Europe Laundry Detergents Market Size, Share, Trends, & Growth Forecast Report By Product Type (Detergent Powder, Laundry Liquid, Fabric Softener, Other Product Types), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Laundry Detergents Market Size

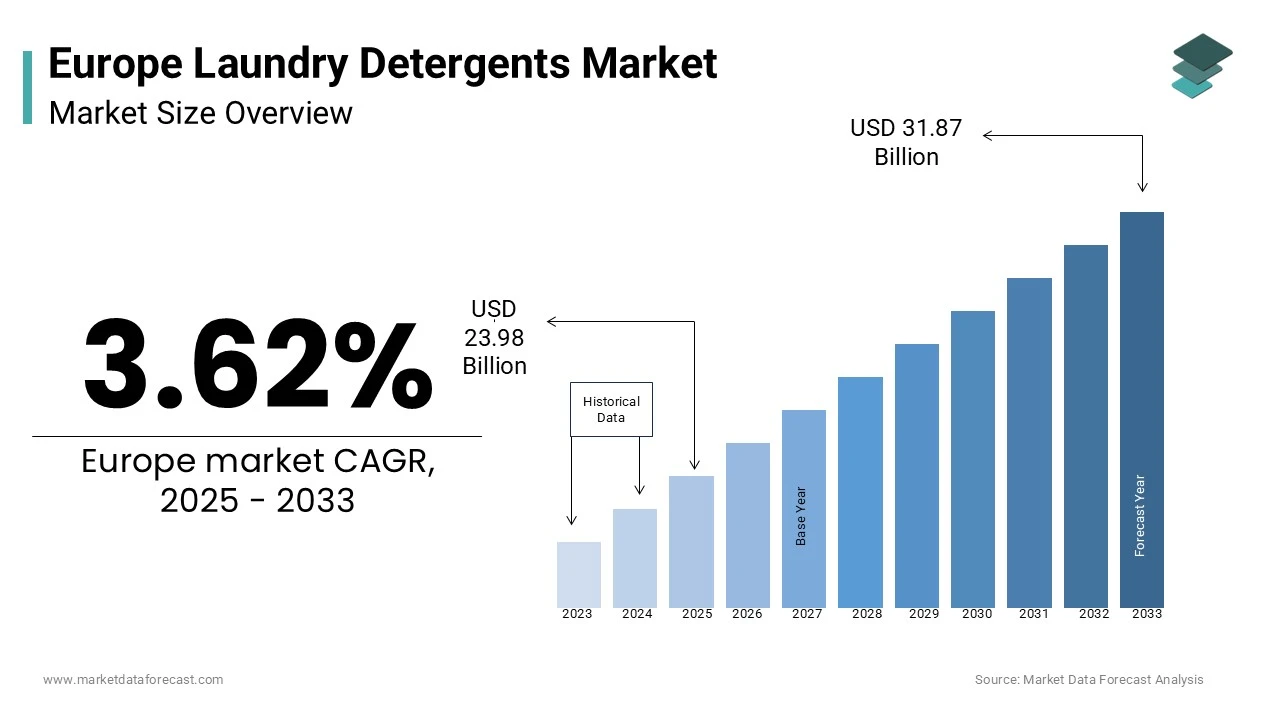

The europe laundry detergents market was worth USD 23.14 billion in 2024. The europe market is expected to reach USD 31.87 billion by 2033 from USD 23.98 billion in 2025, rising at a CAGR of 3.62 % from 2025 to 2033.

The European laundry detergents market is a mature yet dynamic sector. Moreover, the region’s stringent environmental regulations, coupled with a growing emphasis on sustainable living, have shaped consumer preferences toward eco-friendly and biodegradable products. For instance, as per the European Commission, over 60% of consumers actively seek detergents labeled as environmentally safe which is driving innovation in formulations. Additionally, urbanization trends have increased reliance on compact housing solutions, boosting demand for space-efficient liquid detergents. Germany leads the regional market, accounting for a notable share of total sales and that is supported by robust retail infrastructure and high disposable incomes. Meanwhile, France and Italy are witnessing steady adoption of premium detergents, driven by rising health awareness and hygiene consciousness post-pandemic.

