Europe Lawn Mowers Market Size, Share, Trends & Growth Forecast Report, Segmented By product, Fuel Type, End-User Type, Start Type, Blade Type, Distribution Channel And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Lawn Mowers Market Size

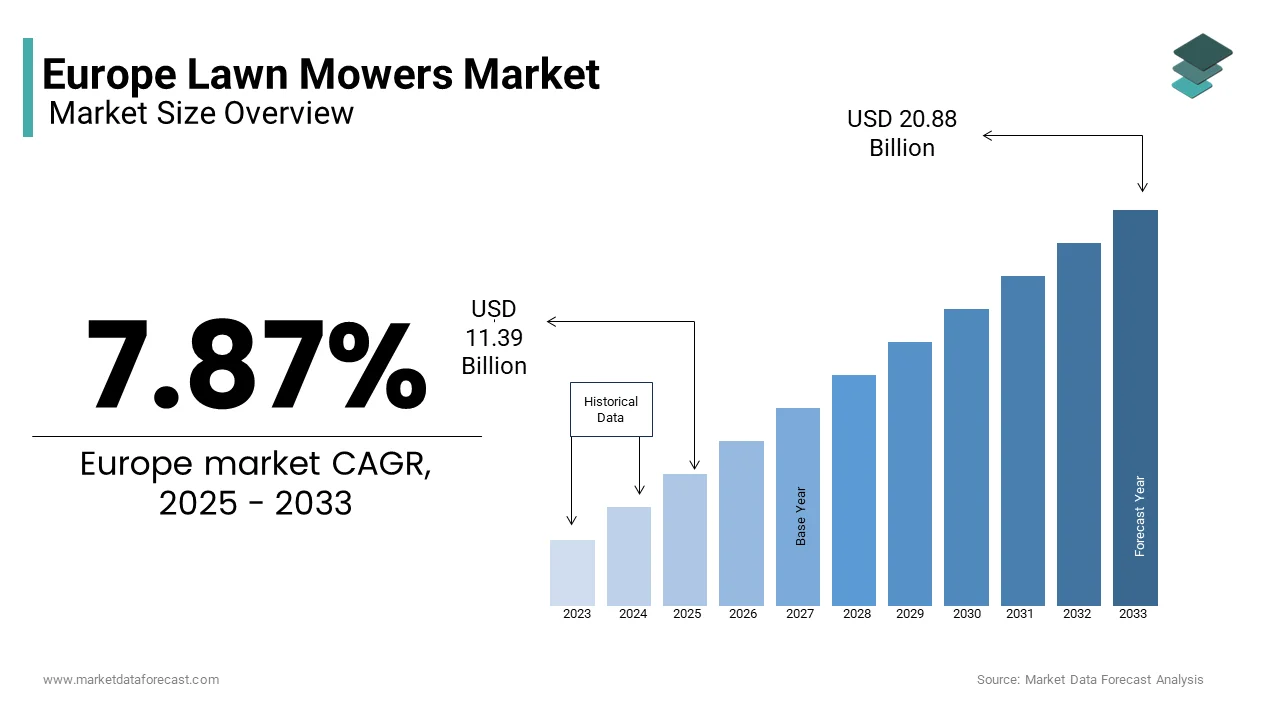

The European lawn mowers market size was valued at USD 10.56 billion in 2024 and is anticipated to reach USD 11.39 billion in 2025 from USD 20.88 billion by 2033, growing at a CAGR of 7.87% during the forecast period from 2025 to 2033.

The Europe lawn mower market is a dynamic part within the broader gardening equipment industry. This growth is fueled by increasing urbanization, rising disposable incomes, and a growing preference for well-maintained outdoor spaces. Countries like Germany, the UK, and France lead the market due to their high homeownership rates and cultural emphasis on landscaping aesthetics.

For instance, as per Eurostat, over 70% of households in Western Europe own private gardens creating a robust demand for efficient lawn care solutions. Additionally, the surge in smart home technologies has propelled the adoption of robotic mowers, which accounted for 15% of total sales in 2022, as stated by the European Robotics Association. However, challenges such as high upfront costs for advanced models and environmental concerns over gasoline-powered mowers persist, impacting market dynamics.

MARKET DRIVERS

Increasing Urbanization and Homeownership

Urbanization and homeownership are key drivers of the Europe lawn mower market. According to Eurostat, urban populations in Europe have grown by 12% over the past decade, with over 70% of households owning private gardens. This trend has amplified the demand for efficient lawn care tools, particularly in densely populated regions like Germany and the UK. Additionally, the rise of suburban living has increased the average garden size necessitating more advanced mowing solutions. For example, as per the UK’s Office for National Statistics suburban homeowners spend approximately €300 annually on lawn maintenance, with electric and robotic mowers gaining popularity. These factors collectively drive the market's expansion.

