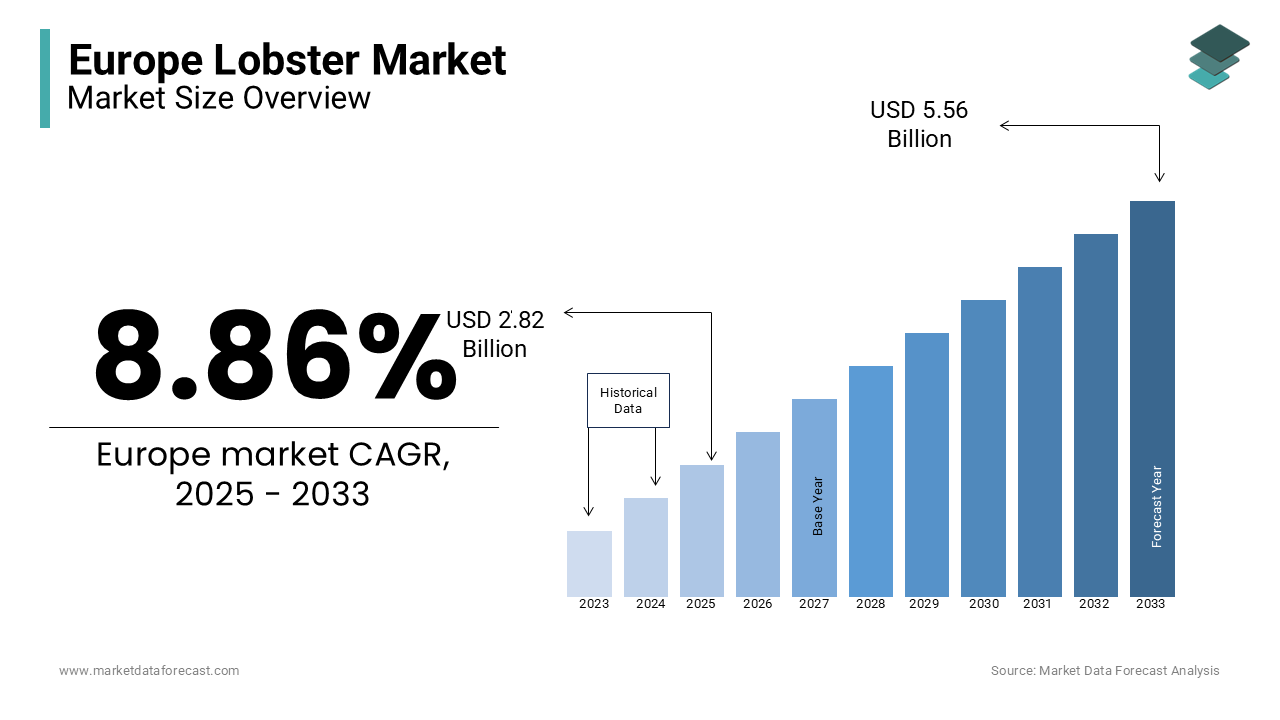

The Europe lobster market size was calculated to be USD 2.59 billion in 2024 and is anticipated to be worth USD 5.56 billion by 2033 from USD 2.82 billion In 2025, growing at a CAGR of 8.86% during the forecast period.

Lobster is popular for its delicate flavor and nutritional value and is widely consumed across Europe in both fine dining establishments and retail sectors. Europe is a major importer of lobsters due to its limited domestic supply. According to the Food and Agriculture Organization, the region imported over 65,000 metric tons of lobster in 2022, with key suppliers including Canada and the United States. The United Kingdom, France, and Spain are leading markets, accounting for the majority of consumption due to their strong seafood traditions and thriving hospitality industries.

