Europe Lithium-Ion Stationary Battery Storage Market Size, Share, Trends, & Growth Forecast Report By Chemistry (Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), and Others), Application (Grid services, Behind the meter, and Off-grid), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Lithium-Ion Stationary Battery Storage Market Size

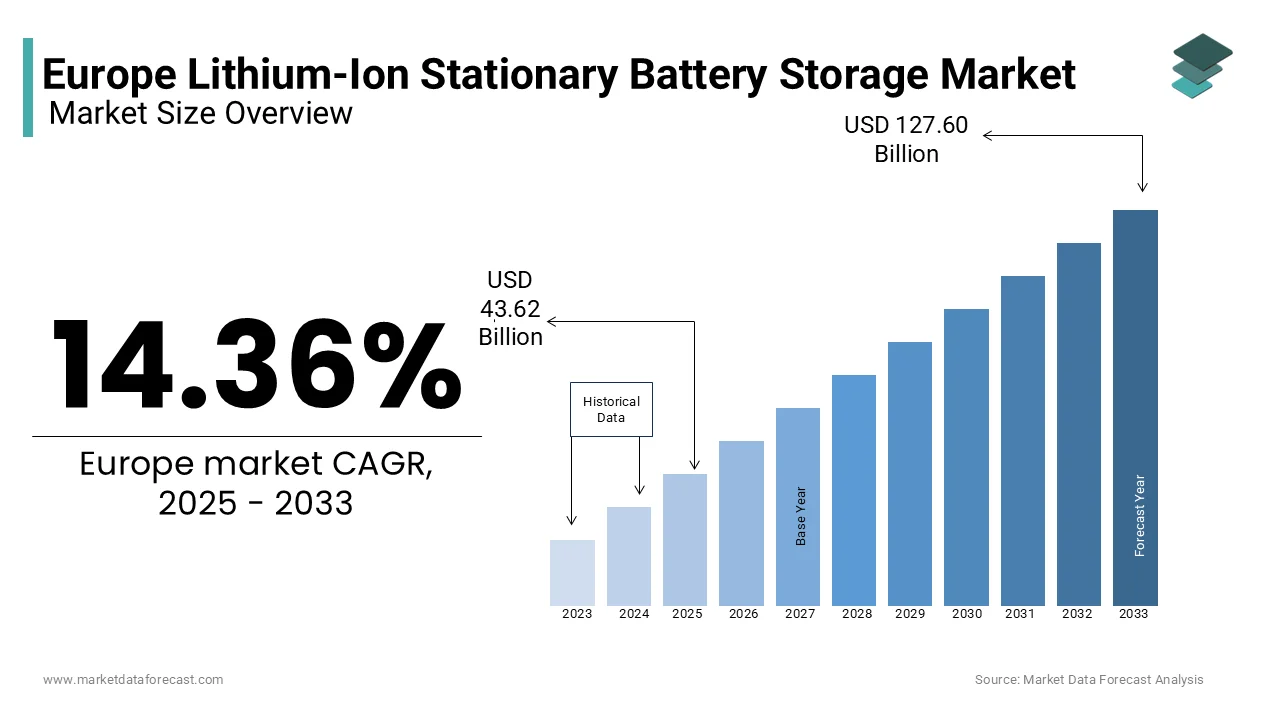

The Europe lithium-ion stationary battery storage market was worth USD 38.14 billion in 2024. The European market is projected to reach USD 127.60 billion by 2033 from USD 43.62 billion in 2025, rising at a CAGR of 14.36% from 2025 to 2033.

Lithium-ion stationary battery storage refers to advanced energy storage solutions that utilize lithium-ion technology to store electricity for later use, enabling grid stabilization, renewable energy integration, and backup power capabilities. These systems are increasingly deployed in residential, commercial, and utility-scale applications to address intermittency issues associated with renewable energy sources like solar and wind. The growing prominence on decarbonization, coupled with ambitious climate goals set by the European Union has positioned lithium-ion batteries as a cornerstone of modern energy infrastructure.

