Europe Light Tower Market Size, Share, Trends, & Growth Forecast Report Segmented By Channel (Sales and Rental), Product, Lighting, Power Source, Technology, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Light Tower Market Size

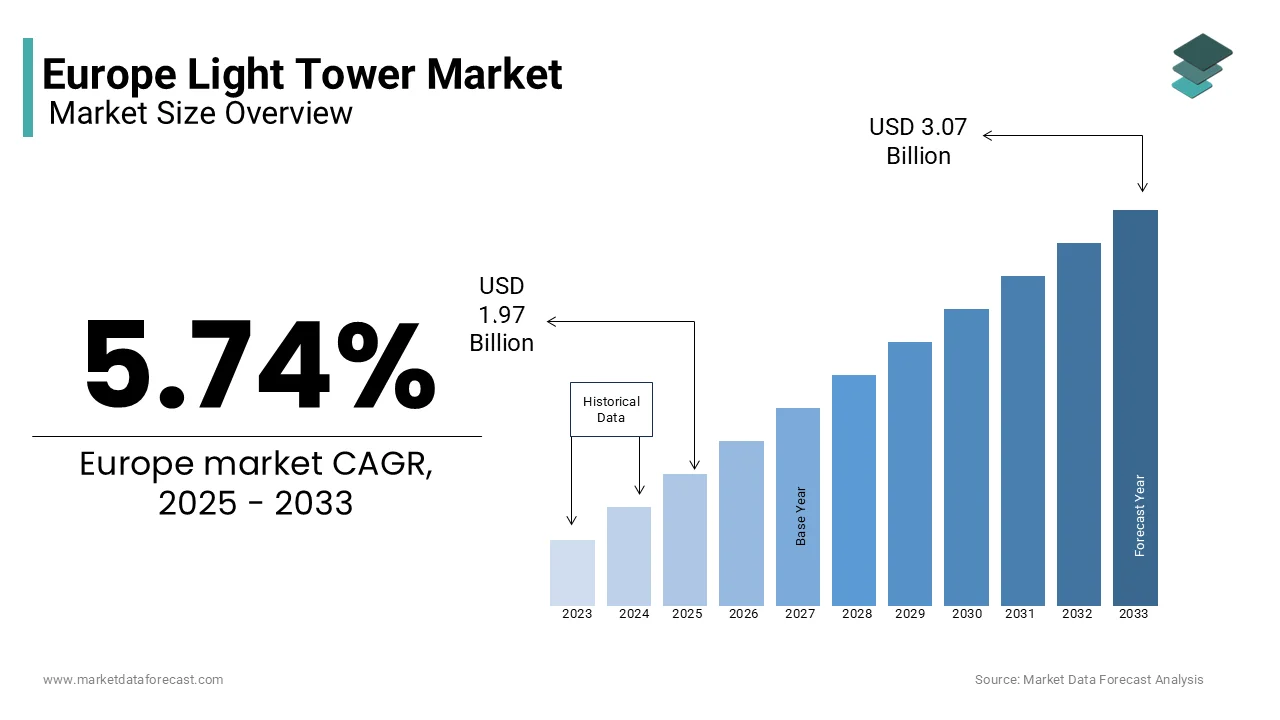

The Europe light tower market was worth USD 1.86 billion in 2024. The Europe market is projected to reach USD 3.07 billion by 2033 from USD 1.97 billion in 2025, rising at CAGR of 5.74% from 2025 to 2033.

Light towers, also known as mobile light masts, are widely utilized across construction sites, mining operations, roadworks, outdoor events, and emergency response scenarios. These systems typically consist of adjustable masts, high-powered luminaires, and power sources such as diesel generators, batteries, or solar panels. According to the European Commission Directorate-General for Energy, the demand for energy-efficient lighting solutions has surged, with LED-based light towers gaining prominence due to their lower energy consumption and extended lifespan compared to traditional halogen or metal halide systems.

