Europe Livestock Monitoring Market Size, Share, Trends & Growth Forecast Report Segmented By Offering, Application, Species, Farm Type And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Livestock Monitoring Market Size

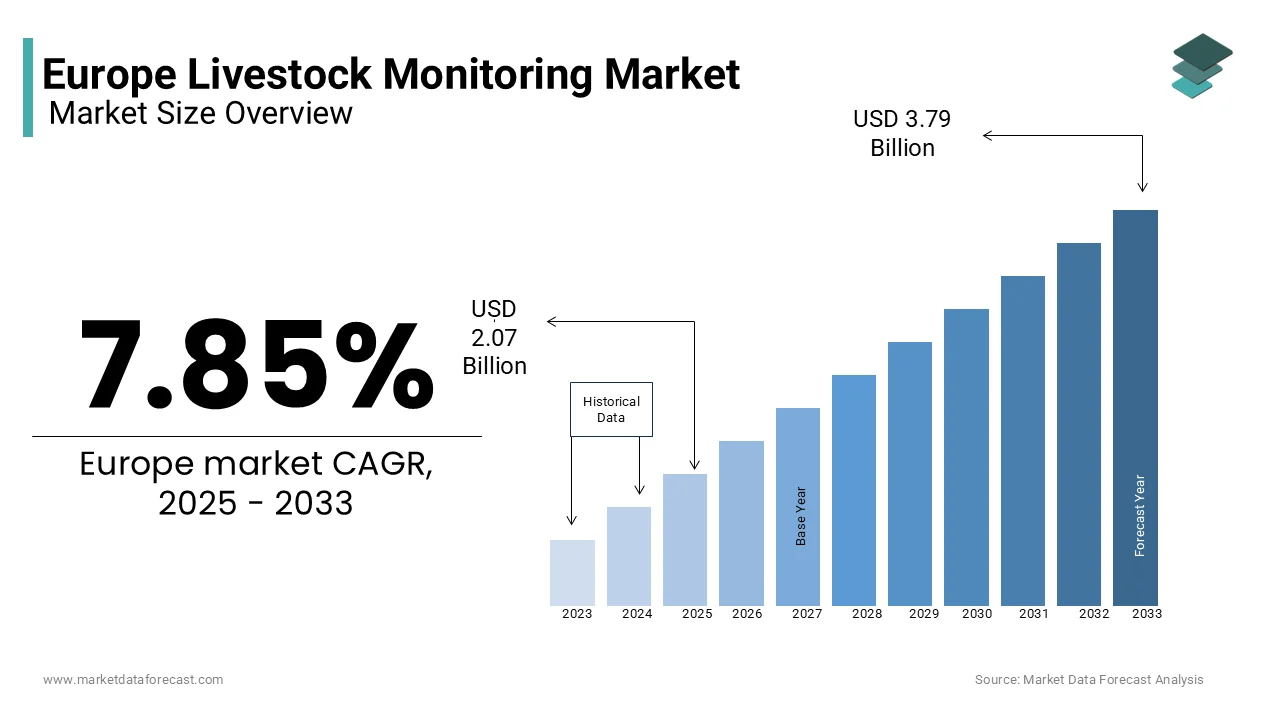

The Europe livestock monitoring market size was valued at USD 1.92 billion in 2024 and is anticipated to reach USD 2.07 billion in 2025 from USD 3.79 billion by 2033, growing at a CAGR of 7.85% during the forecast period from 2025 to 2033.

Livestock monitoring are solutions designed to monitor animal health, behaviour, productivity, and environmental conditions, ensuring sustainable farming practices and enhanced operational efficiency. In Europe, the integration of advanced technologies such as IoT, AI, and big data analytics to optimize livestock management is majorly fuelling the demand for livestock monitoring. According to Eurostat, livestock production contributes approximately 40% of the total agricultural output in Europe, underscoring its economic significance. The adoption of livestock monitoring systems is increasingly viewed as a critical enabler for addressing challenges such as rising consumer demand for high-quality animal products, stringent animal welfare regulations, and the need for resource optimization.

As per the European Commission’s Directorate-General for Agriculture and Rural Development, over 60% of European farmers are now integrating digital tools into their operations, with livestock monitoring emerging as a key focus area. These systems not only improve farm profitability but also align with the EU’s Green Deal objectives, which emphasize reducing the environmental footprint of agriculture. For instance, real-time monitoring of cattle health can reduce antibiotic usage by up to 30%, as reported by Wageningen University. Furthermore, countries like Germany and France have witnessed a surge in smart farming investments, collectively accounting for nearly 50% of the regional market share. With the global population projected to reach 9.7 billion by 2050, the role of livestock monitoring in ensuring food security and sustainability becomes even more pronounced.