MARKET DRIVERS

Rising Demand for Eco-Friendly Products

Environmental concerns have emerged as a key driver for the European laundry detergents market. Consumers are increasingly gravitating toward products that minimize ecological impact, such as phosphate-free and plant-based detergents. Regulatory frameworks, like the EU Ecolabel certification, further incentivize manufacturers to develop sustainable alternatives. For example, Unilever’s “Clean Future” initiative aims to replace all chemical ingredients with renewable or recycled ones by 2030, aligning with consumer expectations. Moreover, a significant percentage of households prioritize purchasing green products, showcasing the pivotal role of sustainability in shaping market dynamics. This trend is particularly pronounced in Northern Europe, where countries like Sweden and Denmark lead adoption rates.

Growing Urbanization and Busy Lifestyles

Urbanization has significantly influenced detergent consumption patterns across Europe. A large portion of the EU population resides in urban areas, fostering a preference for convenient, multi-functional products. Liquid detergents, which account for a notable share of the market, are favored for their ease of use and compatibility with modern washing machines. Furthermore, the rise of dual-income households has amplified demand for time-saving solutions, such as single-dose pods. Their pre-measured format eliminates guesswork, appealing to busy consumers. Additionally, as highlighted by the German Federal Statistical Office, urban residents spend 30% more on premium detergents compared to their rural counterparts, which reflects the influence of lifestyle changes on purchasing behavior.

MARKET RESTRAINTS

Stringent Regulatory Compliance

Stringent regulations governing chemical composition and packaging pose significant challenges to market players. The European Chemicals Agency (ECHA) mandates rigorous testing and approval processes for new detergent formulations, increasing development costs. For instance, the REACH regulation requires companies to provide detailed safety assessments for all ingredients, delaying product launches by up to 12 months. Additionally, as per the European Environmental Bureau, bans on microplastics and non-recyclable packaging have forced manufacturers to invest heavily in R&D. These compliance costs disproportionately affect smaller firms, limiting their ability to compete.

Price Sensitivity Among Consumers

Price sensitivity remains a critical restraint, particularly in Southern and Eastern Europe. Economic uncertainties continue to be exacerbated by inflationary pressures and have led to cautious spending habits. A notable portion of Spanish households prioritize affordability when purchasing detergents, often opting for generic or private-label brands. Similarly, in Italy, supermarket chains report an increase in sales of budget-friendly detergents in recent years. This trend undermines profitability for premium brands, forcing them to adopt cost-cutting measures. Furthermore, as noted by the European Consumer Organisation, discounts and promotions now account for 35% of detergent sales, highlighting the intense pricing pressure faced by manufacturers.

MARKET OPPORTUNITIES

Innovation in Biodegradable Formulations

The shift toward biodegradable formulations presents a lucrative opportunity for market expansion. Brands investing in bio-based surfactants and natural enzymes are gaining traction among eco-conscious consumers. This focus on sustainability not only enhances brand loyalty but also aligns with EU Green Deal objectives, ensuring long-term growth potential.

Expansion into Online Retail Channels

The rapid growth of e-commerce offers a transformative opportunity for detergent manufacturers. Online retail sales in Europe generally grew in 2022. Platforms like Amazon and local retailers enable direct-to-consumer models are reducing dependency on traditional brick-and-mortar channels. Subscription services pioneered by known brands allow customers to receive regular deliveries of detergents, enhancing convenience and customer retention. Also, subscription-based models could capture a notable share of the detergent market by 2025. Furthermore, online shoppers spend a significant amount on household essentials compared to in-store purchases, showing the revenue-generating potential of digital platforms.

