Europe IT Services Market Size, Share, Trends, & Growth Forecast Report Segmented By Approach (Reactive IT Services and Proactive IT Services), Type, Application, and Technology, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe IT Services Market Size

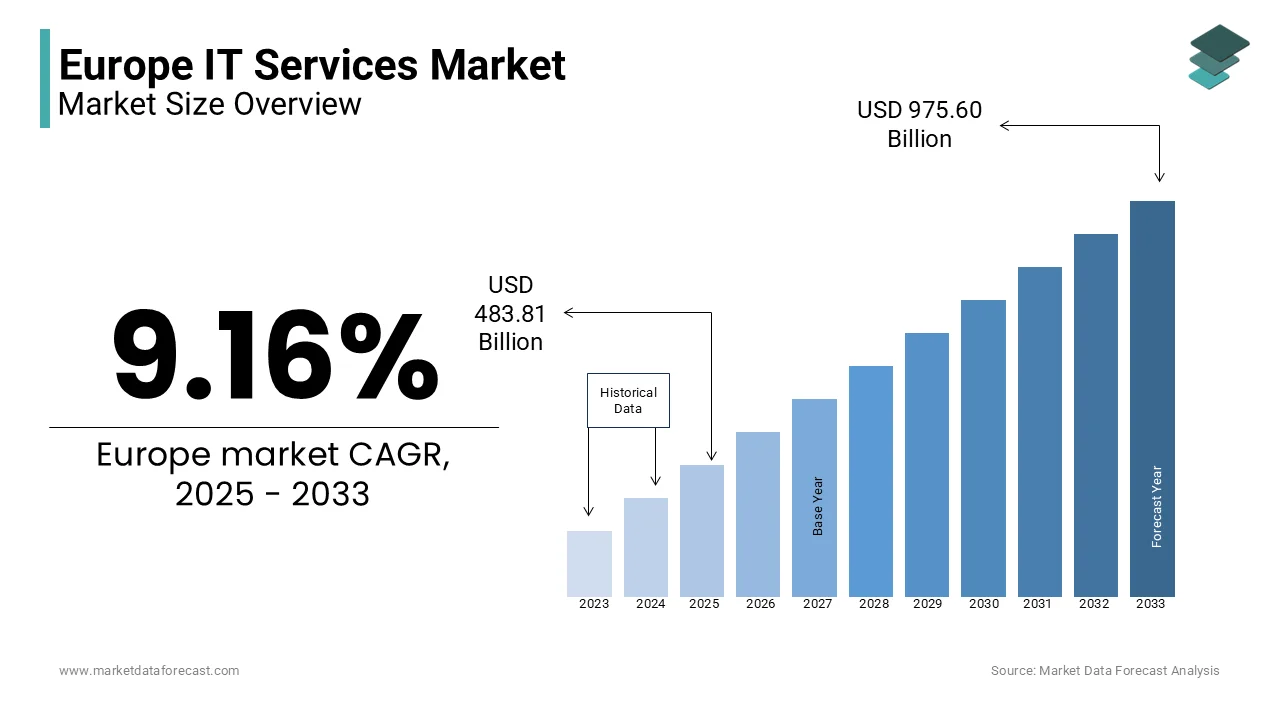

The Europe IT services market was worth USD 443.18 billion in 2024. The European market is projected to reach USD 975.60 billion by 2033 from USD 483.81 billion in 2025, rising at a CAGR of 9.16% from 2025 to 2033.

IT services include the ecosystem of technology-driven services such as IT consulting, application development, system integration, managed services, and cybersecurity solutions that support organizations in optimizing their digital infrastructure and processes. In Europe, the IT services sector plays a critical role in fostering digital transformation across industries such as finance, healthcare, manufacturing, and retail. The commitment of Europe to innovation is evident in its focus on adopting emerging technologies such as artificial intelligence (AI), cloud computing, and the Internet of Things (IoT). European enterprises, both large and small, leverage IT services to address challenges such as cybersecurity threats, regulatory compliance, and the need for scalable IT infrastructures. A key factor promoting the growth of the Europe IT services market is the emphasis of European Union on data protection and privacy, as exemplified by the General Data Protection Regulation (GDPR). This framework has driven demand for IT services that prioritize data security and compliance. Additionally, the growing push towards sustainability has encouraged the adoption of green IT practices, further boosting the market expansion in Europe.

