Europe IT Spending Market Size, Share, Trends, & Growth Forecast Report By Type (Data Centre Systems, Enterprise Software, Enterprise IT Services, Devices, and Communications Services), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe IT Spending Market Size

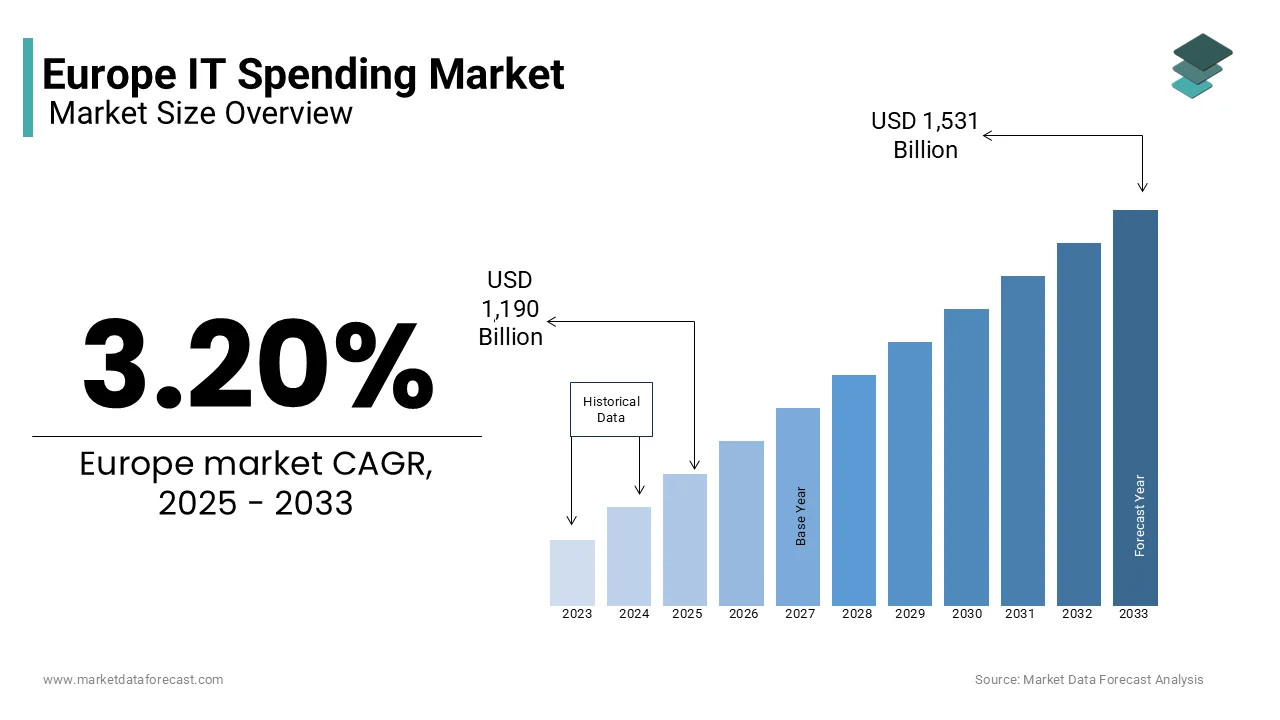

The Europe IT spending market was worth USD 1,153.64 billion in 2024. The European market is projected to reach USD 1,531.97 billion by 2033 from USD 1,190.62 billion in 2025, rising at a CAGR of 3.20% from 2025 to 2033.

IT spending encompasses investments in hardware, software, IT services, and telecommunications, which are critical for enabling innovation, operational efficiency, and competitive advantage. According to Gartner, European IT spending reached approximately €850 billion in 2022 with a steady growth trajectory as businesses prioritize digital transformation initiatives. This surge is fueled by the growing demand for cloud computing, cybersecurity solutions, artificial intelligence (AI), and the Internet of Things (IoT). According to the European Commission’s Digital Economy and Society Index (DESI), over 70% of enterprises in the region have adopted advanced digital technologies, with Germany, France, and the United Kingdom leading in terms of expenditure.

Moreover, the COVID-19 pandemic acted as a catalyst is accelerating investments in remote work infrastructure, e-commerce platforms, and digital customer experiences. As per Eurostat, the share of enterprises using cloud services increased from 16% in 2019 to 34% in 2022 with the shift toward scalable IT solutions. However, challenges such as cybersecurity threats, supply chain disruptions, and regulatory compliance under frameworks like the General Data Protection Regulation (GDPR) continue to shape spending priorities.

