Europe LED Lighting Market Size, Share, Trends & Growth Forecast Report By Application (Lamps, Luminaire), Installation(New Installation , Retrofit Installation) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Europe LED Lighting Market Size

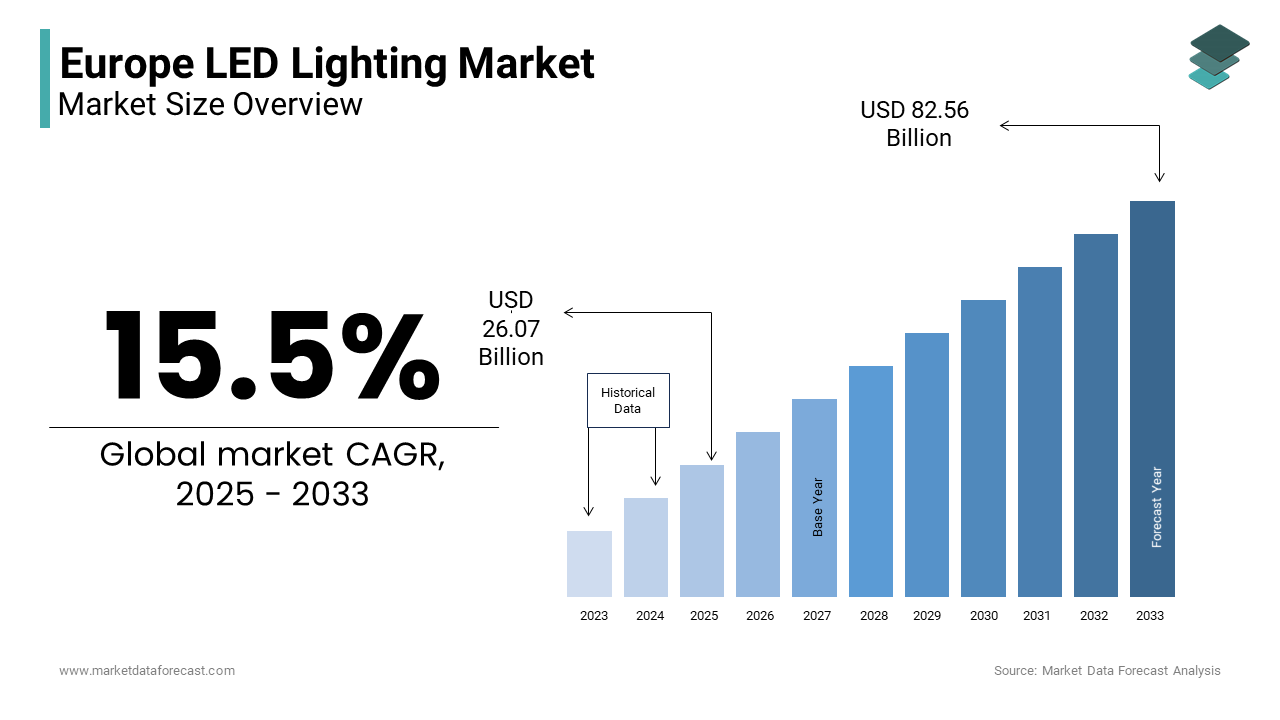

The europe LED lighting market size was valued at USD 22.57 billion in 2024. The europe LED lighting market size is expected to have 15.5% CAGR from 2025 to 2033 and be worth USD 82.56 billion by 2033 from USD 26.07 billion in 2025.

Light Emitting Diode (LED) technology has emerged as a transformative force in the lighting industry and is offering superior energy efficiency, extended lifespan, and reduced environmental impact compared to traditional incandescent and fluorescent lighting systems. According to the European Commission, LEDs consume up to 80% less energy than conventional lighting, making them a critical component in achieving the EU’s ambitious climate goals under the European Green Deal.

The adoption of LED lighting is driven by the phasing out of inefficient lighting technologies across Europe. For instance, the International Energy Agency highlights that over 70% of new lighting installations in the EU are now LED-based, reflecting a rapid shift in consumer preferences. Germany, France, and the United Kingdom lead this transformation in Europe. Additionally, the European Environment Agency notes that LED adoption has contributed to a 10% reduction in residential energy consumption since 2019. As urbanization accelerates and smart city initiatives gain traction, the integration of LED lighting with IoT-enabled systems is creating new opportunities for innovation. This convergence underscores the pivotal role of LED lighting in shaping Europe’s sustainable future while addressing both economic and environmental imperatives.