MARKET DRIVERS

Increasing Focus on Animal Welfare Regulations in Europe

The rising emphasis on animal welfare regulations that mandate the adoption of advanced monitoring technologies to ensure compliance is primarily driving the growth of the European livestock monitoring market. According to the European Food Safety Authority (EFSA), over 70% of livestock farms in Europe are required to adhere to strict welfare standards, including continuous health monitoring and stress reduction measures. These regulations are particularly stringent in countries like Sweden and Denmark, where penalties for non-compliance can exceed €10,000 per violation.

Livestock monitoring systems play a pivotal role in meeting these requirements by providing real-time insights into animal health and behaviour. For example, a study by the Swedish Board of Agriculture highlights that farm using wearable sensors for cattle reported a 25% reduction in disease outbreaks, directly contributing to improved welfare scores. Additionally, the European Commission’s Farm to Fork Strategy emphasizes the importance of reducing antimicrobial resistance through preventive health management, further accelerating the adoption of monitoring technologies. With animal welfare becoming a key purchasing criterion for consumers, the demand for transparent and ethical farming practices continues to drive market growth.

Rising Demand for High-Quality Animal Products

The rising demand from consumers for high-quality animal products that require precision in livestock management is another major factor boosting the expansion of the European livestock monitoring market. According to the European Consumer Organisation (BEUC), over 80% of European consumers prioritize meat, milk, and eggs sourced from farms adhering to strict quality standards. This trend has prompted farmers to adopt monitoring systems that enhance traceability and ensure consistent product quality.

For instance, the French National Institute for Agricultural Research reports that dairy farms utilizing automated milking systems integrated with health monitoring technologies have achieved a 15% increase in milk yield and a 20% improvement in milk quality. Similarly, poultry farms in the Netherlands have adopted behavioural monitoring tools to detect early signs of distress, reducing mortality rates by 10%, as per data from the Dutch Ministry of Agriculture. By enabling precise control over feeding, breeding, and health management, livestock monitoring systems not only meet consumer expectations but also enhance farm profitability, making them indispensable in modern agriculture.

MARKET RESTRAINTS

High Initial Investment Costs

The high initial investment required for deploying these advanced systems is one of the significant restraints to the growth of the European livestock monitoring market. According to the German Federal Ministry of Food and Agriculture, the average cost of implementing a comprehensive livestock monitoring solution ranges from €20,000 to €50,000 per farm, depending on the scale and complexity. This financial barrier disproportionately affects small and medium-sized farms, which constitute over 70% of Europe’s agricultural landscape.

A report by the Italian Ministry of Agriculture highlights that nearly 40% of small-scale farmers cite affordability as a major obstacle to adopting monitoring technologies. While larger farms can absorb these costs through economies of scale, smaller operations often struggle to justify the expenditure, especially when immediate returns are uncertain. Additionally, the ongoing costs of maintenance, software updates, and technical support further exacerbate the financial burden. For instance, a study by the University of Hohenheim estimates that annual maintenance expenses account for 15-20% of the initial investment. Without accessible financing options or government subsidies, this cost barrier remains a significant impediment to widespread adoption.

Limited Technical Expertise Among Farmers

Limited technical expertise among European farmers, particularly in rural areas that hampers the effective implementation and utilization of livestock monitoring systems is another major factor hindering the growth of the European market. According to the European Federation of Agricultural Machinery, over 60% of farmers in Eastern Europe lack the necessary skills to operate advanced digital tools, leading to underutilization or improper deployment of these technologies.

This issue is compounded by the generational gap in the agricultural workforce. A survey conducted by the Czech Ministry of Agriculture reveals that 70% of farmers aged 55 and above express reluctance to adopt new technologies due to unfamiliarity or perceived complexity. Furthermore, inadequate training programs and technical support services exacerbate the problem, leaving many farmers ill-equipped to troubleshoot issues or interpret data generated by monitoring systems. For example, the Spanish Federation of Livestock Farmers reports that 35% of farms that purchased monitoring systems discontinued their use within two years due to operational challenges. Bridging this knowledge gap requires targeted educational initiatives and hands-on support, which remain insufficient in many regions.

