Europe Lithium-Ion Batteries Market Size, Share, Trends & Growth Forecast Report – Segmented By Battery Type, Capacity, Voltage, Industry And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Lithium-Ion Batteries Market Size

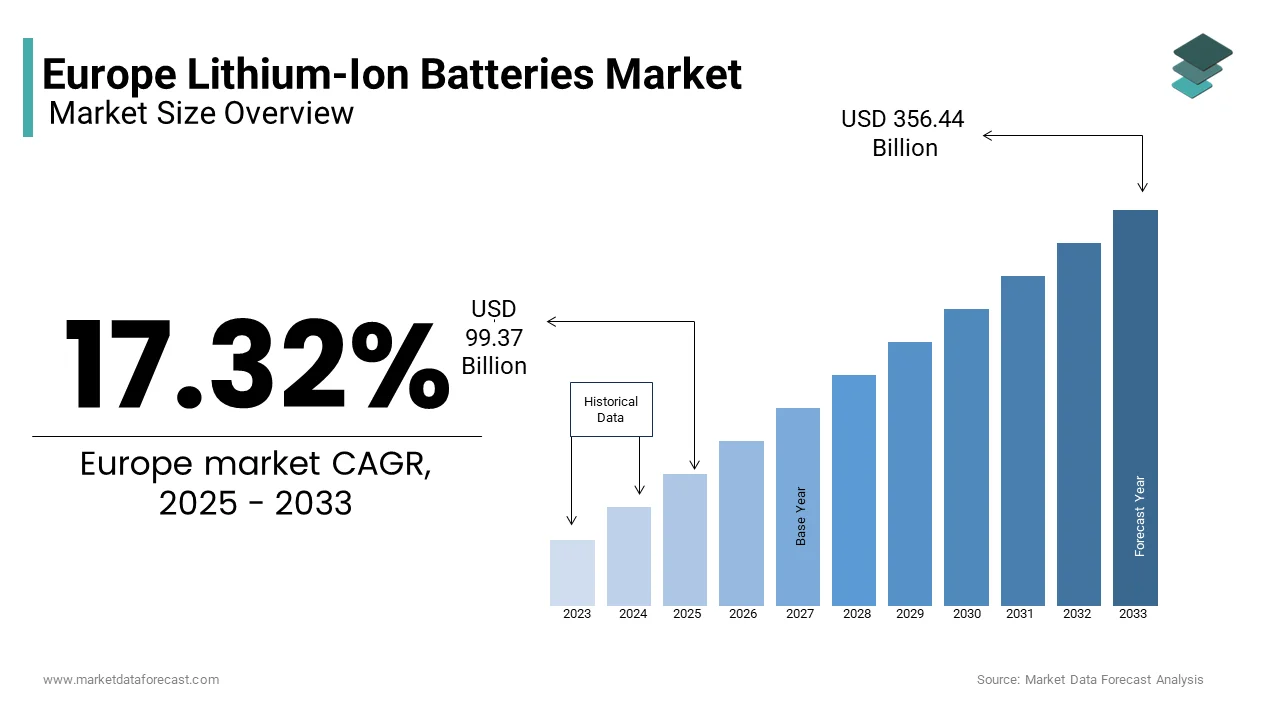

The Europe lithium-ion batteries market size was valued at USD 84.70 billion in 2024 and is anticipated to reach USD 99.37 billion in 2025 from USD 356.64 Billion by 2033, growing at a CAGR of 17.32% during the forecast period from 2025 to 2033.

Lithium-ion batteries are known for their high energy density, long lifespan, and rechargeability and are integral to powering electric vehicles (EVs), consumer electronics, and renewable energy storage systems. As Europe accelerates its commitment to reducing carbon emissions under the European Green Deal, the demand for lithium-ion batteries has surged. This growth is further propelled by the rapid adoption of EVs, which accounted for 20% of new car sales in Europe in 2022, as reported by the European Automobile Manufacturers’ Association (ACEA).

The market is characterized by significant investments in domestic production capacities, driven by the EU’s goal to reduce dependency on Asian manufacturers. The European Commission highlights that over 30 gigafactories are planned or under construction across Europe, aiming to meet the growing demand for battery cells. Additionally, advancements in battery chemistries, such as nickel-manganese-cobalt (NMC) and lithium iron phosphate (LFP), are enhancing performance while addressing concerns about raw material scarcity and environmental impact.

Environmental sustainability remains a key focus, with stringent regulations mandating recycling and ethical sourcing of materials like cobalt and lithium. The European Environment Agency reports that only 50% of lithium-ion batteries are currently recycled, underscoring the need for improved recycling technologies. As Europe positions itself as a global leader in clean energy, the lithium-ion battery market is poised for exponential growth, driven by innovation, policy support, and increasing consumer awareness of green technologies.