Europe’s commitment to achieving net-zero emissions by 2050 is driving significant investments in clean energy technologies. According to the International Energy Agency, renewable energy accounted for nearly 40% of the EU’s electricity generation in 2022 is amplifying the urgent need for reliable storage solutions. Additionally, as per the European Environment Agency, energy storage capacity will need to expand exponentially to meet future demand with the escalating electric vehicle adoption in developed and developing countries in European region. Furthermore, Eurostat data reveals that household electricity prices in Europe have risen by approximately 11% annually since 2021 that intensify the interest in decentralized energy systems. The role of lithium-ion stationary storage becomes increasingly indispensable as Europe continues its shift toward a low-carbon economy.

MARKET DRIVERS

Increasing Integration of Renewable Energy Sources

The rapid expansion of renewable energy sources serves as a primary driver for the lithium-ion stationary battery storage market in Europe. According to the European Environment Agency, renewable energy accounted for 40% of the EU’s electricity generation in 2022 by posing a need for energy storage solutions to manage intermittency. Germany leads this trend with the German Federal Ministry for Economic Affairs and Climate Action reporting that over 10 GW of solar and wind capacity is supported by stationary battery storage systems. According to the Denmark’s Energy Agency, battery storage systems have reduced curtailment of wind energy by 25% by enhancing grid efficiency. According to the French Ministry of Ecological Transition, investments in renewable energy projects have grown by 20% annually since 2020 with the rising demand for advanced storage technologies. These advancements not only align with the EU’s renewable energy targets but also enhance the economic viability of stationary battery systems by making them indispensable for sustainable energy infrastructure.

Government Policies Supporting Grid Modernization

The stringent government policies aimed at modernizing aging power grids are additionally to promote the growth of the Europe lithium-ion stationery battery storage market. According to the European Commission, member states are mandated to invest €100 billion in grid modernization projects by 2030 with the adoption of lithium-ion battery storage systems. According to the French Transmission System Operator (RTE), €15 billion was allocated to upgrade grid infrastructure in 2022, supported by favorable subsidies. According to the UK’s National Grid, stationary battery systems account for 60% of new grid stabilization projects. According to the Italian Ministry of Infrastructure and Transport, with EU directives has led to a 30% increase in the adoption of energy storage solutions. These policy frameworks not only ensure long-term market stability but also foster innovation and technological advancements in lithium-ion battery systems.

MARKET RESTRAINTS

High Initial Investment Costs and Economic Uncertainty

The substantial initial investment costs associated with lithium-ion stationary battery storage systems pose a significant restraint to market growth in Europe. According to Eurostat, the average cost of installing a 1 MW battery storage system ranges between €1 million and €2 million by depending on technology and scale. As per the UK’s Department for Business, Energy & Industrial Strategy, capital expenditure on new storage projects declined by 15% during periods of economic uncertainty by delaying critical infrastructure upgrades. According to the Norwegian Petroleum Directorate, exploration activities in the North Sea were scaled back by 10% in response to price fluctuations by reducing demand for storage equipment. According to the French Ministry of Economy and Finance, economic uncertainties, exacerbated by geopolitical tensions, have led to a 10% reduction in long-term contracts for battery manufacturers. These financial constraints limit the scalability of projects in regions dependent on high-cost offshore operations by threatening the market’s growth trajectory.

Supply Chain Disruptions and Material Shortages

The supply chain disruptions and material shortages are attributed to hinder the growth of lithium-ion stationery battery storage market in Europe. According to the European Commission, the cost of lithium, a key raw material for battery manufacturing, increased by 40% in 2022 due to geopolitical tensions and supply chain bottlenecks. According to the German Electrical and Electronic Manufacturers' Association (ZVEI), these disruptions delayed over 25% of battery production schedules in Germany, impacting project timelines. As per Italy’s Ministry of Economic Development, the price volatility of cobalt, another critical material, has led to a 20% increase in production costs for local manufacturers. According to the European Commission, logistical challenges, including port congestion and labor shortages, have extended lead times by up to eight months in some regions. These factors not only strain manufacturers’ profit margins but also hinder the timely delivery of essential components for energy storage projects.