MARKET DRIVERS

Digital Transformation Initiatives in Europe

European enterprises are increasingly investing in digital transformation to enhance operational efficiency and remain competitive. This shift involves adopting advanced technologies such as cloud computing, artificial intelligence, and the Internet of Things. According to the European Commission's Digital Economy and Society Index (DESI) 2024, 68% of European businesses have integrated at least one digital technology, reflecting a substantial increase from previous years. This widespread digital adoption underscores the critical role of IT services in facilitating seamless integration and management of new technologies across various sectors.

Government Initiatives and Regulations

European governments have implemented policies and regulations that promote the adoption of IT services. For instance, the European Union's General Data Protection Regulation (GDPR) enforces strict data protection standards, compelling organizations to invest in robust IT solutions to ensure compliance. Additionally, the EU's Digital Strategy aims to make digital transformation beneficial for all businesses and citizens, further driving the demand for IT services. The European Commission reports that by 2025, 75% of European enterprises are expected to use cloud computing services, big data, and artificial intelligence, highlighting the impact of governmental policies on the IT services market.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

The European Union has enacted comprehensive legislation, such as the Digital Markets Act and the Digital Services Act, aiming to regulate digital businesses and promote fair competition. While these regulations intend to protect consumers and ensure market fairness, they often result in increased compliance costs and operational complexities for IT service providers. A report by the Financial Times highlights concerns that excessive regulation may hinder innovation and competitiveness within the European tech industry.

Shortage of Skilled IT Professionals

According to a report by the European Commission, there could be a shortage of up to 500,000 ICT professionals in the EU by 2025. This talent gap makes it challenging for companies to find qualified personnel to manage and implement IT services effectively. The scarcity of skilled workers not only escalates labor costs but also delays project timelines, thereby impeding the overall efficiency and expansion of IT service providers in the region.

MARKET OPPORTUNITIES

Green and Digital Transition

The European Union's Green Deal Industrial Plan aims to achieve climate neutrality by 2050 while enhancing industrial competitiveness. This strategy emphasizes the integration of digital technologies to support environmental sustainability, presenting substantial opportunities for IT service providers to develop solutions that facilitate this dual transition. The European Commission highlights that digital solutions can advance the circular economy and support the decarbonization of all sectors, underscoring the critical role of IT services in this transformation.

Advancements in Cybersecurity

As digitalization accelerates across Europe, the demand for robust cybersecurity measures has become paramount. The European Union Agency for Cybersecurity (ENISA) reports that enhancing cybersecurity capabilities is essential to protect critical infrastructure and data. This focus creates opportunities for IT service providers to offer advanced cybersecurity solutions, ensuring the resilience and security of digital systems across various sectors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.16% |

|

Segments Covered |

By Approach, Type, Application, Technology, and Country |

|

Various Analyses Covered |

Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Oracle, Amazon Web Services, Inc., SAP, Accenture, Capgemini, Huawei Cloud Computing Technologies Co. Ltd., Cisco Systems, Inc., and Atos SE are some of the major players in the Europe IT services market. |

SEGMENTAL ANALYSIS

By Approach Insights

The proactive IT services segment led the European IT services market and accounted for the leading share of the European market in 2023 due to their preventative and strategic nature. This segment's prominence stems from its focus on continuous system monitoring, predictive analytics, and maintenance, which reduce risks and operational downtimes. By prioritizing efficiency and reliability, proactive IT services ensure business continuity and cater to industries where IT stability is critical. Enterprises increasingly adopt these services to streamline operations, enhance cybersecurity, and align with long-term goals.

The reactive IT services segment is estimated to grow at a remarkable CAGR of 7.1% over the forecast period. This growth reflects the ongoing demand for immediate problem-solving capabilities, particularly in addressing sudden IT disruptions such as system failures or cybersecurity incidents. Many small and medium-sized enterprises rely on reactive services to resolve critical issues without significant upfront investments in IT infrastructure. The segment's importance lies in its ability to deliver timely, on-demand support, helping businesses minimize losses and resume operations quickly during unexpected challenges. This growth also highlights the enduring relevance of reactive solutions in dynamic and evolving IT environments.

By Type Insights

The operations & maintenance segment held the largest share of the European IT services market in 2023. Its dominance stems from the critical role it plays in ensuring the seamless functionality of IT systems. These services include system monitoring, updates, troubleshooting, and performance optimization, which are essential for minimizing downtime and maintaining business continuity. The importance of this segment lies in its ability to support long-term operational efficiency, particularly for businesses that depend on consistent IT infrastructure to remain competitive.

The design & implementation segment is growing at the fastest and is predicted to grow at a CAGR of 10.2% over the forecast period. This growth is driven by the widespread adoption of advanced technologies as businesses increasingly invest in modern IT infrastructure. The segment focuses on creating and deploying customized solutions, including network setups, software integrations, and IT architecture design, enabling businesses to enhance productivity and scalability. Its importance lies in facilitating smooth digital transformations, which are pivotal for organizations aiming to achieve greater innovation and operational efficiency in an evolving technological landscape.