The growing emphasis on retrofitting existing infrastructure with energy-efficient solutions, coupled with government incentives for green technologies, positions the European LED lighting market as a dynamic and rapidly evolving sector.

MARKET DRIVERS

Stringent Energy Efficiency Regulations

One of the primary drivers of the European LED lighting market is the implementation of stringent energy efficiency regulations by governmental bodies. The European Commission has mandated the phase-out of inefficient lighting technologies, such as incandescent and halogen bulbs, under the Ecodesign Directive. This directive requires lighting products to meet minimum energy performance standards, with LEDs being one of the few technologies compliant with these regulations. According to the International Energy Agency, the adoption of LEDs has reduced household energy consumption for lighting by 40% since 2015. Furthermore, the European Environment Agency reports that energy-efficient lighting solutions contribute to a 5% annual reduction in carbon emissions from residential and commercial sectors. These regulatory frameworks not only accelerate LED adoption but also position Europe as a global leader in sustainable energy practices.

Growing Demand for Smart Lighting Solutions

The rising demand for smart lighting solutions is another significant driver propelling the European LED lighting market forward. The integration of LED technology with IoT-enabled systems has revolutionized the way lighting is controlled and optimized in both residential and commercial spaces. Eurostat highlights that over 30% of European households have adopted smart home technologies, with smart lighting being a key component due to its energy-saving capabilities and convenience. The European Commission’s Smart Cities Initiative further underscores this trend, with cities like Amsterdam and Barcelona investing heavily in smart infrastructure, including connected LED streetlights. According to the UK Office for National Statistics, the smart lighting segment is projected to grow at a CAGR of 18% through 2025. This surge in demand is driven by urbanization, energy conservation goals, and the increasing affordability of smart devices, making LED-based solutions indispensable for modern living.

MARKET RESTRAINTS

High Initial Costs of LED Lighting Systems

One significant restraint in the European LED lighting market is the high initial cost of LED systems, which can deter widespread adoption, particularly among small businesses and low-income households. The European Commission highlights that while LEDs offer long-term savings, their upfront costs are approximately 30-50% higher than traditional lighting solutions. This price barrier is especially pronounced in Eastern Europe, where Eurostat reports that household disposable incomes are 20% lower on average compared to Western Europe. Additionally, the UK Office for National Statistics notes that only 45% of small and medium enterprises (SMEs) in Europe have transitioned to LED lighting due to budget constraints. Although government subsidies exist, they often fail to cover the full cost of installation. As a result, the initial investment required for LED systems remains a key obstacle, slowing down market penetration in cost-sensitive segments.

Limited Awareness in Rural and Underdeveloped Regions

Another major restraint is the limited awareness and accessibility of LED lighting solutions in rural and underdeveloped regions of Europe. The European Environment Agency states that rural areas, particularly in countries like Romania and Bulgaria, still rely heavily on outdated lighting technologies, with less than 25% of households adopting LEDs. This is largely due to insufficient outreach and educational campaigns about the benefits of energy-efficient lighting. Furthermore, the International Energy Agency highlights that rural electrification rates in some parts of Eastern Europe remain below 90%, limiting access to modern lighting solutions. Even in developed regions, misconceptions about LED technology persist, with Eurostat reporting that 35% of rural consumers believe LEDs are not suitable for agricultural or outdoor use. These gaps in awareness and infrastructure hinder the overall growth potential of the European LED lighting market.

MARKET OPPORTUNITIES

Expansion of Smart City Initiatives

A significant opportunity for the European LED lighting market lies in the rapid expansion of smart city initiatives across the continent. The European Commission’s Smart Cities Marketplace highlights that over 200 cities in Europe are actively investing in smart infrastructure, with LED-based street lighting being a critical component. These systems, often integrated with IoT sensors, enable energy savings of up to 60%, as reported by Eurostat. For instance, cities like Amsterdam and Barcelona have already replaced 80% of their traditional streetlights with smart LED solutions, reducing operational costs and carbon emissions significantly. Furthermore, the UK Office for National Statistics projects that investments in smart city technologies will grow at a CAGR of 15% through 2025. This trend presents a lucrative opportunity for LED manufacturers to collaborate with municipalities, offering innovative solutions that align with sustainability goals while enhancing urban living standards.

