Europe Intragastric Balloon Market Size, Share, Trends & Growth Forecast Report By y Product Type (Single, Dual, and Triple), By Administration, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Intragastric Balloon Market Size

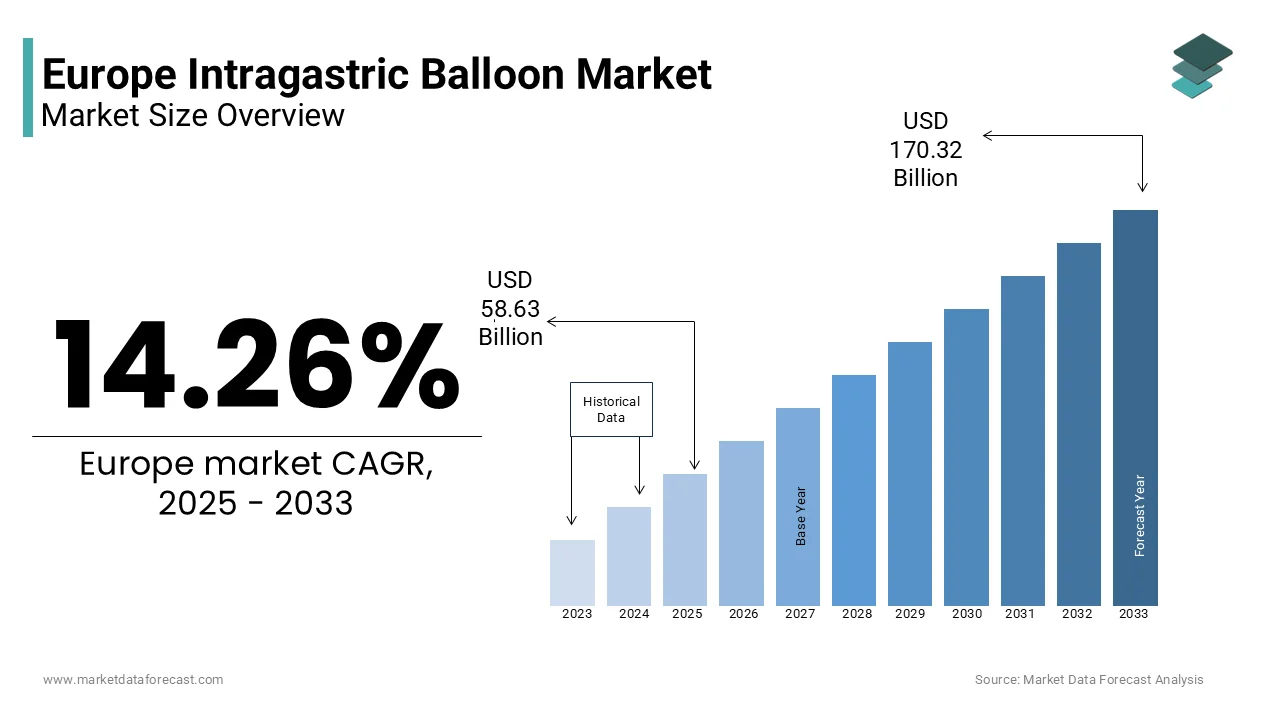

The Europe intragastric balloon market size was valued at USD 51.31 billion in 2024. The European market size is estimated to be worth USD 170.32 billion by 2033 from USD 58.63 billion in 2025, growing at a CAGR of 14.26% from 2025 to 2033.

The Europe intragastric balloon market is witnessing steady growth with the rising obesity rates and an increasing preference for non-surgical weight management solutions. According to the World Health Organization, over 50% of adults in Europe are classified as overweight or obese, creating a significant demand for minimally invasive interventions like intragastric balloons. Additionally, reimbursement policies in countries like the UK and Spain have further bolstered accessibility to these devices. As per the European Association for the Study of Obesity, approximately 30% of eligible patients opt for intragastric balloons due to their cost-effectiveness compared to bariatric surgeries.

MARKET DRIVERS

Rising Prevalence of Obesity

Obesity has emerged as a critical public health concern across Europe. The surge in obesity rates has fueled the adoption of intragastric balloons, which offer a non-invasive alternative to traditional weight loss surgeries. Intragastric balloons are particularly appealing because they provide immediate volume restriction without requiring permanent anatomical changes. Studies indicate that patients using these devices achieve an average weight loss of 10-15% within six months by making them highly effective for short-term interventions. Moreover, government initiatives aimed at combating obesity, such as the UK’s National Health Service (NHS) weight management programs, have further normalized the use of intragastric balloons.

