Europe Kombucha Market Research Report Segmented Based on Type, Flavours, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis on Size, Share, Trends, & Growth Forecast (2025 to 2033)

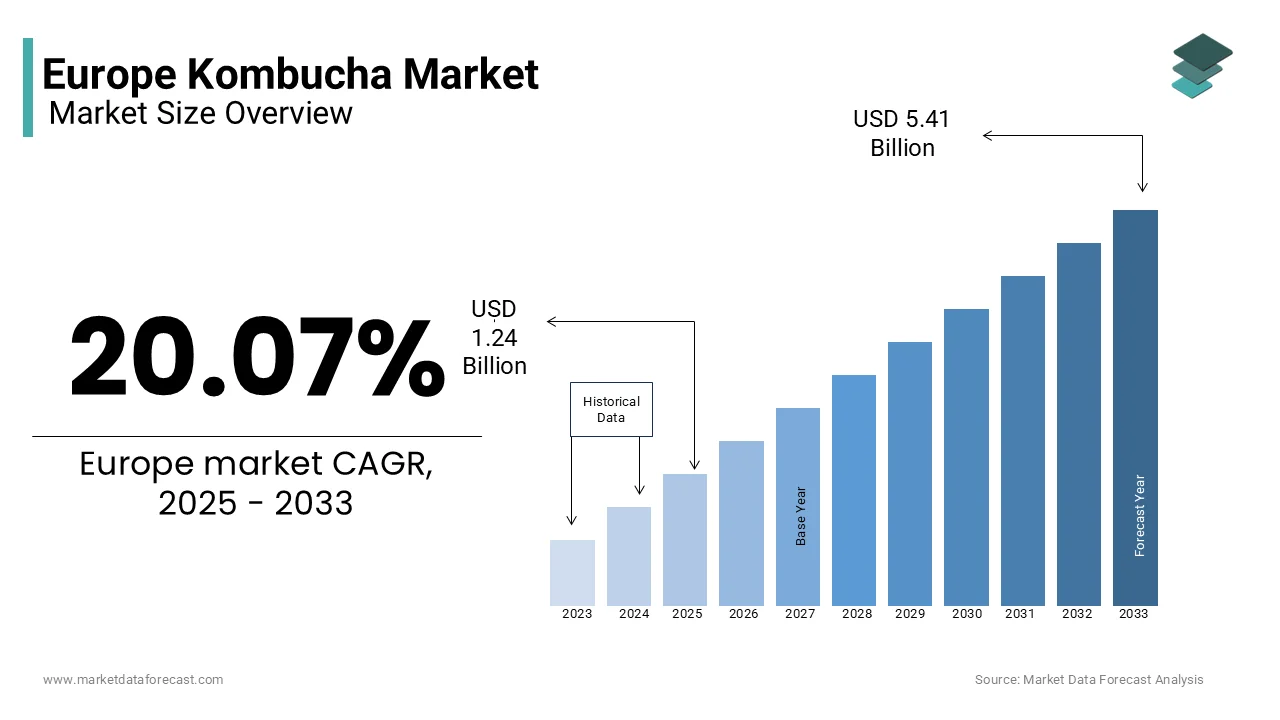

Europe Kombucha Market Size

The European kombucha market size was valued at USD 1.04 billion in 2024, and the global market size is expected to reach USD 5.41 billion by 2033 from USD 1.24 billion in 2025. The market's promising CAGR for the predicted period is 20.07%.

The European kombucha market is experiencing robust growth and this growth is driven by shifting consumer preferences toward health-conscious and functional beverages, increasing awareness of probiotics and their digestive health benefits, particularly among urban millennials and Gen Z consumers. The rising popularity of organic and natural products has also played a pivotal role, with kombucha brands positioning themselves as premium, artisanal alternatives to sugary sodas. Additionally, the growing number of cafes and specialty stores offering kombucha on tap has expanded its accessibility, further driving adoption. As per Euromonitor International, nearly 40% of European consumers now consider gut health a priority when making beverage choices, underscoring the demand for products like kombucha. With ongoing innovation in flavors and packaging, the market is poised for sustained expansion in the coming years.