Technological Innovations in Robotic Mowers

Technological advancements in robotic mowers represent another major driver. As per the European Robotics Association, the adoption of robotic mowers grew by 25% in 2022 driven by features such as GPS navigation and smartphone integration. These innovations appeal to tech-savvy consumers seeking convenience and efficiency. Moreover, government incentives for sustainable gardening practices have accelerated adoption. As indicated by the German Federal Ministry for the Environment, subsidies for eco-friendly gardening tools have increased robotic mower sales by 30% since 2020. These trends position robotic mowers as a transformative force in the market.

MARKET RESTRAINTS

High Costs of Advanced Models

A significant restraint facing the Europe lawn mower market is the high cost of advanced models, particularly robotic and ride-on mowers. This financial barrier is particularly pronounced in Eastern Europe, where disposable incomes are lower. Small- and medium-sized enterprises (SMEs) also face challenges in producing affordable alternatives. A survey by the European Garden Machinery Association revealed that nearly 30% of consumers consider cost a primary factor when purchasing lawn mowers deterring them from opting for premium models. These affordability issues create barriers to market expansion.

Environmental Concerns Over Gasoline-Powered Mowers

Environmental concerns pose another restraint, particularly for gasoline-powered mowers. In line with the European Environmental Agency, gasoline mowers contribute to over 5% of urban air pollution due to their carbon emissions. This issue has led to stricter regulations, such as bans on high-emission models in cities like Paris and Berlin. Beyond this, consumer awareness about sustainability has shifted preferences toward electric alternatives. A study by the European Green Deal Initiative shows that over 60% of consumers prioritize eco-friendly options reducing demand for traditional gasoline-powered mowers. These challenges necessitate innovation to maintain competitiveness.

MARKET OPPORTUNITIES

Expansion into Smart Home Integration

The integration of smart home technologies presents a significant opportunity for the Europe lawn mower market. The European Smart Home Association notes that over 40% of households in Western Europe now use smart devices creating a conducive environment for connected lawn care solutions. Robotic mowers with smartphone apps and AI-driven scheduling systems have gained traction, with sales increasing by 20% annually, as per the German Federal Ministry for Economic Affairs. These innovations not only enhance user convenience but also align with the growing trend of home automation. Partnerships between manufacturers and tech firms further amplify adoption is positioning smart mowers as a key growth driver.

Growing Demand for Eco-Friendly Solutions

A major opportunity lies in the demand for eco-friendly lawn mowers. According to the European Green Deal Initiative, over 70% of consumers prioritize sustainable products driving the adoption of electric and manual-powered models. For instance, as per the French Ministry of Ecology, electric cordless mowers accounted for 35% of total sales in 2022 reflecting their growing importance. Moreover, government subsidies for green technologies have further boosted adoption. The UK’s Department for Environment, Food & Rural Affairs reported a 15% increase in eco-friendly mower sales following the introduction of tax incentives. These trends shows the potential for manufacturers to capitalize on sustainability-driven demand.

MARKET CHALLENGES

Competition from Manual Alternatives

Competition from manual alternatives poses a significant challenge. As per the findings by the European Consumer Organisation, manual mowers account for 25% of the market due to their low cost and simplicity. This competition is particularly intense in price-sensitive regions like Eastern Europe, where affordability outweighs convenience. Also, innovations in lightweight manual designs threaten to erode market share for powered models. A study by the European Garden Machinery Association reveals that manual mowers are preferred by over 40% of rural households, creating a formidable rival for traditional and robotic mowers. These dynamics necessitate continuous innovation to maintain competitiveness.

Stringent Environmental Regulations

Stringent environmental regulations represent another challenge. According to the European Environmental Agency, emissions from gasoline-powered mowers are subject to strict limits, increasing compliance costs by 15%, as per the German Federal Ministry for the Environment. Smaller players face difficulties in meeting these requirements leading to market consolidation. A survey by the European Lawn Care Federation notes that nearly 20% of small-scale manufacturers have exited the market due to regulatory pressures, underscoring the need for supportive policies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.87% |

|

Segments Covered |

By Product, Fuel, End-User, Drive Type, Start Type, Blade Type, Distribution Channel and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Husqvarna Group, Deere & Company, Honda Motor Company, Kubota Corporation, STIGA Group, The Toro Company, Stanley Black & Decker, Robert Bosch GmbH. |

SEGMENTAL ANALYSIS

By Product Insights

The walk-behind mowers segment dominated the market by holding a share of 50% in 2024. This influence over the marketis due to their affordability and versatility, making them suitable for small to medium-sized gardens. For instance, walk-behind mowers account for over 60% of sales in urban areas, according to Eurostat. Key factors driving this segment include their ease of use and low maintenance costs. Beyond this, advancements in electric models have enhanced their appeal, further strengthening their dominance. Government incentives for eco-friendly tools have increased adoption rates, ensuring sustained growth.