MARKET OPPORTUNITIES

Expansion of Electric Vehicle Charging Infrastructure

The rapid expansion of electric vehicle (EV) charging infrastructure presents a transformative opportunity for the lithium-ion stationary battery storage market in Europe. According to the European Automobile Manufacturers' Association (ACEA), the number of EVs on European roads surpassed 10 million in 2022 by driving demand for reliable charging networks. As per a study the German Federal Ministry for Digital and Transport Infrastructure revealed that over 50,000 public charging stations were installed in Germany alone in 2022, each requiring specialized battery storage systems for peak load management. According to the UK’s Office for Zero Emission Vehicles, £20 billion was allocated to expand EV charging infrastructure by 2030 by creating a robust pipeline for battery manufacturers. According to the European Investment Bank, investments in EV-related infrastructure are projected to reach €50 billion by 2030.

Growing Adoption of Smart Grid Technologies

The growing adoption of smart grid technologies offers another significant opportunity for the lithium-ion stationary battery storage market in Europe. According to ENTSO-E, smart grid investments are expected to exceed €100 billion by 2030, which is driven by the need for enhanced grid resilience and efficiency. According to the Italian Transmission System Operator (TERNA), smart grid projects have reduced energy losses by 15% in urban areas. According to the Sweden’s Energy Markets Inspectorate, smart meters, which rely on advanced battery systems, have been installed in over 90% of households by improving energy management and reducing costs. According to the European Commission, smart grid initiatives are integral to achieving the EU’s 2050 carbon neutrality goals, with lithium-ion battery systems playing a pivotal role in enabling real-time data monitoring and grid optimization. As Europe accelerates its digital transformation, the demand for innovative battery solutions will continue to rise by creating lucrative opportunities for manufacturers to capitalize on this emerging market.

MARKET CHALLENGES

Competition from Alternative Energy Storage Solutions

The growing competition from alternative energy storage solutions represents a formidable challenge for the lithium-ion stationary battery storage market in Europe. According to the International Energy Agency, hydrogen-based storage systems and pumped hydro storage are emerging as viable alternatives for long-duration energy storage, diverting investments away from lithium-ion technologies. As per French Ministry of Ecological Transition, hydrogen infrastructure projects received three times more funding than lithium-ion initiatives in 2022. The Spanish Ministry of Science and Innovation studies have shown that pumped hydro storage is gaining traction due to its lower environmental impact and compatibility with decarbonization goals. The hybrid energy systems, which combine multiple storage technologies are likely to hinder the growth of the lithium-ion stationary battery storage market.

Environmental Concerns and Recycling Challenges

The environmental concerns and recycling challenges present another significant challenge for the lithium-ion stationary battery storage market in Europe. According to the European Environment Agency, improper disposal of lithium-ion batteries can lead to soil and water contamination by raising public opposition to new projects. The environmental impact assessments delayed the construction of two large-scale battery storage projects in 2022 due to concerns about hazardous waste management. The compliance with stringent recycling regulations requires significant adjustments that further adds operational complexities. The prolonged project timelines and increase costs are discouraging new entrants and slowing down overall market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.36% |

|

Segments Covered |

By Chemistry, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

BYD, Contemporary Amperex Technology, Hitachi Energy, Hithium, Hoppecke Batteries, Johnson Controls, LG Chem, Panasonic, Philips, Samsung SDI, Siemens Energy, Tesla, Toshiba, Varta. |

SEGMENTAL ANALYSIS

By Chemistry Insights

The lithium Iron Phosphate (LFP) segment dominated the chemistry segment with a significant share of 49.6% in 2024 due to its superior safety, longer lifespan, and lower risk of thermal runaway compared to other chemistries. The German Federal Ministry for Economic Affairs and Climate Action studies revealed that LFP batteries account for over 60% of new installations in residential and commercial applications. According to the UK’s National Grid, LFP systems reduce maintenance costs by 25% by enhancing their economic viability. Their importance lies in their ability to provide reliable and safe energy storage solutions while supporting the transition to renewable energy.

The nickel Manganese Cobalt (NMC) segment is anticipated to witness a CAGR of 15.2% from 2025 to 2033. This growth is fueled by its higher energy density and suitability for applications requiring compact storage solutions, such as electric vehicle charging stations. According to the Swedish Energy Agency, NMC batteries have improved energy efficiency by 30% in urban districts. According to the France’s Ministry of Ecological Transition, investments in NMC technologies have grown by 20% annually.