Increasing infrastructure development and urbanization across Europe is propelling the market’s growth rate. Eurostat reports that over 70% of the EU population resides in urban areas, necessitating advanced lighting solutions for nighttime construction and public safety. Germany, France, and the UK are leading adopters, collectively accounting for approximately 50% of the regional market share. According to the International Energy Agency, the adoption of solar-powered and hybrid light towers has grown at a CAGR of 7.2% over the past five years, reflecting a shift toward sustainable technologies. Furthermore, stringent regulations on carbon emissions, outlined in the European Green Deal, have accelerated the transition to eco-friendly lighting solutions. The Europe light tower market is poised for steady expansion with investments in smart cities and renewable energy integration on the rise.

MARKET DRIVERS

Increasing Infrastructure Development and Urbanization

The rapid pace of infrastructure development and urbanization across the region is majorly driving the growth rate of the Europe light tower market. As per Eurostat, over 70% of Europe’s population resides in urban areas, necessitating advanced lighting solutions for nighttime construction, roadworks, and public safety. The European Investment Bank reports that approximately €500 billion is allocated annually to infrastructure projects, including highways, railways, and smart city initiatives, which rely heavily on mobile lighting systems. Light towers are indispensable for ensuring visibility and safety during nighttime operations, with LED-based models reducing energy consumption by up to 60% compared to traditional halogen systems. The International Energy Agency notes that the demand for energy-efficient lighting solutions has grown significantly which is driven by stringent carbon emission regulations under the European Green Deal.

Rising Demand for Renewable Energy-Powered Solutions

The increasing adoption of renewable energy-powered light towers is gearing up with the Europe’s commitment to decarbonization. The European Commission Directorate-General for Energy emphasizes that solar-powered and hybrid light towers have witnessed a CAGR of 7.2% over the past five years, reflecting a shift toward sustainable technologies. These systems reduce reliance on diesel generators, cutting carbon emissions by up to 30%, as reported by the International Energy Agency. Germany and France lead this transition, with government incentives such as subsidies for renewable energy integration further accelerating adoption. As per the UK Department for Business, Energy & Industrial Strategy, solar-powered light towers are increasingly deployed in remote areas, where access to grid electricity is limited. Their ability to provide cost-effective, eco-friendly illumination makes them vital for achieving net-zero goals while addressing the growing demand for off-grid lighting solutions.

MARKET RESTRAINTS

High Initial Costs of Advanced Light Towers

High initial cost of advanced models those powered by renewable energy or equipped with LED technology is one of the factors that is restraining the growth rate of the market. As per the European Commission Directorate-General for Energy, solar-powered and hybrid light towers can cost up to 50% more than traditional diesel-powered systems, with prices ranging from €10,000 to €25,000 per unit. For small and medium-sized enterprises (SMEs), which account for over 99% of businesses in the EU, this financial barrier limits adoption despite long-term savings. According to the Eurostat, approximately 30% of construction companies cite budget constraints as a primary challenge in upgrading equipment. Additionally, retrofitting older infrastructure to accommodate energy-efficient models often requires additional investments that further increasing costs. This economic constraint slows market penetration in regions with weaker financial incentives or limited access to subsidies.

Limited Awareness and Adoption in Rural Regions

Another key restraint is the limited awareness and slower adoption of advanced light towers in rural and remote areas where traditional lighting solutions remain prevalent. The International Energy Agency notes that rural regions in Eastern Europe, often lack exposure to modern technologies like solar-powered or hybrid light towers. In countries such as Romania and Bulgaria, less than 15% of rural infrastructure projects utilize energy-efficient lighting systems, as reported by Eurostat. This is compounded by inadequate grid connectivity, which restricts the feasibility of electric-powered models. Furthermore, cultural resistance to change and a lack of targeted educational campaigns hinder progress.