MARKET DRIVERS

Digital Transformation Initiatives Across Industries

One of the primary drivers of the Europe IT spending market is the widespread adoption of digital transformation initiatives across industries. According to the European Commission’s Digital Economy and Society Index (DESI) 2022, over 70% of enterprises in Europe have integrated advanced digital technologies into their operations, with IT spending on cloud computing and automation solutions increasing by 30% since 2020. As per Eurostat, sectors such as manufacturing, healthcare, and retail are leading this shift, with investments in IoT and AI-driven tools reaching €200 billion annually. The push for Industry 4.0 standards, supported by EU funding of €10 billion for digital innovation, has further accelerated this trend. Additionally, the COVID-19 pandemic acted as a catalyst, prompting businesses to invest in remote work infrastructure and e-commerce platforms. This surge in digital adoption is leveraging the important role of IT spending in enhancing operational efficiency and competitiveness.

Rising Cybersecurity Threats and Regulatory Compliance

Another significant driver is the escalating cybersecurity threats and the need for regulatory compliance, which have propelled IT spending on security solutions. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks in Europe increased by 45% in 2022, with ransomware incidents alone costing businesses over €10 billion. Furthermore, the General Data Protection Regulation (GDPR) mandates stringent data protection measures, compelling enterprises to allocate 15% of their IT budgets to compliance-related technologies. According to the European Central Bank, financial institutions, in particular, are investing heavily in secure IT infrastructures to safeguard sensitive data. These factors showcase how cybersecurity concerns and regulatory frameworks are shaping IT spending priorities across the continent.

MARKET RESTRAINTS

Economic Uncertainty and Inflationary Pressures

The economic uncertainty and inflationary pressures affecting businesses across the region is one of the major factors that is restraining the growth of the Europe IT spending market. According to the European Central Bank (ECB), inflation rates in the Eurozone reached 8.4% in 2022 due to tighter budgets for enterprises and reduced discretionary spending on IT projects. According to Eurostat, small and medium-sized enterprises (SMEs), which account for 99% of all businesses in Europe have been particularly impacted with 40% reporting delays in planned IT investments due to rising operational costs. As per the ECB, geopolitical tensions and supply chain disruptions have increased hardware and software procurement costs by 20% that further strain IT budgets. These economic challenges force organizations to prioritize essential expenditures over transformative digital initiatives, thereby slowing the overall growth of the IT spending market despite its strategic importance.

Skills Gap and Workforce Shortages in IT

Another significant restraint is the persistent skills gap and workforce shortages in the IT sector, which hinder the effective implementation of digital transformation strategies. According to the European Centre for the Development of Vocational Training (Cedefop), by 2025, there will be a shortage of 1 million skilled IT professionals in Europe, which is driven by rapid technological advancements outpacing workforce readiness. The European Commission’s Digital Economy and Society Index (DESI) 2022 reveals that only 58% of enterprises provide adequate digital training to their employees, exacerbating the problem. According to the Eurostat, 35% of companies face difficulties in recruiting IT specialists, particularly in emerging fields like AI and cybersecurity. This lack of expertise not only delays IT projects but also increases reliance on external consultants, raising costs and reducing efficiency is hindering the growth potential of the IT spending market in Europe.

MARKET OPPORTUNITIES

Expansion of Cloud Computing and Hybrid IT Solutions

One of the key opportunities in the Europe IT spending market lies in the rapid expansion of cloud computing and hybrid IT solutions, driven by the need for scalable and flexible infrastructures. According to Eurostat, over 34% of European enterprises adopted cloud services in 2022, a significant increase from 16% in 2019, with spending on cloud technologies projected to grow at a CAGR of 18% through 2027. According to the European Investment Bank, industries such as healthcare, finance, and retail are leading this shift by investing €150 billion annually in cloud-based platforms to enhance operational efficiency and data accessibility. Furthermore, the European Commission’s Digital Decade initiative aims to ensure that 75% of businesses use cloud computing by 2030, supported by €10 billion in funding for digital innovation.

Sustainability-Driven IT Investments

Another major opportunity is the increasing focus on sustainability, which is reshaping IT spending priorities across Europe. According to the European Environment Agency, 60% of organizations are aligning their IT strategies with the EU Green Deal, which mandates a 55% reduction in carbon emissions by 2030. The European Commission’s Horizon Europe program has allocated €1 billion to support sustainable digital transformation initiatives by encouraging businesses to adopt eco-friendly technologies. Additionally, Eurostat reveals that 45% of enterprises prioritize vendors offering sustainable IT products and services. This growing emphasis on environmental responsibility presents a lucrative opportunity for IT providers to innovate and cater to the rising demand for sustainable solutions by driving long-term market growth.