MARKET OPPORTUNITIES

Integration with Smart Farming Ecosystems

The potential integration with broader smart farming ecosystems that enable holistic farm management and enhanced decision-making is one of the major opportunities for the European livestock monitoring market. According to the European Network for Rural Development, over 50% of large-scale farms in Europe have already adopted smart farming technologies, creating a fertile ground for synergistic applications. Livestock monitoring systems can seamlessly integrate with precision agriculture tools, such as drones, soil sensors, and weather forecasting platforms, to provide a comprehensive view of farm operations.

For instance, a case study by the Dutch Ministry of Agriculture demonstrates that combining livestock health data with environmental metrics led to a 12% reduction in feed wastage and a 10% improvement in water efficiency on pilot farms. Additionally, advancements in cloud computing and AI enable real-time data analysis and predictive modeling, empowering farmers to anticipate challenges and optimize resource allocation. The Horizon Europe program, a flagship initiative of the European Union, has allocated €2 billion for smart farming projects, further catalysing innovation in this space. By fostering interoperability and scalability, the integration of livestock monitoring into smart farming ecosystems unlocks immense growth potential.

Expansion into Emerging Markets within Europe

The untapped potential of emerging markets within Central and Eastern Europe, where adoption rates of livestock monitoring systems remain relatively low, is another significant opportunity to the European market. According to the Romanian Ministry of Agriculture, countries like Romania and Bulgaria have experienced a 15% annual increase in livestock production since 2018, signalling a growing appetite for advanced agricultural inputs. However, penetration of monitoring technologies in these regions is still nascent, presenting lucrative opportunities for market players.

Governments in these regions are stepping up efforts to promote digital agriculture through subsidies and awareness campaigns. For example, the Bulgarian Agricultural Fund recently launched a €10 million initiative to educate farmers about the benefits of livestock monitoring, aiming to double adoption rates by 2025. Additionally, partnerships with local cooperatives and agricultural extension services are helping bridge knowledge gaps and build trust among farmers. By targeting these underserved markets, companies can capitalize on the region’s burgeoning livestock sector while contributing to the broader goal of sustainable agriculture across Europe.

MARKET CHALLENGES

Data Privacy and Security Concerns

The growing concern over data privacy and security, particularly as these systems rely heavily on cloud-based platforms and IoT devices is primarily challenging the growth of the European livestock monitoring market. According to the European Data Protection Supervisor, over 60% of farmers express apprehension about sharing sensitive farm data with third-party service providers, fearing misuse or unauthorized access. This concern is exacerbated by high-profile cyberattacks on agricultural databases, such as the 2021 breach that compromised data from over 10,000 farms in Germany, as reported by the German Federal Office for Information Security.

The lack of standardized data protection protocols further complicates the issue. A study by the University of Copenhagen highlights that inconsistent encryption standards and weak authentication mechanisms make livestock monitoring systems vulnerable to hacking. Additionally, the General Data Protection Regulation (GDPR) imposes stringent penalties for non-compliance, creating additional pressure for manufacturers to ensure robust cybersecurity measures. Without addressing these vulnerabilities, farmers may remain hesitant to adopt monitoring technologies, stifling market growth.

Fragmented Market Landscape

Fragmented nature of the European livestock monitoring market, characterized by the presence of numerous small and medium-sized players offering incompatible solutions is another significant challenge to the European market. According to the European Biotechnology Industry Association, over 80% of available systems lack interoperability, making it difficult for farmers to integrate multiple tools into a cohesive management strategy.

This fragmentation is particularly problematic for cross-border operations, where varying technical standards and regulatory requirements create additional complexities. A report by the French National Institute for Agricultural Research notes that 45% of surveyed farmers cited compatibility issues as a major barrier to scaling their monitoring capabilities. Furthermore, the absence of universal benchmarks for performance evaluation undermines trust in product efficacy. Efforts to establish industry-wide standards, such as those proposed by the European Committee for Standardization, face resistance from stakeholders reluctant to adopt changes. Until these challenges are addressed, the market will continue to grapple with inefficiencies and reduced competitiveness.

SEGMENTAL ANALYSIS

By Offering

The hardware segment dominated the market and captured 46.6% of the European livestock monitoring market in 2024 due to its widespread adoption of IoT-enabled devices like wearable sensors, RFID tags, and GPS trackers that monitor animal health, location, and activity. The European Union’s stringent regulations on animal welfare and food safety have propelled farmers to invest in advanced hardware solutions. For instance, the European Commission mandates real-time monitoring for large-scale dairy farms, driving demand for robust hardware systems. Additionally, the rising number of cattle and poultry farms across Germany, France, and the Netherlands has further fuelled this segment's growth. A study by Eurostat reveals that over 60% of livestock farmers in Europe rely on hardware-based monitoring tools to enhance productivity.