By Application Insights

The systems & network management segment captured 41.8% of the European market share in 2023. The domination of the systems and network management segment in the European market is majorly attributed to its critical role in maintaining IT infrastructure, the increasing complexity of networks and systems across industries. These services ensure optimal network performance, minimize downtime, and support efficient resource utilization. Their importance is highlighted by the rising reliance on cloud computing and hybrid work models, where seamless connectivity and robust infrastructure are essential for productivity and operational efficiency.

On the other hand, the security & compliance management is gaining traction and is anticipated to record a CAGR of 11.5% during the forecast period. An increase in the number of cybersecurity threats in Europe and stricter regulatory requirements across Europe, such as GDPR compliance are propelling the growth of the security and compliance management segment in the European market. Businesses are prioritizing robust security measures to safeguard sensitive data and avoid penalties, driving demand for risk assessments, compliance audits, and advanced cybersecurity solutions. As digital adoption increases, this segment’s importance continues to grow, ensuring that organizations maintain trust, data integrity, and adherence to regulatory standards in an increasingly connected environment.

By Technology Insights

The AI & Machine learning segment dominated the market and occupied 32.3% of the European market share in 2023. This dominance is attributed to the widespread adoption of AI-powered solutions across industries to enhance operational efficiency, optimize processes, and provide tailored customer experiences. AI technologies enable intelligent automation, predictive maintenance, and advanced analytics, making them indispensable for modern businesses. Their importance lies in driving innovation and helping organizations remain competitive in a rapidly evolving digital landscape.

The threat Intelligence segment is growing rapidly and is expected to register the fastest CAGR of 22.8% over the forecast period owing to the increasing prevalence of sophisticated cyber threats and the growing need for robust security solutions. Threat intelligence leverages AI and real-time data to identify, analyze, and mitigate potential risks before they escalate. Its importance is underscored by the critical role it plays in safeguarding sensitive information, ensuring compliance with stringent regulations, and protecting businesses from financial and reputational losses in a highly connected digital environment.

REGIONAL ANALYSIS

Germany accounted for the leading share of 26.1% of the European IT services market share in 2024. The dominating position of Germany in the European market is attributed to its robust industrial base and commitment to digital transformation. For instance, the German government’s Digital Hub Initiative has allocated €10 billion to support IT innovation, fostering collaboration between startups and established enterprises. According to Eurostat, Germany accounts for 30% of Europe’s total IT spending, reflecting its pivotal role in shaping regional trends. Major industries such as automotive and manufacturing are investing heavily in IT services to enhance productivity and competitiveness. A report by McKinsey highlights that German companies spend €50 billion annually on IT solutions, underscoring their strategic focus on technology adoption. Additionally, the presence of global IT leaders like SAP reinforces Germany’s influence, making it a hub for innovation and expertise.

The UK held a prominent share of the European market in 2024 due to the thriving tech ecosystem and strong government support for digital initiatives. For example, the UK’s Digital Strategy allocates €5 billion to promote AI and cybersecurity, creating opportunities for IT service providers. According to PwC, British enterprises invest €30 billion annually in IT services, driven by the need to comply with post-Brexit regulations and enhance operational resilience. The financial services sector, in particular, is a key contributor, with companies like Barclays adopting advanced analytics to improve customer experiences. A survey by Deloitte reveals that 60% of UK businesses prioritize IT modernization, citing cost savings and competitive advantage as primary motivators. These factors position the UK as a leader in driving innovation and growth within the European IT services market.

France is anticipated to account for a promising share of the European IT services market over the forecast period owing to its focus on sustainability and digital inclusion. For instance, the France Relance Plan allocates €7 billion to support green IT initiatives, encouraging the adoption of energy-efficient solutions. According to Statista, French companies spend €20 billion annually on IT services, with a significant portion dedicated to cloud computing and cybersecurity. The healthcare sector is a major adopter, leveraging IT services to enhance patient care and streamline operations. A report by McKinsey highlights that 50% of French enterprises prioritize digital transformation, driven by the need to remain competitive in a rapidly evolving market. Additionally, the presence of global tech hubs like Paris reinforces France’s influence, making it a key player in the European IT services landscape.