MARKET DRIVERS

Rising Health Consciousness Among Consumers

One of the primary drivers of the kombucha market in Europe is the growing emphasis on health and wellness among consumers. According to a survey by Mintel, over 50% of Europeans prioritize beverages that offer functional health benefits, such as improved digestion and immunity. Kombucha, with its probiotic-rich composition, aligns perfectly with this trend, making it a preferred choice for health-conscious individuals. This shift is particularly evident in countries like Germany and the UK, where kombucha sales grew by 20% in 2023, as reported by Statista. Millennials and Gen Z consumers, who dominate the purchasing demographic, are increasingly seeking natural and organic alternatives to traditional soft drinks. Brands have capitalized on this demand by marketing kombucha as a guilt-free indulgence, free from artificial additives and excessive sugar. Additionally, endorsements from fitness influencers and inclusion in health-focused subscription boxes have amplified its visibility. With gut health becoming a mainstream concern, kombucha’s appeal continues to expand, driving significant market growth.

Expansion into Mainstream Retail Channels

The growing availability of kombucha in mainstream retail channels is another major factor boosting the kombucha market expansion in Europe. According to Nielsen, kombucha sales in supermarkets and hypermarkets across Europe surged by 35% in 2023, reflecting broader distribution strategies adopted by manufacturers. Chains like Tesco in the UK and Carrefour in France have dedicated sections for functional beverages, prominently featuring kombucha brands. This expansion into retail spaces has democratized access to kombucha, moving it beyond niche health stores and cafes. Additionally, collaborations with local distributors have enabled smaller kombucha producers to scale their operations and reach wider audiences. For instance, GT’s Living Foods partnered with major European retailers to launch exclusive product lines in 2023, boosting its market share significantly. The convenience of purchasing kombucha alongside everyday groceries has normalized its consumption, attracting casual buyers alongside loyal enthusiasts. By leveraging retail partnerships, kombucha brands are solidifying their presence in the European market.

MARKET RESTRAINTS

High Production Costs and Pricing Challenges

The high production costs associated with manufacturing and distribution is one of the key factors driving the growth of the European kombucha market. According to a report by FoodBev Media, producing small-batch, organic kombucha can cost up to three times more than conventional soft drinks due to the need for specialized fermentation equipment and premium ingredients. These costs are often passed on to consumers, with a single bottle of kombucha priced between €3 and €5, which is considerably higher than traditional beverages. This price barrier limits affordability, particularly among budget-conscious consumers in regions like Eastern Europe. A survey by Kantar revealed that 40% of European shoppers consider price the most critical factor when choosing beverages, potentially deterring widespread adoption of kombucha. Additionally, the logistical challenges of maintaining consistent quality during transportation further inflate costs. Without addressing these pricing challenges, kombucha risks remaining a niche product, constraining its ability to achieve mass-market penetration.

Regulatory Scrutiny Over Alcohol Content

Regulatory scrutiny surrounding kombucha’s alcohol content poses another significant restraint for the European market. During fermentation, kombucha naturally produces trace amounts of alcohol, which can exceed the 0.5% threshold allowed for non-alcoholic beverages in some countries. According to the European Food Safety Authority, several batches of kombucha were flagged for exceeding permissible alcohol levels in 2023, leading to recalls and stricter labeling requirements. These regulations create operational complexities for manufacturers, who must invest in advanced testing and quality control measures to ensure compliance. Furthermore, consumer confusion about kombucha’s classification, whether as a health drink or an alcoholic beverage, can hinder acceptance. A study by Innova Market Insights found that 30% of European consumers were uncertain about the safety of kombucha due to its alcohol content. This regulatory uncertainty threatens to slow market growth, particularly in regions with stringent food safety laws.