The software segment is anticipated to register the fastest CAGR of 12.8% over the forecast period. Factors such as the advancements in artificial intelligence (AI) and machine learning algorithms that enable predictive analytics for livestock management is majorly propelling the expansion of the software segment in the European market. Farmers increasingly prefer cloud-based platforms that integrate data from multiple sources, such as feeding patterns, milk production, and behavioural anomalies. According to Statista, the adoption of livestock management software in Europe surged by 30% between 2020 and 2022, primarily due to its ability to reduce operational costs by up to 25%. Moreover, startups like Connecters and Cainthus are pioneering AI-driven solutions tailored for European markets, enhancing the appeal of software offerings. The growing emphasis on precision farming, coupled with government subsidies for digitalization in agriculture are further boosting the segmental growth in the European market.

By Application

The milk harvesting management segment accounted for the leading share of 27.7% of the European livestock monitoring market in 2024. The dominance of milk harvesting management segment in the European market is attributed to Europe's position as a global leader in dairy production, with countries like Germany and France contributing significantly to the EU’s annual output of 160 million tons of milk. Automated milking systems (AMS), also known as robotic milkers, have become indispensable tools for modern dairy farms. ResearchGate states that AMS adoption increased by 40% in Western Europe between 2018 and 2022, reducing labour costs by 30% while improving yield consistency. Furthermore, the European Dairy Association notes that efficient milk harvesting directly impacts product quality, which is critical for maintaining export competitiveness. With consumer demand for organic and sustainably produced dairy products rising, precise monitoring systems ensure compliance with eco-label certifications.

The behavioural monitoring & control segment is likely to expand at a promising CAGR of 13.88% over the forecast period. The growing awareness among farmers about early detection of diseases and stress indicators through behavioural analysis are driving the growth of the behavioural monitoring and control segment in the European market. Technologies such as computer vision and motion sensors allow real-time tracking of livestock movements, enabling timely interventions. A case study published by Wageningen University demonstrates that behavioural monitoring reduced mortality rates by 15% in Dutch pig farms. Similarly, the UK Department for Environment, Food & Rural Affairs reports that behavioural analytics helped cut antibiotic usage by 20% in cattle herds. The rise of zoonotic diseases and the need for biosecurity measures post-COVID-19 have accelerated investments in this segment. Additionally, partnerships between tech firms and agricultural cooperatives, such as those seen in Scandinavia, highlight the collaborative efforts boosting innovation.

By Species

The cattle segment had the largest share of 35.8% in the European market in 2024. The prominent position of cattle segment in the European market is attributed to the Europe's extensive cattle population that is estimated at over 88 million heads, and the high economic value of beef and dairy products. The European Livestock and Meat Trades Union highlights that cattle farming contributes €100 billion annually to the EU economy. Advanced monitoring technologies, including rumen boluses and ear-tag sensors, are widely deployed to optimize herd health and productivity. For example, Ireland’s Agri-Food and Biosciences Institute found that sensor-based monitoring improved calving success rates by 20%. Furthermore, the push for carbon-neutral farming under the Common Agricultural Policy (CAP) encourages cattle farmers to adopt precision tools that minimize methane emissions. Given their dual contribution to meat and dairy sectors, cattle remain central to Europe’s agri-food strategy, making this segment both dominant and strategically vital.

The poultry segment emerges as the fastest-growing species segment by registering CAGR of 13.6% over the forecast period due to the rising consumption of chicken and eggs, which are considered affordable protein sources. The International Egg Commission estimates that egg production in Europe will reach 7.5 million tons by 2025, driven by urbanization and dietary shifts. Simultaneously, innovations in poultry monitoring, such as automated feeding systems and environmental controllers, are enhancing efficiency. A study by the University of Bristol shows that smart ventilation systems reduced energy costs by 18% in UK broiler farms. Moreover, concerns over avian influenza outbreaks have prompted stricter biosecurity protocols, increasing reliance on monitoring technologies. Governments, too, are incentivizing sustainable poultry farming; for instance, France offers subsidies for installing IoT-based monitoring equipment.