MARKET OPPORTUNITIES

Expansion in Smart City and Infrastructure Projects

The growing emphasis on smart city development and large-scale infrastructure projects. The European Investment Bank reports that over €500 billion is allocated annually to infrastructure initiatives, including smart highways, urban redevelopment, and public transit systems, all of which require advanced lighting solutions. Light towers equipped with IoT-enabled features, such as remote monitoring and energy optimization, are increasingly integrated into these projects. As per the International Energy Agency, LED-based light towers reduce energy consumption by up to 60%, aligning with the EU’s sustainability goals. Additionally, the European Commission Directorate-General for Energy emphasizes that investments in renewable energy-powered light towers are expected to grow at a CAGR of 7.2% through 2030. This trend positions light towers as critical tools for enhancing safety and efficiency in modern urban environments.

Rising Demand for Off-Grid and Emergency Lighting Solutions

Another major opportunity is the increasing demand for off-grid and emergency lighting solutions which is driven by the need for reliable illumination in remote areas and disaster response scenarios. The UK Department for Business, Energy & Industrial Strategy notes that solar-powered light towers are gaining traction in regions with limited grid access, offering cost savings of up to 40% compared to diesel generators. According to the International Energy Agency, over 20% of emergency response operations in Europe now utilize renewable energy-powered light towers by ensuring uninterrupted lighting during power outages or natural disasters. As per Eurostat, rural infrastructure projects in Eastern Europe are adopting hybrid models to address connectivity challenges. These advancements escalate the versatility of light towers in supporting both off-grid applications and critical emergency services, which is driving market expansion across diverse sectors.

MARKET CHALLENGES

Dependence on Seasonal and Cyclical Demand Patterns

A significant challenge for the Europe light tower market is its dependence on seasonal and cyclical demand patterns, which create revenue fluctuations for manufacturers and suppliers. According to the European Commission Directorate-General for Energy, over 60% of light tower usage is concentrated in construction and outdoor events, sectors highly sensitive to weather conditions and economic cycles. For instance, Eurostat reports that construction activity declines by approximately 25% during winter months in Northern Europe by reducing the need for mobile lighting solutions. As per the International Energy Agency, the COVID-19 pandemic caused a 30% drop in outdoor events is severely impacting demand for event-specific light towers. This reliance on seasonal industries makes it difficult for companies to maintain consistent sales throughout the year by posing a significant challenge to long-term growth and operational stability.

Competition from Alternative Lighting Solutions

The growing competition from alternative lighting solutions, such as permanent grid-connected systems and portable LED lights. According to the UK Department for Business, Energy & Industrial Strategy like advancements in fixed LED lighting have reduced costs by up to 40% by making them an attractive option for small-scale projects. Additionally, according to the International Energy Agency, portable LED floodlights, which are compact and cost-effective are increasingly replacing traditional light towers in specific applications like small construction sites or local events. These alternatives, while less versatile, often offer lower upfront costs are promoting light tower manufacturers to innovate and differentiate their products. As per Eurostat, the adoption of smart streetlights in urban areas has further eroded demand for mobile lighting systems is intensifying competition and challenging market players to adapt to evolving consumer preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.74% |

|

Segments Covered |

By Channel, Product, Lighting, Power Source, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Atlas Copco, Chicago Pneumatic, Caterpillar, Doosan Portable Power, Generac Power Systems, Inc., HIMOINSA, Inmesol gensets, S.L.U., JC Bamford Excavators Ltd., Larson Electronics, Light Boy Co., Ltd., Luxtower, Multiquip, Inc., The Will Burt Company, Trime S.r.l., United Rentals, Inc., and Wacker Neuson SE. |

SEGMENTAL ANALYSIS

By Channel Insights

The sales channel held the dominant share of Europe light tower market and held 60% of share in 2024. This dominance is driven by industries like construction and mining, where long-term ownership ensures cost efficiency. As per Eurostat, over 70% of large-scale projects prefer purchasing light towers, particularly in Germany and France, due to government incentives for energy-efficient technologies. Solar-powered and LED models, offering up to 60% energy savings, further boost sales. According to the International Energy Agency, direct purchases with sustainability goals is making this channel critical for infrastructure development and industrial growth.