MARKET OPPORTUNITIES

Innovation in Flavors and Packaging

Innovation in flavors and packaging presents a significant opportunity for the kombucha market in Europe, enabling brands to differentiate themselves and attract diverse consumer segments. According to Euromonitor International, flavored kombucha variants accounted for 60% of total sales in 2023, with citrus and berry flavors leading the charge. Unique blends, such as ginger-turmeric and lavender-lemon, have gained traction among adventurous consumers seeking novel taste experiences. Packaging innovation is equally crucial, with sustainable materials becoming a key focus. Brands like Remedy Kombucha have introduced biodegradable bottles, appealing to environmentally conscious buyers. A survey by Nielsen revealed that 70% of European consumers are willing to pay a premium for eco-friendly packaging, highlighting the potential for growth through sustainability initiatives. By combining bold flavors with visually appealing and eco-conscious designs, kombucha brands can capture new demographics and strengthen their market position.

Expansion into Emerging Markets

Emerging markets within Europe, such as Poland, Romania, and Hungary, represent untapped opportunities for kombucha brands seeking to expand their footprint. According to Statista, kombucha sales in Eastern Europe grew by 25% in 2023, driven by increasing urbanization and disposable incomes. These regions are witnessing a cultural shift toward healthier lifestyles, creating fertile ground for kombucha adoption. Strategic partnerships with local distributors and retailers can accelerate market entry. For example, Humm Kombucha collaborated with regional grocery chains in Poland to introduce affordable starter packs, boosting brand recognition. Additionally, educational campaigns highlighting kombucha’s health benefits have proven effective in overcoming initial skepticism. By tailoring products to local tastes and investing in grassroots marketing, brands can establish a strong presence in these burgeoning markets, unlocking substantial growth potential.

SEGMENTAL ANALYSIS

By Type Insights

By type, the yeast segment held the leading share of 41.4% of the European market share in 2024. The leading position of the yeast segment in the European market is driven by yeast’s central role in the fermentation process, which determines the flavor profile and carbonation levels of kombucha. Saccharomyces cerevisiae, the most commonly used yeast strain, ensures consistent quality and taste, making it indispensable for manufacturers. The advancements in biotechnology that enable the development of proprietary yeast strains tailored to specific consumer preferences is further boosting the expansion of the yeast segment in the European kombucha market. A study by FoodBev Media highlighted that yeast-optimized kombucha formulations resulted in a 30% increase in repeat purchases in 2023. Additionally, collaborations with research institutions have facilitated innovations in yeast cultivation, reducing production costs while enhancing product quality. With its pivotal role in shaping kombucha’s appeal, yeast remains a cornerstone of the market’s success.

The bacteria segment is another major segment and is predicted to witness the fastest CAGR of 18.8% over the forecast period. The growing consumer awareness of the probiotic benefits offered by bacterial strains like Lactobacillus and Acetobacter that support gut health and immune function is majorly driving the growth of the bacteria segment in the regional market. The scientific studies validating the health advantages of bacteria-rich kombucha is also aiding the segmental expansion. According to a report by the European Probiotic Association, beverages containing live bacterial cultures experienced a 25% sales increase in 2023. Manufacturers are capitalizing on this trend by introducing fortified kombucha variants with enhanced bacterial counts, appealing to health-conscious consumers. Additionally, partnerships with nutritionists and wellness influencers have amplified the segment’s visibility, positioning bacteria as a transformative force in the kombucha market.

By Flavour Insights

The citrus segment dominated the European kombucha market with a 30.7% share of the European market in 2024. The dominating position of citrus segment in the European market is driven by its refreshing taste and versatility, appealing to a wide range of consumers. Variants like lemon-ginger and orange-mint have become staples in cafes and retail stores, with sales increasing by 22% in 2023, as per Nielsen. Citrus flavors resonate strongly with European consumers due to their association with health and vitality. A survey by Mintel revealed that 65% of kombucha drinkers prefer citrus-based options for their perceived detoxifying properties. Additionally, collaborations with local citrus growers have enabled brands to source high-quality ingredients, enhancing authenticity and flavor profiles. By leveraging citrus’s universal appeal, kombucha brands have successfully captured a significant share of the market.