MARKET DRIVERS

Electrification of Transportation

The rapid electrification of transportation is a major driver of the European lithium-ion battery market, fueled by stringent emissions regulations and government incentives. The European Automobile Manufacturers’ Association (ACEA) reports that electric vehicles (EVs) accounted for 20% of new car sales in Europe in 2022, a significant increase from previous years. This surge is driven by policies such as the EU’s ban on internal combustion engine vehicles by 2035, which has accelerated EV adoption. Additionally, government subsidies and tax benefits have made EVs more affordable for consumers. For instance, countries like Germany and France offer incentives of up to EUR 9,000 per vehicle, boosting demand for lithium-ion batteries. The European Battery Alliance (EBA) estimates that the demand for EV batteries will grow at a CAGR of 14% from 2023 to 2030, underscoring the critical role of transportation electrification in propelling the lithium-ion battery market.

Renewable Energy Storage Solutions

The increasing deployment of renewable energy systems is another key driver, as lithium-ion batteries play a vital role in energy storage for solar and wind power. The European Environment Agency highlights that renewable energy sources accounted for 40% of electricity generation in 2022, creating a need for efficient storage solutions to address intermittency issues. Lithium-ion batteries are preferred due to their high energy density and long cycle life, making them ideal for grid-scale and residential storage. The European Commission projects that energy storage capacity will grow by 25% annually over the next decade, driven by investments in clean energy infrastructure. Furthermore, initiatives like the EU Green Deal emphasize energy independence, encouraging the adoption of decentralized storage systems. According to BloombergNEF, Europe’s energy storage market is expected to reach 100 GWh by 2030, reinforcing the pivotal role of renewables in driving lithium-ion battery demand.

MARKET RESTRAINTS

Raw Material Supply Chain Constraints

One significant restraint in the European lithium-ion battery market is the dependency on imported raw materials like lithium, cobalt, and nickel, which are critical for battery production. The European Raw Materials Alliance (ERMA) highlights that Europe relies on imports for 98% of its lithium needs, primarily from Australia, Chile, and China. This over-reliance creates vulnerabilities due to geopolitical tensions and price volatility. For instance, the price of lithium carbonate surged by 400% between 2021 and 2022, as reported by the International Energy Agency (IEA). Additionally, ethical concerns surrounding cobalt mining, particularly in the Democratic Republic of Congo, further complicate supply chains. These challenges hinder Europe’s ability to scale up domestic battery production, despite ambitious plans for gigafactories, making raw material availability a critical bottleneck for market growth.

Recycling and Environmental Challenges

Another major restraint is the limited recycling infrastructure for lithium-ion batteries, which poses environmental and economic challenges. The European Environment Agency reports that only 50% of lithium-ion batteries are currently collected for recycling, with even lower rates for actual material recovery. This inefficiency leads to significant waste and loss of valuable materials like cobalt and nickel. Moreover, the energy-intensive processes involved in battery production and recycling contribute to carbon emissions, contradicting Europe’s sustainability goals. The European Commission mandates a recycling efficiency target of 70% by 2030, but achieving this requires substantial investment in advanced recycling technologies. According to the IEA, scaling up recycling capacity could reduce reliance on virgin materials by 25%, yet current infrastructure gaps remain a barrier to sustainable market expansion.

MARKET OPPORTUNITIES

Expansion of Gigafactories and Local Production

A significant opportunity in the European lithium-ion battery market lies in the expansion of gigafactories and localized production, reducing dependency on imports and boosting the continent’s battery ecosystem. The European Battery Alliance (EBA) reports that over 30 gigafactories are planned or under construction across Europe, with a projected annual production capacity of 700 GWh by 2030. This surge in domestic manufacturing is driven by EU funding initiatives, such as the European Green Deal, which aims to create a self-sufficient battery supply chain. For instance, Germany has allocated EUR 3 billion to support battery production projects. These investments not only enhance energy security but also create thousands of jobs, fostering economic growth. By scaling up local production, Europe can meet the rising demand for electric vehicles and renewable energy storage while adhering to stringent environmental standards.

Advancements in Battery Recycling Technologies

Another major opportunity lies in advancements in battery recycling technologies, which address raw material shortages and promote sustainability. The European Environment Agency highlights that improving recycling efficiency could recover up to 95% of critical materials like lithium, cobalt, and nickel, significantly reducing reliance on imports. The European Commission mandates that by 2030, 70% of lithium-ion batteries must be recycled, creating a lucrative market for innovative recycling solutions. According to BloombergNEF, the global battery recycling market is expected to grow at a CAGR of 20% from 2023 to 2030, with Europe poised to lead due to its stringent regulations and focus on circular economy principles. Companies investing in advanced recycling methods, such as hydrometallurgical processes, can capitalize on this trend, aligning profitability with environmental goals while supporting Europe’s green transition.