MARKET DRIVERS

Growing Demand for Premium Seafood in Europe

The increasing consumer preference for premium seafood products is a significant driver of the Europe lobster market. Lobster is considered a luxury item, often associated with fine dining and special occasions, contributing to its robust demand. According to the Food and Agriculture Organization, Europe’s seafood consumption exceeded 24 kg per capita in 2022, with lobsters accounting for a growing share of high-value seafood imports. Key markets such as France and Spain show strong demand for lobster in upscale restaurants and retail outlets. This trend aligns with rising disposable incomes and the growing inclination for gourmet experiences, propelling the market’s growth.

Expansion of Sustainable and Certified Seafood Options

The rising focus on sustainability and ethical sourcing is transforming the Europe lobster market. Consumers increasingly seek seafood certified by organizations like the Marine Stewardship Council (MSC), ensuring responsible fishing practices and environmental preservation. The European Commission reported a 15% annual increase in demand for MSC-certified seafood between 2020 and 2022, with lobsters being a prominent category. Countries such as the United Kingdom and Denmark are leading in promoting sustainable seafood consumption. This emphasis on sustainability not only supports ethical sourcing but also strengthens consumer trust, creating opportunities for producers and suppliers to meet evolving market preferences.

MARKET RESTRAINTS

High Import Dependence and Supply Chain Challenges

Europe's heavy reliance on imported lobsters presents a significant restraint in the market, making it vulnerable to supply chain disruptions and price volatility. The region imports the majority of its lobster supply, with Canada and the United States accounting for over 80% of total imports, as noted by the Food and Agriculture Organization. In 2022, logistical challenges such as increased freight costs and delays led to higher prices for imported lobsters, straining affordability for consumers and businesses. These supply chain dependencies expose the market to risks related to global trade dynamics, including tariffs and export restrictions, further complicating access to consistent, high-quality lobster supplies.

Environmental Concerns and Overfishing Regulations

Strict environmental regulations and concerns over overfishing pose challenges to the Europe lobster market. Governments and regulatory bodies such as the European Commission enforce stringent quotas and fishing restrictions to protect marine ecosystems and prevent overexploitation of lobster populations. The European Environment Agency highlights that unsustainable fishing practices have reduced some lobster stocks by up to 30% in certain regions. These regulations, while essential for sustainability, limit the availability of locally sourced lobsters and increase dependence on imports. Compliance costs for fisheries and suppliers further add to operational expenses, creating obstacles for smaller players in the market to compete effectively.

MARKET OPPORTUNITIES

Rising Popularity of Lobster in Retail and E-Commerce

The growing accessibility of lobster through retail and e-commerce channels presents a significant opportunity in the Europe lobster market. Advancements in cold-chain logistics and packaging technologies have enabled suppliers to maintain the freshness of lobsters, facilitating their availability in supermarkets and online platforms. The European Commission reports that seafood e-commerce sales grew by 18% annually between 2020 and 2022, reflecting changing consumer purchasing habits. Countries like the UK and Germany are leading this shift, with increasing consumer preference for convenient access to premium seafood. This expansion into direct-to-consumer channels allows suppliers to reach a broader demographic, driving growth beyond traditional hospitality and fine dining sectors.

Expansion of Value-Added Lobster Products

The development of value-added lobster products, such as pre-cooked, frozen, and ready-to-eat options, represents another key growth avenue for the Europe lobster market. These products cater to busy consumers seeking convenience without compromising on quality. According to the Food and Agriculture Organization, demand for frozen and prepared seafood in Europe grew by 14% in 2022, driven by innovations in product diversification. Markets like France and Spain are witnessing increased interest in marinated and pre-packaged lobster dishes, enhancing consumer appeal. This trend provides manufacturers with opportunities to create differentiated offerings, capitalize on evolving consumer preferences, and tap into the growing market for high-quality, ready-to-cook seafood products.