By Application Insights

The grid services segment was the largest and held 45.1% of the Europe lithium-ion stationary battery storage market in 2024 with the increasing need for grid stabilization and load balancing in regions with high renewable energy penetration. According to the German Federal Ministry for Economic Affairs and Climate Action, grid services account for over 50% of stationary battery storage applications in urban areas. As per the UK’s National Grid, grid services reduce energy losses by 20% by enhancing their economic benefits.

The frequency regulation segment is likely to register a fastest CAGR of 16.8% from 2025 to 2033. This growth is driven by the increasing demand for real-time grid stabilization in regions integrating high levels of renewable energy. As per the Danish Energy Agency, frequency regulation systems have reduced grid instability by 35%. According to the France’s Ministry of Ecological Transition, investments in frequency regulation technologies have grown by 25% annually. According to the European Investment Bank, investments in frequency regulation systems are projected to reach €15 billion by 2030.

REGIONAL ANALYSIS

Germany was the top performer in the Europe lithium-ion stationary battery storage market with a 30.2% of share in 2024. The country’s dominance is driven by its robust renewable energy infrastructure and strong policy support, with over €10 billion allocated to upgrade existing networks. Germany’s investments in LFP and NMC systems have reduced energy losses by 25%. According to the German government, the battery storage sector contributes €5 billion annually to the economy.

The UK is likely to experience a fastest CAGR of 14.5% during the forecast period. The country’s market growth is driven by its extensive renewable energy capacity, with over 15 GW supported by stationary battery systems. According to the National Grid, battery storage systems reduce curtailment by 30% by enhancing grid efficiency. The UK government investments in battery storage infrastructure will reach £20 billion by 2030 that is ascribed to promote new opportunities for the market to grow in this country.

France is expected to showcase a steady growth rate throughout the forecast period with the growing focus on grid modernization, with €15 billion allocated to upgrade infrastructure. France’s investments in smart grid technologies have optimized energy distribution by enhancing operational efficiency. France’s strategic initiatives reinforce its regional importance.

Italy lithium-ion stationary battery storage market growth is driven by its adoption of LFP systems by reducing emissions by 25%. Italy’s investments in renewable energy integration have grown by 15% annually with rising support from government through subsidies. Italy’s focus on sustainability positions it as a key player in advancing battery storage solutions.

Sweden lithium-ion stationary battery storage market growth is attributed with its reliance on NMC systems by improving energy efficiency by 30%. Sweden’s investments in frequency regulation systems have reduced grid instability, enhancing reliability. Sweden’s focus on innovation is also to escalate the growth of the market.

KEY MARKET PLAYERS

The major players in the Europe lithium-ion stationary battery storage market include BYD, Contemporary Amperex Technology, Hitachi Energy, Hithium, Hoppecke Batteries, Johnson Controls, LG Chem, Panasonic, Philips, Samsung SDI, Siemens Energy, Tesla, Toshiba, and Varta.

MARKET SEGMENTATION

This research report on the Europe lithium-ion stationary battery storage market is segmented and sub-segmented into the following categories.

By Chemistry

- Lithium Iron Phosphate (LFP)

- Nickel Manganese Cobalt (NMC)

- Others

By Application

- Grid services

- Behind the meter

- Off grid

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe lithium-ion stationary battery storage market?

The market is growing due to increasing renewable energy integration, government incentives for energy storage, and advancements in battery technology that improve efficiency and lifespan.

What are the main applications of lithium-ion stationary battery storage in Europe?

The primary applications include grid stabilization, renewable energy storage, backup power for industrial and residential sectors, and electric vehicle charging infrastructure support.

How does lithium-ion battery storage contribute to Europe’s energy transition?

It helps integrate intermittent renewable energy sources like wind and solar, enhances grid reliability, and reduces dependence on fossil fuels for power generation.

What advancements are improving lithium-ion battery performance for stationary storage?

Innovations include solid-state batteries, improved battery management systems, and new cathode materials that increase energy density and safety.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]