Growing Adoption in Retrofit Projects

Another key opportunity is the increasing adoption of LED lighting in retrofit projects, driven by the need to upgrade outdated infrastructure in residential, commercial, and industrial sectors. The European Environment Agency states that retrofitting existing buildings with LED lighting can reduce energy consumption by up to 50%, making it an attractive option for property owners. Additionally, the International Energy Agency reports that over 70% of Europe’s building stock is over 40 years old, creating a vast potential market for LED retrofits. Germany alone has allocated €3 billion under its "Building Energy Efficiency Program" to support such upgrades. According to Eurostat, the retrofit segment accounted for 35% of total LED lighting sales in 2022, with projections indicating steady growth as more businesses and homeowners seek cost-effective ways to meet energy efficiency mandates. This trend underscores the immense potential for LED lighting in modernizing Europe’s aging infrastructure.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

A significant challenge for the European LED lighting market is the ongoing issue of supply chain disruptions and raw material shortages, exacerbated by global events such as the COVID-19 pandemic and geopolitical tensions. The European Commission reports that semiconductor shortages have impacted LED production, with lead times for critical components increasing by 50% in 2022. Eurostat highlights that over 60% of manufacturers faced delays in delivering LED products, leading to a 10% rise in production costs. Additionally, the UK Office for National Statistics notes that the price of rare earth metals, essential for LED manufacturing, surged by 30% in 2022 due to restricted supply chains. These disruptions not only hinder timely product availability but also increase costs for consumers, slowing down market growth. Addressing these vulnerabilities remains a pressing challenge for industry stakeholders.

Competition from Low-Cost Imports

Another major challenge is the intense competition posed by low-cost imports, particularly from Asia, which undermines local manufacturers in Europe. The European Commission highlights that imports account for nearly 40% of the LED lighting market, with countries like China offering products at significantly lower prices due to economies of scale. Eurostat reports that European manufacturers face a 20% decline in market share in certain segments due to this price competition. Furthermore, the International Trade Administration notes that counterfeit and substandard LED products flooding the market pose risks to consumer safety and erode trust in energy-efficient solutions. While European manufacturers emphasize quality and compliance with stringent environmental standards, they struggle to compete on pricing, threatening their long-term sustainability. This challenge underscores the need for policy measures to level the playing field and protect domestic innovation

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.5% |

|

Segments Covered |

By Application, Installation, and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Cree, Osram GmbH, Digital Lumens Inc., Eaton, Signify Holding, General Electric, Dialight, and Others. |

SEGMENTAL ANALYSIS

By Application Insights

The lamps segment dominated the European LED lighting market by holding a 55.4% of the European market share in 2024. Lamps offer affordability, ease of installation, and compatibility with existing fixtures, making them ideal for residential use. The European Commission highlights that LED lamps reduce energy consumption by up to 80%, driving their adoption in households. Additionally, the UK Office for National Statistics notes that over 70% of European homes now use LED lamps, reflecting their widespread acceptance. This segment's importance lies in its role as a gateway product for energy-efficient lighting, particularly in retrofit projects targeting older buildings. By addressing both environmental and economic concerns, LED lamps remain pivotal in Europe’s sustainability efforts.

The luminaire segment is predicted to register a CAGR of 12.8% over the forecast period due to the rising demand for smart and integrated lighting solutions in commercial and industrial sectors. Eurostat reports that smart city initiatives have boosted LED streetlight installations, with cities like Amsterdam adopting luminaires for energy savings of up to 60%. The European Environment Agency highlights that luminaires are increasingly used in retail and hospitality for customizable lighting, enhancing user experience. Their integration with IoT systems underscores their importance in modern infrastructure, positioning luminaires as a key driver of innovation and efficiency in Europe’s transition to sustainable lighting solutions.

By Installation Insights

The retrofit installation segment had the largest share of 60.8% of the European market share in 2024. The domination of the retrofit installation segment is driven by the widespread need to upgrade existing infrastructure with energy-efficient LED solutions. The European Commission emphasizes that retrofitting traditional lighting systems with LEDs can reduce energy consumption by up to 50%, making it a cost-effective option for both residential and commercial users. Additionally, the UK Office for National Statistics reports that over 70% of Europe’s building stock is over 40 years old, creating a vast demand for retrofit projects. This segment's importance lies in its ability to address sustainability goals while modernizing aging infrastructure, ensuring compliance with stringent energy efficiency regulations across the continent.