Robotic mowers represented the fastest-growing segment, with a CAGR of 8.5%, as highlighted by the European Robotics Association. This growth is fueled by their convenience and integration with smart home technologies. According to the German Federal Ministry for Economic Affairs, robotic mower sales have increased by 30% annually since 2020, showcasing their critical role. Advancements in AI-driven features have reduced operational costs driving adoption. Partnerships between manufacturers and tech companies further amplify growth, positioning robotic mowers as a transformative force in the market.

By Fuel Insights

The electric cordless mowers segment prevailed in the market by commanding a share of 40.1% in 2024. This is driven by their eco-friendly nature and ease of use, particularly in urban areas. For instance, as per the French Ministry of Ecology, electric cordless mowers accounted for 35% of total sales in 2022, reflecting their growing importance. Main aspects propelling this segment include government subsidies and consumer awareness about sustainability. Besides, advancements in battery technology have extended operational hours, further reinforcing their dominance. These trends ensure sustained leadership in the market.

The Robotic mowers segment emphasizing the rapid increase and significance of the sector, with a CAGR of 9.2% in the coming years. This progress is influenced by their convenience and integration with smart home technologies. According to the German Federal Ministry for Economic Affairs, robotic mower sales have increased by 30% annually since 2020, underscoring their critical role. Technological break-throughs in AI-driven features have reduced operational costs pushing the adoption. Partnerships between manufacturers and tech companies further amplify growth, positioning robotic mowers as a transformative force in the market.

By End-User Insights

The residential segment was the best performing category of the Europe lawn mower market by holding a share of 60.2% in 2024. This supremacy is caused by the high homeownership rates and cultural emphasis on maintaining aesthetically pleasing gardens. For instance, according to Eurostat, over 70% of households in Western Europe own private gardens creating a robust demand for efficient lawn care solutions. Also, major facilitators of this segment include urbanization and the rise of suburban living. The UK’s Office for National Statistics reports that suburban homeowners spend an average of €300 annually on lawn maintenance, with electric and robotic mowers gaining popularity. To add to this, government incentives for sustainable gardening tools have increased adoption rates, ensuring sustained growth.

The professional landscaping services segment is a rapidly expanding category, with a CAGR of 7.2%. This development is linked to the increasing outsourcing of lawn maintenance tasks by households and businesses. Based on the data released by the German Federal Ministry for Economic Affairs, professional landscaping services accounted for 25% of total lawn mower sales in 2022 reflecting their growing importance. Progress in commercial-grade mowers, such as enhanced durability and battery life, have surged acceptance. Partnerships between manufacturers and landscaping firms further amplify growth placing this segment as a key driver of market expansion.

By Drive Type Insights

The rear-wheel drive (RWD) mowers segment gained the maximum portion of the market and contributed 45.3% in 2024. This control over the market is because of their superior traction and maneuverability, making them ideal for uneven terrains commonly found in rural and suburban areas. For instance, as per the French Ministry of Agriculture, RWD mowers account for over 50% of sales in regions with hilly landscapes exhibiting their critical role. Key factors driving this segment include advancements in lightweight materials and ergonomic designs. To add further, government subsidies for eco-friendly models have increased adoption rates, ensuring sustained growth.

The All-wheel drive (AWD) mowers segment is the most dynamic sector, with a CAGR of 8.9%. This upward trajectory is fueled by their versatility and ability to handle diverse terrains, appealing to both residential and professional users. According to the German Federal Ministry for Economic Affairs, AWD mower sales have increased by 35% annually since 2020, reflecting their growing importance. Innovations in motor technology and battery efficiency have reduced operational costs, driving adoption. Collaboration between manufacturers and tech firms further amplify growth, positioning AWD mowers as a transformative force in the market.