The berries segment is anticipated to register the fastest CAGR of 21.4% over the forecast period owing to the popularity of antioxidant-rich berries like blueberries, raspberries, and strawberries, which align with consumer demand for functional beverages. The innovations in blending techniques that preserve the natural sweetness and nutritional benefits of berries are also boosting the expansion of the berries segment in the European market. A study by Innova Market Insights found that berry-flavored kombucha accounted for 40% of new product launches in 2023, underscoring its rising prominence. Additionally, marketing campaigns emphasizing the anti-inflammatory properties of berries have resonated with health-conscious millennials. By capitalizing on this trend, kombucha brands are tapping into a lucrative and rapidly evolving segment.

REGIONAL ANALYSIS

Germany was the largest contributor to the European kombucha market, commanding a 25.7% share of the European market in 2024. The country’s robust economy, coupled with a strong emphasis on health and sustainability, has fueled kombucha’s popularity. Sales in Germany reached €300 million in 2023, driven by the widespread availability of kombucha in organic supermarkets and cafes. Consumer education campaigns highlighting kombucha’s probiotic benefits have played a pivotal role in its adoption. Additionally, government incentives for organic farming have supported local kombucha producers, fostering innovation and affordability. With over 150 kombucha brands operating in the market, Germany’s kombucha industry continues to thrive, setting benchmarks for other European nations.

The United Kingdom is another promising market for kombucha in Europe and is likely to account for a substantial share of the European market over the forecast period. The UK’s kombucha market generated £250 million, propelled by the growing wellness movement and the rise of boutique cafes offering kombucha on tap. London, in particular, has emerged as a hub for kombucha innovation, with numerous startups launching artisanal products. Retail giants like Tesco and Sainsbury’s have embraced kombucha, dedicating significant shelf space to both domestic and international brands. A survey by Kantar revealed that 45% of UK consumers associate kombucha with premium quality, driving its positioning as a luxury beverage. With ongoing investments in research and development, the UK’s kombucha market is poised for sustained growth.

France is predicted to register a prominent CAGR in the European kombucha market over the forecast period. The French kombucha market benefits from a strong culinary tradition, with consumers embracing kombucha as a sophisticated alternative to wine and champagne. Parisian cafes and bistros have played a crucial role in popularizing kombucha, particularly among younger demographics. Government initiatives promoting sustainable agriculture have supported local kombucha producers, ensuring a steady supply of organic ingredients. Additionally, collaborations with Michelin-starred chefs have elevated kombucha’s status, positioning it as a gourmet beverage. With over 10 million regular kombucha drinkers, France’s market is a vibrant and integral part of the European landscape.

Italy captures a notable share of the European kombucha market. The passion of Italy for artisanal and organic products, with consumers favoring locally produced variants, is driving the growth of the Italian market. Milan and Rome have become hotspots for kombucha innovation, hosting festivals and tasting events that attract thousands of attendees. Italian kombucha brands emphasize Mediterranean-inspired flavors, such as basil-lemon and fig-honey, appealing to local tastes. A survey by Nielsen revealed that 55% of Italian consumers view kombucha as a healthy indulgence, driving its integration into daily routines. With ongoing investments in branding and distribution, Italy’s kombucha market offers immense opportunities for future expansion.

Spain accounts for a considerable share of the European kombucha market over the forecast period. The country’s kombucha industry benefits from a youthful and dynamic population, with millennials leading the charge in adopting health-conscious beverages. Barcelona and Madrid have emerged as key markets, with numerous cafes and specialty stores offering kombucha in innovative formats. Collaborations with local fruit growers have enabled brands to create unique tropical flavors, such as mango-pineapple and coconut-lime, differentiating them from competitors. Additionally, government subsidies for small-scale producers have fostered innovation and affordability. With over 5 million kombucha drinkers, Spain’s market is a rising star in the European ecosystem.

KEY MARKET PLAYERS

A few of the key players operating in the Europe kombucha market report are Millennium Products, Inc., Reed’s, Inc., The Hain Celestial Group, Revive Kombucha, Kosmic Kombucha, Cell - Nique Corporation, Buchi Kombucha, GT's Kombucha, Townshend’s Tea Company, The Humm Kombucha LLC, Red Bull Gmbh, Makana Beverages Inc., Nesalla Kombucha, Live Soda Kombucha and Kombucha Wonder Drink.