The rental channel is likely to experience a CAGR of 8.5% from 2025 to 2033. This growth is fueled by demand from short-term applications like outdoor events, roadworks, and emergency response. According to the UK Department for Business, Energy & Industrial Strategy, rentals reduce upfront costs by up to 50%, appealing to SMEs and event organizers. Eurostat reports that temporary projects account for over 20% of rental demand. The flexibility and cost-effectiveness of rentals make them vital for addressing cyclical needs by ensuring adaptability in dynamic markets while supporting Europe’s urbanization and infrastructure expansion efforts.

By Product Insights

The mobile light towers segment led the market by capturing 60% of the European market share in 2024. Their versatility makes them ideal for diverse applications such as roadworks, outdoor events, and emergency response. As per UK Department for Business, Energy & Industrial Strategy, mobile units with LED and hybrid systems reduce fuel consumption by up to 50% are aligned with EU sustainability goals. According to the Eurostat, industries like construction and event management prefer mobile solutions due to their portability and ease of deployment.

By Lighting Insights

The LED lighting was the largest segment with 55% of the total share in 2024. Its superior energy efficiency by consuming up to 60% less energy than metal halide systems, and a lifespan of up to 50,000 hours is majorly propelling the segment’s growth rate. As per Eurostat, industries like construction and events are rapidly adopting LEDs due to their cost savings and alignment with EU decarbonization goals. Their ability to integrate with renewable energy sources further enhances their appeal. LED lighting’s plays major role in reducing operational costs and carbon emissions while supporting sustainable development across Europe.

By Power Source Insights

The diesel-powered light towers dominate the Europe light tower market with 50% of the total share in 2024. Reliability and high power output is making them ideal for large-scale projects like mining and construction. As per the International Energy Agency, diesel systems can operate continuously in remote areas, where grid access is limited. As per Eurostat, rising fuel costs and emissions regulations are challenging their dominance. Despite this, diesel-powered towers remain critical for applications requiring uninterrupted performance by ensuring their continued importance in industries where consistent and robust lighting solutions are non-negotiable.

The solar-powered light towers segment is anticipated to witness a CAGR of 10.5%in the foreseen years. This growth is fueled by Europe’s push toward decarbonization with solar systems reducing carbon emissions by up to 30% compared to diesel alternatives. According to the UK Department for Business, Energy & Industrial Strategy, government incentives, such as subsidies for renewable energy are accelerating adoption of light towers which is driving the growth rate of this segment. As per Eurostat, solar-powered towers are increasingly used in off-grid and emergency scenarios are offering cost savings and sustainability. Their eco-friendly design with EU Green Deal targets is making them pivotal in driving the transition to sustainable and energy-efficient lighting solutions across Europe.

By Technology Insights

The hydraulic lifting systems segment dominate the Europe light tower market and held 70% of the total share in 2024. The efficiency, durability, and ease of operation with precise height adjustments and reducing manual effort are greatly influencing the growth rate of the market. According to the International Energy Agency, hydraulic systems are preferred in industries like construction and mining, where reliability is hi8ghly required. As per Eurostat, these systems lower long-term maintenance costs are enabling EU sustainability goals through improved energy efficiency. Their ability to deliver consistent performance in demanding environments is making them indispensable for large-scale projects requiring robust and adaptable lighting solutions.

By Application Insights

The construction sector segment dominated the market and held 35% of the total share in 2024. The rapid urbanization and infrastructure development across Europe, with over €500 billion annually invested in construction projects is elevating the growth rate of the market. According to the International Energy Agency, LED and solar-powered light towers are increasingly adopted for nighttime operations, offering energy savings of up to 60%. Their ability to enhance safety and productivity on large-scale sites makes them indispensable. Light towers play a critical role in supporting sustainable construction practices and ensuring compliance with EU safety and environmental standards.