MARKET CHALLENGES

High Production Costs and Economic Viability

One of the major challenges in the European lithium-ion battery market is the high production costs, which hinder economic viability compared to established Asian manufacturers. The European Commission highlights that producing battery cells in Europe is 30-40% more expensive than in China due to higher labor and energy costs. Additionally, the lack of economies of scale exacerbates this issue, as many European gigafactories are still in the development phase. The International Energy Agency (IEA) notes that subsidies and incentives for EVs have helped offset some costs, but long-term competitiveness remains uncertain. For instance, Germany’s EUR 3 billion investment in battery projects has yet to fully bridge the cost gap. Without significant technological breakthroughs or policy support, European manufacturers may struggle to compete globally, impacting market growth.

Regulatory Compliance and Environmental Concerns

Another significant challenge is navigating stringent regulatory requirements and addressing environmental concerns associated with battery production. The European Environment Agency emphasizes that battery manufacturing is energy-intensive, contributing to 15% of the carbon footprint of an electric vehicle over its lifecycle. Furthermore, sourcing raw materials like cobalt and lithium raises ethical and ecological issues, particularly in regions with poor mining practices. The EU Battery Regulation mandates that by 2030, batteries must meet strict sustainability standards, including a carbon footprint declaration and minimum recycled content thresholds. While these regulations aim to promote greener practices, they increase compliance costs and operational complexities for manufacturers. According to the IEA, achieving full alignment with these standards could delay project timelines, posing a barrier to rapid market expansion.

SEGMENTAL ANALYSIS

By Battery Type

The Lithium Nickel Manganese Cobalt (NMC) batteries segment dominated the European lithium-ion battery market by holding 45.6% of the European market share in 2024. The growth of the NMC segment in the European market is driven by their high energy density, reaching up to 250 Wh/kg, making them ideal for electric vehicles (EVs) and renewable energy storage. The International Energy Agency (IEA) reports that NMC batteries account for over 60% of EV battery installations in Europe. Their versatility, long lifespan, and ability to deliver extended driving ranges solidify their importance. Ongoing research into low-cobalt variants aligns with sustainability goals, ensuring NMC remains central to Europe’s green energy transition.

The Lithium Iron Phosphate (LFP) segment is growing at a remarkable pace and is estimated to grow at a CAGR of 30.3% over the forecast period. The thermal stability, safety, and lower cost of LFP batteries compared to cobalt-based alternatives is majorly propelling the growth of the LFP segment in the European market. LFP batteries are increasingly adopted in mid-range EVs and stationary energy storage systems, supported by the EU’s push for ethical sourcing. The IEA highlights that LFP adoption reduces reliance on cobalt, addressing supply chain vulnerabilities. With advancements in cell design improving energy density, LFP batteries are becoming a sustainable and cost-effective solution, positioning them as a key driver of future growth in the lithium-ion battery market.

By Capacity

The 3,001 – 10,000 mAh segment had the leading share of the European market in 2024. The dominance of this segment in the European market is attributed to its versatility that cater to mid-range laptops, tablets, e-bikes, and scooters. According to the German Engineering Federation, e-bike sales are growing rapidly and boosting demand for this capacity range. These batteries balance energy density and affordability, making them ideal for both consumer electronics and light electric vehicles. Their widespread adoption supports urban mobility trends and renewable energy integration, solidifying their importance in Europe’s transition to sustainable energy solutions.

On the other hand, the above 60,000 mAh segment is likely to register a prominent CAGR over the forecast period owing to factors such as the rising demand for premium EVs and grid-scale energy storage systems. The International Energy Agency (IEA) projects energy storage installations to reach 100 GWh by 2030, driven by Europe’s renewable energy targets. These high-capacity batteries enable long driving ranges for EVs and stabilize renewable energy grids, aligning with the EU Green Deal. Advancements in manufacturing and economies of scale are reducing costs, accelerating adoption. Their critical role in decarbonization makes them indispensable for Europe’s sustainable future.