Advancements in Device Technology

Technological innovations have significantly enhanced the safety and efficacy of intragastric balloons, contributing to their growing popularity. For instance, newer models now feature biodegradable materials by reducing the need for surgical removal and minimizing risks associated with prolonged device retention. According to the European Medical Devices Regulation Authority, over 40% of recently approved intragastric balloons incorporate smart features like real-time monitoring systems, allowing healthcare providers to track patient progress remotely. Furthermore, clinical trials conducted by leading manufacturers demonstrate a reduction in adverse events by 25% compared to older versions. These advancements not only improve patient compliance but also expand the addressable market by attracting individuals who may have previously been hesitant due to perceived risks.

MARKET RESTRAINTS

High Procedure Costs

Despite their benefits, intragastric balloons remain relatively expensive are limiting their accessibility for many patients. The average cost of the procedure ranges from €3,000 to €5,000 is depending on the country and healthcare provider. According to the European Obesity Management Task Force, less than 20% of eligible patients can afford the treatment without financial assistance. This economic barrier is particularly pronounced in Eastern European nations, where healthcare budgets are constrained, and out-of-pocket expenses deter widespread adoption. While some countries like Germany offer partial reimbursements, inconsistent insurance coverage across Europe exacerbates affordability issues.

Risk of Complications

Post-procedural complications, including nausea, vomiting, and balloon deflation, pose another challenge to market growth. In severe cases, complications such as gastric ulcers or intestinal obstruction necessitate emergency interventions will deter the patient confidence in the technology. Although improvements in material science have mitigated some risks, the perception of potential side effects continues to deter prospective users.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Eastern European countries represent untapped opportunities for intragastric balloon manufacturers. Nations like Poland and Romania exhibit rapidly increasing obesity rates, with prevalence surpassing 25% in urban areas, according to the European Regional Obesity Observatory. However, limited access to advanced weight management solutions creates a gap that intragastric balloons can fill. Additionally, lower operational costs in these regions enable competitive pricing strategies, making the devices more affordable for patients.

Collaborations with Digital Health Platforms

Integrating intragastric balloons with digital health platforms presents another lucrative opportunity. Wearable devices and mobile apps that monitor dietary habits and physical activity can complement the effectiveness of these devices. According to research published in the Journal of Obesity & Weight Loss Therapy, combining intragastric balloons with digital coaching programs results in a 20% higher success rate compared to standalone treatments. Leading tech firms in Europe are already exploring collaborations with medical device manufacturers to develop comprehensive weight management ecosystems. Companies can enhance patient engagement and differentiate their offerings in a crowded marketplace by leveraging these synergies.

MARKET CHALLENGES

Regulatory Hurdles

Navigating stringent regulatory frameworks poses a significant challenge for intragastric balloon manufacturers. Each European country has unique approval processes, often requiring extensive clinical trials and documentation. According to the European Medicines Agency, obtaining CE certification for new devices can take up to two years is delaying market entry and increasing development costs. Furthermore, recent revisions to the Medical Device Regulation (MDR) mandate stricter compliance standards by forcing companies to invest heavily in quality assurance.

Competition from Alternative Treatments

Intragastric balloons face stiff competition from other weight loss interventions, including pharmaceuticals and lifestyle modification programs. According to the European Pharmaceutical Market Research Association, prescription medications like semaglutide have gained traction due to their convenience and proven efficacy. Similarly, personalized diet plans offered by wellness startups attract budget-conscious consumers seeking non-invasive options. These alternatives erode the market share of intragastric balloons among younger demographics. To remain competitive, manufacturers must emphasize the unique advantages of their products while addressing gaps in patient education and awareness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.26% |

|

Segments Covered |

By Product Type, Administration, Filling Material, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Allurion Technologies, Apollo Endosurgery, Medispar NV, Endalis, Districlass Medical, ReShape Lifesciences, Spatz Medical, Lexel SRL, Silimed Brazil, Suzhou Shenyun Medical Equipment, and others. |

SEGMENT ANALYSIS

By Product Type Insights

The single balloons segment dominated the Europe intragastric balloon market with 60.3% of the total share in 2024 with the simplicity in design and ease of insertion by making them ideal for first-time users. Additionally, single balloons are cost-effective, with prices averaging €2,500, compared to dual or triple configurations. A survey conducted by the European Society for Clinical Nutrition highlighted that 70% of patients prefer single balloons due to fewer procedural risks and quicker recovery times.