By Farm Type

The large farms segment dominated the market by occupying a share of 40.7% in the European market in 2024. The dominating position of large farms segment in the European market is rooted in economies of scale, enabling them to invest heavily in cutting-edge monitoring technologies. According to the European Parliament, large farms cover over 60% of the EU’s arable land, leveraging mechanization and automation to maximize yields. In livestock monitoring, these farms deploy comprehensive systems that integrate hardware, software, and services, ensuring seamless operations. For instance, a report by the German Agricultural Society reveals that large dairy farms utilizing full-scale monitoring solutions achieved a 25% increase in milk production efficiency. Regulatory frameworks favouring industrial-scale farming, coupled with access to capital, further solidify their market position. Large farms also play a crucial role in meeting Europe’s export demands, underscoring their strategic importance in sustaining the agri-food supply chain.

The medium-sized farms segment is estimated to exhibit the highest CAGR of 14.9% over the forecast period. The transition of small-scale farmers toward medium-scale operations that are supported by EU funding programs like Horizon Europe is driving the growth of the medium-sized farms segment in the European market. Medium farms benefit from hybrid models that combine traditional practices with modern technology, striking a balance between cost-effectiveness and innovation. A survey conducted by the Italian Ministry of Agriculture indicates that medium farms adopting livestock monitoring saw a 22% reduction in resource wastage. Additionally, the proliferation of cooperative networks allows medium farms to pool resources and share technological expertise. For example, Danish farmer cooperatives have successfully implemented shared monitoring platforms, boosting profitability by 18%. As medium farms bridge the gap between smallholders and industrial giants, their adaptability and scalability make them a key driver of future growth in the livestock monitoring sector.

COUNTRY ANALYSIS

Germany led the European livestock monitoring market by holding for 22.9% of the European market share in 2024. The leading position of Germany in the European market is driven by the country’s robust agricultural sector, which spans over 285,000 farms and generates €50 billion annually. According to the Fraunhofer Institute, German farmers spend approximately €1.2 billion annually on digital farming technologies, reflecting their commitment to innovation. The prominence of Germany is further reinforced by its strong regulatory framework and investment in research. A report by the German Agricultural Society highlights that over 60% of livestock farms in the country have adopted monitoring systems, ensuring compliance with welfare regulations.

France is a notable regional segment for livestock monitoring in Europe. The diverse agricultural landscape of France that spanned across cattle, poultry, and swine is creating a fertile ground for monitoring system adoption in France. According to Eurostat, France’s livestock production grew by 10% in 2021, driving demand for advanced technologies. Government initiatives, such as the Eco Phyto Plan, have allocated €1.5 billion to promote digital agriculture, further propelling monitoring system adoption. A study by INRAE reveals that French farmers using monitoring systems reported a 15% increase in productivity, underscoring their economic benefits.

Italy holds a substantial share of the European livestock monitoring market owing to its focus on high-value livestock products like Parmesan cheese and premium beef. According to Coldiretti, Italy’s largest farmers’ association, monitoring systems are used on over 40% of cattle farms, ensuring premium quality produce. The country’s Mediterranean climate and rich biodiversity make it ideal for monitoring applications. A report by the University of Milan highlights those Italian farms treated with monitoring systems achieved a 20% improvement in animal health and productivity.

Spain is estimated to play a notable role in the European livestock monitoring market over the forecast period due to its extensive cattle and poultry farming sectors. According to the Spanish Federation of Livestock Farmers, monitoring system usage has grown by 25% over the past five years, supported by favorable climatic conditions. Spain’s leadership is bolstered by its focus on water-efficient farming practices, where monitoring systems play a critical role. A study by the University of Seville demonstrates that monitoring systems reduce water usage by 10%, addressing scarcity challenges.

The Netherlands is predicted to register a healthy CAGR in the European livestock monitoring market during the forecast period due to the expertise of Netherlands in greenhouse farming and floriculture. According to Wageningen University, Dutch farms utilizing monitoring systems achieved a 30% reduction in chemical inputs, aligning with sustainability goals. The country’s leadership is supported by its advanced logistics network, enabling efficient distribution. A report by the Netherlands Enterprise Agency highlights that monitoring system exports grew by 18% in 2022, underscoring its global influence.

MARKET SEGMENTATION

This research report on the Europe Livestock monitoring market is segmented and sub-segmented into the following categories.

By Offering

- Hardware

- Software

- Services

By Application

- Milk Harvesting Management

- Breeding Management

- Feeding Management

- Heat Stress Management

- Animal Comfort Management

- Behavioural Monitoring & Control

- Others

By Species

- Cattle Segment

- Poultry Segment

By Farm Type

- Large Farms

- Medium Farms

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]