By Voltage

The high-voltage lithium-ion batteries segment led the market by accounting for 45.4% of the European market share in 2024. The critical role high-voltage lithium-ion batteries that play in electric vehicles (EVs) and renewable energy storage systems is primarily contributing to the domination of this segment in the European market. The International Energy Agency (IEA) reports that EV sales accounted for 20% of new car sales in Europe in 2022, with high-voltage batteries enabling extended driving ranges and fast charging. Additionally, these batteries are pivotal for grid-scale energy storage, with BloombergNEF projecting installations to reach 100 GWh by 2030. Their ability to deliver high power output ensures their importance in decarbonizing transportation and stabilizing renewable energy grids.

By Industry

The automotive segment dominated the market by accounting for 40.4% of the European market share in 2024. The rapid adoption of electric vehicles (EVs) in Europe is majorly driving the automotive segment in the European market. High-voltage lithium-ion batteries are essential for enabling long driving ranges, fast charging, and improved performance. BloombergNEF projects EV battery demand to grow at a brisk pace due to the stringent emissions regulations and government incentives. The EU’s goal to phase out internal combustion engines by 2035 further accelerates adoption, making automotive the cornerstone of the market.

The power segment is growing rapidly and is estimated to register a CAGR of 30.7% over the forecast period owing to the integration of renewable energy sources and the need for grid-scale storage. The European Environment Agency projects energy storage installations to reach 100 GWh by 2030, driven by Europe’s renewable energy targets. Lithium-ion batteries stabilize grids and store excess energy, supporting the transition to clean energy. Innovations in recycling and second-life applications enhance sustainability, addressing environmental concerns. This segment’s pivotal role in achieving energy independence and combating climate change ensures its rapid expansion in the coming years.

REGIONAL ANALYSIS

Germany held the leading position in the European lithium-ion battery market in 2024 by holding 30.6% of the European market share. The robust automotive industry and significant investments in gigafactories in Germany are majorly boosting the German market growth. The European Battery Alliance (EBA) reports that Germany hosts over 10 planned or operational gigafactories, supported by EU funding and incentives. Additionally, Germany’s focus on sustainability aligns with the EU Green Deal, driving advancements in recycling and low-carbon battery production. These factors position Germany as a hub for innovation and manufacturing in the lithium-ion battery sector.

France is another leading player in the European market. The strong aerospace and automotive sectors and government initiatives promoting renewable energy storage are boosting the market growth in France. FranceAgriMer highlights that France has invested EUR 5 billion in battery projects, focusing on sustainable materials like lithium iron phosphate (LFP). The French government’s push for carbon-neutral transportation and renewable energy integration further accelerates adoption, making it a key player in Europe’s green transition.

The UK is anticipated to account for a substantial share of the European market over the forecast period. The growth of the UK market is majorly driven by the rapid adoption of EVs, supported by policies such as the ban on internal combustion engines by 2030. The UK Automotive Council reports that the country is investing heavily in battery R&D, including the Faraday Battery Challenge, which has allocated GBP 330 million for innovation. The UK’s focus on reducing reliance on imported batteries and fostering domestic production ensures its prominence in the European lithium-ion battery market.

KEY MARKET PLAYERS

BYD Co Ltd ADR, Hitachi Ltd, Johnson Controls International PLC, LG Chem, Panasonic Holdings Corp, Samsung SDI Co Ltd GDR - 144A, Toshiba Tec Corp ADR, GS Yuasa Corp. These are the market players that are dominating the Europe lithium-ion batteries market.

MARKET SEGMENTATION

This research report on the Europe lithium-ion batteries market is segmented and sub-segmented into the following categories.

By Battery Type

- Lithium Nickel Manganese Cobalt (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Titanate Oxide (LTO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

By Capacity

- Below 3,000 Mah

- 3,001 – 10,000 Mah

- 10,001 – 60,000 Mah

- Above 60,000 Mah

By Voltage

- Low (Below 12v)

- Medium (12v - 36v)

- High (Above 36v)

By Industry

- Consumer Electronics

- Automotive

- Aerospace

- Marine

- Medical

- Industrial

- Power

- Telecommunications

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe lithium-ion batteries market?

The current market size of the Europe lithium-ion batteries market was valued at USD 99.37 billion in 2025.

What are the market drivers that are driving the Europe lithium-ion batteries market?

The Electrification of transportation and Renewable energy storage solutions are the market drivers that are driving the europe lithium-ion batteries market.

What are the major challenges that are faced by the Europe lithium-ion batteries market?

The High production costs and economic viability and Regulatory compliance and environmental concerns are the major challenges of the Europe lithium-ion batteries market.

Who are the market drivers that are driving the Europe lithium-ion batteries market?

BYD Co Ltd ADR, Hitachi Ltd, Johnson Controls International PLC, LG Chem, Panasonic Holdings Corp, Samsung SDI Co Ltd GDR - 144A, Toshiba Tec Corp ADR, GS Yuasa Corp.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com