MARKET CHALLENGES

Fluctuating Lobster Prices

Price volatility in the lobster market poses a significant challenge for Europe, affecting both suppliers and consumers. Factors such as seasonal availability, climatic conditions, and global trade dynamics contribute to unstable prices. According to the Food and Agriculture Organization, lobster prices in Europe increased by 20% in 2022 due to higher demand and limited supply from North American exporters. These price fluctuations create uncertainty for restaurants, retailers, and consumers, making it difficult to plan budgets or maintain consistent pricing. Such instability limits the accessibility of lobster to a broader demographic, potentially restricting market growth and impacting demand in price-sensitive segments.

Strict Environmental and Import Regulations

The Europe lobster market faces stringent environmental and import regulations designed to protect marine ecosystems and ensure food safety. The European Union imposes strict guidelines on the importation of lobsters, requiring certifications and inspections to meet sustainability and quality standards. The European Commission has also increased restrictions on the use of non-native species, such as the American lobster, due to concerns about ecological impact. In 2022, regulatory compliance costs rose by 15%, as reported by the European Environment Agency, creating challenges for suppliers and importers. These regulations, while necessary for sustainability, add financial and logistical burdens, hindering smaller market players and slowing overall market expansion.

REGIONAL ANALYSIS

France dominates the lobster market in Europe and is predicted to continue to be the top performing regional market for lobster in Europe throughout the forecast period due to the growing demand for seafood and high demand in fine dining and retail in France. The French Ministry of Agriculture and Food reported that France imported over 12,000 metric tons of lobster in 2022, making it one of the largest consumers in Europe. Lobster is a staple in gourmet cuisine, with dishes like lobster thermidor featuring prominently in French gastronomy. Additionally, the country’s emphasis on sustainably sourced seafood has boosted demand for certified products, aligning with consumer preferences. France’s well-established hospitality sector and vibrant culinary traditions cement its position as a leader in the lobster market.

The UK is another solid regional segment for lobster in European market and is expected to hold a substantial share of the European market during the forecast period. The lobster market growth in the UK is driven by both domestic production and imports. The UK’s fishing industry, particularly in Scotland, contributes to local lobster supplies, with over 5,000 metric tons landed annually, according to the UK Marine Management Organisation. Additionally, the UK imported approximately 10,000 metric tons of lobster in 2022 to meet growing consumer demand. The country’s love for premium seafood is evident in both retail and dining sectors, where lobster is a popular choice. With an increasing focus on sustainable sourcing and a strong e-commerce seafood market, the UK maintains its leadership in the European lobster landscape.

Spain is a noteworthy market player for lobster in Europe and is expected to showcase a prominent CAGR during the forecast period due to the strong seafood culture and high consumption rates. The Spanish Ministry of Agriculture, Fisheries, and Food reported that Spain imported over 11,000 metric tons of lobster in 2022, with significant demand in regions like Catalonia and Galicia. Lobster features prominently in Spanish gastronomy, including festive dishes like arroz con bogavante (lobster rice). The country’s thriving tourism industry also contributes to high lobster demand in luxury dining establishments. Spain’s leadership stems from its rich culinary heritage and strategic import partnerships, ensuring consistent availability of high-quality lobster in both domestic and international markets.

MARKET SEGMENTATION

This research report on the European lobster market is segmented and sub-segmented into the following categories.

By Species

- American Lobster

- Spiny Lobster

- Rock Lobster

- European Lobster

By Product Type

- Whole Lobster

- Lobster Tail

- Lobster Meat

- Lobster Claw

By Distribution Channel

- Food Service

- Retail

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who are the primary suppliers of lobster to Europe?

The Canada, United States, and local European fisheries are key suppliers.

2. What drives demand for lobster in Europe?

Increasing demand is driven by luxury dining, seafood festivals, and the growing popularity of gourmet cuisine.

3. How is lobster typically sold in Europe?

Lobster is sold fresh, frozen, canned, or as ready-to-eat meals in supermarkets, restaurants, and seafood markets.

4. Which factors influence lobster prices in Europe?

Prices are influenced by supply, demand, seasonality, and import/export regulations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]