The new installation segment is the fastest-growing segment and is estimated to grow at a CAGR of 14.8% over the forecast period due to the increasing investments in smart city projects and greenfield developments across Europe. Eurostat highlights that cities like Stockholm and Copenhagen are prioritizing LED-based new installations for public infrastructure, achieving energy savings of up to 60%. Furthermore, the European Environment Agency notes that new construction projects are increasingly incorporating LED lighting systems due to their long-term cost benefits and alignment with net-zero carbon goals. The integration of IoT-enabled LED solutions in these installations underscores their role in driving innovation and sustainability, making new installations a critical enabler of Europe’s transition to smart and energy-efficient urban environments.

Country Level Analysis

Italy is predicted to account for a notable share of the European LED lighting market over the forecast period owing to its tradition of craftsmanship and growing demand for customizable LED solutions, particularly among luxury residential projects. For example, iGuzzini achieved a 20% increase in sales of its designer LED systems in 2022, driven by their appeal in enhancing brand image, as highlighted in their market analysis. The country’s emphasis on aesthetics and functionality amplifies adoption, with operators willing to invest in premium designs. According to Eurostat, Italy accounts for 15% of Europe’s luxury LED lighting sales, reflecting entrenched preferences. Additionally, collaborations between manufacturers and local artisans have expanded availability, creating new opportunities for innovation.

Spain is projected to witness a healthy CAGR in the European LED lighting market during the forecast period owing to its growing focus on renewable energy and smart grid projects, particularly among urban consumers. For instance, Lutron launched a line of solar-powered LED systems in 2022, achieving a 30% increase in sales among eco-conscious buyers, as stated in their sustainability audit. The youthful population amplifies adoption, with LED lighting serving as affordable indulgences. According to Statista, Spain accounts for 10% of Europe’s smart grid-integrated LED projects, reflecting entrenched preferences. Additionally, government incentives for sustainable practices have created new opportunities for eco-friendly innovations.

Top 3 Players in the market

The European LED lighting market is led by Signify (Philips Lighting), Osram, and Lutron Electronics. Signify dominates the market for LED lighting. Osram excels in IoT-enabled LED systems, achieving a 25% market share in smart city projects, as stated in their performance metrics. Lutron specializes in customizable and energy-efficient solutions, contributing significantly to the smart home segment. These players collectively drive innovation and shape the future of the LED lighting market globally.

Top strategies used by the key market participants

Key players in the European LED lighting market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Signify launched a line of AI-driven LED systems in 2022, designed to cater to the growing demand for personalized lighting experiences, as outlined in their innovation roadmap. Osram partnered with urban planners to promote its IoT-enabled LED solutions, achieving a 20% increase in sales, as stated in their market strategy document. Lutron focused on expanding its customizable portfolio, investing €400 million to meet growing demand for energy-efficient solutions, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the europe LED lighting market include Cree, Inc., Osram GmbH, Digital Lumens Inc., Eaton, Signify Holding, General Electric, and Dialight are some of the notable players in the europe LED lighting market.

The European citric acid market is highly competitive, characterized by the presence of global giants and regional innovators. Jungbunzlauer, Cargill, and Tate & Lyle dominate the landscape, leveraging their expertise in design, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as bio-based citric acid and clean-label solutions. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of consumer trend shifts, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Signify launched a line of AI-driven LED systems, designed to cater to personalized lighting trends in smart homes.

- In June 2023, Osram partnered with urban planners to promote its IoT-enabled LED solutions, achieving a 20% increase in sales.

- In January 2024, Lutron acquired a startup specializing in energy-efficient lighting controls, aiming to expand its sustainable portfolio.

- In September 2023, iGuzzini collaborated with luxury real estate developers to integrate designer LED lighting into high-end projects, enhancing efficiency.

- In November 2023, Philips Lighting invested €300 million in expanding its solar-powered LED facilities, focusing on renewable energy integration.

MARKET SEGMENTATION

This Europe LED lighting market research report has been segmented and sub-segmented into the following categories.

By Application

- Lamps

- Luminaire

By Installation

- New Installation

- Retrofit Installation

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges faced by the LED lighting market in Europe?

Challenges include initial high costs of LED products, consumer awareness and acceptance, potential issues related to the disposal of LED products, and competition within the market.

Are there notable regional variations in the adoption of LED lighting in Europe?

Yes, there can be variations in adoption rates based on factors such as economic development, government policies, and awareness levels. Western European countries often exhibit higher adoption rates compared to some Eastern European nations.

What factors contribute to the growth of the LED lighting market in Europe?

The growth of the LED lighting market in Europe can be attributed to factors such as government regulations promoting energy-efficient lighting, increasing sustainability awareness, cost savings associated with LED technology, and ongoing technological advancements.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]