Emergency & disaster relief segment is witnessed to grow at a projected CAGR of 9.8% from 2025 to 2033. The rising frequency of natural disasters and the need for reliable off-grid lighting solutions are ascribed to bolster the segment’s growth rate. According to the UK Department for Business, Energy & Industrial Strategy, solar-powered light towers are increasingly deployed during emergencies by reducing reliance on traditional power sources. According to the Eurostat, governments are prioritizing resilient infrastructure with investments in disaster preparedness boosting adoption. Their portability and ability to operate independently make them vital for emergency response with their importance in enhancing public safety and disaster management capabilities across Europe.

REGIONAL ANALYSIS

Germany led the Europe light tower market with a 25% share in 2024 owing to its robust infrastructure development and commitment to sustainability. As per the European Commission Directorate-General for Energy, Germany’s investments in smart city projects and renewable energy integration have accelerated the adoption of solar-powered and LED-based light towers. As reported by Eurostat, Germany prioritizes energy-efficient solutions to meet its Green Deal targets with over €100 billion allocated annually to construction and infrastructure. The country’s well-established manufacturing base further supports innovation in light tower technologies with its leadership in the regional market.

The UK light tower market is attributed to grow with a CAGR of 6.9% in the coming years, with the strict carbon emission regulations and rapid urbanization. As per UK Department for Business, Energy & Industrial Strategy, retrofitting programs and renewable energy incentives are driving demand for eco-friendly lighting solutions. Rising urban development projects in London and Manchester, require advanced lighting systems for nighttime construction and public safety. Additionally, the UK’s focus on reducing carbon emissions by 78% by 2035, as part of its net-zero strategy, has boosted the adoption of energy-efficient light towers. These factors position the UK as a key player in the Europe light tower market.

Italy light tower market is expected to grow steadily throughput the forecast period. The Italian Ministry of Economic Development notes that tax incentives like the "Superbonus 110%" scheme have spurred upgrades to modern infrastructure by boosting light tower adoption in construction and public safety projects. Italy’s aging building stock and growing emphasis on renewable energy integration further drive demand for sustainable lighting solutions. Eurostat reports that Italy’s urbanization rate exceeds 70% is creating significant opportunities for light tower applications in urban redevelopment and roadworks. This proactive approach to infrastructure modernization ensures Italy’s steady growth and prominence in the regional market.

KEY MARKET PLAYERS

The major players in the Europe light tower market include Atlas Copco, Chicago Pneumatic, Caterpillar, Doosan Portable Power, Generac Power Systems, Inc., HIMOINSA, Inmesol gensets, S.L.U., JC Bamford Excavators Ltd., Larson Electronics, Light Boy Co., Ltd., Luxtower, Multiquip, Inc., The Will Burt Company, Trime S.r.l., United Rentals, Inc., and Wacker Neuson SE.

MARKET SEGMENTATION

This research report on the Europe light tower market is segmented and sub-segmented into the following categories.

By Channel

- Sales

- Rental

By Product

- Stationary

- Mobile

By Lighting

- Metal Halide

- LED

- Electric

- Others

By Power Source

- Diesel

- Solar

- Direct

- Others

By Technology

- Manual lifting system

- Hydraulic lifting system

By Application

- Construction

- Infrastructure development

- Oil & gas

- Mining

- Military & defense

- Emergency & disaster relief

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe light tower market?

The growth of the Europe light tower market is driven by increasing construction activities, rising demand for infrastructure development, and the need for efficient lighting solutions in remote and off-grid locations.

What are the advantages of solar-powered light towers over diesel-powered ones?

Solar-powered light towers offer advantages such as lower operational costs, reduced carbon emissions, quieter operation, and minimal maintenance compared to diesel-powered units.

Is there a growing trend toward hybrid and battery-powered light towers in Europe?

Yes, there is a growing trend toward hybrid and battery-powered light towers due to increasing environmental concerns and government regulations on emissions.

What is the future outlook for the Europe light tower market?

The future outlook for the Europe light tower market is positive, with increasing demand for eco-friendly and energy-efficient solutions, advancements in LED technology, and government support for sustainable infrastructure projects.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]