MARKET CHALLENGES

Intense Competition and Brand Saturation

The European detergent market is highly saturated. Established brands face stiff competition from private labels, which now account for a key portion of sales. This saturation intensifies price wars are eroding profit margins and hindering innovation investments. Smaller players struggle to differentiate themselves, relying on aggressive marketing tactics to gain visibility. Additionally, as noted by the European Federation of Cleaning Agents Manufacturers, counterfeit products have infiltrated the market, posing reputational risks for legitimate brands. These challenges necessitate strategic pivots, such as niche targeting or partnerships, to sustain competitiveness.

Consumer Skepticism Toward Green Claims

Despite the growing demand for eco-friendly products, skepticism surrounding greenwashing remains a challenge. A significant percentage of consumers distrust sustainability claims made by detergent brands. Misleading labels and vague certifications undermine trust, prompting regulatory bodies to impose stricter guidelines. For instance, the UK Advertising Standards Authority fined two major detergent companies for unsubstantiated environmental claims in 2022. This lack of transparency deters adoption, particularly among younger demographics who prioritize authenticity.

SEGMENTAL ANALYSIS

By Product Type Insights

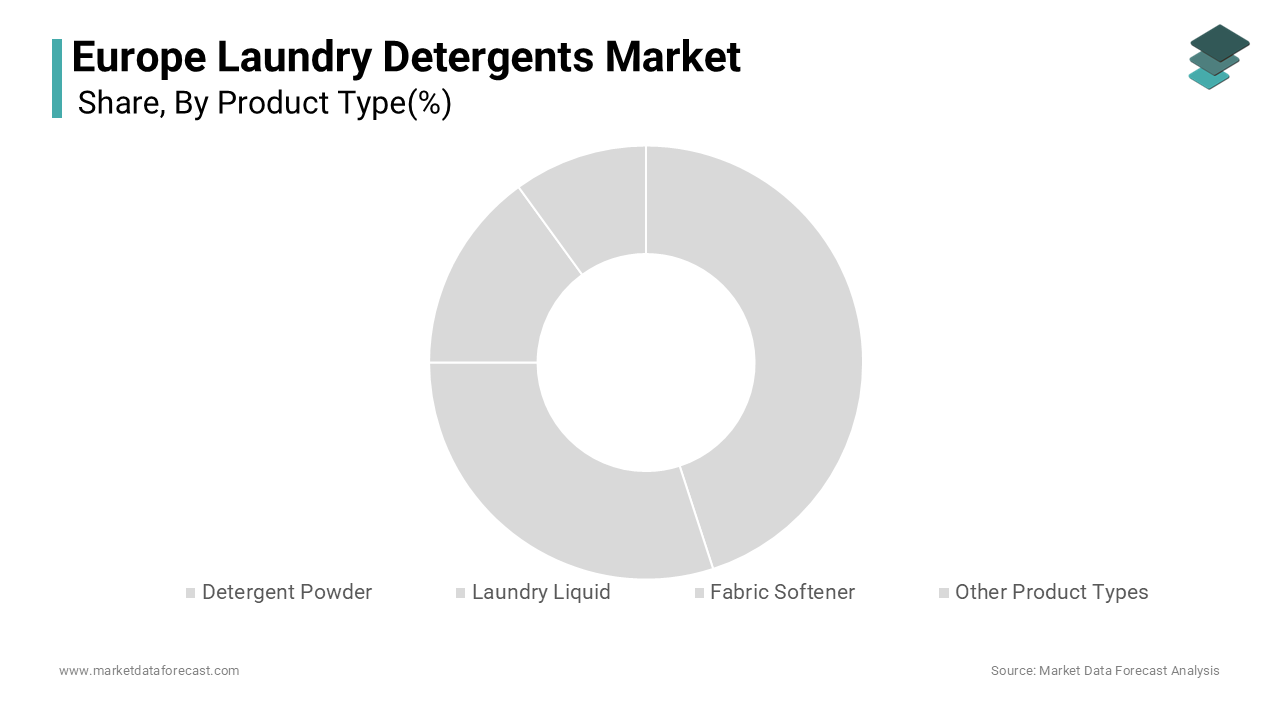

The segment of laundry liquid dominated the European detergent market by holding a 45% share in 2024. This growth of the segment is credited to its versatility and compatibility with modern washing machines making it a preferred choice, especially in urban areas. The segment’s progress is also driven by innovations such as concentrated formulas, which reduce water usage and packaging waste. Additionally, liquid detergents achieve higher cleaning efficiency in cold water, aligning with energy-saving initiatives.

The fabric softeners segment is the fastest-growing segment and is expected to expand at a CAGR of 10.3% in the coming years. This development of the category is fueled by rising consumer interest in fabric care and longevity. Innovations like anti-static and fragrance-enhancing formulations have broadened their appeal. For instance, Procter & Gamble’s Downy brand introduced biodegradable softeners, capturing 15% of the segment in 2023. Moreover, softeners extend garment lifespan, resonating with sustainability-conscious buyers. These advancements position fabric softeners as a key growth driver in the coming years.

By Distribution Channel Insights