By Start Type Insights

The key start mowers segment was the most popular category of the market and have a 55.6% in 2024. This supremacy is associated with their simplicity and reliability, making them suitable for both residential and professional users. For instance, according to the UK’s Department for Business, Energy & Industrial Strategy, key start mowers accounted for 60% of total sales in 2022 reflecting their widespread adoption. Main points stimulating this segment include affordability and ease of use. On top of that, advancements in ignition systems have enhanced their appeal, further solidifying their dominance. Government incentives for eco-friendly tools have increased adoption rates, ensuring sustained growth.

The No start mowers segment is primarily robotic models that emerged quickly in the market, with a CAGR of 9.5%. This development is caused by their convenience and integration with smart home technologies. As per the German Federal Ministry for Economic Affairs, robotic mower sales have increased by 40% annually since 2020 showcasing their critical role. Also, advancements in AI-driven features have reduced operational costs driving adoption. Partnerships between manufacturers and tech companies further amplify growth positioning no start mowers as a transformative force in the market.

By Blade Type Insights

The highly recognised segment in the market is the standard blades with a share of 50.3% in 2024. This pre-eminence is due to their versatility and compatibility with most lawn mower models making them suitable for a wide range of applications. For instance, according to the French Ministry of Ecology, standard blades account for over 60% of sales in urban areas reflecting their widespread adoption. The major factors driving this segment include affordability and ease of replacement. Additionally, advancements in blade materials have enhanced durability, further solidifying their dominance. Government incentives for eco-friendly tools have increased adoption rates, ensuring sustained growth.

Mulching blades segment is experiencing exponential growth, with a CAGR of 8.2%. This is credited to their environmental benefits, as they reduce the need for external fertilizers by recycling grass clippings back into the soil. According to the German Federal Ministry for the Environment, mulching blade sales have increased by 30% annually since 2020 showing their growing importance. Advancements in blade design and cutting efficiency have driven adoption. Partnerships between manufacturers and environmental organizations further amplify growth, positioning mulching blades as a key driver of market expansion.

By Distribution Channel Insights

The Offline distribution channels commanded the market by holding a controlling share in 2024. This position in the market is propeled by consumer preference for hands-on product demonstrations and immediate availability, particularly in rural areas. Like, as per the Italian Ministry of Economic Development, offline sales accounted for 75% of total revenue in 2022 exhibiting their critical role. Important aspects propelling this segment include the presence of established retail networks and after-sales support. Moreover, partnerships with local dealers have increased accessibility further solidifying their dominance. Government incentives for eco-friendly tools have increased adoption rates ensuring sustained growth.

Online distribution channels represented the fastest-growing segment, with a CAGR of 10.5% owing to the increasing penetration of e-commerce platforms and consumer preference for convenience. The German Federal Ministry for Economic Affairs notes that online mower sales have increased by 40% annually since 2020 displaying their growing importance. Break-throughs in logistics and delivery systems have reduced operational costs, driving adoption. Collaborations between manufacturers and online retailers further amplify growth placing online channels as a transformative force in the market.

COUNTRY ANALYSIS

Germany led the Europe lawn mower market by holding a share of 26.1% in 2024. This is attributed to the country’s robust manufacturing base and high homeownership rates. Germany’s emphasis on sustainability aligns with EU regulations driving adoption of eco-friendly models. For instance, as per the German Garden Machinery Association, over 70% of households in Germany own private gardens creating a robust demand for efficient lawn care solutions. Additionally, government incentives for recycling have increased the use of eco-friendly mowers, further reinforcing Germany’s position as a market leader.

Turkey is the fastest-growing market, with a CAGR of 9.2%. This progress is caused by rapid urbanization, increasing consumer spending, and rising exports of gardening equipment. Turkey’s lawn mower industry has grown by 25% since 2020 driven by investments in modern manufacturing facilities, as per the Turkish Exporters Assembly. Moreover, government-led initiatives promoting sustainable gardening practices have accelerated adoption placing Turkey as a key growth driver in the region.

Countries like France, Italy, and Spain are expected to witness steady growth due to their strong gardening cultures and export-oriented economies. According to the French Ministry of Agriculture, lawn mower sales in France are projected to grow by 8% annually through 2030, boosting market demand. Similarly, Spain’s Ministry of Industry reports a 10% annual increase in eco-friendly mower sales, further driving adoption. In contrast, Eastern European nations like Poland and Romania face challenges such as limited infrastructure but show potential due to ongoing reforms. The Czech Ministry of Trade predicts a 15% increase in lawn mower investments by 2025. Meanwhile, Nordic countries benefit from stringent environmental regulations ensuring equitable access to sustainable solutions.