The triple balloons segment is projected to grow at a CAGR of 9.5% in the next foreseen years driven by their superior efficacy in achieving sustained weight loss. According to findings presented at the European Bariatric Conference, triple balloons result in an additional 5-7% weight reduction compared to single or dual options. This advantage appeals to severely obese patients seeking more aggressive interventions. Furthermore, technological advancements enabling customizable filling volumes enhance their adaptability to individual needs. Triple balloons are poised to become a cornerstone of advanced weight management strategies with growing emphasis on personalized medicine.

By Administration Insights

The endoscopic placement segment was accounted in holding prominent share of the Europe intragastric balloon market in 2024 owing to the precise positioning and reduced risk of migration by ensuring optimal therapeutic outcomes. Endoscopy-based procedures also allow for real-time adjustments, enhancing patient safety. According to clinical data from the European Obesity Surgery Network, endoscopically placed balloons demonstrate a complication rate of less than 10% by reinforcing their reliability.

The Pill-based intragastric balloons segment is likely to gain huge traction with a CAGR of 11.2% in the next coming years due to their non-invasive nature and minimal discomfort. According to a study published in the European Journal of Gastroenterology, pill-based systems reduce procedure time by 50% compared to endoscopic methods. Their appeal extends to patients with needle phobia or those seeking outpatient solutions. Manufacturers are investing in R&D to refine pill designs that is accelerating adoption rates among diverse demographic groups.

By Filling Material Insights

The saline-filled balloons held prominent share of the Europe intragastric balloon market in 2024. Their biocompatibility and ease of adjustment make them a popular choice among practitioners. Clinical evidence shows that saline-filled balloons cause fewer gastrointestinal irritations is improving patient tolerability. According to the European Obesity Research Institute, saline solutions are preferred for their stability and compatibility with imaging techniques by facilitating accurate monitoring.

The gas-filled balloons segment is estimated to witness a CAGR of 8.8% in the forecast period driven by their lightweight design and enhanced durability. According to the European Society for Bariatric Surgery, gas-filled variants reduce pressure on gastric walls that minimizes the risk of erosion. Their ability to maintain consistent volume over time also enhances long-term effectiveness. This segment is expected to witness exponential growth in the coming years as manufacturers focus on refining gas compositions.

By End-User Insights

The hospitals and clinics were accounted in holding significant share of the Europe intragastric balloon market with the advanced infrastructure and multidisciplinary teams capable of managing complex cases. These institutions also benefit from economies of scale by enabling them to offer competitive pricing and attract a larger patient base.

The outpatient surgical centres segment is projected to be the top performer in the market with a CAGR of 10.3% in the next coming years with their cost-efficiency and convenience. According to the European Ambulatory Surgery Association, outpatient settings reduce overall treatment costs by 30% by making them attractive to budget-conscious patients. Additionally, shorter wait times and flexible scheduling enhance patient satisfaction.

REGIONAL ANALYSIS

Germany dominated the Europe intragastric balloon market by holding a 28.5% of share in 2024 with the country’s robust healthcare infrastructure and high obesity prevalence, with over 23% of adults classified as obese. The government’s proactive stance on obesity management, including subsidies for non-surgical interventions, has bolstered adoption. According to the Robert Koch Institute, approximately 15,000 intragastric balloon procedures were performed in Germany in 2023, with its importance as a regional leader.

Spain is projected to grow at a CAGR of 9.2% during the forecast period with increasing awareness about minimally invasive weight loss solutions. The obesity rates have risen by 12% over the past decade by prompting greater investment in advanced treatments. Public health campaigns promoting early intervention have significantly boosted demand for intragastric balloons. Additionally, favorable reimbursement policies introduced in 2022 have made these devices more accessible among middle-income groups.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Allurion Technologies, Apollo Endosurgery, Medispar NV, Endalis, Districlass Medical, ReShape Lifesciences, Spatz Medical, Lexel SRL, Silimed Brazil, and Suzhou Shenyun Medical Equipment are playing dominating role in the Europe intragastic balloon market.