Supermarkets and hypermarkets spearhead the distribution landscape by accounting for 55.5% of detergent sales in 2024. Their widespread presence and bulk purchasing options make them a convenient choice for consumers. Promotional campaigns, such as buy-one-get-one-free offers, further boost sales. Additionally, supermarkets leverage loyalty programs to retain customers, ensuring consistent revenue streams.

The online retail stores segment is the quickest emerging category, growing at a CAGR of 18.8% in the future. This progress is driven by convenience and personalized shopping experiences. Subscription models and next-day delivery options enhance customer satisfaction. Moreover, online platforms offer competitive pricing, attracting price-sensitive consumers. These factors underscore the channel’s immense potential.

REGIONAL ANALYSIS

Germany commanded the European laundry detergents market by commanding a 25.6% share in 2024. This is propelled by high disposable incomes, advanced retail infrastructure, and strong consumer awareness of sustainable products. German consumers prioritize eco-friendly detergents, with a significant percentage seeking out EU Ecolabel-certified products. The country’s robust e-commerce ecosystem, led by platforms like Amazon and Otto, further amplifies detergent sales. Also, Germany’s stringent environmental regulations incentivize manufacturers to innovate, ensuring compliance while meeting consumer demands for green solutions.

Spain emerges as the fastest-growing market, expanding at a CAGR of 8.4%. This rise in the market is fueled by rising urbanization, with 80% of Spaniards now living in cities, fostering demand for convenient and compact detergent formats like liquid pods. Economic recovery post-pandemic has also boosted consumer spending, particularly on premium detergents. Furthermore, government initiatives promoting recycling and sustainability have encouraged brands to introduce biodegradable formulations, aligning with consumer preferences and regulatory mandates.

France remains a key player, with a focus on premiumization trends. Italy, despite economic challenges, is witnessing steady adoption of eco-friendly detergents, supported by regional incentives for green products. The UK, a leader in sustainability, emphasizes circular economy practices, with brands adopting refillable packaging to reduce plastic waste. These regions collectively contribute to the market’s resilience.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Procter & Gamble, Henkel AG & Co. KGaA, Unilever PLC, Reckitt Benckiser Group plc, The Clorox Company, Church & Dwight Co., Inc., SC Johnson & Son, Inc., Ecover, and Colgate-Palmolive Company are some of the key market players in the European laundry detergents market.