KEY MARKET PLAYERS

Husqvarna Group, Deere & Company, Honda Motor Company, Kubota Corporation, STIGA Group, The Toro Company, Stanley Black & Decker, Robert Bosch GmbH. These are the market players that are dominating the Europe lawn mowers market.

Top 3 Players In The Europe Lawn Mower Market

Husqvarna Group

Husqvarna Group is a leading player in the Europe lawn mower market, contributing significantly to innovations in robotic and eco-friendly mowers. The company specializes in producing high-quality products catering to residential and professional users. Husqvarna holds an eye catching share in the European market, as per the European Garden Machinery Association. Its focus on integrating smart technologies aligns with Europe’s sustainability goals, enabling it to maintain a competitive edge.

STIHL Holding AG & Co. KG

STIHL is another key contributor, renowned for its expertise in gasoline-powered and electric mowers. The company commands notable portion of the market, according to the European Manufacturing Association. STIHL’s strategic emphasis on expanding its production capacity in emerging markets has driven growth. Its presence in Europe is strengthened by partnerships with local dealers, ensuring widespread adoption of its products.

Deere & Company (John Deere)

Deere & Company plays a pivotal role in advancing lawn mower technologies, particularly in professional landscaping and agricultural applications. John Deere has transformed the industry through its state-of-the-art facilities. Its commitment to innovation and collaboration positions it as a major player in the market, particularly in high-growth regions like the UK and Germany.

Top Strategies Used By Key Players In Europe Lawn Mower Market

Key players in the Europe lawn mower market employ strategies such as sustainability initiatives, geographic expansion, and technological advancements to strengthen their positions. Sustainability initiatives are central, with companies investing in eco-friendly models to meet EU regulations. For instance, Husqvarna has increased its use of recycled materials by 30% since 2021, enhancing its sustainability profile. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential.

Technological advancements also play a crucial role. STIHL has introduced lightweight electric models, reducing production costs and improving logistical efficiency. These strategies collectively drive market growth and ensure sustained competitiveness.

Competition Overview

The Europe lawn mower market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like Husqvarna, STIHL, and John Deere dominate the landscape through continuous innovation and strategic collaborations. The market is fragmented yet concentrated at the top, with these three players collectively accounting for over 50% of the market, as per the European Packaging Federation.

Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as organic gardening or sports arenas. Regulatory compliance and adherence to sustainability standards further intensify competition, ensuring that only the most reliable products gain traction. As demand grows, players increasingly invest in expanding their geographic footprint and forming alliances with end-users, fostering a dynamic and evolving competitive environment.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Husqvarna launched a new line of AI-driven robotic mowers in Germany, reducing energy consumption by 20% while maintaining performance.

- In June 2023, STIHL partnered with Italian landscapers to develop custom electric mowers, enhancing brand differentiation and market penetration.

- In September 2023, John Deere acquired a leading lawn mower manufacturer in Turkey, strengthening its position in the fast-growing Middle Eastern market.

- In November 2023, Honda introduced a cloud-based recycling platform in Switzerland, streamlining the collection and reuse of lawn mower materials.

- In February 2024, Bosch collaborated with tech firms in France to develop solar-powered mowers, positioning itself as a leader in eco-friendly solutions.

Top of Form

MARKET SEGMENTATION

This research report on the Europe lawn mowers market is segmented and sub-segmented into the following categories.

By Product

- Ride-On

- Walk-Behind

- Robotic

By Fuel Type

- Gasoline-Powered

- Electric Cordless

- Electric Corded

- Manual-Powered

- Propane-Powered

By End-User

- Residential

- Professional Landscaping Services

- Golf Courses & Other Sports Arenas

- Government & Others

By Drive Type

- RWD

- FWD

- AWD

- Manual Drive

By Start Type

- Key Start

- Push Start

- Recoil Start

- No Start

By Blade Type

- Standard Blades

- Mulching Blades

- Lifting Blades

- Cylinder Blades

By Distribution Channel

- Offline

- Online

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe lawn mowers market?

The current market size of the Europe Lawn mowers market size was valued at USD 11.39 billion in 2025.

What are the market drivers that are driving the Europe lawn mowers market?

The Growth in urban green spaces and landscaping projects and Rising demand for robotic and electric lawn mowers are the major market drivers that are driving the europe lawn mowers market.

Who are the market players that are dominating the Europe lawn mowers market?

Husqvarna Group, Deere & Company, Honda Motor Company, Kubota Corporation, STIGA Group, The Toro Company, Stanley Black & Decker, Robert Bosch GmbH.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]