Italy is predicted to register a notable CAGR in the European IT services market over the forecast period owing to the increasing digitization of traditional industries such as manufacturing and agriculture. For example, the Italian government’s Industry 4.0 plan provides tax incentives worth €3 billion to encourage IT adoption, driving demand for services like automation and data analytics. According to Eurostat, Italian enterprises spend €15 billion annually on IT solutions, focusing on areas such as supply chain optimization and cybersecurity. The rise of remote work has further accelerated adoption, as companies seek to enable seamless collaboration and access to data. A study by Gartner reveals that 65% of Italian businesses plan to expand their IT investments by 2024, underscoring their commitment to innovation and growth.

The Netherlands is projected to witness a healthy CAGR in the European IT services market during the forecast period. The advanced digital infrastructure and strong emphasis on innovation are driving the IT services market in Netherlands. For instance, the Dutch government’s Digital Delta program allocates €2 billion to support IT research and development, fostering collaboration between academia and industry. According to Statista, Dutch companies spend €10 billion annually on IT services, with a focus on cloud computing and AI-driven solutions. The logistics sector is a key adopter, leveraging IT services to optimize supply chains and improve operational efficiency. A report by Deloitte highlights that 70% of Dutch enterprises prioritize IT modernization, driven by the need to remain competitive in a globalized economy. These factors position the Netherlands as a leader in driving technological advancement within the European IT services market.

KEY MARKET PLAYERS

Oracle, Amazon Web Services, Inc., SAP, Accenture, Capgemini, Huawei Cloud Computing Technologies Co. Ltd., Cisco Systems, Inc., and Atos SE are some of the major players in the Europe IT services market.

TOP 3 PLAYERS IN THE MARKET

The European IT services market is led by IBM, Accenture, and Capgemini. IBM contributes significantly to the European market through its AI-driven solutions. Accenture excels in digital transformation, helping clients achieve €50 billion in cost savings annually, as stated in their performance metrics. Capgemini plays a pivotal role in cloud migration and cybersecurity, with a 15% market share in Europe, as highlighted in their financial disclosures. These players collectively drive innovation and shape the future of IT services globally.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the European IT services market employ strategies such as mergers and acquisitions, partnerships, and R&D investments to strengthen their positions. For instance, IBM acquired Red Hat for €30 billion to expand its cloud capabilities, as outlined in their acquisition announcement. Accenture partnered with Microsoft to develop AI-driven solutions, enhancing its service offerings. Capgemini invested €1 billion in cybersecurity R&D, as stated in their innovation roadmap. These strategies enable companies to stay ahead of technological trends and address evolving customer needs.

COMPETITIVE LANDSCAPE

The European IT services market is highly competitive, characterized by the presence of global giants and regional innovators. IBM, Accenture, and Capgemini dominate the landscape, leveraging their expertise in AI, cloud computing, and cybersecurity. According to a study by Gartner, the market is fragmented, with numerous players targeting niche applications such as healthcare and finance. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of technological advancements, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, IBM partnered with Siemens to develop AI-driven industrial solutions, aiming to enhance predictive maintenance capabilities.

- In June 2023, Accenture acquired Droit, a regulatory technology firm, to strengthen its compliance management services.

- In January 2024, Capgemini launched a new cybersecurity platform, designed to address rising ransomware threats.

- In September 2023, DXC Technology collaborated with AWS to offer hybrid cloud solutions, targeting enterprise clients.

- In November 2023, HCL Technologies invested €500 million in expanding its European operations, focusing on digital transformation initiatives.

MARKET SEGMENTATION

This research report on the Europe IT services market is segmented and sub-segmented into the following categories.

By Approach

- Reactive IT Services

- Proactive IT Services

By Type

- Design & Implementation

- Operations & Maintenance

By Application

- Systems & Network Management

- Data Management

- Application Management

- Security & Compliance Management

- Others

By Technology

- AI & Machine Learning

- Big Data Analytics

- Threat Intelligence

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of growth in the Europe IT services market?

The main drivers include digital transformation initiatives, increasing cloud adoption, demand for cybersecurity solutions, and the push for automation and AI-driven services.

Which industries contribute the most to IT services demand in Europe?

The leading industries include banking and finance, healthcare, retail, manufacturing, and government sectors, all of which require advanced IT solutions for operations and compliance.

What is the impact of artificial intelligence on IT services in Europe?

AI is driving automation, predictive analytics, and intelligent customer service solutions, leading to increased efficiency and cost savings for businesses.

What are the trends in IT outsourcing in Europe?

Companies are increasingly outsourcing IT functions such as application development, infrastructure management, and technical support to nearshore and offshore providers for cost and efficiency benefits.

What is the future outlook for the IT services market in Europe?

The market is expected to grow steadily, driven by digital transformation, emerging technologies like 5G and blockchain, and increasing reliance on cloud-based services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com