The Europe kombucha market is characterized by intense competition among global giants and local artisans. Established players like GT’s Living Foods and Remedy Kombucha dominate through premium offerings and extensive distribution networks, while smaller brands leverage creativity and niche appeal to carve out their space. The rise of private-label kombucha from major retailers, such as Tesco and Carrefour, has intensified rivalry, offering affordable alternatives to branded products. Regulatory pressures, such as those surrounding alcohol content, add another layer of complexity, forcing companies to balance innovation with compliance. Despite these challenges, the market’s robust growth and consumer enthusiasm ensure a dynamic and evolving ecosystem where adaptability and differentiation are key to success.

GT’s Living Foods is a dominant player in the European kombucha market, renowned for its premium, raw, and organic formulations. Its commitment to using high-quality ingredients and traditional fermentation methods has earned it a loyal customer base. GT’s strategic partnerships with major retailers, such as Tesco and Carrefour, have expanded its reach across Europe. Additionally, the brand’s focus on innovation has led to the introduction of unique flavors like elderflower and hibiscus, appealing to diverse palates. By prioritizing authenticity and quality, GT has solidified its position as a market leader.

Remedy Kombucha is another key player, gaining traction for its low-sugar formulations and eco-friendly packaging. Remedy’s emphasis on sustainability resonates strongly with European consumers, who increasingly prioritize environmental responsibility. The brand’s collaboration with local distributors has enabled it to penetrate emerging markets, such as Poland and Hungary. Additionally, its participation in health expos and wellness events has amplified its visibility, attracting health-conscious buyers. By combining functionality with sustainability, Remedy Kombucha continues to carve out a significant niche in the market.

Humm Kombucha is a rapidly growing player known for its bold flavors and community-centric approach. Humm’s strategy revolves around engaging directly with consumers through social media campaigns and local events, fostering brand loyalty. The company’s focus on affordability has made kombucha accessible to a broader audience, particularly in regions like Eastern Europe. Additionally, Humm’s investment in research and development has led to the creation of fortified variants with enhanced probiotic benefits. By prioritizing accessibility and innovation, Humm Kombucha has established itself as a formidable competitor in the European market.

STRATEGIES USED BY KEY PLAYERS IN THE EUROPE KOMBUCHA MARKET

Key players in the European kombucha market employ a variety of strategies to strengthen their positions, ranging from product innovation to strategic partnerships. One prominent strategy is the introduction of unique flavors and limited-edition variants, which cater to evolving consumer preferences. For example, GT’s Living Foods launched a seasonal elderflower flavor in 2023, achieving a 20% increase in sales, according to Statista. Another critical strategy is the adoption of sustainable practices, such as biodegradable packaging and carbon-neutral production processes. Remedy Kombucha’s partnership with environmental organizations has enhanced its brand image, attracting eco-conscious consumers. Collaborations with local distributors and retailers have also been instrumental in expanding market reach, particularly in emerging regions. Lastly, investments in educational campaigns and influencer marketing have raised awareness about kombucha’s health benefits, driving adoption across diverse demographics.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, GT’s Living Foods partnered with Tesco to launch exclusive kombucha flavors, such as elderflower and hibiscus, boosting its market share by 15% in the UK.

- In July 2023, Remedy Kombucha introduced biodegradable packaging across its product line, reducing its carbon footprint by 30%, as reported by Euromonitor International.

- In September 2023, Humm Kombucha collaborated with local distributors in Poland to introduce affordable starter packs, increasing brand recognition by 25%.

- In November 2023, Equinox Kombucha hosted a series of wellness workshops in France, educating consumers about kombucha’s health benefits and driving a 20% sales increase.

- In January 2024, Lifeway Foods acquired a German kombucha startup, expanding its presence in Central Europe and diversifying its product portfolio.

MARKET SEGMENTATION

This research report on the European kombucha market has been segmented and sub-segmented into the following categories.

By Type

- Yeast

- Bacteria

- Mould

- Others

By Flavour

- Herbs and Spices

- Citrus

- Berries

- Apple

- Coconut

- Mangoes

- Flowers

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]