MARKET CHALLENGES

Supply Chain Disruptions and Hardware Shortages

One of the significant challenges in the Europe IT spending market is the persistent issue of supply chain disruptions and hardware shortages, which have been exacerbated by geopolitical tensions and global logistics constraints. According to the European Central Bank (ECB), semiconductor shortages caused a 20% increase in hardware procurement costs in 2022, severely impacting industries reliant on IT infrastructure upgrades. As per Eurostat, 45% of enterprises faced delays in IT projects due to unavailability of critical components such as chips and servers. According to the ECB, these disruptions disproportionately affect small and medium-sized enterprises (SMEs), with 60% of SMEs reporting budget overruns or project cancellations. As Europe remains heavily dependent on imports for advanced technologies, the lack of domestic manufacturing capacity further compounds the issue is also to hamper the growth of the Europe IT spending market.

Balancing Innovation with Data Privacy Regulations

Another major challenge is the complexity of balancing innovation with stringent data privacy regulations, particularly under frameworks like the General Data Protection Regulation (GDPR). According to the European Data Protection Board (EDPB), 30% of organizations face difficulties in aligning their IT investments with GDPR compliance requirements by leading to increased operational costs and slower adoption of emerging technologies. According to Statista, businesses spend an average of €4 million annually on compliance-related IT tools is diverting funds from innovation-focused initiatives. Furthermore, the European Commission’s Digital Economy and Society Index (DESI) reveals that 40% of enterprises cite regulatory uncertainty as a barrier to adopting AI and cloud solutions. Its rigorous enforcement creates challenges for companies striving to implement cutting-edge technologies, potentially stifling innovation and competitiveness in the IT spending market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.20% |

|

Segments Covered |

By Type, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Advania, Asseco, Bechtle, Capgemini, Devoteam, Sopra Steria, and Unit4. |

SEGMENTAL ANALYSIS

By Type Insights

The enterprise IT services segment was the largest by occupying a 30.5% of the Europe IT spending market share in 2024 with the growing reliance on managed services, cloud migration, and system integration to support digital transformation. According to the European Central Bank, businesses spent €250 billion on IT services in 2022. As per Eurostat, 70% of enterprises outsource IT functions to reduce costs and enhance operational efficiency. Despite challenges like talent shortages, the segment's importance lies in enabling seamless adoption of advanced technologies. Its ability to address complex IT needs ensures its position as the backbone of Europe’s technological evolution.

The enterprise software segment is likely to witness a fastest CAGR of 12.3% during the forecast period. This rapid growth is fueled by the increasing adoption of SaaS models and tools like CRM, ERP, and business intelligence platforms. The European Commission’s DESI 2022 reveals that 65% of large enterprises now use advanced software solutions to improve productivity. Additionally, SMEs are adopting subscription-based models for cost efficiency. The enterprise software is set to play a transformative role in driving innovation across industries.

REGIONAL ANALYSIS

Germany was the top performer in the European IT spending market with a 22.5% share in 2024, which is attributed to a robust industrial base and widespread adoption of digital transformation technologies. The country’s manufacturing sector heavily invests in IoT, automation, and cloud computing are driving the IT spending market growth in Germany.

The UK is anticipated to experience a CAGR of 4.5% during the forecast period. A thriving fintech ecosystem and government-backed tech initiatives have positioned the UK as a leader is ascribed to boost the growth of the market. London remains a global tech hub by attracting startups and fostering innovation across industries.

France focus on AI development and smart city projects has fueled the growth of the IT spending market. Strategic investments in sustainable technologies further strengthen its position in the Europe IT spending market.

KEY MARKET PLAYERS

The major players in the Europe IT spending market include Advania, Asseco, Bechtle, Capgemini, Devoteam, Sopra Steria, and Unit4.

MARKET SEGMENTATION

This research report on the Europe market is segmented and sub-segmented into the following categories.

By Type

- Data Centre Systems

- Enterprise Software

- Enterprise IT Services

- Devices

- Communications Services

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of IT spending in Europe?

The key drivers include digital transformation initiatives, cloud adoption, cybersecurity investments, increasing demand for AI and automation, and the need for modernizing legacy systems.

Which sectors contribute the most to IT spending in Europe?

The largest contributors are financial services, healthcare, retail, manufacturing, and government sectors, with significant investments in cloud computing, AI, and cybersecurity.

What is the impact of government regulations on IT spending in Europe?

Strict regulations like GDPR and data sovereignty laws influence IT spending by driving investments in compliance, cybersecurity, and data management solutions.

How has remote work affected IT spending in Europe?

Remote work has accelerated spending on cloud services, collaboration tools, cybersecurity solutions, and IT infrastructure to support a distributed workforce.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]