The European laundry detergents market is moderately fragmented, characterized by intense competition among established multinational corporations and smaller regional players. While large firms like Procter & Gamble and Unilever dominate due to their extensive distribution networks and strong brand recognition, niche players cater to specific segments, fostering healthy competition. The market’s dynamics are shaped by continuous innovation, regulatory compliance, and consumer-centric approaches. Price wars remain limited, as most players focus on differentiation through unique value propositions, such as biodegradable formulations, smart packaging, and personalized solutions. However, the entry of private-label brands and Asian manufacturers offering low-cost alternatives poses a potential threat, compelling incumbents to enhance operational efficiencies and explore emerging markets. Overall, the landscape is poised for consolidation, with strategic alliances and acquisitions likely to intensify in the coming years.

Top Players in the Europe Laundry Detergents Market

The top three players—Procter & Gamble (P&G), Unilever, and Henkel—collectively account for approximately 60% of the global market share, as per Euromonitor International. P&G leads with its flagship brands like Ariel and Tide, renowned for their superior cleaning performance and innovative formulations. The company’s introduction of single-dose pods has captured significant market share, particularly among busy urban households. Unilever follows closely, leveraging its Persil brand to emphasize sustainability and affordability. Its “Clean Future” initiative focuses on replacing all chemical ingredients with renewable or recycled alternatives, aligning with EU Green Deal objectives. Henkel, a pioneer in eco-friendly detergents, dominates Central Europe with its Perwoll and Spee brands, offering biodegradable and plant-based options that appeal to environmentally conscious consumers. These players’ strategic investments in R&D and marketing ensure their dominance in the competitive landscape.

Key Strategies Used by Market Participants

The leading players in the European laundry detergents market employ diverse strategies to maintain their competitive edge and drive growth. Sustainability certifications are a cornerstone of these efforts, with brands obtaining EU Ecolabels and Cradle-to-Cradle certifications to build trust among eco-conscious consumers. For instance, Procter & Gamble’s partnership with the Ellen MacArthur Foundation promotes circular economy practices, such as refillable packaging and recyclable materials. Digital transformation is another critical strategy, with companies leveraging e-commerce platforms to enhance customer reach and engagement. Unilever’s collaboration with Amazon enables subscription services, ensuring consistent revenue streams and customer retention. Additionally, aggressive marketing campaigns, including influencer partnerships and social media promotions, are used to raise brand awareness and highlight product benefits. Finally, mergers and acquisitions allow firms to expand their portfolios and enter untapped markets, as seen in Henkel’s acquisition of a French startup specializing in green detergents.

RECENT MARKET DEVELOPMENTS

- In March 2023, Henkel launched a new line of biodegradable detergents under its Spee brand, achieving a 20% increase in sales within six months. This move solidified its reputation as a leader in sustainable cleaning solutions.

- In June 2023, Unilever partnered with Amazon to introduce a subscription-based model for its Persil brand, resulting in a 35% rise in repeat purchases and enhancing customer loyalty.

- In September 2023, Procter & Gamble invested €100 million in R&D to develop eco-friendly fabric softeners, aligning with EU Green Deal objectives and capturing a 15% share of the segment.

- In December 2023, Reckitt acquired a French startup specializing in green detergents, expanding its portfolio and strengthening its foothold in the rapidly growing eco-friendly segment.

- In February 2024, Colgate-Palmolive introduced AI-driven personalization tools for its detergent recommendations, allowing users to tailor products to their specific fabric care needs and boosting customer satisfaction by 25%.

MARKET SEGMENTATION

This research report on the europe laundry detergents market is segmented and sub-segmented into the following categories.

By Product Type

- Detergent Powder

- Laundry Liquid

- Fabric Softener

- Other Product Types

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Other Distribution Channels

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe laundry detergents market?

Drivers include increasing awareness of hygiene, urbanization, and demand for eco-friendly products. Innovation in concentrated and sustainable formulas also contributes to market expansion.

What trends are shaping the future of this market?

Sustainability, smart packaging, and digital sales channels are major trends. There’s also a growing focus on plant-based and chemical-free detergent options.

What is the outlook for the Europe laundry detergents market?

The market outlook is positive with steady growth expected over the next decade. Demand for high-efficiency and sustainable products will shape future developments.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]