The Europe intragastric balloon market is characterized by intense competition, with established players like Apollo Endosurgery and emerging firms vying for dominance. The market exhibits moderate fragmentation, allowing smaller innovators to carve niche positions through specialized offerings. Apollo Endosurgery leverages its extensive clinical trial data and brand recognition to maintain its position, while ReShape Lifesciences disrupts traditional paradigms with dual-balloon systems. Meanwhile, Spatz FGIA focuses on differentiation via adjustable designs catering to individual needs. Regional distributors also contribute to competitive dynamics by expanding access in underserved areas. Pricing wars occasionally arise, particularly in cost-sensitive markets like Eastern Europe, where affordability influences purchasing decisions. Regulatory frameworks further intensify rivalry, as companies must continuously adapt to evolving compliance requirements.

TOP PLAYERS IN THIS MARKET

Apollo Endosurgery

Apollo Endosurgery led the Europe intragastric balloon market with its flagship Orbera device. The company’s focus on clinical validation and partnerships with European hospitals has strengthened its market position.

ReShape Lifesciences

ReShape Lifesciences contributes significantly through its innovative dual-balloon system, which addresses safety concerns associated with single balloons. As per the European Obesity Surgery Network, ReShape’s devices achieve an average weight loss of 12-15% by enhancing their appeal.

Spatz FGIA

Spatz FGIA specializes in adjustable balloons, offering unparalleled customization for patients. The company emphasizes patient-centric designs that will promote the marketplace position.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe intragastric balloon market employ diverse strategies to maintain competitiveness and drive growth. Product innovation remains a cornerstone, with companies investing heavily in R&D to enhance device functionality and safety. For instance, Apollo Endosurgery launched biodegradable balloons to reduce risks associated with surgical removal. Strategic collaborations also play a vital role. ReShape Lifesciences partnered with European wellness platforms to integrate digital coaching programs, improving patient outcomes. Pricing strategies further differentiate players, as seen in Spatz FGIA’s tiered pricing models tailored to regional affordability levels. Additionally, regulatory compliance is prioritized, with manufacturers aligning products to meet stringent EU Medical Device Regulation standards. Marketing efforts focus on raising awareness through educational campaigns targeting both healthcare providers and patients. These multifaceted approaches ensure sustained market presence and foster trust among stakeholders by enabling key players to navigate challenges effectively.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Apollo Endosurgery launched its next-generation Orbera 365 balloon in Europe. This initiative aims to extend treatment duration and improve weight loss outcomes.

- In May 2024, ReShape Lifesciences partnered with Vitality Wellness Solutions, a UK-based platform. This collaboration seeks to integrate digital health tools with intragastric balloon therapies.

- In July 2024, Spatz FGIA announced a distribution agreement with MedLife Group in Italy. This move enhances accessibility to adjustable balloons across Southern Europe.

- In September 2024, Apollo Endosurgery secured expanded reimbursement coverage in France. This development ensures broader patient access to its devices under national healthcare programs.

- In November 2024, ReShape Lifesciences initiated a clinical trial in Germany to validate the efficacy of its dual-balloon system for adolescent obesity.

MARKET SEGMENTATION

This research report on the Europe intragastric balloon market is segmented and sub-segmented into the following categories.

By Product Type

- Single

- Dual

- Triple

By Administration

- Pill

- Endoscopy

By Filling Material

- Saline-Filled

- Gas-Filled

By End-User

- Hospitals & Clinics

- Outpatient Surgical Centers

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key opportunities in the Europe Intragastric Balloon Market?

The market is expanding due to increasing obesity rates, rising demand for non-surgical weight loss treatments, growing awareness of bariatric procedures, and supportive healthcare policies across countries like Germany, France, and the UK.

2. What are the major challenges facing the Europe Intragastric Balloon Market?

Challenges include high treatment costs, limited reimbursement coverage in certain countries, post-procedure side effects, and the need for specialized medical expertise for safe balloon insertion and monitoring.

3. Who are the leading players in the Europe Intragastric Balloon Market?

Key players include Allurion Technologies, Apollo Endosurgery, Spatz Medical, Obalon Therapeutics, and ReShape Lifesciences, known for their advanced weight management solutions and strong presence in European healthcare systems.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]